Home • Blog • Online cash registers and 54-FZ • How to make a return to a buyer using an online cash register: step-by-step instructions

April 20, 2020

461

4

Online checkout returns are a frequent and very significant operation in trade of any scale. There are many reasons why a cashier needs to return money to a customer. How to make a return at the online checkout to avoid mistakes. First, let's figure out what types of checks there are and what a “sign of payment” is.

Sign of payment in a cash receipt - what are they?

After the adoption of the new law on cash registers and the transition to online cash registers, a new check format came into force, and checks began to be presented not only in paper, but also in electronic form. The first type is mandatory, and the second is issued at the buyer’s request.

Checks, regardless of their type, must contain:

- Data of the seller organization;

- Serial number of the check;

- Tax system of an organization or individual entrepreneur;

- Settlement transaction amount;

- Date and time the check was created;

- Calculation sign;

- Fiscal storage data, operator and other information.

Discount on annual technical support of the cash register

Servicing the cash register for 1 year with a benefit of 3600 ₽ on the “Standard” and “Maxi” tariffs.

Technical support includes consultations on the operation of the cash register. Find out details

Use of cash register when returning

In case of return, the seller is obliged to carry out the transaction, including via cash register. The fiscal carrier's receipt reflects only the amount paid by the buyer.

List of details in the CCP strict reporting form and CCP cash receipt:

- QR code;

- Title of the document;

- time of the operation;

- the address where the payment was made;

- name of the organization or full name of the individual entrepreneur;

- TIN and taxation system, if we are talking about individual entrepreneurs.

Important! Even if at the time of sale of the goods the receipt on the cash register was not punched, in case of return it must be printed.

An important condition for issuing a check is the presence of a payment indicator. This sign indicates the type of transaction performed - purchase of goods, return of goods or adjustment. In the case when a return is made, the client is given a check with the calculation sign “return to the buyer (client) of funds received from him - return of receipt.”

When to return goods via online checkouts

Returns through online cash registers occur differently than returns to old-type cash registers. How to technically carry out the return procedure depends on the model of your online cash register and its capabilities, as well as the software and firmware version.

To return a purchase, the buyer must punch a special receipt. The sign of settlement in which funds are returned to the buyer—an individual—is called return of receipts. It is issued when:

The need to return money to the buyer for the goods he purchased, which he refuses.

Incorrect value or quantity of goods in the receipt (seller's error during registration).

After returning the goods and receiving funds in the amount of its full cost, the buyer is given a cash receipt, which states that a “return of receipt” has occurred. However, for the tax inspectorate, a receipt alone is not enough, so you need to take care of preparing other documents that confirm the correctness of the procedure for returning goods through the online cash register.

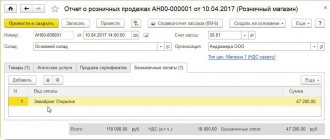

On the left you see what a receipt for a refund looks like.

Responsibility for non-use of cash registers

Responsibility for violation of the law regarding the mandatory use of cash registers is established by the Code of Administrative Offenses.

The violator pays a fine. The amount depends on how much revenue the organization received that was not passed through the cash register. Both the organization itself (or individual entrepreneur) and the cashier who did not punch the check are fined.

So, the cashier will pay a fine of 25-50% of the proceeds that he did not clear through the cash register (minimum 10 thousand rubles), an organization or individual entrepreneur will pay a fine of 75-100% of the revenue (minimum 30 thousand rubles).

In the event of a repeated violation (failure to carry out transactions through a cash register) and if the revenue amounted to more than one million rubles, the company’s activities are suspended for up to three months.

How to make returns via online cash registers: step-by-step instructions

Returns are processed differently depending on the reason for the return.

Same day refund via online checkout (seller error)

If, when issuing a check in front of the client, the cashier made a mistake in the number of units of goods or the price being punched does not correspond to the one recorded on the price tag, then a “Return of Receipt” check is first generated, and then a new check with the correct data. It is the cashier who returns it to the buyer and compensates for the monetary difference. No documents are required from the buyer.

However, the legality of the return must be confirmed by the tax office. Therefore, the cashier draws up a memo in which he writes which particular check was issued incorrectly, and confirms that 2 more checks were immediately printed - “return of receipt” and new receipt. It is necessary to attach both the incorrectly printed check and the “return of receipt” check to the note.

If you are interested in how to make a refund through an online cash register as quickly as possible, we recommend paying attention to the Evotor 5 smart terminal. Thanks to the touch screen, intuitive interface and Android operating system, it is now much easier to carry out standard operations when working with an online cash register, which means that with Evotor 5 you can significantly speed up the customer service process.

If the buyer wants to return the product in full, then the procedure is the same as if the buyer came in a week.

Refund to the buyer at the online checkout (the buyer returns the goods)

It happens that the buyer wants to return the product and get back the money paid for it. There may be several reasons: an incorrectly chosen size (if we are talking about clothes), the buyer changed his mind, a defect, etc. Regardless of when the buyer went to the store to return the purchased item (after a while or on the day of purchase), the return goods at the online checkout should go through the following algorithm:

Refund to the buyer

Article 18 and the above-mentioned law “On Protection of Consumer Rights” allow the return of goods in the following cases:

- the product has shortcomings, defects, does not correspond to the declared quality, or is expired;

- The product has no defects, but does not fit in size, color, style, etc.

In these cases, the consumer has the right to replace the product with a similar one, or (in the absence of analogues) to return its cost. The following deadlines are established for filing claims:

- 14 days (not counting the day of purchase) – for quality goods that do not fit in size, shape, color, etc.;

- expiration date, warranty period or reasonable period (no more than two years) - in case of detection of defects;

- When selling remotely, the buyer has the right to refuse the goods within 7 days after receiving them.

Writing an application

The buyer must come with a receipt and passport.

If we are talking about the interaction between the cashier and the buyer, product returns through online cash registers begin with filling out an application. The buyer writes an application in any form, but it must include his full name, passport details, reason for refusing to purchase, purchase price, date of application and signature. Some stores print such application forms in advance to avoid errors during registration. After the buyer has filled out the form, the cashier is obliged to verify the correctness of the passport data and check details specified in the application.

Many entrepreneurs are wondering: how to process returns through online cash registers if the receipt was not saved, for example, it was lost by the buyer. In this case, it is necessary to restore the purchase information from the fiscal registrar and indicate in the application that the receipt was lost.

In order to securely save all information about your purchases, we recommend purchasing an ATOL 25F cash register. This fiscal recorder fully complies with the requirements of 54-FZ and is characterized by ultra-fast printing speed - up to 250 mm/sec.

Please note that you do not need to collect the check from the buyer (although many do this), just make a copy. An application for a refund written by the buyer is an effective confirmation for the Federal Tax Service that the money was actually returned to the client and was not withdrawn by the entrepreneur in order to avoid taxes.

Registration of an invoice for the return of goods

Since there is no single standard for the invoice form for returning goods at an online checkout, an entrepreneur can independently develop a sample and use it in such situations. The invoice is drawn up in two copies and signed by two parties: one is the buyer, the other is the seller.

Printing a receipt for returning goods at the online checkout

After the buyer writes an application, confirms the fact of purchase, and issues an invoice, a return receipt is printed. The only difference between a refund check and a regular check is that in a refund check, in the “payment attribute” field, not “receipt” is indicated, but “return of receipt”, i.e. the same check is issued as you saw above in the example picture.

Transfer of funds to the buyer

After all the documents have been prepared and signed, all that remains is to return the money he paid for the goods in cash. If the return occurs only partially (for example, the buyer bought fish, milk and slippers, and wants to return the slippers), then the whole procedure follows the same algorithm, the name and quantity of the product and the amount of the return are indicated in the application.

Returning money to the buyer by bank transfer: procedure and terms

In 2021, according to the law, the return of funds to the buyer by bank transfer has a number of features. Next, solutions to typical situations will be considered, but there are also isolated cases that require a personal approach. To resolve a specific issue, it is better to contact a specialist.

What is important to know

In 2021, the system of non-cash payment between buyers of goods/services and sellers is becoming increasingly popular. Financial organizations provide special terminals for making non-cash payments free of charge or for a small commission.

For various reasons, a situation may arise when the funds paid are subject to refund. Because of this, some difficulties arise.

Basic terms

In case of returning goods purchased by bank transfer, you must be guided by regulatory documents. It is also important to know the basic terminology.

| № | Basic terms | Explanation |

| 1 | Cashless payment (according to Russian legislation) | A type of payment for goods/services that uses electronic payments. This can be payment by bank/credit card, electronic wallet, etc. |

| 2 | KKM (cash register machine) | A device that reads data from bank/credit cards |

| 3 | Correspondent account | An account that is opened with a credit institution for further financial transactions. Information about every action is tracked and saved. |

| 4 | Creditor | A bank that acts as an intermediary and provides the service of opening a current account. |

| 5 | Personal account | An account through which transactions between sellers and buyers take place. On your personal account you can find information about the transaction being made, the conditions for its implementation, etc. |

| 6 | Unpaid payment document | A document on the basis of which the bank can carry out various operations. These include: letters of credit, checks, collection orders. Such documentation is usually used for settlements between legal entities. |

| 7 | Payment order - | Order of the bank account owner. According to this order, transactions will be carried out between current accounts. |

| 8 | Electronic document in paper form | Generated electronic document printed on paper |

| 9 | Electronic payment document | A document that serves as the basis for performing various transactions on current accounts. An electronic payment document has the same legal force as a regular paper document. |

Acceptable grounds

In 2021, a number of situations were approved when the buyer has the right to return funds paid by bank transfer on the same day:

- If the purchased product does not fit in size, style, color, etc.

- If the product turns out to be of inadequate quality, and the buyer was not warned about this in advance.

In the latter case, the buyer may have difficulties returning the product itself, which turns out to be of poor quality.

In most cases, you have to conduct an examination at your own expense to prove the presence of a defect in the product (a defect that existed before purchase).

If a product is found to be defective, the seller is obliged to return the full amount of money paid, including the amount for the examination carried out by the buyer.

In accordance with the legislation of the Russian Federation, the buyer can return the purchased product within 14 days and return the money paid. The day of purchase of the goods is not included in this period.

Legal grounds

Federal Law No. 161 of June 2011 is the main regulatory document regulating the procedure for returning funds for non-cash payments. This federal law should be referenced to ensure there is no misunderstanding or your refund is denied.

Is it possible to get cash from the cash register?

Cash cannot be issued to the buyer from the cash register. This is regulated by government agencies and relevant documents. For example, in the Letter of the Federal Tax Service of Russia for Moscow dated September 15, 2008. The procedure for returning funds to the buyer's account is explained.

Refund of money to the buyer by bank transfer in accordance with the Civil Code of the Russian Federation

Let's consider the features of the procedure for returning funds by non-cash form, which are important to know.

When can I get my money back?

The time frame for transferring funds depends on the reason for requesting a refund:

| № | Cause | Term |

| 1 | The product turned out to be of poor quality | According to the Federal Law “On the Protection of Consumer Rights”, refunds will be made within 10 days. |

| 2 | The product turned out to be of poor quality, but it was returned within 14 days, indicating the reason “did not fit” | According to Article 25 of Federal Law No. 2300-1 of February 1992 “On the Protection of Consumer Rights,” the return period will be no more than 3 days. |

If the seller, without legal grounds, refuses to return the money in full, then in this case you can also demand a penalty.

For each day of delay, the seller will owe 1% of the total amount. More details in Art. 26 Civil Code of the Russian Federation.

You can only receive payment of the penalty through the court (forcibly).

Package of necessary documents

Only the buyer can initiate a cashless refund. This is stipulated in the legislation of the Russian Federation. To do this, previously purchased goods must be handed over to a trading organization according to certain rules.

The product must be accompanied by a package of documents:

- warranty card (if available);

- a statement drawn up according to a certain sample, requesting a refund (or exchange of goods). Such a statement can also act as a claim;

- document confirming payment;

- copy of the passport;

- act on the results of the examination (if there was one).

If a quality product is returned, the seller is interested in exchanging it, but will not refuse a refund.

According to Russian law, you should request a replacement for a previously purchased product on the day of purchase.

You can only request a replacement for a similar product. If this is no longer the case, then the seller is obliged to return the money.

The loss of a sales (or cash register) receipt is not a reason for refusal to return funds.

According to the Civil Code of the Russian Federation, funds can be returned to the buyer on the basis of:

- testimony;

- package of necessary documents.

If payment was made by bank card, then the payment receipt will serve as a document confirming the purchase of goods. You can print it out in your personal online account or order it from a banking institution.

According to the legislative norms of the Russian Federation, the seller may refuse to return money in the following cases:

- The consumer tried to return a quality product included in the food group.

- Products subject to exceptions (not subject to exchange or return) are returned. This includes personal hygiene items, some medications, jewelry, etc. A detailed list of exception goods is in Decree of the Government of the Russian Federation No. 55 of January 1998.

- More than 14 days have passed since the date of purchase (during this period, an exchange of goods or a refund for it is possible).

It is important to know about these points in order to avoid misunderstandings between the buyer and seller.

Nuances with VAT

If the purchased product is included in the category of products subject to VAT (value added tax), then when returning the funds, the seller can reserve the tax deductible.

In this case, it is necessary to correctly process the refund to the buyer, and then enter the information into the created declaration. The deduction will be made according to the standard sample.

Reflecting transactions using postings

When organizing a return, it is necessary to make appropriate records of the business transactions performed.

Postings that can be used to record the return of goods in 2021:

| Explanation | Debit | Credit |

| Selling products | 62 | 90 |

| Payment for purchased goods | 51 | 62 |

| Writing off the cost of purchased goods | 90 | 41 |

| Restoring the price of returned goods | 41 | 90 |

| Decrease in revenue | 76 | 90 |

| A refund | 51 | 76 |

If an organization reflects its activities in the general system, then it is necessary to additionally reverse the VAT withheld from the goods by adjusting invoices.

| Explanation | Debit | Credit |

| VAT is charged on sales | 90 | 68 |

| VAT reversed due to refund | 68 | 90 |

When using these postings, various types of misunderstandings will be eliminated.

Refund period

According to the law, a refund to the buyer for non-cash payments must occur within 10 days from the date of filing the application. If the amount is returned for goods of inadequate quality, the period is extended to 14 days.

The seller sends a payment document to the bank for a refund. Within 3 working days, a bank specialist:

- register the payment document;

- will check if it is reliable;

- will send the payment for execution.

Further, the return period depends on the personal work of the individual bank. Commercial banks make refunds for non-cash payments faster than government ones. But, under no circumstances should the return period exceed 30 days.

How to return goods purchased in an online store

Buying and selling goods online is especially popular now. It is also possible to return a product purchased in this way.

Each online store is required to provide the buyer with instructions on the possibility of returning goods within a certain period. If this is not the case, the period for returning the product is extended to 3 months.

If the goods are purchased by bank transfer, the funds are returned to the buyer’s account.

How to transfer money to another card

If the purchase of goods was made using a bank card, then the refund will be made through the bank (or company) to the same card from which the money was debited.

The cash register reads not only the amount of funds, but also the method of purchasing the goods.

The situation when funds for refund are provided from the cash register is considered by government agencies as misuse. After this, unpleasant consequences and difficulties may follow for the store.

There are exceptions to every situation. Sometimes sellers can accommodate you and transfer funds for returning the goods to another account or card. To do this, you must indicate the details of your bank account or other card in your application.

To avoid any misunderstandings when returning goods, learn how to correctly return products purchased by bank transfer.

How to process a refund using online cash registers if the purchase was made by bank transfer.

The procedure for returning a non-cash payment via an online checkout is not fundamentally different from that which is carried out if the buyer pays in cash. First, the client fills out an application, including standard information plus details for a cashless transfer. Then an invoice is prepared and a receipt “return of receipt” is printed. Within ten days the funds will be credited to the buyer's account.

As a rule, the buyer is recommended to keep all the paperwork and receipt issued for return. If the money does not arrive in due time, then you need to contact the bank whose card holder you are and present these documents.

What is an assignment

Article 31 of Federal Law No. 395-1 of December 2, 1990 “On Banks” states that credit institutions must carry out money transfer orders. In this case, the rules approved by the Central Bank must be observed. The form is established by Central Bank Rules No. 383-P dated June 19, 2012. The order must contain mandatory information. A list of them is in Appendix 1 to Central Bank Regulation No. 383-P dated June 19, 2012.

The correct indication of all details in the payment order is essential for the correct identification of the payment. Without the details, it is impossible to complete the order. Without them, it is simply not clear to whom to transfer money. If the document contains incorrect details, the funds will be transferred to the wrong place. What to do if such an error occurs? It is necessary to issue a refund for the payment.

What do you need to know about the payment order ?

If the buyer bought for cash and wants to receive a refund by bank transfer

Yes, a non-cash refund can be made if the buyer, in the return application, expresses a desire to receive funds in a non-cash form and indicates his details. In this case, the funds are debited from the organization’s current account. If the buyer paid by card, then the refund occurs only in non-cash form. Refunds are issued only to the same card with which the purchase was made.

Returning goods by non-cash means takes place in several stages:

- The buyer brought the goods, a receipt or other document confirming the fact of purchase, a passport, a card.

- The seller checks the goods for compliance and integrity. If everything is in order, a refund will be issued. If the goods are returned in improper condition due to the fault of the buyer, then a statement of non-conformity is drawn up. The return certificate is drawn up in free form, which must include a description of the product, the reason for the return, the amount, and the buyer’s passport details. A payment order is sent to the bank.

How to return goods through a Pos terminal.

The procedure in this case looks something like this:

- Go to the operations menu (for some terminals this is the F key);

- Financial transactions - return of goods, insert the buyer's card;

- information about the card will appear on the screen, check it, press the green button, then enter the refund amount;

- If it is necessary to enter a PIN code, we transmit it to the client;

- Two checks are issued, one for the seller, the other for the buyer;

- We return the card and check.

The period for returning goods depends on the bank and payment system. Usually the transfer of money takes from 3 to 5 days. The return of goods in this way does not take place on the day of purchase. If the buyer returns the product on the day of purchase, the transaction is canceled.

Canceling an operation when returning on the same day looks like this:

- Go to the financial transactions menu, sub-item cancel transaction by number;

- enter the check number, click confirm;

- Confirm payment information;

- The refund receipt is printed.

Features of accounting for returns when combining tax regimes

The main feature of returning funds to the buyer’s bank card is that the acquiring bank does not explicitly write off the refund amount from the organization’s current account, but withholds it from subsequent deposits under the acquiring agreement.

A taxpayer who does not keep separate records may have problems accounting for income if the tax treatment of the refund and subsequent sales paid for with cards do not match.

According to the Tax Code of the Russian Federation, when combining the simplified tax system and UTII, the taxpayer must organize separate accounting of income and expenses within each type of activity (clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation). At the same time, for the purpose of calculating and paying UTII, tax accounting of income and expenses is not required. After all, the tax base—the amount of imputed income—is fixed.

Consequently, the main task when combining these regimes is to correctly determine the tax base and calculate the tax when applying the simplified tax system. This rule applies not only to “simplified” people with the object “income minus expenses,” but also to those who count only income.

For example, goods sold as part of activities on UTII are returned, and the following card payments are made for sales on the simplified tax system. This means that when the acquirer credits funds, it is necessary to recognize income under the simplified tax system in the full amount, without deducting the withheld return. And for the amount of the withheld refund - reverse the income on UTII.

We will consider the procedure for reflecting refunds to customers’ payment cards from “simplified” companies when combined with UTII using the following example.

How to make a correction check and when is it used?

The correction check is processed if the cashier made a mistake on the check and the buyer has already left; if at the end of the day the total receipts in the cash register do not match. Adjustments can be made either to increase or decrease funds.

What data is contained in such a check:

sign, here is a correction check;

check transaction type;

correction amount;

payment type;

and other information.

Such checks can be punched only before the shift is completed and the Z-report is generated.

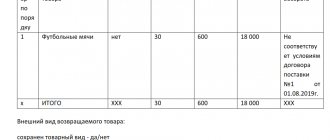

On the left you see an example of a correction check.

When issuing a correction check, a special act is drawn up indicating the reason for the correction.

At the online checkout, it is recommended to make a correction check only if you find more money than needed. If the revenue is less, i.e. there is a shortage, the check does not go through.

Read more: Correction check at online cash register

Procedure on the part of the recipient of the money

What should a company do if it has received an erroneous payment? She needs to send a notification of the error to the bank within 10 days. The form of notification is not specified by law. It is established by internal acts. If the bank does not have a prescribed form, the notice is drawn up in free form.

Further actions on the part of the banking institution:

- If direct debit is possible, the funds are debited without additional instructions.

- If this option is not available, a debit order will be required from the recipient of the erroneous payment.

Partially, the procedure for returning funds depends on local instructions established for a particular bank.

If everything is still not clear, watch the following video:

How to make a refund using an online cash register: types of returns and adjustments of income/expenses

How to make a refund at the online checkout: refunds at the Mercury, Atol, Shtrikh M checkout

If your cash register does not support all existing functionality, or performing the necessary operations on your cash register is difficult, we recommend that you upgrade to new equipment. Get acquainted with the catalog of online cash registers of a new type. These cash registers fully comply with the updated legislation and Federal Law 54, and also support all the necessary functions and capabilities of a cashier. It is also recommended to switch to new cash registers for those who have not yet switched to online cash registers, but must do so, and for those whose equipment must be updated by law.

Need help using the online checkout?

Don't waste time, leave a request for technical support.

Certificate of return of funds at the cash desk: details of registration

Often during a work shift, cashiers develop a cash gap. This may be due to several reasons:

- The employee mistakenly entered an incorrect check (for example, the amount in the fiscal document is greater than the cost of the actual purchased goods).

- The cashier punched the receipt, but the client changed his mind about purchasing it - the situation is relevant for retail outlets, where they first pay for the purchase, and then release the products in the desired department.

- The buyer returns the goods directly on the day of purchase and is reimbursed from the operating cash register.

In all of the above cases, it is necessary to draw up an act f. KM-3. It is drawn up in a single copy when closing a shift and making a Z-report on the same day when the cash gap occurred. When conducting a tax audit, Federal Tax Service employees pay special attention to the correctness of the document and the supporting documents attached to it. Therefore, when designing, it is necessary to take into account some nuances.

The act of returning funds from the cash register is signed by a commission, which includes: the head of the company (branch manager), the head of the department, the senior cashier and the cashier. After signing, the cashier enters the total amount of the act (for all canceled fiscal documents) in gr. 15 register f. KM-4 (Cashier-operator's journal).

You must also attach incorrectly punched checks. For convenience, they can be glued to a sheet of paper. Each document must bear the signature of the manager and a stamp with Fr. The fiscal document is not always available. This may be because it was not presented by the buyer or was lost by the cashier.

In the first case, the client must write a statement indicating the reason why he was unable to present the check. The document is endorsed by the head of the outlet and attached to the act. If a cash register provides the ability to print information about a purchase, it can also be an application.

If a fiscal document is missing due to the fault of the cashier, but a decision is made not to punish him, then the employee only needs to write an explanatory note and draw up a sales report. In this case, Federal Tax Service employees can fine the entrepreneur for not posting the proceeds, but, based on judicial practice, the courts most often side with the businessman.

In the absence of supporting documents, tax authorities may equate this to illegal trafficking and bring both tax and administrative liability. However, in accordance with Part 1 of Art. 4.5 of the Administrative Code, a legal entity or individual entrepreneur cannot be held accountable after 2 months have passed from the date of the offense.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

You might also be interested in:

Correction receipt at the online cash register

Online cash register receipt. Details in a new way

BSO - Strict reporting form according to 54-FZ.

Online cash register for dummies

Scanners for product labeling

The cash register is broken, what should I do?