A selection of questions from readers.

My vacation pay is being delayed; I have been on vacation since 08/01/19.

You have the right to demand from the employer monetary compensation for the delay in the payment of vacation pay in the amount of not less than one hundred and fiftieth of the key rate of the Central Bank of the Russian Federation in effect at that time from the amounts not paid on time for each day of delay, starting from the next day after the established payment deadline until the day of actual payment inclusive.

Art. 236 Labor Code of the Russian Federation. Contact the prosecutor's office or the labor inspectorate, they will conduct an inspection and issue an order to eliminate the violation.

Can vacation be delayed and for how long?

According to Art. 124 of the Labor Code of the Russian Federation, if the employee was not paid in a timely manner for the duration of the annual paid leave or the employee was warned about the start time of this leave later than two weeks before its start, then the employer, upon the written application of the employee, is obliged to postpone the annual paid leave to another agreed period with an employee.

In exceptional cases, when the provision of leave to an employee in the current working year may adversely affect the normal course of work of an organization or individual entrepreneur, it is allowed, with the consent of the employee, to transfer the leave to the next working year. In this case, the leave must be used no later than 12 months after the end of the working year for which it is granted.

It is prohibited to fail to provide annual paid leave for two years in a row, as well as to not provide annual paid leave to employees under the age of eighteen and employees engaged in work with harmful and (or) dangerous working conditions.

Thus, vacation can be delayed only with the consent of the employee.

Does the employer have to delay the next vacation?

No. If you were included in the vacation schedule in advance and wrote an application 14 days in advance.

Maybe, if it is related to the production needs of the organization. Then the employer will be obliged to provide vacation at a time convenient for you outside the previously agreed schedule.

The employer is obliged to provide you with leave for the previous year of work within 2 years, but only with your consent.

The employer's actions are unlawful, because according to Art. 123 of the Labor Code of the Russian Federation, the vacation schedule is mandatory for both the employer and the employee. Transferring your vacation to another date is possible only with your consent (Article 124 of the Labor Code of the Russian Federation).

Do they have the right to delay vacation pay and pay it only after going on vacation?

The delay is unlawful.

How long does it take to write a vacation application and can vacation be delayed?

The application must be submitted in advance; three days before the start of the vacation, vacation pay must be paid. They cannot detain; leave is granted strictly according to schedule (Article 123 of the Labor Code of the Russian Federation).

The boss delays the signature on the vacation application.

Contact the labor inspectorate.

Does an employer have the right to delay vacations until the end of the working year?

No, it doesn't. Vacation is granted based on the vacation schedule. Article 123 of the Labor Code of the Russian Federation - the vacation schedule is mandatory for the employer and for the employee.

I am on maternity leave, our institution has already delayed the payment of wages for 7 days, and I have child care benefits! I want to properly file a claim.

When you compose it in the name of the manager, do not forget to add a clause about the penalty, which is accrued from the first day of the delay, and indicate the calculation.

My wife is a contract worker and was supposed to be on maternity leave until March 2021, but decided to leave earlier; does she have the right to a reduced working day? Don't work shifts? Don't stay late after work at work (work overtime)?

If we are talking about military service, then your wife, until the child reaches 3 years of age, in accordance with paragraph 9 of Art. 10 Federal Law “On the status of military personnel” in conjunction with Art. 259 of the Labor Code of the Russian Federation cannot be involved without her consent in the performance of military service duties at night, on non-working days, weekends and holidays. As for the shortened day, it is not provided for by current legislation for military personnel.

My husband works in the organization, either through labor or under a contract! Salaries are delayed, sometimes they give an advance, sometimes they don’t! I did not take vacation during the period of work. Wants to leave work. What payments are due?

He is entitled to a salary for the period he worked, and compensation for vacation days not taken off.

I have been on vacation since June 25, 2019; I have not received my vacation pay until today. How long can payment be delayed by law?

Since 2021, I should have received internships, but I haven’t received them due to the fact that they forgot about me. Is this punishable? Certainly. Write a complaint to the labor inspectorate and the prosecutor's office.

What to do in the following case: an in-person meeting of the owners of an apartment building has been held, the elected chairman of the meeting is delayed on vacation and does not have time to return within 10 days to sign the protocol and submit it to the management company. Who can sign the protocol for him and how to do it correctly?

During the absence of the chairman, there must be a person who replaces him and acts by proxy.

I work officially. Now on maternity leave for up to 1.5 years. The maternity leave was supposed to arrive on the 15th, today I wrote to the accountant. She said they would come today, but they never came. How long can an employer delay maternity leave?

The legislation does not establish a time limit for delaying transfers, so it is impossible to answer on the merits.

What is the period for payment of vacation pay provided by law?

The three-day period before the start of the vacation, during which the organization is obliged to pay vacation pay to the citizen, is determined by Article 136 of the Labor Code, and Articles 114 and 115 indicate that if these days fall on weekends or holidays, then the money is accrued in advance.

Important! Labor law prohibits the accrual of vacation pay in installments.

In practice, most employers tend to transfer them much earlier, since delays sometimes arise due to unforeseen circumstances: for example, a bank delay in a transaction.

In this case, the organization will be obliged to additionally pay the employee for each day of delay, regardless of the reason. Since payment of annual leave is the employer’s responsibility, he cannot justify the delay in transferring finances by ignorance of the employee’s retirement, lack of funds, etc.

When an employer does not have the right to make deductions

The law provides for special cases that prohibit an employer from withholding vacation amounts “overspent” by an employee upon dismissal. This is directly related to the reason for dismissal. The employee’s initiative, like most other grounds for dismissal, completely frees the employer’s hands with regard to retention. But there are reasons when this procedure cannot be performed. Funds paid for vacation will remain with the dismissed person if he leaves work due to:

- conscription into the Armed Forces or alternative service;

- inability to continue working due to health conditions (based on a medical report);

- reduction in numbers or staff;

- liquidation of an enterprise or termination of the activities of an individual entrepreneur-employer;

- a change in the owner of the organization if the director, his deputy or the chief accountant resigns;

- the need to give way to the main employee who previously occupied this position;

- emergencies, disasters, cataclysms and other force majeure;

- the fact that one of the parties to the contract is no longer alive.

How is personal income tax paid on deductions for unworked vacation days upon dismissal?

Where to go if you haven't paid your vacation pay

As practice shows, most issues of calculating vacation pay on time are resolved at the stage of notifying the manager of the employee’s intention to appeal to the labor inspectorate or court.

But if this does not bring results, the citizen can submit an application to the specified authorities to bring the company’s management to justice.

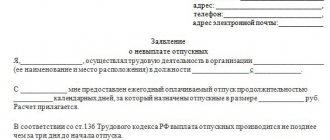

The application is drawn up in free form in compliance with the rules for maintaining official documentation and indicating the following information:

- Details: Full name of the person to whom the document is sent, Full name, registration address and contact telephone number of the applicant, full name of the employing organization indicating the form of ownership, contact telephone number, address of the head office and Full name O. manager.

- The essence of the complaint: the date of leaving on vacation according to the schedule, the amount due for payment, the expected date of payment, the number of days of delay.

- Link to the document on the basis of which the applicant cooperates with the organization (employment contract), its details.

- The applicant’s demands: consideration of the complaint, inspection of the enterprise’s activities, collection of debt from the employer along with compensation.

- Date of document preparation and signature.

Sample application for late payment of vacation pay to the labor inspectorate:

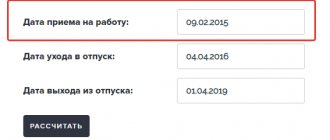

How to calculate compensation

If there is a violation of the deadline for paying vacation pay, prepare for a compensation payment. The minimum amount of compensation for late payment of vacation pay to an employee depends on (Article 236 of the Labor Code of the Russian Federation):

- the amount of funds not paid on time;

- number of days late with payment;

- the current key rate of the Central Bank of the Russian Federation.

Calculate using the formula:

Where

- O - the amount of vacation pay due;

- KS is the key rate of the Central Bank of the Russian Federation, its value can be found on the official website of the Central Bank of Russia;

- D - number of days overdue for payment.

Moreover, the amount of the employee’s vacation pay “in hand” is taken into account, that is, after withholding income tax. And the calculation of days of delay is carried out from the day following the day of the end of the payment period according to the law, to the day of the actual transfer (issue from the cash register) inclusive.

Employer's liability for delay

When an employee goes to court or the prosecutor's office with a statement about late payment of the vacation period, the company not only undertakes to accrue compensation, but also becomes liable.

Most often, fines are applied, however, in case of serious violations and repeated cases of bringing such issues to court, the responsible official may be subject to stricter administrative and even criminal liability.

Amounts of fines for late payment

Penalties for delaying vacation pay:

- for officials - up to 5 thousand rubles;

- for individuals who are individual entrepreneurs - 1-5 thousand rubles;

In case of repeated violations, the amount of fines increases, and other penalties are applied to officials and organizations - removal from office for 1-3 years and temporary or complete suspension of activities, respectively.

Criminal liability, according to Article 145 of the Criminal Code, can be a fine of 120 thousand rubles. or imprisonment for up to three years.

Let's sum it up

- Compensation for delayed payment of vacation pay is calculated as the amount not paid on time, multiplied by 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay.

- The days must be counted from the date following the last day of payment of vacation pay in accordance with the Labor Code of the Russian Federation.

- Compensation for delayed payment is not subject to income tax, but insurance premiums are charged on it.

- It is unlawful to include compensation payments for delays in income tax expenses.

Right to rest

First of all, you need to figure out who can rest and when.

According to Article 114 of the Labor Code of the Russian Federation, an employee has the right to annual leave. The number of days of legal rest depends on many factors:

- length of service in the organization;

- special working conditions specified in the employment contract;

- climatic conditions at the place of work;

- the employee’s rights to additional leave, voluntarily prescribed by the employer in the collective agreement or internal regulations.

A standard vacation lasts 28 days (Article 115 of the Labor Code of the Russian Federation). In this case, we are talking about calendar days, including weekends, but excluding public holidays (this is a closed list of dates prescribed in Article 112 of the Code).

For example, an employee wrote an application for leave from March 1 to March 20, 2019. This is a period of 20 days, if you count strictly according to the calendar. But March 8, an official holiday, falls within this period. Therefore, the duration of the vacation will be only 19 days. And it is on the basis of 19 days that vacation will be paid.

Please keep in mind that postponing weekends is not considered a holiday. That is, in the above example, despite the fact that Monday March 7 was a non-working day, it does not apply to holidays and does not reduce the number of vacation days.

Additionally, the law provides for cases of increasing the duration of rest.

The table shows the minimum duration of the increase to 28 days.

| Employee category/exceptional working conditions | Minimum duration of additional leave | Note |

| Work with harmful or dangerous working conditions | 7 days | A special assessment of working conditions and stipulated conditions for the duration of leave in the employment contract are necessary. |

| Workers with a special nature of work | Determined by the Government of the Russian Federation | Only if indicated in the list approved by the Government of the Russian Federation. |

| Irregular working hours | 3 days | In commercial organizations, the duration of such leave is prescribed in the collective agreement or internal labor regulations. In government agencies - normative legal acts. |

If there is no desire to rest for longer than 4 weeks, then the law provides for the possibility of replacing additional leave with monetary compensation (Article 126 of the Labor Code of the Russian Federation).

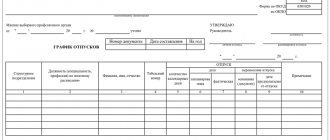

The frequency of employee rest is prescribed in the vacation schedule approved annually.

Two weeks before the start of his vacation, the employee must be notified against signature. If his plans change, then upon application, the vacation dates can be postponed.

Payment order

To calculate vacation pay, the concept of average wages (AWS) is used.

When calculating this indicator, you must use the formula: SWP = ZP / 12 / 29.3

The numerator (ZP) will include all accruals provided for by the remuneration system and the employment contract for the 12 months preceding the vacation.

The denominator includes 12 calendar months and a certain number 29.3. This is exactly what is considered to be the average number of days in a month in the 2021 edition of the Labor Code.

Wages do not include all social payments (sick leave, benefits, etc.), vacation pay and bonus payments that are one-time in nature and not reflected in the remuneration system or employment contract.

Now he is going on vacation for 14 days. In this case, the amount of vacation pay will be (30,000*12 5,000 5,000)/12/29.3*14=14,732.65 rubles.

Deadlines

Vacation pay must be paid no later than three days before the start of the vacation.

Moreover, if such a day falls on a weekend, then the money is transferred the day before. But there are cases when an employee writes a statement and goes on vacation the very next day. The legislator does not prohibit such surprises with the mutual consent of the parties. In this case, you must understand that the employer cannot comply with the requirements of the Labor Code.

And it would seem that in such a situation the violation of the law occurs through no fault of the company. But there is a practice when companies are fined in these cases too.

For most small commercial organizations, the Labor Inspectorate is a kind of mythical body that can only come after receiving a complaint from an employee.

But for budgetary organizations and for organizations that are large taxpayers, the prospect of meeting such an inspector is very real.

How vacation is paid according to the Labor Code of the Russian Federation in 2021

While the employee is on vacation, he retains his place of work (position), as well as his average earnings (Article 114 of the Labor Code of the Russian Federation). Already from this provision of the Code it is clear that vacation payment is made based on the employee’s average earnings.

Calculating vacation in 2021 should begin by determining the calculation period. If a person has been working at his place of work for more than 1 year, then this is 12 calendar months preceding the month the vacation begins (clause 4 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

That is, when calculating vacation pay, you need to use the employee’s income received during these 12 months. In this case, a calendar month is the period from the first to the last day of the month inclusive.

EXAMPLE 1

The manager has been working at Parma LLC since February 5, 2021. From June 3, 2021, in accordance with the vacation schedule, he must be granted annual paid leave. This means that his average earnings are determined for the billing period - from June 1, 2021 to May 31, 2021.

EXAMPLE 2

Calculation of vacation pay for a fully worked pay period in 2021

Employee Petrov A.S. in accordance with the vacation schedule, from May 20, 2021, another paid vacation of 14 calendar days should be granted. The billing period is from May 1, 2021 to April 30, 2021. The amount of payments taken into account when calculating average earnings was 516,000 rubles.

Solution

Average daily earnings: 1467.58 rubles. (RUB 516,000 / 12 months / 29.3)

Total amount of vacation pay: 20,546.12 rubles. (RUB 1,467.58 × 14 days)

Who is responsible?

Most often, an organization can be held accountable based on a complaint from the employee himself. But sometimes violations can be discovered during a scheduled inspection by the Labor Inspectorate.

When imposing fines, they are guided by the Code of Administrative Offenses.

Or it may happen that inspectors will resort to the Criminal Code if the delays in payments are very large.

Moreover, if in the case of payment of compensation, the presence or absence of the employer’s fault is not taken into account, then this is the main argument for bringing to administrative or criminal liability. And depending on the seriousness of the violation, a fine may be imposed on the official or the organization as a whole, or there may be talk of disqualification or even imprisonment of the manager.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Holding limit

Art. 138 of the Labor Code of the Russian Federation limits the amount of deduction that an employee can make without the knowledge and consent of the employee to 20% of the payments due to him upon dismissal, and in some cases specified in federal legislation - up to half. If the resulting amount exceeds this value, the employer has several options:

- limit yourself to 20% of the salary, forgiving the employee the rest of the debt;

- invite the employee to deposit the remaining money into the cash register on a voluntary basis (coercive measures in the form of delaying the work book, etc. are prohibited);

- try to recover the missing funds from the former employee in court (Articles 382, 383 of the Labor Code of the Russian Federation).

FOR YOUR INFORMATION! If the employee does not want to contribute the missing amount, and the employer does not intend to return it through the court, this money will not be included in the tax base of the Unified Social Tax and the Pension Fund of the Russian Federation, for which it must be debited to account 91 “Other expenses” (clause 3 of Article 236 of the Tax Code of the Russian Federation and paragraph 2 of Article 10 of Federal Law No. 167 of December 15, 2001).

How to prevent delays and eliminate consequences

- The fact is that, in addition to penalties, officials and the organization may be subject to penalties from the labor inspectorate. A written statement from the employee, in which he agrees to receive vacation pay later than required, will help you avoid a fine during an audit. This will not reduce the risk of prosecution, but it will help to challenge the fine.

- Establish an advance method for calculating vacation pay, so that later you do not have to charge a penalty on additional payment for vacation.

- If the accounting department is late with the transfer of vacation pay, then try asking the employee to shift the start of the vacation by three calendar days from the payment date. But in the end, you need to rewrite the application and order.

- Offer to write an application for leave at your own expense for a couple of days, and for the remaining time - for annual paid leave.

No matter what difficult situations arise in the organization, always try to find a common language with employees. And your decisions and actions must always be within the framework of labor laws.

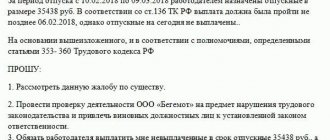

Appeals to higher authorities

In the event that an employee of an enterprise has been delayed in the payment of vacation funds, and he does not want to transfer his legal vacation to another period, he has every right to appeal to higher authorities.

However, if an offense on the part of the employer occurred for the first time, and the employee does not want to spoil labor relations, then he can contact the organization’s trade union with a demand for immediate payment of vacation funds.

As a rule, in such situations it is possible to resolve the issue peacefully, since the trade union was specially created to monitor the implementation of the labor rights of workers, as well as resolve conflict situations related to their violation.

If it is impossible to resolve a conflict issue peacefully, a citizen has the right to appeal to one of the higher authorities:

- Federal Labor Inspectorate . This body was created to control and supervise compliance with established labor standards of the Russian Federation. Both a representative of the trade union from the enterprise and the employee himself can contact it. After a written request, service inspectors will check whether the head of the enterprise complies with labor legislation. Appropriate measures will also be taken to restore the legal rights of the citizen.

- Prosecutor's office . In case of non-receipt of legal vacation money after contacting the labor inspectorate and trade union, the employee can contact the prosecutor's office. You can also contact this body directly, avoiding previous authorities. After filing a complaint, an inspection of compliance with labor discipline at the enterprise will also be carried out, and an appropriate decision will be made.

- The final highest authority is the court . A citizen has the right to file a claim in court at his location.

In any case, it is not worth leaving the situation of late payment of vacation money without a solution.

How to determine vacation experience

An employee's right to vacation arises after he has worked for a certain period for a specific employer. To calculate the number of vacation days that he is entitled to, he needs to determine the vacation period. To do this, it is important to remember several rules. For example, do not forget that work experience with a previous employer does not count.

Calculate vacation pay automatically and without errors

There are periods that are included in the vacation period, and there are those that, on the contrary, are excluded from it. However, some periods are controversial.

Vacation experience: how to determine in various situations

Read