General approach

The legal relations that arise between the claimant, the debtor and the bank during the execution of the enforcement document by the bank are subject to the provisions of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as the Law on Enforcement Proceedings).

Part 1 of Art. 8, parts 5 and 7 art. 70 of the Law on Enforcement Proceedings establishes the possibility of sending a writ of execution for the collection of funds directly by the collector to the bank that services the debtor’s accounts.

If the debtor receives funds in respect of which Art. 99 of the Law establishes restrictions and/or which, in accordance with Art. 101 of the Law, foreclosure cannot be made; the bank servicing these accounts calculates the amount that can be foreclosed on, taking into account the requirements.

The procedure for calculating the amount of funds in the account that can be foreclosed on or seized, taking into account the requirements of Art. 99 and 101 of the Law on Enforcement Proceedings was approved by Order of the Ministry of Justice dated December 27, 2019 No. 330.

Disputes arising between the claimant, the debtor and the bank during the execution of the writ of execution by the bank are considered by the courts in the manner of civil and administrative proceedings.

Let us note that in the review under consideration, the RF Supreme Court does not provide details of specific court decisions.

Termination of office work due to statute of limitations

| Document | Maximum term |

| Performance list | 3 years |

| Court order | 3 years |

| CTS certificate (commission on labor disputes) | 3 months |

| Alimony and other penalties with monthly payments (acts) | The entire duration of the payment (for alimony - until the child reaches adulthood) |

| Resolution on an administrative offense | 2 years |

Presentation of the writ of execution to the bank

| TOPIC/SITUATION | POSITION OF THE COURT |

| Deadline for submitting the writ of execution to the bank | A writ of execution can be presented to the bank for execution within 3 years from the date the judicial act enters into legal force |

| Duration of the period for presenting the document for execution | The bank that received the writ of execution for execution checks the claimant’s compliance with the deadline for presenting it for execution, taking into account the provisions on the interruption of such deadline |

| When filing a document for execution is not overdue | The bank cannot accept a writ of execution for execution if the deadline for its presentation for execution has expired. The exception is when such a period is restored by the court. |

| Features of acceptance for execution of an electronic writ of execution | The Bank has the right to accept for execution an electronic executive document signed with an electronic signature only after checking the validity of such a signature in the manner prescribed by law |

| The bank requires additional documents | Return of the writ of execution in connection with the bank’s demand from the claimant for documents and information not established by Part 2 of Art. 8 of the Law on Enforcement Proceedings, is unreasonable and entails the bank’s liability with a court fine (Part 1 of Article 332 of the Arbitration Procedure Code of the Russian Federation). |

Specific rules

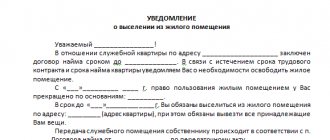

The period during which the writ of execution is presented to the citizen coincides with the payment periods. This applies to situations where amounts are collected on a monthly basis. This rule applies to alimony and compensation payments for personal injury.

Once the payment deadline has expired, the period for presenting the slip is extended. Additionally, there are three more years after the end of the allotted time for payment.

The rule applies to alimony agreements. It is important that the document be notarized.

Federal Law No. 229 introduced a special procedure, according to which legal relations are of a continuing nature. The deadline for submitting a sheet to begin collecting periodic payments also has some features. The beginning of the period is determined for each payment individually.

Execution by the bank of the writ of execution

| TOPIC/SITUATION | POSITION OF THE COURT |

| Start of execution of the document by the bank | Immediate execution of the requirements of the writ of execution means that such execution must begin no later than the first working day after the day the writ of execution is received by the bank. |

| Write-off from one account, as indicated in the claimant’s application, although there are more accounts | Indication in the claimant's application of one current account of the debtor in the absence of information about other accounts does not prevent the debiting of funds from other accounts of the debtor that are not protected by executive immunity. |

| Write-off by the bank by crediting the account, although the debtor did not have the consent of the latter | In the absence of the will (consent) of the debtor to receive a loan, crediting an account for which an overdraft is allowed for the purpose of executing a writ of execution is unlawful |

| Who should calculate the penalty - the bank or the creditor? | The bank, empowered to enforce the requirements of the writ of execution, is obliged to calculate the amount of the penalty awarded for the future |

| Restrictions from the bank on money for which the law prohibits foreclosure | When executing the request of a writ of execution to seize the debtor's funds, the bank does not have the right to impose restrictions on the disposal of funds that, by virtue of law, cannot be seized |

| Debits from the account for major repairs | The bank's debiting from a special account opened for the formation of a capital repair fund of funds to pay for obligations not related to the major repairs of the common property of an apartment building is not permissible |

| Collection of salary debt during the surveillance procedure | During the monitoring procedure, the bank is obliged to accept for execution and execute a writ of execution issued on the basis of a judicial act on the collection of wage arrears from an insolvent debtor |

| Informing the bank about execution | In the process of executing a writ of execution, the bank is obliged, at the request of the claimant, to provide information:

|

Special cases

If the application deadline is missed, then it is worth remembering some actions. It is important to note that a citizen is given a fairly significant period to submit a writ of execution. Therefore, non-compliance with the rules must be due to valid reasons.

The law states that the court must confirm the objectivity of the impossibility of appeal. There are no clear grounds for making decisions in favor of the plaintiff in the law.

Significant circumstances include:

- absence from the city;

- long-term illness;

- being on a business trip.

The citizen is required to contact the judicial authority with an application to restore the deadline for presenting the sheet.

Compensation for losses from illegal actions (inaction) of the bank

| TOPIC/SITUATION | POSITION OF THE COURT |

| Poor execution of executive documents by the bank | Failure to fulfill or improper fulfillment by the bank servicing the debtor's accounts of the obligation to execute enforcement documents, including verification of their authenticity, may become the basis for compensation to the debtor and/or the collector for losses caused by such actions (inaction) |

| Bank withholding from salary more than required | Collection of losses from the bank in the amount of amounts transferred to the creditor in excess of the maximum permissible monthly deductions from the salary of the debtor-citizen is permissible provided that the bank knew and/or should have known:

|

| There are no funds in the account for collection | If there are no or insufficient funds in the debtor’s account, the bank places the writ of execution in the file cabinet, and if there is a corresponding application from the claimant, it returns the writ of execution without execution. In this case, there are no grounds for collecting damages. |

| The bank declares that the account is closed and refuses to fulfill | The bank's refusal to execute the writ of execution due to the termination of the bank account agreement with the debtor may be grounds for recovery of losses from the bank if at the time of such refusal the debtor's bank account is not closed. |

| Consequences of collection through child benefits | The bank's foreclosure on funds for which this is prohibited in Part 1 of Art. 101 of the Law on Enforcement Proceedings, including for child benefits is illegal. The debtor has the right to recover from the bank losses caused by such actions. |

How is the statute of limitations calculated?

The statute of limitations for IL is not indicated in the text of the document. However, the interested party must carefully ensure that all actions on the document are carried out in a timely manner.

The statute of limitations for IL is calculated from the moment the court decision is made, but it may expire earlier than the established time. For example, if the claimant did not hand over the documents to the bailiffs due to the conclusion of a peace agreement with the debtor, in the case of partial repayment of the debt on a voluntary basis or during debt restructuring.

If employees have received IL, but the debtor has no property and it is impossible to collect the obligation from him, the expiration of the statute of limitations is suspended.

Procedural issues

| TOPIC | POSITION OF THE COURT |

| Consequences of canceling a court order | The bank must return the court order to the collector when the bank receives information about its cancellation |

| What type of court to file against the bank | Jurisdiction of cases (courts of general jurisdiction or arbitration courts) challenging the actions (inaction) of a bank depends on which of these courts issued the writ of execution |

| Where to sue a bank office | An application for a challenge by a recoverer - an individual - to actions (inaction) of an internal structural unit of a bank (including an operational office) or its official is filed with the court of the district in which this unit operates. This position can be applied by analogy in arbitration courts |

Explanations on issues arising in judicial practice

| QUESTION | ANSWER |

| How is the 7-day period calculated (Part 6, Article 70 of the Law on Enforcement Proceedings), for which the bank has the right to delay the execution of the enforcement document? | The period for which the bank has the right to delay the execution of a writ of execution begins the next day after the date of actual receipt of such a document. However, the 7-day period does not include:

|

| Is a writ of execution subject to execution by the bank if the claimant requests its partial execution? | If the writ of execution provides for the recovery of funds in a larger amount than the applicant requests when applying to the bank with an application for collection under the writ of execution, the bank is obliged to fulfill within the limits of the requirements stated by the recoverer. |

| Is a writ of execution subject to execution by the bank in relation to a person who has changed his name (last name, first name, patronymic) after the adoption of a judicial act? What documents should be presented to the bank by the creditor or debtor? | If the claimant or debtor changes the name (last name, first name, patronymic), the bank is obliged to accept the writ of execution for execution if data confirming the fact of such a change is provided. This may be a certificate of change of name, marriage registration certificate, divorce certificate, etc. |

Moment of calculation

Particular attention is paid to the issue of establishing the date from which the period for presenting the writ of execution for production will be counted. The standards are reflected in several legislative acts. Thus, Article 428 of the Civil Procedure Code of the Russian Federation and Article 321 of the Arbitration Procedure Code of the Russian Federation indicate a certain determination procedure.

Article 428 of the Code of Civil Procedure of the Russian Federation. Issuance of a writ of execution by the court

Article 321 of the Arbitration Procedure Code of the Russian Federation. Deadlines for submitting a writ of execution for execution

Only after the decision is made, a citizen can receive in his hands:

- definition;

- solution;

- sentence.

The list of exceptions includes acts that must be implemented immediately. In this case, the writ of execution must be issued immediately after adoption.

If a person applies for an installment plan, deferment, or restoration of the deadline, the calculation begins from the moment the determination is approved.