Who is entitled to long-service benefits?

Law N 4468-1 regulates the legal relationships of retired servicemen. There has been no significant editing since its publication in 1993.

Who receives payments:

- To the security forces for long-term service to the Motherland for citizens with over 20 years of experience.

- If a serviceman retired at age 45:

- due to the inability to serve the Fatherland due to poor physical condition;

- during restructuring procedures in the case of service time of 12.5 years and general labor time of 25 years.

When identifying the general labor period, the same activities are included as for insurance pensions. Pension social security for servicemen applies to both Russians and some foreigners who previously served in the Russian Federation (USSR), if their country did not provide them with payments.

For example, this may include the Baltic countries (Latvia, Lithuania, Estonia).

Important! Powers arise for senior, middle and lower-ranking military personnel who served in various law enforcement agencies of the Russian Federation and the USSR. The exception is prosecutors and judges. They have their own social security algorithm. Download for viewing and printing:

Law of the Russian Federation dated February 12, 1993 N 4468-1 (as amended on May 1, 2017) “On pension provision for persons who served in military service, service in internal affairs bodies, and the State fire protection system...”

Procedure and deadlines for applying for an appointment

For the assignment of a military pension based on length of service, you must contact the authorities of those services in which the recipient of the pension served before dismissal : pension authorities of the Ministry of Defense of the Russian Federation, the Ministry of Internal Affairs of the Russian Federation, the Federal Penitentiary Service and the FSB of the Russian Federation. When applying, a serviceman must submit:

- application for a pension;

- documents (if necessary) confirming the existence of conditions for increasing payments or establishing bonuses.

You can contact the pension authority in person or send the application and documents by mail. After checking the submitted documents, if everything is in order with them, within ten days after submitting the application (if the necessary documents are submitted no later than 3 months from the day they were requested), the pension benefit is assigned.

Algorithm for identifying years served

The minimum length of service required for social security for a military personnel is 12.5 years.

The required time period includes involvement in various job positions in such law enforcement agencies as:

- Russian, Soviet Armed Forces, United Armed Forces of the CIS;

- internal, railway and border troops;

- federal government communications and information institutions;

- troops gr. defense;

- FSB, counterintelligence, foreign intelligence agencies;

- state security authorities;

- state fire service, state drug control authorities, penal institutions;

- other paramilitary structures.

Also take into account:

- employment in government agencies and law enforcement agencies;

- if before service a person was in captivity, served a sentence, was detained in cases of unlawful prosecution or illegal repression with subsequent rehabilitation as a result.

Sometimes studying also comes into play.

Important! Service processes included in military service are counted on a calendar basis. But service under special conditions is calculated at a preferential rate. Study is counted as 1 year in 6 months.

For example, serving as a flight crew (with regulated flight hours) in remote areas, in the Far North, 1 month goes by 2.

Financial maintenance of military personnel for settlements

It is understood as the official salary, summed up from:

- salary according to military or special rank (without additional payment for exceptional conditions);

- bonuses due for service before retirement.

If, before retirement, a serviceman was transferred due to poor health from flying positions, service activities on submarines, or nuclear ships to a lower-paid position, then it is permissible to use in the calculations the provision for a career change for these reasons.

Amount of payments for long-term service

The amount of social security for retired servicemen is related to:

- number of grace years;

- official positions and ranks, being in which the warrior went on a well-deserved rest;

- the presence of class ranks;

- the presence of financially dependent people.

The more privileges a serviceman has achieved and the longer he has served, the higher his security will be after retirement.

Important! With 20 years of service, you are entitled to 50% material support + 3% allowance for 12 months beyond the 20th anniversary. Those who have a mixed length of service and 25 years of total work experience are credited with 50% of the allowance + 1% for every 12 months over the 25-year period.

The volume of payments should not exceed 85% of the financial content. Incomplete years do not count. The regional coefficients established in the place of residence of the pensioner are applied to the accrued amount. Social security with mixed service is usually less in volume than with 20 years of service.

Attention! Supplements, increases and raises are calculated from the amount of social benefits provided for by Federal Law No. 166 and are considered anew along with the increase in the specified benefit.

Increase in payments to military pensioners

Financial support was previously applied in full, but after its significant increase, restrictions were established for pension calculations.

Since 2012, when calculating pensions, monetary allowance began to be taken into account as 54%. From 2013, the increase began again by 2% until reaching 100%. At the same time, the volume of benefits in absolute terms has increased. Attention! There are categories of security forces for whom the established restrictions do not apply. These are pensioners of the Military Collegium of the Supreme Court of the Russian Federation, military courts, the Prosecutor's Office, and the Investigative Committee of the Russian Federation. The volume of military pensions is being revised as the earnings of active security forces increase.

In addition to the basic pension amount, some categories of citizens are entitled to increases similar to civil pensions:

- Heroes of the USSR, Russian Federation, awarded the Order of Glory of 3 degrees - 100%;

- To the Heroes of Socialist Labor and Labor of the Russian Federation - by 50%.

If persons have been awarded an honorary title more than once, the pension increases for each title awarded:

- champions of the Olympic, Deaflympic and Paralympic Games - by 50%;

- full holders of the Order of Labor Glory or “For Service to the Motherland in the USSR Armed Forces” - by 15%;

- participants, disabled people of the Second World War, former minor prisoners of fascist concentration camps, ghettos, places of forced detention created by the German fascists and their allies during World War II, awarded the badge “Resident of besieged Leningrad” - by 32%;

- persons illegally repressed for political reasons and rehabilitated - by 16%.

Military pension supplements

The following allowances for military personnel, if there are legal grounds, are established:

- disabled persons 1 gr., persons who have reached the 80th birthday are assigned a 100% premium for inspection;

- for financially dependent people without ability to work, in the absence of a job for the applicant and a pension for the financially dependent person - 32%, 64% or 100%, depending on the number of dependent persons;

- WWII participants, if there is no disability - 32%, and upon reaching 80 years old - 64%.

When determining the right to such allowances, military personnel are in a disadvantaged position compared to civilians. The military has limitations in the form of the inevitable lack of work and benefits for the financially dependent; if the 2nd parent is also a pensioner. Civilians have no such restrictions.

Conditions of appointment

The procedure for assigning such a payment has been regulated for a long time by the Law of the Russian Federation “On Military Pensions”, which spells out the entire procedure for registering and receiving money. According to this document, the right to it is given to various types of employees who have completed their service in various structural divisions of the Russian Federation and have the appropriate length of service, which is sufficient to apply for benefits. There are two options for this exit.

A long-service pension for military personnel is entitled to:

- Persons who, on the date of dismissal from the competent authorities, have a total work experience of at least 20 full years;

- Persons who have already reached the maximum permissible age for service in the authorities (by law - 45), or those subjects who were dismissed for health reasons or for other reasons. The total work experience is 25. But out of these 25, at least 12.5 of the work was in the military department.

As a result, how many years are included in the length of service individually, but in general, from 20.

Such service involves military service, service in internal affairs bodies, in executive or fire service bodies, and in other bodies that are subordinate to the Ministry of Internal Affairs of the Russian Federation.

Services in which work can be equated to military service:

- Ministry of Internal Affairs;

- Federal Security Service;

- Ministry of Emergency Situations;

- Corps of Engineers,

- Foreign intelligence;

- Other

I would also like to note that a citizen is considered a military man as long as he serves and has not retired to the reserve. When the fact has occurred, then the person can be considered a pensioner accordingly.

Moreover, both the employee himself and his family can apply for such benefits in the event of the death of an entity directly entitled to benefits from the state.

Also, if a person of such a profession has not accumulated the required duration to receive security for length of service, then until he reaches a certain age he will also receive security, but depending on the person’s rank, position, total length of service, and other factors.

The age at which a person can claim money without achieving 20 years of military service:

Also, according to current legislation, a person who, after leaving the relevant structures for vacation, continues to work under an employment contract or a contract in another industry, has the right to receive two pensions: military and general labor pensions through contributions to the Pension Fund.

At the same time, the procedure for calculating and registering such security is regulated by the Federal Law of the Russian Federation “On Labor Pension”. Its size will depend on the average earnings that a person will receive after leaving his new job and the contributions that will be made to the fund.

Conditions for assigning two benefits:

- Age: for men – 60, for women – 55;

- Dismissals based on length of service from the structures of the Ministry of Internal Affairs, etc.;

- Work experience of at least 5.

Indexation of benefits in 2021

The amount of material support when assigning a pension is annually indexed by 2% until the value reaches 100%. The State Duma Defense Committee supported the indexation of payments to military pensioners in 2021 and the financial basis for calculating payments was set at 69.45%.

By 2021, on February 1, it increased to 72.23%, and therefore the benefits of military pensioners increased. In April 2021, pensions were indexed by 4%. In the next 3 years they will also be indexed:

- in 2021 by 4.3%;

- in 2021 – by 3.8%;

- in 2021 – by 4%.

From October 1, 2019, the reduction coefficient has been increased to 73.68%, and the overall increase in pensions together with indexation will be 6.3%.

Right to a share of the insurance pension

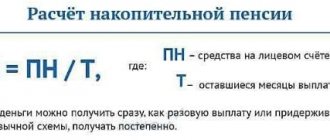

If a military pensioner, discharged from service, continues to work in civilian positions, and the employer pays insurance contributions to the pension fund for him, or the pensioner operates as an individual entrepreneur with the payment of appropriate contributions to the Pension Fund, he may be entitled to receive a second pension - an insurance pension for old age (except for a fixed payment to it) upon reaching the conditions required by law:

- Age 65 for men, 60 for women. In 2021, the age value will be lower (more details here). It is possible to assign an old-age insurance pension early for work in particularly difficult conditions and areas.

- The minimum insurance period is at least 10 years (if it was not taken into account when assigning a military pension). The length of service requirement increases every year by 1 year up to 15 years.

Additional requirements provided for the assignment of an insurance pension:

- The minimum individual pension coefficient (IPC) is 18.6. The requirement for it increases by 2.4 annually until it rises to 30.

- Availability of a military pension for long service or disability.

Minimum benefit amount

The state guarantees a minimum of pension payments to military personnel.

It is identical to the social benefits of persons listed in Federal Law-166 and from April 1, 2017 is equal to 5034.25 rubles. Important! The amount of pension provision assigned at the state level must not be lower than the subsistence level. If for some reason the opposite happens, then the pensioner is automatically assigned a social supplement to the benefit. The amount of service payments depends on the size of the salary received. Most often, it is quite high in comparison with other types of pension provision, so social benefits are not established for the military.

What pensions can military personnel receive?

The legislation on pension provision for military personnel for this category of citizens establishes three types of pensions :

- by length of service;

- due to disability;

- due to the loss of a breadwinner.

At the same time, the law stipulates some nuances when obtaining the right to pension provision:

- A long-service pension is assigned and paid to its recipient after his dismissal from service .

- The assignment of a disability or survivor's pension does not depend on the length of service of the military personnel .

- A pension benefit for disability is established if it occurs during service or within three months after dismissal, or even later, but arose due to illness or injury received during the period of service.

What will the transition from the old length of service indicator to the new one look like?

Practice shows that it is simply not possible to make such serious changes overnight. To implement the state’s goals of increasing the length of service to 25 years, a “transition period” is necessary, which will ensure the painlessness of the innovation.

The retirement age for military personnel will be raised in stages. This period will be 5 years.

As time passes, the situation will be adjusted. Changes will be made if necessary.

Disadvantages and problem areas will be obvious in any case. Now many military personnel will not be able to count on the so-called “double pension”; they will have to choose between service and civilian self-realization in work.