How to pay overtime at night

Additional work at night must be paid both as night time and as overtime.

The reason is that working in such conditions is abnormal work, which must be compensated separately, additionally. The amount of additional payments can be established by local acts of the employer (collective agreement, regulations on remuneration and others), but the values fixed in them should not be lower than those established at the legislative level.

invites you to a free webinar about upcoming reporting: we’ll tell you everything and show you with clear examples. Sign up, we'll meet on October 11th.

Overtime pay

Art. 152 of the Labor Code of the Russian Federation obliges the employer to pay overtime according to the following scheme:

- the first 2 hours of processing - one and a half times the amount;

- the third and subsequent ones are doubled.

That is, the cost of an hour of work for an employee remaining after the end of the shift is multiplied by 1.5 for the first two hours of overtime, and then by 2.

Payment for night

Decree of the Government of the Russian Federation dated July 22, 2008 No. 554 established that the minimum additional payment for night work should be 20% of the hourly tariff rate.

For salaried employees, this is the amount obtained by dividing the salary by the monthly time standard according to the production calendar. Night time is considered to be the period from 22:00 to 6:00. If the shift ends at 20:00, then overtime for three hours after its end will include 1 night hour (from 22:00 to 23:00). And a person working from 9 to 18 hours who remains to work overtime must work at least 5 hours to fall into the night-time range. And this is strictly prohibited by law. The employer is allowed to involve staff in overtime for no more than 4 hours over two consecutive days.

Having calculated additional payments for overtime and night work, pay the employee in full in total, so as not to become one of the labor law violators. Incomplete payment of wages is punishable by a fine in accordance with clause 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Let's look at the example of calculating wages for overtime work at night.

Example

The official salary of accountant L.P. Petrova is 80,000 rubles, the working hours are five days a week from 10 a.m. to 7 p.m. with one hour for a lunch break. During the reporting period on July 19, 2021, she was assigned to work after the end of her daily shift for 4 hours until 11 p.m.

Calculation:

The standard time in July 2021 for a 40-hour work week is 176 hours. Therefore, an hour of work by Petrova L.P. under normal conditions is 454.55 rubles. (RUB 80,000 / 176 hours).

Additional payment for overtime work (4 hours) = 454.55 * 1.5 * 2,454.55 * 2 * 2 = 3,181.85 rubles.

Additional payment for night work (1 hour) = 454.55 * 20% = 90.91 rubles.

Salary of Petrova L.P. for July 2021 will be:

- salary - 80,000 rubles;

- additional payment for RMS - 3,181.85 rubles;

- surcharge for night time - 90.91 rubles.

Total - 83,272.76 rubles.

Additional pay for working on weekends and non-working holidays

According to Art. 153 of the Labor Code , work on such days must be paid at least double the amount, or single if an additional day off is provided.

If an employee works according to the regular production calendar, then everything is clear, because he usually does not work on Saturday, Sunday and non-working holidays. If an employer wants an employee to come to work, for example, on Saturday, he must issue an order, and the employee must sign and agree to work on a day off. In this case, the director must either pay double for work on Saturday, or single, but give a day off, say, on Monday next week.

When working on a shift schedule, everything is somewhat more complicated, because such workers have weekends and working days that do not coincide with the generally accepted ones. In this case, work on Saturday and Sunday is not paid additionally if they are considered working hours according to the employee’s schedule.

Payment looks different on generally accepted holidays, which are established by Article 112 of the Labor Code. If the employee’s schedule is designed so that the working day falls on such a holiday, then he must be paid double.

Let's sum it up

- Night overtime hours are paid both as overtime and as extra pay for night time.

- Both one and the other compensation payment are calculated based on the cost of an employee’s working hour.

- The amount of additional payments cannot fall below the values established by the state. The employer has the right to pay more. This must be enshrined in the company’s local regulations.

- If you are forced to regularly leave an employee on overtime, arrange an internal part-time job for him. This will help avoid unnecessary questions from regulatory authorities.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Standard hours for a shift work schedule, summarized recording of working hours

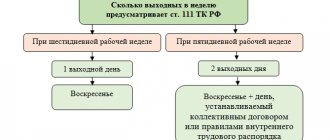

Labor legislation regulates the normal length of the working week - no more than 40 hours in the general case. A shortened week and a shorter duration of daily work are established by the Labor Code of the Russian Federation for certain groups of workers due to their age, health status, training, as well as employment at work with harmful or dangerous working conditions (Articles 92, 94 of the Labor Code of the Russian Federation). These standards are generally applicable, including for shift work.

As for harmful and dangerous working conditions, see the article “Dangerous and harmful production factors (list)” .

However, employers who practice shift work often find it difficult to adhere to the principle of a normal working week of no more than 40 hours. This is due to the specifics of the production process. In this case, Art. 94 of the Labor Code of the Russian Federation allows the employer to use summarized recording of working time.

Receive step-by-step instructions for introducing summarized working time tracking at your enterprise by signing up for a free trial access to the ConsultantPlus system.

When calculating hours worked, the base period is taken to be a month, quarter or year. This period for calculating the number of working hours is called accounting. The time spent by the employee on performing work duties in the accounting period should not exceed the normal number of hours of the working week, a multiple of the number of weeks.

Consequently, when using summarized working time tracking, 1 individual shift may differ in duration both up and down. But in general, the number of hours worked for the period of time accepted as an accounting period should not be more than established for this period, provided that the work hours are normal.

For the form for recording working time and the procedure for filling it out, see the article “Working time sheet - form T-13 (form)” .

The Labor Code of the Russian Federation limits the duration of the accounting period: it cannot be more than 1 year. The use of summarized working time recording affects the fundamental rights of the employee - to work and rest. That is why it must be formalized by a separate local legal act of the employer or a regulation on internal regulations.

Increased surcharges

Increased amounts of additional payments for night work can be established in industry agreements. For commercial organizations, such agreements are mandatory only if they join them (Article 48 of the Labor Code of the Russian Federation). For example, according to the industry agreement for employees working in the oil and gas industry, additional payments for night shift work should be 40 percent of the hourly rate or salary (clause 3.6 of the Industry Agreement dated December 13, 2013). This agreement is binding only for those organizations that have joined it (clause 1.3 of the Industry Agreement dated December 13, 2013). At the same time, organizations in the oil and gas industry are considered to have acceded to the agreement if, within 30 calendar days from the date of official publication of the relevant proposal, they have not sent a reasoned refusal to accede to the agreement to the Ministry of Labor of Russia (letter of the Ministry of Health and Social Development of Russia dated March 29, 2011 No. 22-5/10/ 2-3015).

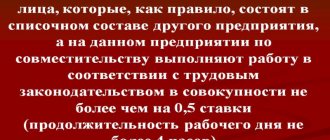

Who cannot be involved in night work

It is prohibited to engage in night work (Article 96 of the Labor Code of the Russian Federation):

- pregnant women;

- minor citizens (those under 18 years of age).

This prohibition does not apply to citizens participating in the creation and performance of artistic works and to employees specified in the Labor Code of the Russian Federation and other federal laws.

Some employees may be required to work night work only with their written consent and notification that they have the right to refuse such a work schedule. These include, in particular:

- women with children under 3 years of age;

- disabled people;

- employees with disabled children;

- workers caring for sick family members (based on a medical report);

- single parents and guardians raising children under 5 years of age.

These employees can be involved in night work only if it is not prohibited for medical reasons.

Minimum and increased rates for night work

According to Article 154 of the Labor Code of the Russian Federation, the amount of bonuses for night work must be indicated in internal documents, the provisions of which “work” in the organization. The legislation sets the minimum markup level at 20% of the hourly rate, but there are other “minimum” rates: 35% and 50% (see table).

Table “Amount of bonus for night work”:

| Area of work of employees | Supplement amount (to the hourly rate) | Regulatory documents giving this right to the amount of the premium |

| Healthcare | 50% (increased tariff) | Clause 1 of Article 5 of the order of the Ministry of Health of the Russian Federation “On approval of the Regulations...” dated October 15, 1999 No. 377, Letter of Rostrud dated October 28, 09 No. 3201 |

| Paramilitary/fire/guard security | 35% (increased tariff) | Resolution of the USSR State Labor Committee “On remuneration...” dated August 6, 1990 No. 313/14-9, Letter of Rostrud dated October 28, 09 No. 3201 |

| Criminal correctional system (regardless of position - rank and file or management) | 35% (increased tariff) | Part 3 of the order of the Ministry of Justice of the Russian Federation “On approval of the Instructions...” dated April 16, 2000 No. 155, Letter of Rostrud dated October 28, 09 No. 3201 |

| Ambulance and emergency workers | 100% | Letter of Rostrud dated October 28, 09 No. 3201 |

| Regardless of the field of work | Not less than 20% | Decree of the Government of the Russian Federation “On the minimum wage” dated July 22, 2008 No. 554 |

Advantages and disadvantages

When getting a job, everyone chooses a convenient schedule, salary, etc. Sometimes even the work schedule becomes an advantage when choosing a vacancy. The so-called night work may be to your liking. Let's look at the main pros and cons.

Pros:

- Receiving increased wages;

- A free day to devote to other things;

- Not such strict control on the part of the employer.

Minuses:

- A disrupted sleep schedule can cause health problems that are difficult to compensate for with additional pay;

- Differences in the work schedules of all family members can cause various family problems;

- Heavy nights nullify the “weekend” days (accumulated fatigue makes itself felt during the day).

Of course, this is not a complete list of pros and cons. Depending on the activity performed, the number of pros and cons may vary.

Operating mode

The work schedule in which the hired employee will work is specified in advance in the employment agreement (contract). It is especially important to stipulate the shift schedule for those employees whose work schedule differs significantly from the schedule of the rest of the organization’s employees. The procedure for paying for night hours during a shift schedule must also be formalized in the contract.

Shift work assumes that some part of it, one way or another, will occur at night. Naturally, the pay for such shift work is an order of magnitude higher than for daily work. But the contract must indicate exactly what time will be considered night. According to the Labor Code of Russia, the duration of the night shift should be reduced by 1 hour (no further work required).

Question answer

Question No. 1. The watchman works for a company in the housing and communal services sector, which has joined the industry agreement. It provides for a larger percentage of additional payment in relation to the normative one. Can he count on receiving it?

Yes maybe. Thus, the surcharge according to the federal standard is 35%, and according to the industry standard it is 40%. The employer is obliged to adhere to the rate indicated in the industry document.

Question No. 2. Does the bonus for night work depend on working time standards?

No, it doesn't depend. Additional payment must be accrued to all employees, without exception, part of whose daily activities relate to the time period from 22 to 6 hours. At the same time, it does not matter whether they work during hours that fit into working standards or are outside them. It also does not matter whether the employee performs the actions prescribed in the employment agreement or not.

Question No. 3. Is compensation due in case of night work under a civil contract?

No, if employment was formalized by a civil contract, then the labor law norms on night supplements do not apply to such an employee.

Question No. 4. If night work is overtime, plus it coincides with weekends or holidays, what allowances are due?

When all three of these grounds are combined, the employee enjoys the right to additional payment for each of them.

What is meant by increased pay?

The current labor legislation provides for a separate classification of additional payments. According to this division, increased wages for work at night belong to a special category of additional payments provided for work in special conditions and conditions that differ from normal ones.

The Code sets out the requirement that such increased payment is subject to each working hour in which the employee performed the labor functions assigned to him as part of a work shift.

At the same time, it is also possible to calculate other preferential payment options, for example, payment for night shifts. Legislative acts, thanks to which the manager has the right to choose another available preferential option for increased pay, can be a collective agreement, a local regulation or an employment contract.