4.5 / 5 ( 2 voices)

The issue of filing a claim for the division of property rights between former spouses is regulated by multiple articles of Russian codes. The question of how much state duty is paid when dividing property in 2021, and the procedure for its payment are considered by the Tax Code. Next, we will determine how to calculate the required amount, which categories of citizens are required to pay state duty and who is exempt from this need, as well as methods for making payments.

Who pays the state fee

According to the Tax Code of the Russian Federation, the plaintiff is required to pay the state fee for filing an application for division of marital property. If, when filing a claim, he does not provide a payment document confirming the payment of the required amount, then his claim will simply not be accepted for consideration.

If the plaintiff makes a demand for the division of the spouses’ property, it means that he initially assumes that part of the common property will come into his possession through the court. Such a court decision allows you to include in the claim a petition for the division of state fees between him and the defendant. Then, depending on the shares received in the divisible property, the amount of state duty when making a court decision will be divided.

For example, if its amount was 12 thousand rubles, and 2/3 of the divisible property was awarded to the plaintiff, and 1/3, respectively, to the defendant, then the latter will be charged 8 thousand rubles in favor of the plaintiff from the amount of the duty paid.

Procedure for payment of duties

Payment of the state fee is carried out immediately before filing the claim. The application for division of property, together with a package of documents, is submitted to the court only with the original receipt for payment of the fee.

When filing an application to reduce the fee, the plaintiff has the right to pay the amount to which he requests to reduce the fee. If the court grants the petition, the claim will be accepted for proceedings, but if the duty is left unchanged or reduced to a smaller amount than the plaintiff planned, he will have to pay it additionally. The claim will remain motionless at this time.

Where can I get the details?

The details for paying the fee when dividing property must be clarified directly in the court to which the statement of claim will be filed.

You can also check the details on the court’s website and, in most courts, immediately print a completed receipt from the website.

It is better to check the relevance of the details directly at the court reception. Official websites of judicial authorities are not always promptly updated, which may result in erroneous crediting of the fee amount using outdated details.

Where to pay?

Payment of the fee is carried out at any bank branch that accepts these payments. As a rule, even in regions and small cities there is at least one bank that is ready to accept duty payments without commission.

It is best to clarify other conditions for paying the duty at the place of payment.

You can pay the fee from any region; it is not at all necessary to make the payment in the exact city or region where you plan to file the claim. That is, you can pay the fee at your place of residence, and send the claim by mail, along with the original receipt, to a court in another region.

How to confirm?

The fact of payment of the fee is confirmed by the original receipt or check order printed by the terminal (if the payment was not made through the operator).

Please note that when paying fees through online banking, you will need to go to the bank office to have the check printed at home certified. The courts will not accept a check printed on a printer and without a bank mark as proof of payment of the duty.

As of February 2021, payment of the state fee for going to court through the State Automated System of Justice is not yet supported. However, the site suggests using a calculator to calculate the duty.

How to calculate the state duty

When dividing jointly acquired property, the amount that must be paid as state duty will have to be calculated independently; it is not a fixed amount.

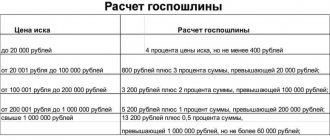

To carry out the calculation procedure, you need to familiarize yourself with the Tax Code of the Russian Federation (primarily Article 333.19). The document states that the amount of the state duty in 2021 directly depends on the value of the property that is supposed to be divided in court.

Claim price up to 20,000 rubles

The first price threshold for value is 20 thousand. If the property is valued at an amount less than that, then to determine the state duty, 4% should be subtracted from it. For example, the price is 17 thousand rubles, which means you need to deposit 680 rubles. It should be taken into account that the minimum state duty is set at 400 rubles.

The cost of the claim is up to 100,000 rubles

With a cost range from 20 thousand to 100 thousand rubles. The calculation occurs according to the following scheme. A fixed price is set at 800 rubles, and from the amount that turns out to be above 20 thousand, they take plus another 3%.

For example, the property is valued at 70 thousand rubles. Then we add 1500 to 800 (3% of 50 thousand), and the result is 2300 rubles.

Claim price up to 200,000 rubles

If the cost threshold exceeds 100 thousand rubles, but does not reach 200 thousand rubles, you should take a fixed amount of 3200 rubles. and add it to 2% of the cost exceeding the lower threshold.

For example, the price is 140 thousand rubles. Then add 800 to 3200 (2% of 40 thousand) and get 4000 rubles. eventually.

The cost of the claim is up to 1,000,000 rubles

If the cost is set at 200 thousand to 1 million rubles, then a fixed amount of 5200 rubles is taken. and 1% is added to it from the part that goes beyond the lower price threshold.

For example, the price is 440 thousand rubles. So, we add 5200 and 4800 (1% of 240 thousand), we get 10,000 rubles. in total.

The cost of the claim is over 1,000,000 rubles

Provided that the price is above 1 million rubles, it is necessary to take a fixed amount of 13,200 rubles. and add to it 0.5% of the cost, which exceeds the threshold of 1 million rubles.

For example, the property is valued at 3 million rubles. In this case, we take 13,200, add 10,000 (0.5% of 2 million), and the result is 23,200 rubles. The law establishes that the maximum amount of state duty is 60 thousand rubles.

If the value of the claim changes during the course of the case

Before filing a claim, the applicant is obliged to determine the value of the divisible property, calculate the estimated amount of the state duty and pay it. When considering a claim, the judge may not be satisfied with the price presented and order an examination to accurately determine it. In this case, the cost may change down or up. This automatically leads to a change in the amount of state duty when dividing property.

Why does the law require you to pay duty twice?

Based on the concept of state duty, the state must be paid for any legally significant services of government agencies and their registration of facts. It seems that divorce is one procedure, and citizens are outraged when they are required to pay again.

Duplicate payments occur when a divorce goes through the courts. The state fee is charged for accepting and considering the claim. But the court does not issue divorce certificates - it only protects the interests of the parties.

Divorce certificates will be needed to change the status in your passport and to independently dispose of your part of the property. They are issued by the registry office. The services of the registry office are the services of another body, therefore they must also be paid through a state fee.

So it turns out that the spouses first have to pay 650 rubles for the trial, then another 650 rubles for the evidence. This is by way of a joint decision without judicial division of property.

It should be noted that each spouse will have to pay for their certificate separately. There are situations when one spouse is officially divorced, and the registry office informs the other that he is still married (before paying the fee for the certificate).

The property will still have to be divided, even if not through a statement of claim. With a different approach, a fee is charged for notary services.

Who evaluates the property to calculate the claim?

Initially, the value of the property to be divided can be determined by the plaintiff himself. In this matter, he should rely on the agreements under which it was received. If we are talking about real estate, then you need to contact the BTI and request documents indicating the price.

In addition, you should analyze the average market value of similar properties in your region of residence. For example, if we are talking about dividing a car, you need to look at car sales sites and determine the cost of a car with similar characteristics.

How an expert evaluates property during division.

If the parties to the proceeding do not agree on the value of the claim, then an independent appraiser from the SRO may be invited. He conducts an examination and draws up an act indicating the approximate value of the property being divided.

How does the division of property proceed in court?

The procedure in court is as follows:

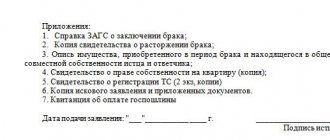

- The plaintiff submits a statement of claim with documents and a receipt for payment of the state fee, the court secretary registers them and gives an extract of acceptance.

- A court date is set. If problematic issues can be resolved, repeat hearings are not held.

- At the hearings, the parties provide arguments on the basis of which the court must make a decision.

- A court decision is issued. It comes into force in a month - this time is given to the parties to challenge it on appeal. After the expiration of the period, only cassation is possible.

In the future, the former spouses act on the basis of the court decision: they re-register property rights, transfer monetary compensation, etc.

Payment of the state fee is one of the most important stages when submitting documents on the division of property to the court. Without a receipt, the plaintiff will be legally denied consideration of the case, so it must be provided without fail.

Procedure for paying state duty when dividing property

The required amount of money must be paid by the plaintiff before filing an application for division of jointly acquired property. He needs to attach payment documents to the claim. Otherwise, it will not be accepted for consideration in the court office.

Where to get details

To pay the required amount of state duty, payment details are required. For information, you should contact the court where you intend to file your claim directly. This will be either a magistrate's court or a city (district) court. Perhaps the necessary information is posted on the official website of the judicial organization.

How to pay

There are several ways to pay state duty:

- Payment via bank teller. This is a standard method in which you simply need to provide the cashier with your payment details and the required amount of money.

- Payment using a bank terminal. It's easy to do, you just need to enter your payment details and ID details.

- Transfer funds using an electronic wallet. The procedure is available to persons who have their own electronic wallet (Qiwi, Yandex Money, WebMoney) and the required amount in it.

Receipt for confirmation

If payment is made through a cash register, the bank teller will issue a receipt. When depositing funds through the terminal, after the money is accepted by the bill acceptor, the machine issues the necessary receipt. When payment is made online, you need to print out a receipt yourself, which the electronic wallet sends by e-mail. It is these payment receipts that should be attached to the claim for the division of jointly acquired property in 2021.

Property valuation

The court will not accept the application if the calculation of the state duty is based on the personal opinion of the plaintiff. Before going to court, it is necessary to evaluate the disputed property. And based on the results, calculate the payment.

The assessment procedure varies depending on the type of property:

- Real estate . From 01/01/2020, a cadastral value is established for all real estate in the country. She takes it as a basis. You can confirm the amount using a certificate from Rosreestr. It can be ordered online or through the MFC. The cost in 2021 is 290 rubles.

Important! If the plaintiff believes that the cadastral value is too high, then he can contact an independent appraiser.

- Movable property . For movable objects, you will have to contact an independent appraisal company. The cost of work varies depending on the specific organization and region of circulation. The result of the work will be an assessment report.

Deferment and installment payment

If the plaintiff has serious financial difficulties, then he has the right to file a petition for an installment payment plan. Those. he will have to pay a certain amount (for example, 1000 rubles), and the remaining parts will be collected within a certain period of time established by the court. There are a number of reasons why installments may be granted:

- low income;

- presence of disabled dependents;

- loss of source of income;

- the presence of a serious illness requiring expensive treatment;

- pensioner status.

The list of reasons is more extensive. It is advisable to obtain advice from the court in each specific case. In a number of cases, by a court decision, these groups of citizens may be provided not only with installment payments, but also with a reduction in the amount of state duty.

Who should pay the state fee?

One of the spouses Share equally

The plaintiff, when filing a request for an installment plan, must understand that granting it is not an obligation, but a right of the judge.

In what cases is duty charged?

Spouses can resolve property disputes in two ways:

- In peaceful way.

- Through going to court.

The first option is called contractual. It implies that the husband and wife were able to peacefully resolve the property conflict. In this case, going to court is not required. The intentions of the parties are secured by a special agreement, which is drawn up in writing.

Going to court is used in any controversial situations that arise during a divorce. This applies to the payment of alimony, the issue of child custody, as well as property division (the specifics of the division of property if there are children are discussed here). The courts will help resolve the dispute if the spouses cannot reach an amicable agreement. But you will have to pay for the procedure.

Important! The state duty is levied on the application to the court itself, as well as the provision of services for the division of property. The amount of the duty is regulated by the Tax Code of the Russian Federation.

Refund of state duty when dividing joint property

The law provides several reasons why the amount paid as state duty may be returned to the payer:

- if, after filing the claim, the judge made a decision to refuse to consider the case;

- when the court returns the statement of claim to the plaintiff;

- in case of termination of legal proceedings in the case;

- if it has been established that the price of the claim is lower and the amount of the state duty paid is greater than required by law. Then the difference in amounts is returned.

To return the required amount, you must first submit an application to the court office. The plaintiff will be provided with a response within 15 days. If the claim is found to be valid, the applicant will be issued a resolution, which must be submitted to the Tax Service. The Federal Tax Service is obliged to transfer the required amount to the plaintiff within a month after receipt of the application.