What should you think about “on the shore” before taking out a mortgage for two?

Yuliy Rovinsky: Before becoming co-borrowers, it is worth thinking about the consequences that may occur in the event of a divorce. In our opinion, the main risk for each of the borrowers is the fact that he [the borrower] remains a joint and several debtor of the loan to the bank, regardless of what rights to the apartment he retains. In other words, even if the apartment became the property of one of the spouses after a divorce, the risk remains that in case of non-payment, the bank may make a claim against the other spouse, who no longer has ownership rights to the housing.

Article on the topic

More alive than dead: how the year began for the real estate market

Pavel Ivchenkov: To avoid problems, you need to draw up a written agreement on what to do with the mortgage and apartment in the event of a divorce. It must state who will get the apartment (one of the spouses or will be divided into shares), who will receive compensation (if one of the spouses renounces his share), who will then pay the mortgage. This agreement must be executed by a notary. It is also worth agreeing with the bank and stipulating in the mortgage agreement what will happen to the mortgage and apartment in the event of a divorce of the borrowers. Some banks agree to include these clauses in the mortgage agreement.

What does the law say?

In accordance with the norms of the Family Code, which regulates property relations between spouses during family life and after divorce, a married couple has the right to determine for themselves how their property relations will be structured. Both the RF IC and a specially drawn up agreement between husband and wife can be used.

If the spouses do not enter into an agreement, in this case they will be subject to the provisions of the Family Code. If an agreement is drawn up, this document will be the main document when considering property disputes that may arise after a divorce.

A married couple has a choice - to enter into a contractual relationship between themselves that will provide rules for the division of their property during a divorce or to comply with the requirements established by the state.

If we consider the issue of a mortgage that was issued before marriage, guided by the Family Code of the Russian Federation, it can be argued that everything acquired by each individual spouse before marriage remains his property (clauses 1 and 2 of Article 34 of the RF IC). In this regard, no one should divide such property after its termination. But only if the mortgage was paid in full before the couple got married.

An apartment purchased by the borrower before the official registration of the relationship legally belongs only to him, and the second spouse cannot, in accordance with the law, claim this living space as a whole or any part of it.

How to get a divorce in a civilized manner if there is a mortgage for two?

Yuliy Rovinsky: If the concept of “civilized” implies the ability to divide property and debts without going to court, then doing this is quite problematic. However, when reaching agreement between spouses on property issues, there are ways that will allow you to get by with “little bloodshed.” If the spouses have agreed that upon division each will receive 1/2 of the ownership of the apartment, then after completing the appropriate procedures with the registrar's authorities, they should apply to the court with an application to divide the amount of debt and interest on the loan. Court practice on this issue is ambiguous, but the most recent decisions give a positive answer.

Pavel Ivchenkov: You can get a divorce “in a civilized manner” only with the help of a peaceful pre-trial agreement. It is better to involve lawyers for this and have all agreements drawn up in writing and notarized. Spouses can either divide the apartment and the mortgage payment into parts (equal or whatever they want), or one of the spouses will give up his share in the apartment in favor of the second, but then the mortgage will be paid by the spouse who receives the entire apartment. In the second option, the spouse who refuses the apartment can do so for free or receive compensation for his share from the second spouse (the so-called “compensation”) - this is at the discretion of the person himself. If he renounces his share in the apartment, the spouse must contact the bank so that it transfers his part of the mortgage debt to the second spouse, who will receive the apartment. There is also a third option - the spouses can sell the apartment purchased with a mortgage, pay the remaining debt to the bank from the amount received, and divide the rest of the money at their own discretion. Any of the actions described above requires permission from the bank, because with a mortgage the apartment is pledged. Thus, Article 391 of the Civil Code of the Russian Federation states that the transfer of a debt from a debtor to another person can be made by agreement between the original debtor and the new debtor. In this case, the debtor's transfer of his debt to another person is permitted with the consent of the creditor and in the absence of such consent is void. And the mortgage law prohibits performing any actions with the collateral without the permission of the mortgagee, i.e. in this case the bank.

Dialogue always helps. Advice from a psychologist for those who want to save their family

Read more

From love to divorce: who needs prenuptial agreements and why?

Every year in Russia, almost 100 thousand couples enter into marriage contracts - the Federal Notary Chamber has spoken about this trend over the past two years. Alexandra Stirmanova from S&K Vertical S&K Vertical Federal rating. group Family and inheritance law group Private wealth management group Arbitration proceedings (major disputes - high market) group Bankruptcy (including disputes) group Corporate law/Mergers and acquisitions 18th place By revenue 25-27th place By number of lawyers 6th place By revenue per lawyer (more than 30 lawyers ) connects this with the fact that the general idea of a marriage contract is changing. If earlier it was perceived more as a way to protect the rights of a non-working spouse, now it is an effective protection mechanism for both. According to Olga Puchkova, leading expert of the family and inheritance law group of Pepelyaev Group Pepelyaev Group Federal rating. group Foreign trade activities/Customs law and currency regulation group Tax consulting and disputes (Tax consulting) group Tax consulting and disputes (Tax disputes) group Labor and migration law (including disputes) group Digital economy group Antimonopoly law (including disputes) group Land law/Commercial real estate/Construction group Intellectual property (including disputes) group Compliance group Natural resources/Energy group Pharmaceuticals and healthcare group Environmental law group Bankruptcy (including disputes) group Corporate law/Mergers and acquisitions group Family and inheritance law TMT group (telecommunications, media and technology ) group Financial/Banking Law group Arbitration proceedings (major disputes - high market) group Dispute resolution in courts of general jurisdiction the media, or rather scandalous stories of division of property and, conversely, successful examples: those who understood the advantages of concluding such a agreement. Now, according to Kira Coruma, partner at AK Asnis and Partners Asnis and Partners Federal Rating. family and inheritance law group, the portrait of those who enter into a contract looks like this: 50 years old, above average income, have property, married for 20-30 years, want to get a divorce.

Despite the growing popularity of prenuptial agreements, many are still wary of them. In Puchkova’s practice, there are cases when a wedding was canceled after one of the future newlyweds proposed to conclude an agreement.

Perhaps this is for the best: financial issues in the family are very sensitive, and if the couple is not ready to talk about it right away, “on the shore,” then it will be even more difficult later.

Olga Puchkova, leading expert of the family and inheritance law group Pepelyaev Group Pepelyaev Group Federal rating. group Foreign trade activities/Customs law and currency regulation group Tax consulting and disputes (Tax consulting) group Tax consulting and disputes (Tax disputes) group Labor and migration law (including disputes) group Digital economy group Antimonopoly law (including disputes) group Land law/Commercial real estate/Construction group Intellectual property (including disputes) group Compliance group Natural resources/Energy group Pharmaceuticals and healthcare group Environmental law group Bankruptcy (including disputes) group Corporate law/Mergers and acquisitions group Family and inheritance law TMT group (telecommunications, media and technology ) group Financial/Banking law group Arbitration proceedings (major disputes - high market) group Dispute resolution in courts of general jurisdiction

The rules and procedure for such an agreement are regulated by Chapter. 8 SK. The agreement can be drawn up before marriage, then it will acquire legal force with a “stamp in the passport,” or it can be concluded by a married couple. In this case, it is considered concluded from the moment it is certified by a notary. This procedure is mandatory. The notary will check the legality of the conditions and “weed out” unacceptable clauses.

The Supreme Court allowed spouses to divide personal property

Previously, Stirmanova says, notaries refused to include provisions on the spouse’s personal property in the marriage contract. When, for example, a husband decided to transfer to his wife an apartment that he had bought long before marriage. Disputes on this issue were resolved by the Supreme Court in 2021. Having considered case No. 2-1070/2018, the “troika”, chaired by Alexander Klikushin, gave the couples freedom, indicating that spouses can not only change the regime of assets acquired during marriage, but also decide the fate of personal assets. Svetlana Ivanova from FTL Advisers FTL Advisers Federal rating. Group Family and Inheritance Law Group Compliance Group Private Wealth Management Group Corporate Law/Mergers and Acquisitions Group Tax Consulting and Disputes (Tax Consulting) believes that if previously the courts considered the issue differently, now the practice will become uniform.

Marriage contract: expectation and reality

Prenuptial agreements in Russia are not as common as in the West. The media cite the most incredible points of agreement between stars and public figures. Tom Cruise and Katie Holmes have as many as 900 clauses in their contract, one of which is that the wife must agree with everything her husband says. And Bill Gates prescribed the right to cheat once a year. Another famous couple, Catherine Zeta Jones and Michael Douglas, estimated their infidelity at $5 million. Russian couples also tried to bring Hollywood scenarios to life. Thus, a family from the Moscow region entered into an agreement that if the husband cheats, he will lose his property. But later the Supreme Court declared this clause illegal. He noted that compensation for infidelity is not allowed in a marriage agreement (case No. 2-6102/2013). According to Stirmanova, everything related to personal relationships must be deleted from the contract.

What a marriage contract does not regulate:

- responsibility for treason or insults;

- the right to choose a profession;

- getting an education;

- duration of marriage;

- the birth of a child of a certain gender;

- who will the child stay with after the divorce?

As for the recognition of the entire marriage contract as invalid, this will happen if it “puts one of the spouses in an extremely unfavorable position” (according to Article 44 of the Family Code). In judicial practice, starting with the Resolution of the Plenum of the Supreme Court of November 5, 1998 No. 15, an approach has been formed according to which we are talking specifically about “deprivation of all property.” Thus, in case No. 2-2637/15, the Supreme Court declared the marriage contract invalid because the person was left without anything.

But unequal division of assets is not a reason to cancel the agreement, the courts come to this conclusion. So, the ex-wife received an apartment, and her ex-husband only received a garage and a car, and the Supreme Court did not find anything illegal here (case No. 2-96/2015).

What to include in a prenuptial agreement?

A prenuptial agreement can solve several problems, according to Denis Golubev, advisor in the judicial and arbitration practice of AB Egorov, Puginsky, Afanasyev and Partners Egorov, Puginsky, Afanasyev and Partners Federal Rating. group Antitrust law (including disputes) group Arbitration proceedings (major disputes - high market) group Compliance group Corporate law/Mergers and acquisitions group International litigation group International arbitration group Maritime law group Dispute resolution in courts of general jurisdiction group Capital markets group Family and inheritance law group Insurance law group Labor and migration law (including disputes) group Criminal law group Private capital management group Pharmaceuticals and healthcare group Financial/Banking law group Environmental law group Bankruptcy (including disputes) group Foreign trade activities/Customs law and currency regulation group PPP/Infrastructure projects group Land law/Commercial real estate/Construction group Intellectual property (including disputes) group Tax consulting and disputes (Tax consulting) group Tax consulting and disputes (Tax disputes) group Natural resources/Energy group TMT (telecommunications, media and technology) group Transport law group Digital Economy 1st place By revenue 1st place By revenue per lawyer (more than 30 lawyers) 1st place By number of lawyers Company profile:

- protection of personal property of spouses acquired before marriage;

- termination of the regime of joint ownership of new property;

- protection of the personal assets of one of the spouses in the event of financial difficulties or claims against the other spouse;

- resolving inheritance planning issues.

The exact wording of the prenuptial agreement depends on the couple: “There is no single solution for newlyweds and spouses with multiple marriages and significant assets.” But the expert recommends that all couples enter into contracts. According to Puchkova, a marriage contract is a flexible and universal instrument; in practice, not all of its capabilities are used.

What to include in a prenuptial agreement:

- changes in the composition of the property of each spouse depending on the number of children: as a rule, two or three children born one after the other do not allow the mother to fully build a career, and therefore over time her financial situation becomes dependent;

- provision for the maintenance of an economically weak spouse upon divorce. As a rule, this is a spouse who did not have an independent income and devoted his time and effort to children and the household. The agreement will help take into account his services to the family;

- procedure for incurring family expenses during marriage. This will help maintain mutual respect, especially when the family is financially dependent on one person.

Olga Puchkova, leading expert of the family and inheritance law group Pepelyaev Group Pepelyaev Group Federal rating. group Foreign trade activities/Customs law and currency regulation group Tax consulting and disputes (Tax consulting) group Tax consulting and disputes (Tax disputes) group Labor and migration law (including disputes) group Digital economy group Antimonopoly law (including disputes) group Land law/Commercial real estate/Construction group Intellectual property (including disputes) group Compliance group Natural resources/Energy group Pharmaceuticals and healthcare group Environmental law group Bankruptcy (including disputes) group Corporate law/Mergers and acquisitions group Family and inheritance law TMT group (telecommunications, media and technology ) group Financial/Banking Law group Arbitration proceedings (major disputes - high market) group Dispute resolution in courts of general jurisdiction.

The spouses themselves decide what expenses to include in the agreement: from paying for housing and communal services to purchasing vouchers and expenses for the education of children. The main thing, Puchkova notes, is that both clearly understand what legal consequences may arise.

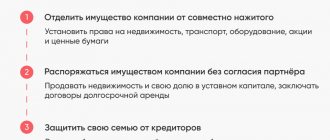

Protect your business

Now, according to Natalya Kotlyarova, partner of MGP Lawyers MGP Lawyers Federal rating. Group Bankruptcy (including disputes) Group Land Law/Commercial Real Estate/Construction Group Corporate Law/Mergers and Acquisitions Prenuptial agreements are very popular among businessmen. The agreement gives entrepreneurs freedom in marriage, says Natalya Patseva, managing partner of FTL Advisers FTL Advisers Federal Rating. Group Family and Inheritance Law Group Compliance Group Private Wealth Management Group Corporate Law/Mergers and Acquisitions Group Tax Consulting and Disputes (Tax Consulting) . You do not need to obtain your spouse’s consent to make transactions with shares in an LLC, and in the event of a divorce, you can avoid splitting the company. That is, in fact, to separate business and family. Otherwise, if such a contract is not concluded, in the event of a breakup, the ex-husband or wife will receive part of the shares in the company. He or she can either sell it or try to exercise his corporate rights: interfere in the affairs of the company, including for revenge.

Personal or joint: division of property during divorce

Often the business partners of one of the spouses insist on concluding a marriage contract - they do not want family affairs to affect the common business. Koruma recommends including in the contract a provision on the transfer of the business to the spouse who runs it, and on the payment of maintenance or compensation to the other spouse. This should suit both parties.

The spouses share not only income, but also debts. That is, if a husband or wife took out a loan to develop a business, then debt collection can be applied to joint property. So, a marriage contract is also convenient for the other party in order to protect themselves from business risks. To do this, you need to include a clause on the personal responsibility of the businessman for debts associated with his work.

Lately, Puchkova admits, her colleagues have often been involved in comprehensive estate planning for entrepreneurs. Having grown their own business, they want their business to continue. Together with testamentary dispositions, a prenuptial agreement can help with this.

If it's a mortgage?

Mortgage debt is not common regardless of who the loan is issued to. Now, according to Puchkova, banks themselves often offer to conclude a marriage contract. This is also necessary for their convenience: it is easier to deal with one borrower than with two. Koruma believes that this is how banks insure themselves against non-repayment of loans and division of mortgage housing. A prenuptial agreement will help you agree in advance on how to return money to the bank in the event of a divorce and who will ultimately get the property. Then after the breakup there will be no questions.

The banks themselves recommend specifying several points in the agreement:

- who is responsible for the down payment;

- who will pay for the loan;

- determine shares in real estate;

- indicate the amount of compensation in case of relinquishment of the share;

- how to divide property during divorce.

Puchkova says that in some cases banks will not approve a mortgage without a prenuptial agreement, for example, if one of the spouses has a “white” salary, and the other is semi-officially engaged in freelancing. The expert advises couples to first consult with specialists. It is possible to draw up an agreement under which one of the spouses acquires the property as personal property and assumes the entire debt. Even if his partner helps with payments, he will not receive legal rights to purchase.

There is no general recipe here, says Puchkova, you need to take into account all the details of the family’s financial situation.

There are also those who view the marriage contract as a tool for illegal actions. Thus, potential bankrupts use such agreements to hide property from creditors. But Coruma believes that the jurisprudence has already matured, and these attempts are often futile. Ivanova agrees with her. According to her, transactions involving the alienation of the debtor’s property are quite successfully challenged by creditors or financial managers. A prenuptial agreement is no exception. The Plenum of the Supreme Court in 2021 indicated that the spouse who received common property under a division agreement must return it to the bankruptcy estate (“On some issues related to the peculiarities of the formation and distribution of the bankruptcy estate in cases of bankruptcy of citizens”). One of the latest examples is case No. A51-12465/2018, in March 2021 the cassation declared the marriage contract invalid.

Family transactions in bankruptcy: do's and don'ts

Conscientious spouses will turn to prenuptial agreements even more often, Golubev believes. He attributes this to both the growth of mortgage lending and the abandonment of the prejudice that “a prenuptial agreement is a sure sign of a future divorce.”

Some people are still prejudiced against, say, televisions, Puchkov says ironically, but they are in almost every home. The same will happen with prenuptial agreements.

- Anastasia Sinchenkova

- Business

- Supreme Court of the Russian Federation

What to do if you couldn’t get a divorce in a civilized manner?

Pavel Ivchenkov: If a civilized divorce did not work out when the mortgage was issued for two spouses, then there is only one option left - going to court. In this case, each of the parties will present their demands and their justifications to the court, and the court will decide how to divide the apartment purchased with a mortgage, and who will pay it in what shares. True, in such cases the court always involves a third party - the bank. As a rule, the court makes one of the following decisions:

Article on the topic

Life after a mortgage. Will rates on already issued loans increase?

– The apartment becomes the property of one of the spouses together with the obligations to pay the remaining part of the mortgage. In this case, the court collects compensation from the wife in favor of the husband in the amount of half of the paid value of the mortgage. That is, for example, the apartment goes to the wife along with the mortgage debt, and the husband gets compensation.

– The apartment is divided between the spouses into shares (most often into equal shares, but the share of the spouse who will directly live with minor children can be increased), and each spouse pays the mortgage for their share independently. No compensation is awarded to either spouse.

Protecting the child as an owner

A transaction involving a minor is complex, as there is a conflict between banking interests and the guardianship authorities. To sell an apartment, the share of which belongs to a child in accordance with an article of the Civil Code of the Russian Federation, it is necessary to obtain permission from the guardianship authorities. Basically, the rights of minors are protected by departments of the district administration or other divisions of local self-government bodies.

To obtain their consent, it is necessary to collect certain documents:

- Parental passports

- Marriage certificates

- Birth certificates of children

- Title documents for both apartments being sold and purchased

- Certificates of estimated value and cadastral passports

If the child is already 14 years old, his consent to conduct this transaction is also required. This package of documents is sometimes much larger than the package required to complete the purchase and sale transaction itself.

But even after this, the guardianship authorities may refuse to carry out the transaction. After all, according to common sense, if an unencumbered one-room apartment is exchanged for a more spacious one, but mortgaged to the bank, this can also be regarded as a deterioration in the child’s living conditions. A default can always happen, and the child will remain on the street, and the guardianship authorities have no right to allow this. Municipal employees, as a rule, are sensible people and should understand that a small risk in this case is justified - otherwise the family is unlikely to ever be able to move into a normal apartment. Therefore, most often consent is still given.

“A lot depends on the type of permission issued by the guardianship authorities. The result is also influenced by the quality of preparation for the meeting with municipal authorities, as well as the specific district, specialist and even the application form,” says the general director

"First Mortgage Agency", Maxim Eltsov. Permissions vary. The first provides the option of allocating a new share of the property to the child after the mortgage is paid off. The second permit requires this to be done immediately, at the moment when the purchase and sale agreement is concluded. The first method is more convenient, as the bank will issue a mortgage loan sooner. But the second method, according to Maxim Eltsov, is used much more often.

How will the paid and remaining payments be divided in the event of a divorce?

Pavel Ivchenkov: If during a divorce one of the spouses abandons the apartment in favor of the other, then he can claim compensation, usually in the form of half the cost of the apartment. In this case, the spouses can agree among themselves on the amount of compensation independently; they know better who is owed what.

There are cases when the second spouse receives compensation in the amount of the mortgage debt already paid at the time of divorce (i.e., the first spouse buys out the mortgage from the second or buys out the part that the second paid from his income), and the remainder of the debt is paid by the one to whom I got the whole apartment. If the spouses cannot agree, the amount of compensation is determined by the court. As a rule, the court simply divides the market value of the apartment in half or divides the cost of the mortgage in half (finds it out from the bank).

If during a divorce neither spouse gives up the apartment in favor of the other, then each receives their own share in it (they agree on it themselves or through the court). In this case, the remaining part of the mortgage unpaid at the time of divorce is also divided into shares that are equal to the shares in the apartment. And each spouse pays their share of the remaining debt. Previous payments (debt already paid at the time of divorce) are not taken into account, and in this case no one is entitled to any compensation.

30 thousand for divorce. Will the government teach Russians to keep love a tax?

Read more

Child and mortgage

The child itself will not change anything - the bank, when making a decision on issuing a mortgage loan, does not divide clients into “children” and “childless”. The bank only tracks the borrower's income level. It’s a different matter if the family already owns an apartment, upon the sale of which it will be possible to make a down payment.

If a minor lives in this residential premises as a member of the owner’s family (that is, has a regular residence permit), then you can buy, sell and pledge the acquired property as usual. It’s another matter if the child is the owner of the apartment or a share in it. Then the real difficulties begin.

Have there been cases in your practice when people changed their minds about getting divorced because of the mortgage?

Pavel Ivchenkov: No, there were no such cases. But I can say that here everything depends on the reasons for the divorce and the financial condition of the people: if these are minor quarrels, everyday disagreements that one of the spouses can no longer tolerate, then a mortgage can “save” the family, since too much money is at stake . If the reason for the divorce is some difficult circumstances, then a mortgage will not save the marriage.

See also: State duty for divorce in 2015 →

Who can withdraw from the contract?

It is allowed to change the composition of debtors under a loan agreement. With the consent of the bank, the following rearrangements can be made within the framework of one agreement:

Replacing the title borrower with another individual - transfer of debt obligations.

Loan “Collateral Loan+” Norvik Bank (Vyatka Bank), Person. No. 902

from 8.8%

per annum

up to 8 million

up to 20 years

Get a loan

Replacement of one or more co-borrowers, or their withdrawal from the agreement without the involvement of other (alternative) persons.

Reassignment of status - replacement of the title borrower with a co-borrower and vice versa.

There are no restrictions on such actions. Changes in the composition of debtors are initiated by the main client. Exception: withdrawal or replacement of a co-borrower when it comes to an official family. It is prohibited to remove a spouse from a loan agreement if the marriage has not been officially dissolved, or if a marriage agreement (contract) has not been concluded between the parties.

Advantages and disadvantages of the decision to sell

Selling a mortgaged apartment during a divorce has its pros and cons.

The advantages include:

- Release from debt obligations.

- Former spouses are freed from the need to live together.

The disadvantages include:

- Difficulties in obtaining bank consent.

- Difficulties in finding a buyer who would agree to buy an apartment under encumbrance.

- The property will have to be sold below market price.

So, if the division of property and debt obligations is impossible for some reason, the former spouses can sell the property. When looking for a buyer, there is no need to hide the fact that the apartment is under encumbrance . However, due to the encumbrance, the apartment will have to be sold at a price that is lower than the market price.