Who can receive the payment

Bonuses for length of service vary in size, it all depends on factors, both external and internal:

- The size of the salary and the dynamics of its increase. The salary increases - the additional payment increases. This is explained by the fact that it is calculated as a percentage of the salary. A year is not counted as two, like in the military.

- Region. For example, in the North, regional coefficients are increased. They increase the premium as they are included in the formation of the monetary allowance.

- Kind of activity.

Longevity bonuses for different categories of employees (by duration):

| % premium | Ministry of Internal Affairs, firefighters, Ministry of Emergency Situations | Budget positions | Teachers, doctors, scientists |

| 10% | 2-5 | 2-5 | 1-3 |

| 15% | 5-7 | 5-7 | — |

| 20% | 10-15 | 10-15 | 3-5 |

| 25% | 15-20 | — | — |

| 30% | 20-25 | more than 15 | more than 5 |

| 40% | more than 25 | — | — |

REFERENCE: the premium is set not only as a percentage, but also as a fixed amount.

How to get a bonus for experience

Additional payment for length of service in 2021 is calculated on the basis of the citizen’s work book, which is stored in the personnel department. In addition, the presence of orders regarding the employee that explain his length of service is taken into account. The availability of the right to additional payment is determined by the personnel department of the enterprise where the person works. Employees are required to issue an order to accrue an increase to the official salary to a specific person.

How to calculate budget experience

Work experience in a budgetary institution is calculated cumulatively and consists of periods during which a citizen:

- worked in budgetary institutions;

- filled government positions at the federal and municipal levels;

- performed military duty;

- worked in the Ministry of Internal Affairs, the Ministry of Emergency Situations, institutions of the correctional system and authorities for control of the circulation of narcotic and psychotropic substances.

The length of service is determined on the basis of entries in the work book, as well as other documents that can confirm the period of work in government agencies (for example, copies of employment contracts).

To acquire the right to a bonus, the length of service of a public sector employee must not be continuous. If a citizen left public office, worked for some time in a production or commercial organization, and then returned to public service, then the period of his “budgetary” service is calculated as a continuation of the previously existing government service.

Rules for calculating the allowance

Having received an order for a percentage increase for length of service, the accounting department of the enterprise must be based on the calculation rules:

- When calculating the additional payment, the length of service obtained only at the main place of work is taken into account. Part-time work does not count.

- Other provisions for calculating the duration of their service apply to certain categories of persons undergoing military service. For example, a month of sunshine can be calculated in one and a half, two months.

- The work experience includes not only the time when a person worked on site, but also time intervals:

- maternity leave;

- the citizen actually did not work while maintaining his job.

- For social workers: the time spent working in government organizations is taken into account, regardless of who the enterprise was subordinate to. Earnings are calculated according to the wage regulations for the category of employees.

IMPORTANT: the employee should not wait long for the bonus for length of service to be calculated. Additional payment is made starting from the next month after the relevant order is issued. Accordingly, the right to it was obtained.

Example:

The personnel service is considering the possibility of awarding a bonus for the length of service to Maria Igorevna Brusnichkina. She works as a teacher. She began her career after college, in 2014, or more precisely on September 16. In three years, in 2021, her experience will be 3 years. She is entitled to 10% of her salary, but only from October.

REFERENCE: the presence of a bonus for length of service does not terminate the rights of citizens working at enterprises to other payments. If a person is entitled to several additional payments, they are added together.

To receive payments, the interested person must provide documents to the personnel service. Their list depends on the category of service. For example:

- for persons passing the Armed Forces - a military ID;

- work book (for employees of government organizations);

- documents (from the archive);

- orders (in case the citizen does not have a work book).

IMPORTANT: the employer cannot refuse to pay bonuses if they are established by law. If their appointment is the initiative of the head of the company, he can cancel the financial incentive.

Definition of the term and legal regulation

Article 135 of the Labor Code of the Russian Federation, which regulates the procedure for remuneration, establishes recommendations for ensuring a uniform procedure in the formation of wages for public sector employees. Decree of the President of the Russian Federation No. 1152, as amended on January 16, 2017, determines the procedure for calculating length of service to establish compensatory payments for length of service for state and municipal employees.

The amount and procedure for payments are regulated by their own regulations in each field of activity, but the unifying indicator is length of service. What is this – a parameter of quantity or quality of service? The indicator combines the impeccable performance of official duties, takes into account the period of exposure to extreme conditions, the arithmetic calculation begins immediately from the moment of registration for the corresponding position and ends with the moment of termination of the relationship. When resuming after a break, regardless of the duration, it continues to be calculated on a cumulative basis.

In accordance with acts of law enforcement agencies and civil regulations, in addition to the actual performance of duties during the period of service, the following is included:

- time of treatment and rehabilitation after injury or occupational disease;

- being in captivity or on the list of missing persons;

- appointment to an elected position;

- illegal dismissal with subsequent reinstatement by court decision;

- training in the direction of management personnel for a period not exceeding five years.

Separately, the time spent in hot spots, places of accidents and disasters as liquidators, the period of service in the Far North and equivalent territories are taken into account.

In accordance with Law No. 306-FZ of November 7, 2011, length of service is considered according to certain parameters for military personnel:

- pilots, parachutists and workers testing ejection devices – 1:2;

- crew members of combat ships and oceanographic expeditions - 1: 1.5.

Additional payment for length of service, taking into account the special procedure for calculating length of service, is an obligation at the level of local, regional and federal budgets, under government control. Commercial organizations, when forming a remuneration mechanism, can indicate in local documents an increase for length of service, but this is only a right, and not an obligation, unlike state employees.

Amount of additional payments

How to calculate the premium? There is no single size of payments, since this indicator is set as a percentage of the salary. Let's look at the example of employees of the Ministry of Internal Affairs:

It is necessary to calculate the salary for an employee of the Ministry of Internal Affairs: salary - 13,000, according to rank - 11,000, length of service - 20 years 1 m. Service life - from 20 to 25 years, he is entitled to a 30% bonus. This is seniority. Let's consider it as a simple example: (13000+11000)*30% = 8600 rubles. Allowance amount: 8600+13000+11000. Total 32600.

The legislator introduced bonuses for employees of the budgetary and military spheres. Commercial organizations, that is, private ownership, are not required to establish additional payments based on length of service. Their presence is the right of the employer and his attitude towards employees. No one can guarantee a citizen additional payments for length of service for working in such an organization.

In order to understand what you should expect, you need to familiarize yourself with the labor and collective agreement, bonus provisions, and other local acts of the company regulating the issue of remuneration.

If additional payments are established at the enterprise, they are determined as a percentage of the salary amount. If an employee was sick or was on a business trip, then usually the bonus is not counted. It is usually set by the employer. The minimum rate is 5%, the maximum is 30%.

If a private company has provided for the payment of a bonus for its staff, then it is obliged to familiarize the employee, upon signature, with the local act where the payment is prescribed. In particular, when clarifying the issue of the allowance, the act reflects the following information:

- size;

- calculation algorithm;

- accrual procedure.

The signature of the employees, indicating that they have read the act, is recorded in a journal or familiarization sheet (Article 68 of the Labor Code of the Russian Federation).

Example 4

The employee is engaged in educational work in a special correctional orphanage. Rate – 1. Previously, this person had rank 10 in the ETS. Worked in the field of educational institutions for 3 years (10%).

Salary based on position – 3,278 rubles.

Rate + specifics of work 3278x(1+0.2+0.2) = 4589 rub.

0.2 – bonus for working in an orphanage. 0.2 – bonus for working in a special institution.

4589%10=458.9 – bonus for teaching experience. 4589+458=5047.9 rubles final salary.

Example 5

A person works as a teacher of his native language in one of the republics of the Russian Federation. He teaches first through fourth grades at a comprehensive boarding school.

His teaching load is 24 hours a week. Qualification: first category. This employee is assigned a class, and accordingly he has a bonus for class management. Twenty-four hours a week are spent checking notebooks. The teacher has 2 years of teaching experience (10%).

Net salary – 3,589 rubles.

Then 3589×1.168×1.15 = 4820.7.

Where 1.168 is an increase in salary for the first category. 1.15 additional payment for the specifics of the work.

We calculate the bonus for the hours actually worked (4820.7×24 hours)/20 hours. = 5784.8.

This person receives 15% for class management (4820.7 × 0.15 = 723.1 rubles).

We calculate the extra charge for checking notebooks (4820.7×0.15)x24h./20h. = 867.7 rub.

3589%10=358.9 rubles – bonus for teaching experience. And that’s 5784.8 + 723.1 + 867.7 + 358.9 = 7734.5 – the final salary with all allowances.

Supplement to pension for length of service

According to the explanation of the Pension Fund, citizens receiving pensions cannot count on an additional percentage of the total service life. The fund's specialists had to explain this to the general public due to increasing rumors that pensioners with a long period of service may apply for a recalculation of the benefits they receive. The duration of labor activity is determined when assigning state support.

REFERENCE: In some regions, incentive payments for seniority have been established for pensioners. It is necessary to find out the nuances from the social protection authorities. For example, in the Altai Republic an increase is provided for pensioners for length of service.

Regulatory acts

The following list of documents regulates bonuses for length of service in various budget areas: from the central government and the military, to workers in the educational and medical industries.

Labor Code of the Russian Federation (Articles: 21, 135, 143 and others).

Also, this type of incentive bonuses is regulated by many regulations:

- by resolution of the Council of Ministers (No. 638);

- by order of the Ministry of Health of the Russian Federation (No. 377);

- Decree of the Government of the Russian Federation (No. 583);

- by decree of the President of the Russian Federation (No. 1532);

- federal law (No. 73-F3), etc.

Increase in long service bonus in 2019

If there are special conditions, a certain category of citizens can count on an increase in the premium:

- Obtaining the status of “Veteran of Labor”.

- Women with 30 years of experience – additional accrual of one pension point.

- Men - with more than 35 years of experience - similar enrollment.

- Men with a duration of 35+5 years – a conversion of 5 coefficient units occurs.

In addition, citizens who have worked in the field of agriculture with more than 30 years of experience are entitled to apply for the bonus.

The premium is fixed at 25%. Order a free legal consultation

What innovations exist?

The entire process of calculating additional payments and allowances is regulated by Federal Law No. 400 adopted in 2001. Based on the provisions of this document, a pensioner has the opportunity to receive additional points for continuous long-term work. But for this there must be an impressive period of work.

But if we take into account the history of changes in the procedure for calculating pensions and taking into account the norms of Federal Law No. 173, there is no interaction between continuity of service and the amount of pension payments. Since today pensions are calculated taking into account the amount of contributions to the Pension Fund during the employee’s working life.

Therefore, to fill this gap, the Pension Fund of the Russian Federation has developed additional standards for calculating allowances.

How was it calculated?

Periods of work without breaks were calculated quite simply. To do this, it was necessary, using the employee’s work book, to calculate how long he worked at a given place of work.

It should be taken into account that in expressly defined cases, continuity was maintained even at the moment when the employee quit his previous place of work, but before the expiration of the relevant period he was again employed in another place. For different categories of workers and in different situations, this period ranged from two to three months . So, for example, a person dismissed due to a reduction in the organization’s staff could count on maintaining his seniority if he was employed before the expiration of three months from that moment.

Attention! In the event of termination of the employment relationship, which was initiated by the employee himself, the continuous period was maintained if the citizen found employment within 3 weeks (4 weeks for a valid and significant reason).

In addition, when calculating it, certain periods were taken into account when the citizen was not directly engaged in labor activity.

These include:

- training in specialized secondary, vocational and higher education programs, but only in cases where more than three months have not passed since graduation from the educational institution, and before the start of studies the citizen had work experience;

- service in the Armed Forces and structures equivalent to the army;

- forced absenteeism due to the fault of the employer;

- paid internship while studying in educational institutions.

This list is not completely exhaustive.

For clarity, an example should be given:

Below are the periods of work of citizen Ivanov.

- In the period from 04/01/2002 to 04/01/2003, he worked at Vector LLC as a general worker.

- From 04/02/2003 to 04/02/2005 – compulsory military service.

- From 05.05.2005 to 31.12.2006, he worked at Chance LLC as a slinger.

Accordingly, all the periods presented above are included in continuous service, since military service is not a basis for its termination, and more than 3 months have not passed since demobilization and until new employment. From January 1, 2007, continuous service ceased to be taken into account as the basis for calculating sick leave and pension payments.

The procedure for calculating the allowance

When paying bonuses, the following rules are observed:

- Payments are calculated based on salary. Additional payments to the employee (bonuses, etc.) will not be taken into account in the calculation.

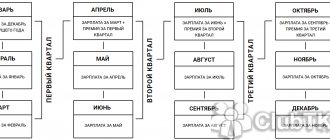

- Payments are made monthly on the day the salary is issued.

- If a person worked in several positions on a part-time basis, payments are calculated based on the basic salary.

- If, during the period of reaching a certain length of service, a person is on sick leave or on vacation, he receives all additional payments after returning to work.

- If an employee resigns, the amount of the bonus will be determined based on the actual time worked.

- The length of service of civil service representatives when calculating bonuses will be established by a commission, the participants of which are approved by the regional manager of the government agency.

To receive compensation, an employee must provide certain documents:

- Military ID (for military personnel).

- Work book (for government and budget employees).

- Certificates from the archive, extracts from orders (if there is no work book).

The convened commission decides on the calculation of the premium. The decision is drawn up in the form of a protocol, on the basis of which the manager must issue an order. The order specifies the amount of the premium. A copy of this document is attached to the employee’s personal file. Upon reaching a new level of experience, the amount of the bonus increases. That is, there is a regular increase in the employee’s salary.

The manager does not have the right not to make payments if they are due to the employee by law. However, if the increase is the initiative of the employer himself, this decision can be canceled.

As a rule, compensation is provided to employees of various types of government agencies. Allowances are extremely rarely paid in commercial organizations for a number of reasons. In particular, this is simply unprofitable for an entrepreneur. It’s rare that a company owner has a vested interest in keeping an employee in one place for several decades, and this form of bonus is designed to encourage just that.

When is accrual not possible?

If a number of conditions are not met, a citizen will not be able to count on receiving pension supplements.

- An additional payment to the pension is possible only if the presence of the required period of employment is confirmed by documents and during this entire period insurance payments were made to the Pension Fund, including by private entrepreneurs. If the employment was unofficial, even with 34 years of experience, and contributions were not made on time or in full, no supplements to the pension are due.

- Please note that, according to current legislation, work experience does not include the period of study at a university, while maternity leave (no more than five years) and service in the Armed Forces do.

Thus, you can receive a bonus for length of service only if you have a 30/35-year period of working activity, which is explained by economic motives: the state seeks to encourage citizens to continue working after their retirement.

But in the context of reforming the pension system in the direction of strengthening its insurance component, these rules may change in the near future.