A significant share of the expenses that business entities incur monthly falls on wages and deductions from them. In order to save a little money, owners increasingly prefer to carry out informal (without documentation) employment. Sometimes this step is beneficial not only to management, but also to the employee himself. However, it must be remembered that the law provides for liability for this action.

Labor legislation establishes that an employment relationship is considered formalized if an employment contract is drawn up and signed between the parties.

The concept of informal employment does not exist in the law. However, by analogy it can be understood that this is a type of relationship in which an employment contract is not signed between the parties, an entry is not made in the work book, and management will issue the salary unofficially “in an envelope.”

However, such an employee is not considered a full-time employee, he is not listed in any documents and insurance premiums are not transferred to him. Therefore, this period of work is not included in his pension experience.

Important! The law does not allow work to be performed without an employment contract being signed with the employee. This will be an offense on the part of both the company and the employee himself.

Pros and cons of working without an agreement for an employee

For an employee, this mode of work has both its pros and cons.

| Advantages | Flaws |

| The employee is paid a higher salary because taxes and other payments are not withheld from him | The employer may not provide leave at all, or only a small number of days, and may not pay for it |

| Since there is no official contract, the employee cannot be held liable for damage to property, embezzlement, etc. If the employer puts pressure, you can always submit an application to the regulatory authorities. | Payment for sick leave may not be made at all, or not in full |

| Amounts under writs of execution are not deducted from wages | Special assessments are not carried out at work sites; special clothing is most often missing |

| You can work even in situations where the law prohibits this or limits opportunities (teenagers, pensioners, etc.) | Time worked does not count towards pensionable service. |

| An employee can be fired at any time, and management may not give out the money earned at all. |

Negative consequences of informal employment for a worker

Unfortunately, there are many such consequences. By renouncing his right to official employment, the employee, first of all, becomes completely dependent on the employer, namely:

● Loss of a job without explanation (in this case, the employer’s decision may be completely unexpected for the employee, for example, today he works, but tomorrow he no longer needs to come);

● Refusal to pay (very often unscrupulous employers use unregistered workers for a week or a month, and then fire them without paying a penny);

● There is no opportunity to go on vacation, since there are no guarantees that it will be possible to keep the job, and the employer will not pay vacation pay;

● You can easily lose your job due to illness; not every employer will want to wait for the employee to return; as you understand, you shouldn’t count on paid sick leave in this situation either.

In the current situation with the Covid-19 pandemic, many people have fully felt the consequences of being exposed to the arbitrariness of employers.

Thus, if in relation to officially employed citizens the state, at the very least, controlled the observance of their rights, then unregistered workers were literally left without a means of subsistence and out of sight of the state.

In addition to being dependent on an employer, there are other negative consequences. Work without registration does not form a length of service, and an unscrupulous employer does not make contributions to the pension fund and health insurance fund.

It means that:

● The employee may in the future lose his pension or a significant part of it;

● The employee will have to be content with the amount of social health insurance;

● If you lose your job when applying to the employment exchange, you can only count on a minimum unemployment benefit of 1,500 rubles, as a person who has never worked.

Pros and cons for the employer

Most often, it is the employer who initiates the work without drawing up a contract. This situation is beneficial, first of all, for him.

Let's consider the advantages and disadvantages of an unconcluded employment agreement for a company:

| Advantages | Flaws |

| You can save money that the employer would normally transfer to social funds (up to 35% of the salary). This represents a significant amount of savings. | If an employee damages or loses company property, he cannot be held liable, since there is no such agreement between the parties. |

| The procedure for hiring new employees and firing them is significantly simplified. Since no paperwork is completed, the employee begins to perform duties immediately. You can also fire within 5 minutes. | If the unofficial registration becomes known to the inspection authorities, this will result in serious fines for the company, and for the director in some situations - criminal punishment. |

| If necessary, the administration can involve employees in working overtime, on weekends, etc., and sometimes without proper payment for their labor. In case of refusal, it is possible to immediately fire such a person. | |

| The company can save money if there are downtime, interruptions in operations, etc. - the administration may simply not pay for them. | |

| If there are no officially employed employees, then maintaining personnel records is significantly simplified; there is no need to draw up and submit special forms. | |

| The administration may not comply with the social guarantees established by law - pay sick leave, vacations, etc. |

The law does not contain cases in which the parties may not draw up an employment agreement. On the contrary, it contains an obligation for the employer to draw up an agreement within 3 days with the employee who has begun to perform his duties and has received permission, with the employer’s knowledge, to work in the company.

Position on parole

The plaintiff tried to prove in court that there was a real employment relationship between her and her employer. And it was difficult to prove this without a trial. Because no employment order was written, there was no entry in the work book. And the employment contract itself was signed only after some time.

The citizen was unlucky in the local courts - two instances rejected all the employee’s arguments and rejected the claim. But the Supreme Court explained to its colleagues that the absence of papers in such a situation does not at all mean the absence of labor relations.

The circumstances that developed for our heroine are no exception.

Working without registration, of course, carries many risks for citizens. But, as the explanations of the Supreme Court show, even in such situations, citizens can actually prove, and therefore defend, their rights.

This story began with the fact that our heroine worked for more than six months as a salesperson in a certain store with an artsy name. And only then they signed an employment contract with her and gave her a job description. At the same time, the general director of the limited liability company, which was the official name of the store, was aware that the saleswoman was working for him without registration. The saleswoman herself worked all this time as expected. The woman obeyed the internal labor regulations, went on leave according to the schedule drawn up by the organization and, as required by the position, bore full financial responsibility. She also received a pre-agreed salary - 30,000 rubles per month. This went on for four years.

And then the woman was simply shown the door, that is, the saleswoman was verbally fired, without even bothering to explain to her the reason for such an action. Since the employer did not consider it necessary to calculate wages and did not pay the saleswoman the vacation pay due in such cases, she submitted a statement of claim to the court and demanded that she be paid.

The citizen also indicated in the lawsuit that she was asking the court to establish the fact of labor relations, and the plaintiff also demanded that the store, which was listed in the documents as a limited liability company, be required to make an entry in the work book.

But this was not a complete list of requirements. The citizen asked the court to declare her dismissal illegal, reinstate her at work, and pay her the lost money. Plus, in her statement of claim, she asked to be compensated for her forced absence and be sure to pay her for moral damages.

If a person was allowed to work, but did not draw up a contract with him, then this is an abuse of right

At first instance, the case was heard in the city court. The Vorkuta City Court called and heard numerous witnesses. They practically said in unison on the record and confirmed that the saleswoman really fully fulfilled her official duties. She regularly ordered, received and released goods.

The court also examined a bunch of official documents signed by the plaintiff. It is important to emphasize that in some of them she is referred to as a senior salesperson, as was printed in the agreement on full individual financial responsibility, the employment contract, salary reports, vacation schedules, the job description of the senior salesperson, invoices and product reports. The same thing was indicated in numerous lists of write-offs of goods, inspection reports of the object, and even in certificates for the consignment note.

But it turned out that the testimony of the absolute majority of witnesses and a huge number of papers did not convince the court. And in the end, he came to the conclusion that the evidence presented “does not confirm the emergence of labor relations between the plaintiff and the LLC: the performance of a certain labor function, the permanent and paid nature of the work.”

The court in its decision referred to the absence of a senior salesperson position in the staffing table of this limited liability company.

In addition, the city court did not accept a copy of the agreement on full financial responsibility and pointed out the discrepancy between the position in the employment contract. As a result, the citizen’s claim to establish labor relations was denied.

The next instance, the Supreme Court of Komi, only confirmed the correctness of the decision of the lower court and said that it completely agreed with its colleagues.

But the citizen did not accept the refusal and went all the way to the Supreme Court of the Russian Federation, defending her labor rights. Her case was requested by the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation. And there they checked her arguments and stated that the saleswoman’s arguments were trustworthy.

This is the main thing that the Supreme Court said after studying this case. The court clarified that the mere absence of a written employment contract does not exclude the possibility of recognizing it as concluded, and the relationship that has developed between the parties as labor if the appropriate signs are present.

If the employer, the court emphasized, actually allowed the employee to work, but did not draw up a written contract with him, then this can be regarded as an abuse of right, which is the subject of Article 67 of the Labor Code of the Russian Federation.

The Supreme Court emphasized that if an employee with whom an employment contract has not been drawn up begins work with the knowledge or on behalf of the employer, then the employment contract is considered concluded. In this case, the Supreme Court referred to Articles 15-16, 56 and 67 of the Labor Code of the Russian Federation.

The Judicial Collegium for Civil Cases of the Supreme Court stated the following - the local court must in such a situation establish whether an agreement was reached on the personal performance of work, whether the plaintiff was allowed to perform this work, whether she obeyed the internal labor regulations in force at the employer, whether she performed the work in accordance with interests, under the control and management of the employer, whether wages were paid to her.

Since the local courts for some reason did not analyze this, the Supreme Court canceled all decisions taken in this case and ordered to reconsider this dispute from the very beginning, taking into account its explanations.

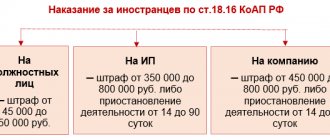

What threatens the director of the organization

Working without an employment contract is the responsibility of the employer-manager in both administrative and criminal cases.

In case of administrative liability, a fine of up to 20 thousand rubles or disqualification of up to 3 years is imposed.

If the case is transferred to the criminal category, the fine will be from 150 thousand rubles, and there may also be imprisonment for up to 2 years.

If the underpayment of taxes is qualified as particularly large, then the fine will be from 200 thousand rubles, and the period of imprisonment will increase to 6 years.

Attention! Also, the guilty person will be prohibited from holding a leadership position or engaging in certain activities.

Responsibility of the individual entrepreneur

In the general situation, a fine is imposed on the entrepreneur, the amount of which is established by the administrative code. But such a step is usually possible only if several people worked informally for the individual entrepreneur for a short period of time.

If the number of employees with whom there are no labor agreements is significant, then criminal liability may already be imposed for this. The general qualification of the situation is based on the amount of tax unpaid to the budget.

A criminal case usually results in a real prison sentence rather than a suspended sentence. In addition, individual entrepreneurs are awarded a serious fine, which must be paid along with the repayment of tax debts. In such a situation, you usually need to make tax payments first, and then pay the fine.

Attention! Also, the result of the trial may be the imposition of a ban on activities in the area where the violation was committed.

What does an employee face for working without registration?

The law does not establish punishment for an employee if he operates without an employment contract, since the obligation to draw up a contract lies with the employer.

At the same time, the employee himself has no way to force the administration to sign the contract, except for filing complaints. An employee can send a registered letter to the manager with a request to sign an employment agreement with him. In the event of litigation, this letter will serve as evidence that the employee wanted to work officially, and the company’s management refused him this.

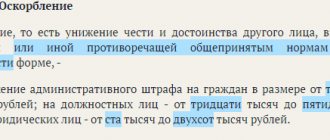

Penalties for failure to conclude an employment contract with an employee, its incorrect drafting, or execution of a GPC agreement instead of an employment agreement are established in Parts 5 and 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

When is it possible not to formally register an employee?

The law does not specify situations in which it is permitted not to formalize an employment agreement between the parties to the employment relationship.

On the contrary, the current Labor Code obliges the employer to draw up an employment contract within three days with an employee who has begun to perform work duties, i.e. the employee has received permission to work with the knowledge or on behalf of the employer.

Attention! However, if it is planned that the employee must perform some work or provide a service within a short period of time, then instead of an employment contract it would be more advisable to draw up a civil legal contract.

To prevent the court from reclassifying one type into another, the following conditions must be met:

- The employee provides a strictly defined service.

- The relationship between the parties is equal, not subordinate.

- Payment of remuneration is established by agreement of the parties.

- The contract ends when a certain result is achieved.

In what cases can a director be subject to criminal penalties?

Criminal liability is imposed when the employer does not make mandatory tax payments to the budget.

If the amount of underpayment is determined to be large:

- A fine in the amount of 150,000-300,000 rubles;

- Salary or other earnings for a period of 1-2 years;

- Assignment of forced labor for a period of up to 2 years with a ban on engaging in certain activities for a period of up to 3 years;

- Arrest for up to 6 months;

- Imprisonment for up to 2 years with a ban on engaging in certain activities for up to 3 years.

If the violation is committed by a group of persons, or the underpayment is qualified as a particularly large amount:

- A fine in the amount of 200,000-500,000 rubles;

- Salary or other earnings for a period of 1-3 years;

- Assignment of forced labor for a period of up to 5 years with a ban on engaging in certain activities for a period of up to 3 years;

- Imprisonment for up to 6 years with a ban on engaging in certain activities for up to 3 years.

Attention! Criminal liability can be avoided if this crime is committed for the first time, and the company voluntarily pays off all debts on taxes, penalties and fines.

How to prove the fact of labor relations

As soon as management announces to an employee who is not officially employed that he is being fired, he must immediately take appropriate measures to protect his rights.

He needs to try to get from his employer all the documents on which he signed. It is necessary to collect this evidence as quickly as possible, and under no circumstances notify your management about this, as they will interfere with this. This evidence may simply be destroyed.

After this, it is necessary to send an application to the management, which must contain a requirement to include this temporary period of work in the labor record.

This application must be handed over to management and one copy with an incoming mark must be received. However, it is best to send such an application to management by registered mail with acknowledgment of receipt.

Attention! It is advisable for the employee to find witnesses who can confirm the fact of his employment at this enterprise. They will most likely have to appear in court and confirm that this company employee carried out the instructions received from the company administration.

Where to contact in case of refusal

If the director categorically does not want to formalize the employment relationship, you will have to complain to the regulatory authorities - the labor inspectorate, the prosecutor's office or the court.

Labour Inspectorate

The application can be submitted in person or by proxy through an authorized representative. The document must detail the essence of the violation, and then ask the inspector to apply sanctions against the employer.

When applying, it is very important to back up your words with evidence - some documents from the company with employee marks, with the help of which you can generally prove the existence of a relationship.

Attention! If the labor inspectorate, based on the results of the inspection, actually discovers evidence of the existence of an unconcluded labor relationship, it will issue an order and also impose an administrative fine for non-compliance with labor legislation.

Going to court

Going to court is the last resort between an employee and an employer. In addition to filing a statement of claim, it is necessary to provide the judge with a broad legislative basis proving the employment relationship without concluding an employment contract.

Legal practice shows that if the court rules in favor of the employee, the employer may be required to formally register the employee, pay compensation for moral damage, and cover legal costs.

Attention! In fact, the consequences for the company will be much more serious, since this may lead to the opening of a criminal case, as well as close attention from the tax authority for evasion of mandatory payments.

How to convince a director to formalize an employment agreement

If management does not register an employee, it will be very difficult to convince him to do so. You can try to talk to the director, tell him how he likes the work, what suits him with the remuneration for his work, and the daily routine. However, he needs to be officially employed for this job.

If after this conversation, the manager refuses the employee, then he should send an official letter addressed to him. The best way to do this is by letter.

In this document, he needs to reflect that he has been working for a certain period of time, and the administration has still not issued him an employment contract and an employment order.

Attention! It is advisable to include in the letter that unofficial employment is a violation of labor law, in terms of Article 67 of the Labor Code of the Russian Federation.

When an employee understands that the administration is avoiding concluding an employment contract by all means, he can complain to the labor inspectorate, the prosecutor's office, and the court.

Advantages and disadvantages of hiring an employee without an employment contract for the employer

In most cases, the initiative for informal employment comes from the administration of the company or individual entrepreneur. This is due to the fact that this situation is most beneficial for the employer.

The following advantages of not concluding a formal employment contract with employees can be highlighted:

- An opportunity to save in such a situation on paying insurance premiums to the Pension Fund and social insurance. In case of unofficial registration. The employer does not make any contributions to salaries, so these funds remain with him. The savings in this situation amount to more than 30% of labor costs, which is a significant amount.

- There is no need to follow all the stages of hiring and dismissing an employee; therefore, time is reduced and the procedure for an individual’s hiring and dismissal is simplified. With such employment, an employee can be fired immediately for an unreasonable refusal to carry out an assignment.

- If there is a shortage of workers, the administration can attract existing employees without complying with the standard length of the working week, paying them remuneration based on an oral agreement, which is often less than the options established by law (for example, double pay for weekends).

- If a company experiences interruptions in operations, then in such a situation the company management does not pay for downtime, which also saves the company money.

- In the absence of official employees, the company does not keep personnel records, which allows the employer to reduce the composition of its reporting.

- With such employment, the employer has the opportunity not to fulfill social guarantees to the employee, which are defined in the Labor Code of the Russian Federation. Therefore, he may not pay for sick leave, vacations, etc. This also allows him to reduce his expenses.

In addition to the advantages of such employment, there are also negative aspects, which include:

- If an employee causes damage to the employer, he cannot be held liable; it implies the existence of a concluded agreement between the parties.

- There is always a risk that such relationships between the company and its employees will become known to the competent authorities, and working without an employment contract will become the responsibility of the employer in accordance with the law.

Labour Inspectorate

The employee submits an application to the labor inspectorate about the employer’s non-compliance with the law, either independently or through his representative.

In this document, a company employee must describe in detail the situation that indicates a violation by the enterprise administration (unreasonably refusing to formalize an agreement) and ask the inspectorate to take appropriate action.

The application must be accompanied by documents available to the employee confirming the existence of an employment relationship between him and his employer.

The inspector must, on the basis of the received application, identify that there is an employment relationship without concluding an employment contract, then he will issue an order and bring the employer to administrative liability.

Is it possible to work without an employment contract?

Labor law rules determine that the basis of labor relations is the execution of an employment contract between the parties. The provisions of legislative acts do not define the concept of informal employment.

But based on their content, it can be established that the type of relationship between the employer and the employee is when an employment contract is not signed between them, entries are not made in the work book, and wages are issued unofficially.

Therefore, an employee hired in this way is not considered an employee of the company, is not included in its payroll, contributions are not paid to him, and as a result, this period is not counted as part of the length of service that gives the right to receive a pension.

Current regulations stipulate that working with an employee without drawing up an employment contract is not allowed. This is a serious offense both on the part of the employer and on the part of the employee himself.

Important! If this fact is revealed, liability measures are applied to these entities. Therefore, working without an employment contract is prohibited by law. See how to officially hire an employee.