Sometimes employers consider it necessary to pay their employees additional funds in addition to their salaries in order to reward them for good work or to compensate them in some way. The very name of the bonus indicates that it is not assigned to everyone, but only to specific employees based on certain indicators.

Let us clarify on what basis a personal allowance can be established, which categories of workers are not entitled to it at all, how to properly formalize it, and, if necessary, cancel it.

How to set a personal allowance for an employee ?

The essence of a personal allowance

An employee can receive not only a “bare” salary, but also additional payments, including those assigned in addition to wages.

The Labor Code does not have a precise definition of a bonus. The bonus included in the salary, reflected in the employment contract or additional agreement to it, is common to all personnel when certain conditions occur, for example, for work in certain climatic zones, for shift work, etc. Such bonuses are not considered personal.

If the employer is not obliged to assign a bonus, but he does it for individual employees on an individual basis, reflecting the conditions of the appointment in a special Regulation, collective agreement or other local act, such payment will be a personal bonus .

The right to assign such payments by the employer is granted by Art. 135 Labor Code of the Russian Federation.

Reflection on the payslip

The bonus is considered part of the basic salary and is paid directly for work. This feature obliges the employer to display a separate column in the statement and indicate how much they pay for hazardous conditions - the amount of compensation payments for hazardous working conditions.

The need for taxation

Additional payment is accrued to workers in accordance with Art. 146 and 147. It is indicated on the receipt, and the amount is taken into account when calculating personal income tax in the manner approved by law.

Nuances of personal income tax taxation

If there is a need to establish additional compensation for harm at work in a collective agreement adopted by the organization, or by local regulations, then it can exempt such compensation from deducting personal income tax; it is necessary to confirm the compensatory nature. If supporting documentation is not available, then the additional payment is subject to mandatory personal income tax deduction.

The nuances of compensation for moral damage

According to the letter of the Federal Tax Service No. GD-4-11/4238 dated March 05, 2021, all types of increased fees based on compensation for damage for injury or deterioration of health are not subject to personal income tax. In case of moral damage, the court obliges the offender to pay compensation. Its size is determined by the nature of the moral or physical injuries caused, as well as the degree of guilt of the offender, taking into account reasonableness and fairness.

The feasibility of assigning personal allowances

In what cases may an employer need a personal allowance mechanism? When might it be necessary to make remuneration special for a specific employee or group of employees? The following options are possible:

- the employer wants to highlight the successes of a particular employee;

- there is a desire to reward an employee for having outstanding or unique knowledge and skills;

- It is undesirable to change the existing system of rates and salaries, but at the same time there is a need for additional incentives for workers.

Question: When calculating vacation pay, should I take into account the bonus paid to the employee by March 8, the personal bonus to the salary and the one-time charge for mentoring? View answer

Possible mistakes

Let's look at possible errors using the northern surcharge as an example. If the “Northern surcharge” is not calculated, you should check:

- Is the length of service completed in the employee’s card?

- Is the type of accrual we use (for example, “Payment by salary”, “Payment by salary (hourly)”) included in the calculation base of the accrual “Northern allowance”;

- The presence of duplicate accruals included in the calculation base (one is included, and the employee is assigned another);

- Presence of duplicate “Northern surcharge” accruals or indicators involved in the calculation;

- If there are separate divisions, assigning territorial conditions both to the organization as a whole and specifically to each division.

We will help you set up the correct calculation of allowances in 1C:ZUP. The first consultation is free!

Different types of personal allowances

The type of allowance can be determined by various factors:

- Basis for accrual - the employer has the right to assign a personal allowance:

- for experience;

- for skill level;

- for a certain intensity of work;

- for professional excellence;

- for performing tasks of special importance and/or urgency;

- for “bonus” skills and abilities, for example, knowledge of a foreign language;

- for an academic degree in a specialized field;

- for work under conditions of official secrecy, etc.

- Duration of validity of the provisions on the allowance - these payments can be established either permanently or temporarily:

- for a month;

- per quarter;

- for a year;

- indefinitely.

- The amount of the premium can be determined in different ways:

- a fixed amount is fixed in local documents;

- the amount of the bonus is calculated in a certain way, for example, as a percentage of the salary or average salary;

- determination of the size by the labor participation rate: the monthly amount allocated for allowances will be distributed differently within the group of workers.

NOTE! Despite the fact that the amount for personal allowances is not limited by law, they should not be set in an amount exceeding the monthly salary. Large premiums are difficult to justify in court in the event of any disputes; there is a high probability that they will be recognized as part of mandatory payments. Practice shows that the maximum amount of a personal bonus should not be more than 50% of the salary, and the optimal amount is 10-20%.

Liability for non-payment

If a person does not receive the required compensation, the organization bears responsibility for this. In this case, employees have the right to refuse to stay in the “harmful” zone as social protection. Such actions can be taken after 15 days of delay and before payment. Employees also have the right not to come to work, having previously notified the employer of the reasons. However, it is important for employees to familiarize themselves with the list of professions when it is unacceptable to suspend the company’s activities, as described in Art. 142.

The organization is also involved in:

- To financial liability and pays the entire amount for the period, taking into account the percentage of additional payment for harmful working conditions for each day of delay based on the Central Bank rate. The company can also set an increased size - the main thing is not to reduce the minimum value.

- To administrative liability with a warning or a fine.

- In rare cases, criminal liability is possible for a manager in the form of financial sanctions and a ban on performing official duties, assignment of correctional labor or imprisonment.

Who gets a personal allowance and who doesn’t?

Additional personal benefits can be assigned to any full-time employee of the organization, since they are added to his salary, often calculated as a percentage of his salary. At the same time, the registration of an employee on the staff does not have much significance; the following may qualify for a personal allowance:

- an employee who has entered into a regular employment contract;

- "conscript";

- part-time worker.

It is not customary to assign personal bonus payments to the following categories of workers:

- freelancers;

- workers working under a contract;

- who have concluded civil contracts.

Types of compensation measures

Among those workers who have the right to monetary compensation for harmful working conditions, other types of stimulation are also being considered.

Allowances

Additional payments are calculated monthly, and the amount is calculated from the base salary. In this case, the information is displayed in the payslip, since they are an addition to the salary.

Vacation

The beginning of vacation days is displayed in the schedule. However, to determine the number of days earned, the time of actual stay in the zone is taken into account. This is how the number of hours worked is calculated for each person. If the total number of days in the danger zone is less than the monthly average, the month is excluded from the calculation.

Shortening the working week

Hours are recorded through the Timesheet. It must reflect the abbreviation using the code "21" or "LC".

Registration of a personal allowance

IMPORTANT! A sample order for establishing a personal allowance from ConsultantPlus is available here

The employer is not obliged to include the terms of the personal bonus in the employment contract, since this is an incentive payment. But since this is still part of the remuneration, it must be documented.

To do this, you need to regulate the personal bonus in a collective agreement or in the Regulations on remuneration and be sure to refer to this document in the text of the employment agreement (Article 57 of the Labor Code of the Russian Federation).

IMPORTANT! If the employer does not include provisions on the bonus in local documents, paying it without registration, he is not threatened with legislative liability. The only thing that can serve as a disadvantage for the employer in such a situation is that unreasonable payments cannot be attributed to expenses that reduce the tax base.

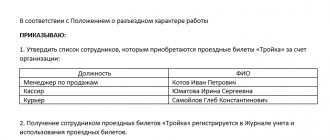

Petition and order for personal allowance

How else can you arrange the payment of a personal allowance, if not through a separate document? This may be necessary when the nature of the payments is not systematic, but one-time or calculated for a certain period. In this case, it is advisable to draw up a memo (petition) from immediate management to a higher one who has the authority to assign a bonus. This could be the general director, financial director, head of the personnel department, chief accountant, etc. In the text of the note, in addition to the mandatory details of business documents, you should indicate:

- arguments justifying the assignment of a bonus to a specific employee or their group;

- the expected amount of additional payment;

- at what expense is the premium supposed to be assigned (for example, from the wage fund or by increasing profits from sales, etc.);

- validity period of additional payments.

ATTENTION! It is not customary to formalize permanent allowances using memos. After the expiration of the specified period, you can again apply for a supplement. With this kind of document you can request the appointment, increase, decrease, extension or cancellation of a personal payment.

The compiled memo, signed by management, will become the basis for preparing an order for the calculation of the allowance. The execution of this order can be in any form. It is important to correctly motivate the appointment of additional payments, since their feasibility from a production or economic point of view is a guarantee that these costs are included in the cost of production, which is very strictly checked by tax authorities.

After issuing an order to assign an allowance, the employee must be familiar with it, which is confirmed by a personal visa (this procedure is common for any orders).

Additional payments and allowances for overtime work

If an employee was forced to stay overtime, this is a chance for him to earn more. In accordance with Article 152 of the Labor Code of the Russian Federation, for the first two hours he will receive one and a half times more than for two hours within working hours. And if he works even longer, he will be paid double for the next hours.

Let’s assume that engineer Pavlov works under a contract from 8:00 to 17:00 (minus 60 minutes for lunch) with an hourly rate of 300 rubles. Due to production needs, he had to stay in the workshop until 22:00.

Let's calculate his earnings for this day.

For standard eight hours, Pavlov will receive 300 × 8 = 2400 rubles.

Over the next two hours, his income will be 300 × 1.5 × 2 = 900 rubles.

The remaining three hours will cost the employer 300 × 2 × 3 = 1800 rubles.

The total daily salary of an engineer is 5,100 rubles.

If all 13 hours were within the working time range, Pavlov would have received only 3,900 rubles.

Important nuances of personal increases

It is important to regulate all financial issues correctly and take into account all legislative subtleties. When assigning personal increases, the employer must take into account certain circumstances:

- A correctly executed personal allowance in accounting is treated as “labor expenses”.

- The bonus is calculated simultaneously with the salary.

- This payment is included in the calculation of average earnings necessary for calculating, for example, vacation pay (Resolution of the Government of the Russian Federation No. 922 of December 24, 2007, as amended on October 15, 2014).

- If the deadline specified in the bonus regulations is violated, when the payment is unreasonably and unexpectedly terminated earlier for the employee, the employee has the right to demand additional accrual of the bonus and payment of late fees.

- If the head of a structural unit does not send a memo on time, personal payments will be stopped, because this document is the basis for issuing an order to accrue funds.

- If an employee receiving a personal allowance is transferred to another position, the right to the allowance is not retained unless it is provided for by the provisions of the new position.

- A change in the leadership of an organization may lead to changes in the provisions on personal allowances.

- A personal allowance must be reflected in the staffing table, indicating the numbers of orders for its accrual.

What is the surcharge for harmfulness calculated according to the Labor Code of the Russian Federation?

After an expert assessment of the SOUT, specialists determine the class. If a deviation from standard indicators is detected, the employer is obliged to provide benefits. In case of refusal to provide them, the managing person will be subject to punishment under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

When determining class 3 or 4, the following are provided:

- increasing payment to salary;

- days of paid additional leave;

- shortening the week.

No compensation was previously paid

Compensatory measures are not intended if conditions are within normal limits. However, in the course of carrying out the special assessment, inappropriate factors may be identified that increase the class. In this situation, it is necessary to establish an appropriate additional payment, as well as increase annual leave.

Repeated (regular) bonuses

During the routine certification of workplaces for employees and positions, the commission may make 1 of 2 decisions:

- confirmation of the hazard class, which obliges the employer to continue providing increased salary in the previously determined volume;

- reduction of compensation or its complete cancellation (when installing new equipment or reconstructing premises).

Reducing the measures provided while maintaining or deteriorating the parameters of the working environment is unacceptable. Also, if managers previously shied away from responsibilities, this does not deprive them of the right to receive it at the current time.