Read about the specifics of returning funds to the buyer’s payment card in 1C: Accounting 8, including when combining special tax regimes.

In the articles “Features of accounting for acquiring transactions under the simplified tax system” and “Accounting for acquiring transactions in 1C: Accounting 8”

1C experts talked about the concept of an acquiring agreement, how acquiring transactions are reflected in 1C: Accounting 8 (rev. 3.0) when applying the general taxation system and the simplified tax system.

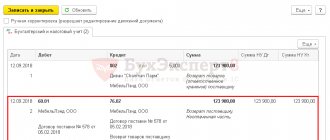

If the buyer returns the goods, the acquiring bank does not write off the funds that should be transferred to the buyer’s bank card from the seller’s current account, but deducts them from the amounts of subsequent deposits in accordance with the acquiring agreement. Starting from version 3.0.49 in the 1C: Accounting 8 program version 3.0, such operations are automated.

Sign of payment in a cash receipt - what are they?

The format of a modern cash receipt is very different from what it was just a few years ago. Today, every document must include the following information:

- Store information.

- The total amount of the transaction.

- Serial number of the order.

- Tax contributions.

- The exact time and date of receipt generation.

- Fiscal data.

- Actually a sign of calculation.

At the request of the owner of the outlet, many other data can be printed, however, the ones listed above are mandatory.

What are the signs of settlement in a check of any type and format?

This term describes one of the mandatory initial data indicated on the cash receipt. It must be present on the document, regardless of whether it is presented to the buyer in paper or electronic form. Possible options for details are established by federal legislation. Among them:

- Receipt is a standard sale of goods, records the moment when the purchaser hands over money to the seller and receives purchases in return.

- Receipt return – printed when a reverse operation occurs, that is, the purchased item is returned to the store, and the buyer’s money is returned to the buyer in cash or to the card.

- Expense – registration of the issuance of material funds to the client from the cash register for things received from him. Used in scrap metal collection points, pawn shops and other similar institutions.

- Refunding is the reverse operation. It is used extremely rarely, but is nevertheless possible.

It should be noted that the procedure requires printing a new check, since all information received by the cash register is immediately transferred to the tax department. At first glance, this creates some difficulties, but in fact it also brings convenience, not only to the buyer, but also to the seller. Thanks to this introduction, there is no need to additionally create an act, which saves time.

Incorrectly addressed money arrived in the current account: postings

For the recipient of funds to whose current account money was mistakenly received, a posting reflecting the receipt of unidentifiable funds will be made at the time the payment document is linked to the accounting accounts.

A similar amount is debited to account 76, and this is done by posting Dt 76 Kt 51 (52).

Accordingly, if the erroneous payment is returned to the counterparty's current account, the posting will be reversed: Dt 51 (52) Kt 76. The exchange rate difference when returning currency will be reflected by the posting Dt 91 Kt 76 or Dt 76 Kt 91.

If, in relation to a payment reflected as an error, a decision arises to take it into account as payment for a future or already completed sale of goods (performance of work, provision of services), then on the basis of written information received from the payer, an entry will be made Dt 62 Kt 76 with the ensuing hence the VAT implications.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

When to return goods via online checkouts

There are different situations possible in which, in principle, one has to resort to the procedure, but basically this happens for two objective reasons. The first is related to the client's refusal to purchase. What caused such a desire, inadequate quality or one’s own preferences, is completely unimportant. When everything complies with the law, the seller is obliged to return the goods to the buyer via the online checkout.

The second reason for canceling a purchase is a typo during the initial checkout. The problem may be an incorrectly entered amount, unit of product or its name. In this case, it is impossible to do without correction, since this will lead to the transfer of incorrect information to the tax service, and at the same time to other troubles. As a result of the procedure, the buyer receives a new receipt, and the seller has to prepare other documents, which we will talk about later.

You might also be interested in:

Correction receipt at the online cash register

Online cash register receipt. Details in a new way

BSO - Strict reporting form according to 54-FZ.

Online cash register for dummies

Scanners for product labeling

The cash register is broken, what should I do?

How to make a refund for goods at the online checkout: step-by-step instructions

The actions of the store employee are subject to the situation that led to the registration of the procedure. The period during which funds must be returned to the consumer’s hands also depends on this. If we talk about the most general algorithm of actions, it will look like this:

- The customer notifies of his desire to cancel the purchase by means of a statement.

- The employee draws up an invoice for that part of the purchased items that should be returned to the warehouse.

- The entire debt amount is calculated.

- A cash transaction is being completed.

Next, we will consider in more detail different situations and ways to overcome them.

Registration of a refund for goods on the same day of purchase at the online checkout due to a seller’s error

This option is the simplest, including for the buyer himself. He does not need to submit any documents or write an application. It is enough to reprint the order with the correct price, name and quantity of the product. The client receives it directly at the cash register. If necessary, he is also compensated for the monetary difference.

For the cashier, this is not the end of the procedure. He must draw up a memo indicating the mistake made and also confirming the printing of new documents. The “wrong” check is retained by the employee and attached to the note as evidence.

It should be noted that these instructions only apply to situations where the problem was identified directly on the day of sale, and, if possible, at the very moment of purchasing the product. However, it is impossible to return it and get your money back in full. This requires a procedure using a different algorithm, which we will discuss below.

How to make, process and process a refund for a product to the buyer through an online checkout when the product is returned

No one can take away the right to completely cancel a transaction from a client, so if there are legal grounds for this: for example, the item turned out to be of inadequate quality, the wrong size, or the buyer simply changed his mind, the procedure is also carried out without delay, but is somewhat more complicated.

First, he will have to write a statement addressed to the store director, which indicates exactly what was purchased and for what amount, as well as the reason for the refusal. The form can be found on the Internet or requested directly at the point of sale. Additionally, you will have to attach a previously issued check and show your passport.

If the receipt was lost, the seller will be able to find it on the fiscal registrar, so there will be no problems for the buyer in any case. Unless more time is spent on registration. Next, the seller will have to take a few more steps:

- Issue an invoice.

- Print a check.

- Give a new receipt and money to the client.

If the purchase was made using a bank card, the funds will be credited back to it.

How to make a return at the online checkout not on the day of purchase

This situation, according to the rules of the event, completely coincides with the previous one. The consumer will need a completed application and a receipt (if available), and the store employee will need an invoice and a printout of new documents. Upon completion of the transfer of funds back to the acquirer, the transaction is considered cancelled.

In addition, we note only one point. Returning an item several days after purchasing it requires special attention. Different groups of products have different periods during which such a procedure can be carried out. In addition, there are certain groups of items that cannot be replaced or returned to the store.

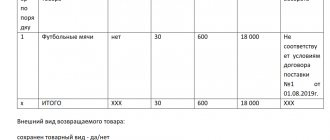

How to issue a partial refund at the online checkout

One receipt often indicates several product items, but the buyer's claims may relate to only one or some of them. In this case, you have to resort to a completely different version of the procedure. In general, it is similar to the situation when the client wants to completely abandon what he purchased, which means an application, delivery note and other documents are drawn up. But all this describes only specific items that must be returned to the store.

Accordingly, the new fiscal document will also contain information only on certain items. The funds are returned according to the same. The original receipt, which contains proof of other purchases, is not taken from the purchaser. A copy is simply made from it, which remains at the point of sale. Thus, the person receives a new warrant covering the items that were returned and keeps the old one to confirm ownership of all the others.

How to return a receipt using an online cash register legally: documentation

Despite the fact that for the buyer the algorithm of actions is quite simple and requires practically no effort, the seller has to additionally prepare a lot of paperwork so that there are no problems with the tax service in the future. Among them may be:

- Fiscal documents, that is, created directly on the cash register. These include all cash receipts, including those made for the purpose of correcting information.

- Exculpatory – confirming the legality of the procedure. They can be an application from the buyer, an act of delivery of a previously purchased product, or a letter of guarantee.

- Cash registers, which are created to record all transactions carried out at a retail outlet. These include receipts and expenditures, and a cash book.

With the introduction of innovations in the laws on trading activities, it has become easier to generate such reports, so this should be done without fail, and, if necessary, submitted to the tax service.

Writing an application

We have already talked about what is being included in this document, but let’s put another emphasis on its content. The buyer has the right to write an appeal to the director, but it must contain the following:

- Passport details.

- Why does the consumer refuse the purchased item?

- The price of the purchased product, the date and time of the transaction.

- Date, signature.

The store employee will have to ensure that it is filled out correctly, since this paper will remain here. The easiest way is to take care of timely printing of forms, which clients can fill out if necessary. As for the cash receipt, if possible, a copy should be made of it. If the receipt is lost, the cashier will have to find confirmation in the Federal Register, and reflect in the documents that the order itself was lost.

How to issue a refund on a card from an online cash register

Today, purchases with non-cash payments using credit cards are made much more often than with cash. In general, the measures for returning assortment do not differ, regardless of the payment method. Unless the card details are additionally entered into the application written by the buyer. In this case, funds can take up to ten days to arrive, and the client’s attention should be drawn to this so that he does not doubt the correctness of the seller’s actions.

Features of accounting for returns when combining tax regimes

The main feature of returning funds to the buyer’s bank card is that the acquiring bank does not explicitly write off the refund amount from the organization’s current account, but withholds it from subsequent deposits under the acquiring agreement.

A taxpayer who does not keep separate records may have problems accounting for income if the tax treatment of the refund and subsequent sales paid for with cards do not match.

According to the Tax Code of the Russian Federation, when combining the simplified tax system and UTII, the taxpayer must organize separate accounting of income and expenses within each type of activity (clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation). At the same time, for the purpose of calculating and paying UTII, tax accounting of income and expenses is not required. After all, the tax base—the amount of imputed income—is fixed.

Consequently, the main task when combining these regimes is to correctly determine the tax base and calculate the tax when applying the simplified tax system. This rule applies not only to “simplified” people with the object “income minus expenses,” but also to those who count only income.

For example, goods sold as part of activities on UTII are returned, and the following card payments are made for sales on the simplified tax system. This means that when the acquirer credits funds, it is necessary to recognize income under the simplified tax system in the full amount, without deducting the withheld return. And for the amount of the withheld refund - reverse the income on UTII.

We will consider the procedure for reflecting refunds to customers’ payment cards from “simplified” companies when combined with UTII using the following example.

If the purchase was made for cash, and they want to receive a refund via non-cash payment

To begin with, the client will have to clarify this desire in the application along with the details for transferring funds. Otherwise there are no differences from the general procedure.

The only point that should be further clarified is that such a change in the form of payment is possible only if cash was initially used. If the purchase was initially made using a bank card, it is impossible to exchange it for real money; the funds will be transferred to the credit card from which they were debited.

How to complete the procedure via POS terminal

Steps may vary slightly. It depends on the hardware you're using, but they usually look like this:

- The store employee selects the “Financial” section.

- Next, you need to stop at returning the goods and insert a customer card into the device.

- After this, the amount is entered, and the consumer confirms it and enters the PIN code.

- The completed check is printed and given to the purchaser.

The money must be returned within five working days.

Transfer of funds

You can return the money to the buyer when all documents have already been signed and prepared. If we are talking about a partial refund, and not about the full purchase amount, then the procedure will be similar. The cost, name and quantity of returned products must be indicated in the application.

If the purchase was made by bank transfer, then the sequence of actions of the cashier when returning the funds will not fundamentally change. In this case, the client will need to additionally indicate in the application the details for making a non-cash transfer. The money will be returned to the specified account within ten days.

Until funds are received, the buyer is advised to keep all completed paperwork. In most cases, no problems arise, but if, after all, the money has not been returned to the account, you will need to contact the bank and provide the responsible employee with documents to clarify the situation.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Why do you need a correction check?

The need for this document arises if the seller discovered his own mistake some time after the transaction was completed, when the buyer had already left the outlet. It is impossible to leave the situation as it is, since at the end of the day the profit at the cash desk will not correspond to the report. The printing of such a receipt is always accompanied by the preparation of a report indicating the error that occurred.

However, the preparation of an adjusted order is required only when excess funds are detected. If there is a shortage, there is no need to punch additional checks. The procedure must be completed before the end of the work shift and the preparation of the Z-report.

Responsibility for non-use of cash registers

Responsibility for violation of the law regarding the mandatory use of cash registers is established by the Code of Administrative Offenses.

The violator pays a fine. The amount depends on how much revenue the organization received that was not passed through the cash register. Both the organization itself (or individual entrepreneur) and the cashier who did not punch the check are fined.

So, the cashier will pay a fine of 25-50% of the proceeds that he did not clear through the cash register (minimum 10 thousand rubles), an organization or individual entrepreneur will pay a fine of 75-100% of the revenue (minimum 30 thousand rubles).

In the event of a repeated violation (failure to carry out transactions through a cash register) and if the revenue amounted to more than one million rubles, the company’s activities are suspended for up to three months.

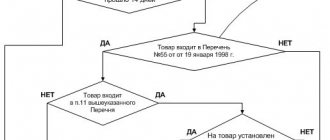

What products can be returned through online checkouts?

The consumer has the right to refuse any purchase, regardless of its quality, within a specified period. For products with properties that meet the requirements, it is 14 days, for defective items - a warranty period or 2 years, if one was not declared.

But there are exceptions included in a special list. These include things that provide personal hygiene, cosmetics and perfumes, underwear, medicines, household chemicals, plants, technically complex goods, animals and some other groups. They are not returnable under any circumstances.