Author

Sergey Ershov

Registration number in the register of lawyers of St. Petersburg – 78/5563

In your new marriage, you have a child and the burden on the family budget has increased. And the “ex” doesn’t want to hear about reducing the amount of payments for your first-born. The only way out is to reduce child support at the birth of a second child through the court. In the article I will provide an algorithm of actions in the form of step-by-step instructions, as well as examples from existing judicial practice.

Is it possible to reduce the amount of payments?

The law allows for a reduction in the amount of alimony. This is possible if the parties have changed their financial/family situation. Other significant circumstances that have arisen in the life of the payer or recipient of funds may also be taken into account - Art. 119 RF IC. It could be:

- The appearance of other minor/disabled adult children by the alimony payer, as well as other persons whom he is obliged to support.

- Low income/loss of job by payer.

- Deterioration in the health of the person making the payments/child for whose maintenance they are paid.

You can reduce alimony:

- Judicially.

- By concluding a notarized agreement/amending it by the parents of the child for whom payments are made.

In the second case, this is allowed if the recipient of alimony meets the payer halfway in this matter. However, in practice, the first option is most often used.

As a rule, when reducing the amount of payments, courts take into account the following circumstances:

- The amount of income of the payer.

- The presence of other children and their number among the parties.

- Being dependent on other parties.

- The health status of the child's parents.

Important! Changing the amount of payments when a child appears in a second marriage is the right of the court, not an obligation.

See also:

In what cases is the payer exempt from paying alimony in 2021 - a complete list of grounds

What are the reasons for reducing alimony in practice?

The legislation of the Russian Federation does not contain rules establishing a list of grounds for reducing alimony payments. However, after considering numerous court cases, an approximate list was formed. So, changing the payment amount downward is possible in the following cases:

- When assigning the first/second disability group to the payer. Because he needs significant additional expenses to improve his health.

- Ownership of property by a minor that generates significant additional income (for example, an apartment that is rented out).

- The presence of a minor child for whose support payments are made has his own source of income, and its amount is sufficient to provide for his basic needs. In this case, the salary of the parent paying child support must be minimal.

- Being dependent on the payer of other persons whom he is obliged to support by force of law (elderly parents/disabled people).

- Significant deterioration in the financial situation of the payer due to the birth of a second/third/fourth child. At the same time, it is possible to reduce the amount of payment for the first-born if the level of support for the second child deteriorates significantly due to alimony payments to the first.

- The payer is already making payments to other minor children with different mothers.

- The minor is fully supported by the state. For example, if he lives in a boarding school/studies in a cadet corps. The payment is set in an amount sufficient to purchase things exclusively necessary for the child.

- Significant reduction in earnings/loss of income by the payer.

- The payer has a very high income, a quarter of which covers all the necessary needs of the minor.

What are the nuances of reducing payments at the birth of subsequent children?

Next, we will consider the nuances of reducing payments in court when the payer has subsequent children:

- The birth of a third child does not affect the process of reducing the amount of payments for the previous two children. Since three children are entitled to half of the total income, and shares are distributed at 1/6 for each of them.

- The amount of payments may be able to be changed upon the birth of a fourth and subsequent children to a man in a new family. At the same time, the shares are redistributed as follows: for four children (50% of total earnings) - 12.5% for each child, for five children (50% of total earnings) - 10% for each.

Rules for filing claims

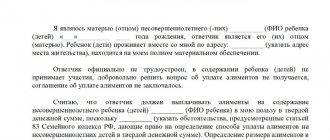

A statement of this kind requires the following information:

- personal data of the plaintiff and defendant;

- a brief summary of the issue;

- contact details of both persons (addresses, telephone numbers, email addresses);

- information necessary to consider a specific situation.

A claim to reduce the amount of alimony can be filed by a person who is married or who is officially divorced at the time of filing.

The application is submitted to the judicial authorities located directly at the place of registration of the person who is entrusted with the obligation to pay alimony. If for some reason this is not possible, then the filing on behalf of the plaintiff can be made to the court at the place of his own residence. This can be done either in person or by mail (regular, or better yet, registered mail).

There is a simplified form created by the legislation of the Russian Federation for the collection of alimony payments using a court order. The person concerned must apply to the local judicial authorities to obtain such an order against the person obligated to make such payments. The review of such a document is much faster and the response to it is also faster. If the defendant receives any objections, the process of considering the court order will be canceled, and the final outcome of the case will be decided within the framework of the lawsuit.

Who has the right to file a claim?

The legislator limits the circle of persons who have the right to initiate a claim to change the amount of alimony. Such a requirement may be made:

- A person obligated to pay alimony (to reduce the amount).

- Recipient of payments (about increasing their size).

This is possible if there is a change in the financial or marital status of either party. At the same time, such a change in the parent’s position in itself is not an unambiguous basis for satisfying his claim. When considering the case, the court must establish the fact that these changes do not allow the party to maintain payments in the same amount - clause 57 of the RF Supreme Court No. 56.

Who can apply

An explanation of how to reduce the amount is contained in Resolution No. 56 of December 26, 2017. Clause 57 states that a request to change the amount of payments may be made by:

- a parent obligated (by court or voluntarily) to pay child support;

- the actual recipient of alimony acting in the interests of the minor.

The list is exhaustive; other interested citizens (new spouse, second wife, mother of a newborn) cannot file a similar claim.

How to reduce child support for the first child at the birth of the second

Decide on a method to reduce the amount of payments for the first-born.

Depending on the method of assigning payments for the first child, actions aimed at reducing payments will differ. The following methods are distinguished:

- Appointment of alimony in proportion to the parent’s income.

- Payments are set in a fixed amount.

- Payments are determined in shares and in a fixed amount of money, taking into account the requirements of paragraph 1 of Art. 81 and paragraph 1 of Art. 83 RF IC.

- Alimony payments are made by agreement of the parties.

Next we will consider them in more detail.

Important! When considering cases of reduction of payments due to a change in the financial/family situation of the parties, the application of clause 2 of Art. 81 of the RF IC is erroneous, since this paragraph regulates the possibility of reducing shares when assigning alimony in court. You should be guided by Art. 119 RF IC - Section VIII of the Review of Judicial Practice of the RF Armed Forces.

How to reduce alimony paid as a share of income

This method is also called “standard”, since it is quite common in practice.

If, when considering a case on the collection of alimony for a minor in proportion to earnings, it is established that the person is already paying it on the basis of a judicial act/agreement for other children, the amount is determined by the court in accordance with the law.

In this case, the court should be guided by the provisions of paragraph 1 of Art. 81 of the RF IC, according to which payment is subject to recovery from the child’s parents monthly in the amount of:

- For one child - one quarter.

- For two children - one third.

- For three or more children - half the earnings/other income of the parents.

The most common misconception when reducing payments is that it will be enough to contact the bailiffs for a recalculation or immediately go to court with a claim to reduce alimony, attaching the birth certificate of the second child. In this case, the bailiff will recalculate, and the court will automatically reduce the amount. However, it is not.

There is a certain order that must be followed to obtain the desired result. Please note that it is important to file a statement of claim, and not receive a court order, as was done previously.

Why a statement of claim and not an application for a court order?

Previously, the mother of the second child filed an application for a court order, which was silent about the first child and the obligation to pay child support to him.

Next, they received a court order, which ordered payment in the amount of ¼ of the income, and then a claim was filed to reduce payments for both women to the same magistrate. However, now this does not work in court.

This is due to the fact that such cases were previously heard by the same magistrate. Now claims to reduce alimony are being considered by district courts. RF Armed Forces Resolution No. 56 blocked this possibility.

A court decision to collect alimony is guaranteed evidence of a change in the financial and family situation of the payer in his claim to change the amount of payments for the first child. In this case, the circumstances established by the court in the framework of the claim for the recovery of alimony by the second wife are not subject to re-establishment and proof in the claim for the reduction of alimony.

After receiving such a decision and entering into legal force, the alimony payer submits a claim to the court to reduce the amount of alimony previously established by the court for a child from the first marriage from ¼ to 1/6 of the income. The reasons are given as circumstances indicating his difficult financial situation in connection with the birth of his second child.

The courts often satisfy such claims and reduce child support payments from 25% to 16.5%. At the same time, they are guided by the provisions of the law, according to which the amount of alimony for the maintenance of two children should not exceed 1/3 of the parent’s earnings. Since children are equal in their rights, this share is distributed proportionally.

Please note that if payments for children were awarded in shares of income, then their new amount must also be determined in shares.

The court decision to collect alimony is subject to immediate execution - Art. 211 Code of Civil Procedure of the Russian Federation. The writ of execution for their collection must be sent to the bailiffs for execution.

Also, with this method of assigning alimony, you can use the following option for changing the amount of payments for the first child - switching from a shared form to a fixed one. The basis for this will be the payer’s lack/reduction of official income.

Let me give you an example. At the time of collecting alimony, the man was employed. Later, he entered into a new marriage and had a daughter. The money became insufficient, and I was fired from my job. He filed a claim to reduce payments and change the amount from equity to lump sum. The reason is the deterioration of the financial situation and lack of work. The claim was satisfied.

How to reduce alimony paid in a fixed (fixed) amount

Alimony is collected in a fixed amount of money in the absence of an agreement between the parents on its payment in the following cases - Art. 83 Civil Code of the Russian Federation:

- The person obliged to pay them has irregular earnings/income.

- The parent receives the salary fully/partially in kind/foreign currency.

- If he has no earnings/income.

- Collecting alimony in proportion to the parent’s earnings/income is impossible, difficult or violates the interests of one of the parties.

It is also possible to reduce such alimony payments on the basis of judicial acts (as with the shared option). However, it is more difficult to achieve a reduction if the amount is fixed and linked to the cost of living. The plaintiff will need to prove:

- Change in financial situation.

- Increase in his expenses.

- Inability to maintain the previous level of payments.

Sometimes it is possible to achieve a reduction in payments by switching from a fixed form to an equity one. An additional basis may be, for example, the official employment of the payer and the provision of a certificate of income.

However, in this case, the plaintiff must prove the change/absence of the circumstances that served as the basis for the collection of alimony in a fixed sum of money - Section VIII of the Review of Judicial Practice of the Armed Forces of the Russian Federation.

Let's look at an example. At the time of collecting alimony, the man was unemployed, and the court established payments in the form of 9,000 rubles. Then he got a job and had a son. He goes to court with a claim to change the method of collection from a fixed form to a shared one. The salary is 18,000 rubles, if the claim is satisfied, alimony will be 4,500 rubles, not 9,000 rubles.

Important! Judicial practice on alimony disputes shows that when considering this category of cases, judges are guided by their inner conviction. Under the same circumstances, some refuse to reduce payments, while others, on the contrary, satisfy the claim.

How to change payments paid by agreement of the parties

If you paid alimony for your first-born child under a notarial agreement, you can change it at any time with the consent of the other party. This is possible by making changes to it, which must also be certified by a notary.

However, in practice, the mother of the first child rarely agrees to resolve this issue. Therefore, the payer has the right to make such changes to a previously concluded agreement in court. The lawsuit should ask the court to change the terms of the agreement, and not to reduce alimony.

See also: How to terminate an agreement to pay child support in 2021 - instructions + judicial practice

What other ways can you reduce alimony?

I will give another effective way to reduce payments previously established by the court. Sometimes, as a basis for reducing alimony, you can refer to Art. 61 of the RF IC, according to which parents have equal rights and bear equal responsibilities in relation to their children.

Let's look at an example. The payer has a high income of 250,000 rubles. The amount of payment per child in the amount of ¼ of the income is 62,500 rubles, which is significantly more than the amount of funds sufficient to support a minor, because The cost of living in this region is 12,400 rubles.

The ex-wife’s income is 40,000 rubles. If alimony was collected from her, she would pay 10,000 rubles. Since according to Art. 61 of the RF IC, parents bear equal responsibilities for the maintenance of their children. In the claim, we ask:

- Reduce the amount of alimony to the amount of 12,400 rubles.

- Change the previously established amount of payments from a share of earnings to a fixed sum of money equal to one subsistence minimum in the child’s region of residence, which will amount to 12,400 rubles.

It should be noted that this method sometimes works.

Alimony through court

For two children, the court sets alimony in the amount of 1/3 of the income. Since one of the mothers decided to use this method, the payment will be 1/6 of all sources of income.

Accordingly, if both women decide that they want to go to court, then the father will have to pay 33% of his total income for child support every month. Moreover, in addition to salary, this could be the amount from renting out the property. It can also be deductions from pensions, scholarships, bonuses and all other sources.

As a rule, such deductions go through the employer's accounting department. The bailiffs send a writ of execution there, and when your salary is calculated, the required amount will be automatically debited from you every month.

There is also a simplified procedure when the mother applies to the magistrate to obtain a court order. This method is very convenient if the second spouse is not hiding and is ready to provide financially for his son or daughter.

How to apply for a reduction in alimony - instructions

Follow the following algorithm:

- Prepare documents confirming the validity of filing a claim in court.

- Determine the court you should go to.

- File a claim in accordance with the requirements set out in Art. 131 Code of Civil Procedure of the Russian Federation.

- Find out the bank details for paying the state fee on the court’s website/at its office and pay it.

- Send one copy of the claim with copies of the attached documents by a valuable letter with an inventory of the attachments to the Defendant (ex-wife).

- Submit a statement of claim to the court in one of the following ways: by post, in person/through a representative at the court office, or through the State Automated System “Justice” portal on the court’s website. Please attach to the claim receipts for payment of state fees and documents confirming that a copy of the claim was sent to your ex-wife.

- Take part in court hearings.

- After a positive court decision is made, wait for it to enter into legal force. If the decision is not in your favor, appeal.

- Receive and submit a writ of execution to the bailiffs/employer at the place of work for recalculation of payments.

Important! If the court changes the amount of previously established payments, their collection in the new amount is made from the day the court decision enters into legal force, that is, one month from the date of its issuance - Art. 209 Code of Civil Procedure of the Russian Federation. However, such a reduction does not relieve the obligation to pay existing alimony arrears.

How to prepare a claim for reduction

When preparing a claim, adhere to the requirements specified in the Code of Civil Procedure of the Russian Federation.

The document is drawn up in writing and must comply with those specified in Art. 131 Code of Civil Procedure of the Russian Federation requirements. The claim states:

- The name of the court you are applying to.

- Your full name and place of residence, as well as your contacts (phone, email).

- Information about the defendant - full name, place of residence/work, as well as one of the citizen’s identifiers: SNILS, INN, passport series and number, driver’s license series and number, vehicle registration certificate series and number.

- The title of the document is “Statement of Claim to reduce the amount of alimony previously established by the court.”

- Circumstances that serve as grounds for reducing the amount of payments: changes in financial/family status, as well as other grounds worthy of attention.

- Evidence demonstrating the impossibility of maintaining payments in the same amount.

- References to legal norms, including Art. 119 of the RF IC that the amount of payments can be changed, as well as based on judicial practice.

- Request to the court - Change downward the amount of alimony established by a judicial act/agreement of the parties. For example: in proportion to earnings from ¼ of income to 1/6 of the Plaintiff’s income.

- List of documents attached to the claim.

- Date of preparation.

Be sure to sign the statement of claim in person.

Sample statement of claim to reduce the amount of alimony (DOC 19 KB)

What documents will be needed

Prepare the following package of documents:

- A copy of your passport.

- Copies of children's birth certificates.

- Copies of marriage/divorce certificates.

- Confirming the basis for the occurrence of the obligation to pay alimony (agreement of the parties/court decision/court order), the fact of a change in the financial situation of the payer and the impossibility of maintaining payments in the same amount.

- A certificate of income of the payer for the year preceding the filing of the claim.

- Confirming payments previously made by the alimony payer for the first/second/third child.

- Evidence supporting the grounds for reducing alimony.

- Confirming compliance with the pre-trial procedure (on amendments to the agreement on the payment of alimony).

- Receipt for payment of state duty/documents confirming the right to benefits.

- Documents confirming the sending/delivery of copies of the claim and documents attached to it to the parties.

- Other documents.

How much is the state fee for filing a claim?

A document confirming payment of the state duty must be attached to the claim. Its size is determined as follows.

According to clause 5 of PP RF Armed Forces No. 56, the rules for claims of a property nature subject to assessment are applied to claims of alimony payers to change the amount of payments established by the court - clauses. 1 clause 1 art. 333.19 Tax Code of the Russian Federation.

In accordance with paragraphs. 2 p. 1 art. 333.20 of the Tax Code of the Russian Federation, the price of a claim for a request to reduce the amount of alimony is determined according to the rules of clause 6, part 1, art. 91 of the Code of Civil Procedure of the Russian Federation - for claims for reduction of payments, based on the amount by which payments are reduced, but not more than for a year.

To calculate the duty, you need to establish the difference between the established and the amount of payments to be established for the future for the year. In simple words - the size of the reduction per year.

The specifics of calculating the state duty depend on the method of payment and the amount of potential benefit that the plaintiff may receive after the claim is satisfied. In this case, the amount of income of the alimony payer is taken minus the withheld income tax.

Below I will give examples of duty calculations for different payment methods.

How to calculate the state duty when reducing alimony in hard form

In this case, calculating the amount of state duty will not be difficult. For example, a man pays alimony in a fixed amount of 12,000 rubles. monthly. The lawsuit asks to reduce the payment to 7,000 rubles. per month, justifying this by the birth of a second child and a difficult financial situation.

If the court reduces the amount of payment, its benefit will be: 5,000 rubles * 12 months = 60,000 rubles. This will be the price of the claim. According to paragraphs. 1 clause 1 art. 333.19 of the Tax Code of the Russian Federation when the claim price is from 20,001 rubles to 100,000 rubles. The fee is set at 800 rubles + 3% of the amount exceeding 20,000 rubles.

In this case it will be 800 rubles. + 40,000 rub. (60000-20000) *3% = 800 + 1200 = 2000 rub. Thus, you need to pay 2000 rubles.

How to calculate when reducing alimony in a shared ratio

Calculating alimony collected on a shared basis is somewhat more difficult. There are two calculation methods that are accepted by courts. The average income for the previous year or the current one can be taken as a basis.

Let's consider the calculation procedure using the example of the average income received by the payer for the last year. To determine the amount of the fee, the payer's income for the year preceding the filing of the claim is taken.

For example, a man makes payments in the amount of ½ part (50%) of all types of earnings for three children from a previous marriage. In connection with the birth of his fourth child, he goes to court and asks to reduce the amount of payments to 1/3 (33%) of his total earnings.

His total income for the year preceding the filing of the claim amounted to 500,000 rubles:

- From this amount, alimony in the amount of 250,000 rubles was withheld.

- 1/3 (33.3%) of the total income would be 166,500 rubles.

- 250000 – 166500 = 83500 rub.

Consequently, the benefit (cost of claim) from reducing the amount of payment will be 83,500 rubles. According to paragraphs. 1 clause 1 art. 333.19 of the Tax Code of the Russian Federation when the claim price is from 20,001 rubles to 100,000 rubles. The fee is set at 800 rubles + 3% of the amount exceeding 20,000 rubles.

In our example it will be 800 rubles. + 63500 rub. (83500-20000) *3% = 800 + 1905 = 2705 rub. Thus, the state duty will be 2705 rubles.

Important! Disabled people of groups I and II are exempt from paying state fees when going to court - paragraphs. 2 p. 2 art. 333.36 Tax Code of the Russian Federation. To confirm the benefit, you must attach a supporting document to the claim/application.

Which court should I go to?

Cases arising from family relationships, including requests to reduce the amount of alimony, are subject to the jurisdiction of district (city) courts, regardless of the cost of the claim.

Claims by payers to change the amount of payments established by the court, in accordance with Art. 28 of the Code of Civil Procedure of the Russian Federation, subject to the jurisdiction of the court at the place of residence of the defendant - clause 2 of the RF Supreme Court No. 56.

What are the deadlines for considering a case in court?

According to Art. 154 of the Code of Civil Procedure of the Russian Federation, civil cases are subject to consideration and resolution within two months from the date the application is received by the court. Depending on the complexity of the case, it can be extended by no more than 1 month.

The period for consideration of the case does not include the time given by the court for reconciliation of the parties and elimination of shortcomings when leaving the claim without progress.

Paying taxes when filing a claim

Almost any legal proceedings involve the payment of certain types of tax. In this situation, this is a state duty. There is no clear indicator, and its size depends on various factors:

- the real cost of a claim to reduce alimony;

- the price of a claim of a property nature (not subject to assessment);

- the specific value of the claim based on a non-property issue.

The issue is regulated by Article No. 333 (19) of the Tax Code of the Russian Federation, and calculations are carried out on an individual basis based on the current situation.

When can a reduction be refused?

Prepare significant grounds for reducing alimony.

It is more likely that the claim will be denied if the court finds that:

- The funds remaining at the payer’s disposal after paying alimony exceed the minimum subsistence level established in the Russian Federation.

- The person paying alimony lives together with his second wife, runs a common household with her and has a common budget.

- The payer's real income allows him to support all his children.

- When a child is supported, he or she needs increased financial expenses.

- The payer did not provide documentary evidence of the grounds specified in the claim.

What reasons should not be given for reducing alimony?

When considering this category of cases, an unspoken list of reasons was formed that should not be indicated in the claim, otherwise you will face a refusal to satisfy it. So, you cannot justify your demands with the following formulations:

- The child is already living well. The financial/family status of children is not a basis for reducing the payment.

- The second parent has a high salary and can support the child himself. This wording contradicts Art. 61 of the RF IC, according to which parents are assigned equal responsibilities for the maintenance of their children.

- The ex-husband inherited an apartment and his financial situation improved significantly.

- The ex-wife now has a “patron” who can easily support everyone.

- The grandmother transferred the apartment to her beloved granddaughter.

- The child began to earn extra money.

- The firstborn was assigned a social pension, etc.

Required documents

A reduction in child support at the birth of a second child may require the following documentary evidence:

- Certificates of marriage and divorce, birth of the first and second child.

- Written information from the employer about the level of income.

- Conclusion, conclusion of the members of the medical and social examination (MSE).

- Draft agreement between parents on the amount of payments for the child.

- A previously drawn up agreement, order or decision issued by a representative of Themis, on the basis of which current payments are made.

- Extracts from state registers about the state of affairs at the enterprise in which the payer works.

- Certificates from local authorities on the minimum and average wages in the region.

- Statement of claim, petitions.

- Court decision, order and writ of execution.

- Other documents that confirm the circumstances stated in the claim.

A common mistake that is found on legal websites and forums is that the plaintiff is recommended to submit copies of certificates and certificates certified by a notary. This is not necessary if it is expected that original documents will be presented during the meeting. This approach eliminates additional costs.

In case of deterioration of health and loss of ability to work for this reason, the conclusion of the ITU members must be submitted to the court. Ignoring this requirement or presenting certificates of treatment from a clinic or hospital will lead to the judge rejecting this basis. The reason is that the plaintiff did not prove the fact of loss of ability to work due to illness.

Extracts from state registers are required if the enterprise:

- Wage arrears have increased;

- There are reductions underway, which the payer has fallen under;

- A liquidation or bankruptcy procedure has been initiated.

In such cases, the applicant is advised to anticipate the judge's question and the defendant's argument that another job can be found. This can be done by submitting written appeals to other enterprises and negative responses to them. The more such documents the plaintiff presents, the more confidence he will have that he did everything possible to maintain his previous earnings.

What does judicial practice say?

An analysis of the materials in this category of cases shows that the most common circumstance indicated by payers when requesting a reduction in payments was the birth of other children, for whom alimony payments were also collected.

Before the ruling of the Supreme Court of the Russian Federation No. 56 was issued, the courts almost automatically reduced the amount of payments for a child upon the birth of a second child in a new family. However, with its release, everything changed and the courts changed their approach to consideration.

I’ll say right away that judicial practice on these requirements is ambiguous and depends on the evidence presented by the plaintiff in the case. The mere need to pay child support for another child is not taken into account by the courts, and is not an absolute basis for changing the amount of payment. If there are no other circumstances, the court will refuse to satisfy the claim.

The following review of judicial practice allows us to draw the following conclusions:

- The court will refuse if the plaintiff does not provide evidence confirming that his financial/family situation has changed so much that he cannot provide minor children with maintenance in the same amount. Moreover, such circumstances occurred regardless of the will of the payer - case No. 2-926/2020.

- The court will reduce alimony if the defendant recognizes the claim - case No. 2-1757/2020.

- In claims to reduce the amount of payments, the courts are guided by clause 1 of Article 81 of the RF IC, according to which the amount of alimony for the maintenance of two children should not exceed 1/3 of the parent’s earnings - case No. 2-185/2020, case No. 2-610/2020 .

- The court will not reduce the amount of alimony if the child has special physical/mental development problems or a deterioration in his health, since such a change will not ensure the proper level of his maintenance and development - case No. 2-832/2020.

How much should I pay for my second child?

To determine the size, you need to know the exact number of minor children a parent has. The amount of payments for each of them will depend on this.

If the defendant has two children, then by law he must pay 33% of all his monthly income. If there are three children, the size increases to 50%. These rules are written in paragraph 1 of Article 81 of the Family Code of the Russian Federation.

It turns out that when a second child is born from another woman, she can receive half of this 33%, that is, 33/2 = 16.5 percent. If you count in shares, then it will be 1/6 of the salary and other income of the payer.

| Child support calculator | |

| How many children do you have under 18 years of age? | |

| Is the children's father officially employed? | |

| How much does the alimony payer receive? | rubles Error |

| The amount of other income of the alimony payer (for example, from renting out an apartment): | rubles Error |

| Alimony will range from 400 rubles to 13,000 rubles for each child. The judge will determine the exact size! If he is not registered with the employment center, then you need to file a claim and set alimony in a fixed amount. |

FAQ

Q: Is it possible to collect alimony for a second child in a second marriage without a divorce?

A: It does not matter legally to the court whether you are officially married to the mother of your second child or not. Therefore, you can apply for a reduction in payments without filing a divorce from her.

Q: Can the second wife apply for a reduction in alimony for the payer’s ex-wife?

A: The second spouse does not have the right to initiate a claim for a reduction in payments against the ex-wife, since the request to change them has been submitted to the person obligated to pay them - Art. 119 RF IC.

Q: How can I reduce the interest on child support at the birth of my second child?

A: You have the right to apply to the court to reduce the amount of alimony. In this case, refer to the birth of a second child, as well as other circumstances (for example, a difficult financial situation, illness, etc.).

Q: Is it possible to apply for a reduction in child support if the second child was born out of wedlock?

A: To file a claim for a reduction in payments for a child born out of wedlock, it will be enough that your data is entered in his birth certificate in the “father” column and paternity is not disputed by you.

Lawyer's answers to private questions

Is it possible to apply for a reduction in the amount of alimony if it is collected by court order?

Yes. The type of document on the basis of which payments are withheld does not matter. This can be an order or a writ of execution, they are equivalent.

Is it possible to file an objection to a reduction in the amount of alimony due to the birth of a second child if the first one requires expensive treatment and the claim cannot be satisfied?

You can file, but in such a situation it is better to file a counterclaim for the recovery of additional expenses if the minor needs treatment (Article 86 of the RF IC).

Will the court provide a sample application for a reduction in child support if a second child is born?

There are standard application forms there, but a sample with just such a requirement is unlikely to appear in court.

Is it possible to apply to the court to reduce alimony online?

Yes. To do this, it is enough to use the GAS “Justice” system. You need to click on “New Appeal”, select the court and attach the statement of claim with the remaining documents, then send everything.

Who calculates the amount of alimony reduction?

The calculation is made by the plaintiff, and the state duty is then calculated from the final amount. All figures must be reflected in the application.

Remember

- Reducing the amount of alimony payments is a right, not an obligation of the court.

- The need to pay child support for a second/third child is not an unconditional basis for changing the amount of payment. In addition, there must be other circumstances, otherwise the court will refuse to satisfy the claim.

- Cases regarding demands for reduction of alimony are subject to the jurisdiction of district (city) courts.

- Before filing a claim to reduce the amount of alimony payments, prepare evidence for the court confirming the impossibility of providing the first child with maintenance in the previous amount.

Has anyone you know already gone to court to reduce alimony? Are you planning to go to court for a reduction in payments yourself?

Is it possible to recalculate - reasons

In this case, the main reason why a change in the amount of payments is required is precisely the appearance of another baby. However, practicing lawyers recommend adding others to this basis. These include :

- Deterioration of the payer’s health, registration of the first or second group of disability;

- Loss of previous job due to illness;

- Dismissal and inability to find a job;

- The appearance of other dependents in the family (for example, retired parents);

- The first child receives an income that fully or partially satisfies his material needs.

The latter includes cases when the firstborn:

- Received as a gift or inheritance property that brings him income;

- Got a job;

- He began to engage in entrepreneurial activities.

Other grounds that allow you to reduce the amount include:

- The firstborn is maintained by the state;

- Excessively high total income of the payer.

You can read more about the grounds for reducing alimony in this article.

How to reduce alimony payments expressed in a fixed amount?

A fixed amount is established if the parent does not have a regular income and a permanent place of work. The amount of the payment is calculated as a multiple of the minimum subsistence level, which is officially approved for the child in the region where he lives. The grounds for reducing fixed alimony do not differ from those established by law for shared payments. The parent needs:

- collect the above package of documents;

- prepare a statement of claim in two copies;

- contact the magistrate of the area in which he is registered.

If the representative of the law considers the father’s arguments to be justified, he will decide to assign a new fixed amount of alimony.

Voluntary modification of the agreement

The law provides for the introduction of changes or additions to the concluded voluntary agreement. In this case, the original document does not lose force, but, on the contrary, becomes an integral part of the second. When the agreement is drawn up again, the first one becomes invalid.

For the reduction procedure, it is advisable to contact a competent lawyer for help, who will help calculate the new amount of alimony. This is important, since if the document does not comply with the requirements of Article 103 of the RF IC (if the conditions in any way violate the rights of the child), the written agreement will be considered invalid.

If the first wife refuses to cooperate, that is, to voluntarily reduce the amount of payment, the man will have to turn to a magistrate in order to achieve justice.

What is better not to use as arguments

A man and a woman should refrain from mutual reproaches and accusations in the presence of a judge. Crying and seeking pity is the worst behavior when resolving such an important issue. You should not refer to:

- improving the financial condition of the parent receiving child support;

- a woman raising a child without a husband receiving an expensive inheritance;

- completion of payments by the mother on loans, as a result of which more funds appeared at her disposal.

The father's responsibility is not to count his ex-wife's income, but to provide financial support to his child. Child support can only be reduced in order to respect the rights of all children without exception.

Where to contact

Adjustment of payments for financial support of minor dependents falls within the competence of the magistrate's court. If there is a previously concluded mutual agreement, the former spouses can draw up a repeated document, which will indicate the amount of alimony reduced within the framework of the law. Thus, to change the amount of the monthly payment for the first child you will have to contact:

- if there are contradictions regarding the size of the shares - to the magistrate serving the area where the parent with child support obligations is registered (you will have to file a claim);

- when drawing up an agreement, go to a notary to certify the new document.