In order to register an inheritance, to receive property that is due by inheritance, you must pay a fee, as well as pay money to the notary for his services. Without paying the fee, the heirs have no right to take possession of the testator's property. Only after paying the fee will a certificate be issued, which serves as a document confirming the rights of the heirs.

But in some cases, an inheritance can be registered without paying a fee. This opportunity is presented to a certain category of citizens.

Legislation

According to Art. 333.38 of the Tax Code of the Russian Federation, citizens with disabilities of group 1 or 2 have the right to a discount of 50% for performing any notarial acts. This benefit applies to all notaries: working in private offices or in government institutions.

If a transaction requires a mandatory notarial form, a state fee is paid on the basis of Art. 333.24 Tax Code of the Russian Federation. If this form is not provided, when visiting a specialist, the notary fee is transferred in accordance with Art. 22.1 Federal Law “On Notaries”. These are two completely different concepts that do not intersect in any way. The simultaneous collection of duties and tariffs is not allowed, but a notary may require a separate fee for performing actions of a technical and legal nature.

“Disabled people belong to a socially protected category of citizens, and we are constantly developing new sets of measures aimed at improving their standard of living. For example, now in the Russian Federation new hospitals and medical institutions are being built and benefits are being paid. They can also enjoy the provided benefits on taxation and payment of duties."

YES. Medvedev, Chairman of the Government of the Russian Federation.

What can you save on?

Often, notaries are persuaded to make a separate copy of the certificate for each heir. They strongly recommend that you draw up a document for any object from the will. Each additional certificate costs money, but whether to do it or not is a personal matter; the procedure established by law does not oblige you to do so.

Evaluation of successors, incl. pensioners must do it at their own expense. Independent organizations or BTI will help with this. In order for a pensioner to save money, it is necessary to take into account the cadastral value, which is lower than the market value. In order for the property to be calculated at the cadastral price, the pensioner needs to contact the BTI.

Regions have their own benefits for a certain category of citizens, including pensioners. Before completing all the paperwork, it is recommended to ask a representative of the notary’s office to tell you about your rights and ask other questions about receiving an inheritance. In addition, the legislation is changeable, but all the benefits mentioned earlier are valid to this day in the Russian Federation. You can find out information on other countries on the corresponding Internet resources. For example, information on Ukraine is on the state’s legal portal.

Thus, pensioners will not be able to receive an inheritance without spending their own money. Even if the heir is one of the persons entitled to benefits, in any case he will have to pay notary services, property tax, etc.

What is the cost of notary services?

Often the price list in notary offices consists of several thousand for a single service, while in the legislation there are fees of 200-500 rubles. Here it’s all about the cunning design of the notaries’ price list: they indicate the cost of one service in the complex, and add an additional one “of which 100 rubles. - state duty." As a rule, people do not know their rights, and for a regular signature they pay 5-10,000 rubles.

Thus, the price tag consists of two parts:

| Fee or notary fee | Payment for services |

| Established by federal legislation and valid throughout the Russian Federation | Determined by the notary chamber of the region; at the federal level there is no maximum price limit |

Example No. 1: payment for certification of a gift agreement

A citizen decided to donate one of his apartments to his adult daughter. The transaction does not require notarization, the property is solely owned. Payment is made in accordance with Art. 22.1 Tax Code of the Russian Federation. The estimated cost of housing is 3,000,000 rubles.

How is the tariff calculated:

3,000,000 x 0.2% = 6,000

6,000 + 3,000 = 9,000 rub. – cost of certification service.

According to Art. 22 of the Law “On Notaries”, disabled people are entitled to a similar discount as when paying state fees. Thus, having 2 or 1 group, the donor pays instead of 9,000 rubles. 4,500 rub.

Subject of inheritance

First of all, you need to understand what inheritance is. The Civil Code of the Russian Federation qualifies the concept of inheritance as the totality of all material assets (including property rights and debt obligations) belonging to a citizen at the time of his death. This list includes:

- Real estate and land

- Means of transport and other equipment

- Deposits, securities, cash

- Things (both valuable and ordinary “household trash”)

- Property rights (for example, shares in a business)

- Debentures

All this, subject to certain conditions, becomes the property of other persons - heirs.

How to get a discount

To take advantage of the discount when transferring state fees, it is enough to present a certificate of disability to the notary’s office. No additional documents are required. A copy is made of it, the original is returned to the owner.

Often, notaries do not explain the possibility of obtaining a discount, although by law they are required to do so before making transactions. You can remind specialists of your rights, but in such situations they often completely refuse to provide services. It is recommended to request a written refusal from the notary and appeal it in court or send a complaint to the notary chamber of your region. Notaries cannot impose additional services if they are not required.

The most common example is a refusal to a citizen who came to the office with an already completed power of attorney, purchase and sale or gift agreement. Here, the notary only needs to put a resolution, signature and seal, because his main task is to certify the legal capacity of the parties to transactions and the legality of their implementation, and not to earn fabulous sums. In practice, things are different:

A citizen comes to the office with a ready-made power of attorney to represent interests in government bodies. The document is subject to mandatory certification, the cost is established by Art. 333.38 Tax Code of the Russian Federation. The notary's price list states the cost of the certificate is 2,000 rubles, of which 200 rubles. – state duty.

The principal pays only the fee, but the specialist refuses to certify the power of attorney, citing incomplete payment and demanding an additional 1,800 rubles. This is illegal, because the citizen already has a ready-made and completed power of attorney form, the notary only has to sign.

The specialist begins to explain that the power of attorney was drawn up incorrectly and needs to be reissued. In most cases, citizens agree to this and pay several thousand. As a result, they receive the same document brought initially.

Disinheritance

Not all candidates for the estate of a deceased loved one are worthy of receiving an inheritance. There are 2 ways to solve this issue:

- if the testator executed a will, he could indicate in it the circle of persons who will not receive the property in any case (this is an expression of the will of the applicant, therefore the rules established by him are undeniable);

- recognition of legitimate claimants as unworthy through the court by other relatives or government agencies (in the absence of a will).

Article 1117 of the Civil Code outlines the acts, the commission of which gives rise to legal grounds for establishing the status of an unworthy heir:

- criminal actions against the testator with the aim of causing his death;

- criminal actions against other family members claiming property with the aim of causing their death;

- intentions to forge, destroy or change the will in one’s favor;

- the presence of deprivation of parental rights in relation to a child, after whose death property remains;

- refusal to maintain and care for a dying or sick relative who subsequently passed away.

Important ! All grounds are considered in court; to establish them, evidence and truthful testimony are required.

This procedure is carried out not only within the 6 months allotted for entering into an inheritance, but also after receiving it by law.

If the judicial authority makes such a determination, the unworthy citizen is obliged to return his part, which will be divided among the remaining owners. A person who has received such status has the right to challenge the verdict within 1 month from the date of the hearing in an appeal to a higher authority in order to protect his own rights. Order a free legal consultation

Amounts of state fees when performing various notarial acts

As mentioned earlier, the cost of notary services depends on the form of the transaction: whether it requires certification or not. This is regulated by various legislative acts.

Inheritance

The inheritance procedure is regulated by Art. 1111 of the Civil Code of the Russian Federation, according to which inheritance can be transferred in two ways:

- In law. The legal successors of the first stage enter into the inheritance, and if there are none, the second, etc.

- According to the will. The testator draws up a will before a notary; the document requires notarization.

According to Art. 333.38 of the Tax Code of the Russian Federation, heirs are exempt from paying state duty for issuing a certificate of inheritance of real estate if at the time of the death of the testator they lived together with him. In other cases, it all depends on the degree of relationship:

| Children, spouses, parents, brothers, sisters | 0.3% of the price of the inherited property, maximum 100,000 rubles. |

| Other categories of citizens | 0.6% of the cost of housing, but not more than RUB 1,000,000. |

If the notary has to take measures to protect the inheritance, an additional 600 rubles are paid. For example, this is relevant when inheriting limitedly negotiable items (weapons), if the successor does not have a license.

Important! If the heir is a minor, he is exempt from paying state duty. Disabled people receive a 50% discount.

Certification of a will will cost 100 rubles.

Example No. 2: acceptance of an inheritance by a disabled person

Citizen Serafimovsky inherited an apartment from his uncle according to his will; the estimated cost of the housing is 5,000,000 rubles. The legal successor is a disabled person of group 2 and did not live with the testator at the time of death.

The state duty is calculated as follows:

5,000,000 x 0.6% = 30,000 rub. – the cost of accepting an inheritance.

30,000 x 50% = 15,000 rub. – final price taking into account benefits for the legal successor.

Donation

The gift agreement does not require mandatory certification. The cost of notary services is established by Art. 22.1 Federal Law “On Notaries”:

| Gift to parents, spouses, grandchildren depending on the value of real estate | |

| 10,000 rub. | 3 000 +0,2% |

| From 10,000 rub. | 23,000 +0.1% of the amount over RUB 10,000,000, maximum RUB 50,000. |

| To other persons | |

| Up to 1,000,000 rub. | 0.4%+ 3,000 rub. |

| 1-10,000,000 rub. | 7 000 +0,2% |

| More than 10,000 rub. | 25 000 +0,1% |

Example No. 3: providing a discount to a disabled person when drawing up a deed of gift

The donor is a group 2 disabled person. He decided to give his apartment to his adult son. The cost of housing is 5,000,000 rubles. To draw up the deed of gift, we turned to a notary.

5,000,000 x0.1% = 5,000 rub.

5,000 +23,000 = 28,000 rub. – total cost of the service.

Agreement on payment of alimony

According to the RF IC, child support obligations are established for a parent who does not live with the child. Alimony is transferred to them to the spouse or ex-spouse with whom the minor is.

Collection of alimony is carried out in two ways:

- Through the court in the order of writ or claim proceedings. The form and method of payment are established by the court at the request of the plaintiff.

- By drawing up a child support agreement, in which the parties independently determine the amount and procedure for paying money for the maintenance of the child. It is permitted to transfer valuable property to pay off alimony obligations.

The agreement has the force of an executive and must be notarized. The state duty here will be 250 rubles. The parties independently determine who pays it. If the payer is disabled, taking into account the discount, 125 rubles are transferred to them.

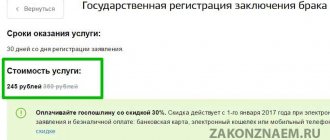

Marriage contract

The marriage contract must be certified. The purpose of its preparation is to regulate financial and property relations in the family. It can be issued before the marriage is registered, but in this case it will take effect only after making an entry about the new unit of society in the registry office documents.

The cost of notarization of the contract is 500 rubles. The duties of the notary here include checking the correctness of the drafting and legal capacity of the parties. If it is necessary to draw up a contract indicating all the nuances, an additional payment for services will be required, set by the notary himself.

For a disabled person, certification will cost 250 rubles.

Constituent documents

If a disabled person is one of the founders of a legal entity, the constituent documents are subject to notarization. The state duty here will be 500 rubles, with a discount of 250 rubles.

Power of attorney for the right to use property

When carrying out legally significant actions with real estate and other property by a third party (attorney), a power of attorney must be drawn up. The state duty for close relatives will be 100 rubles, for other persons – 500 rubles.

If a power of attorney is issued for the right to use a vehicle (for example, for the purpose of sale by a third party), you will have to pay 250 rubles. for close relatives, for other persons – 400 rubles. Taking into account the discount, the duty is reduced by 50%.

Certification of translation accuracy

If the beneficiary is a foreign citizen and an official translation of his documents is required in the Russian Federation, this must be notarized. Payment is made for each page - 100 rubles, for disabled people - 50 rubles.

Indivisible property

Article 133 of the Civil Code regulates the concept of an indivisible thing, which in kind cannot be divided between potential candidates without destruction or damage, or a change in purpose. In relation to such property when divided between heirs, Article 1168 of the Civil Code applies. It establishes a priority right to become the owner of the recipient who jointly owned the property with the deceased person over other claimants.

If the estate includes residential premises, indivisible in kind, citizens who are relatives, living and registered in the apartment or house at the time of death, their right to receive ownership of the object is regarded as priority.

Other benefits for people with disabilities

In addition to privileges when paying for notary services, people with disabilities can enjoy other benefits. They are provided depending on the group; the widest list is provided for citizens with disabilities in the first group.

| Tax | Housing | Social |

| Exemption from paying land tax for a plot of up to 6 acres. Only the area exceeding the specified value is paid | Providing discounts or compensation when paying for housing and communal services | Free medical care in state and municipal institutions |

| Possibility of obtaining a tax deduction for employed citizens | Providing free housing if a disabled person needs improved living conditions and is on the waiting list for Social Security | Free installation of dentures made from inexpensive materials. If expensive materials are used, they are subject to payment |

| Reducing the cost of transport tax or completely eliminating taxation | Compensation for the cost of purchasing fuel if the disabled person’s home is not supplied with gas | Provision of medicines at the expense of the federal or regional budget |

Also, upon the onset of disability, citizens are entitled to an insurance or social pension. The first is assigned if there is at least one day of experience, the second - if there is no experience.

Missing and reinstating a missed deadline

If the heir of priority missed the six-month deadline for a valid reason (for example, he was seriously ill, was on a business trip abroad, or simply did not know about the death of his relative), he can file a lawsuit for a special extension of the inheritance period. It will be necessary to provide the court with evidence of a valid reason for missing the deadline.

ATTENTION! The heir has the right to file such a claim no later than six months after the deadline has expired.

FAQ

Question No. 1. When is the notary fee paid?

According to Art. 333.18 of the Tax Code of the Russian Federation, payment must be made before notarial acts are performed.

Question No. 2. What documents do notaries require?

It all depends on the type of transaction. For example, when alienating real estate, you will need a certificate of ownership. To issue a power of attorney, the attorney's passport information is sufficient. Only passports and receipts for payment of fees are required.