General information Setting up the accrual type Calculation and accrual of payment for downtime due to the fault of the employer

General informationGeneral

Simple

– this is a temporary suspension of work for reasons of an economic, technological, technical or organizational nature (Part 3 of Article 72.2 of the Labor Code of the Russian Federation).

Downtime caused by the employer is paid in the amount of at least 2/3 of the employee’s average salary. The average salary is calculated based on the actual accrued wages and actual time worked for the 12 months preceding the month the downtime began.

Labor legislation establishes a minimum amount of payment for downtime. The organization has the right to set the specific amount of payment for downtime independently in a local regulatory act, but not lower than that established by Art. 157 Labor Code of the Russian Federation. At the same time, the length of time during which payment for downtime is made is not limited.

The employee must inform his immediate supervisor in writing about the beginning of downtime caused by reasons that make it impossible for the employee to continue to perform his job function. Downtime due to the fault of the employer is formalized by an order (instruction) of the employer in any form, which indicates in respect of whom the downtime is introduced (an employee, all employees of the organization, department, etc.), the reason for the downtime, the start and end time of the downtime, the amount of payment for the time. downtime, where employees will be during downtime.

Payment for downtime is subject to personal income tax and insurance premiums.

What is simple

Downtime occurs when a company is forced to stop operations for a while.

Downtime may result from organizational, technical or economic reasons. This may affect the entire company, a specific department, or some employees depending on their positions and job characteristics. In 2021, many businesses were idle due to coronavirus quarantine measures. To formalize downtime, the manager issues an order. The procedure for paying for downtime is prescribed in Art. 157 Labor Code of the Russian Federation. Apart from the definition of downtime and payment rules, the legislation does not prescribe anything else.

Employer Responsibilities

The employer has the following responsibilities during the downtime period:

- Drawing up an order in accordance with the Labor Code.

- Taking all possible measures to resume work processes.

- Calculation of compensation in the established amount.

An employer does not have the right to send employees on unpaid leave.

Transferring an employee to another location during downtime

The manager has the right to transfer an employee to another department or to another position. This is the most optimal solution for both the employer and the employee. However, such a decision is rarely made, since its implementation requires free space in the enterprise.

IMPORTANT! Transfer of a person without his consent is possible only if the downtime lasts no more than a month, and the employee is offered a position equal to his qualifications. Also, in the new place, the employee must receive a salary the same as his previous salary. If one of these conditions is not met, the employee's consent is required for the transfer.

The maximum duration of the transfer is 12 months. After the end of the year, the manager must either return the employee to his previous position, or officially register him in a new one.

How to arrange a simple

Step 1. If downtime concerns one employee: for example, his equipment has broken down or he has run out of materials for work, the employee notifies management about this. There is no written form of such notification, so the employee reports in free form: orally or in a memo.

If the downtime affected an entire structural unit, its manager needs to draw up a report and describe in it the reasons for the downtime and its features. There is no special form either; draw up a document in free form.

If the entire company is idle, the manager knows about it without memos.

Step 2. Having learned about the downtime from an employee or independently, the manager issues an order. It describes:

- the reason for the downtime and its type - due to the fault of the employee, employer or for reasons beyond their control;

- downtime;

- employees and departments subject to the downtime order;

- do employees need to be at their workplace during this period or should they not visit the company’s premises;

- payment order.

If the end date of the downtime is unknown, you can indicate this in the order, for example, in the wording “until the order of the regional governor to cancel the high alert regime.”

In an order with an open end date for downtime, you can write:

- conditions for ending downtime;

- method of notifying employees about the resumption of work.

Send the order to employees by email or show them the order against signature.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Step 3. If the entire company is idle, the manager must inform the employment service within three working days after issuing the order (Clause 2 of Article 25 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population”). There is also no single form for this, although some regions establish one: this is often done on the websites of the Employment Services by filling out an online form. Typically, in a notice of suspension of work, entrepreneurs report:

- reason for downtime;

- start date;

- if the duration is known, the end date;

- number of employees affected by downtime.

If you do not submit information to the Employment Service, you may receive a warning or a fine (Article 19.7 of the Administrative Code). The fine is up to 500 rubles for officials and up to 5,000 rubles for an organization.

Accounting in 1C

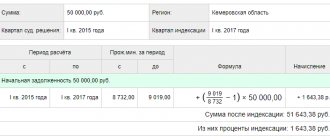

From April 13 to April 30, employee A.P. Vorobyov was issued an order for downtime due to the fault of the employer. PDF

Downtime is paid at the rate of 2/3 of average earnings. Employee working hours are recorded in days.

In the billing period from April 1, 2021 to March 31, 2020, the employee:

- payments accrued: salary - 415,500 rubles;

- vacation pay - 25,000 rubles;

- days worked - 277.

Creating an accrual type

There are two points of view on the issue of reflecting downtime due to the fault of the employer in personal income tax reporting:

- Income code 2000 - in accordance with clause 6 of Art. 255 of the Tax Code of the Russian Federation, this type of payment refers to labor costs. Amounts of payment for idle time are reflected in 6-NDFL in the same way as a regular salary: the date of receipt of income is the last day of the month;

- withholding date—the day of payment.

- Revenue code 4800 — these payments are not listed in Appendix 1 to the Order of the Federal Tax Service of the Russian Federation 09.10.2015 N MMV-7-11/[email protected] (Letter of the Federal Tax Service of the Russian Federation 07/06/2016 N BS-4-11/12127). Amounts of payment for downtime are reflected in 6-NDFL:

date of receipt of income - day of payment;

- withholding date—the day of payment.

In our example, we adhere to the first point of view and use the income code 2000.

Create and configure a new type of accrual - Downtime due to the fault of the employer 2/3 (section Salaries and personnel - Salary settings - Payroll - link Accruals - Create button).

Install:

In the personal income tax :

- switch - taxable , income code - 2000 ;

In the section Insurance premiums :

- Type of income - Income entirely subject to insurance premiums ;

In the Income Tax section, type of expense under Art. 255 Tax Code of the Russian Federation :

- switch - taken into account in labor costs under article : pp. 6 tbsp. 255 Tax Code of the Russian Federation;

In the section Reflection in accounting :

- Reflection method - not filled in (accruals are reflected in the same way as wages for a specific employee).

Calculation of payment for downtime due to the fault of the employer

Step 1. Calculate the amount of payment for downtime outside the program using the formula:

To do this, first calculate your average daily earnings:

- Average earnings;

- How to view accruals for calculating average earnings?

Average daily earnings according to our example:

- 415,500 / 277 = 1,500 rubles.

The amount of downtime payment according to our example:

- 1,500 * 2/3 * 14 = 14,000 rub.

Step 2. Reflect the accrual of payment for downtime in the Payroll document in the Salaries and Personnel section - All accruals - Create button - Payroll.

Fill out the document in the usual manner, then in the Accrued , follow the link, make changes for the employees for whom the downtime was issued:

- using the Add , indicate the previously created accrual of Downtime due to the fault of the employer 2/3 , days, hours and amount from the calculation made outside 1C;

- adjust other accruals for the month according to the hours worked.

Postings according to the document

The document generates transactions:

- Dt Kt - payroll;

- Dt Kt - calculation of payment for downtime due to the fault of the employer;

- Dt Kt 68.01 - calculation of personal income tax from the total amount of salary;

- Dt Kt 69.01 - calculation of contributions to the Social Insurance Fund;

- Dt Kt 69.03.1 - calculation of contributions to the FFOMS;

- Dt Kt 69.11 - calculation of contributions to NS and PZ;

- Dr Kt 69.02.7 - calculation of contributions to the Pension Fund.

Reporting to the Pension Fund

In the annual report of SZV-STAZH, when filling out information about an employee who has periods of downtime due to the fault of the employer, in the Information about length of service , indicate:

- column Period —downtime period;

- Countable length of service column : Parameter - manually enter the SIMPLE .

See also:

- How to reflect the accrual of downtime due to reasons beyond the control of the parties?

- Calculation of earnings during a business trip based on daily average

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Error in “Downtime, suspension from work” due to the fault of the employer when editing average earnings manually...

- According to the Ministry of Labor, the period of downtime due to the fault of the employee does not reduce the vacation period. Specialists of the department in Letter dated 04/10/2019 N 14-2/B-260 noted that...

- New amendments to the Code of Administrative Offenses make it possible to punish employers through whose fault drivers violated the work and rest regime. The President signed the law with amendments to Art. 11.23 Code of Administrative Offenses of the Russian Federation,…

- Should insurance premiums be charged for payments for downtime or not? The Ministry of Finance explained whether it is necessary to impose contributions on payment of forced downtime...

How to pay for downtime

Downtime caused by an employee is not paid. And due to the fault of the company or for reasons beyond the organization’s control (for example, the same coronavirus) you will have to pay.

Downtime due to independent reasons is paid in the amount of ⅔ of the employee’s salary. For calculations, not the monthly salary is taken, but the salary calculated from downtime (Part 2 of Article 157 of the Labor Code of the Russian Federation).

Downtime due to reasons beyond the control of the organization and the employee, pay in an amount no less than 2/3 of his tariff rate (salary), calculated in proportion to the downtime. Such rules are established by part 2 of article 157 of the Labor Code.

If an employee works on an hourly basis, the salary for the month in which there was downtime is calculated using the formula:

Salary = Hourly Rate * Normal Hours + ⅔ * Hourly Rate * Idle Hours

If the employee is on a daily wage, calculate the salary using the formula:

Salary = Daily rate * Days of normal work + ⅔ * Daily rate * Days of downtime

If the employee is on a monthly salary, calculate the salary using the formula:

Salary = Salary / Number of working days * Days in normal mode + ⅔ * Salary / Number of working days * Downtime days

If the downtime lasts for the entire month, the first part before the addition sign simply disappears from the formulas.

With piecework payment, you will have to calculate the average daily or hourly rate of earnings and calculate payment for downtime days, multiplying this amount by ⅔.

How does it arise (according to the Labor Code of the Russian Federation)

- if the employee did not pass a medical examination or a knowledge test on occupational safety through no fault of his own (Article 76);

- if an employee is required to undergo a knowledge test on occupational safety during underground work, but such a test did not take place due to the fault of the employer (Article 330.4);

- if the credit institution’s license has been revoked (Article 349.4);

- if the strikers prevented a person not participating in the strike from performing his duties (Article 414).

In addition, there are many more options that the Labor Code is not able to provide for: a financial crisis, replacement of equipment or interruptions in the supply of components. And all these circumstances are characterized as simple - payment in this case is made in accordance with the Labor Code.

How to take into account downtime during the coronavirus epidemic

In 2021, when registering downtime due to a high-alert regime, justify the suspension of work in the order. If the company cannot send employees to work remotely, the order should prohibit their presence at the workplace. How you write down the justification for the downtime and determine whose fault the downtime is, determines how it will be paid further.

If your company is subject to a presidential decree on non-working days with pay, then it is better not to introduce a simple one - you will have to comply with the rule on maintaining pay. If you introduce downtime, justify it on economic grounds, but be prepared to defend your position in court if disputes arise with employees or the labor inspectorate.

For personnel records, payroll and other payments, and employee reporting, use the Kontur.Accounting service. Here you can easily maintain accounting and tax records, send reports via the Internet, view management reports, use electronic document management and other accounting tools. The first two weeks are free for all new users.

Is sick leave benefits available during downtime?

It all depends on the period of illness:

- If an employee falls ill and recovers during the downtime period, he is not paid sick leave. He receives money only for downtime.

- If the illness began during a period of downtime and continued after its end, sick leave benefits are paid only for days of illness outside of the downtime.

- If the incapacity for work began before the downtime and ended during or after it, days of illness outside of the downtime are paid in the general manner. And sick days that fall during downtime are paid either as sick leave or as downtime (based on which amount is less). In other words, during the downtime period, you will have to calculate the amount for both sick leave and downtime and give the employee the lesser of them.

This procedure is provided for by the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ.

Read about sick pay during vacation in the article “Sick leave during vacation in 2017 (nuances)” .

Obligations of the employer and employees

Both managers and subordinates must comply with all obligations to each other during downtime:

| Employer | Workers |

| tries to avoid forced downtime, calculates risks in advance and responds to them in a timely manner | report every instance of equipment breakdown or other circumstances that may cause production downtime |

| informs about the suspension of work in writing | carefully read the order and put their signature on it |

| reflects the cost of working time in the time sheet, on the basis of which the worked and unworked time of subordinates is calculated | stop working, while leaving or not leaving the workplace (depending on the content of the order) |

| invites employees to move to another job in the same organization, if possible | follow all orders of the employer |

Downtime is not a day off or a vacation: employees are required to follow all instructions from their immediate supervisors.

Why is it so important to correctly indicate the reason for forced downtime?

The employer must justify why the employee was sent on “forced rest”. Firstly, the employee is unlikely to be happy with such news: at the same time, he will significantly lose in income. He may even complain to the labor inspectorate or the prosecutor's office. Accordingly, the head of the organization will have to prove his case in order not to fall under Art. 234 of the Labor Code of the Russian Federation, which provides for the employer’s obligation to compensate for earnings not received by an employee in the event of illegal deprivation of his opportunity to work.

If downtime is associated not with production problems, but with emergency situations, there is another feature in the legislation of the Russian Federation. If a natural disaster, accident or epidemic led to removal from work, the employer may temporarily transfer the employee to another type of work in the same organization. This is possible even without the consent of the employee himself, but only for a limited period - up to 1 month.

In addition, the calculation of wages for the downtime period also depends on the reason for such a management decision.

Accordingly, a correctly documented reason for sending an employee to forced downtime is an argument for the subordinate and a guarantee for the manager in case of disputes and litigation.