State duty is a mandatory payment to the Russian budget, which can be made at any bank branch. Payment for public services is made immediately before an individual submits documents to the appropriate authority and is provided to responsible persons in the form of a payment receipt.

The actual state duty for divorce must be clarified before making payment. This is very important, since after paying the state fee receipt, the spouses may change their minds about filing a claim for divorce.

Procedure for paying state fees for divorce

How long the state duty for divorce is valid can be found on the official website of the relevant government service. If the parties cannot reach a compromise, it is worth considering what the procedure for paying the divorce fee should be:

- You can pay the receipt at any bank in Russia. To do this, you need to provide the cashier with payment details and announce the required amount.

- If the payment is made on behalf of an organization, funds are transferred from the company's current account to the current account of the government agency.

- Payment can be made using a self-service terminal. After entering the relevant details, a receipt will be issued, which, in essence, is a payment document. Since terminals are located almost everywhere today, this payment method is one of the most common.

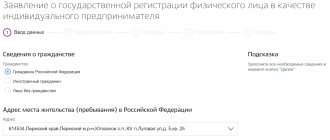

- State fees for divorce in 2021 can be paid online. This can be done in your personal account on the State Services website. Also on the Internet service page you can find a list of documents that will be needed for divorce.

The expiration date of the state duty for divorce can also be clarified on the website of the state service. This information is constantly updated, eliminating the possibility of errors or false data.

How long is the state duty on a driver's license?

The new driver's license is made on plastic with special protection made from special materials. Money is spent on its production. The state fee is charged at different times and for different reasons, so drivers should be aware of the expiration date of the driver's license fee.

The amount of payment for obtaining a driver’s license is determined by the fiscal authorities. According to the Russian Tax Code, in order to obtain a license, you must present a receipt for payment of the state duty to the traffic police. No law specifies the validity period of a receipt for state duty. Therefore, the legislation does not determine the validity period of this document . In this regard, the validity period of the receipt can be considered unlimited.

But in practice it turns out differently - the period is limited to the end of the calendar year. A receipt for payment of the duty to the traffic police is valid until the end of the year. During this time, the document can be presented to the State Traffic Inspectorate.

The fact is explained by the fact that when the driver paid the state tax, but applied for the service after a long time, the following problems may appear:

- The payment amount has changed.

- The bank details of the government agency in whose favor the payment was made have changed.

This does not directly relate to the validity period, but since a long period has passed, the receipt will no longer be valid. Moreover, the amount of payment may increase.

You can do this in two ways:

- Pay the money again and return the previous amount. To do this, you need to note on the receipt that the money has not been used and submit an application addressed to the head of the government agency where the person applied for the service. If this was the registration of a driver’s license, then you need to go to the State Traffic Inspectorate. After completing all the procedures at the traffic police, you need to go to the treasury, into whose account the budget money is received. If the request is granted, the unused money will be credited to your account.

- Pay the missing amount, attach two receipts at once - old and new. Before the procedure, you need to clarify the correctness of actions in the traffic police, where the license will be issued. Usually in such cases no questions arise.

If the bank details are changed, then everything will depend on whether the treasury has received information about the payment. If not, then it is better to pay again and return the previously paid money according to the above procedure.

When calculating the validity period of a receipt for the state fee for a driver’s license, it is important to keep in mind that the Ministry of Finance of the Russian Federation gives recommendations to return funds for the state fee no later than 3 years after payment.

If a driver’s license is being replaced due to a change in surname, or the license has been lost or become unusable, then the procedure is exactly the same as the initial receipt of documents.

This applies not only to the validity period of the receipt, but also to the amount of payment :

- For a driver's license on a plastic base of a national standard - 2000 rubles.

- International license – 1600 rubles.

- Temporary driver's license – 800 rubles.

Validity of the state duty for divorce in accordance with the current legislation of the Russian Federation

Very often you may encounter a situation where the state fee has been paid, but the spouse does not agree to the divorce.

In this case, the divorce process can drag on for several months or even years. But after evaluating all the pros and cons, the spouses finally reach agreement. This is where the question arises, how much is the state fee for divorce valid to pay? In accordance with the current legislation of the Russian Federation, after filing an application, the couple is given one month for reconciliation. If no compromise has been found within this period, the couple is officially divorced. In turn, the validity period of the state fee for divorce is three years from the date of payment. This means that during the specified period, the married couple has the right to submit an application to the relevant authorities in order to formalize the divorce.

How do you pay state duty?

The Russian Ministry of Finance reminded: on the issue of the procedure for paying state duty for carrying out legally significant actions, one should be guided by Article 333.18 of the Tax Code of the Russian Federation.

For example, for the majority of legally significant actions, the fee must be paid before submitting applications or documents to perform such actions (subclause 6, paragraph 1, article 333.18 of the Tax Code of the Russian Federation). If several payers who do not have the right to benefits apply for a legally significant action at the same time, then they pay the fee in equal shares (Clause 2 of Article 333.18 of the Tax Code of the Russian Federation).

The state duty is paid at the place where a legally significant action is performed in cash or non-cash forms (Clause 3 of Article 333.18 of the Tax Code of the Russian Federation).

How can I confirm payment of the state fee for divorce?

When officially registering a divorce, one of the following documents must be provided to the registry office or court:

- Payment to the government in the form of a payment order. The receipt must indicate the date and amount of payment. This document is a confirmation of the payment that was made by bank transfer.

- Bank receipt of the established form. Such payment can be made at the cash desk of a financial company in cash or by bank card.

- If payment is made on the State Services website, you must provide information about payment of the state duty electronically.

Thanks to the rapid development of technology, today you can contribute money to the state budget in any convenient way. To do this, there is no need to stand in line at the cashier for hours to pay the fine for divorce.

How to confirm payment of duty

The fact of payment of state duty in cash is confirmed:

- or a receipt issued by the bank;

- or a receipt issued by an official or the cash desk of the authority to which the payment was made.

The fact of payment of state duty in non-cash form is confirmed by a payment order with a note of its execution made:

- or bank;

- or a territorial body of the Federal Treasury;

- or other body that opens and maintains accounts, including making payments in electronic form.

On the issue of correctly filling in the details of a payment document for the transfer of state duty, the Russian Ministry of Finance recommends contacting the state body performing a legally significant action (arbitration court), or the state body that is the main administrator for its payment (Federal Tax Service of Russia).

The fact of payment of the state duty is also confirmed using the information contained in the State Information System on state and municipal payments, provided for by Federal Law No. 210-FZ of July 27, 2010 “On the organization of the provision of state and municipal services” (hereinafter referred to as the GIS GMP). According to the Russian Ministry of Finance, if information about the payment of state duty is contained in the GIS GMP, then no additional confirmation is required.

How can I get a refund of the state fee for divorce?

A refund is possible only when the divorce is done through the court. As for divorce through the registry office, a refund is not possible. This means that if the spouses decide to divorce in court and change their minds, they can expect that the payment will be returned in full.

If you decide to postpone an event such as divorce for a while, the receipt can be kept and used for three years.

In order to return payment of the state fee for divorce, it is necessary to carry out the following operations:

- Filling out an application in the prescribed form. This document must be drawn up in the name of the head of the body to whose details the funds were transferred. If you do not know whose name should be indicated on the application, this information can be clarified on the receipt for payment of the state fee.

- The application must be accompanied by a payment document. If you want to return the full amount, you must present the original receipt. If you have exceeded the established amount and want to return the excess, in this case a copy of the payment order will be sufficient. In addition to the receipt, certificates, confirmations and other documents are attached to the application, which are evidence of refusal of divorce.

- Make a personal delivery of a package of documents or send certificates by registered mail to the tax authority at the place of registration of the court where the divorce case was to be heard.

- Wait for confirmation of the refund of the state duty from the above-mentioned authority.

- If your request is fully satisfied, contact the Federal Treasury to receive a refund.

How to take into account the state duty

In accounting and tax accounting, depending on what kind of legally significant action is paid, the amount of state duties:

- or taken into account as part of other expenses associated with production and sales on the date of their accrual (clauses 4, 11 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n, clause 1 p. 1 Article 264, paragraph 1 paragraph 7 Article 272 of the Tax Code of the Russian Federation);

- or included in the value of assets (clauses 7, 8 PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, clauses 6, 7, 8 PBU 14/2007 “Accounting for intangible assets”, approved by order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n, paragraphs 1, 3 of Article 257 of the Tax Code of the Russian Federation).

The amount of state duty for divorce in court

Spouses resort to divorce through the court if there are minor children or the couple was unable to reach an agreement amicably.

In this case, the state duty will be 600 rubles (from January 1, 2021). Payment must be made by one of the spouses who initiated the breakup. The second party to the lawsuit will be the defendant. The process of divorce is that the plaintiff pays the state fee, goes to court and, after the decision of the legal body, applies to the registry office in order to legalize the divorce. Also at the registry office you will have to pay a set amount for issuing a divorce certificate.

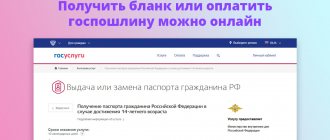

Where can I get a receipt for paying the state fee for a foreign passport?

A receipt for paying the cash fee for obtaining a foreign passport can be obtained from the Federal Migration Service or Sberbank. It is also available on various websites that allow their users to download various official forms. When filling out receipts for your international passport, you must correctly indicate the purpose of the payment. The document must indicate for which passport the fee is paid - bimetric or regular, and whether the document is being processed for an adult or a child. The amount of the duty largely depends on these data. Therefore, you need to carefully indicate the BCC when filling out the payment document. It will be different for each type of passport. If you enter the BCC incorrectly, the payment will not be credited. It will have to be recalled and contributions must be transferred using the correct details.

Payment can be made in different ways. A convenient option is to do this through a bank or terminal. If the future owner of a foreign passport has the Sberbank Online service connected, he can use it. In this case, he will not have to manually fill out a receipt or stand in line at the bank. He will do everything online and pay the mandatory state fee using his debit or credit card.

Payment of state fees for divorce if there are children under 18 years of age

If spouses who have minor children are divorcing, certain difficulties may arise. It is important to remember that divorce is possible only in court. As for the size of the state duty, the amount remains unchanged. But issues that relate to the upbringing and maintenance of each child may become the subject of dispute and additional expenses.

The divorce procedure in families with children requires filing an application and paying a state fee of 150 rubles. If the other party has no claims and agrees with the established residence of the child, the court makes a decision that immediately enters into legal force.

The spouse who will live with the child has the right to apply for compensation. The second parent will have to make monthly payments that will help cover the costs of maintaining and raising the child until the age of 18. In most cases, alimony is applied for when it is not possible to reach an agreement amicably. It is worth remembering here that paying alimony is not a reason for the second parent to refuse to raise the child and fulfill his parental obligations.

Application for restoration of payment of state duty

Reinstatement of payment of state duty begins with the preparation of an appropriate application. Its form is determined by Order of the Tax Service No. ММВ-7-8/90, which is dated March 3, 2015. Filling out the application is not particularly difficult, especially since it is quite easy to find already fully completed samples on the Internet.

Photo No. 2. Application form for refund of state duty

A citizen must submit an application to the department whose services he planned to receive. That is, in the case of issuing a foreign passport that has not been completed, the application is submitted to the Federal Migration Service, and when replacing a driver’s license, to the traffic police. The same procedure is provided in the event of an erroneously executed payment using incorrect details indicated in the receipt or an incorrect amount of the transferred amount.

The only exception to this rule is the situation regarding the return of state duty upon a statement of claim to the court. According to Article 333 of the Tax Code, in this case it is necessary to submit an application for a refund to the tax office at the location of the court.

The decision on the legality of restoration or refund of the state duty is made by the body to which the corresponding application was submitted.

Exceptions to the rules for restoring payment of state duty

In some cases, an individual does not have the right to a refund or restoration of the state duty that was paid by him in error. These cases are exceptions and are clearly stated in the legislation. Refund of state duty is not possible:

- if a citizen was denied registration of rights to property or transactions with it on legal grounds;

- when the defendant fulfilled what was required of him by the plaintiff before the consideration of the case, but after it was accepted into proceedings;

- in case of refusal of an individual from state registration of a civil status act (any of the above);

- if the settlement agreement was concluded during consideration by the court or during the execution of the adopted judicial act;

- when the three-year period provided for filing an application for a refund of state duty has expired.

Any of these cases is grounds for refusing the applicant for the restoration of an erroneously paid state duty. Naturally, the citizen does not lose the right to file a claim in court.

In what cases are duties paid?

Services for which you always need to pay a fee are any registration actions, together with the issuance of license plates (2000 rubles), production and issuance of a certificate of registration of equipment (500 rubles), filling out the clause about the other owner in the vehicle passport (350 rubles .).

Here it should be clarified: in order to register a car when there is no space for a mark in the vehicle’s passport, the owner will have to pay 800 rubles. for issuing another PTS form. Soon it is planned to introduce electronic vehicle passports, where it will be possible to enter data as many times as desired. Electronic driver's licenses will also be introduced. All these innovations will improve the level of service to the population when registering transport and reduce the amount of state registration fees.