Sometimes company personnel have to work beyond the established working hours. And we are not talking about a banal delay at work. Overtime refers to work outside the established working hours, when the initiative comes from the employer . If an employee is late or goes out to work on weekends on his own initiative, this is not considered overtime work and is not paid.

The rules for overtime work are stated in Article 99 of the Labor Code. The maximum processing time is 4 hours over two consecutive days and 120 hours per year.

Next, we’ll look at how to process processing.

Is it necessary to issue an order?

The need to fulfill or exceed the production plan does not always fit into the framework of working hours. In this case, there is a need to organize work beyond the normal duration of the shift, but overtime work according to the Labor Code of the Russian Federation has restrictions on attracting personnel to work outside the limits of the normal working day. In addition to its own restrictions established by Article 99 of the Labor Code of the Russian Federation, involvement in such work requires additional payment for overtime hours, which is established by Article 152 of the Labor Code of the Russian Federation.

The Labor Code of the Russian Federation does not indicate that registration of overtime work requires the issuance of a separate order from the manager. The main requirement is the employee’s written consent to work beyond the norm.

An exception is the cases listed in Part 3 of Art. 99 Labor Code of the Russian Federation. The employee’s consent may not be asked if:

- there is a need to prevent an accident or natural disaster;

- engage an employee to eliminate a breakdown that interferes with the enterprise’s water supply, lighting, communications, transport and other communications;

- An emergency arose, martial law was introduced, etc.

Despite the fact that in the above cases the employee’s written consent to overtime work is not necessary, overtime must be formalized and paid for.

For payment, overtime time in the time sheet is indicated by the code “C” or “04”. The basis for paying overtime hours is the timesheet.

The following categories of employees have the right to refuse overtime work:

- disabled people;

- women raising children under three years of age;

- a parent raising a child under five years of age alone;

- citizens raising disabled children;

- employees caring for a sick relative.

Such employees must be informed in writing of the possibility of refusing overtime work. This information can be indicated in the order. Managers of organizations should be aware that it is prohibited to involve pregnant employees and minors in extracurricular work.

Permission required!

In order for an employee to work longer than required by the established work schedule or shift duration, or to exceed the total number of hours during the pay period, the employer must first seek consent to this. Before you think about involving your subordinates in overtime work, you should obtain permission from:

- a trade union organization that protects workers' rights, or a representative of this body;

- the employee himself in writing.

Question: Are payments for overtime work, the duration of which exceeds 120 hours per year, included in expenses for income tax purposes (clause 3 of Article 255 of the Tax Code of the Russian Federation)? View answer

How much and how are overtime hours paid?

Organizational managers are often interested in how much to pay for overtime worked by an employee? For greater clarity, we have placed a table:

| Period of extracurricular work | Overtime pay |

| First 2 hours | Must be paid at least one and a half times the amount |

| Subsequent hours | At least double the size |

The amount of payment for overtime work indicated in the table is considered minimal, that is, the employer does not have the right to pay less. But the amount of payment for work above the norm can be increased by the head of the enterprise. Information about this should be indicated in the company’s local act or employment contract with the employee.

If the employee does not mind, the organization can compensate him for the time worked above the norm, not in cash, but with additional days off. The duration of the non-working period cannot be less than the time spent on work. But such overtime work is paid at a single rate.

If processing is the employee’s own initiative, then such work is not extracurricular and is not paid.

Reasons to work extra

The employer does not have the right to simply ask an employee to stay at work and work overtime. Special time is stipulated for work in the Labor Code, employment contract and other legislative acts, and no one is allowed to violate this regime without reason. However, from time to time unforeseen events or special circumstances occur when overtime work becomes necessary. The law provides for the following reasons that may force an employer to introduce overtime work:

- when the work was not completed during the working day due to technical reasons or force majeure, and it is necessary to complete it in order to avoid potential property damage or a threat to health or life;

- if overtime work is a temporary “emergency emergency” associated with the repair or installation of equipment, without which a large number of people will not be able to perform their duties;

- there cannot be any interruptions in the work, and the next shift worker does not show up on time: he must be immediately replaced by another competent worker, even if his shift has already come to an end.

What methods of recording working hours exist?

Choosing a method for recording working time is a concern for managers. Much in this matter depends on the scope of the organization. The chosen type of accounting must be specified by the director of the company in the internal regulations. The following types of accounting are distinguished:

- daily;

- Monday;

- summarized.

With summarized accounting, there may be a deviation in the duration of working hours during the day, week or month. The main requirement: at the end of the accounting period, the employee must have worked a number of hours in accordance with the approved norm.

The standard working day is 8 hours. With a five-day working week, the working time limit reaches 40 hours. But there are exceptions. If a person works a shift, his working day can last 12 hours. For some categories of employees, a shortened working day may be established. In this case, their working week is 24-36 hours. You can find out how much time a worker with a normal or reduced working day must work per month, quarter and year using the production calendar. Using a regular calculator, it will not be difficult to calculate recycling.

In the case of daily accounting, overtime or shortfalls are recorded within one day. Labor payment is calculated for each day of processing separately. And overtime (payment) is given at the end of the month.

Overtime pay: example

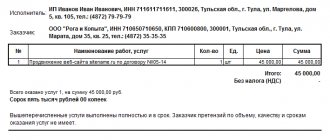

Let's look at a specific example of how to calculate overtime (2019). Manager Barulin V.M. worked 3 hours after hours on 03/03/2019 and 4 hours on 03/10/2019. His hourly earnings are 140 rubles. The first two hours of each overtime must be paid at one and a half times the rate. The rest of the time is double time. The amount will be:

March 3 = (140 rub. × 1.5 × 2 hours) (140 rub. × 2 × 1 hour) = 700 rub.

March 10 = (140 rubles × 1.5 × 2 hours) (140 rubles × 2 × 2 hours) = 980 rubles.

Barulin V.M. 1680 rubles will be credited. for extra work.

When recording working hours in aggregate, overtime work (payment) should be assessed as follows: time worked outside of normal hours is calculated based on the results of the accounting period. The first two hours of work are paid at least time and a half. The rest of the time is double time.

Exceeding temporary standards - under no circumstances!

The law defines those employees who, under no circumstances, can be involved in additional workload. Even with consent, you cannot ask or oblige to work overtime:

- women expecting a child;

- subordinates for whom an apprenticeship contract is currently in effect;

- persons who have not yet turned 18 years of age;

- other categories of workers for whom such a restriction is determined by federal laws and the Labor Code of the Russian Federation.

EXCEPTION! It is permissible for minor employees to remain at work beyond the time limit if they:

- belong to creative professions;

- work in the media sector;

- appear on television;

- engaged in a play, circus performance, show;

- participate in the exhibition of any works.

These types of activities are enshrined in the list of professions and positions approved by Decree of the Government of the Russian Federation No. 252 of April 28, 2007.

How is overtime paid on a salary basis?

In Art. 152 of the Labor Code of the Russian Federation there is no information about what amount should be taken into account. Therefore, many employers are wondering whether to take into account only salary or average income along with bonuses and allowances. When calculating overtime, managers often take double the tariff as a minimum. Incentive and compensation payments are not taken into account. Overtime work is paid inclusive of bonus payments only if the employer has established such a procedure.

If such a procedure is not established, then the cost of an hour is equal to the salary divided by the number of standard hours in the accounting month according to the production calendar. If the period of summarized accounting is more than one month, it is necessary to determine the average cost of an hour for the entire period (for example, salary income for a quarter divided by the standard time for the specified quarter). Overtime calculations must be made from the resulting cost per hour.

What happens if the 120 hour limit is exceeded?

The government is busy setting up a new production calendar every year. It contains the following information:

- weekend;

- holidays;

- transfers of working days;

- quarterly, annual and monthly work hours.

For example, 1973 hours was the working time for 2021. 2093 hours is the norm in case of emergency situations.

It will be difficult to avoid fines if management did not take care of timely registration of holidays for subordinates. Especially when the processing time has already reached and exceeded 120 hours. This is an administrative offense. Fines of 5 thousand rubles are applied to officials.

The penalty for enterprises will be 80 thousand rubles. Managers and enterprises are subject to disqualification and deprivation of the right to work if the violation is repeated. Such punishments are an incentive for management to keep records in accordance with all the rules.

What are the rules for paying overtime on a shift schedule?

Let's look at how overtime is paid during a shift work schedule. If a worker works in shifts, his salary can be calculated using both hourly tariff rates and on a salary basis.

In the first case, overtime is calculated as follows: the number of hours worked during a certain period is multiplied by the established rate.

If the organization uses a salary system, then every month the employee is transferred the same amount of remuneration.

Features with a 40-hour week

The easiest calculation is for citizens who maintain normal schedules with a 40-hour week. It is enough to record the time spent on processing once. B 04 or C – codes for accounting sheets during registration. The exact duration is placed next to this designation.

The code describes recycling standards for the year and day. But there are no indicators for the month. You can only carry out calculations theoretically. It is acceptable to assume that the maximum processing time per month is 84 days. But in practice, managers are rarely able to achieve agreement with such difficult conditions. Trade union bodies also do not agree with this.

How is overtime pay for piece workers calculated?

Citizens who work piecework are paid for each part produced. Overtime pay for piece workers depends on how many parts they produce outside of normal working hours, as well as on the length of overtime work. Cash is paid without taking into account one and a half or double premium.

Example: Kurochkina A.N. works at the factory. She works piecework. For each part made, she is paid 400 rubles. On 03/09/2019 she worked 4 hours outside of school hours, producing 5 parts during this time: 2 pcs. - for the first 2 hours and 3 pcs. — for the remaining 2 hours. Payment depends on the number of parts produced and on the time worked above the norm. Therefore the calculation is:

(400 rub. × 1.5 × 2 pcs.) (400 rub. × 2 × 3 pcs.) = 1200 rub. 2400 rub. = 3600 rub.

How to use the calculator

There are a total of five windows in the calculator in which you will need to enter the following data:

- the cost of one working hour - in the first field;

- hours and minutes worked within the first two hours at a factor of 1.5;

- hours and minutes worked within subsequent hours at a factor of 2.

Immediately after filling out each field, an intermediate answer will appear, to which, as new values are added, adjustments will be made until the calculation is completed.

Results

Shift work refers to working under flexible working hours. Labor legislation regulates the specifics of its organization, accounting and payment.

The employer needs to correctly calculate the duration of work shifts and rest breaks, draw up a shift schedule, promptly familiarize employees with it, record the time actually worked by employees, and then correctly calculate wages taking into account the peculiarities of shift work.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.