Reasons for debt

Any debt cannot arise out of nowhere; there are always certain reasons. Thus, the accumulation of debt for alimony payments can occur:

- Due to the payer's fault.

- Not through the payer's fault.

So, in the first option, the debtor knows and understands perfectly well that he has an obligation to pay alimony, which must be carried out according to the established rule. Nevertheless, it consciously takes actions to evade this responsibility. For example, a person may hide his real address of residence, as well as his official place of work, from the executive authorities and the collector.

Naturally, for such behavior a person will be held accountable in the future, in accordance with current legislation. Thus, persistent non-payers of alimony may well be subject to criminal liability.

As for the reasons belonging to the second group, they are not so common. We are talking about those circumstances that occur through no fault of the person. These could be, for example, mistakes made by an accounting employee. In this case, all responsibility will rest with the accountant. It is also quite possible that the person who is charged with paying alimony is seriously ill, and therefore all financial resources are spent on treatment, and not on the maintenance of the child.

Another reason could be the death of the person paying the alimony. However, if there is a payment debt, the heirs of the deceased debtor are obliged to pay it. This is carried out only if a corresponding court decision is made in the case.

There is also an option in which arrears in alimony payments arise due to the claimant. This can happen if the recipient of alimony untimely provided the bailiff with a document for collection. In any case, no matter what causes the accumulation of arrears in child support for a minor child, the debtor is obliged to pay it off in any case.

Executor

Control of the process of deduction and transfer of assistance to disabled citizens is entrusted to the bailiff, who is presented with a writ of execution (i/l) to initiate proceedings. The FSSP official sends a copy of the resolution, the collection document with a detailed description of the execution procedure to the debtor’s place of employment.

The employer's accounting service is obliged to register the receipt of enforcement documents in the accounting journal and ensure their safety as for strict reporting forms. In exceptional cases, the resolution may contain a requirement for the need to calculate the debt within a specified time. Then the specialist will independently calculate the debt and carry out deductions according to the established procedure.

Debt collection is carried out with the assistance of the bailiff service

For example, a child support worker has been working for a company since March, but the bailiff found out about the place of employment only in June. Therefore, the executor must calculate the amount of the debt based on the established size and amount of income for the previous months of the debtor’s work. The FSSP must be notified of the result of the accrual.

If the accountant does not understand the procedure for determining payments and debts, he may leave the document unexecuted until the bailiff provides the appropriate explanations upon written request.

It is important that the total amount of alimony deductions for one citizen does not exceed 70% of earnings. The bailiffs in the resolution prescribe an additional requirement for the employer to provide monthly or quarterly information about deductions and transfers made, with payment documents attached. This policy is aimed at continuous monitoring of the correctness of collections on obligations, which will allow timely measures to be taken to bring the debtor and violator to justice in accordance with the Criminal Code, the Code of Administrative Offenses, and the Arbitration Procedure Code of the Russian Federation.

If a citizen terminates an employment contract with an organization, the accountant must immediately return the writ of execution to the bailiff service with the appropriate notes on deductions, transfers, as well as indicating information about the amounts not withheld and the reasons for failure to comply with the requirements of the resolution.

The bailiff, on the basis of a written application from the claimant, calculates the alimony debt according to one of three existing methods. After the expiration of the two-week period, notifications are sent to the debtor and recipient of assistance indicating the amount to be collected.

In what cases is alimony debt calculated?

Many citizens are interested in the question of how to calculate alimony debt. Calculation of alimony debt can be calculated according to two rules.

First rule. The calculation is carried out if there is a court decision to collect payments or an agreement between the parties on alimony. In other cases, the debt cannot be calculated. So, for example, if during the period of divorce the child’s mother did not file a lawsuit to collect alimony, but decided to do so several years later. In this case, we will not be talking about the presence of arrears in alimony payments, but about the collection of child support payments for the past time.

Second rule. This rule states that the period of alimony arrears is 3 years, that is, you can demand payment only for the last 3 years. The only exception to this rule is when the debtor evades the obligation to pay alimony. In such a case, the debt is paid for the period of evasion.

In what cases can the amount of debt be reduced?

In some cases, the alimony payer may be completely or partially released from the obligation to pay the debt. Such a decision can only be made by a court , and the reasons for the formation of debt must be sufficiently compelling.

Reduction or cancellation of the debt can only occur if the payer is not to blame for its formation. The court may take into account the following reasons:

- serious illness of the debtor himself or his relatives, associated with significant financial costs;

- the payer encounters force majeure conditions: natural disaster, natural or man-made disaster, and so on;

- error of third parties when transferring alimony;

- dismissal of the alimony worker from his place of work is not at his request and the inability to find a job in a short time - only with a short period of debt (up to 2 months), since then the payer must either find a new place of work or register with the Employment Center.

If the alimony payer has a serious reason , he can apply to the magistrates' court with a claim to reduce or cancel the debt.

The procedure for calculating alimony debt based on the cost of living

This method is used when payments are collected in hard cash. In this case, the amount of a person’s income is not taken into account; instead, they are based on the cost of living, which is established by region or country. The amount of payments is determined depending on the situation and can be, for example, 0.5 or 2 subsistence minimums.

By the way, this value is not constant, so the bailiff must calculate the debt in a new way every quarter.

Formula for calculating alimony debt:

Amount of debt = (amount of alimony assigned by the court, which corresponds to the subsistence level * subsistence level) * period of non-payment of alimony payments

Procedure and example of calculating arrears of alimony based on the average salary

This method is used if:

- The debtor does not have documents on hand that would confirm his income for the period when the debt arose.

- The debtor receives income unofficially.

- The debtor has no income.

As for the procedure for calculating debt, it is very simple. It is necessary to take the average salary as a basis, calculate from it the share of alimony payments that were established by agreement or court order and multiply the result by the number of billing months. Thus, it is possible to determine the amount of debt for the entire period when the alimony debt arose.

Since the average salary changes from time to time, calculations must be carried out every quarter.

Example of calculating alimony debt

On July 1, 2021, the court ordered alimony for a minor child in the amount of ¼ of the parent’s income. However, the alimony provider did not provide information about his income and payments for child support were not received.

The average salary in the country in the first quarter of this year was 73,800 rubles. Taking this information into account, the bailiff calculated the debt for 7 months of non-payment of financial resources in the following way:

Amount of debt = Amount of deductions (average salary * share of earnings) * number of months

Debt is calculated as follows:

(73,800 * 0.25) * 7 = 129,150 rub.

How to collect debt

The conditions and procedure for its collection provide for the existence of enforcement proceedings. It should be remembered that overdue alimony debt cannot be transferred for collection by debt collectors. This is illegal and the recipient of alimony may incur criminal liability for extortion.

Collection of payments is carried out exclusively through the mediation of a bailiff. The claimant should submit an application to the bailiff to initiate enforcement proceedings.

The application shall indicate:

- name of the FSSP department;

- information about the bailiff;

- information about the debtor;

- request to initiate enforcement proceedings.

A copy of the applicant’s passport, as well as an executive document, must be attached to the application. Collection is carried out according to a writ of execution, which is issued on the basis of an application to the court. A court order and alimony agreement also serves as an executive document. A copy of the order is kept by the debtor. The original is presented for execution at the debtor’s place of work or to a bailiff, if the debtor does not have an official place of work. Collection is carried out until the debt is fully repaid. At the end of the enforcement proceedings, the bailiff makes a decision and returns the writ of execution to the claimant.

Expert commentary

Kamensky Yuri

Lawyer

If the debtor has a permanent place of work, the writ of execution is sent to the organization. The employer is obliged to withhold alimony and transfer it to the details provided. If he does not do this, the organization will face a possible on-site inspection and a fine.

Debt collection as a share of salary

Former spouses can independently set the amount of alimony, but it cannot be less than that established by law. In some cases, the parties use a calculation method - as a share of income.

For example:

Epifanov O.N. he has a minor son; he divorced his wife in 2015. By alimony agreement, the parties established that every month the man would transfer half of his income to support the child. Salary of Epifanova O.N. after calculating personal income tax it is 80,000 rubles. he faithfully paid alimony until 2021, but from May to August inclusive he was in arrears.

80,000/2 = 40,000 rub. – the amount of alimony to be paid monthly.

40,000 x 4 = 120,000 rub. – the total amount of debt as a share of salary.

Debt collection for alimony in a fixed amount

A court decision, order or alimony agreement may determine payments in a fixed amount. Their size cannot be less than the established minimum subsistence level in the region, and if it increases, payments are similarly indexed.

Let's look at an example:

The cost of living is 9,536 rubles. The payer did not transfer funds for three months. 9,536 x 3 = 28,608 rubles. – amount to be paid.

Filing a claim for alimony in a fixed amount

There may be situations where the debtor has to pay a share of his regular earnings, which may be inconvenient for the claimant. The person liable for alimony may not have a constant income or his earnings may change. Then you should file a claim to establish alimony in a certain amount of money. The claim must be filed according to the rules of the Code of Civil Procedure of the Russian Federation - Art. 131-132. The statute of limitations for the collection of alimony in the TDS is limited to the period during which payments must be received. You can go to court to collect alimony in TDS until the child is 18 years old.

The claim should indicate:

- name of the court;

- information about the parties – the plaintiff and the defendant;

- data about third parties.

The claim will need to be titled. It is important to outline the grounds for collecting alimony in a fixed amount of money.

The following must be attached to the claim:

- a copy of the plaintiff's passport;

- copies of executive documents;

- a copy of the minor's birth certificate;

- a copy of the divorce certificate (if available).

The statement of claim must be signed and dated. The claim can be filed in person or through a representative. The authority of the representative must be supported by a notarized power of attorney.

Expert commentary

Shadrin Alexey

Lawyer

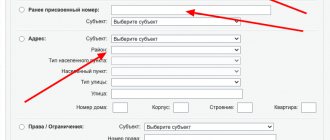

You can find out your alimony arrears online, on the FSSP website – via the Internet. Child support debt does not go away even after 18 years. Later, the child can collect the debt on his own. Payments can be withheld from the debtor's pension and his property many years after the recipient reaches adulthood. A penalty can be withheld in a similar way.

A waiver of alimony debt in exchange for the debtor's property is invalid. The payer should never make such a deal. A way out of controversial situations should be sought through negotiations or litigation, preferably with the help of a qualified lawyer.

Statement of claim to bring the alimony debtor to administrative liability (sample)

The procedure for calculating alimony debt based on the debtor’s income

This method of calculating debt occurs if the debtor has official income, but for a certain period of time there was no deduction from it for alimony payments.

In such a case, debt calculation will be carried out as follows. First, the bailiff must determine the income of the person from which payments are being withheld. From the amount received, it is necessary to deduct deductions that are mandatory under current legislation (in particular, we are talking about personal income tax).

Then from the amount it is necessary to calculate the share of alimony payments, which is established by agreement or court. The resulting amount is multiplied by the number of months when alimony payments were not made.

Calculation rules

There is an approximate action plan for determining the amount of alimony debt:

- The recipient of alimony, based on the current i/l, submits an application to the FSSP with a request to determine the amount of the debt.

- The bailiff carries out calculations according to a specific methodology determined by a court decision and depending on the circumstances of the case.

- Notifications are sent to the debtor and the collector.

- The resolution to withhold arrears is transferred for execution to the debtor’s employer, to a credit institution, the Pension Fund of the Russian Federation, etc.

To begin debt collection, you need to take some initial steps.

The period for calculating alimony debt is taken based on the application of the recipient of assistance. The percentage or fixed amount is calculated according to the writ of execution issued by the court. It is important that according to Art. 117 of the RF IC, assistance in a fixed amount must be indexed in the prescribed manner. Indexing is carried out by the bailiff or the employer's accounting service.

The amount of income of the defaulter is determined by accounting documents from the place of employment or based on data from the tax registers of the Federal Tax Service. For non-working debtors, amounts of monetary benefits are taken, determined by federal and municipal legislation.

The collector has the right to initiate the procedure for calculating the debt immediately at the moment of violation of the deadlines for receipt of funds. In practice, very often cases arise when an employer temporarily delays the payment of wages and alimony, respectively. The bailiff first of all requests written explanations from the organization about the reason for the untimely fulfillment of legal obligations. Next, the authorized person assesses how correctly the resolution is being implemented.

In any case, the applicant will be required to provide evidence of the absence of transferred funds. For example, this fact will be confirmed by a bank account statement for the specified period.

Depending on the violation detected, the bailiff has the right to bring the employer to administrative liability. The debtor may be subject to restrictions on territorial movement, driving, and penalties in the form of a penalty.

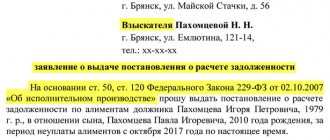

Application for calculation of alimony debt (sample)

If child support payments have not been paid for a long period, resulting in arrears, the main question will be to calculate it correctly.

When the bailiff does not accept the settlement of the debt, the collector should do this on his own initiative by filing an application. This right is enshrined in Article 50 of the Federal Law “On Enforcement Proceedings”. The document is addressed to the bailiff who is handling the case.

There are no special requirements for the application form; it is drawn up in free form. However, it is still worth relying on the basic rules of office work.

Attention! The application is submitted in two copies.

A sample application for debt settlement can be downloaded here

How to file a claim

After all calculations have been made, a claim is filed to recover the penalty. The statement of claim is drawn up according to standard rules:

- in the header of the claim, indicate to which court the petition is being filed, and the contact information of the plaintiff and defendant;

- the descriptive part of the claim contains a brief but understandable statement of the circumstances of what happened: the grounds for payment of alimony, how long there has been no payment, the amount of payments;

- what the plaintiff is asking the court to do;

- list of attached documents.

Calculation of debt by a bailiff. Resolution on the calculation of alimony debt

The bailiff cannot refuse a request to provide information about the amount of debt at the request of the creditor. Thus, having received a corresponding application from the claimant, the bailiff is obliged to consider it within 10 days.

As soon as a decision is made on the calculation of alimony debt, the bailiff sends the relevant papers to the collector and the debtor. The decision to calculate the debt, like other decisions, is formalized in the form of a resolution.

However, the calculation itself can be done on a separate paper, which will be in the form of an addendum to the resolution.

The resolution must contain the following information:

- The basis on which the calculation was made.

- Information about the debtor and the collector.

- The period during which the debt has accumulated.

- The method by which the debt was calculated.

- The amount of total debt for the entire period.

Such a resolution is necessary for the collector of alimony payments to go to court with a demand for payment of the debt. This paper cannot be called mandatory, however, it can play the role of a powerful argument.

How is alimony collected?

To collect alimony, parents do not have to divorce: if they decide to end their life together, the spouse with whom the children remain has the right to receive financial assistance for the maintenance of minors. There are three options here:

- Conclusion of a peace agreement. The amount of alimony can be either fixed or as a percentage of income - it all depends on the decision of the parties. The document must be notarized.

- Filing an application for the issuance of a court order. This is relevant if there are no disagreements between the spouses, because the second party can challenge the order within 10 days in the manner of litigation, so there is no point in asking for it in court if there are controversial issues.

- Filing a claim. The most common case. Thanks to this, it is possible to collect alimony if the alimony obligee deliberately does not pay it and hides.

You can collect alimony using any of the three options if you have incurred a debt. The size of the main part of alimony is established by Art. 81 SK and depends on the number of children:

| For one child | For two children | For three children or more |

| 25% | 33% | 50% |

These amounts will be taken into account when calculating payments along with the penalty.

Let's consider the calculation of alimony along with the penalty:

Alferov V.V. by court order he was obliged to pay 25% of his salary for child support. For the first six months, he regularly paid alimony, but subsequently he did not pay for three months, and he incurred a debt. The ex-wife decided to claim it through the court. The number of days of delay is 110. According to V.V. Alferov’s income certificate, for the first month of non-payment he earned 45,000 rubles, for the second – 37,000 rubles, and for the third – 50,000 rubles.

How is the calculation done:

45,000 x 25% = 11,250 rub. - this is how much he had to pay in the first month, when the debt began to form.

37,000 x 25% = 9,250 rub.

50,000 x 25% = 12,500 rub.

11,250 + 9,250 + 12,500 = 33,000 rub. – the amount of the principal debt.

33,000 x 0.1% = 33 rubles. – penalty for one day of delay. For 110 days the amount will be equal to 3630 rubles.

Release from alimony debt

At the legislative level, there is a rule that allows the debtor to go to court for the purpose of partial or complete relief from alimony debt. However, there must be certain reasons for this, in particular:

There is a good reason why the debtor did not fulfill his financial obligations. This may include illness, difficult financial conditions, changes in personal life.

If the court takes into account such grounds, considering them valid, it may make a decision in favor of the debtor, reducing or writing off the debt. However, we should not forget that the person will need to collect evidence that would confirm his words.

Important! After the court makes a decision in favor of the debtor, the enforcement service can begin to review the amount of the debt.

Relatives: to whom do you owe

First, let's determine who you may owe alimony to. To do this, it is worth leafing through the Family Code of the Russian Federation. We find the required Chapter V - Alimony obligations of family members. Alimony is paid by blood relatives or persons related by family ties.

Parents must support their minor children, the law says. The amount of obligations has been established. For one child, one quarter of the income is paid, for two - a third, for three or more - half of the income. These obligations will have to be fulfilled even if the court decides to terminate parental rights.

Adult children should take care of parents who need it. Spouses or former spouses also have mutual obligations to pay alimony. For example, a needy ex-spouse, if he became so during the marriage or within a year after its dissolution. Siblings have obligations to support their disabled siblings. They must take care of relatives: grandparents - about their grandchildren and vice versa, pupils - about their teachers, stepdaughters and stepsons - about stepfathers and stepmothers.

Alimony agreement

You can agree to pay alimony orally or in writing. But informal agreements are easy to ignore, because verbal promises cannot be presented to the court. It is better to enter into a written agreement with a notary or establish the amount of alimony in court. In this case, it can only be changed officially by signing a new agreement with a notary. Or through the court. If the party does not fulfill the obligation, then with the notarial agreement you can go to the accounting department where the debtor works, or to the FSPP.

For bailiffs, a notarial agreement on the payment of alimony has the force of an executive document.

Collect through court

Alimony can be established and collected and forcibly - through the court. In this case, there will be a full-fledged trial in which you can present documents, checks, receipts indicating expenses on one side and income on the other.

The payer can give his reasons for reducing the amount of alimony. One of the reasons for reducing child support is if there are other children.

For example, the ex-husband married a second time, another son was born, who also needs to be supported. Previously, the child from the first marriage was the only one and received 25% of the father’s income, but now there is also a dependent. According to the law, if there are two children, 33% of the income can be withheld from the father. Now each son will receive 16.5% of his father's salary. Even if they are in different families.

Appealing a decision on the calculation of alimony arrears

All illegal actions on the part of the bailiff can be appealed, for which the interested person is given 10 days. The countdown of the specified period begins from the moment it becomes known that the bailiff committed unlawful actions.

An interested person has the right to file a complaint addressed to a superior official.

In addition, it is also possible to file an appeal against the decision on the amount and calculation of the debt for payments, if the interested person has doubts about the correctness of the calculations made.

List of documents for filing a claim

If the bailiff disagrees, both the claimant and the debtor have the right to challenge the decision of the bailiff, in which he provides the calculation of the alimony debt. Since September 2015, the rules for appealing decisions of bailiffs have been changed. Now they can be challenged only according to the rules of administrative proceedings. It is characterized by the following features:

- The court authorized to resolve the dispute is the district court located at the location of the bailiff department where the bailiff works, whose decision is being appealed by the plaintiff.

- The applicant has only 10 days to appeal from the moment he received the contested decision or from the moment he learned about the calculation that violates his rights. If the case is particularly difficult for the court, the chairman of the district court has the right to increase the period of proceedings once to 1 month. If the deadline was missed for a good reason, it can be restored. Such reasons include the applicant's illness; refusal to consider the complaint by the head of the bailiff who issued the contested decision; business trip; Military service; participation in hostilities; force majeure circumstances.

- The court is given only 10 days to consider the claim, which is counted from the moment the application and its attachments are received by the court office.

- It is the responsibility of the applicant to prove the validity of the violation of his rights and compliance with the procedural deadlines for filing the application. The bailiff, in turn, is obliged to prove that he issued the contested resolution in accordance with the legislation of Russia and, within the framework of his powers, had grounds for issuing such a resolution.

- The failure of the plaintiff and defendant to appear does not prevent the judge from conducting the proceedings and making a decision.

To prepare a claim, you can use the sample application provided at this link. The following must be attached to the claim:

- The bailiff's decision, which is disputed by the plaintiff.

- The resolution on the basis of which enforcement proceedings were initiated.

- Any evidence confirming the error of the bailiff’s calculations (receipts from the alimony recipient; information about the status of the debtor’s bank account; witness statements; correspondence by email, Skype or instant messengers).

In case of unsuccessful outcome of the case, the applicant can file an appeal to a higher judicial authority within 30 days from the moment the decision is ready in final form. If successful, the bailiff must execute the judgment in final form within 30 days from the date of issuance of the decision.

Making a decision

After the statement of claim, together with the decision on the calculation of the debt, is transferred to the magistrate's court, the court decision is made in a simplified form, and it usually takes 5 days, but sometimes the deadlines can be delayed. Court hearings do not take place, since there are no disputes and the judge is only required to make a decision on the punishment for the defaulter so that this affects the repayment of the debt. As a result, you can get:

- extract from the court decision;

- performance list;

- a copy of the court decision.

After receiving the decision, you are again sent to the bailiff, and based on the issued order, he begins collection measures. The bailiff first notifies the payer about the initiation of enforcement proceedings, about the amount of the debt, and in the absence of complaints, the document takes on legal force. If the defendant does not agree, he can file a counterclaim.

How to calculate correctly

When it becomes clear that you will have to collect from the defaulter not only alimony, but also a penalty for it, the question naturally arises of how to calculate everything correctly.

This is a rather painstaking task that requires patience, although it is not difficult if you follow the instructions. First, let's look at an example of calculating a recovery in a fixed sum of money, in the case where the debtor did not provide a certificate of income. So, you will need a notepad, pen, calendar and calculator.

Determine during what period of time alimony was not paid. For example, alimony must be paid on the 1st of each month in the amount of 5,000 rubles. per month. It is necessary to record the penalty as of August 1. To make it easier to calculate, draw a table with months, where you indicate them from February to July (for example, the penalty period is 6 months).

In the second column of the table, enter the “net” amount of alimony – 5,000 rubles. (In our situation, it is calculated based on the average salary in Russia).

Calculate the overdue payment period. Enter in column 3 the number of calendar days of delay in each month, including the last day (July 31).

The total was 181 days as of February 1st. Accordingly, as of March there will be 153 overdue days, for April - 122, for May - 92, for June - 61, for July - 31.

Calculate the penalty directly (in the fourth column). The amount of the monthly debt is multiplied by 0.1% (according to the Family Code, if the debt arose through the fault of the alimony payer, then the penalty is equal to 0.1% of the daily payment amount), and then multiplied by the number of days of delay.

Until August 9, 2021, it was necessary to calculate the debt at the rate of 0.5% for each day. This is what it looked like.

In this case, 5000*0.005*181=4525. In the second line (for March) - 5000 * 0.005 * 153 = 3825, for April (by the same principle) - 3050 for May - 2300, for June - 1525, for July - 775 rubles. Next, you should add up the resulting parameters: 4525+3825+3050+2300+1525+775= 16,000 rubles

Thus, the total amount of alimony debt will be 46,000 rubles for six months. This includes the amount of basic payments (5000*6=30) plus the amount of the penalty.

Now you need to count 0.1% per day and the calculation will be like this:

In this case, 5000*0.001*181=905. For the following months, calculate similarly.

If the debt began accumulating before August 9, 2021, then you first need to count up to that date. And then calculate at the new rate until the current day. And at the end, add up the results.

If the alimony payer does not pay off the debt, then next month everything will have to be recalculated again, and then the amount of the debt will increase slightly due to the increase in the number of days of delay.

If the collector of funds can present a document that records the official income of the alimony payer, then the penalty will be calculated based on the debtor’s monthly salary on the same principle as in a fixed sum of money.

If such a document is not available, or the payer is declared officially unemployed, then the penalty is calculated based on the average monthly salary in the region of the Russian Federation where alimony is collected.