What is meant when we talk about “duplicate TIN”, “Copy of TIN”, and “re-obtaining TIN”?

So, you've lost your TIN and need to get your TIN back, but what does that mean?

Let us immediately note that the individual number that was initially assigned to you will remain unchanged. Therefore, the procedure for restoring the TIN involves obtaining the document again, rather than issuing a new one.

What will they give you when you apply again: a copy or a duplicate?

A duplicate is an original copy of a previously issued document , which has the same legal force as the original. A duplicate is issued to replace the lost paper and a note is made on it by hand or with a stamp in the upper right corner: “duplicate”.

A copy is issued in the case where the original exists, but there is no way to show it or transfer it for long-term storage. A copy, even a notarized one, does not have the same legal force as an original or a duplicate.

Just in case, it is advisable to always have a certified copy of the document on hand. If you suddenly lose your TIN and need paper, such a precaution will make life much easier, since the identification number will still remain the same.

Thus, if you lose your TIN, you must go through the procedure of re-obtaining it, as a result of which you will be given a duplicate of the lost document. How to apply for a TIN through Gosuslugi - read here.

How to obtain duplicates of constituent documents: request procedure

- name of the legal entity;

- main state registration number;

- TIN and KPP - these data can be clarified on the Federal Tax Service website by entering the name in the form at egrul.nalog.ru;

- legal address of the company;

- information about the applicant: full name, passport details, address and contact telephone number of the director;

- the reason for applying for duplicates (loss, damage to documents);

- preferred method of receiving a response.

We recommend reading: P.228 part 5 the longest term

The applicant in this case is the head of the legal entity (CEO). If another person is engaged in the restoration of documents, the power of attorney on behalf of the executive body of the LLC must contain instructions both for a request to the Federal Tax Service and for receiving ready-made copies with a list of them.

Can it be restored if lost?

As noted above, if you lose your TIN, you can only restore it, but not get a new document. Since the taxpayer identification number is issued only once and does not change throughout life.

This is due to the fact that the TIN is intended to control tax deductions , and all fees are received only according to the identification code assigned to you. This greatly facilitates the work of the tax service, since all information on payments is assigned to one taxpayer number.

At the same time, the TIN code does not contain personal information about an individual or legal entity, only information about his location at the time of receipt of the document.

Thus, all the information necessary to obtain a duplicate TIN is in the tax service database, so you can restore the document under any circumstances.

Consideration of special cases

There are some nuances and key features of obtaining a taxpayer identification number in certain situations that need to be paid attention to, since sometimes the procedure can change significantly.

Obtaining a TIN for a child

Tax registration for children is carried out by legal representatives. In accordance with Russian legislation, a parent, adoptive parent, guardian or trustee can obtain a TIN for a child. To do this, you will need the following documents:

- Passports of the legal representative.

- Birth certificates of a minor.

- Certificates from the passport office (if the passport does not contain a mark indicating registration at the address of residence).

To assign a taxpayer identification number to a child, the legal representative must submit an application to the tax office at the address of residence.

A child over 14 years of age has the right to independently apply both for the initial receipt of a document and for its restoration, replacement or loss at the MFC. A prerequisite in this case is that the minor has a passport.

Restoring the certificate

A unique code is assigned once and remains with the carrier forever. The individual code does not change even if the person moves to a different address. In a situation where the certificate is lost, damaged or stolen, restoration of the TIN is possible by contacting the tax office or the MFC. When applying for a certificate again, a duplicate will be issued.

To restore the TIN if lost through the MFC, you will need to go through a procedure similar to the initial application for a unique code. With one exception, you can obtain a duplicate TIN from the MFC only after providing a receipt for payment of the state duty.

Replacing a document

When a person changes their last name (usually due to marriage or divorce), the unique taxpayer code does not undergo changes. However, in this situation it will be necessary to replace the certificate. To change the TIN at the MFC to a new one with current information, you do not need to pay a state fee. In this case, replacing the TIN in the MFC is carried out in the same way as its initial registration.

Stamp in passport with assigned TIN

A similar service is not provided at the MFC. The mark is affixed only to the tax service. The procedure is carried out in the presence of the client and does not take much time - no longer than 15-20 minutes.

Where to restore? Where to contact?

Only the tax service can help you in restoring your TIN, since all the necessary information is available only there. You can contact it in different ways depending on what is more convenient for you.

The only limitation is that the tax office where you will submit documents must be located at the place of your residence or registration.

So, you can contact the tax service:

- personally;

- through a representative, if an individual for some reason cannot appear in person;

- via mail, and all necessary documents must be sent to the address of the tax office at your place of registration.

How to obtain duplicates of the Charter, TIN certificate and Unified State Register of Legal Entities (OGRN certificate)

OGRN - (main state registration number) - state registration number of a record of the creation of a legal entity or a record of the first submission in accordance with the Federal Law “On State Registration of Legal Entities” of information about a legal entity registered before the entry into force of this Law

Using a regular power of attorney from a company, a duplicate of a record sheet on the creation of a company can be obtained only in two cases: if the manager personally ordered a duplicate of the record sheet, and it is issued by proxy, or the request is submitted as a postal item, and the completed record sheet is sent by mail to legal address of the organization. As experience shows, not everyone has established postal services for the company’s registration address; moreover, the wait for a document by mail sometimes exceeds a month and this letter does not always reach the addressee.

What documents are needed?

Let's figure out what papers need to be provided and how the packages of documents sent to the tax service in different ways differ from each other.

To begin with, here is a list of documents that must be submitted in any situation:

- An identification document, usually a passport. You need to make a photocopy of it in advance (no need to certify it) - it is handed over. Take the original with you too; you will need to show it to the tax officer.

- Document on registration at the place of residence. A photocopy of it is also required.

- Original receipt for payment of state duty.

- Application drawn up in form 2-2.

If you contact the tax office in person, these are all the documents you will need. In other cases, you will additionally need:

- When applying through a representative - an officially certified document certifying the authority of the representative. It is advisable to have a copy.

- If you apply via mail, then copies of identification documents and confirmation of registration must be notarized.

The procedure for obtaining and restoring a TIN is simplified as much as possible, so the list of documents is quite small. The only point with which difficulties may arise is filling out the questionnaire.

The procedure for obtaining a TIN through the MFC

Obtaining a TIN certificate at a multifunctional center is quite simple if you follow the step-by-step instructions presented below.

Required package of documents

When contacting the MFC, if the applicant is receiving a TIN for the first time, you will need to provide the following documents:

- Application in form No. 2-2-Accounting. or fill it out directly when visiting the MFC with the help of an operator.

- Citizen's passport. If there is no registration mark in Russia, it must be stamped or formalized; otherwise, the applicant must provide another document confirming his place of residence (a certificate from the passport office).

Foreigners and stateless persons wishing to obtain a TIN certificate at the MFC will need to provide a completed formalized application and a passport with a notarized translation. To obtain a TIN through the multifunctional center, the applicant presents the necessary package of documents in originals. All copies are made by an MFC specialist independently.

Additional explanations on the procedure and rules for filling out an application for a TIN are given in the video of the tax service.

If the documents will be submitted by a representative, you will additionally need a power of attorney drawn up at a notary office indicating the corresponding authority.

Contacting the multifunctional center

You can obtain a TIN at the MFC either at your place of residence or at any regional office. If there is no permanent registration on the territory of Russia, foreigners issue a certificate at the address of residence, and in the absence of the latter, at the place where the real estate is located or the vehicle is registered.

The certificate is issued at multifunctional centers only in person or through a representative, since it is impossible to obtain a TIN at the MFC via the Internet. Before visiting the establishment, you can choose the most suitable office location and find out the opening hours.

Clients at the MFC are accepted on a first-come, first-served basis using an electronic coupon, which is taken directly upon visiting the office or by appointment (via the website or by phone)

The employee checks the correctness of filling out the application (or helps to complete it on the spot), as well as the completeness and sufficiency of the submitted papers. The planned date when you can obtain a TIN certificate from the MFC must be indicated in the receipt issued by the center employee as proof of the fact of application and submission of documents.

Deadlines and state fees

It is possible to issue a TIN at the MFC free of charge only when applying for a unique code for the first time or when replacing it with another surname. The procedure for issuing a certificate should not exceed 5 working days. Another 1-2 days should be added to this period for sending documents between the MFC and the tax office. Thus, the final processing time for the document will be approximately a week.

To restore the TIN through the MFC if the certificate is lost or damaged, you need to pay the amount of state duty established by law, the amount of which in 2021 is 300 rubles.

Do I need to fill out the application again?

Yes, it's necessary. Moreover, the form for filling out the questionnaire is the same as when you first received the TIN: 2-2 “Application of an individual for registration with the tax authority.”

The application form can be found on the Internet on the official website of the Federal Tax Service and filled out at home yourself. In this case, the following design requirements must be taken into account:

- You cannot print the form on both sides of one paper, that is, all three sheets of the application are printed separately.

- You cannot fasten sheets in a way that destroys the paper, for example, with a stapler.

- The text should not contain corrections, including those made using a proofreader.

- The form is filled out with a ballpoint pen in block letters. If you use computer typesetting, the font should be “Courier New”, size 16.

The application must also indicate the reason for re-issuing the paper. Usually, simply indicating that the previous document was lost is sufficient.

If you decide to submit an application directly to the tax office, they will give you a form. In addition, you can also find an example of filling out the document there. Usually they are weighed on special stands.

State duty for duplicate tax identification number of a legal entity 2021

Cool, man. Galitsky said something similar before his dismissal from Magnit. Well, the official data from Pyaterochka says... Retailers threatened the Central Bank to boycott the fast payment system because of... And I don’t trust it; I describe my opinion on the situation using information available in open sources. The news seems to hint that not everything is within the law.

- application in person, at the place of legal registration. This is the fastest option, but it requires a direct visit. However, the costs will be minimal, that is, only for duties;

- through a representative. Also quite quickly, but you will need to make a power of attorney first. Please note that the head of the company does not need an additional document to obtain the company’s TIN. That is, there is no need to issue a power of attorney for him. But the inspector of the Federal Tax Service of the Russian Federation, when issuing a duplicate, may ask to confirm the authority of such a person, that is, to provide an order for his appointment. But in the case of the founder of the company, this is not required, since data about him is in the Unified State Register of Legal Entities;

- through the website of the Federal Tax Service of the Russian Federation. In this case, you will still have to appear in person to get the duplicate. That is, you can only submit an application electronically. And this form of filing does not relieve you of the need to pay a state fee. Do not confuse obtaining a duplicate with registering a company;

- by registered mail. This option for obtaining a duplicate is the most time-consuming and troublesome. First of all, it's long. You will receive a duplicate 5 business days after the letter reaches the tax office. Secondly, it means additional costs for sending a letter. Thirdly, you will need to enclose copies of passport pages, certified ones, to confirm your identity and that you have the right to a duplicate.

Until 2021, the certificate was issued on a secure color form; later the document began to be drawn up on a regular sheet of paper. And from April 29, 2021, all documents confirming the fact of registration of a legal entity, including a certificate, began to be issued in electronic form. A paper document can now only be obtained upon request from applicants.

- will indicate the payer status - 01;

- recipient - the Federal Tax Service for Moscow, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26);

- KBK - 182 1 0800 110;

- OKTMO - at the location of the court;

- basis of payment (field 106) - TP;

- in fields 107 “Tax period”, 108 “Document number” and 109 “Document date” will enter 0;

Staging physical persons for tax registration. You can generate, register and send an application to the selected inspection, then track information about the status of its processing (see how to order a TIN via the Internet). After the procedure is completed, the user will need to come to the inspection to receive a paper certificate; It is not provided in electronic form, which means you cannot print your TIN from the tax service website.

Cost and state duty. Fines

You can get a TIN for the first time completely free of charge, but there is a state fee for issuing a duplicate. How much ? Its size depends on the time frame you need to receive the document:

- If the paper is not needed urgently, and you are willing to wait five working days, then the fee will be 300 rubles.

- If you need the document urgently, then after paying a fee of 600 rubles, it will be in your hands the very next day.

Russian legislation does not provide for serious fines or administrative liability for loss of TIN. Now you know how much it costs to lose a document!

You can pay the state duty through an ATM, having previously received the details from the tax office, or online, using the official website of the Federal Tax Service.

When submitting documents for TIN restoration, you must provide the original receipt.

State duty for duplicate tax identification number of a legal entity 2021

A duplicate is prepared within 5 working days. If the company is registered before July 1, 2021, the fee will be 200 rubles. If the company is registered after the specified date, the fee will be 20% of the amount paid upon registration. That is, if you paid 2,021 rubles for registration, then the fee for issuing a duplicate will be 400 rubles.

As practice shows, ordering a duplicate TIN certificate of an individual to replace a lost one is available to the public using all the methods listed above. The only drawback when ordering a duplicate TIN via the Internet is the need for personal presence when receiving a paper copy.

This means that you can submit an application through an intermediary or by registered mail without attaching such a copy. However, in this case, the issuance of a duplicate will extend over the period during which the tax office will request information about you from the relevant authorities. So the more data a legal entity provides, the faster it will receive the required document.

Acceptance of requests for the issuance of a duplicate State Registration Number at MIFNS No. 46, submitted personally by the head, is carried out in window 67. You must first obtain a category N coupon. A duplicate certificate is issued when ready in the same window and can be obtained by proxy. The most important thing on the topic: “State duty for a duplicate registration of a legal entity” with comments from professionals. If you have any questions, you can contact the duty consultant.

To eliminate confusion with the coincidence of the full names of individuals and the names of legal entities, a system of unique numbers was introduced to accurately identify the taxpayer. TIN, or taxpayer identification number, is a sequence of numbers, a special code that is assigned in accordance with clause 7 of Art. 84 of the Tax Code of the Russian Federation, to every taxpayer on the territory of the Russian Federation.

How long?

As noted above, you must be issued a new document five working days from the date of submission of the application. Or the next day, if you paid extra for urgency.

There is a way to find out at what stage the application is being considered. When submitting an application, it is assigned a certain code, by entering which in a special section on the FMS website, you can find out the degree of readiness of the document.

The completed document can be collected personally by the taxpayer or his official representative.

If the paper is not received on time or you sent the request by mail, a completed duplicate will be sent by registered mail.

Why do you need a OGRN?

The legislator introduced the OGRN in order to systematize and control enterprises operating in Russia. Using numbers, they create a unified database and registers containing information about taxpayers.

OGRN contains a lot of information. It allows you to check the accuracy of the reporting provided, find out whether the enterprise operates legally, and obtain information about the founders and legal address. With its help, you can check whether the company is at the stage of liquidation or bankruptcy and whether it is included in the tax blacklist.

You will need your OGRN to indicate it as details when drawing up applications to banks, tax and other organizations. It is customary to indicate the registration number along with the name of the organization. In addition, OGRN is useful for providing information about yourself to the counterparty; it is requested as part of the verification of counterparties.

How to restore a TIN if lost via the Internet?

Many people know that today you can absolutely safely obtain a TIN for the first time via the Internet. But is it possible to restore a document just as easily?

Unfortunately, at the moment neither the official website of the Federal Tax Service nor the government services portal provide such an opportunity . The only thing you can do via the Internet is to pay the state fee and receive an application form, Form 2-2.

And if you only need the identification number itself without an official document, you can find it online. To do this, go to the Federal Tax Service website and select the section entitled “Find out your TIN.”

To send a request, you will need to fill out an electronic form, which will require you to indicate your date of birth, full name, series and number of your passport, and the date of issue. Data processing will take a couple of minutes, after which you will see your TIN.

TIN - meaning and application

The identification number is assigned to taxpayers once. This code is unique and consists of 12 digits. It is used for the following purposes:

- individual accounting of tax deductions and pension savings;

- receiving a deduction when filing a tax return 3-NDFL;

- opening your own business with individual entrepreneur status.

Even if the certificate is lost and restored, the individual number is retained. It can be assigned at any age if you have the necessary documents. Persons over the age of 14 who have received a passport receive a certificate on their own; before this age, a parent or legal guardian is required for registration.

All identification numbers are entered into the Unified State Register of Real Estate. This register is the database of the Federal Tax Service. Thanks to it, you can find out your personal taxpayer code. Proceed according to the following algorithm:

- Go to the official website of the Federal Tax Service https://www.nalog.ru/rn43/.

- In the list of services section, find “Information about the TIN of an individual.”

- Confirm your consent to the processing of personal data.

- Fill in the required fields - last name (indicate the one for which the TIN certificate was issued), first name and patronymic, date of birth. Select the type of identification document, enter its series and number. Additionally, you can enter your place of birth with the date of issue of your identity document, but these fields are optional.

- If the data is filled out correctly, a field with the Taxpayer Identification Number (TIN) will appear on the screen.

It is important to note that the request on the official website is free. Third-party resources may provide information for a fee, and entering passport data on them is unsafe.

Precautionary measures

Private Taxpayer Identification Numbers are a real problem. Therefore, we recommend that you take some precautions to help keep the document safe and sound.

So, to begin with, we recommend that you laminate the document if there is a risk of damage. Store documents only in a designated place.

Reference . You should not bend the sheet, as there is a possibility of damage to the document and disappearance of important information. Make several copies of your Taxpayer Identification Number (TIN). This way you definitely won’t be able to lose these important papers.

Alternative methods

Other places where you can also restore your TIN certificate are the post office or an intermediary company. You can collect a package of documents, fill them out and send them to the inspectorate where the first copy was issued by mail.

Lawyers, accountants, lawyers can also help in this matter. In particular, they can act as a representative of an individual, provided that the person himself does not have the opportunity to appear at a government agency in person.

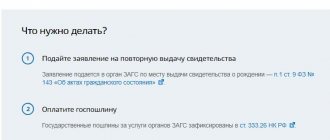

You can also contact the MFC or the State Services portal. And if in the MFC you can restore a document by promptly receiving a duplicate, then this cannot be done on the State Services portal. There you can only request some information that will be useful for correctly filling out the application.

What is a TIN, to whom and why is it issued?

A taxpayer identification number is assigned to citizens of the Russian Federation for the purpose of further payment of the corresponding budget contributions. Details include 12 digits. Each combination carries a specific meaning:

- the first 4 digits are the designation of the tax accounting authority;

- the next 6 digits are the payer number;

- the last 2 digits are control type values.

The value is assigned until the end of a person's life. In accordance with federal legislation, the TIN is included in all documents addressed to direct payers. Replacement can only be carried out after the specific circumstance has been updated.

Brief information - why do you need a TIN?

A taxpayer number can be obtained on a voluntary basis. Some companies won't hire someone who doesn't have one.

Codes of this type have been introduced since 1999. The number is issued to a citizen only once in his life and never changes. If the certificate was lost, a new copy will contain the same number. And data about the code is stored in the Unified State Register of Taxpayers.

Provided that the employer does not insist on providing a paper copy of the number, you can simply call it out to the company. All transferred taxes will be credited exactly to the citizen to whom the TIN belongs. All pension contributions are tied to the same code.

How to change the TIN if personal information changes

In the event of a change in personal data or loss of the TIN certificate, you need to familiarize yourself with the provisions of Article No. 23 of the current Tax Code of the Russian Federation.

This part of the normative act does not provide for applying for a new certificate to the Federal Tax Service when changing the surname. The same is said in the official procedure for assigning a TIN. You can change the document if you wish.

The step-by-step algorithm and registration instructions are very simple for individuals. Citizens can live in any region of the Russian Federation and change their document even remotely. You don't need to have any special skills. It is enough to collect a package of documents and contact the authorized tax authorities. The organization’s employees are always ready to accommodate applicants and provide comprehensive advice on all government services.

It is not recommended to deceive inspectors and obtain a second certificate for selfish purposes. Such offenses fall under administrative liability and entail the imposition of penalties.

How to find out your TIN status online

Information about the status can be found on the Federal Tax Service website. All you have to do is enter your personal information to quickly get the data. Search results are displayed on the screen of a computer or mobile device within a few seconds. You can also directly interact with government agency employees at the place of registration.

The data does not change even if the taxpayer’s personal data changes. Cancellation of the number occurs only after death.

Is it possible to carry out the restoration procedure in another city?

If you need to restore the TIN of a legal entity or individual, all procedures are performed at the tax office. If a person has changed his place of residence, there is no need to adjust the document. The rule applies only if the certificate is in the hands of the taxpayer. However, if the paper is lost, filing an application with the tax authority is acceptable. You need to contact the institution associated with your actual location. All data is in a single database. Therefore, there will be no problems with obtaining paper.