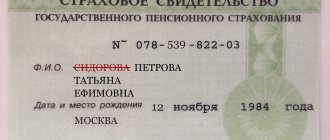

The individual taxpayer number (TIN) must be changed if the last name has been changed.

You can submit an application without leaving your home using the State Services Internet portal. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

This article discusses in detail the possibility of updating an identification number when changing your last name through State Services.

In what cases is it necessary to replace the TIN?

The TIN number is unique and is issued once and for life. The twelve-digit number itself cannot be changed; it will remain the same. However, in some cases it is possible to replace the form of the Certificate of Registration.

Cases when it is necessary to change the TIN certificate:

- its loss or damage;

- change of surname, first name or patronymic.

Replacement is not required if you change your place of registration.

Remember, even the slightest mistake when filling out will either lead to you being immediately asked to fill out the form again, or the documents will be accepted, and later a refusal to assign a TIN will come.

Change the name via the engineering menu

The engineering menu is used for testing and optimal configuration of mobile devices. This area is hidden, but can be activated using certain USSD commands entered through the standard dial pad. These commands may differ for different smartphone models.

After

IMEI is changed as follows:

- Go to Connectivity -> CDS Information.

- Open the Radio Information tab and click on the Phone 1 line.

- In the window that appears, the available IMEI will be indicated in the first field. To replace it, after the AT command, write EGMR=1,7, “New ID”, where you need to indicate the required ID code in brackets.

- Confirm your actions by clicking SEND AT COMMAND.

For the changed settings to take effect, the smartphone must be restarted. After you have succeeded in changing the IMEI, you can verify the positive result using the same command *#06#.

How to change TIN: instructions

TIN - where is it changed?

To change, you can contact the tax office directly (at your place of registration), or the department of the multifunctional center ( MFC ) (this is just the answer to a frequent question from our readers: is it possible to change the tax identification number in the MFC?), which performs the functions of the tax service.

What documents are needed?

To replace, you must provide the following package of documents to the inspection officer:

- passport with registration mark,

- a document confirming permanent registration, if such a mark is not in the passport;

- marriage certificate or a copy thereof (in case of changing the TIN due to a change of surname);

- old Inn certificate to be replaced;

- receipt of payment of the fee (payment must be made only in case of loss or damage to the certificate!);

- statement (more details below).

Do I need to write any statements?

To replace the TIN certificate, you must write an application in the established state form (Form No. 2-2-Accounting). A sample application can be taken from tax service or MFC employees and filled out on the spot.

The application must indicate the full name. And. o., date of birth, gender, passport details, place of residence, information about changing the last name, first name or patronymic (if any).

Application for change of TIN - form.

Cost and state duties

Re-obtaining a certificate is subject to a fee only if it is lost or damaged. The state duty in this case is 300 rubles.

When changing your last name, first name or patronymic, obtaining a duplicate is not subject to state duty.

Replacement timing

The legislation does not regulate the period during which it is necessary to change the TIN. The TIN certificate itself is almost never required to be presented.

An individual also has the right not to distribute information about the TIN anywhere. The only exception is the situation when an individual gets a job in government agencies.

In this case, the new certificate must be in hand and the information in it must match the passport data, which should be taken into account when replacing. A new form with the TIN is made within 5 calendar days , that is, during this period after submitting the application, the citizen is obliged to appear at the tax authority to receive a new TIN certificate.

Required documents

To replace the certificate after receiving a new name, the interested person needs to collect the following list of documents:

- Your passport , which is already registered in your new name.

- A document confirming the citizen’s permanent registration in the area where the tax authority is located. This certificate of permanent residence must be given to tax inspectors if such information is not contained in the document that confirms the identity of this citizen.

- Original and copy of marriage certificate.

- Previously received certificate. After the applicant receives a certificate under a new surname, the old document will be destroyed.

A citizen will be able to go through the procedure for obtaining a new certificate completely free of charge. It is worth noting that payment of a receipt for replacing a tax certificate may only be necessary if the tax document is re-issued.

If a citizen pays an unnecessary receipt, he will not be able to get the money back.

Is it possible to make a replacement online? How to do it?

The TIN certificate can be replaced without contacting the tax office. The change can be made online on two websites:

- official website of the Tax Service of the Russian Federation - www.nalog.ru;

- official website of the Public Services Portal - www.gosuslugi.ru.

Change on the tax service website:

- Go to the website https://www.nalog.ru and find the “Individuals” section. The website must have a registered personal account. If the site does not have a personal account, then on the page that opens, select “Registration”, enter personal data, indicate your email address and create a password. After this, you need to confirm your registration via an email sent to the specified address and log into your personal account.

- On the right, in the “Electronic Services” section, select “Submission of an application for registration” and click on it.

- If payment of a state duty is required (in case of loss or damage), then you must additionally go to the “Payment of state duty” section and make a payment of 300 rubles.

- Fill out the online registration application form, click “Save” and send it to the tax service. If the online application is successfully submitted, a confirmation email will be sent to your email address.

- If an individual does not have an electronic signature, then after some time an email will be sent with information about when and where you can receive a new document.

After this, within the specified period, you must appear in person at the tax office with an identity document and pick up a new document. - If the taxpayer has an electronic signature, then the certificate can be received electronically (download it from the website) or by registered mail with an inventory.

Replacing TIN through State Services:

- Open the official website https://www.gosuslugi.ru. You must also have a registered personal account. Log in to your personal account.

- In the “Public Services” section, select the “Registration of an individual” item and click on it.

- In the window that opens on the right, select the “electronic” option from two options for submitting an application.

- Complete the online application form and submit.

Wait for a response about the place and time of receiving the new document. After receiving the response letter, you must personally go to the tax department within the specified time frame with your passport.

How to obtain a TIN for a foreign citizen through State Services - read here.

Service cost and waiting time

Many people want to understand not only how to change their last name in the TIN, but also how much it will cost. Depending on the reasons for applying for a new certificate, this service is paid or free. A citizen will be charged a state fee of 300 rubles if he asks for a duplicate to replace a lost or damaged original.

If a new certificate is issued due to a change in personal data, the service is free. Some say that even in this case you have to pay a state fee of 300 rubles, but this is not so. If a woman got married and took her husband’s surname, then when presenting a marriage certificate, she will not have to pay for the issuance of a new certificate with the previous TIN. They will not take money even if the citizen has changed his personal data for any other personal reasons.

According to the regulations on how to change the TIN after marriage, tax authorities have 5 working days to prepare the papers. When contacting the MFC, the period increases to 7 working days due to the transfer of documents from the center to the inspection. Usually, the service is provided faster; when applying, we recommend asking for a contact phone number or other means of informing about the readiness of the document.

Please note: now the TIN assignment certificate is issued on a regular sheet of paper with a stamp. Since 2021, the authorities have stopped printing forms with watermarks, holograms and protective layers.

How can you change your TIN if you are not at your place of registration?

Replacing the TIN certificate form in person is only possible at the place of registration. If an individual is in another city and does not have the opportunity to personally come to the tax authority, then a new form can be issued by mail.

To do this, you must send an application in the prescribed form by registered mail with acknowledgment of receipt and attach to it a notarized copy of your passport, a copy of the document confirming registration and a receipt for payment of the fee (only if the TIN is issued due to damage or loss of the old one).

After receiving the letter by the tax authority, a completed duplicate of the TIN certificate is also sent to the individual by registered mail with acknowledgment of receipt.

If an individual has his own legal representative, who has the opportunity to contact the tax service (at the place of registration of the individual), then he can submit all the necessary documents in his place. A representative of an individual also has the right to pick up a new TIN certificate.

To do this, the legal representative must contact the tax office with a written application for registration, a document confirming registration and a passport of the individual being registered.

The legal representative must have a document with him that confirms his authority.

The need to replace a document

A taxpayer identification number (hereinafter referred to as TIN), which consists of 12 digits, is assigned to any citizen only once. This number is assigned to a specific person for his entire life.

The legislation of the Russian Federation does not have such a resolution where it is written that an individual who has changed his last name must necessarily change his TIN. After all, when a person receives a passport with a new last name, information about the change in personal data is immediately sent to the tax service.

Moreover, if a citizen received a new certificate for his current surname, then this action will not contradict the law.

Changing the id through additional software

Using specialized software requires superuser rights on the phone. They can be activated using the programs Romaster SU, UniversalAndRoot, Farmaroot, etc.

So, to open extended access on a mobile device via Farmaroot, you need to:

- Install the program on your phone and run it.

- In the window that appears, tap Install SuperSU.

- Select one of the suggested rooting methods (for example, Boromir).

- Restart the device.