Greetings! Housing prices in Russia “bite” even in a crisis. It is not surprising that Russians are looking for any way to spread out the payment for an expensive purchase over several years.

Most often, a mortgage is used for these purposes, and a little less often - installments. But in 2011, the line of products in the “live now, pay later” format was supplemented with another product: an apartment for lease for individuals.

Today we will talk about the specifics of such a scheme, its pros and cons, and the requirements for the borrower and the object.

What is apartment leasing in simple words

By renting someone else's property, we increase the income of the owner of this property. In return we get a roof over our heads and a minimum of guarantees. Let's say a certain person rents an expensive item and, in addition to the rent, gradually pays its cost. At the end of the term, a bona fide payer can take the object for himself, becoming its full owner. This is leasing - rent translated from English.

The concept of housing leased has existed for quite some time. But in Russia this form of financial relations is still little known. Not everyone understands the difference between leasing and a mortgage, how expensive it is, and what risks await the tenant. Let's take a closer look at these issues.

Leasing and mortgage - what is the difference

The mortgage borrower is the owner of the apartment. He cannot sell it, but registers the property in his name immediately after signing the loan agreement and the purchase and sale agreement.

The subject of leasing relations is not the owner of the property. He's just a tenant. The apartment belongs to the leasing company (LC) throughout the entire term of the contract. Only by making payments in full can you become the full owner of the residential premises. Then he will be able to obtain permanent registration (before that - only temporary registration).

At first glance, buying a home on lease does not seem very profitable. However, such a scheme has its advantages:

- low or zero initial payment;

- simplified registration procedure (no need to look for guarantors, co-borrowers, proof of income and additional collateral are not always required);

- the new apartment is initially in good condition with all the necessary equipment and communications (come in and live).

Thus, if the buyer cannot pass the bank's verification, but has the funds to pay the loan, he can buy housing on lease. At the end of the contract, the tenant buys his square meters at the residual value and becomes the full owner.

Advantages and disadvantages

Like any scheme for buying your own home, leasing has pros and cons.

pros

- High loyalty when assessing the client's solvency. If the apartment costs less than 30 million rubles, then the transaction is completed using three documents in 5-6 days.

- All additional manipulations related to the transaction (insurance, for example) are undertaken by LC. However, the cost of these additional services will be included in monthly payments.

- You can set individual repayment terms (once a month or once a quarter, annuity or differentiated scheme).

- Clients of the leasing company do not need additional security (collateral, third party guarantee).

- LKs conduct a more in-depth and high-quality inspection of real estate. After all, the acquired object will be owned by the company for a long time. And if, a couple of years after the purchase, the transaction is declared invalid (for example, due to incorrectly executed privatization), the LC will suffer first of all.

- The price per square meter is fixed for the entire period.

- You do not need to pay property tax (the LC will pay it).

Minuses

- Interest rates on leasing are, on average, 1.5 times higher than on bank mortgages.

- The duration of the contract, as a rule, does not exceed 10 years.

- The property remains in the ownership of the LC until the complete purchase of the apartment by the lessee.

- Leasing housing cannot be rented out to third parties.

Pros and cons of leasing apartments for individuals

As already mentioned, leasing relationships imply a simpler procedure and a minimum of requirements. A client with a gray salary, without a deposit and without an advance can count on this rental option. The company does not risk anything, because the apartment does not belong to the lessee anyway. He will not be able to sell it or re-register it to someone else.

The second advantage is tax optimization. All property taxes are paid by the owner of the property, not the person living in it. In addition, the lessee has the right to a tax deduction.

The third advantage: you can enjoy all the benefits of rental housing without being its owner. This is beneficial to a certain category of people who cannot or do not want to take over the apartment.

Now let's talk about the disadvantages of leasing real estate for individuals. The main disadvantage is the high cost. Mortgages are expensive, but rent with option to buy is more expensive. This mainly happens because the apartment belongs to a legal entity and is used for business - taxes for it are higher. In addition, to purchase apartments and houses, LK also raises borrowed funds from the bank. The burden of taxes and interest is partially shifted to the client.

Recommended article: How to apply for a mortgage online

Cars and equipment become cheaper over time. But real estate, on the contrary, can increase in price. Therefore, the lessor sometimes includes indexation in the contract. You will have to pay extra to the fixed amount from 2 to 7%. This is less than mortgage interest, but it is an added expense.

It also happens that the price of an apartment rises sharply (for example, a given area has become prestigious). This does not affect the mortgage loan in any way. But the lessee may be faced with a situation where the residual value of the apartment suddenly increases. He will pay all lease payments, but will not be able to pay for the housing in full at the end of the term.

Another indirect disadvantage of leasing relationships is that they are not subject to benefits from the state. A mortgage borrower can take out a loan on preferential terms. But there are no social subsidies for rent with option to buy.

TOP frequently asked questions about leasing

1. Is it possible to close a leasing transaction ahead of schedule?

Most lessors provide for this possibility and include it in the leasing agreement. But this may be unprofitable for the client - if the residual value is paid early, the redemption amount will be higher, and there will be fewer opportunities to reduce the tax burden. A quick buyout attracts the attention of tax authorities - for example, the Federal Tax Service may even cancel a leasing agreement, recognizing it as a trade credit agreement. This automatically deprives the client of tax deductions.

2. When does leased property need to be registered with government agencies?

It is necessary to register property and rights to it if it is:

- transport;

- high-risk equipment.

In this case, the property is registered either in the name of the leasing company or in the name of the client (by agreement between them). If the leasing agreement is terminated due to late and non-payment of leasing payments, the registration authorities will cancel the record of the user of the property.

3. Can a government organization lease property?

Both state and municipal institutions can lease property and act as a lessee. For them Art. 9.1 of the Leasing Law provides for several features:

- the leasing company itself selects the seller of the property and is responsible for its delivery;

- all payments between the client and the leasing company are made in cash, excluding barter;

- Only leased property can be collateral.

4. Is it legal if the lessor delays the delivery of property, citing problems with the seller? At the same time, refusing to compensate for lost time, citing the fact that we found the supplier ourselves.

By law, if a supplier fails to fulfill its obligations, liability falls on the party that selected it.

The same applies to the non-compliance of the property with the objectives of the project. Usually the supplier is chosen by the lessee - this means that all costs and penalties are borne by the client. If the lessor was looking for the seller, he will pay the costs himself. 5. What is subleasing?

Subleasing is the transfer of the right to use property leased to a third party.

For example, a client took equipment for a project and completed it ahead of schedule. He does not want to close the contract ahead of time, because... will incur losses in respect of tax refunds. Then he subleases the equipment and becomes a lessor himself. All that is needed is permission for such a transaction from the leasing company. In addition, the new lessee will have the same tax preferences. If the main leasing agreement is violated, the subleasing agreement is automatically canceled. 6. What is a fictitious lease?

Fictitious leasing is a cover for other transactions with a leasing agreement. Most often, purchase and sale transactions are in installments. This scheme is practiced to obtain tax benefits and government subsidies.

Buying an apartment on lease - theory and practice

The main provisions of leasing relations are regulated by the Federal Law on Financial Leasing dated October 29, 1998 No. 164-FZ. According to this document, leasing is the interaction of three parties: the owner, the intermediary and the tenant. In this case, each of the subjects can be an individual.

Theoretically, an ordinary person who does not have the status of an entrepreneur can rent out an apartment or buy a house on lease. And the subject of leasing relations is ready-made housing in a new building, a secondary building or a residential building (with the exception of a land plot).

In practice, due to various legal subtleties, contracts between individuals are practically not concluded. And an apartment on the secondary market is rarely the subject of leasing. As a rule, the tenant is offered an unsold apartment in a new building.

So, the decision was made to lease an apartment. What happens next:

- The client contacts the LC or the developer and selects a property.

- Brings documents to confirm your solvency.

- Makes a down payment (if required).

- Signs the agreement, which is then registered in Rosreestr.

- Makes payments as agreed.

Thus, leasing real estate implies tripartite cooperation. The owner transfers the property to the lessor, who, in turn, enters into an agreement with the tenant and monitors the implementation of the contract.

Specifics of the acquisition

Requirements for the client when registering

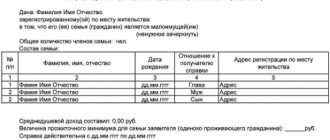

Who is available for leasing? Any citizen of the Russian Federation over 21 and under 60 years old. The potential client should not be at the stage of bankruptcy. And enforcement proceedings should not be conducted against him. Mandatory requirement: having a source of regular income.

The minimum down payment when purchasing through leasing is 10%. The higher the advance amount, the more favorable the repayment terms will be.

Object requirements

The requirements for apartments from leasing companies are quite fair.

The object of the contract must be suitable for permanent residence. And be listed in Rosreestr as “residential real estate.” Unlike taking out a mortgage, you can only take out READY housing on lease (on the primary or secondary market).

You cannot buy an object or land plot under construction through LC.

Primary requirements:

- the object is free from encumbrances (no collateral, no arrest);

- no illegal reconstructions or redevelopments were made in it;

- the building itself is not in disrepair, is not registered for major repairs, and has a stone, brick or reinforced concrete foundation.

Package of documents

In simple transactions, the package of necessary documents for individuals includes a passport, tax identification number and pension card. In more expensive options - documents confirming solvency.

What points should a leasing agreement include?

- Full characteristics of the apartment (address, floor, square footage). The cost of the object fixed in the contract cannot change over time!

- Duration of the contract (the conditions for its possible extension are specified separately).

- Down payment amount.

- Leasing payment scheme.

- Possibility of transferring the property into ownership subject to early repayment.

- Procedure for returning money after termination of a transaction.

Redemption

The lease payment itself consists of two parts:

- rent (for purchase of housing);

- LC remuneration (its amount is agreed upon in advance and is clearly stated in the contract).

Real estate rental and leasing – which is more profitable?

If the borrower is forced to pay rent for many years, and he does not have the opportunity to save for a down payment, then leasing residential real estate can be a good alternative to rental payments.

Sometimes this is the only way out for a person who plans to live in one place for a long time and does not have the opportunity to save up for his own home. At the same time, his income allows him to pay increased rent. If you are constantly changing your place of residence and have an unstable income, it is better to settle on a simple rental.

Features of real estate leasing for individuals

Rent-to-purchase is initially aimed at business. Therefore, this is quite an expensive pleasure. After all, it is assumed that the lessee will generate income from the leased property and therefore will be able to pay an increased rental rate.

A private individual has the right to buy real estate on lease since 2011. But the price of such rent remains high. There are frankly few profitable offers on the market.

Let's list the difficulties a citizen may encounter when leasing an apartment for individuals:

- double re-registration;

- forced eviction in case of missed payments;

- additional expenses above the rent;

- refusal of an apartment in case of relocation or force majeure situation.

In theory, the procedure looks like this. First, LC buys the property from the owner. Then the tenant goes to the lessor. Accordingly, first the LC enters into an agreement with the owner, then with the lessee. Double paperwork costs often fall on the tenant's shoulders.

Recommended article: Is it possible to get a mortgage to buy and renovate an apartment?

The second nuance is related to the eviction procedure. If you don't pay your mortgage, the bank has to collect the debt through the courts. The trial lasts several years. But no one evicts from the apartment.

In the case of purchasing real estate on lease, if payments are missed, the lessor terminates the contract and denies the right to lease. Even the presence of small children will not save an unscrupulous payer from deportation.

What to do if the lessee decides to change his place of residence? In this case, he can:

- buy the apartment as full ownership by depositing the remaining funds;

- terminate the contract and stop making payments (the first payment and payments made will not be returned in this case).

There is one more feature. Leasing payments usually do not cover 100% of the cost. At the end of the contract, you will have to pay some more amount. And this amount may turn out to be prohibitively large.

Attention! As in any case, when we are talking about a large sum of money, it is necessary to carefully read the agreement and delve into all the nuances. The ideal option is to involve an experienced lawyer who will supervise the entire process of transferring property. Then regular payment of rent will allow you to eventually become the owner of the rental property.

What to pay attention to so that there are no problems with leasing

It is necessary to conclude an agreement with companies that have proven themselves well in the market.

You need to make sure that the leasing agreement is registered with Rosreestr.

Insist on the presence in the contract of a clause on early repayment and recalculation of interest. This will allow you to quickly obtain ownership.

To make regular payments smaller, it is worth making an advance amount greater than the minimum 10%.

Calculate both schemes: it may be more profitable to borrow a certain amount at a low interest rate at the start than to overpay for ten years at a high interest rate.

Real estate leasing without down payment

Finance lease, like a mortgage, involves making an advance from personal funds. True, the contribution they ask for is much less than the amount that the bank usually requires.

An apartment on lease without a down payment is a rare occurrence. If only because the LC draws up an agreement according to a simplified procedure, without requiring collateral or guarantee. But she needs at least some guarantees that the buyer has serious intentions.

But you can try your luck leasing an apartment for individuals from a developer. There are cases where builders are happy to rent out homes without requiring a down payment.

Who is leasing suitable for?

Leasing is an option for those who have a stable, but unofficial income, and therefore cannot obtain a classic mortgage. In such cases, banks refuse clients, as well as those who have a damaged credit history. For leasing companies, these points are not important, because they do not risk anything: the property remains their property until the debt is fully paid off.

Most often they resort to leasing:

- young families with a stable income;

- parents who want to buy an apartment for their child when he comes of age.

Sample real estate leasing agreement: what to consider for the tenant

Since the law does not have strict requirements for drawing up an agreement, the tenant’s task is to ensure that his interests are respected. The contract must clearly state:

- rights and obligations of the parties;

- terms of payment and period of use of the property (they may not coincide);

- operating conditions of the premises (what can be done in a rented apartment and what cannot be done);

- check-in/check-out procedure;

- indexing size;

- restrictions on rent increases;

- obligations to pay taxes and insurance payments (which party bears additional costs);

- options for early payment and terms of termination of the agreement;

- dividing the monthly payment into the purchase price and the lease payment.

Be sure to include in the contract the procedure for action in the event of a force majeure situation (flood, fire, natural disaster). Determine the procedure for purchasing the property and the amount that will have to be paid at the end of the term. It will be good if it is fixed.

Important! The main agreement, which must be concluded in writing, is accompanied by a number of additional ones. This may be a collateral agreement if leasing is secured by real estate. Or a surety agreement. The parties can discuss any issues, for example, who does major and current repairs, how the property is returned, what alterations in the apartment are permissible, etc.

Risks and responsibilities of the lessee

Law No. 164-FZ regulates only the most general issues. Many points are advisory in nature. This is both good and bad. If you hire a smart lawyer, you can write down very beneficial clauses in the contract and shift part of the costs to the lessor.

Recommended article: Online military mortgage calculator - how to calculate, apply and pay

On the other hand, the law clearly states the tenant's responsibility for the safety of other people's property. Thus, he carries out repairs at his own expense and ensures the safety of the home. Bears responsibility for the damage caused to him. Also, the tenant cannot carry out redevelopment, major repairs and other major improvements without the written permission of the lessor.

Moreover, if payments are missed twice, the owner of the property can write off funds from the tenant’s bank account in his favor and also demand early termination of the contract and return of the property - without any compensation.

Is it possible to buy an apartment on lease from a bank?

Entrepreneurs know that the most favorable conditions for the purchase of machinery and equipment are provided by banking subsidiaries. The most loyal prices are in companies that directly cooperate with large banks. These include subsidiaries of Sberbank, Gazprombank, Raiffeisen, and VTB Group.

Unfortunately, Sberbank, Gazprom and other structures are not yet ready to offer apartments for leasing to individuals - they only cooperate with companies. The choice of leasing programs for individuals is limited, and the conditions are not very favorable.

conclusions

Leasing is a convenient financial instrument with which you can update fixed assets or expand production without diverting a large amount from turnover. The client of the leasing company avoids long waits for approval of the application, deposits and large investments of own funds.

In addition, the state actively stimulates the industry and provides benefits and tax advantages for clients of leasing companies. For example, you can return VAT and reduce your tax burden, which the loan does not provide for.

Leasing cannot always replace a loan, although it is still the most profitable option for business clients. Therefore, we recommend choosing a financial instrument that suits your individual goals.

Leasing of housing for individuals in JSC System Leasing 24

A subsidiary of VTB Bank offers consumers 2 programs. Using them you can purchase an apartment, a country house, apartments or commercial real estate for a period of up to 3 years. Property insurance is required.

Conditions of the Standard program:

- amount – from 1 to 50 million rubles;

- down payment – 10% (when leasing a house for individuals – 20%).

Conditions of the program Optimal solution:

- amount – from 1 to 30 million rubles;

- advance payment – 40%;

- The contract is drawn up using 3 documents (passport, SNILS, Taxpayer Identification Number or driver’s license).

There is a calculator on the website of the financial institution (https://sl24leasing.ru). Let's do some simple calculations. Let's say an apartment costs 1 million rubles, 100 thousand of which is the down payment. When concluding a contract for 36 months. (maximum possible period), you will have to pay 35.7 thousand rubles monthly. The total overpayment will be 383 thousand rubles over 3 years - without taking into account the cost increase factor.

In the case of a mortgage loan with the same parameters, you will have to pay 29.9 thousand rubles monthly (at a rate of 12%). And the overpayment will be 176 thousand rubles (200 thousand less).

Note! These amounts do not include additional costs (insurance, appraisal, notary services, registration actions, paid certificates).

Let's sum it up

A real estate leasing agreement is a good tool for those who do not have the opportunity to take out a mortgage, but at the same time receive a stable income and need a long-term lease.

According to experts, the number of lease-purchase agreements does not exceed 1%. The reason is that the average citizen knows little about such a financial instrument as leasing residential real estate for individuals or still considers it accessible only to businessmen.

For now, housing leasing in Russia is more in demand during a crisis, when banks reduce or make their mortgage programs more expensive. But perhaps upcoming changes in legislation will make this financial instrument more profitable and transparent and protect the interests of the tenant. Then choosing a mortgage or leasing will give the borrower a chance to determine a truly convenient lending scheme for himself and not depend on banks.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publicationJuly 21, 2019July 21, 2019

Advice from professionals

What should a potential lessee pay attention to?

- Choose only large leasing companies that have been operating in the market for a long time. Ideally, a subsidiary of a systemic bank (VTB, Alfa-Bank, Sberbank).

- The leasing agreement must be registered with Rosreestr.

- Be sure to include in the contract the conditions for early termination of the contract (on your initiative or on the initiative of the LC).

In my opinion, there are fewer advantages than disadvantages to leasing apartments in Russia. However, this is a real opportunity to buy their own home for those who for some reason cannot get a mortgage from a bank.

Subscribe to updates and share links to fresh posts with your friends on social networks!