Joint property of spouses as a regime of joint property

The law establishes that property acquired by spouses during marriage is their joint property. The joint ownership of the spouses may include any property that has not been withdrawn from circulation. The property of spouses may include not only things that have not been withdrawn from circulation, but also rights. Thus, it is necessary to understand the term “any property” used by the legislator. It should be noted that the law classifies only things and rights, but not obligations, as joint property of spouses - this follows from the meaning of the norm provided for in paragraph 2 of Art. 34 RF IC. Things withdrawn from circulation are things the alienation of which is not permitted by law. Property withdrawn from circulation cannot be jointly owned by spouses.

What is joint ownership

The concept of joint ownership is given in Art. 244 of the Civil Code of the Russian Federation, according to which joint property is common property without defining shares. A participant in joint ownership cannot alienate his share in the right of joint ownership of common property, for example, transfer or gift it to another person. To do this, he must first determine and allocate his share. The joint property of spouses is defined by law as property acquired by them during the period of marriage, meaning a marriage concluded in the manner prescribed by law in the registry office. Actual marital relations without their registration in the manner prescribed by law do not give rise to rights and obligations for the spouses in relation to each other and, accordingly, do not create the right of joint ownership of property for the spouses.

What is included in the joint property of spouses

The law defines property acquired during marriage and included in the joint property of spouses as: the income of each spouse from labor, entrepreneurial activity and the results of intellectual activity, pensions and benefits received by them, as well as other monetary payments that do not have a special purpose; movable and immovable things acquired at the expense of the common income of the spouses, securities, shares, deposits, shares in capital contributed to credit institutions or other commercial organizations, and any other property acquired by the spouses during the marriage, regardless of which spouse’s name it was purchased or in the name of whom or which of the spouses contributed funds.

Rights to joint property in case of invalidity of marriage

The rights of spouses to property acquired during marriage, as joint property, are canceled when the marriage is declared invalid. Things acquired during a marriage that was subsequently declared invalid are recognized either as the property of the spouse who acquired them, or as common shared property.

What if joint property is registered in the name of only one of the spouses?

Among the property of spouses, residential premises are of particular value. They are often purchased and registered in the name of only one spouse. However, the conclusion of a transaction and the fact of registering a house or apartment in the name of one spouse does not yet predetermine the ownership of this property. To establish ownership, it is necessary to clarify each time the time, grounds and sources of acquisition of property. If the premises are acquired by the spouses using common funds or the donation agreement is made in favor of both spouses, then their joint ownership of the residential premises arises. For property acquired during marriage and registered in the name of only one of the spouses, the term “title owner” exists.

Mandatory consent of the other spouse to enter into transactions with joint property

Transactions with real estate and other property that require notarization are made only with the notarized consent of the spouse not participating in the transaction, otherwise such transactions are subject to termination in court within a year from the moment when the spouse whose notarized consent was not received, learned or should have known about the completion of this transaction.

How to dispute

To prepare and carry out reliable transactions, you need to know not only the period of their contestability, but also the general rules and principles by which the court recognizes them as invalid.

We at Igumnov Group have never gravitated towards chewing on theory, so we will talk about methods of destroying and protecting transactions below directly using specific examples. We think this will be clearer than quoting laws and plenums here, which you are unlikely to be able to apply in a real situation (otherwise, what have you forgotten here?).

Next, we move directly to the strategy and tactics of protecting personal assets.

Disputes about joint property between spouses

Division of common property of spouses

The division of common property of spouses most often occurs as a result of divorce. Division is also necessary in the event of the death of a spouse, because only the property that was the property of the testator is inherited. The division of joint property can also be made during the marriage, including by the court, at the request of the spouse or at the request of his creditors. The reasons for division may also be the actual termination of family relationships, extravagance of one of the spouses and some others. Most often, spouses themselves decide on the division of joint property. In the event of a dispute, the issue is referred to the court.

Division of property along with divorce

If spouses want to resolve a dispute about the division of common property simultaneously with the divorce, the court finds out whether the dispute about the division of property of the spouses does not affect the rights of third parties, and determines the composition of the property to be divided, the shares due to the spouses, and specific items from the common property , which are allocated to each spouse based on their interests and the interests of the children. In cases where one of the spouses is transferred a share the value of which exceeds the share due to him, the other spouse may be awarded appropriate monetary or other compensation.

Which of the joint property of the spouses is not subject to division?

Property that is not subject to division includes property acquired by spouses before marriage, as well as personal property of spouses, which the law includes:

1) received by each of the spouses during marriage as a gift, by inheritance or through other gratuitous transactions;

2) personal items (clothing, shoes and others, with the exception of jewelry and other luxury items);

3) things acquired solely to meet the needs of minor children - these things are transferred to the spouse with whom the children live;

4) the court may classify as property acquired by each of the spouses and not subject to division, things and rights acquired by the spouses during the period of their separation upon termination of family relations.

These are cases of long-term separation of spouses, when in fact family relations between them are interrupted. These do not include cases of separation of spouses due to objective reasons: one of them is on a long business trip, studying, serving in the army, etc.

All other property acquired by the spouses during the marriage, including deposits made by one of the spouses in a bank or other credit institution, is the common property of the spouses and is subject to division in cases provided for by law. Contributions made by spouses at the expense of their common property in the name of their common minor children are considered to belong to these children and are not taken into account when dividing property. The issues of division and allocation of living space are now becoming of great importance. The division of a residential building owned by spouses under the right of joint ownership is most often made in kind, and since the house remains indivisible, it becomes the subject of their shared ownership.

How to use intact property (apartment, house) in respect of which a division has been made

The use of the premises is carried out by agreement of the spouses or by court decision. In cases where a residential premises is subject to division, the division of which is impossible (for example, a one-room apartment), the court has the right to determine the procedure for using the residential premises or the procedure for monetary or other compensation to one of the spouses. When dividing an unfinished house, the spouses’ ability to complete the construction of their part is taken into account, as well as the obligations under the loan received for the construction of the house.

Defense strategy

All protection of personal property comes down to two sequential tasks.

First. Find an asset custodian.

This can be any legal entity or individual that you either trust as yourself or can control. The main requirement for the Asset Custodian is that he himself should not be at risk. And this includes everyone who is actively running a business.

Finding an asset custodian is always the responsibility of the client; we do not do this. An exception is if we are talking about creating offshore/trust structures and the client is ready to pay several tens of thousands of dollars annually for their maintenance.

Second. Transfer your property to the Custodian.

There are a million options for re-registration of property. And all of them can be laid out on a line, where at point 1 there will be the most reliable and impeccable deal that meets the highest requirements of creditors, and at point 2 there will be a dummy deal that will burst with a slight pressure.

What determines the reliability of a transaction?

Looking at the graph, it’s easy to guess the answer - depending on the availability of resources to complete it. Here and below, by resources I will mean a combination of 3 factors:

- Availability of funds or the ability to obtain them for the required period.

- The amount of time until a judicial act on collection from an individual debtor enters into legal force.

- Willingness to waste your nerves and/or depart from the usual order of things.

Time/money are two key issues. Or trustees turn when there is no longer time to use a reliable tool. Or when there is no longer money to implement it. Considering that transactions can be challenged both 10 years and 3 years before bankruptcy - depending on the basis - it becomes clear that time is a very scarce resource. I'll show you with an example how it works:

Point No. 1 on the chart is a property purchase and sale transaction. This deal is 100% undeniable if 3 conditions are met simultaneously:

- The property is transferred to a non-affiliated person whom you see for the first and last time.

- The transaction is carried out at the market price (not at the cadastral price, not at the residual price, or at any other price - namely, at the market price!)

- The money for the transaction was received in full by bank transfer.

Here are the resources you will need to complete such a transaction:

- Time: the property should not be under arrest or interim measures, i.e. the deal is done in advance. And it is very desirable that the debtor does not have overdue obligations and lawsuits to collect them.

- Money: for running / paying taxes / renting a new home, etc.

- Nerves/personal comfort: you need to live somewhere, get discharged somewhere, register your children somewhere and solve a bunch of other organizational issues, etc.

If the client is ready for such expenses, then the deal will be ideal. If there are no resources to undertake the feat, you will have to move down the curve: compensating mechanisms will be developed that will reduce the level of costs. The negative consequence would be a shift to slightly riskier policies.

An example of how this works can be found in the article “Can a purchase and sale agreement be challenged?”

Point 2 is the most fragile deal option. In practice, this is a gift transaction: it is done when there are no resources: neither time (here, they will arrest you), nor money, and therefore is easily disputed for at least 3 years:

- The default gift is made in favor of an affiliated person (or do you seriously expect that the court will believe that you could have donated property to a stranger off the street?)

- At its core, this is a gratuitous transaction, which means it was made on non-market conditions, which means it deliberately causes damage to creditors.

- The law requires, of course, to prove a third circumstance - that the transaction was made when the individual had signs of insolvency. In fact, the courts turn a blind eye to this or take formal signs from the category: “the debt has not yet existed, but the debtor, having the proper qualifications and competence, could have foreseen its occurrence.”

All other options - no matter how you want them - will be on the curve between points 1 and 2.

Those that are more energy-consuming will be more reliable, others will be riskier. But in fact, both of them have the right to life.

For example, in our practice there was a case when we were able to defend transactions for donating apartments to children. There is nothing special to boast about, since all the courts were won only thanks to the creditor - he did not hire professional bankruptcy lawyers and preferred to gain personal experience in debt collection. As a result, he merged all the courts and gave up his last chances to reach the debtor’s property. And if there were no donation transactions, the apartments would have gone off the market long ago. You can read more about gift transactions as a tool for protecting personal assets in the article “How to challenge a gift agreement.”

Production cooperative

Complexity: 5/5

Price:

- state duty for legal registration. persons - 4000 rubles

- legal services for document preparation - from 0 to infinity.

- annual expenses for maintaining the organization

What you will need: Vasya and at least 4 more people. There may be family, friends or strangers. But it’s better with friends - it’s calmer.

How it’s done: Vasya finds a circle of like-minded people, at least 4 more people. These five form a production cooperative, to which everyone must contribute - some with property, some with labor - the so-called shares.

Moreover, the core of this idea is an indivisible fund into which personal property can be contributed. The strength of this fund is that it cannot be levied against the participant’s personal debts, be they credit debts or subsidies. At the same time, if the PC itself has its own debts, then the property from the indivisible fund will have to say goodbye.

Opinion: Yes, the indivisible fund cannot be levied against the debts of our Vasily, but do not forget that creditors can challenge the very transaction of transferring the property of an individual to this very fund. Therefore, the key resource for its competent implementation is a reserve of time and high-quality elaboration of small details.

In addition, it is advisable for a production cooperative to conduct at least some activity. Otherwise, questions may arise for him.

Well, here’s the cherry: having contributed property to an indivisible fund, you cannot take it away from there whenever you want. Only in case of liquidation of the PC.

Read more about the production cooperative here.

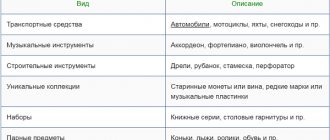

Collections

Collection of property during the period of divorce and division of property represents equivalent monetary compensation to organize equal distribution of property. In legal practice, this approach is often the only way to protect the interests of the parties, since it is impossible to divide some property into two equal shares. Also, such a legal approach often becomes an instrument of voluntary agreement on the peaceful resolution of disputes.

Legislatively, the collection of financial compensation is regulated only in one case, if it is impossible to divide the material possession in half, since the cost of the individual parts may turn out to be unequal.

Pledge agreement

Complexity: 3/5

Preparation cost:

- a bunch of different government duties and rates depending on the type of property, transaction and with whom the contract is concluded. See the table in the article on the topic.

What you will need: Vasya, collateral and lender

How it’s done: Vasya invites his friend Petya to give him money as collateral for the mansion. Considering that we are talking about real estate, a visit to Rosreestr will be required to register the transaction. So, Petya gives money, Vasya gives a mansion. As expected, Vasya stops paying and the deposit goes to Petya. But if everything was so simple, they would live on pledges alone.

If Vasya goes bankrupt, his creditor will need to be included in the register in order to retain the priority right to the pledge. If it does not turn on, you will have to say goodbye to the collateral in favor of other creditors.

Moreover, if the loan amount and interest are lower than the value of the collateral, then after selling the property, the money will go first to a friendly lender, and then will be distributed to other people in need. The defense will be so-so

Opinion: With the help of collateral, you can not only protect property, but also directly participate in bankruptcy. But there is also a downside.

A lopsided pledge with the wrong creditor, property and a dubious transaction amount is a good chance for the pledge agreement to be declared invalid, followed by removal from the register of creditors and loss of the pledged item.

If you need an example, leave your e-mail and we will send you a case law on the application of a pledge agreement:

Read more about collateral transactions here.

Alimony agreement

Complexity: 3/5

Cost: state fee for notarization - 1000 rubles

With whom is it concluded: with the parent or guardian of the child, or family members who are legally entitled to payments. But more often the option with children is used.

How it’s done: Vasya has children who are entitled to alimony. These could be children from a first marriage or in the current one.

Vasya remembered that he had never really bothered with child support, and so he decided to fulfill his parental duty. So, alimony can be paid monthly to a special account, or you can do better - calculate the alimony that is due to children under 18 years of age and pay this entire amount at once. Or give property commensurate to the payments to pay child support. For example, the same mansion. There is a tidy sum, and the children are provided with housing - everyone will be happy.

If there are no children, you can think about relatives who are entitled to payments. But here it is more complicated, because relatives must fall under certain criteria by law. Also, the payment period for them is not defined, which may also raise questions. In general, this is a case where you need to exploit children or your retired parents, especially if the law allows it.

Opinion: From the point of view of protecting assets between close people, this is one of the most reliable methods, provided that it is properly justified and executed, of course. Judge for yourself:

- it is necessary to conclude with family members, i.e. there is no need to go into someone else’s garden and look for strange people;

- Alimony can be both cash and property;

- If alimony has not yet been assigned, you can enter the register of creditors with a demand for payment. Or even file for bankruptcy of the debtor. At the same time, you will be in the first league of creditors.

But don’t rush to write everything off for your children; there is a downside. Despite the universal love for loved ones, it will not be possible to give them all your property. The courts have practice in reducing the amount of alimony based on the ratio of income level to the amount of payments, as well as the average cost of living per child in a specified region or country.

If you need an example, leave your e-mail in the form below.

Also, if Vasya officially has an income of 20,000 rubles, and he assigned alimony in the amount of 200,000 rubles or completely relinquished the mansion, the question arises: where does the money come from?

Read more about the alimony agreement here.