Almost all of them have employees whose job responsibilities involve traveling around the city. Most often these are couriers and managers, however, they can also be lawyers and accountants.

Such employees purchase a travel ticket in advance or are reimbursed for travel expenses based on the documents submitted by the employees. However, employees often lose documents or forget to bring them on time. Even if all the documents are available, accounting and calculation of compensation for accounting is a rather labor-intensive process.

How to make it easier for employees to pay for travel

It is more convenient and profitable to buy travel tickets centrally and distribute them to employees.

Legal entities and individual entrepreneurs can buy travel passes for employees via the Internet by bank transfer through the Troika Business service (ORC LLC, agent of Mosgortrans). There will be no commission for this.

If you suddenly don’t know what “Troika” is. This is an electronic refillable plastic transport card of Moscow, which can be used to pay for travel on all public transport.

Do I need to collect Troika cards from employees in order to use the service?

No, it is enough to know the card number.

You can add tickets to your card immediately after paying the bill:

- through the Troika Business mobile application,

- in the terminals of the Moscow Credit Bank.

If employees do not have cards, they can be purchased through the service with delivery. For orders over 30,000 rubles, card delivery is free..

In general, you don’t need to travel anywhere; you can arrange everything through the website.

Costs subject to compensation and their documentary evidence

You can compensate:

- The cost of travel to the place of rest and back to the place of residence is in the amount of actual expenses, but in an amount not greater than the cost of travel to:

- compartment of a fast branded train;

cabin 5 of group sea vessel;

- cabin of the 2nd category of a river vessel;

- cabin of the 1st category of the ferry crossing;

- economy class air show;

- public road transport and buses (except taxis).

- The cost of travel by public transport (not taxi) to the train station, airport, pier or other place of departure. Confirmed with tickets.

- The cost of transporting baggage up to 30 kg for each member of the family, regardless of how much baggage is allowed on the ticket for free. Confirmed with baggage tickets.

- The cost of gasoline if the trip is carried out using a personal car. Confirmed by receipts from the gas station, but in an amount no greater than the cost of the trip calculated for the shortest route based on average fuel consumption. In this case, you will also need to confirm your presence at the vacation spot.

Spending is confirmed by tickets.

What documents will the accounting department receive when purchasing a travel pass through Troika Business?

1. Agreement (on request).

2. For delivery service, collateral value of cards and wallet service 1 rub.: invoices and waybill TORG 12.

The first copy of the invoice (the “ORC” copy) will be sent to the buyer’s email address at the time the order is transferred to the courier service. At the time of receiving the cards, you must hand over a copy of the invoice with a signature and seal to the courier.

The 2nd copy of the invoice (Buyer’s copy) with the signature and seal of ORC LLC is placed in the envelope with the cards.

3. To pay for travel tickets:

- Report on accepted payments,

- Register for the report on accepted payments.

Documents are generated after recording all travel tickets on Troika cards, paid for on one invoice.

You will be able to receive the originals both in paper and electronic form. To do this, you will need to send an email using the “Complete reporting documents” link, indicating your postal or email address. In addition, documents can be sent via EDF.

Other cases when the employer pays for the trip

The issue of transporting employees to and from work is not regulated by labor legislation, but many employers pay for travel for employees on their own initiative. And if such a clause is provided for in an employment or collective agreement, then, on the basis of clause 26 of Art. 270 of the Tax Code of the Russian Federation, the organization will have the right not to take these expenses into account when determining the taxable base for income tax. The employer most often delivers personnel using its own or rented transport, when the possibility of delivery by public transport is absent or difficult due to the remoteness of production or the peculiarities of the work schedule. But sometimes employees are simply paid monetary compensation for travel to and from work by public transport.

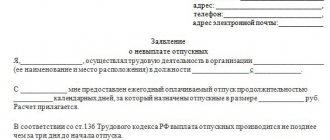

What documents to prepare to justify the need to pay for travel?

The condition regarding the traveling nature of the work is mandatory for inclusion in the employment contract (Part 2 of Article 57 of the Labor Code of the Russian Federation). But the procedure for paying for travel or compensation for it can be determined by a collective agreement or other local regulatory act, for example, a regulation on the traveling nature of work. These documents can be used to establish that the organization itself buys travel tickets and issues them to employees.

The list of employees for whom tickets are purchased is approved by order. For example, like this:

sample order in Word format.

Vacation travel compensation

Article 325 of the Labor Code of the Russian Federation gives the right to reimburse expenses for traveling on vacation not to all workers, but only to northerners. Public sector employees whose employers are located in the Far North and related regions can reimburse expenses for a trip to a vacation spot. According to the legislator, such citizens need a change in the climate situation, since they work in an unfavorable climate. Compensation for the cost of travel to and from a vacation spot is recognized as an incentive payment for these employees. It is made from federal budget funds. To exercise your right to such compensation, you need to comply with many rules and collect a large number of supporting documents. The rules for compensating expenses for vacation trips for workers in the North are enshrined in Article 325 of the Labor Code of the Russian Federation and government decree No. 455 dated June 12, 2008. Thus, travel and luggage transportation for state employees is compensated. bodies and institutions financed from the federal budget, and their family members. Family members mean dependents - an unemployed husband (wife) and children living together. The question of when an employee has the right to take advantage of the required compensation requires separate clarification. Article 325 of the Labor Code of the Russian Federation emphasizes that compensation payments are not cumulative and will expire if the employee does not receive them on time. So when is it necessary to receive the required compensation? It is important that you can compensate for travel costs for each annual vacation, but if you do not have time to do this within 2 years, the right to payment is lost. When going on his first paid vacation, an employee acquires the right to reimbursement of vacation expenses for the 1st and 2nd year of work at the enterprise. In the 3rd and 4th years of work, he can compensate for the expenses for the 3rd and 4th years, but not for the 1st and 2nd. Thus, the right to compensation is interrupted every two years. The right to compensation for travel expenses for relatives arises simultaneously with the same right for the employee. His vacation must coincide in time and place of stay with the vacation of the rest of the family members - only in this case will travel expenses be compensated for everyone. For example, it will not be possible to obtain compensation for the travel of one child to a summer camp, or, when going on vacation with a spouse to different places, to compensate for everyone’s travel. It is advisable to consider in more detail exactly what travel costs northerners can compensate for, and how to confirm their right to monetary compensation.

Accounting

Travel tickets are monetary documents and must be accounted for in account 50 subaccount 3 .

| Operation | Debit | Credit | Source documents |

| Payment for travel tickets has been transferred | 60 (76) | 51 | Bank statement, payment order |

| Travel tickets have been received and posted (only security deposit value) | 50.3 | 60 (76) | Universal transfer document |

| Cards issued to employees (deposit value) | 71 | 50.3 | Log book, card issuance sheet |

| Travel expenses | 60 (76) | 20 (44,26) | Report on accepted payments and register |

| Return of the card by an employee (for example, in case of dismissal) | 50.3 | 71 | Accounting journal, accounting certificate |

The right to compensation for travel expenses for non-budgetary workers

Having briefly familiarized yourself with the norms of Article 325 of the Labor Code of the Russian Federation, you might think that only those workers in the northern regions whose enterprises are financed from the budget can reimburse expenses for travel to a place of rest. However, this is not true. Article 325 of the Labor Code of the Russian Federation does not limit the opportunity to take advantage of this benefit for citizens who work in private enterprises. The last part of the article reports that other employers establish the conditions and procedure for such monetary compensation. contracts, local acts introduced taking into account the opinions of trade unions, and labor. contracts. “Other employers” here mean firms and enterprises that are not related to the public sector and are engaged in entrepreneurship and other economic activities in the territory of the Far North and those included in it. That is, all employers in the North are obliged to compensate for the costs of travel to and from the holiday destination for their employees, facilitating the movement of workers beyond the borders of the unfavorable climatic zone. When establishing the size and scope of such compensation, local acts of the company take into account the real financial capabilities of the organization. But the employer has no right to completely refuse compensation and unjustifiably underestimate it. The Constitutional Court of the Russian Federation interprets the norm of Part 8 of Article 325 of the Labor Code of the Russian Federation, obliging non-public sector employers to also reimburse their employees for travel, as follows. This is an opportunity to maintain a balance of interests between the parties. agreement, that is, the employee and the employer. The interests of the employee cannot be infringed, but the organization must have the economic basis and financial capacity to compensate the employee for the costs.

Answers to common questions about who is paid compensation for travel to the place of vacation

Question No. 1: If the child or spouse of an employee of the Far North, who does not have a job, takes a vacation separately from him, can they be compensated for travel?

Answer: No, travel reimbursement is provided only for shared trips.

Question No. 2: Can family members of an employee working at an enterprise in the Far North receive compensation for travel to the vacation destination if he and his spouse/children go to the same place at different times?

Answer: Yes, in this case the vacation is considered joint, and compensation will be paid to all family members.

Basic provisions

Every citizen of the Russian Federation employed on an official basis has the right to apply for annual leave of at least 28 days. But northerners are entitled to an extended vacation. So, in accordance with Art. 321 of the Labor Code of the Russian Federation, northerners have the right to claim an additional 24 days of vacation. People employed in areas equated to the regions of the Far North are additionally offered 16 days of paid leave.

The employer, at its discretion and the needs of its employees, can extend the vacation of northern subordinates for another 7-16 days.

If the subordinate was unable to take advantage of all the required days off or vacation, the remaining time may be added to the subsequent annual leave. However, its maximum duration is 6 months in a row. A person receives his first leave after six months from the date of employment, the rest - in agreement with his superiors.

What to do if supporting documents are not provided

To compensate for transportation costs, it is necessary to provide supporting documents: railway and air tickets, taxi receipts, certificates of work performed by the transport organization. When paying compensation for the use of personal transport, an agreement on its purpose must be concluded or a rental agreement must be provided. If there are no supporting documents, then:

- An organization will not be able to include transportation costs in expenses when calculating income tax, because they must not only be justified, but also documented.

- If, nevertheless, the organization pays compensation, then the regulatory authorities will consider it part of the salary and will oblige the employee to pay personal income tax, and the organization to pay insurance premiums.