Alimony obligation

Alimony is a certain percentage of the employee's income or a fixed amount that one of the parents transfers for the purpose of supporting a minor child or children. An employee can pay them either voluntarily or forcibly. On a voluntary basis, parents draw up an agreement between themselves, certified by a notary, which sets a certain amount or percentage of the salary for monthly transfer. Compulsory alimony is established by the court, in this case the employer receives a decision. Also, alimony can be transferred according to a writ of execution, which contains information on the amount of deductions from wages for alimony (Read also the article ⇒ Alimony upon dismissal of an employee in 2021).

Father spends vacation with children: what then?

Based on a court decision, if the father is not deprived of his rights, he can spend his vacation with the children. The mother cannot prevent this. Parents must agree on the conditions individually: will it be useful for the children, how many days will they spend with their father on vacation.

At the same time, benefits will continue to be transferred. If child support is paid as a percentage of all earnings, it will still be transferred to the mother. Family law does not provide for compensation in this case. Also, gifts that a father gives to his children are not subject to compensation.

Transfer of alimony from vacation pay

Vacation pay refers to those payments from which alimony is withheld (List, approved by Decree of the Government of the Russian Federation No. 841 of July 18, 1996). The period within which vacation pay must be paid is three days before the start of the vacation. (136 Labor Code of the Russian Federation). Article 109 of the RF IC states that withheld alimony is paid by the recipient within 3 days from the date of transfer of vacation pay. From this we can conclude that it is necessary to transfer alimony before the day the alimony holder goes on vacation.

Let's assume that Ivanov is going on vacation on February 5, 2021. Vacation pay must be given to him no later than three calendar days before the start of the vacation, that is, no later than February 2, 2021. And vacation pay should be transferred within three days after the payment of vacation pay. Accordingly, if vacation pay is transferred to Ivanov on February 2, then alimony must be transferred on February 5. But as a rule, both wages and alimony are transferred on the same day.

Important! The writ of execution for withholding alimony is received by the employer, and accordingly he is responsible for the correctness of the calculations and timing of the transfer of alimony.

Calculation procedure

According to the RF IC, the calculation of funds for the maintenance of children is made after the tax contribution - personal income tax - has been withheld from the parent’s income (including vacation payments, which are part of the earnings).

Personal income tax is 13% of the total amount of accrued wages (including vacation pay).

After income tax has been deducted from the salary retained by the employee while he is on vacation, the percentage of alimony contributions is calculated from the remaining amount.

If an employee received monetary compensation for vacation, including upon dismissal of his own free will or for another reason, as well as upon transfer from another enterprise, the procedure for paying alimony from accrued funds does not change.

In a situation in which the child reaches the age of majority during the period of leave of the paying parent, alimony will be accrued only until the date when the son or daughter turns 18 years old.

Formula

The amount of alimony is determined by Article 81 of the RF IC and is directly related to the number of children:

If the benefit is paid for one child, then deductions for its maintenance amount to 25% of the amount of vacation pay minus 13% of personal income tax and are calculated using the formula:

(CO (amount of vacation pay) - (CO x 13: 100)) x 25: 100 = SA (amount of alimony).

2. For two children - 33.3%:

(CO - CO x 13: 100) x 33.3: 100 = CA.

3. For three or more - 50%:

(CO - CO x 13: 100) x 50: 100 = SA.

In some cases, the amount of alimony payments can reach 70%, that is:

(CO - CO x 13: 100) x 70: 100 = SA.

This is the maximum percentage specified in Art. 138 of the Labor Code of the Russian Federation, which is accrued:

- if there is a large alimony debt;

- if the alimony provider has three (or more) children and one of them is disabled.

Transfer deadlines

In accordance with Art. 136 of the Labor Code of the Russian Federation establishes the accrual of vacation payments 3 days before the day on which the vacation begins.

According to paragraph 3 of Article 98 of the Federal Law “On Enforcement Proceedings,” alimony from the accrued amount is transferred by the employer of the alimony obligee to the recipient’s account no later than 3 days from the moment the vacation pay was transferred to the benefit payer.

Attention! If money for vacation has not been paid, the person obligated to pay alimony may postpone the start of his legal vacation to the period when the employer can transfer the funds.

If the alimony provider has a debt, a penalty of 0.5% of the calculated amount for each day of delay is added to the mandatory payments:

(SA (amount of alimony) x 0.5: 100) x KD (number of overdue days) = SP (amount of penalty).

In case of non-payment, enforcement measures are applied to the paying parent.

Alimony payments from vacation money may not be transferred to the recipient parent due to an accounting oversight. To resolve the issue, it is necessary to send a written request to the head of the enterprise with a detailed explanation of the situation and a request to correct the violation. If there is no response, you will have to go to the district court.

Priority for other monetary obligations

In a situation where, in addition to the writ of execution, there are other documents according to which the alimony payer is obliged to pay debts, funds for the maintenance of children are collected first, and then other deductions are made.

If the parent-alimony provider is in prison or is in a hospital hospital for compulsory treatment, alimony is levied on that part of the payer’s income that remains after deducting the amount of money spent on his maintenance.

Employer's liability

In accordance with Article 109 of the RF IC, the management of the enterprise or organization where the citizen who is obligated to pay alimony works is responsible for withholding funds for the maintenance of the child, both from wages as a whole and from vacation pay as part of it.

If the corresponding document has been sent to the enterprise, the accounting department is obliged to:

- calculate alimony payments;

- withhold funds from the employee-alimony provider’s vacation pay;

- transfer money to the recipient’s account no later than the first day of the employee’s vacation.

In practice, the accrual of funds for vacation and the transfer of alimony payments are usually made on the same day.

Important! Unlawful withholding of alimony entails administrative liability for employees of the enterprise's accounting department.

If alimony payments from vacation pay have not been transferred to the recipient parent, the latter has the right to file a claim in court to recover them.

Art. 109 of the RF IC provides for administrative or criminal liability of the employer both for late payment of vacation pay and for failure to transfer funds for child support on time.

Criminal liability arises in case of intentional failure to comply with a court decision (Article 325 of the Criminal Code of the Russian Federation), as well as in the event of loss of a writ of execution.

If the child comes of age during the vacation period

Before you pay alimony for the first time, you need to decide on the date. The same applies to the termination of alimony payments. The need to withhold and transfer vacation pay will cease as soon as the child for whom deductions were made turns 18 years old (120 RF IC). Situations often occur when the child comes of age at the time of the child support provider’s leave.

In this case, the accountant needs to strictly monitor the deadlines. If the day when the child turns 18 comes before the vacation, then there is no need to withhold alimony from vacation payments. And if the child’s birthday is during vacation, then alimony needs to be withheld only from payments for those days of vacation that were before that day. That is, it is no longer necessary to withhold alimony in full. Let's take a closer look at an example.

If the alimony pays independently

Often, the parties independently agree among themselves about when and in what amount the payer will transfer alimony, but the agreement is not formalized.

From a legal point of view, this is quite risky: the recipient will have to collect money from the alimony payer forcibly through the court in case of non-payment, and the payer has no guarantee that he will not file a claim for collection if the funds were actually transferred without receipts. The best option is to conclude an agreement where the parties independently establish the procedure, amount and timing of alimony payments. The payer can pay money either every month or in other time frames - it all depends on the wishes of the former spouses.

Expert commentary

Gorchakov Vladimir

Lawyer

It is worth noting that alimony is paid both after a divorce and during a de facto marriage, if the spouses do not live together and do not conduct joint economic activities. The money that the payer spends on the purchase of clothes, toys and other goods for the child is not taken into account, therefore alimony will be withheld in the amounts established by law.

Important! If the child support provider took the child with him on vacation, such expenses are also not taken into account, and the money in any case will be deducted by the accounting department from vacation pay.

If the child support provider is hiding

It also happens that a parent deliberately hides from paying by taking an unofficial job. Here, the tasks of the bailiffs include identifying the organization in which he is employed, after which the employer is held administratively liable by the labor inspectorate for the lack of an agreement with the employee, and the alimony provider is obliged by court to pay the entire amount to the child for the period from the date of the court decision on alimony.

Example of withholding alimony from vacation pay

I.I. Ivanov works at Continent LLC. According to the writ of execution, alimony for his son is withheld from Ivanov’s salary until he reaches 18 years of age. The amount of alimony is 25% of income. Ivanov wrote an application for leave for 14 days from February 5, 2021. But on February 10, my son turns 18. Ivanov’s salary is 40,000 rubles. A deduction for Ivanova’s first child is made in the amount of 1,400 rubles.

Let's calculate alimony.

Ivanov’s vacation pay amounted to 19,113 rubles.

Alimony must be withheld from Ivanov’s salary for the period of work in February before the vacation and from vacation pay for those days that fall before the child’s birthday, that is, for the period of time when alimony obligations were still in effect.

In February, Ivanov worked 2 days before his vacation. Let’s calculate his salary for these days:

40,000 rubles / 19 days x 2 days = 4211 rubles

Personal income tax on this amount is equal to: 4211 x 13% = 547.43 rubles

Alimony from salary will be: (4211 – 547.43) x 25% = 915.90

Now let's calculate alimony from vacation pay.

Personal income tax was withheld from Ivanov’s vacation pay: 19,113 rubles x 13% = 2484.70

Now you need to determine the amount of vacation pay that falls on those vacation days when the alimony obligation is in effect:

(19,113 – 2484.70) / 14 days x 5 days = 5938.68 rubles

Thus, for February the amount of alimony will be:

915.90 + 5938.68 = 6854.58 rubles

Example

Citizen Kirichenko A.R. goes on vacation. Compensation for overtime and vacation pay was added to his monthly income. So, his monthly income was 20,000 rubles. Taking into account all charges it amounted to 28,000 rubles. Of this, the accounting department will transfer 7,000 rubles towards alimony: this is the fourth part, 25%. This also included money for vacation: 25% was also written off from them towards alimony.

If citizen Kirichenko decides to quit his job and he is given compensation for unworked vacation days , they will also be written off. Funds will be credited based on a percentage: exactly 25% is transferred if we are talking about one child. Thus, family law regulates the transfer of benefits from money paid for vacation or for its compensation.

For which payments alimony is not deducted?

Once the writ of execution has been received by the employer, the employee will not have to do anything. All other calculations and responsibility for transfers will fall on the shoulders of the employer. Child support should be withheld from income after personal income tax has been withheld from the accrued amount. Alimony is not withheld from some payments (Law No. 229). These include: financial assistance paid in connection with the death of a close relative, or in connection with marriage, or in connection with the birth of a child. Also, alimony is not withheld from compensation paid to an employee, for example, during downsizing, liquidation of a company or certain types of dismissal.

Retention example for 2021

Initial data:

The organization employs an employee, Potapov, who pays child support for one minor child in the amount of 25% of income on the basis of a writ of execution.

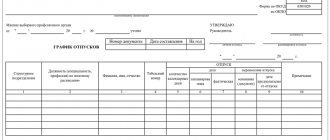

According to the order, Potapov was granted annual leave from November 1, 2021 for 14 calendar days. The accountant calculated vacation pay = 18,900 rubles.

Calculation:

18900 is the accrual amount from which you need to first withhold the required taxes.

| Personal income tax | 18900 * 13% = 2457 |

| Holiday pay after tax | 18900 — 2457 = 16443 |

| Alimony | 16443 * 25% = 4110,75 |

| Vacation pay to be paid after all deductions | 16443 — 4110,75 = 12332,25 |

| Deadline for payment of vacation pay | October 29, 2021 |

| Deadline for payment of alimony | November 01, 2021 |

Employer's liability

The head of the company, as well as the accountant who calculates and transfers alimony, in case of violations may be subject to both administrative and criminal liability. An official who violates the norms of legislation on enforcement proceedings faces a fine: 15,000 - 20,000 rubles (17.14 Code of Administrative Offenses of the Russian Federation). In case of “malicious failure” by company officials to comply with a court decision or an executive document, it is subject to a fine of up to 200,000 rubles, or imprisonment for up to 2 years (315 of the Criminal Code of the Russian Federation). As a rule, a delay in the transfer of alimony is associated with late payment of wages in the company. But sometimes, payment not on time is due to the negligence of an accountant or other person responsible for transferring alimony.

Responsibility for non-payment of alimony

If alimony is not transferred to the recipient, liability for this violation occurs.

First of all, liability will affect the debtor himself. Seizure of property, a ban on leaving the country, suspension of a driver’s license are the most common measures of influence on debtors, which, by the way, have a good effect on violators. In addition, a fine may be imposed on the violator, and if this does not work, then criminal liability will arise.

If alimony is transferred by the employer’s accounting department, then if violations are detected, a fine is imposed (both on the responsible employee and on the organization), the executor may be disqualified or incur criminal liability.

Rubric “Question/Answer”

I plan to receive compensation for unused vacation. Tell me, is child support being withheld from her?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Alimony is paid from all income of the obligated person, including additional remuneration . Vacation pay and compensation for unused vacation are considered as such - by virtue of Government Decree No. 841 of July 18, 1996 (clause “k” of paragraph 1 of the List). In case of maintaining the job and/or dismissal of the employee, the employer pays him compensation for unused vacations. Calculation and payments are similar to payment of wages. Therefore, alimony is withheld according to the same rules as in the case of basic earnings.

If I go on vacation, I will receive my salary and vacation pay, and alimony will be deducted from them. Next month there will be no salary until I earn it. Will alimony debt be accrued?

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

No, there will be no debts. Alimony is withheld from the employee's salary. If the accounting department handles the transfers, they take into account monthly payments. Withholding of alimony from vacation pay and wages occurs no later than 3 days from the moment of their transfer to the employee’s account (Article 109 of the RF IC). The debt arises due to the fault of the accounting department or the employer. For example, if your salary is delayed and, as a result, the schedule for transferring alimony to the recipient is violated. The latter can contact the bailiffs, the prosecutor's office or the court - an inspection will be carried out against the violators (see “What to do if alimony does not arrive”).

The father of the child began his vacation on August 25. And, as I understand, I should receive alimony from his vacation pay, but it still hasn’t arrived. What to do?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

The situation needs to be clarified. There may have been a delay somewhere. The obvious option is to call/go to the accounting department at the place of employment of the child’s father and find out about the reasons for the delay. If it is not possible to go there in person, fill out an application addressed to the employer . The document can be sent by registered mail (with acknowledgment of delivery). In the application, ask the manager to explain the situation with the delay in the transfer of alimony. Indicate that the father went on vacation, but payments for the child were not received within the specified period. The employer must provide an official response. Next, act according to the circumstances. If there is no clear answer, contact the district office of the SSP or file a claim in court . If alimony was not paid on time, the recipient has the right to demand the collection of a penalty and bring the perpetrators to justice (Article 115 of the RF IC). Most likely, the culprit will be the employer or the organization’s accountant (see “What to do if the organization does not pay child support”).

The child’s father managed to receive vacation pay before he received a writ of execution for alimony at work. Will payments be withheld from vacation pay he has already received?

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

The basis for withholding alimony from the payer’s income is a writ of execution (in your case, a writ of execution). The terms and amount of deductions from wages are indicated there. The writ of execution arrived after my father was given the current vacation pay. Therefore, there will be no . But alimony will be deducted from the worker’s subsequent vacation payments.

Alimony is collected from a wide range of incomes.

Vacation pay is no exception; such payments are made every year (most often in the summer). Recipients of alimony need to know when and how child support payments are withheld from the payer’s vacation pay. And if an accountant’s mistake creeps into the case, the minor will not receive alimony. We have to defend our interests in the SSP and the courts. Not everyone knows how to do this or is delaying the application - but time passes. If you have a complex case and require the help of a lawyer, contact us. The site’s lawyers are ready to provide free consultation on issues of calculating alimony from vacation pay. Payers may also need legal assistance. For example, if they are charged with a debt that was not their fault. These and other questions can be discussed with a lawyer online or by phone. Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 1 ratings, average: 5.00 out of 5)

Author of the article

Irina Garmash

Family law consultant.

Author's rating

Articles written

612