If you believe adventure novels, receiving a large inheritance from an unknown or forgotten relative is extremely pleasant. However, for this to happen, someone must inform the heir about the inheritance and organize the process of receiving it. In novels, this is done by executors - people to whom the testator has entrusted the execution of the will.

Now they do not exist, and the functions of dividing the inheritance between heirs are carried out by notaries. Let's find out whether, according to the law, a notary must search for heirs. Cases regarding the division of inheritance can be complex. If you expect to inherit significant property, we recommend enlisting the help of a lawyer.

Fundamentals of Russian legislation on inheritance

Basic information about inheritance, heirs and inheritance is contained in Chapter. V Civil Code of Russia. There you can find out that inheritance is carried out either by will or by law.

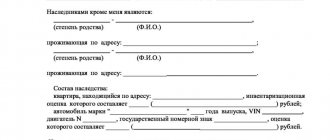

Within 6 months after the opening of the inheritance, all heirs who are ready to accept it must inform the notary at the place of residence of the testator or at the location of the inherited property. The division of property occurs only between heirs who agree to accept it.

Absolutely any person, group of people, any organization or group of organizations can become heirs under a will. The distribution of shares among the heirs occurs according to the will of the testator, reflected in the will certified by a notary. In some cases, the function of certifying a will may be performed not by notaries, but by other officials.

The rights of the testator to distribute his property are limited by law. Disabled relatives who are heirs at law, regardless of the will, receive at least half of what they would have received if there had been no will. Notaries notify the heirs under the will about this and seek the allocation of the share of the disabled heirs.

If there is no will, inheritance occurs according to law. Only relatives of the testator and local authorities can inherit in this way. If there are no heirs, the property becomes the property of local authorities.

Such property is called escheat. The testator's relatives are divided into succession lines. If there is at least one heir in the previous queue, applicants in subsequent queues do not receive anything. The legislation defines 7 lines of inheritance:

- Children, spouses and parents of the testator.

- Brothers and sisters, grandparents.

- Uncles and aunts.

- Great-grandparents.

- Children of nephews and nieces, brothers and sisters of grandparents.

- Cousins: grandchildren and granddaughters; nephews and nieces; uncles and aunts.

- Stepsons, stepdaughters, stepfather, stepmother.

The circle of heirs, depending on the circumstances, can be extremely wide. Some of them may indeed not know either about the inheritance or about the testator himself. Such heirs cannot contact a notary within the period established by law - 6 months after the opening of the inheritance.

The division of property is carried out without taking into account the interests of such people. But they do not lose the right to inheritance and can restore it through the court. If this happens, the division of property between the heirs will be carried out again, taking into account the rights of the new applicant.

If the property is sold, the new heir's share will have to be compensated with money. To prevent this from happening, oddly enough, the remaining claimants to the inheritance are most interested in finding an heir.

Testator

A testator is a deceased person who during his lifetime had property rights to something (movable and immovable property). The inheritance is transferred only after the death of the testator.

Who can be the testator? This is a capable person, an incapacitated person, minor citizens, a stateless person, etc. Depending on the status of the person, inheritance will vary.

If a person has legal capacity, then he has the right to write a will in advance for the person to whom he wants to transfer his inheritance.

If the testator is incapacitated or partially incapacitated, then it will not be possible to transfer his property by documenting it.

If a person did not leave any will during his lifetime, then the inheritance between the heirs will be divided in accordance with the law.

Responsibilities of a notary in searching for heirs

The notary learns about the death of the testator from one of the heirs. The law does not provide for any other communications for this purpose. If the notary knows the coordinates of other applicants for the inheritance, he is obliged to inform them about the inheritance.

The coordinates can be obtained by the notary from the will, from other claimants to the inheritance, or from other sources. So: the notary must inform the applicants for the inheritance, whose coordinates he has, but he is not obliged to search. Information about this is contained in Art. 61 “Fundamentals of legislation on notaries”.

In addition, the notary is not obliged to search for inherited property. He only has to check the estate at the address of the testator. Information about this is contained in Art. 71 of the above document.

The search for heirs of property falls on the remaining claimants to the inheritance, if they consider it necessary to do this. Without experience, it is extremely difficult to achieve results in such searches.

Applicants for inheritance should contact a search office or a notary. The notary is not obliged to search for inheritance and citizens who have the right to inherit, but he is not prohibited from doing so. The notary has access to the necessary databases and experience in such work. You can try to negotiate with him.

- To summarize, by law a notary is obliged to search for heirs if the notary: knows the place of residence of the heir;

- the place of work of the heir is known, which will allow him to be found.

Sources:

Order of succession by law

The notary's duty to notify the heirs

Checking the hereditary mass

Who determines the heirs?

Persons included in the list of heirs are determined at the legislative level by the norms enshrined in the Civil Code. Moreover, in each specific case, a person has the right to determine the fate of his property in the event of his death by leaving a will. This document sets out the last will of the testator regarding:

- persons who have the right to claim inherited property;

- a list of property that will be inherited;

- the shares of each heir in the inheritance (it may also be indicated which of the heirs will receive what property).

Expert commentary

Leonov Victor

Lawyer

By leaving an order in the event of his death, the testator independently determines the circle of heirs, as well as the list of the property that will go to them after his death. In fact, this can be done by every person who owns any property, and he must be fully capable. Persons who have not reached the age of majority, as well as those who are legally incompetent, cannot determine who will inherit property after them.

When can you accept an inheritance through hereditary transmission?

The law establishes a general period for accepting an inheritance both by law and by will; it is one - 6 months from the date of opening of the inheritance, which is the day of death of the testator (Article 1154 of the Civil Code of the Russian Federation).

But there is one deviation from this rule in the law - in the case of inheritance through hereditary transmission.

If the heir died at the beginning of the term or during the first three months of acceptance of the inheritance, then inheritance by way of hereditary transmission can be carried out by his heirs during the remaining part of the 6-month period of acceptance of the inheritance.

If the heir died later , and his heirs have less than three months left to accept the inheritance, then this remaining part of the period for accepting the inheritance is extended to three months (clause 2 of Article 1156 of the Civil Code of the Russian Federation).

If, under such conditions, the heirs miss the deadline for accepting the inheritance, in order to restore it they will have to present in court strong evidence of valid reasons for missing the deadline. However, if the heirs who have the right to accept the inheritance through hereditary transmission prove that they did not know and could not know about the opening of the inheritance, this will be an unconditional basis for restoring the period for accepting the inheritance.

If other heirs do not object to the heirs of the deceased heir accepting the inheritance after the end of the period for accepting the inheritance, then you can do without a trial; the notary will simply issue a new certificate of the right to inheritance, annulling the previous one. But it is important that the consents of other heirs be drawn up in writing and notarized, or drawn up in simple written form, but in the presence of the notary who is conducting the inheritance matter.

If the heir by law dies before accepting the inheritance

The heirs of the deceased heir receive, by way of hereditary transmission, the share of the inheritance that was due to the deceased heir, and divide this share among themselves. Accordingly, if there is only one heir in the order of transmission, the entire inheritance share will pass to him.

Thus, the inherited property is distributed among the heirs who inherit by way of hereditary transmission in the same way as in the case of inheritance by right of representation.

The remaining primary heirs receive their legal shares of the inheritance in accordance with the general procedure.

Cost of inheritance

The costs of acquiring the property of a relative who died but did not have time to accept the inheritance will be:

- 0.3% of the value of the inheritance for spouses, parents, children, siblings, but not more than 100,000 rubles;

- 0.6% for other heirs, but not more than 1,000,000 rubles.

Example. Citizen B. bequeathed an apartment worth 1,000,000 rubles. son S. B died on 01/04/2018, and S - on 01/20/2018, without having time to accept the inheritance. The value of the son’s property in the form of an apartment is 4,000,000 rubles. His wife will accept her father-in-law’s valuables as a transmitter, paying a state fee of 6,000 rubles. (RUB 1,000,000 X 0.06%). When accepting a spouse's apartment as an inheritance, the wife is exempt from paying state duty, since she lived in it with her husband and in accordance with Art. 333.38 of the Tax Code of the Russian Federation falls into the category of persons entitled to benefits.

In the above example, the spouse is the transmitter, since less than 6 months passed between the death of the father-in-law and the husband. If the husband had died on or before the death of his father on July 5, 2018, the wife would have inherited only the husband's property.

In addition to the state fee, the heirs pay the notary for technical and legal services, the cost of which is established by regional notary chambers. You can find out more about the tariff on the website of the Federal Notary Chamber.

Who can be considered unworthy of inheritance?

Current legislation implies the existence of unworthy heirs. But in order to recognize a person as unworthy of receiving inherited property, compelling reasons are required.

The grounds for declaring an heir unworthy include:

- Failure of a potential heir to fulfill his obligations towards the testator - such obligations may arise from the law or from contractual relations. For example, adult children did not provide proper care for their parents, or the person specified in the will did not fulfill his obligations under the lifelong maintenance agreement.

- Depriving parents of their rights - if parents do not fulfill the duties prescribed by law in relation to their children, then they can be deprived of their rights in court. Accordingly, at the same time, they lose the right to receive an inheritance after the death of their children.

- The heir commits illegal acts in relation to the testator - this can be causing death, failure to provide assistance at the right time, leaving him in danger, blackmail, threats and other illegal actions or inaction.

It is worth considering that the presence of each of the above grounds must be proven in the prescribed manner. Any interested party whose rights have been (or may be) violated has the right to do this. Most often, other heirs or their legal representatives apply to the court to declare a person unworthy of inheritance.

Mandatory share for certain categories of heirs

It must be taken into account that even if the testator wishes to leave without inheritance the first-line heirs who cannot provide for themselves, as well as disabled dependents, he will not be able to do this. The fact is that the law protects the interests of the following categories of persons:

- children of the testator who have not reached the age of majority;

- parents and surviving spouse, provided that they have lost their ability to work;

- dependents who are disabled.

The listed persons in any case can claim half of the part of the inheritance that would be due to them by law. It is worth considering that if there is a will, then the obligatory share is allocated from the property that is not indicated in this document. If there is no other inheritance, then the specified heirs have the right to receive their due portion from the inheritance mass determined in the will.

Expert commentary

Kolesnikova Anna

Lawyer

The testator may state his or her wishes regarding disinheritance of disabled relatives in a will. Such a document, in general, is legitimate, but every interested person has the right to challenge such a provision in court by filing a claim in court.