Almost every company has debt. They are formed as a result of previously taken loans, obligations to creditors and the state. An organization does not always have the resources to repay debt on a timely basis. If you have difficulties with payments, there are several possible ways out of the situation. One of them is debt restructuring.

Question: Are there grounds for restructuring debt on a foreign currency loan due to changes in exchange rates? View answer

What is restructuring

Restructuring is a change in the terms of the agreement on the basis of which the debt was formed. This is a kind of concession to the debtor, ensuring the fulfillment of obligations on more convenient terms. Restructuring may involve various conditions: changing the interest rate on the debt, extending the payment period. It is required in the following cases:

- Loss of the previous level of income (for example, the profit of the enterprise has decreased).

- Sudden changes in exchange rates.

- Large debt that does not correspond to the financial condition of the company.

- Other reasons.

How is tax debt restructured ?

The main reason for restructuring is the inability to pay the debt on the same terms. The decision to change the conditions is made by the creditor on an individual basis. Restructuring is offered to individuals, legal entities, and government agencies.

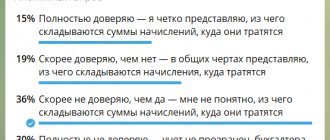

IMPORTANT! Restructuring benefits both creditors and debtors. The benefits for the latter are obvious. Lenders are reducing the number of unpaid loans. Sometimes the terms of the restructuring are such that the creditor receives more benefits. The debtor may take on an even more unbearable burden. In order to avoid this, you need to carefully read the agreement on changing the terms. It is advisable to show it to a lawyer.

Personal bankruptcy procedures

New formulations have been used that are more understandable to the common man: “Restructuring of a citizen’s debts” and “Sale of a citizen’s property.”

According to the letter of the law, in case of bankruptcy of an individual, the following procedures are applied: debt restructuring, sale of a citizen’s property, settlement agreement. The procedures are called rehabilitation, that is, they are initially aimed at restoring the rights of the debtor: in restructuring - to restore solvency, in implementation - to release from fulfillment of obligations, in a settlement agreement the parties agree to resolve the debt problem, and there is no longer any need for bankruptcy proceedings. Get a free consultation

Levels of restructuring

Default, that is, the inability to meet one’s financial obligations, may occur to different categories of debtors, which means that restructuring may be necessary at different levels.

- State. Government debt may need to be restructured. Issues concerning it are resolved at international negotiations, in which financial organizations such as the IMF, etc. act. A state can declare a default, but not be declared bankrupt, because the law on sovereignty takes precedence over financial obligations: the country cannot be invaded and sold off for debts. Powers are taking possible and acceptable measures to reduce their expanding debt obligations: for example, they may allow the development of deposits, transfer a stake in important state-owned enterprises, etc.

- Commercial structure, bank. Bankruptcy of an organization is a rather long and complex procedure. It often turns out that it is more profitable for creditors to go for restructuring. In addition, if the company still has securities, it is easier to lose a share of the profits than not to repay the debt at all. As a rule, restructuring is part of reorganization procedures that can be organized as bankruptcy prevention by the Bank of Russia or the Deposit Insurance Agency.

- Individual borrowers. In this case, you will have to negotiate the restructuring directly with the bank that issued the loan. Financial organizations also strive to preserve their profits as much as possible by receiving part of the money or extending the time of payments, rather than lose their funds altogether, and even waste time on lawsuits. Banks, as a rule, do not agree to reduce the “body” of the loan, but they can “cut off” interest or penalties, as well as extend the payment period.

How to draw up an agreement on debt repayment (restructuring) ?

Debt Restructuring Law

By law, restructuring can be used for any type of loans, ranging from consumer loans, car loans and ending with mortgage lending.

However, it is important to understand that debt restructuring is not always beneficial to the client. This is the best way out of a situation when there is no loan debt yet. If restructuring is used by the bank as the last step before filing a lawsuit to collect debt from the borrower, you should not rush to agree to the restructuring proposal, since in this case pennies will be included in the amount of the new debt. The court will approve the amount of the debt, but may oblige the bank to write off any accrued fines.

When is restructuring not applicable?

If a citizen becomes bankrupt, he cannot always ask for restructuring. The arbitration court, when considering a bankruptcy case of citizens, will not order restructuring in the following circumstances:

- the debtor’s income is absent or does not exceed the subsistence level;

- the debtor has an outstanding conviction for an intentional economic crime;

- the debtor was under administrative punishment for petty theft or intentional destruction or damage to property;

- the individual has already been bankrupt for the last 5 years;

- he had already been granted restructuring for the previous 8 years.

How to achieve restructuring

As a rule, the debtor is the initiator of the restructuring process. If the organization clearly understands that it cannot pay the debt, it should independently contact the creditor. To change the agreement, the following conditions must be met:

- Serious reasons for restructuring (inability to pay the debt as before).

- Lack of restructuring taken earlier.

- No overdue debts.

These are the most approximate provisions. The lender may offer restructuring on other terms. In order for a bank or other institution to offer convenient conditions, it must be confident in the borrower’s reliability. Restructuring is more readily carried out for debts that are secured by collateral (real estate, cars).

IMPORTANT! The procedure requires documentation. An appropriate agreement is drawn up, on which the signatures of the creditor and debtor are placed. After this, the debtor is issued a corresponding document.

Bank loan restructuring

Restructuring is carried out in relation to various loans, including mortgage, target, consumer. The nuances of the procedure depend on the specific banking institution. Let's consider the general sequence of actions:

- The debtor fills out the form. It states the grounds for restructuring (for example, a sharp deterioration in the financial situation), information about the company’s property, its income and expenses.

- A suitable refinancing option is selected.

- The questionnaire is analyzed by the department for working with overdue loans.

- An interview is conducted with department employees.

- The debtor collects documents.

- Based on the documents provided, a decision on restructuring is made.

- An agreement is drawn up and signed.

In some banking institutions, instead of a questionnaire, the debtor fills out an application.

Application for debt restructuring

A timely written application for loan restructuring is an opportunity to get out of a difficult financial situation with honor without violating your obligations to the bank. Restructuring (carried out in a timely manner) will save your credit history from negativity, and you from additional fines, penalties, and proceedings with the bank.

Remember that it is advisable to write an application for debt restructuring before the first delay on the loan. Firstly, banks are more loyal to conscientious borrowers, and secondly, any late fees will be included in the principal debt during restructuring.

Main types of restructuring

There are many types of restructuring. Let's look at the most common of them:

- Prolongation. The debt payment period is extended. Consequently, the size of monthly payments decreases. The loan amount remains the same.

- Credit holidays. The payment of benefits or the main “body” of the loan is canceled for some time. In some cases, payments are completely canceled for a period of 3-6 months. It is assumed that during this time the debtor will put his financial affairs in order and will be able to continue paying the debt. Credit holidays are provided extremely rarely. This is due to the fact that this option is unprofitable for banks.

- Change in the currency in which the loan was provided. With the rise of the dollar, it has become extremely difficult for organizations to repay loans previously issued in foreign currency. This form of restructuring is also extremely unprofitable for the bank.

- Reduced interest rates. In this case, the size of monthly payments is reduced, but the size of the loan itself remains unchanged or increases. A rate reduction is only practiced if the debtor’s credit history is perfect.

- Write-off of penalties. Banking institutions can either provide a deferment for the payment of fines or write them off altogether. This measure is used extremely rarely. It is relevant in case of bankruptcy of an enterprise.

- Combined restructuring. Involves a combination of several methods. For example, the loan term is extended. At the same time, penalties are written off.

The choice of a specific method depends on the wishes of the banking institution and the debtor himself.

Establishing conditions and terms for debt restructuring: step-by-step instructions

Both the bank and the borrower company can take the initiative to restructure the loan debt. Financial experts recommend that insolvent organizations be the first to initiate a restructuring procedure, without waiting for failure to repay debts, accrual of fines and penalties.

Now let's move on to consider step-by-step instructions for restructuring debt obligations.

Step 1: Meet with creditors.

The first stage is an objective analysis of the financial condition of your organization. You must honestly answer the question: does the company have a sufficient amount of material resources to make timely payments on all debt obligations. If the answer is no, you must initiate a meeting of all creditors of your organization.

At the meeting, you should talk about the current state of affairs, describe an approximate strategy for improving the financial situation and proceed to a joint discussion of further interaction with creditors. It is not recommended to postpone such a meeting, since after the organization violates the deadlines for making regular payments, the attitude of creditors towards the borrower will significantly worsen. Your task is to show your readiness to cooperate, demonstrate confidence in the future and the possibility of a quick way out of a difficult situation.

Please note that starting negotiations separately with each creditor at the first stage is not a good idea. So, you are unlikely to be able to quickly reach an agreement on debt restructuring, because each creditor will have its own vision of the current situation, its own requirements, and, most likely, a lack of trust in other credit institutions.

At the first meeting, creditors will want to hear information about the total amount of debt, the capital available to the borrower, as well as approximate provisions of the anti-crisis strategy and information about the prospects for business development. However, even if you cannot provide complete information on the above points, this is not a reason to delay the start of interaction with creditors regarding restructuring and violate debt repayment deadlines.

If during the meeting you are asked questions to which you cannot immediately give an accurate and detailed answer, you can always set a time frame during which the company will provide creditors with all the information they are interested in.

In the process of communicating with creditors, you must not only inform them about the current state of affairs at the enterprise, but also determine the time frame after which the company will be able to resume payments on existing loans.

Step 2. Get a moratorium on loan repayments.

At a meeting with creditors regarding the restructuring of your debt, you will need to not only discuss the important nuances outlined in the description of the previous stage, but also agree on a moratorium on debt payments. This definition refers to the period during which the organization will not be able to meet its loan obligations. A moratorium on debt payments will allow you to get a reprieve in order to develop an anti-crisis action plan and begin to implement it.

You can argue your request for a moratorium by saying that the company needs time to agree on loan restructuring by writing a corresponding statement. The standard moratorium period on debt payment is approximately three months, with the possibility of extension by mutual agreement of the parties. A shorter period of time is often not enough, and a longer moratorium period is quite difficult to negotiate with the bank. But please note that after signing the moratorium agreement, restrictions on certain actions will be imposed on the debtor company. Thus, an organization may be prohibited from:

- pay dividends;

- increase the total amount of debt by attracting new loans and credits;

- issue guarantees and warranties;

- sell or pledge assets without the approval of creditors.

If your organization has several lenders, it will be better if they create a coordination committee, which will include several representatives of the largest credit companies. Members of the coordination committee, for additional remuneration (its amount depends on the amount of debt and the complexity of the current situation), will conduct further negotiations on debt restructuring, analyze the correctness of all information provided by the debtor, and also take part in the development and approval of the necessary financial documents.

If the debtor company is a fairly large organization, negotiations with creditors on debt restructuring may last more than one year.

Step 3. Determine the stages of corporate loan restructuring and the work to be done.

Restructuring the debt of an individual entrepreneur or organization is accompanied not only by financial losses, but also by the expenditure of time and management resources. The last nuance is often underestimated by the borrower, which causes an increase in the terms of negotiations regarding restructuring or even leads to failure of the procedure.

From practice it follows that negotiations with a bank regarding debt restructuring are a fairly long process, especially if the borrowing company is the owner of a large business and large-scale debts. That is why it is necessary to carefully prepare for interaction with a credit institution from the very beginning and appoint a competent and responsible employee (several at once) for these purposes.

In medium-sized organizations, responsibilities for interaction with the bank are usually assigned to the CFO. In large companies, the contact person most often becomes one of the deputy managers responsible for attracting financing, for example, the head of the treasury department.

The contact specialist must interact with all creditors, coordinate the activities of various services and consultants of the enterprise, have sufficient authority to make operational decisions, and also regularly report to the company’s management about the progress of negotiations, results achieved and emerging problems.

At this stage, a general algorithm for the restructuring procedure should be determined and a list of upcoming work should be drawn up. It is very important to make as accurate calculations as possible regarding the amounts that the organization will need to spend on the cost items associated with the restructuring. For large businesses, these amounts can be in the hundreds of thousands of dollars. Please note that members of the creditor coordination committee, external consultants, external lawyers, etc. will require payment for their work.

Do not forget about developing a financial model indicating the planned profit and possible losses for a period of at least five years (preferably on a quarterly basis), since most lenders want to see exactly this type of forecast.

Restructuring on taxes and penalties

Restructuring involves transferring a company's obligations to the state from short-term to long-term. The method is used for the financial recovery of the organization. Restructuring is only granted in cases where the company has special circumstances. To formalize other conditions of the organization, you need to submit an application and documents to the relevant authority. Based on the submitted papers, a decision is made on the possibility of restructuring.

What documents are needed for restructuring?

To obtain a restructuring, you need to fill out an application. It must comply with the form approved by Order of the Federal Tax Service dated September 28, 2010 No. ММВ-7-8 / [email protected] If the company applies for an extension of the debt period, the application must indicate consent to the obligation to pay interest. A number of documents are attached to the application:

- A certificate from the tax office indicating the status of the organization’s tax calculations.

- A certificate from the tax office indicating the list of company accounts with credit institutions.

- Documents on cash flows in the company's accounts for the last 6 months.

- Documents on the presence or absence of current accounts.

- Certificates from credit institutions about funds available in accounts.

- List of counterparties indicating the cost of agreements.

- Papers confirming compelling reasons for restructuring.

In some cases, additional documents may be required.

Grounds for granting restructuring

The basis for restructuring is bankruptcy or threat of bankruptcy. The signs of bankruptcy are set out in Article 6 of the Federal Law of October 26, 2002 No. 127:

- Failure to fulfill obligations to creditors.

- Inability to pay taxes.

- The amount of liabilities is at least 100,000 rubles.

- The company's obligations were not fulfilled for more than 3 months.

Restructuring may also be granted if the company operates seasonally.

Restructure debt - what does it mean in practice?

Credit institutions offer this service to their clients who are experiencing difficulties in repaying debts. It allows you to solve the problem without involving the authorities.

For example, a person’s income has decreased or he has found himself in a difficult life situation that requires a lot of money. As a result, he stopped making payments on the loan. Then he can contact the bank with a request for more lenient conditions.

If the reasons turned out to be truly valid, the answer will be positive. Banks do not want to lose customers and, whenever possible, meet them halfway. In such a situation, an unblemished credit history will be very helpful.

Forms of restructuring

Tax restructuring is divided into two forms:

- Privileges. The company is provided with tax benefits. A payment schedule is drawn up that suits all participants. The schedule indicates the amount and timing of payments. Payments must be made at least quarterly. The maximum period for fulfilling tax obligations is 10 years.

- Tax credit. It is a kind of installment plan for tax payments. The maximum repayment period is 1-5 years. If the company is included in the register of residents, this period increases to 10 years.

IMPORTANT! A company is not granted restructuring if it is subject to a criminal case relating to tax liabilities.

The possibility of changing the conditions is also excluded when the organization has committed an administrative violation related to taxes.