Where are the vacation pay rules written?

Everyone who works under employment contracts, agreements and contracts is provided with guaranteed rest time.

The minimum duration is 28 days. But only for a fully worked calendar year. But employees who are signed under GPC, author’s order and contract agreements are not entitled to paid leave. Essentially, vacation is paid time off. Moreover, the procedure and principles of payment are fixed at the legislative level:

- Chapter 19 of the Labor Code of the Russian Federation - regarding duration, payment terms, job retention. The standard contains provisions on both main labor and additional leaves.

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (as amended on December 10, 2016) - regarding the calculation of average earnings.

- Letter of the Ministry of Labor dated April 15, 2016 No. 14-1/B-351 - regarding the determination of indicators of actual time worked in case of deviations from the standard regime.

Legislative acts and departmental letters of recommendation establish only general provisions for the provision of rest. Specific values, payment procedures and other factors are established individually by the organization. The standards must be specified in the employment contract with the employee, in the collective agreement, as well as in other local regulations of the institution.

Online vacation pay calculator in 2021

The vacation pay calculator from the Kontur.Accounting service will help you calculate the amount of payments for various types of vacations, taking into account sick leave, time off, and changes in salary. The calculator is available free of charge and without registration; its calculations meet all legal requirements. It's very easy to use:

- In the “Initial data” tab, indicate the vacation period, its type and the boundaries of the billing period. Indicate exclusion periods and salary increases, if any.

- In the “Pivot Table” tab, enter data on monthly accruals to the employee for the billing period.

- In the “Results” tab, you will see the amount of vacation pay and the approximate amount of personal income tax to be withheld (to accurately calculate personal income tax, you need to take into account deductions, taxes and charges).

The calculation will take a couple of minutes. If you work under an employment contract, add our calculator to your “Bookmarks” and you can always find out the amount of your vacation pay. If you are an accountant for a company, you will appreciate the ease of working with the calculator. Kontur.Accounting has many other tools for accounting and payroll.

Free calculators for sick leave, maternity leave, and vacation pay are our open access widgets. If you want to quickly and easily calculate salaries, keep records and send reports via the Internet, register in the online service Kontur.Accounting. The first 14 days of work for each new user are free.

What determines the amount of vacation pay?

The amount of vacation pay directly depends on the employee’s salary. For example, if the earnings were significant, then you can count on good vacation pay. If the salary is modest, then you shouldn’t claim large sums.

There is no specific dependence on what percentage of the salary the vacation pay is. But the amount of payments is influenced by the following factors:

| Factor | Result |

| Duration of the rest itself | The amount of payment directly depends on how many days of rest the employee takes. The longer the period, the greater the payment amount. |

| Duration of the billing period | If the period is not fully worked, the employee does not have the right to claim a full rest period. |

| Deviations in hours worked in the billing period | We are talking about sick leave, maternity and parental leave, as well as other periods that are excluded from the calculation (study, business trips, time off and days without pay, downtime, etc.). |

| Transfer to a high-paying position | Has a positive impact on the payout volume. The higher salary will be taken into account in the pay period depending on the date of increase. |

| Transfer to a lower paid position | A reduction in official salary will negatively affect the amount of vacation pay. When transferring to a low-paying job, it is most profitable to take a vacation right away, while the pay period includes months with a large salary. The later the leave since the demotion, the lower the amount. This is the main reason why vacation pay is less than salary. |

| General salary increase in the institution | If the increase in earnings affected all employees of the company or a separate structural unit, then indexation is carried out when calculating payments. This is a mandatory procedure, and the employer has no right to refuse it. But if salaries were increased not for all employees, but selectively, then indexation is not carried out. |

In addition to the listed factors, the company may provide additional conditions that improve the financial situation of subordinates. For example, financial assistance, additional days of rest and other bonuses.

Actions of the employee in case of non-payment

Many employers violate existing legal norms. Employees must know how to assert their rights and where to go for help and support.

Late transfer of funds is a direct violation of the rights of a party to an employment contract, therefore no independent agreements should be reached with the employer.

The injured party may appeal to any of three authorities if desired:

- Labor inspection.

- The prosecutor's office.

- Court.

The order of appeals does not matter, so you can even start right away with the court, but it is more logical to complain to the Labor Inspectorate first. This organization guards compliance with labor legislation. Upon receipt of a statement of violations, it initiates an unscheduled inspection and seeks confirmation of the information received. If such evidence is identified, then she tries to resolve the conflict by forcing payment or takes the case to court herself.

How are vacation pay calculated?

As a general rule, vacation pay is calculated using the formula:

It's quite simple. But problems may arise with the calculation of an employee’s average daily earnings. We calculate the average earnings according to the calculation: we divide the calculation base by the time worked in the billing period. To calculate, follow the instructions:

- The billing period is 12 months preceding the month the holiday begins. For example, if an employee goes on vacation in June 2021, we include in the calculation the period from 06/01/2018 to 05/31/2019.

- If the calculated leave falls entirely on maternity leave or childcare, then the period must be replaced with an earlier one.

- We count the time worked. These are all the days that the employee actually worked. Sick leave, business trips, and any vacations are not taken into account. Also excluded are all periods during which the subordinate was suspended from performing work for any reason.

- For a fully worked month, we take into account 29.3 days. This is the standard number of days on average.

- For a month worked partially, we calculate: 29.3 is divided by the number of days in a month according to the calendar and multiplied by the number of calendar days worked. That is, in days worked we include weekends and holidays that fall during the time worked.

- The accrual base includes all types of remuneration accrued for actual time worked. But do not include sick leave, vacations, business trips and downtime in the calculation.

IMPORTANT!

There are no restrictions on average earnings for vacation accrual. No maximum limit has been approved. But the minimum average earnings must be calculated according to the minimum wage.

Compensation for unused vacation

A resigning employee receives not only wages for days worked, but also monetary compensation for unused vacation. The calculation for this compensation is the same as when calculating vacation pay for a partially worked period. First, we find out the average daily earnings, then multiply this amount by the days of unused vacation. The Labor Code teaches that for each month worked in full, an employee is entitled to 2.33 days of vacation. That is, we must multiply the number of full months worked by 2.33 and round to the nearest whole number in favor of the employee. There is one nuance in calculating compensation: if you are dismissed after the 15th, the current month is considered a full month. If you leave before the 15th day, the month is not taken into account at all.

An example of calculating compensation for unused vacation

Employee Kotov worked for 9 months and resigned on April 20, 2021. The number of vacation days will be 10 × 2.33 = 23.3 days, rounded to 24 days.

Kotov’s average daily earnings was 1,700 rubles, which means compensation for unused vacation will be 1,700 × 24 = 40,800 rubles. Minus personal income tax (40,800 × 13% = 5,304 rubles), Kotov will receive 35,496 rubles in compensation for unused vacation.

Calculation example

Kochergin A.P. goes on vacation from 06/19/2019 for 14 days.

For the billing period from 06/01/2018 to 05/31/2019 he was accrued:

- salary - 450,000 rubles;

- vacation pay - 34,000 rubles;

- sick leave - 18,257 rubles.

Kochergin A.P. I rested for 14 days - from 07/04 to 07/17/2018 and was sick for 7 days - from 02/06 to 02/12/2019.

In the estimated time, 10 months have been fully worked out - 293 days. (10 months × 29.3).

The number of days for calculating vacation pay for July 2021 is 16.07 days. (29.3 / 31 days × (31 days - 14 days)), for February 2021 - 21.98 days. (29.3 / 28 days × (28 days - 7 days)).

The total number of days worked by Kochergin A.P. in calculation - 331.05 days. (293 days + 16.07 days + 21.98 days).

The base for calculating vacation pay is RUB 450,000. Amounts due for sick leave and vacation are not included.

Kochergin’s average daily earnings is 1,359.31 rubles. (RUB 450,000 / 331.05 days).

The amount of vacation pay is RUB 19,030.34. (RUB 1,359.31 × 14 days).

Payments when going on vacation in non-standard situations

The application of legislative norms in practice raises many questions, which are regularly answered by federal departments and courts. Let's look at some of them.

Payments for vacation in working daysAccording to Art. 121 of the Labor Code of the Russian Federation, the duration of annual leave is calculated in calendar days. However, there are a number of exceptions to this rule. Thus, for an employee whose activities are seasonal, the period must be calculated in working days (Articles 291, 295 of the Labor Code of the Russian Federation). Judges and scientists also belong to a special category. Accruals will have to be made according to a schedule with a 6-day week. First, you will need to mark the beginning and end of the vacation, and then convert the received data into calendar days. The procedure is described in clause 11 of the Regulations on the specifics of the procedure for calculating average wages, approved by government decree No. 922. The legality of the application of the scheme has been repeatedly confirmed by judicial practice (for example, the appeal ruling of the Orenburg Regional Court in case No. 33-7247/2014).

Annual leave before maternity Pregnant women can take advantage of the right to paid leave immediately before the birth of the child. At the same time, they will not need to work for 6 months. Payments will be accrued in advance, the legal basis for this will be Art. 122 and 260 of the Labor Code of the Russian Federation.

Errors in payroll calculations Often, when calculating vacation pay, an accountant discovers irregularities, as a result of which missing bonuses and remunerations are paid to the employee. In this case, it is necessary to take all transfers as a basis. The fact that payments go beyond the billing period does not matter

According to Art. 139 of the Labor Code of the Russian Federation, when determining the average monthly salary, one should take into account all funds due to a person as part of wages. A counting error should not infringe on the interests of the employee.

Insurance contributions from vacation payChapter 34 of the Tax Code of the Russian Federation does not classify the payments in question as income exempt from taxes, therefore, contributions from all amounts will have to be transferred to extra-budgetary funds

The official position on this matter is enshrined in the letter of the Ministry of Labor of Russia dated June 20, 2016 No. 17-3-OOG-994.

Work experience for part-time work The calculation procedure does not change: since the condition for a shortened shift was agreed upon by the parties, it will not affect the recording of time. So, if the contract provides for the performance of a labor function within 4 hours, the day will be considered fully worked. The accountant is obliged to include all days worked and weekends in the vacation period. The substantiation of the position is Art. 93 and 139 of the Labor Code of the Russian Federation.

Payments for vacation divided into parts In this case, the only limitation is that the duration of the main part of the vacation must be at least 14 days (Article 125 of the Labor Code of the Russian Federation). Regarding the distribution of the remaining time, the employee and the employer have the right to agree on any schedule. In this case, the rule regarding the timing of payment will apply, according to which money must be transferred for that part of the vacation that is provided to the employee. So, if an employee rests for 14 days, the amount is calculated by multiplying the average daily earnings by 14. The amount due is issued 3 days before the start of the rest.

Thus, the procedure for calculating payments when an employee goes on vacation is strictly regulated. Deviations from the established rules threaten the organization with administrative fines and labor disputes. This means that in order to avoid lengthy proceedings, the accountant should be guided not only by the articles of the Labor Code of the Russian Federation, but also by numerous clarifications of federal departments. Judicial practice will also serve as a reliable support.

If the year is not completed

Not all employees go on vacation after working a full calendar year. For example, if a specialist hired for the first time is working in an institution, then he can be granted leave no earlier than six months later. And then only for 14 days, no more. This is necessary to avoid unjustified overpayments. But in any situation there may be exceptions.

For such employees, consider the duration of vacation in proportion to the time worked. Calculate your average earnings for the billing period, starting from the date of employment with the company. Otherwise, carry out the calculations in the standard manner.

Example.

Sovkov I.K. got a job at the State Budget Educational Institution of Children's and Youth Sports School "Allur" from 11/01/2018. Let's calculate how much he is entitled to when booking a vacation from 06/01/2019.

Duration of rest - 19 days: 28 days / 12 months × 8 months worked (from 11/01/2018 to 05/31/2019). The calculation turns out to be 18.67 days, but we round up in favor of the employee.

We calculate the accrual base for the period from 11/01/2018 to 05/31/2019. For example, Sovkov earned 700,000 rubles during the specified time. There were no deviations (business trips, sick leave or downtime).

We count the time worked: 29.3 × 8 months. = 234.4 days.

We calculate the average earnings: 700,000 / 234.4 = 2986.35 rubles.

We calculate the amount of vacation pay: 19 days. × 2986.35 rubles = 56,740.65 rubles.

Nuances

Despite the fact that the payment of vacation pay and wages before a planned vacation is regulated by law, problems arise in practice. Disputes that cannot be resolved between the employee and the employer are resolved by the courts.

6 reasons for disputes regarding vacation pay are as follows.

- Vacation pay is paid in working days. According to the general rule established by Article 12 of the Labor Code, the duration of vacation is considered calendar days. But there are employees for whom time is counted in working days. These include scientists, judges and persons performing seasonal duties. When calculating, you need to proceed from a 6-day work week. The moment of the beginning of the rest and its end are noted. Then you need to convert the data per day.

- Rest before maternity leave. Pregnant women do not need to work for six months to go on vacation. Payment is made in advance. You won't have to worry about working out.

- Incorrect payment for labor. All payments are taken into account when calculating vacation pay. It does not matter whether the accountant made mistakes.

- Taxation of contributions. Payment of wages before vacation is not exempt from taxes.

The procedure for paying contributions has changed. Now the Federal Tax Service receives cash instead of funds. However, this does not affect the procedure for assessing contributions. Contributions are withheld from payments.

- Inclusion of length of service for part-time work. The day is taken into account in full if the parties included in the contract a condition for an incomplete shift. If a person works for 4 hours, he is paid in full for the day. The rule is based on Articles 93 and 139 of the Labor Code.

- Payment for vacation, which is divided into parts. Each part of the vacation on which the employee went must be at least 14 days. The parties can negotiate how to provide the remaining time. The payment amount depends on the duration of the vacation. Transfers are made 3 days before leaving for vacation.

Often an employee decides to go on vacation in the middle of the month. The question arises whether the company should pay for days worked along with vacation pay. According to Art. 139 of the Labor Code, 3 days before the planned vacation you must pay for the vacation itself. The manager is not obliged to pay for the time worked, so the employee is entitled only to wages. Payments are made on the day established by the collective agreement or employment contract.

https://youtube.com/watch?v=eKVsZm5mnD4

When do they pay and what is withheld?

The period when vacation pay and salary before vacation are paid is indicated in Article 136 of the Labor Code of the Russian Federation. The amount of vacation pay must be paid no later than three calendar days before the start of the vacation. But it is not necessary to transfer wages by the specified date. Wages must be paid according to the general rules established in the labor and collective agreement.

Determine the period in calendar days. But if the specified period includes weekends or holidays, then issue a vacation calculation in advance. That is, the day before (Letter of Rostrud dated July 30, 2014 No. 1693-6-1). For example, an employee goes on vacation on Monday. Pay your vacation pay on the previous Thursday. In this case, GIT inspectors will not be able to accuse the employer of violating the provisions of Art. 136 Labor Code of the Russian Federation.

IMPORTANT!

If vacation pay is accrued in favor of civil servants, then the salary for the vacation must be paid no later than 10 calendar days before its start date (Part 10, Article 46 of Law No. 79-FZ of July 27, 2004). For municipal employees, deadlines are established by regional and local legislation.

Do I need to pay salary along with vacation pay? No, but it's possible. If you still decide to pay, then check the requirement of Art. 136 of the Labor Code of the Russian Federation, so that earnings are transferred to employees at least every half month. Otherwise, administrative penalties may be applied to the employer under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Withhold personal income tax from the accrued amount for vacation in the same way as from wages. The deadline for transferring income tax on vacation and sick leave is no later than the last day of the month in which the income was paid. Calculate insurance premiums in the general manner. Insurance coverage must be paid to the Federal Tax Service and the Social Insurance Fund before the 15th day of the month following the reporting month.

What the courts say

Judges are not unanimous about whether the day of payment of vacation pay is included in the three-day period. Some of them believe that it is included (rulings of the Kemerovo Regional Court dated January 26, 2017 No. 33-942/2017, Leningrad Regional Court dated August 6, 2015 No. 33-3731/2015).

Other arbitrators say that three full days, counted from 00:00, must pass between the start date of the vacation and the date of payment of vacation pay. (decisions of the Perm Regional Court dated January 23, 2018 No. 21-46/2018, Chelyabinsk Regional Court dated September 17, 2015 No. 11-11043/2015).

Considering the current arbitration practice, it is safer to issue vacation pay not three days before the vacation, but four .

So, if an employee goes on vacation from August 16, it is better to issue vacation pay no later than August 12. If you pay them on August 13, three full days may not pass before the start of your vacation.

An expert spoke even more about vacations and vacation pay in 2021 in a recorded webinar on “Clerk”: you can watch it right now.

Do I need to write an application for vacation pay?

If an employee goes on vacation in accordance with the vacation schedule, then it is not necessary to write a statement (Article 123 of the Labor Code of the Russian Federation). The employer undertakes to notify the subordinate of the upcoming leave against his signature. Moreover, this must be done no later than two weeks before the event. But the employee, if there is an approved schedule, should not write anything.

IMPORTANT!

If the vacation is not provided according to schedule, then an application is required. How to correctly draw up a document: “Instructions: write an application for leave for 14 days.”

Number of vacation days in 2020

The minimum duration of annual paid leave is 28 calendar days (Part 1 of Article 115 of the Labor Code of the Russian Federation).

From the letter of the Ministry of Labor dated September 24, 2019 No. 14-2/OOG-6958, we can conclude that an employee must take 14 days off in a row for the current working year. Let me explain.

The Labor Code of the Russian Federation allows annual paid leave to be divided into parts by agreement of the parties (Part 1, Article 125). In this case, one of the parts must be at least 14 calendar days.

Sometimes an employee urgently needs unscheduled leave - from the next day at his request. In this case, the accounting department usually has difficulty applying and complying with the statutory deadline for payment of vacation pay. In addition, there is conflicting jurisprudence on this issue. ConsultantPlus knows how to properly pay vacation pay in the event of a sudden vacation and avoid administrative liability for failure to meet the payment deadline :

At the personal request of the employee, the employer has the right to postpone the employee’s annual basic paid leave, despite the approved vacation schedule.

In this case, it is necessary to comply with the requirements of Art. 136 of the Labor Code of the Russian Federation, according to which payment for vacation is made no later than three days before its start. If, upon application, the employee is granted leave the next day after submitting the application, and the accountant does not have time to accrue and pay vacation pay within the period established by the Labor Code of the Russian Federation, then... Read the complete decision.

According to the Ministry of Labor, at least 14 calendar days should be part of the annual paid leave for the current working year. If an employee, for example, takes 7 days for the last year and 7 for the current year, the requirement of Part 1 of Art. 125 of the Labor Code of the Russian Federation will not be implemented .

EXAMPLE

The employee has accumulated 7 unused calendar days of vacation over the past working year. He plans to add them to the vacation for the current working year. In this situation, the duration of one part of the vacation in the current year should be at least 21 calendar days (14+7). Then there will be no . That is, the employee must take at least 14 days off in a row for the current working year.

At some enterprises, it is customary to give short-term vacations (1-2 days) due to the large number of unused vacation days. It is important to know that the timing of payment of vacation pay for a one-day vacation has its own characteristics and risks. They are explained in ConsultantPlus:

However, providing employees with leave of a specified duration is associated with certain difficulties and risks for the employer, associated, in particular, with the timing of payment of vacation pay.

Read the entire consultation.

Is it possible to increase vacation pay?

There are no measures to significantly increase vacation pay. But almost doubling the duration of vacation is quite acceptable. The minimum duration of vacation is 28 calendar days (Article 115 of the Labor Code of the Russian Federation). Employees have the right to rest the entire period or break it into several parts.

The legislation provides that one part of the vacation cannot be less than 14 days (Article 125 of the Labor Code of the Russian Federation). And the remaining two weeks can be divided as you wish. That is, you can take periods from Monday to Friday, and additionally rest on weekends.

Splitting vacation pay leads to a significant underestimation of the calculation base and a decrease in average earnings for calculating vacation. Therefore, the employee must make an independent choice about how to rest: longer or more expensive. Please note that not every employer will agree with such division.

Do not forget that there are profitable months for vacation, and there are unprofitable ones. It is most profitable to vacation in those months where there are more working days. Then the cost of one day is lower. Examples of such months are August, September, October. In January, for example, it is unprofitable to rest because there are few working days.

Additional leave

The employees listed in Art. 116 Labor Code of the Russian Federation:

- employed in hazardous and hazardous industries;

- with irregular working hours;

- working in the regions of the Far North, territories equivalent to them, and in other regions of the North, where the Republic of Kazakhstan and percentage increases in wages are established;

- performing work of a special nature and others.

At the employer’s discretion, additional paid leave is also provided to employees who are not entitled to it, but then the procedure for granting additional leave must be specified in a collective agreement or local regulation. Unlike regular vacations, non-working holidays are excluded from the calendar days of additional paid vacation.

Method 3: excluding the last month

Vacation pay is first calculated without taking into account the salary for the last month of the pay period. When the month ends, recalculation and additional payment are made. This method is optimal when the salary has a variable part, for example, it consists of a salary and a monthly bonus, the amount of which is unknown until the end of the month.

Let's assume that the employee's earnings are a small salary and a percentage of sales (the main part). On July 26, the accountant will calculate and pay him vacation pay based on average earnings for August 2021 - June 2021. When the income for July is known, he will make an additional payment.

How to calculate vacation pay if there is a day off during the vacation period, for example, May 1? Find out the answer to this question from a calculated example from ConsultantPlus experts by receiving a free trial access.

Now you know how to correctly calculate vacation pay from the 1st. It remains to figure out what to do with taxes in each of these cases.

Why were vacation pay less than salary?

There may be several reasons for this.

Firstly, if during the last year a specific employee’s salary was increased (that is, not for the whole company or department, but for this particular employee), the current salary will be higher than vacation pay. Let us illustrate this with an example.

The second reason is that during the billing period the employee worked part-time for some time, but now works full-time. Then the amounts actually accrued to the employee will be included in the calculation, but working part-time will not affect the number of calendar days taken into account.

The third reason is that the employee himself asked not to include “borderline” weekends in his vacation. For example, I wrote a statement from Monday not to Sunday, but to Friday. The Labor Code does not prohibit doing this. Having received less vacation pay because of this, he will have more days of rest.

Decentralized regulation

Decentralized regulation is based on labor and collective agreements of each company.

Each employer has the right to reflect the procedure, conditions and amount of remuneration of personnel at the enterprise, which do not contradict the law, in the regulations in force for a particular organization.

All features of the procedure in which the provision, use and calculation of vacations are carried out are provided for by the laws of the Russian Federation.

The regulations governing vacation pay include:

- The Constitution of the Russian Federation is in Art. 43 enshrines the right of every worker to annual leave.

- Labor Code of the Russian Federation - Chapter 12 of this regulatory act provides the definition of leave, duration, priority of provision, procedure for calculating funds, etc.

- Resolution of the Ministry of Finance of the Russian Federation dated October 31, 2010 No. 94 “On approval of the approximate form of a note on leave.”

Consequences of not meeting the deadline

Legislative norms not only establish deadlines for issuing vacation compensation in person, but also provide for penalties for unpaid amounts. Vacation pay and wages must be received by hired persons in a strictly established manner. Salaries are transferred on pre-agreed dates, and vacation pay three days before leaving for vacation.

Late transfer of funds is classified as a serious violation of worker rights and entails:

- Accrual of penalties for amounts not paid on time.

- Awarding a fine, which is paid to the state budget.

- Criminal penalties applied to officials who are involved in an identified violation.

- Temporary ban on the organization's activities.

A penalty is charged in all cases, regardless of why the employer did not pay vacation pay. The amount of the penalty is set as 1/300 of the refinancing rate of the National Bank of the Russian Federation, taken on the day of actual payment of the delayed amount. The specified amount is charged for each overdue day.

Depending on the length of the delay, the scale of non-payment and the degree of revealed guilt of the responsible persons, administrative or criminal liability may be applied.

Administrative penalties are expressed in the form of imposed penalties:

- The official may be given a warning or a fine of up to five thousand.

- Individuals, such as individual entrepreneurs or owners of private practices, are given from one to five thousand.

- Legal entities are fined larger sums from thirty to fifty thousand.

Depending on the time of delay, individuals and legal entities may also be subject to forced suspension of the general activities of their enterprises for a period of up to three months and up to three years if a violation is detected again.

May holidays

Let's take a closer look at the upcoming May holidays.

According to the Decree of the Government of the Russian Federation dated October 15, 2012. No. 1048 “On the transfer of days off in 2013”, due to the coincidence of non-working holidays on January 5 and 6 with Saturday and Sunday, and February 23 with Saturday, the transfer of days off is provided from Saturday, January 5 to Thursday, May 2, from Sunday 6 January to Friday May 3 and from Monday February 25 to Friday May 10.

Thus, in the coming May we are closed from May 1 to May 5 inclusive and from May 9 to May 12 inclusive.

May 6, 7 and 8 are working days.

In total, May has 31 calendar days, 18 working days, 2 holidays and 11 weekends.

Two holidays are May 1 and May 9 (Article 112 of the Labor Code of the Russian Federation). All other days are a transfer of weekends and are not considered as holidays from the point of view of labor legislation. This circumstance is important, since in accordance with Article 120 of the Labor Code of the Russian Federation, non-working holidays falling during the period of annual paid leave are not included .

Weekends are a completely different matter. They are included in the number of calendar days of vacation. Accordingly, if an employee writes an application for vacation from May 1 to May 10, then he uses 8 calendar days of vacation (May 1 and 9 will not be included in the number of vacation days). Of these, 3 days will be on weekdays and 5 on weekends.

From the point of view of vacation payments, this is a more pleasant option. However, it is completely unsuitable for the majority of workers who value the vacation days themselves. Thus, to save vacation days, a vacation application can be written for May 6, 7 and 8 - 3 days.

In Table No. 4 we present the calculation of “losses” for this choice, using the data from Example No. 1 (salary 50,000 rubles “net”, price of a vacation day 1,700.68 rubles).

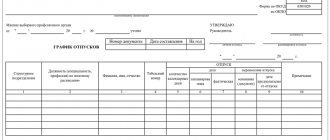

Table No. 4

| year 2013 | number of working days in a month | salary amount | working day price | number of working days worked | Salary amount for time worked | Vacation pay (1,700.68*3) | Total "on hand" | Difference (salary - total "in hand") |

| May | 18 | 50 000,00 | 2 777,78 | 15 | 41 666,67 | 5 102,04 | 46 768,71 | 3 231,29 |

As can be seen from the table above, the “cost” of a May vacation for 3 working days will be 3,231.29 rubles.

Now let’s consider another option for combining a short vacation and the May holidays - 2 days of vacation are taken at the end of April (29 and 30). Thus, the last 2 weekends in April are added to 2 vacation days and to the 5 days of the first May holidays. The result is a 9-day vacation, as well as saving money and 1 vacation day.

The calculation of the “cost” of such a vacation is presented in Table No. 5.

Table No. 5

| year 2013 | number of working days in a month | salary amount | working day price | number of working days worked | Salary amount for time worked | Vacation pay (1,700.68*2) | Total "on hand" | Difference (salary - total "in hand") |

| April | 22 | 50 000,00 | 2 272,73 | 20 | 45 454,55 | 3 401,36 | 48 855,91 | 1 144,09 |

As can be seen from Table No. 5, the “cost” of an April vacation for 2 working days will be 1,144.09 rubles. (plus one vacation day is saved at a cost of 1,700.68 rubles), which is much more profitable than the May vacation:

- savings on payments RUB 2,087.20. + vacation day savings RUB 1,700.68. = 3,787.88 rub. saving everything.

Choose your vacation dates to your advantage!

Example 2.

The situation is much more complicated if the employee, although he works on a 5-day work week, but at the same time:

- happens on long unpaid vacations.

- often takes sick leave.

- often travels for long periods of time.

- receives different amounts of salary each month.

It is very difficult for such an employee to calculate the exact amount of his income for the previous 12 months, and even more difficult to calculate the amount of calendar days attributable to this income.

In Table No. 3, we calculate the amount of average earnings for an employee who joined the company in January. Let’s assume that this employee worked the entire month of January and was absent due to illness in February and March.

Employee remuneration includes bonuses based on the results of the month.

Table No. 3

| Year | Month | Payments taken into account when calculating average earnings, rub. | number of calendar days worked in a month not fully worked | Days taken into account (column 4*29.4/number of days in a month) |

| 1 | 2 | 3 | 4 | 5 |

| 2013 | January | 50 000,00 | 29,40 | |

| 2013 | January Bonus for 1 month: | 3 318,00 | ||

| 2013 | February | 40 000,00 | 22,00 | 23,10 |

| 2013 | February Bonus for 1 month: | 2 242,00 | ||

| 2013 | March | 45 000,00 | 29,00 | 27,50 |

| 2013 | March 1 month bonus: | 2 462,00 | ||

| Total | 143 022,00 | 80,00 |

| Number of calendar days of the billing period | Average daily earnings, rub. (payment amount/number of calendar days) |

| 80,00 | 1 787,78 |

Unfortunately, calculating average earnings in the case under consideration is unnecessarily labor-intensive. Therefore, we propose to use a simplified calculation, recognizing that this will lead to some errors in the calculations. As for the “profitability” of the vacation, it will be similar to Example 1 with a greater or lesser difference.