Briefly about shared ownership

Shared ownership is one of the types of common property. Its peculiarity lies in the definition of a specific part of the common property, which belongs to a specific owner. The right of shared ownership is provided for objects that cannot be divided without deterioration in quality.

In practice, the following reasons for the emergence of shared ownership are possible:

- Allocation of shares in the common property of spouses. Separation is possible both during marriage and after divorce. The law provides for division by voluntary or judicial procedure.

- Inheritance. If the owner has several heirs by law, then each of them has equal rights to the property. Each recipient becomes the owner of an equal share.

- Acquisition of one of the shares in property, through purchase, exchange, donation.

The owner has the right to use and dispose of the property at his own discretion: donate, bequeath, sell, lease. However, the right to dispose of shares is somewhat different from the general rules.

The Civil Code (Article 250) limits the owner’s ability to sell or exchange property owned by him by right of shared ownership. Initially, information about the sale of the property should be communicated to other owners. Co-owners must express their views regarding the sale.

The law establishes deadlines for the redemption of shares by co-owners:

- when selling real estate – 30 days;

- when selling movable property - 10 days.

Selling a share in an apartment

Let’s take a closer look at how to buy out a share in an apartment from a relative. The presence of family ties between the parties does not provide relief. The parties formalize the transaction in the generally established form.

Transaction algorithm:

- Preparation of property documentation.

- Signing the purchase and sale agreement.

- Registration of the agreement in Rosreestr.

- Payment of tax.

Documentation

In the process of preparing documentation, it is initially necessary to issue a notice of sale to other owners. The document must contain detailed information about the terms of the transaction (term, price). If one of the relatives agrees to the purchase, the other owners can issue a written refusal of the transaction to speed up the sale.

Other documents required for the transaction:

- seller's civil passport;

- notarized consent of the spouse;

- extract from the Unified State Register of Real Estate;

- legal information (sale and purchase agreement, exchange, donation, certificate of inheritance, privatization act);

- cadastral passport;

- extract from the house register;

- utility bills.

Contract

The purchase and sale agreement can be drawn up through a lawyer or a notary. Drawing up a contract yourself without experience is not recommended.

Notarization of the purchase and sale agreement for residential premises is a mandatory requirement starting from 2021. Therefore, the parties must additionally pay a fee for performing notarial acts. Drawing up an agreement at a notary office is paid separately.

Registration

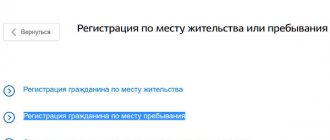

The parties sign a contract and jointly submit it for registration with Rosreestr. Documents can be sent to:

- through the MFC;

- through the State Services website;

- by mail.

Documents for registration:

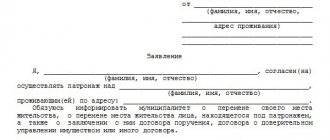

- statement of the parties;

- civil passports;

- notarized consent of the spouses;

- marriage documents (if available);

- legal information;

- extract from the Unified State Register of Real Estate;

- cadastral documentation;

- birth certificate and permission from the guardianship department (if there are minors among the parties).

The buyer must pay the registration fee. Its size in 2018 is 2000 rubles. for individuals.

Tax

The last step is the payment of income taxes by the seller. The payment amount will be 13% of the share value.

○ Purchase and sale agreement.

To draw up a purchase and sale agreement, you should contact a notary’s office; it will be drawn up by a notary’s assistant. The notary does not certify independently executed purchase and sale agreements regarding real estate. The contract must contain the following:

- Information about the parties (full name, passport, place of registration).

- Information about the share in the apartment (what address it is located at, the size of the share, the area of the apartment).

- Price, payment terms, payment procedure.

- Information about the presence or absence of restrictions and rights of third parties.

- Rights and obligations of the parties.

- Based on what documents the share is being sold.

- Information about the transaction for the alienation of real estate on the right of shared ownership to the persons who will reside.

- Information that the premises are suitable for habitation.

- The procedure for paying transaction costs, in what order and by whom they are paid.

- Information that other owners have been notified of the sale of the share.

As well as other information that the parties to the agreement would like to indicate in it. Obviously, the contract is a fairly voluminous document and it is better to entrust its drafting to a professional. The contract is drawn up in three copies: 1 – to the Seller; 2 – Buyer; 3- to Rosreestr. An act must be drawn up with the agreement, which indicates the transfer of the share to the new owner (Clause 1, Article 556 of the Civil Code of the Russian Federation).

Preemptive right of the owner

Let's look at how it goes to buy a share in an apartment from a relative. The pre-emptive right of purchase applies to relatives, spouses and former spouses. The presence/absence of family ties does not affect civil rights.

The principle of exercising the pre-emptive right:

- the owner draws up a notice;

- sends the document to all co-owners;

- receives a written refusal or consent to complete the transaction within 30 days;

- does not receive a response.

The Civil Code establishes a 30-day period for making a decision on the purchase of a share in a shared property. If one of the owners agrees to buy out a share in the apartment from relatives, then the others can issue a written refusal.

If the co-owners refuse to purchase the share, then the owner has the right to sell the share to strangers. It is mandatory to comply with the conditions specified in the notice.

When does the pre-emptive right not work?

How to buy a share in an apartment from relatives? The Civil Code provides a list of situations when the right of first refusal does not work. In such a situation, it is impossible to legally buy out the share to other owners.

The law allows a shared owner to independently dispose of a share in an apartment without taking into account the opinions of other owners in the following cases:

- will of a share;

- transfer of an object as a gift;

- sale of shares to pay debts forcibly by bailiffs;

- in case of bankruptcy;

- if there are several people willing.

our employees

Tatiana Alexandrova

Director of Development

In the company since 2002. Education: software engineer (graduated from MSTU STANKIN) and economist (Moscow Banking Institute at Sberbank of the Russian Federation).

+7

Slav Alena

Lawyer

Work experience since 2014. Higher legal education. Specialization: civil relations. Legal support of transactions with residential and commercial real estate.

Olga Polovnikova

operational management and customer relations specialist

Has been working for the company since 2021. Graduated from the Moscow Institute of Public Administration and Law. A lawyer by training.

Kovalev Alexander

facilities operation and maintenance engineer

Has been working for the company since 2010. Higher technical education. Graduated from the National Research Moscow Civil Engineering University (NRU MGSU) with a degree in mechanical engineer.

What to do if one of the owners is against selling the apartment?

Let’s take a closer look at how to buy a share in an apartment if one of the co-owners is against it. The law does not give other owners of the property the right to prohibit the sale of shares to third parties.

A citizen can either buy the share on his own or refuse to purchase it. In this case, the owner exercises the owner’s right to dispose of the property and selects a buyer from among strangers.

The law does not protect the rights of minor property owners. If one of the parents sells his share in the apartment after a divorce, then the presence of minor children among the co-owners does not prohibit him from selling his share without taking into account the opinions of his ex-wife and children.

○ Advice from a lawyer:

✔ Ways to bypass the pre-emptive right to purchase a share and the risks associated with these methods.

There are two options when the application of a preemptive right can be avoided:

1. Conclusion of a gift agreement. 2. Conclusion of a loan agreement.

Donation agreement. When drawing up a gift agreement, no one can prohibit the owner from donating his share. Guided by paragraph 1 of Article 250 of the Civil Code of the Russian Federation, the preemptive right applies only to sales contracts. Risks of registering a gift agreement:

- For the Buyer: the co-owner can go to court to have the transaction declared invalid or sham. In this case, the court will oblige the acquirer of the share to return it.

- For the Seller: the gift agreement, on the basis of clause 1 of Article 572 of the Civil Code of the Russian Federation, is gratuitous and for this reason the Buyer may not pay the Seller, and it will not be possible to recover funds from the dishonest Buyer in the future.

Loan agreement. The seller and buyer enter into a loan agreement for the amount of the cost of the share, and at the same time an agreement is signed to secure this loan with a pledge of the share in the right to the apartment. After which the person who is the borrower misses the loan repayment deadline and the parties draw up a compensation agreement, the subject of which is a share in the apartment.

Risks:

- For the Buyer: other owners can go to court to declare the transaction a sham, and the court will oblige the buyer to return the share.

- For the Seller: In case of a sham transaction, the Seller will be obliged to return the amount of money to the Buyer.

What if one of the owners refuses to receive notice of the sale?

Buying out 1 2 shares of an apartment may require a significant amount of cash. In the absence of the necessary capital, a co-owner may obstruct the sale of the property by refusing to receive notice.

The duration of the period provided for in Art. 250 of the Civil Code of the Russian Federation, begins from the moment other owners of shares receive notification of the sale.

If a co-owner refuses to receive notice voluntarily, then it is possible to send the document in the following ways:

- Mailing. The citizen issues a notification in the form of a letter with a declared value. It is accompanied by a notification of delivery and a list of documentation contained in the attachment. The inventory must be certified by a postal employee. The document is sent to the address of the co-owner. In case of refusal to receive the envelope, it is proof of the notification. It is advisable to calculate the period from the day the envelope is returned to the sender.

- Notarial letter. A citizen has the right to involve a notary in notifying co-owners. To do this, you need to contact a notary office and pay a fee for performing notarial acts. The specialist will issue a notification and send it to co-owners. Upon receipt of the letter, the notary issues a certificate of notification to the addressee. If you refuse to receive, the notary will issue a document stating the measures taken to provide timely notification.

Risks when buying a share in an apartment

When purchasing a share in a residential property from strangers, it is necessary to take into account a number of risks to which the buyer exposes himself. Buying a share in an apartment pitfalls:

- Drawing up a gift agreement instead of a purchase and sale contract. This option is suitable exclusively for co-owners or persons living in this residential premises. Otherwise, the buyer is deprived of the right to challenge the transaction in court if false information about the object is provided. It will not be possible to return the money paid even in court.

- Subsequent implementation of the object. When selling a share of an apartment, the cost of the property is significantly lower than the market price of the residential premises as a whole. Buying out a problematic share in an apartment should not be considered for investment purposes. Subsequent implementation of the project is significantly difficult. At the same time, the deal is profitable for the co-owners. By purchasing all parts of a residential property, the owner increases the overall cost.

- Acquiring a share in an apartment of strangers for personal residence is inappropriate. Constantly living with strangers becomes difficult, from a moral point of view.

Purchasing a share in an apartment is a profitable deal for co-owners. The execution of a transaction has its own characteristics. The owner must warn other owners of his intentions. It is better to send a notification in writing, just like refusing a transaction. The agreement is subject to mandatory notarization and state registration.

Possible problems and risks

In fact, there are “pitfalls” of buying a share in an apartment, and they are significant. One of the main ones is the inability to allocate and assign to the co-owner a specific material part of the object. When purchasing a share in an apartment, you are not buying a room or a certain part of it, but just a “virtual” number with a fraction, which can only be converted into square meters by agreement of all property owners. And if it is not possible to reach a consensus, take legal action. Moreover, when determining the part of the property of each co-owner, the judge will take into account a lot of nuances: whether the residents have minor children, dependents, or an alternative place to live. It is possible that a more comfortable, spacious, advantageous room in some respects will go to your neighbor, who has a share of the same size as you, or even less.

Life in an apartment that is in common ownership is even more difficult than, say, in a communal apartment, where residents still have “inviolable” personal space. Even having drawn up a written agreement about who will be located where and what boundaries not to cross, you should not relax - it will be abolished with the change of any of the co-owners. And the process of “conquering territory” will have to start all over again.

Without the consent of the co-owners, you cannot accommodate or register someone in your part of the home (even if they are immediate relatives or family members). To achieve such goals, it is necessary initially, when registering ownership rights, to further split your share into those people whom you want to see nearby in the apartment, or who need to be registered in it.

A significant risk in purchasing a share in an apartment is the fact that you, in a sense, become dependent on the future co-owners. You cannot, without obtaining the consent of your neighbors or notifying them, perform any actions with your part of the property (rent, make repairs, etc.). Even to sell to whomever you wish, you must first offer to buy the share to the co-owners of the property, because the law has given them the pre-emptive right to purchase. Only if you have written refusals to purchase a share on the terms established by you from the co-owners of the apartment (you need to notify them no later than 30 days before the expected date of the transaction), you have the right to sell your share to an outsider.

Some use a trick: they draw up a gift agreement and, on its basis, transfer the share to the new owner, supposedly for free (this operation does not require the consent of the co-owners of the property). However, such a transaction may be considered void if legal proceedings are initiated by disgruntled neighbors. In such a situation, both the seller and the buyer of the share in the problem apartment risk losing money.

In general, when planning to buy a share in real estate, it is extremely important to study the features of the relationship between co-owners and predict how they will affect you personally if you join a friendly or not so friendly team. Make sure that the seller sells it, having official refusals from the acquisition of the share by the “first priority”. In addition to considering the technical parameters and location of the object of interest, it is necessary to determine whether acquiring a share in it will allow you to achieve your goals and obtain the expected benefits.