When the heirs cannot peacefully resolve the issue with the property of a deceased relative, they file a lawsuit claim for division of inherited property. In it, its author proves his rights to the disputed assets, motivating their use during the life of the testator, and other arguments. Accordingly, opponents are forced to object.

The subject of appeal to the justice authority is not only real estate, transport, things, but also monetary compensation for part of their value. Especially when it is simply not physically possible to divide an object.

In this article, the reader will learn the basic intricacies of resolving property disputes between heirs. The sample application to the court will be supplemented by judicial precedents and current recommendations.

Grounds for filing a claim

The main reasons for dividing inherited property through the court:

- The will does not specify the shares of the beneficiaries.

- The claimants do not agree on the size of their share of the inheritance.

- The beneficiary has a priority right to receive the property. For example, the heir is a co-owner of the apartment or lived in it together with the testator.

- The spouse's share is not allocated from the inheritance mass.

- The rights of compulsory heirs have been violated.

- Other controversial points.

Example. After the death of citizen M., the following came into the inheritance: her daughter from her first marriage, her son from her second marriage, and her husband. The inherited property included an apartment, a car and a bank account. The objects were divided into 1/3 shares. And the funds were withdrawn from the account and divided among the recipients. However, the deceased’s husband always lived in the living space. The son did not own any other home. The car was used by the daughter of the deceased. It was not possible to divide the property on our own. Therefore, the son went to court to divide the inherited property.

Rules

Everything related to inheritance is covered by Section V of Part 3 of the Civil Code of the Russian Federation, which has the appropriate name. It contains several Chapters concerning the general principles of inheritance and methods of obtaining the property of a deceased citizen.

Some types of property are inherited taking into account certain features, which are collected in the articles of Chapter 65. There, in particular, the conversation is about enterprises, land plots, and insignia of the testator.

There is also Chapter 64, devoted to the technical details of acquiring an inheritance. It is worth recalling that in order to assume your rights, you must both submit an application to a notary and perform one or more actual actions. At this point there is a smooth transition to methods of inheritance.

In law

Here, the right to inheritance arises from the relatives of the deceased, regardless of their age. By the way, in accordance with Art. 1116 of the Civil Code of the Russian Federation, children born after the death of their father can also become heirs. Much less often - mothers, we are talking about surrogacy.

Depending on the degree of relationship, there are 3 main lines of heirs. The first to have the opportunity to assume their rights are parents, children (including adopted children) and the spouse of the deceased. If there is only one person on the first step, then everything goes to him.

The shares are recognized as equal by default. The exception is situations when one of the heirs renounced his claims in favor of the other.

By will

Every capable person during his lifetime has the right to make written orders regarding the fate of his property in the event of death. Moreover, some people manage to draw up several wills during their lifetime, revising their plans.

The will may include not only the relatives of the testator, but also strangers. Property can also be turned over to the benefit of enterprises and the state.

We recommend! Inheritance of an apartment after the death of a husband according to the law by several heirs, re-registration of rights to property

The document in question has priority over inheritance by law. It clearly describes both the property and who will get it. The ratio of shares does not matter.

The law allows for the invalidity of a will. When this happens, the legal heirs take over.

Marital share

It is clear that the husband or wife of the deceased is included in the circle of priority heirs. But an allowance must be made for common property acquired during the existence of the family.

It is worth referring to the contents of Art. 1150 Civil Code of the Russian Federation. It follows from it that the object of inheritance is the testator's share in family assets, as well as his personal property.

Accordingly, the surviving spouse’s share in the joint property is not included in the inheritance estate. After all, these rules were established by law. The only thing is that if it is not documented, the apartment is registered in the name of the husband or wife, you need to submit an application to a notary for the allocation of the marital share.

The procedure for dividing property

The mechanism for dividing property depends on the method of accepting the inheritance:

- Law

- Will.

Let's say the testator left an order. The document may provide for the following scenarios:

- The testator indicated the type of property and shares of the heirs. The least problematic option. Although this division procedure does not exclude the possibility of litigation. For example, if the will infringes on the interests of the obligatory heir.

- The will is drawn up for all property that will be revealed on the day of the citizen’s death, but without indicating shares. The property is divided equally between the applicants. The rule on the application of the priority right to inheritance applies to an indivisible thing (Article 1168 of the Civil Code of the Russian Federation).

If the owner of the property did not leave a will, then the inheritance is accepted by law. Close relatives of the deceased citizen are first in line. The property is divided equally between them.

The exception is the marital share of property. It is allocated before the actual division of the inheritance between the claimants. This is monitored by a notary.

However, the spouse will need to submit a corresponding application. On its basis, the notary will issue a certificate of ownership (Article 75 of the Law on Notaries).

If the spouse does not want to allocate her part of the property, then she can submit a corresponding application to the notary.

Reasons for dividing property between heirs

This process occurs when the registration of inheritance is carried out between the legal claimants to the property. Indeed, in this situation, it is not specific things that are outlined, but the size of the shares. As a result, a conflict arises over who should get what.

Contradictions also occur when property simply cannot be physically divided. A good example is a car or a tiny one-room apartment. Then the conversation turns to the existence of preferential rights with the simultaneous provision of counter monetary compensation.

Sometimes disputes arise when part of the deceased's assets are not covered by the will. As an example, it is appropriate to cite one of the situations that the Supreme Court dealt with (ruling in case No. 87-KG17-14 of 02/06/2018).

A citizen made a will for a house, forgetting to mention the land plot in it. One of the heirs considered that the land is indivisible from real estate and is automatically inherited in the corresponding part.

Other candidates did not agree with this and the matter went to court. As a result, the cassation court concluded that the plot is a separate object and is subject to distribution according to the law.

Finally, the reason for clarifying the relationship is whether one of the heirs has the right to an obligatory share. In this case, claims are made to reduce it or even deprive it altogether.

Pre-trial solution to the problem

The law offers heirs a number of solutions to avoid litigation:

- Concluding an agreement on the division of property even before receiving a certificate of inheritance rights. The document is drawn up in writing and submitted to the notary's office. In accordance with the agreement, the notary makes a division of the inheritance.

- Determination of the procedure for using joint property . This option is suitable if a certificate of inheritance rights has been received and shared ownership has been registered with the authorized body. The heirs enter into an agreement and register it with a notary.

If the heirs fail to resolve the issue pre-trial or one of them refuses to sign the agreement, then the initiator of the division will have to go to court.

How is the inheritance divided between legal heirs?

The first thing you need to know is when inheritance by law is possible:

- Inheritance by law is not changed by a will, that is, the testator did not make a will during his lifetime

- The will was declared invalid by the court

- The heirs under the will did not accept the inheritance (the will was not presented for execution)

- The heirs under the will refused the inheritance

- The will is canceled by the testator

- The heirs under the will are excluded from inheritance as unworthy

- The heir under the will died before the opening of the inheritance or at the same time as the testator, and the will does not designate an heir

As is known, there is a strictly defined order of inheritance , based on kinship and marital relations with the testator, but when dividing the inheritance, the priority right of inheritance by the disabled dependents of the testator, who have the right to an obligatory share in the inheritance even in the presence of a will, is taken into account.

Heirs of subsequent orders inherit only on the condition that there are no heirs of previous orders: either they are absent altogether, or none of them has the right to inherit, or all the heirs of the previous order did not accept or refused the inheritance.

The law provides for eight lines of inheritance (Articles 1142-1148 of the Civil Code of the Russian Federation):

1st priority: children, parents, spouse of the testator (grandchildren inherit as part of the first priority by right of representation )

2nd priority: siblings and step-brothers, as well as grandparents of the testator (the testator’s nephews and nephews inherit as part of the second priority by right of representation)

3rd priority: siblings and half-brothers and sisters of the testator’s parents, i.e. uncles and aunts on both sides (cousins and brothers inherit in third place by right of representation)

If there are no heirs of the first three orders, then the right of inheritance is transferred to the heirs of the subsequent orders:

4th stage: great-grandparents of the testator

5th line: cousins, granddaughters and great-aunts, grandfathers of the testator

6th line: great-great-grandchildren and great-uncles, aunts of the testator

7th stage: stepsons and stepdaughters, as well as stepfather and stepmother of the testator

8th stage: disabled dependents of the testator who are not related to him

One important aspect should also be remembered: conceived a child during his lifetime , then the inheritance can be divided only after the birth of this child, since he will be the heir of the first priority and share the inheritance equally with other called heirs.

Read more about how the testator's grandchildren inherit, who is considered the testator's disabled dependents, and how the inheritance is divided if there are disabled dependents of the testator .

Lawyer on inheritance issues in St. Petersburg. Tel.+7 (812) 989-47-47 Telephone consultation

The first principle of inheritance by law says that the inheritance is divided only between the heirs of one line called to inherit . Heirs of the second and third orders, and even more so heirs of subsequent orders, do not have the right to claim an inheritance in the presence of first-priority heirs, with the exception of the disabled dependents of the testator, who have the right to inherit on an equal basis with the called heirs, regardless of which order of inheritance they themselves belong to.

The second principle of inheritance by law is the principle of equality of shares in the inheritance.

The division of the inheritance between the heirs of the called line is based on equality of shares (Part 2 of Article 1141 of the Civil Code of the Russian Federation).

However, shares in the inheritance are not always distributed equally. This applies to cases where the right of inheritance after the death of the testator passes to the heirs by right of representation and in the order of hereditary transmission .

If there are several heirs by right of representation or heirs by transmission, they do not inherit on an equal basis with the other heirs of the called line, but share among themselves only one share of the inheritance, which was intended for the deceased heir (Articles 1146, 1156 of the Civil Code of the Russian Federation).

How to properly file a claim for division of inherited property

When drawing up an application, you must take into account the provisions of the Code of Civil Procedure of the Russian Federation. The document must be submitted exclusively in written form.

Mandatory claim details:

- The name of the court in which the case will be heard.

- Information about the applicant/respondent/third parties. This indicates the residence/location address, last name, first name and patronymic of citizens.

- The cost of the stated requirements.

- Name of the statement of claim.

- Circumstances of the case.

- Section option.

- Link to regulations.

- Plaintiff's claims.

- List of attached documents.

- Date, signature.

The content of the application is an equally important component of the document. It can be divided into several blocks.

Contents of the statement

| No. | Section name | Content |

| 1 | Description of the fact and date of death of the testator | It is also appropriate to display information about the composition of applicants and the amount of inheritance. A link to the death certificate is also provided. |

| 2 | The essence of the conflict | It is necessary to describe the reason for the impossibility of solving the problem peacefully. The plaintiff will have to offer his own version of the division of property. The statement of claim must briefly describe the essence of the problem. It will be necessary to succinctly state the circumstances of the case. |

| 3 | Reference to legal provisions that provide protection of the civil rights of the heir | Part 2 art. 1153 of the Civil Code of the Russian Federation - if the inheritance was actually accepted; Art. 1150 of the Civil Code of the Russian Federation - for the allocation of the marital share; Art. 1149 of the Civil Code of the Russian Federation - to protect the rights of compulsory heirs; Art. 1122 of the Civil Code of the Russian Federation - when determining the owner of an indivisible thing. |

| 4 | Plaintiff's request | I ask you to divide the testator's property as follows: |

| 5 | Application | List of documentation that proves the applicant is right |

| 6 | Date, signature | The right to sign the application is vested in the person whose rights have been violated or his representative. |

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

It is not recommended to describe in detail the circumstances of the case, attempts to solve the problem pre-trial, all the defendants. No one will read works of fiction. The acceptable length of the claim is no more than 3 pages. Circumstances not specified in the application can be expressed orally in court or presented in the form of additional documents.

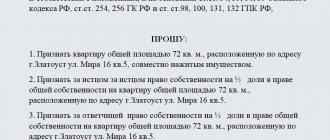

Sample statement of claim for division of inherited property

Sample statement of claim for division of inherited property

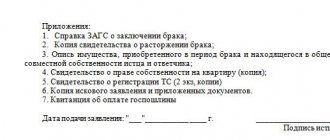

Attached documents

To substantiate its position, the plaintiff must attach relevant written evidence to the application. The list of documents depends on the subject of the dispute, the number of participants and other circumstances.

The following documents will be required:

- a copy of the statement regarding the number of participants in the case;

- plaintiff's identity card;

- death certificate of the property owner;

- documents for property owned by the testator;

- original administrative document (if available);

- confirmation of family relationship with the deceased subject;

- evidence of being a dependent of the deceased citizen;

- a certificate from the place of registration of the testator;

- asset value report;

- proof of payment of state duty.

If a lawyer acts on behalf of the plaintiff, then an additional notarized power of attorney will be required. Guardians of incompetent citizens must submit a court decision declaring the person incompetent and an order appointing a guardian.

Legal representatives of minor citizens must have with them:

- passport;

- birth certificate or passport of the minor;

- resolution on appointment of guardianship/trusteeship;

- guardian's certificate;

- agreement on the transfer of a minor to a foster family;

- foster parent's certificate;

- order for placement under supervision in an organization for orphans;

- order on the appointment of a director of the organization;

- power of attorney signed by the head of the organization.

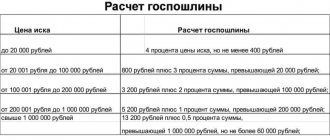

State duty

When filing a claim, you must pay a state fee. Its size is determined by the Tax Code.

The final tax rate depends on the value of the claim. The higher the amount, the higher the state duty. When calculating the amount of the fee, 2 factors are taken into account - the minimum indicator + the percentage of the amount exceeded.

Payment calculation principle

| Cost of claim (r.) | The fee is fixed (r.) | Additional percentage |

| Up to 20,000 | 4% of the claim amount but at least 400 rubles. | No additional interest |

| from 20,001 to 100,000 rub. | 800 rub. | 3% of the amount exceeding 20 thousand rubles. |

| from 100,001 to 200,000 rub. | 3200 rub. | 2% of the amount exceeding 100 thousand rubles. |

| from 200,001 to 1,000,000 rub. | 5200 rub. | 1% of the amount over 200 thousand rubles. |

| More than 1 million rubles | RUB 13,200 | 0.5% of the amount over 1 million rubles, but the duty cannot be higher than 60 thousand rubles. in total. |

Indivisible property upon inheritance

According to Article 133 of the Civil Code of the Russian Federation, a thing is recognized as indivisible, the real division of which cannot be carried out without destruction and damage to such property, as well as a change in its purpose.

For example, a car inherited by two persons is indivisible, due to the fact that its physical division will cause a complete loss of the ability of such a thing to fulfill its functional purpose inherent in the vehicle.

In addition, according to practice, an apartment located in a multi-story building will not be subject to division, since in most cases the layout of such premises does not provide the possibility of separating parts of the said real estate in kind, as in the case of dividing a residential building by inheritance.

Procedure for filing a claim

The claim must be filed in the district court. The claim must be accompanied by documents confirming the circumstances of the case.

Options for filing a claim:

- in general order - at the place of registration of the defendant;

- if the dispute concerns real estate, the connection goes to the location of the object.

Documents can be submitted to the court:

- personally;

- by mail;

- through a representative.

Procedure after receipt of case materials:

- the court checks them for compliance with the law;

- sets a hearing date;

- The court sends a copy of the statement of claim to the defendant and third parties.

- the court notifies of the date of the hearing, the address of the district court, the status of the participants and the list of papers that must be presented at the first hearing.

When is a trial needed?

Filing a claim in court to divide inherited property or challenge the will of the testator is not uncommon.

The division of inheritance in court is a complex, rather lengthy process that arises in the absence of a voluntary agreement between the successors of the deceased.

There is no other way but legal proceedings when:

- Several people inherit an immovable property. Then it becomes their common property and a court decision is necessary to allocate each person’s share.

- The will of the testator is disputed.

- The marital share and the right to an obligatory share are disputed.

- The heir is considered unworthy.

- The six-month deadline for submitting an application to the office has been missed.

When going to court, a statement of claim is written according to the form, the whole situation is described, and one’s disagreement is stated, with references to the norms of the law. Supporting documents are attached to it.

All this is filed in court either at the location of the inheritance, if these are houses, apartments or other real estate, or at the place of residence of the defendant, if he needs to be declared unworthy, to challenge the will.

Court hearing

Actions of the defendant:

- After receiving the claim, he can file a written objection to it.

- If there is written evidence that the plaintiff is wrong, it must be submitted to the court.

- May claim that the statute of limitations has passed.

- Has the right to file a counter-application with his own version of the section.

By law, each party must justify its stated claims. If there are difficulties in providing any documents, they can be requested by court decision. The participant in the process only needs to submit a corresponding petition.

The parties are exempt from proving the facts if there is a court decision where similar circumstances between the same persons were considered. Any document that the parties present to the court as evidence of their position can be challenged by the participants in the process.

If necessary, the parties may use witness testimony. Witnesses are summoned to court at the request of the plaintiff or defendant (Article 69 of the Code of Civil Procedure of the Russian Federation). The person filing a petition to invite witnesses must indicate the circumstances of the case that they can confirm.

A civil case must be considered within 2 months . If unforeseen circumstances arise, the hearing may take longer.

Reasons for increasing the period:

- the defendant filed a counterclaim;

- one of the participants was hospitalized;

- there was a need to request new documents.

When considering the issue of division of inheritance, the court must establish the circle of heirs and check whether they have a priority right to the property. The rule applies when dividing an indivisible thing (apartment, car). The interests of minors and incapacitated citizens are also taken into account. The presence of such persons is the basis for involving the guardianship authority in the hearing of the case.

Division of inheritance by will

When dividing an inheritance under a will, the fact that the will indicates specific objects bequeathed to certain heirs becomes fundamental.

In this case, fulfilling the will of the testator when dividing property is not particularly difficult. And it is difficult to challenge such a section, even in court.

Having identified the heirs of his property by name, the testator may not indicate specific objects intended for each. In this case, all heirs inherit in equal shares and the property becomes common shared ownership. Expenses for the maintenance of inherited property are made by all heirs in equal shares.

The exception is the inheritance of a compulsory share. The recipient of a compulsory share may claim a share that is at least half the share that this heir would receive if he inherited by law.

Entry into inheritance under a will

Mandatory share in inheritance

End of trial

Based on the results of the proceedings, the court makes an appropriate decision. The operative part of the procedural act is announced on the day of its adoption.

5 days to write a full decision . After which the full version of the document must be issued to the parties to the case. If the plaintiff/defendant did not participate in the hearing of the case, then a copy of the court decision is sent to him by mail.

1 month is given to appeal the procedural act . The countdown begins from the moment the court decision is announced. If the parties do not file an appeal, the decision will enter into legal force. If the plaintiff/defendant filed an appeal, then the court decision gains force based on the results of review in the court of second instance.

Limitation of actions

You can file a claim for division of property within three years. The countdown of the period begins from the date of violation of inheritance rights, and not from the moment the inheritance case is opened. For good reasons, an heir whose rights have been violated may file a claim later than three years, but first the court must file a petition to extend the period. If it is satisfied, then the above procedure can be initiated.

How to prove kinship with the deceased: complete informationShould relatives pay the loan for the debtor?

Arbitrage practice

If there is strong evidence, courts quite often satisfy claims for division of inherited property.

Example. Citizen Khazova E.V. filed a lawsuit for division of inheritance. Her mother died. The inheritance consists of 2 apartments, 2 garages, a residential building and 2 plots of land. In addition to the plaintiff, the inheritance is due to the husband and son of the deceased. The woman promptly contacted the notary and received a certificate. Its share is 1/3 of the identified property. However, the plaintiff cannot use the property. The reason is the illegal actions of the defendants. The co-heirs also refuse to draw up an agreement on the division of property. The woman asked for a division of the inheritance. She is ready to pay the defendants compensation for exceeding the size of her share. The defendants did not admit the claim. The co-heirs were unable to explain to the plaintiff how to use the property. The court satisfied the claims. The plaintiff was awarded a 1-room apartment and a garage. The plaintiff must pay the difference between her allotted share and the value of the allocated property to the defendants (Decision of the Dzerzhinsky City Court of the Nizhny Novgorod Region dated February 15, 2011, case No. 2-370).

Dispute resolution in court

It is necessary to go to court due to several circumstances. In the first place is a dispute between heirs when a compromise cannot be reached.

An option is possible when it is necessary to exclude part of the property from the inheritance mass. The above primarily concerns the share of the testator’s spouse in the existing joint property.

Finally, it is necessary to resort to the help of the court when it is not possible to formalize an inheritance in the standard way. For example, there are no title documents for real estate. Be that as it may, it is worth knowing some procedural subtleties.

Deadlines

Filing a claim for division of inheritance requires compliance with the statute of limitations established by law. A dispute over the property of a deceased person is not an exception. However, what starting point to take for reference.

There are two options depending on whether the heirs submitted documents to the notary or not. When everyone applied in a timely manner, the three-year limitation period is calculated from the date of the citizen’s death.

But it also happens that news of the death of a relative comes late. In this case, claims regarding property are put forward simultaneously with the renewal of the deadlines for receiving an inheritance. To file a corresponding claim, Art. 1155 of the Civil Code of the Russian Federation allots 6 months from the moment the reasons that did not allow one to take possession on time disappear.

Parties

The plaintiff is a citizen interested in the division of property. There are examples when one application is addressed to the court from several persons at once.

The defendants will be those heirs who filed documents with the court or actually assumed their rights. Since these are relatives, their circle is known to the author of the claim in advance.

Sometimes third parties are involved in the case. For example, this could be a notary who opened an inheritance case.

Documentation

It is impossible to suggest the entire set of applications for a claim, since each situation is different and disputes are individual. At the same time, you can outline the list of documents that will be needed in any case when going to court.

First of all, this is a receipt for payment of the state duty and evidence of sending a copy of the application to one or more opponents. Documentary confirmation of the death of the testator and the presence of family ties with him are required.

Other materials:

- title documents for the disputed property, extract from the Unified State Register;

- proof of residence, maintenance of the property;

- a copy of the application to the notary for acceptance of the inheritance and information about the results of its consideration.

It is also worth being prepared for the fact that the court will require other evidence during the consideration of the case. Then they must be provided without delay and on time.

Where to file a claim

Cases related to the division of inherited property are considered by district courts. The exception is cases in which the amount of claims does not exceed 50 thousand rubles. Here there is an opportunity to appeal to the magistrate.

When there are several heirs on behalf of the defendants, the application is submitted at the place of residence of one of them. This rule is enshrined in Art. 31 Code of Civil Procedure of the Russian Federation.

There are certain features in situations where the object of division is real estate. The Supreme Court of the Russian Federation in paragraph 3 of the Resolution of the Plenum No. 9 of May 29, 2012 explained that if the property was located at the place of residence of the deceased, the claim is filed there. When several objects are located in different cities, the claim is brought at the location of one of them.