The issue of wages has always been and remains one of the most trembling for any person. Finance, in particular its volume, solves many problems in our time and allows us to create conditions for a comfortable existence: from satisfying our natural needs to consolidating our social status, self-affirmation, etc. We can call money a tool for getting what you want. For most workers, the size of their salary, also referred to as salary, is the main motivation for working. This is exactly what this article will be about.

Let's look at the formulas and algorithms for calculating wages

What is salary

First of all, let's figure out what salary is. The concept of “wages” is enshrined in the labor legislation of the Russian Federation. In simple words, wages are payment for the work of employees.

Article 129 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) states that wages are remuneration for an employee’s work depending on his qualifications, the complexity of the work itself, including compensation payments.

Based on the legislative definition, you can find out what salary depends on:

- employee qualifications;

- the nature of the activity being carried out; quality of work;

- allowances, compensation, incentives.

Salary consists of the established remuneration (salary) and compensation and incentive payments (allowances, bonuses, bonuses for length of service, etc.)

Awards

In another way, they are called incentive payments, assigned based on positive performance results of the employee. Bonuses are established in the company by local acts or collective agreement. They are not mandatory, therefore they are increased or decreased by the decision of the head of the company.

Attention! The regulations specify for what indicators or achievements bonuses are awarded.

If in employment contracts bonuses are part of the salary, then it is not allowed to refuse to transfer them. Other incentive payments include additional payments, bonuses or other rewards. In budgetary institutions, bonuses are assigned on the basis of Order No. 818 of the Ministry of Health and Social Development.

Some additional payments are assigned in the following situations:

- the presence of years of service or a long period of work in the company;

- professional skill of the employee;

- implementation of particularly important work;

- keeping trade secrets.

Bonuses are given in a fixed amount or assigned as a percentage of the salary.

The main differences between salary and salary

Citizens often perceive official salary as synonymous with wages. Although both of these definitions refer to the wage fund and are its components, they are completely different concepts. The official salary is a fixed amount of remuneration, which is established for the performance of labor activities in a worked calendar month. Salary is the final payment to the employee, which includes additional types of payments.

What is the difference between salary and salary:

- No additional payments, bonuses or allowances;

- The size is fixed in the individual employment contract;

- Changing the size is not allowed without the consent of the employee;

- It is permissible to set the minimum wage below the minimum wage if the total amount does not fall below the minimum wage.

Salary is included in the salary structure

Basic salary

It is represented by the minimum payment, which is assigned to the employee without additional transfers. The official salary is assigned to employees of state or municipal institutions. When determining its size, the following parameters are taken into account:

- involving an employee in harmful or overtime work;

duration of work at one workplace;- exceeding the established plan;

- hours worked per month;

- the need to take into account federal or regional regulations that provide wage calculation rules for specific categories represented by military personnel, civil servants or employees of the Ministry of Internal Affairs.

When calculating the salary, it is taken into account how many days a hired specialist worked per month. The exact amount is specified in the employment agreement. For example, if according to the contract the salary is 40 thousand rubles, but out of 22 working days the citizen worked only 19, then the payment per day is initially determined: 40,000 / 22 = 1818 rubles. The salary is: 1818 * 19 = 34542 rubles.

Pay systems

Remuneration systems - a method of calculating funds, rules for remuneration of an employee, which include: the remuneration itself for work activity, incentive payments, various types of compensation.

Article 135 of the Labor Code of the Russian Federation states that wages are set in accordance with the employer’s remuneration system. The employer has the right to choose any suitable payment system, provided that it does not contradict current legislation and labor law standards. The payment method is accepted by the employer depending on the following factors:

- Features of work;

- Employer capabilities;

- The need to motivate employees;

- Working conditions.

Let's look at some of the most common remuneration systems.

Tariff system of remuneration

The tariff system for remunerating employees is the only one enshrined in the Labor Code (Article 143 of the Labor Code of the Russian Federation). Based on the compliance of the remuneration with the employee’s category. What does wages consist of in the tariff system:

- Tariff rate (category correspondence to coefficient);

- Official salary;

- Tariff schedule (list of categories of work);

- Tariff coefficient (the value of the coefficient depends on the rank of the tariff schedule).

The tariff schedule is common at various enterprises. For example, when applying for a job at a state-owned and unitary enterprise, you will find that each position has a corresponding salary. In this case, any differences within the same position between different employees are impossible.

Tariff-free wage system

With a tariff-free system, the amount of payments depends on each specific case. Directly depends on the amount of effort invested and the contribution of the employee himself. Includes various criteria, most often:

- The employee’s contribution to the work process;

- The complexity of the work being performed;

- The volume of tasks completed and their quality (for example, the number of products produced, transactions completed);

- Qualification level of the employee (example: level of education).

The non-tariff system is most often used when work is carried out collectively to take into account the initiative and individual contribution of each employee, which helps to increase motivation.

The tariff-free system most effectively takes into account the interests of the employee and employer

Mixed remuneration system

Already from the name you can understand that this mixed system combines the features of tariff and non-tariff. An employee's salary consists of a fixed and variable part.

- The fixed part includes the salary itself;

- The variable part is a combination of additional payments.

Additional payments can be determined, for example, by the following indicators: employee efficiency ratio; labor productivity; quality of the work result; percentage of revenue.

There are three types of mixed payment system.

- "Floating" salary. Monthly wages directly depend on the results of work activities over the same period. For example, the employee’s fulfillment of the established plan.

- Commission form. An employee’s income depends on the quantity of goods produced and sold. The commission form must include a percentage of sales volume.

- Dealer form. The employee himself ensures sales volumes, invests his funds in the goods purchased from the enterprise and is interested in selling them.

Legal regulation

The state controls the earnings of citizens, so they cannot receive less than what is established at the legislative level. The necessary information is fixed in various articles of the Labor Code:

- Art. 133 of the Labor Code establishes the minimum wage (minimum wage), less than which it is impossible to pay employees for their work;

- according to Art. 137 of the Labor Code determines the maximum amount of deductions from earnings;

- When using the tariff system, you have to rely on Art. 143 TK;

- The rules for settlements with a dismissed employee are given in Art. 140 TK.

Attention! If an employer violates the rules for calculating and determining earnings, then he is held accountable under Art. 142 TK.

Types of remuneration

What types of wages exist? There are only two types of remuneration: basic salary and additional salary.

- Basic payment. The wage structure is a combination of time worked, volume and quality of work;

- Additional. (Vacation, benefits, preferential payments).

Types of remuneration

Forms of remuneration

If we talk about forms of wages, there are much more of them. Form of payment - a mechanism for calculating remuneration to an employee, including accounting for the amount of work performed. Let's next look at the existing forms of remuneration.

Piecework

Piecework wages occur when a salary is calculated for the amount of work performed by employees, and does not depend on the amount of time for which it was completed. In this case, employees strive for their own improvement in productivity and quality. According to the method of calculating salaries, the following types of payments are distinguished:

- Direct piecework. The main calculation factor is the number of products produced or actions performed, which are multiplied by a certain corresponding price.

- Piecework - premium. Consists of direct piecework payment and bonus payment. The bonus may depend on various factors, for example, on exceeding the plan.

- Piecework – progressive. Exceeding the plan is paid at progressive rates.

- Chord. In the chord form, the complex of work performed is taken into account. As an example: a one-time payment to a construction team for laying tiles completed within five days.

The most common type of piecework wage is direct piecework wage.

Time wages

Time wages are calculated for the amount of time actually worked, where the result of the work itself is not taken into account. It is used in cases where the performance of work by an employee is not standardized or it is difficult to record the actions performed. The following subspecies are distinguished:

- Simple time-based form. It is calculated as the product of the tariff rate for the work performed and the amount of time worked.

- Time-based bonus. It is defined as a simple time-based form with payment of a bonus based on the results of work.

At the same time

When working part-time, an employee can work no more than four hours a day. The payment amount is not lower than the minimum wage if the employee has fulfilled the norm. However, Letter of the Ministry of Labor of Russia dated 06/05/2018 N 14-0/10/B-4085 established that if the norm is not completed, it is possible to pay less than the established minimum. Labor legislation distinguishes 3 ways of working part-time:

- Based on time worked.

- According to the volume of work performed.

- Under an agreement with a part-time worker.

Any person has the right to official part-time work

In maternity leave

Pay during maternity leave is also called maternity benefits. Thus, the state compensates for lost earnings for those who go on maternity leave. Salaries are paid in full. Salary recipients on maternity leave include:

- Officially employed women;

- Military personnel (contract);

- Full-time students;

- Registered individual entrepreneurs;

- Those dismissed and declared unemployed due to the liquidation of the enterprise;

- Adopted a child.

Pregnant women have increased guarantees of labor rights

The amount of time and amount of payments varies depending on several factors:

- In standard cases, it begins 70 days before birth and 70 days after it.

- Complicated childbirth. Maternity leave is extended by 16 days.

- In case of multiple pregnancy and complicated childbirth, maternity leave lasts 194 days.

In less than a month

For an incomplete month, the employee is calculated in accordance with the established salary and the number of days worked. Weekends and holidays worked by the employee are also taken into account. Weekends or holidays do not replace wages on days when the employee was not present, that is, the calculation occurs separately. In this case, the payment amount may be lower than the established minimum wage.

This type of payment is most typical for students who work part-time. Therefore, wages are calculated for less than a full month.

Payment according to the tariff rate

Salary calculation can also be used for those employees who work on a shift schedule, but this will raise many more questions for both the accountant and the employees. It is better to use a tariff rate set per shift or per hour. Let's compare these calculations.

Example 1. Calculation based on the tariff rate per shift:

Let's imagine a store that is open from 10 am to 10 pm, the work schedule of the salespeople in it is 2 every 2, the work shift lasts 10 hours. For one employee, the first working day in June falls on the first day, for the second, on the third. There are only 30 days in a month, the first employee is scheduled to work 16 shifts per month, and the second - 14. If the tariff rate is set per shift or per hour, we can calculate the monthly payment in accordance with it. Let’s say a shift costs 1,300 rubles.

For the first employee: 16 shifts × 1,300 rubles = 20,800 rubles.

For the second employee: 14 shifts × 1,300 rubles = 18,200 rubles.

This calculation is simple and clear. Let's see what the calculation will be if you use salary payment during a shift schedule.

Example 2. Salary calculation for a shift schedule

Let’s imagine the same store and the same employees, but now they have a monthly salary of 30,000 rubles instead of a shift or an hour. This is where the difficulty arises in determining working hours. To calculate the amount of salary per month, we will take the actual time worked from the employee’s schedule, but it is not clear where to get the norm. This is not described in the legislation and there are different options that do not contradict the laws. You can determine the standard working time based on the employees' schedule, on the standard calendar for a 5-day 40-hour week, or on the average for the year.

Option 1. The time limit is determined according to the employee’s schedule, for each it is different, because different number of shifts.

If both worked all the shifts, then both will receive the same salary, because they worked all the days on schedule.

- 30 000 / 16 × 16 = 30 000

- 30 000 / 14 × 14 = 30 000

This calculation option raises questions from workers: after all, one employee worked 16 shifts, and the other worked 14. And their salary is the same.

Let’s assume that the first employee took two days off at her own expense, and instead of 16 shifts, she worked 14. It turns out that the employees’ hours worked are the same, but the first will receive less salary, because it will be calculated in proportion to the amount worked, taking into account the norm, and their norm is different:

- 30,000 / 16 ×14 = 26,250 rubles.

- 30,000 / 14 × 14 = 30,000 rubles.

Option 2. It happens that the standard working time is determined not according to the employee’s schedule, but according to the production standard calendar. In this case, another difficulty arises. Since the norms are different in different months, employees do not understand why this or that amount was obtained. Let’s take July 2021; according to the production calendar, the norm for a forty-hour work week is 176 hours. Both employees worked less than the norm, and one will receive 27,272.73 rubles, and the other - 23,863.64 rubles.

- 30,000 / 176 × 160 = 27,272.73 rubles.

- 30,000 / 176 × 140 = 23,863.64 rubles.

Let's look at the same situation in another month, for example, in February 2021. According to the production calendar, the norm is 151 hours. In this case, with the same work schedule, one employee will overwork the norm and receive 31,788.08 rubles, and the second will work less than the norm and will receive 27,814.57 rubles. Both may have questions about the calculation.

- 30,000 / 151 × 160 = 31,788.08 rubles.

- 30,000 / 151 × 140 = 27,814.57 rubles.

Option 3. Determining the standard time according to the production calendar, but on average for the year. To do this, you need to multiply the employee’s salary by 12 months and divide by the number of hours per year according to the standard calendar. In our case, the rate per hour in 2021 is 182.56 rubles (30,000 rubles × 12 months / 1,972 hours). This calculation is more or less understandable and is close to the tariff rate, because here the rate per hour is known, which does not change throughout the year. But then it will be more convenient for the employee if we write down the rate per hour in the employment contract, rather than the salary per month. An employee must understand how exactly and what his salary consists of.

So, for those employees who work on a shift or staggered schedule, it is more convenient to make calculations if the tariff rate is set per shift or per hour.

Positive and negative aspects of various forms of remuneration

Establishing forms of remuneration allows employees and employers to achieve a balance of interests expressed in wages. Although there are many differences between the types of wages, each has positive and negative sides. When determining the pros and cons, it should be remembered that positive and negative aspects for the employer do not always coincide with the interests of employees and vice versa.

Pros and cons of piecework payment

| pros | Minuses | |

| For employee | The employee is motivated to perform his further work functions; Possibility of earning money with a lack of qualifications; Interested in improving productivity. | Dependence on equipment, other workers, and other factors beyond his control; Uncertainty of wages; |

| For the employer | The employer may not control the amount of labor; No need to pay for time spent ineffectively; High labor productivity. | Lack of team cohesion; "Personnel turnover"; Difficulties in determining individual contribution; |

Table of pros and cons of piecework wages

Pros and cons of time payment

Pros:

- Teamwork cohesion;

- Compensation for actual time spent;

- Guarantee of payment at a certain time.

- Quite an easy way to calculate employees;

- Employees work longer in one place (No turnover);

- The workforce is easier to manage and motivate to work.

Minuses:

- When paying, effort and quality of the result are not taken into account;

- The same amount of remuneration for workers who put different efforts into performing the work;

- The salary is lower than for piecework;

- The employer has to constantly monitor employees;

- Decreased employee productivity;

- Companies spend on employee salaries, regardless of their productivity.

All forms of remuneration have both positive and negative sides

Advantages and disadvantages

Using a piecework or time-based payment system has both advantages and disadvantages. Positive features include:

- motivating staff to achieve high performance results;

- flexible approach to the costs associated with the wages;

- individual approach to each employee.

The disadvantages include the complexity of the calculation, which brings additional difficulties to accountants. After all, it is easier to charge the same amounts every month than to calculate hours worked and take into account the results of labor. Workers cannot determine their salary in advance, and this option is not suitable for seasonal work.

What salary calculation formula can be used?

It's time to find out how salaries are paid. To do this, it is first important to understand the mechanism for its calculation.

- Wages and salaries are calculated in accordance with the following formula:

Formula for calculating wages based on salary

At the same time, 13% - personal income tax - is obligatory withheld from the remuneration amount.

- When calculating payment in the tariff system, use the formula:

ZP= TSch (TSdn)* Chf (DNf)

TSch (TSdn) – hourly or daily tariff rate;

Chf (DNf) – hours or days actually worked.

- In piecework payment, the formula is as follows:

ZP = SP * KP

SP – cost of production (per unit);

KP – the amount of products produced by the employee.

Salary calculation for piecework and tariff systems

What you need to know to correctly calculate wages

For correct calculation, you will need accurate data, including from your employment contract:

- The established salary or rate depending on the form of remuneration, which we considered earlier;

- Amounts of allowances (for length of service, qualification category, level of education, irregular working hours, etc.);

- Amounts of bonus payments;

- Other allowances.

What to pay attention to when making your own calculations

Savicheva Olga

Corporate accountant, practicing economist

Ask a Question

If you want to learn how to calculate your income in the form of salary yourself, pay attention to: 1. Availability of an advance (Labor legislation obliges employers to make the accrual twice a month, the amount of the advance changes depending on the change in the amount of the salary); 2. Subtraction of income tax; 3. Application of bonuses, coefficients, and other additional payments; 4. Incorrectly credited amounts are subject to refund/withholding in the next month.

Nuances for military personnel

When receiving allowances, military personnel rely not only on salary, but also on an amount that is determined on the basis of rank and position. They charge income tax at a standard rate of 13%.

Attention! The allowance of military personnel is calculated taking into account the provisions of Art. 218 NK.

An additional payment based on the position is added to the standard salary, as well as other payments related to the place of service, length of service and other parameters. Tax deductions are available for some individuals. Therefore, the amount of allowance may differ every month. All changes are recorded in management orders or additional agreements.

The salary is represented by a basic payment, which is assigned based on the position and professionalism of the employees. Other payments and additional payments are added to it. The total amount of earnings cannot be less than the minimum wage established in each region by local authorities.

Top

Write your question in the form below

Factors influencing salary size

Everyone wondered what factors influence the amount of salary. There are such concepts as nominal and real wages. And the first factor influencing the size of the salary is the nominal value - the higher the nominal value, the higher the real salary. Tax rates also affect real wages. The more taxes and the higher their rates, the lower real wages are. Another factor is the price level for services and (or) goods. Real wages fall when prices and tariffs rise.

In addition to the above factors, other factors also influence the size of real wages. Article 132 of the Labor Code of the Russian Federation speaks about this; it identifies the factors on which the salary of each employee depends.

Employee qualification

An employee’s qualifications are the ability to perform job duties in a particular area. Article 195.1 of the Labor Code of the Russian Federation gives the following definition of qualification as the totality of an employee’s education, his skills and abilities, as well as experience in professional activities. The employee’s level of competence must be documented in a legally approved form (certificate, diploma, certificate). The qualification of workers is an entry in the work book about the assignment of a rank.

Difficulty of work

The complexity of the work is inextricably linked with qualifications, since work of a certain complexity can be performed by workers who have the appropriate specialization and professional skills. The complexity of the work includes:

- complexity of work;

- independent nature of work performance;

- additional employee responsibility.

Amount of work

In addition to time-based wages, the amount of work always affects the amount of remuneration. The amount of goods produced, operations performed, exceeding the plan - all this directly affects the amount of wages.

The amount of work performed is the most important criterion for determining the salary amount

Quality of work

Nowadays, in completely different places you can find assessments of the quality of work of an employee or an enterprise as a whole. This was done for several reasons:

- The quality of work is a general indicator of the professional level of the company;

- The level of quality of employee work allows us to effectively build a tariff system of remuneration;

- An overall assessment of the quality of work allows you to attract more clients.

Composition of infants

The minimum wage (minimum wage) determines the amount of earnings, since it is the smallest bar for establishing the size of an employee’s salary, being a means of regulating income. The minimum wage is influenced by the following factors:

- Price level by country;

- Unemployment rate;

- Workers' needs;

- Inflation rates.

The minimum wage is set at the country level and is subject to regular adjustments based on the needs of citizens in each region.

What does the salary consist of?

07.09.2017

Why do they pay me so much? What does my salary consist of? These questions most likely arise for any employee. From here it's not far to the next thing: how much should I be paid by law? To answer it, you need to know the law and regulations. About them, the deputy head of the department of social and labor relations of the FNPR, Elena Kosakovskaya, wrote a series of articles, which we bring to the attention of trade union activists.

Wages are the main source of income for most employees around the world and in our country. However, not every worker’s salary allows him to provide a decent life for himself and his family.

What should the salary be? What determines the level of remuneration for each employee? What needs should wages provide?

To answer these pressing questions for every employee, you need to know:

- concept and structure of wages;

- grounds for establishing a specific wage;

- mechanisms for increasing wages;

- basic principles of wage regulation;

- types of remuneration systems and methods of their establishment.

Concept and structure of wages

Article 7 of the Constitution of the Russian Federation proclaims the Russian Federation as a social state, the policy of which is aimed at creating conditions that ensure a decent life and free development of people. This article also determines that a guaranteed minimum wage is established in the Russian Federation.

According to Part 3 of Art. 37 of the Constitution of the Russian Federation, everyone is guaranteed the right to work in conditions that meet safety and hygiene requirements, as well as to remuneration for work without any discrimination and not lower than the minimum wage established by federal law (minimum wage).

The constitutional guarantee of remuneration for work not lower than the minimum wage was developed in the Labor Code of the Russian Federation.

In Art. 129 of the Labor Code of the Russian Federation defines the concept of wages.

According to the Labor Code of the Russian Federation, wages, or remuneration (these concepts are identical), recognizes remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal ones, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Thus, in accordance with the law, wages consist of three components:

- remuneration for work,

- compensation payments,

- incentive payments.

All three parts differ significantly in their purpose and in the legal mechanism for their establishment.

The first component of the salary: Remuneration for labor

The first component of wages—remuneration for labor—depends on four factors: the qualifications of the worker, the complexity, quantity, and quality of his work.

Let's consider these four factors that influence remuneration for work: worker qualifications, complexity, quantity and quality of work.

Employee qualification

The definition of an employee's qualifications is established in Art. 195.1 Labor Code of the Russian Federation. According to this article, an employee’s qualifications are his level of knowledge, skills, professional skills and work experience.

The term “qualification” in labor relations means the level of professional preparedness of an employee necessary to perform a specific type of work in a profession or position at a specific workplace in an organization. Each position or profession has its own set of requirements for employee qualifications.

There are two components to qualification: horizontal and vertical.

The horizontal component is a certain type and content of specific work, which are combined into the concept of “profession”. A profession is defined by a specific set of knowledge required in working with equipment, tools and materials to produce a specific type of goods and services. This is achieved primarily through the acquisition of knowledge in the process of obtaining professional education.

The vertical component of qualification is the level of complexity and responsibility of the tasks and responsibilities performed within one profession. The deeper an employee is immersed in his profession, the higher the level of qualifications he has, the more complex and responsible tasks he can perform. The vertical component of qualification determines the degree of professionalism of the employee and is achieved by increasing the level of education and acquiring skills in direct work with tools, mechanisms and other instruments of labor in the process of professional activity. Professional experience is assessed by the level of professional education and work experience.

Difficulty of work

Determined by the following parameters:

- the complexity of the equipment used,

- the complexity of the objects of labor,

- complexity of technological processes,

- the breadth of the range of operations performed,

- degree of independence and

- degree of responsibility.

The concepts of “complexity of the work performed” and “level of qualifications of the employee” are closely related: the complexity of the work that an employee can perform directly depends on the level of his qualifications.

Amount of work

The amount of work (and not the result of it) is:

- or duration of work,

- or the quantity (volume) of products produced within the normal intensity of labor established on the basis of labor standards.

Normal intensity of work should ensure such expenditure of a person’s physical and (or) mental energy that, after completing the required amount of work, the person is able to restore his strength to the same extent.

It was previously noted that the higher the level of qualifications of the employee, the higher the degree of professionalism, the higher the level of knowledge, as well as skills and abilities that are acquired through repeated activities. Thus, the higher the skill level of a worker, the faster he can complete the job, solve a given problem, or produce a larger quantity of products. Therefore, the amount of labor depends on the skill level of the worker.

At the same time, both the speed of work and the quantity of products produced must correspond to a certain quality.

Quality of work

This is a characteristic of a particular work, reflecting the degree of its complexity, responsibility and intensity. Which means that the more complex and responsible work an employee can perform with minimal time, the higher the quality of his work.

The quality of an employee’s work is determined by practice, that is, by actions for which the employee uses the knowledge, skills, and abilities acquired in the process of training and work, that is, his entire professional potential. Consequently, the quality of work, like other factors influencing remuneration for work, depends on the level of qualifications of the employee.

So, the legislator in Art. 129 of the Labor Code of the Russian Federation made remuneration for work dependent on qualifications - the employee’s knowledge, ability to use their knowledge and abilities in specific work, as well as skills that allow them to perform work of varying complexity, quantity and quality. A Art. 132 of the Labor Code of the Russian Federation directly indicates that wages depend on the qualifications of the employee, the complexity of the work performed, the quantity and quality of labor expended.

Moreover, in Part 2 and Part 3 of Art. 129 of the Labor Code of the Russian Federation establishes that the tariff rate and salary (official salary) are a fixed amount of remuneration, depending on the employee’s fulfillment of labor standards or labor (official) duties of a certain complexity (or qualification) per unit of time, without taking into account compensation, incentives and social payments. Thus, tariff rate, salary, official salary are types of remuneration for work .

Consequently, in accordance with the Labor Code of the Russian Federation, the first component of wages is remuneration for labor:

- is part of the wages, which must remunerate for the work performed in accordance with its name;

- is established directly for the work performed, since it depends on four factors: the qualifications of the worker, complexity, quantity and quality of work;

- is a fixed amount of remuneration in the form of salary, official salary, tariff rate;

- should increase in size as the worker’s skill level increases and the complexity, quantity and quality of the work he performs increases. The higher the level of qualifications and the complexity of the work performed, the higher the tariff rates or salaries (official salaries) should be.

COMPOSITION OF THE MINIMUM WAGE

Federal Law No. 54-FZ in 2007 from Art. 129 and art. 133 of the Labor Code of the Russian Federation the following definitions were excluded:

1) “Minimum wage (minimum wage) is the amount of monthly wage established by federal law for the work of an unskilled worker who has fully worked the standard working hours while performing simple work under normal working conditions. The minimum wage does not include compensation, incentives and social payments.”

2) “The size of tariff rates, salaries (official salaries), as well as basic salaries (basic official salaries), basic wage rates for professional qualification groups of workers cannot be lower than the minimum wage.”

These legal norms directly indicated that:

- the minimum wage does not include compensation, incentives and social payments;

- tariff rates and salaries cannot be lower than the minimum wage;

- The minimum wage was to be paid to a worker for unskilled labor in simple conditions.

However, the exclusion of a number of norms from the Labor Code of the Russian Federation did not change the structure of the minimum wage, which still cannot include any payments other than remuneration for labor.

Let's consider the norms of the Constitution of the Russian Federation and the Labor Code of the Russian Federation in the system.

In accordance with the definition of wages in Art. 129 of the Labor Code of the Russian Federation, wages consist of three parts. And in accordance with the definition of remuneration systems in Art. 135 of the Labor Code of the Russian Federation, the remuneration system also consists of three parts:

If we compare these definitions with each other, it is obvious that remuneration for work in Art. 129 of the Labor Code of the Russian Federation is equated by the legislator to the amounts of tariff rates and salaries in Art. 135 of the Labor Code of the Russian Federation, in which there are no compensation or incentive payments.

Also in accordance with Part 3 of Art. 37 of the Constitution of the Russian Federation “everyone has the right... to remuneration for work without any discrimination and not lower than the minimum wage established by federal law...”. The Constitution of the Russian Federation also does not provide for any compensation or incentive payments in remuneration for labor.

Previously, we found out that the tariff rate, salary (official salary) are types of remuneration for work. That is, in accordance with the Constitution of the Russian Federation, remuneration for work cannot be lower than the minimum wage. Consequently, salaries (official salaries) or tariff rates also cannot be lower than the minimum wage.

Thus, by virtue of Part 3 of Art. 37 of the Constitution of the Russian Federation, as well as on the basis of Part 1 of Art. 129 and part 2 of Art. 135 of the Labor Code of the Russian Federation, the sizes of tariff rates and salaries, as types of remuneration for work, cannot be lower than the minimum wage.

Moreover, in accordance with Part 3 of Art. 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage. Provisions of Art. 133 of the Labor Code of the Russian Federation directly indicate that wages in that part that is paid for work performed: working hours or labor standards (labor duties) cannot be lower than the minimum wage. Remuneration for work is established directly for work performed in the form of a specific tariff rate or salary (official salary). Therefore, the size of the tariff rate or salary (official salary) cannot be lower than the minimum wage, as on the basis of Part 3 of Art. 37 of the Constitution of the Russian Federation, and on the basis of Part 3 of Art. 133 Labor Code of the Russian Federation.

Consequently, the employer is obliged to pay the employee wages in the form of a tariff rate or salary not lower than the minimum wage, regardless of whether the organization (enterprise) pays compensation, incentives or social payments.

Note that, in contrast to the minimum wage established by federal law, compensation and incentive payments can be established by other regulatory legal acts (decrees of the President of the Russian Federation, decrees of the Government of the Russian Federation, orders of the Ministry of Labor of the Russian Federation and other federal executive bodies, regulatory legal acts of constituent entities of the Russian Federation and acts of bodies local government), as well as agreements, collective agreements, orders or instructions of the head of a particular organization. This means that neither the President of the Russian Federation, nor the government of the Russian Federation, nor the authorities of the constituent entities of the Russian Federation, nor local governments, and especially employers, have the right, through their decisions, to interfere with the Constitution of the Russian Federation and the Labor Code of the Russian Federation and influence the composition of the minimum wage.

This means that the above payments must be set in excess of the salary or tariff rate. And in cases of regional coefficients and percentage bonuses for work in the regions of the Far North and territories equivalent to them - in addition to all three components of wages.

Thus, remuneration for work in the form of salary (official salary), tariff rate cannot be lower than the minimum wage - without taking into account compensation, incentives and other payments.

* * *

You can learn more systematically and comprehensively about the implementation and protection of labor rights, freedoms and legitimate interests of workers, including in the field of remuneration, in the scientific and practical publication of the Secretary of the FNPR, Candidate of Legal Sciences, Honored Lawyer of the Russian Federation N.G. Gladkova “Implementation and protection of labor rights, freedoms and legitimate interests of workers: a handbook for trade union workers and trade union activists” (Moscow: Prospekt, 2017).

To be continued

- Source:

- Newspaper "Solidarity"

The influence of the regional coefficient on wages

The Labor Code designates the regional coefficient as a mechanism for equalizing the income of workers in different regions. The regional coefficient is established in connection with some features of the region:

- Transport options;

- Ecology of the region;

- Climate;

- Sphere of the enterprise.

Thus, in the Russian Federation, such areas include: the Far East, the East Siberian region (Southern part), the Far North and similar regions.

How to check if your salary is calculated correctly

An employee's salary is determined on the basis of a number of documents. The easiest way is to contact the company's accountant. It is the accountant who checks the correctness of salary payments to eliminate accounting errors. If payments were inflated by mistake and were not discovered within a month, then such payment is not subject to withholding in the next month. And in case of illegal understatement, the manager and the organization may be fined.

Monitoring compliance with labor legislation is carried out by the Federal Service for Labor and Employment.

How is it calculated?

The procedure for calculating wages is determined:

- Employment contract;

- Regulations on bonuses, internal regulations on allowances;

- Working time sheet;

- Compensation Regulations;

- Orders on awards and incentives.

The accrual to your account occurs as follows: initially the salary is credited, and then compensation and incentive payments. Such payments occur in separate transactions.

What does the average monthly salary consist of?

From time to time it happens that in order to provide an employee with information or make payments that comply with the law, the manager resorts to tricks. Most often, she only takes into account one salary, and additional payments are left aside . Of course, such actions do not occur in accordance with the law.

Regulations for calculating average monthly wages are prescribed in the Labor Code of the Russian Federation (Article 139) . Therefore, when an employer calculates the average monthly salary, he needs to take into account:

- accrued actual payments for the last year;

- hours worked in each month.

A month is its duration according to the calendar (from the first to the thirty-first day, except February).

It is advisable to give an example in the following circumstances: the worker performed his job duties for the entire last twelve months, without missing work days or taking sick leave. He wants to take advantage of his vacation. In this case, payments are determined simply: Average monthly salary = payments for the year/12.

What are the allowances?

Allowances are payments intended to stimulate employees. Payments of bonuses are carried out so that the employee is more interested in professional development, motivated and better performs his work duties in the future.

The Labor Code of the Russian Federation provides for different types of salary bonuses

Bonuses

One type of salary supplement is a bonus. Provided for by the bonus regulations, employment contract or local regulations of the enterprise. For example, a bonus for increasing labor productivity, other achievements in the performance of labor functions.

Incentive payments and salary supplements

Such bonuses include payments that will increase the motivation of employees and encourage them to further effective professional activities.

Additional payments of a compensatory nature

Payments of this nature are those that are designed to compensate the employee for additional expenses, unfavorable working conditions, for work on weekends and holidays, traveling nature, and others.

Salary supplements

In addition to incentive transfers, employees often count on incentives provided by bonuses. They are calculated as a percentage of the salary. They are usually assigned to employees who have unique skills that differ from those of other hired professionals. Therefore, they are appointed on the following grounds:

high level of qualifications;- professionalism;

- dedication to the organization;

- knowledge of several languages;

- obtaining a unique scientific title.

Allowances are issued on the basis of regulations or official orders of the employer. Often they are provided in a collective agreement or in an individual agreement.

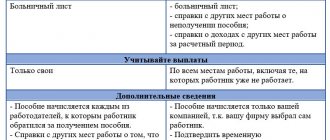

How to reduce salary losses during sick leave and vacations

At best, if you are able to work, try to negotiate with your boss about remote work. If you have opened a sick leave, then payment of wages is impossible, since you will be paid sick leave payments. However, upon returning from sick leave, your bosses may, for example, give you a bonus to compensate for your work during your illness.

Remember, if your work experience is less than 1 year, the calculation of sick days will not correspond to your average salary. In practice, for 10 sick days under the specified conditions, you can receive less than 1 thousand rubles.

What about vacation? It is not profitable to take holidays as vacation, since they are not included in the calculation of vacation pay, although they increase your vacation. If you have unused vacation days, then by agreement with your boss you can take days off as vacation. Thus, non-working days will be paid.

Compensation

They come in two varieties:

- must be included in the salary;

- act as reimbursement for expenses incurred by employees during their work activities.

According to Art. 129 of the Labor Code, compensation is part of income if, during work, citizens are forced to face conditions that differ from standard ones or have unique professional skills. The exact amount of payment is prescribed in the collective labor agreement, but cannot be lower than a certain limit established by the Government. Compensations that are included in the salary are paid on the following basis:

- work in dangerous or harmful conditions, requiring payment in excess of 4% of the salary or tariff rate;

- work in special climatic conditions;

- salary increases due to increased qualifications;

- combining several positions or fulfilling the duties of an absent employee;

- overtime or night work.

Earnings do not include payments:

- travel allowances;

- money assigned to citizens in the implementation of government duties;

- payment issued when combining work and study;

- severance pay.

Attention! Taxes and insurance premiums are paid on any compensation.

Differences in wages in different regions

Salaries by region differ for several reasons:

- Minimum wage (For example, for 2021 the minimum wage in Moscow is 20,589 rubles, and in Sochi 12,298 rubles);

- Real estate prices (The cost of housing and its rent affect salaries in different regions, employers try to raise wages so that the employee has the opportunity to work);

- Working conditions (Example: work on a rotational basis in the north, climatic conditions of the regions, and so on).

Salary depends on the region where you work

Let's look at average wages in recent years in Russia:

- For 2021, the average salary in Moscow was 135 thousand rubles.

- The average salary in St. Petersburg is 83.5 thousand rubles.

- Chukotka Autonomous Okrug - about 135 thousand rubles, Kirov region - 35.9 thousand rubles.

The highest average salary level in large cities of Russia

How to properly ask for a salary increase

How can you achieve a salary increase? Some simple tips on how to correctly ask for a raise from your boss:

- Get ready! Be confident in yourself and your price. Think about what kind of increase will be discussed, compare whether your salary really lags behind the market average.

- Give reasons why you deserve a raise and not another employee. Demonstrate your importance to the company and convince your boss of this.

- Don't try to blackmail your superiors.

- Showcase your achievements and work results.

- Try to be objective, first of all, to yourself.

Checking the correctness of the calculation

When receiving a salary, citizens can independently determine the correctness of the calculation of their payment. For this, information from the payslip is used. Here you can find data on all transactions performed to calculate earnings.

The payout sheet contains an algorithm for determining payment, which takes into account salary, bonuses and allowances. Therefore, citizens can check using this information. If errors are identified, this becomes the basis for recalculation or holding the company’s accountant liable.