Read about the specifics of returning funds to the buyer’s payment card in 1C: Accounting 8, including when combining special tax regimes.

In the articles “Features of accounting for acquiring transactions under the simplified tax system” and “Accounting for acquiring transactions in 1C: Accounting 8”

1C experts talked about the concept of an acquiring agreement, how acquiring transactions are reflected in 1C: Accounting 8 (rev. 3.0) when applying the general taxation system and the simplified tax system.

If the buyer returns the goods, the acquiring bank does not write off the funds that should be transferred to the buyer’s bank card from the seller’s current account, but deducts them from the amounts of subsequent deposits in accordance with the acquiring agreement. Starting from version 3.0.49 in the 1C: Accounting 8 program version 3.0, such operations are automated.

Regulatory regulation of the return of goods from customers in retail trade

When selling goods using payment cards, a situation may arise when a previously purchased product is returned by the buyer back to the seller.

The buyer has the right to exchange non-food goods of good quality within fourteen days (unless a longer period is announced by the seller), not counting the day of its purchase. If the seller does not have the goods necessary for exchange, then the buyer has the right to return the purchased goods and receive the amount of money paid for it (clause 1 of Article 502 of the Civil Code of the Russian Federation, clause 1, clause 2 of Article 25 of the Law of the Russian Federation dated 02/07/1992 No. 2300 -1 “On the protection of consumer rights”).

The procedure for the seller when returning goods by the consumer, as well as the list of documents that the buyer must provide, is given:

- in the Standard Rules for the Operation of Cash Registers when Carrying Out Cash Settlements with the Population, approved. Ministry of Finance of Russia 08/30/1993 No. 104;

- in the Methodological recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations, approved. by letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5.

According to these sources, the procedure for the seller and buyer when returning goods is as follows:

- the buyer provides an application for the return of goods in any form accompanied by a receipt for the purchase of goods. The buyer’s application must be endorsed by the head of the organization or another authorized person to obtain permission to return funds to the buyer;

- a cash receipt order must be issued for the funds returned to the buyer;

- at the time of acceptance of the returned goods, the seller issues an invoice for the return of goods in two copies: one copy for the seller, the second for the buyer.

In the case of the return of goods by the buyer, the amount of VAT paid by the selling organization upon the sale of these goods is subject to tax deduction in full after the corresponding adjustment operations are reflected in the accounting in connection with the return of goods (clause 5 of Article 171 of the Tax Code of the Russian Federation, clause 4 . Article 172 of the Tax Code of the Russian Federation), but no later than one year from the date of return or refusal.

Sign of payment in a cash receipt - what are they?

The format of a modern cash receipt is very different from what it was just a few years ago. Today, every document must include the following information:

- Store information.

- The total amount of the transaction.

- Serial number of the order.

- Tax contributions.

- The exact time and date of receipt generation.

- Fiscal data.

- Actually a sign of calculation.

At the request of the owner of the outlet, many other data can be printed, however, the ones listed above are mandatory.

The procedure for settlements with customers when returning goods

When paying in cash with the buyer, the procedure for returning funds depends on the day on which the goods are returned. In relation to payments via bank cards, the procedure for returning funds must be specified in the agreement with the bank. Revenue received using a plastic card is reversed, and the payment document is taken from the buyer. If the buyer does not have a cash receipt, he still has the right to receive his money from the seller (when he returns the goods), proving the fact of purchasing the goods in this store with other documents or testimony.

In practice, the following situations are possible when a product is returned:

- on the day of purchase, the goods were paid for in cash;

- on the day of purchase, the goods were paid for by bank card;

- later than the day of purchase, the goods were paid for in cash;

- later than the day of purchase, the goods were paid for by credit card.

The procedure for cash payments made using payment cards is regulated by Bank of Russia Regulation No. 266-P dated December 24, 2004 “On the issuance of payment cards and on transactions carried out using them” (hereinafter referred to as Regulation No. 266-P).

If the returned goods were previously paid for by a bank card, then the money is returned to the buyer by bank transfer by transfer to the buyer’s card, since cash can be returned only if payment for the goods was made in cash (clause 2 of the Bank of Russia Directive dated 10/07/2013 No. 3073-U “On cash payments”). According to the letter of the Federal Tax Service of Russia for Moscow dated September 15, 2008 No. 22-12/087134, when returning goods not on the day of purchase, operations for issuing funds are carried out in accordance with the concluded acquiring agreement (agreement between a credit institution and a trade organization).

What do you need to do to get it?

To understand the “challenge” process, let’s first go through the entire path of payment with a plastic card: Why a refund is possible

In what situations can you get a chargeback?

As a bank customer, you can contact them with a chargeback request.

To request a chargeback, you don’t even have to be in the same country as the seller. International payment systems establish the right to refund for bank customers around the world. The following situations may be grounds for chargebacks: Step 4. Wait for a response from your bank. This usually takes months.

Returning funds to the buyer’s bank card in “1C: Accounting 8” (rev. 3.0)

We remind you that the return of goods by the buyer in “1C: Accounting 8” edition 3.0 is registered by the document Return of goods from the buyer (Sales section). To reflect transactions involving payment for goods (work, services) by customers using a bank payment card, the Payment Card Transaction document is intended. To summarize information on cash flows under acquiring agreements, subaccount 57.03 “Sales by payment cards” is intended.

Starting from version 3.0.49 of the program, you can issue a refund to the buyer to his payment card using the document Transaction on a payment card with the transaction type Return to the buyer (section Bank and cash desk).

We will consider the procedure for transferring funds to the buyer’s bank card when returning goods using the following example.

Example 1

| Andromeda LLC sells goods and services at retail, applies the general taxation system, is a VAT payer, and does not apply the provisions of PBU 18/02. In accordance with the accounting policy of the organization, retail goods are accounted for at purchase prices. Goods and services are sold through an automated point of sale using cash register equipment (CCT). Andromeda LLC accepts bank cards for payment. According to the terms of the agreement concluded by the organization with the acquiring bank: the acquiring bank's remuneration is 2% of the amount of revenue received; funds for goods paid for by the buyer by bank card (minus the amount of remuneration) are credited to the organization’s bank account the next day after the day of purchase; In the case of a return of goods not made on the day of purchase, the funds for the returned goods credited to the buyer’s card are withheld by the acquiring bank from the amount due for the transfer to the organization. In this case, no bank commission is charged for transferring funds. Sequence of operations: — On April 10, 2017, the organization sold men’s suits (5 pieces) for the amount of RUB 118,000.00. (including VAT 18%), which were paid by buyers in cash (RUB 70,800.00) and payment cards (RUB 47,200.00); — on April 12, 2017, the acquiring bank transferred funds to the settlement account of Andromeda LLC, minus the amount of remuneration; — 04/13/2017 an individual buyer returned a suit (1 piece), paid for by bank card, in the amount of RUB 23,600.00; — On April 17, 2017, the organization provided services in the amount of RUB 100,000.00. (including VAT 18%), which were paid by the buyer by payment card; — On April 18, 2017, the acquiring bank credited the bank account of Romashka LLC with funds minus the amount of remuneration and the amount transferred to the buyer when returning the goods. |

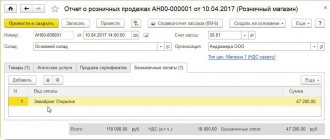

Retail sales of suits are reflected in the document Retail Sales Report (Sales section) with the transaction type Retail Store. On the Products tab, the goods sold to retail customers per day are indicated: their product range, quantity, price and amount (five suits for RUB 23,600.00, including 18% VAT).

By default, all payments are considered cash. If during the day payments were made with payment cards, bank loans or gift certificates, then you must fill out the Non-cash payments tab (Fig. 1).

Rice. 1. Non-cash payments in the retail sales report

On the Non-cash payments tab, in the Payment type field, indicate the type of payment from the directory of the same name and the amount of non-cash payments per day - RUB 47,200.00. The following details must be indicated in the form of the Payment Types directory element (Fig. 2):

- payment method - Payment card;

- information about the acquiring bank: agreement, settlement account, amount of bank commission.

Rice. 2. Type of payment

If there are several payment options from customers, retail revenue is reflected in the intermediate account 62.Р “Settlements with retail customers”, after which it is distributed according to payment methods.

After posting the document Retail Sales Report dated April 10, 2017, the following accounting entries will be generated:

Debit 90.02.1 Credit 41.01 - for the cost of suits sold (RUB 80,000.00); Debit 62.R Credit 90.01.1 - for the amount of proceeds from the sale of suits (RUB 118,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 47,200.00); Debit 50.01 Credit 62.R - for the amount of cash payment received (RUB 70,800.00); Debit 90.03 Credit 68.02 - for the amount of VAT (RUB 18,000.00).

For the purposes of tax accounting for income tax, the corresponding amounts are also recorded in the resources Amount NU Dt and Amount NU Kt for accounts with a tax accounting attribute (TA). Since, according to the conditions of Example 1, there are no differences between accounting and tax accounting, we will not mention these resources in the further description.

An entry is entered into the Sales VAT accumulation register reflecting the accrual of VAT payable to the budget to create a sales book for the second quarter of 2021.

We will generate a document Receipt to the current account dated 04/12/2017 with the transaction type Receipts from sales on payment cards and bank loans. Minus the amount of remuneration, the acquiring bank transfers funds to the organization in the amount of RUB 46,256.00. (47,200.00 - 2%). If the document is not downloaded from the “Client-Bank” program, but is entered manually, then in the Amount of services field you need to indicate the amount of the bank’s commission (944.00 rubles).

After posting the document, the following entries are entered into the accounting register:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (RUB 46,256.00); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (944.00 rubles).

The buyer returns one suit on April 13, 2017. The document Return of goods from the buyer can be generated based on the document Retail Sales Report dated April 10, 2017.

On the Products tab, the tabular part needs to be adjusted so that only the returned suit in the amount of RUB 23,600.00 is indicated there.

Despite the fact that the sale was carried out at retail, where analytical records of counterparties are not kept, when processing a return you should pay attention to the following points:

- in the header of the document you must indicate the name of the counterparty and the agreement with the counterparty. To simplify accounting, you can specify an abstract individual and an abstract agreement with him as a counterparty (for example, Retail sales);

- on the Settlements tab, account 62.01 “Settlements with buyers and customers” and account 62.02 “Settlements for advances received” are indicated as accounts for settlements with customers (and not auxiliary account 62.R).

The fields Cash receipt order No. and from are not filled in, since the refund to the buyer will be made to his bank card, that is, by non-cash method.

After posting the document Return of goods from the buyer, the following entries are entered into the accounting register:

REVERSE Debit 90.02.1 Credit 41.01 - for the cost of the returned suit (-16,000.00 rub.); REVERSE Debit 62.02 Credit 90.01.1 - for the amount of proceeds from the sale of the returned suit (-23,600.00 rub.); REVERSE Debit 90.03 Credit 19.03 - for the amount of VAT (-3,600.00 rub.).

In the postings to accounts 62.02 and 19.03, the individual buyer is indicated as the counterparty.

In addition to the accounting register, an entry is entered into the VAT register presented with the type of movement Receipt.

To reflect the transaction of transferring funds to the buyer to the card, we will create a document Payment card transaction with the type Return to buyer (Fig. 3). It is convenient to create a document based on the document Return of goods from the buyer.

Rice. 3. Payment card transaction

As a result of posting the Payment Card Transaction document, the following transactions will be generated:

Debit 62.02 Credit 57.03 - for the amount of return of funds to an individual (RUB 23,600.00).

Settlements with an individual can be viewed by generating the Account Card report for account 62.02 and setting the selection for the counterparty Individual. The report clearly shows that on April 13, 2017, the buyer returned goods in the amount of RUB 23,000.00. On the same day, the bank was instructed to return the money to the buyer’s card. Thus, the organization’s debt to the buyer is repaid. In other words, at the time of the chargeback operation, the organization’s debt to the retail buyer is transferred to mutual settlements with the acquiring bank.

The provision of services to individuals is also reflected in the document Report on Retail Sales dated April 17, 2017.

On bookmarks:

- Goods - indicates the cost of the service sold to a retail buyer (RUB 100,000.00);

- Non-cash payments - type of payment and amount of non-cash payments per day (RUB 100,000.00).

After posting the document Retail Sales Report dated April 17, 2017, the following transactions will be generated:

Debit 62.R Credit 90.01.1 - for the amount of revenue from the sale of services (RUB 100,000.00); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (RUB 100,000.00); Debit 90.03 Credit 68.02 - for the amount of VAT (RUB 15,254.24).

An entry is entered into the Sales VAT accumulation register reflecting the accrual of VAT payable to the budget to create a sales book for the second quarter of 2021.

On April 18, 2017, the acquiring bank transfers funds to the organization minus the amount of remuneration (RUB 2,000) and minus the amount returned to the buyer (RUB 23,600.00), that is, a total of RUB 74,400.00.

We will generate a document Receipt to the current account with the transaction type Receipts from sales on payment cards and bank loans in the amount of RUB 74,400.00. In the Amount of services field, you need to indicate the amount of the bank commission (RUB 2,000.00).

After posting the document, the following entries are entered into the accounting register:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (RUB 74,400.00); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (RUB 2,000.00).

Let's create a balance sheet for account 57.03. The absence of a balance on account 57.03 indicates the complete completion of settlements with the acquiring bank.

To claim input VAT on returned goods for deduction, you must create a document Creating purchase ledger entries (section Operations - Regular VAT operations).

Data for the purchase book on the amounts of tax to be deducted in the current tax period must be reflected on the Purchased assets tab.

As a result of posting the document, an accounting entry is generated:

Debit 68.02 Credit 19.03 - for the amount of VAT accepted for tax deduction (RUB 3,600.00).

An entry with the type of movement Expense is made in the VAT accumulation register presented. To create a purchase book for the second quarter of 2017, an entry is made in the Purchase VAT accumulation register.

| 1C:ITS For step-by-step instructions on recording transactions involving the transfer of funds to the buyer’s bank card when returning goods, see the “Handbook of Business Transactions. 1C: Accounting 8" in the "Accounting and Tax Accounting" section. For information on accounting for VAT in transactions for the return of goods from customers in retail trade, see the reference book “Accounting for Value Added Tax” in the “Accounting and Tax Accounting” section. |

How to return a receipt using an online cash register legally: documentation

Despite the fact that for the buyer the algorithm of actions is quite simple and requires practically no effort, the seller has to additionally prepare a lot of paperwork so that there are no problems with the tax service in the future. Among them may be:

- Fiscal documents, that is, created directly on the cash register. These include all cash receipts, including those made for the purpose of correcting information.

- Exculpatory – confirming the legality of the procedure. They can be an application from the buyer, an act of delivery of a previously purchased product, or a letter of guarantee.

- Cash registers, which are created to record all transactions carried out at a retail outlet. These include receipts and expenditures, and a cash book.

With the introduction of innovations in the laws on trading activities, it has become easier to generate such reports, so this should be done without fail, and, if necessary, submitted to the tax service.

Features of accounting for returns when combining tax regimes

The main feature of returning funds to the buyer’s bank card is that the acquiring bank does not explicitly write off the refund amount from the organization’s current account, but withholds it from subsequent deposits under the acquiring agreement.

A taxpayer who does not keep separate records may have problems accounting for income if the tax treatment of the refund and subsequent sales paid for with cards do not match.

According to the Tax Code of the Russian Federation, when combining the simplified tax system and UTII, the taxpayer must organize separate accounting of income and expenses within each type of activity (clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation). At the same time, for the purpose of calculating and paying UTII, tax accounting of income and expenses is not required. After all, the tax base—the amount of imputed income—is fixed.

Consequently, the main task when combining these regimes is to correctly determine the tax base and calculate the tax when applying the simplified tax system. This rule applies not only to “simplified” people with the object “income minus expenses,” but also to those who count only income.

For example, goods sold as part of activities on UTII are returned, and the following card payments are made for sales on the simplified tax system. This means that when the acquirer credits funds, it is necessary to recognize income under the simplified tax system in the full amount, without deducting the withheld return. And for the amount of the withheld refund - reverse the income on UTII.

We will consider the procedure for reflecting refunds to customers’ payment cards from “simplified” companies when combined with UTII using the following example.

If the money is sent to another bank

The problem gets worse if the money is sent to another bank. As a rule, clients make such mistakes when making a transfer using a card number - again, an error in one digit will be enough for the funds to be transferred to the account of a complete stranger.

It is logical that the sender will not be able to contact the recipient of the transfer directly, since he will not have any contacts other than the bank card number. This is not enough to solve the problem on your own. In the first stages you will need:

- Contact your bank for a certificate indicating in which direction the money went.

- Request a certificate with transaction data - the document will be needed to present it to a third-party credit institution.

In some cases, banks themselves can send a request to another organization, but it is easiest for the client to act independently, since a response to such a request may take a month or longer. Submitting documents to another bank does not guarantee that the money will be returned.

A credit institution does not have the right to disclose the data of its clients. It’s worth a try, because, as a rule, there is no other way out of the problem.

An advantage for the sender is that interbank transactions are not processed immediately. The translation can take from several hours to 5 working days. If the error is detected on time, the operation is canceled in the Internet bank or by a personal visit to the office of your credit institution.

Comments: 4

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Lana

09/12/2021 at 15:11 Edadil does not pay cashback for every check!

From Biglion, it is also no longer possible to withdraw money for each check - you can only take something from coupons with them, and then there are restrictions on the amount, and the amounts from checks burn out every month! Reply ↓ - Faith

07/01/2021 at 20:50I want to download the application

Reply ↓

- Anastasia

05/18/2021 at 04:29Which application do you think is the best from this list?

Reply ↓

Anna Popovich

05/18/2021 at 08:56Dear Anastasia, this question cannot be answered unambiguously: each of them may be the best for specific user requests.

Reply ↓

Pitfalls of cashback from checks

Cashback services are beneficial for users, but you won’t earn a lot of money from this, although you won’t lose anything. The only problem that can happen is that cashback from the purchase will not be credited.

You can also end up with an unscrupulous service, but in most cases cashback is not credited due to the fault of the client himself. Buyers are not familiar with the conditions of promotions in stores or do not comply with the store’s requirements. For example, the condition for cashback is scanning the receipt within 24 hours. Those customers who ignore this restriction and scan the receipt later will not receive the money.

It is more profitable to install several cashback applications and track the most profitable offers and promotions. You can also participate in affiliate programs and thus increase your final cashback.

Information sources:

- BacKit

- Cash4brands

- Edadeal

- Biglion

- Qrooto

- Inshopper

- Disconto

- Scan

- Check.2gis

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email