Can heirs receive the pension savings of a deceased relative? What steps need to be taken to do this?

We talked about how the funded part of a pension is formed and how to increase it or at least maintain it given today’s inflation.

But, unfortunately, in Russia there are often situations when a person does not live to see retirement. A person can die after retirement, leaving an unpaid portion of pension savings.

First, let us remind you what is due to the future pensioner.

Law on the payment of pension savings to the heirs of the deceased

In recent years, there has been so much talk about the pension “piggy bank” that it seems as if people know absolutely everything about it. At one time, a co-financing program was widely advertised, which provided for an equivalent “supplement” from the state for every thousand a citizen contributed to his personal pension account. Then citizens were faced with a choice: to maintain the unity of the pension parts or to make the pension exclusively insurance. Now, in connection with the pension reform, we are again talking about pension savings, which can be used to increase the size of future payments.

But it also happens that a citizen simply does not live to see his pension, and relatives believe that the contributions are lost forever. And if we really are not talking about returning the insurance part, then it is quite possible to receive accumulated pension funds - despite the popularity of the pension topic, not everyone knows about it.

Sources of savings:

- insurance premiums paid by the employer (the period from 2002 to 2014, since currently only employee insurance pensions are formed);

- participation in the State Co-financing of Pensions Program;

- maternity capital allocated for pension savings;

- investment income from pension fund investments (for example, in commercial funds).

For each case, a separate legislative norm has been developed regulating the process of transferring savings to the relatives of the deceased.

Special rules were enshrined on July 30, 2014, when the Government of the Russian Federation adopted two relevant resolutions: No. 711 (applies to the Pension Fund) and No. 710 (regulates payments to non-state pension funds). For the most part, the provisions of the Rules are the same (for example, the pensioner retains the right to indicate heirs in a special application, the order of inheritance and the rules for inheriting maternity capital funds are determined), but there are a number of differences in them, for example, the timing of notification of the opening of an inheritance varies.

The fundamental legislative act that established the emergence of the right to a funded pension and the possibilities for its implementation among Russian citizens was Federal Law No. 424-FZ.

Who is owed unpaid pension savings?

Of course, many of us want to get more money by delaying the retirement date. However, we should not forget that by putting off applying for a pension, even a seemingly healthy person may not use his pension savings at all.

While still alive, a future pensioner has the right at any time to write to the Pension Fund a statement about who will receive his savings. In NPF, heirs are indicated in a separate clause of the agreement.

A person can identify specific recipients of these funds, as well as determine in what shares the specified funds should be distributed among them (Clause 6, Article 7 of Law No. 424-FZ “On Funded Pension”).

The future pensioner has the right to name any person who is not even his relative as an heir.

And if a person did not write any application or did not include anyone in the contract, then who has the right to claim his pension savings? Then the payment is made to the legal successors of the deceased from among his relatives in order of priority:

- first priority - children, spouse and parents;

- second line - sisters, brothers, grandmothers, grandfathers, grandchildren.

The distribution of the pension among the heirs of each line is carried out in equal shares.

Heirs of the second stage will be paid the deceased’s pension in the absence of applications from close relatives of the first stage.

Rules for the payment of pension savings to the legal successors of the deceased

First, you need to clearly define the cases in which relatives can claim the return of pension funds accumulated by the deceased. It is often said that only death before retirement age is a reason for legal successors to apply for payment. It is not right.

The list of cases in which pension savings are paid to the legal successors of a deceased insured person includes:

- Non-retirement.

- Failure to receive a pension, taking into account additional pension savings (recalculation is made once every 3 years; maternity capital is not taken into account).

- Failure to receive an assigned urgent payment (with the exception of maternity capital funds). A person could have applied for a one-time payment of individual pension capital, as the funded part is now called, but did not have time to receive it.

An important condition: if a person has chosen an indefinite lifelong pension, there can be no talk of any payments to legal successors.

You can dispose of your savings in advance; it is enough to indicate in the application to the fund, which is the insurer, the list of persons to whom the insured wishes to address his savings in the event of death, and the amount of funds transferred. Many short-sightedly neglect this right for obvious reasons: youth and excellent health do not allow one to think about death, everyone believes that this is a matter of the distant future, that there is plenty of time left.

But situations can be very different, no one is immune from tragedy, and therefore it is better to make all important decisions independently and on time.

The absence of an appropriate lifetime disposition necessitates the entry into force of a legal instrument called “Intestate Succession”. And here it is worth mentioning right away that the accumulated pension capital is not an inherited estate, since until issuance it remains the property of the fund acting as the insurer. Therefore, citizens applying for payments are usually called not heirs, but legal successors.

Money becomes part of the total inheritance if relatives do not apply to the funds for accrual of payments within the time limits established by law. This is an important digression, which allows you to better understand the scheme for obtaining accumulated savings and not get confused in concepts. After the account owner passes away, his relatives contact the funds about opening an inheritance. In this case, it appears in the form of a specific amount of savings.

The succession queues coincide with the inheritance queues accepted in legal practice:

- The first priority of legal successors is spouses, children and parents . Important points: the husband/wife is legally married at the time of death, parents and adoptive parents are not deprived of parental rights, adopted children have equal rights with the half-blooded children of the deceased. The named persons have the right to receive payments and must apply for their appointment within six months after the death of a relative.

- The second line of legal successors are brothers, sisters, grandfathers, grandmothers, and grandchildren . They have the right to claim payment of the insured person’s savings only if the first-priorities have not submitted relevant applications.

The distribution of shares within one queue is carried out in equal parts.

When paying maternity capital from the funded part of the pension, succession lines are not taken into account. Legislators give a special status to state support funds as part of the funded part of a woman’s pension, and therefore a special list of applicants for this payment has been created. These include the father or adoptive parent of the child; in their absence, succession passes to the children of the deceased: minors or those who have reached the age of 18, but are studying full-time at universities (until they reach the age of 23).

In other cases, age is not taken into account, as is the health status of the legal successors. That is, it is pointless to challenge the transfer of funds to a child with disabilities who is the son of a deceased insured person. Just as one cannot question the legality of payments to the parents of the deceased, who are at a very advanced age.

The law leaves legal successors the opportunity to choose: accept the due share or refuse it. If a refusal is issued, the share will be divided equally among the remaining applicants. You can refuse in someone else's favor. For example, the parents of a deceased daughter can write a statement of refusal in favor of their granddaughter, who will receive the funds from the pension accumulated by the mother.

Let's consider a specific case. Anna Igorevna Ivanova created a pension “piggy bank” in a non-state fund, where she periodically deposited money. Alas, she did not live to see retirement and was unable to use the accumulated funds. According to the law, her family has the right to receive savings. Anna Igorevna was married, raised a daughter, she also has a father and two sisters. There are many heirs, and they all address the fund with applications for payment of the pension savings of a deceased relative.

The Fund accepts applications, reviews them and determines the order of succession, according to which Ivanova’s husband, father and daughter are the first priority successors. The amount of accumulated additional pension benefits is divided between them in equal shares.

But the grandfather (Ivanova’s father) renounces his share in favor of his granddaughter, who will thus receive her share and the grandfather’s share, the third part will be paid to Anna Igorevna’s husband.

Inheritance of funds from the funded portion of a pension

Yu.A. KOZHINA, Yu.I. FROLOVSKAYA

Yulia Alekseevna Kozhina, senior lecturer at the Department of Civil Law and Process of the Academy of Law and Management of the Federal Penitentiary Service, Candidate of Legal Sciences.

Frolovskaya Yulia Ivanovna, associate professor of the department of civil law and process of the Academy of Law and Management of the Federal Penitentiary Service, candidate of legal sciences, associate professor.

Throughout the civilized world, a funded pension is a guarantee of a decent life for citizens of retirement age. Funds accounted for in the pension account of the accumulative part of the insured person's pension, or accumulative pension under an agreement with a non-state pension fund or management company, are paid to the legal successors of the deceased person.

The funded part of the pension, as well as the full funded pension, is the property of citizens, which allows us to talk about the emergence of inheritance legal relations in the event of the death of a person entitled to an insurance pension, in which the funded part was formed before January 1, 2015, and for a funded pension. Not everyone knows that the funded part of the insurance pension is paid to the legal successors of the deceased insured person, subject to the application being sent to the Pension Fund of the Russian Federation (hereinafter referred to as the Pension Fund of the Russian Federation) within six months from the date of death of the person. A funded pension is paid when an application is sent to a non-state pension fund or the testator's management company, where the testator's pension savings were formed. Declaring a citizen dead by a court entails the same consequences as the death of a citizen.

Let us remind you that pension savings are formed only for citizens born in 1967 and younger, for whom insurance premiums are paid by the employer. For three years, from 2002 to 2004, the funded part was also formed for men born in 1953 and younger, and women born in 1957 and younger, if they worked.

For working people of the older generation, employers also pay insurance contributions, but they are not divided, but are entirely credited only to the insurance part of the pension, which is the property of the state.

Since January 1, 2009, pension savings have another category - those who participate in the program of state co-financing of pension savings. Part of the funds transferred to the funded part of the pension is paid by the citizen himself, the other part by the state.

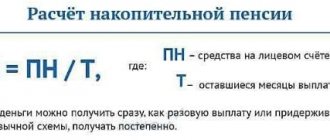

From January 1, 2015, the methodology will be calculated, but the formula for determining the funded pension has remained virtually unchanged, which cannot be said about the attitude of government authorities to this type of social security. Economically, the funded pension is being pushed out of the sphere of compulsory insurance contributions so that it becomes predominantly voluntary, as is practiced in developed countries. For this purpose, increasing coefficients have been introduced that put the mandatory funded part of the pension at a disadvantage compared to the insurance pension. Throughout the civilized world, a funded pension is a guarantee of a citizen’s dignified old age. At its core, a funded pension is an additional type of pension formed by a person independently.

The size of the funded pension from August 1 of each year is subject to adjustment and indexation based on the amount of insurance contributions received to finance the funded pension, additional insurance contributions for the funded pension, employer contributions, contributions for co-financing the formation of pension savings, as well as the result of their investment and funds (parts funds) of maternal (family) capital aimed at forming a funded pension, as well as the result of their investment, accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person's funded pension, which were not taken into account when determining the amount of pension savings for calculation of the amount of a funded pension upon its assignment or previous adjustment <1>.

———————————

<1> See: Federal Law of December 28, 2013 N 424-FZ “On funded pensions” // SZ RF. 2013. N 52 (part I). Art. 6989.

So, in our opinion, it is necessary to distinguish between two cases of hereditary succession in the field of funds of the funded part of the pension:

1) succession under a non-state pension agreement with a non-state pension fund or management company, according to which the fund undertakes to pay a non-state funded pension to a fund participant;

2) succession under a compulsory pension insurance agreement, according to which the Pension Fund of the Russian Federation is obliged, upon the onset of pension grounds, to assign and pay to the insured person the funded part of the labor pension or pay it to its legal successors. In this case, the funded part of the pension will be an integral part of the entire pension provision of the insured person.

From January 1, 2015, pension provision, formed through insurance and savings contributions, divided the pension provision into insurance and savings. Insurance pensions are formed on the personal account of the insured person in the Pension Fund of the Russian Federation and are the property of the state; the only exception is the savings part, which was formed on the person’s personal account before January 1, 2015 and was not transferred at the request of the insured person to a non-state pension fund or other management company.

Payment of pension savings to relatives of a deceased insured person of the same priority is carried out in equal shares. Relatives of the second stage have the right to receive pension savings accounted for in a special part of the individual personal account of the deceased insured person or in the pension account of the accumulative pension of the deceased insured person, only in the absence of relatives of the first stage. If the insured person does not have relatives, these funds are taken into account as part of the insurer's reserve for compulsory pension insurance. In this case, a special part of the individual personal account of the insured person or the pension account of the funded pension is closed.

To receive pension savings, you must submit an application for payment of pension savings and provide the following documents (originals or duly certified copies):

— identification document, age, place of residence;

- a document confirming the relationship with the deceased insured person (for children - a birth certificate);

— death certificate of the insured person (if available);

— insurance certificate of compulsory pension insurance of a deceased insured person or a certificate from the Pension Fund indicating his insurance number of an individual personal account (if any).

The legislator does not provide for a situation in which an insured person can deprive all of his legal successors of the rights to the funded part of his pension.

Citizens become legal successors by law or through a statement in which the owner of the savings indicated information about the heir in advance. In the first case, the legal successors of the first stage are parents (adoptive parents), spouses and children, including adopted children, of the deceased, the second stage are brothers, sisters, grandparents, grandchildren. In the second case, legal successors can be any individuals chosen by the insured person.

It should be remembered that, according to civil law, parents do not inherit by law after children in respect of whom they were deprived of parental rights and were not restored to them by the day the inheritance was opened.

In the event that persons who did not have the right to inherit or who were excluded from inheritance received funds generated on the personal account of the testator as part of a funded pension, they are obliged to return these funds. At the same time, this rule applies to legal successors who have the right to an obligatory share in the inheritance.

The funded pension, as well as the funded part of the pension (formed on the personal account of the testator before January 1, 2015), can be transferred not only to the persons indicated in the testator’s application, but also to persons who are heirs under the will. If the distribution of shares between the heirs is not indicated in the application, the future pensioner can do this at a notary’s office.

If there is no application, then the pension savings accounted for in the pension account of the insured person's funded pension are subject to payment to the first and second priority relatives of the deceased. Between them, savings are distributed in equal shares within six months from the date of death of the insured. If this deadline is missed, the right of inheritance can be restored in court at the request of the successor.

The payment of pension savings is carried out by the Pension Fund of the Russian Federation or a non-state pension fund or a management company, depending on where the pension savings or funded pension of the deceased citizen was formed on the date of death. In this case, the legal successors must submit an application (in person or through a representative or with a notarized power of attorney).

In Art. 16 of the Law on Labor Pensions indicates the size of pensions in the event of the loss of a breadwinner and only talks about the payment of funds to the relatives of the deceased breadwinner, although the deceased may not necessarily be the breadwinner of the legal successor (for example, the children may have already grown up). This provision should be extended to all cases of succession. However, this issue must be resolved at the legal level or in court.

The following gaps in the legislation can also be noted: it is not specified to what degree of relationship brothers and sisters are recognized (siblings, cousins, etc.); There is no provision for such a category of heirs as disabled dependents.

If the deceased insured person does not have legal successors, then the funds recorded in his pension account of the accumulative part of the labor pension are transferred by the fund to the Pension Fund of the Russian Federation; the transfer procedure is established by the Government of the Russian Federation.

Funds accounted for in the pension account of the accumulative part of the insured person's pension or accumulative pension in a non-state pension fund are paid to the legal successors of the deceased insured person, subject to their application to the fund within six months from the date of death of the insured person. At the request of the legal successor who missed this deadline, it can be restored in court. The procedure for the legal successors of deceased insured persons to apply for payments to the fund, as well as the procedure, timing and frequency of making these payments are established by the Government of the Russian Federation.

The procedure for calculating the amounts of pension savings to be paid by the fund to the legal successors of deceased insured persons is established by the Government of the Russian Federation.

No special regulatory documents regarding the rules for payments by a non-state pension fund to the legal successors of a deceased fund participant under a non-state pension agreement have been adopted. Therefore, it is necessary to be guided by the general rules on inheritance specified in Section V “Inheritance Law” of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). In this case, the inherited property under this agreement are property rights and obligations (the possibility of inheriting these rights is provided for in Article 1112 of the Civil Code of the Russian Federation). Exactly what rights and obligations are inherited depends on the terms of the specific agreement.

There are no special rules regarding this type of property <2>. In particular, Art. 1183 of the Civil Code of the Russian Federation “Inheritance of unpaid amounts provided to a citizen as a means of subsistence” <3>.

———————————

<2> See: Abramenkov M.S. On the issue of legal regulation of posthumous transfer of pension savings // Inheritance law. 2014. N 4. P. 22; Kiyashko V. Inheritance of unpaid pensions // Russian justice. 2002. N 11. P. 35.

<3> About this see: Blinkov O.E. Inheritance of unpaid amounts provided to a citizen as a means of subsistence // Inheritance law. 2013. N 3. P. 29 - 32; Blinkov O.E. Posthumous succession in unpaid amounts provided to a citizen as a means of subsistence // News of the South-West State University. Series “History and Law”. 2013. N 3. P. 7 - 11.

A non-state security agreement can be:

— or re-registered to the legal successor of the participant;

- or the successor may demand the redemption amount under this agreement.

The basis for these transactions should be a certificate of the right to inheritance, issued in the prescribed manner.

Difficulties may arise when renegotiating contracts, in particular if the investor and the participant are not the same person. This situation can be foreseen in advance by introducing (at the stage of concluding an agreement with the initial investor and participant) the appropriate conditions in the agreement.

It is possible that the transfer of property rights to a successor under an agreement will be equated to cases of succession of means of subsistence or succession of the funded part of a pension. In order to carry out the correct succession of these objects, it is advisable to make an official request to the authorized bodies.

In accordance with Decree of the Government of the Russian Federation of August 18, 2010 N 635 “On amendments to certain acts of the Government of the Russian Federation on the payment of pension savings to the legal successors of a deceased insured person,” a decision to refuse to pay pension savings to the heirs will be made in the event if pension savings consist only of funds (part of funds) of maternal (family) capital, including income from their investment.

At the same time, this does not mean that these pension savings funds will not be paid to the legal successors at all or will disappear. For example, if a woman, who during her lifetime allocated maternity capital funds to the funded part of her future pension, dies, then the maternity capital funds are returned to the account of her certificate and subsequently transferred to her husband or children.

So, the existing procedures for receiving a funded pension or a funded part of a pension provide for the legal successors to apply for payment of pension savings

Literature

1. Abramenkov M.S. On the issue of legal regulation of posthumous transfer of pension savings // Inheritance law. 2014. N 4. P. 22 - 24.

2. Blinkov O.E. Inheritance of unpaid amounts provided to a citizen as a means of subsistence // Inheritance law. 2013. N 3. P. 29 - 32.

3. Blinkov O.E. Posthumous succession in unpaid amounts provided to a citizen as a means of subsistence // News of the South-West State University. Series “History and Law”. 2013. N 3. P. 7 - 11.

4. Kiyashko V. Inheritance of unpaid pensions // Russian justice. 2002. N 11. P. 35.

Source: INHERITANCE LAW magazine

How can a successor find out the amount of payment of pension savings of a deceased person?

“Individual pension capital” can be formed from the moment of receipt of SNILS and during any period when a person considers it possible to transfer certain amounts to the fund. Relatives may not even know that he makes any contributions. Therefore, after the death of a relative, not everyone thinks of applying for payments.

The rules regulate the obligation of funds to notify legal successors of the termination of the insurance contract and the release of the existing savings of the deceased person. In reality, structures do not always inform relatives about the available opportunity, citing the lack of information about the heirs in the documents. Therefore, it is better for legal successors to resolve this issue independently.

The amount of savings can be clarified in the fund that accumulates savings, or done online: through the Gosuslugi portal or the services of the Pension Fund of Russia, or use the option of obtaining information through Sberbank.

And if in the first case the data can be obtained only after confirmation of the family relationship with the insured, and in the latter you need not only to register in your Personal Account, but also to visit the bank office, then the options of accessing online services are much more convenient. It is enough to go to the Personal Account of the deceased, but this is sometimes the most difficult task, since the data is unknown: login and password. In this case, you can enter the passport data and SNILS of the deceased owner of the pension account and create a new account. On the PFR website, all data is presented in the “Contributory Pension” section; on “State Services” it is assumed that a request will be sent, the response to which will be sent by email.

Heirs of pension savings: who are they?

A citizen can appoint legal successors. To do this, he can at any time contact the insurer with an application for the distribution of pension savings. In this statement, he identifies the specific individuals to whom his pension savings will be paid in the event of his death, and indicates the distribution shares between them.

The application can be submitted electronically. To do this, you must have access to your personal account on the Pension Fund website and have a qualified electronic signature.

The persons indicated in the application can be either relatives or any other persons.

If more than one application for distribution of pension savings is submitted, then the application having a later date is accepted for execution.

If there is no application, then the citizen’s pension savings will be distributed among relatives of the same line in equal shares.

The procedure for receiving payment of pension savings by legal successors

A step-by-step algorithm will help legal successors navigate and competently perform all the necessary actions:

- Find out where your pension savings are stored. The Pension Fund of the Russian Federation will help with this by accumulating information about pension savings of citizens, including those stored in non-state funds.

- Send an application and accompanying documentation to the fund: payment of pension savings to the legal successors of the NPF is no different from payment by the state pension fund and is carried out according to similar rules.

- Receive notification of registration of the application and save it.

- Wait for the conclusion of the application.

- Get money (methods are regulated by the Rules).

In this case, it is important to comply with the deadlines specified by law, equal, as in the case of accepting an inheritance, to 6 months, during which an application for payment should be submitted. During, and not after, the incorrect interpretation of this provision is the big mistake of many heirs and legal successors. It is possible to register ownership of inherited property and receive payment of savings only after six months. Of course, in difficult times, when the pain of loss is great, there is no time to think about wills, statements and other documents. But within six months you still need to find the strength to contact a notary and pension funds.

After the deadline has expired, no one will consider the application. You will have to prove through the court that the person was unable to apply for payment on time for valid reasons. It is unknown whether the court will consider the evidence presented to be strong enough and whether it will restore the deadline for the application. In current practice, there have been both positive decisions and negative verdicts.

It is worth noting that the legal successor can submit documents to the funds either independently or through a legal representative, if the latter has a notarized power of attorney and a passport. This is very convenient if the legal successor is abroad and does not have the opportunity to personally send papers to the fund.

What documents must legal successors provide regarding the payment of pension savings?

- Statement from the successor. It may contain a request for payment of savings or a refusal of it (in principle or in favor of another relative).

- Passport with a registration mark - for a legal successor who has reached the age of 14; birth certificate and document confirming registration at the place of residence - for legal successors under 14 years of age.

- Documents to confirm the relationship with the deceased are provided by legal successors, unless an order is left on the distribution of shares of savings (described in detail below).

- The legal representative and the representative of the legal successor supplement the package with identification documents and confirming their authority. In the first case, authority can be confirmed by an adoption certificate, an act on the appointment of a guardian or trustee issued by the guardianship and trusteeship authority, and other documents. In the second case, a notarized power of attorney is sufficient.

- Certified bank details for the successor’s account (either with the seal of the banking organization or by the submitting party independently: “I confirm the details”, full name, signature, date).

- Confirmation of changes in personal data: certificates of marriage/divorce, change of name, establishment of paternity.

- Court decision to restore the deadline for filing an application for payment (if any).

- Death certificate (if available).

- Insurance certificate of compulsory pension insurance or a Pension Fund document containing SNILS (insurance number of an individual personal account) of the deceased insured person (if available).

- A refusal to receive payment of pension savings submitted by the legal representatives of the legal successor should be accompanied by documents confirming the prior permission of the guardianship and trusteeship authority to carry out such refusal.

Sometimes this list may be supplemented with other documents. If the fund deems it necessary, it has the right to request additional information.

The list of documents confirming family relationships is worth considering especially, since each legal successor will need his own set of papers:

- Spouse – marriage certificate . Succession arises in the case of a registered marriage. If at the time of death the marriage is officially dissolved, as there is a corresponding entry in the Civil Registration Book, or a court decision has entered into force, then the right to payment of pension savings is lost.

- Children (including adopted children) – birth/adoption certificates, marriage certificates (if the surname is changed).

- Parents (adoptive parents) – birth or adoption certificates of the deceased. The legal consequences of adoption also imply the equality of the rights and responsibilities of adopted children and their adoptive parents to the rights and responsibilities of relatives by origin. In this case, the fact of adoption is registered in the prescribed manner and implies the issuance of an appropriate certificate.

- Brothers and sisters – birth certificate (your own and the deceased insured person’s), marriage certificate (if your last name is changed).

- Grandparents – birth certificate of the deceased insured person; birth certificate of the parent of the deceased insured person; marriage certificate of the parent of the deceased insured person (if the surname is changed).

- Grandchildren – birth certificate (own); parent's birth certificate; parent's death certificate. Grandchildren become legal successors if, on the day of death of the grandmother or grandfather, the parent who would be the first-degree successor is not alive.

It happens that documents confirming relationship cannot be submitted to the fund for objective reasons (for example, they were lost in a fire or lost). Then the successor can seek to establish the fact of relationship with the insured person in the courts, a positive decision of which becomes the only document confirming the family relationship of the applicant and the deceased.

How can an heir receive a pension?

Whatever fund the accumulated savings of the deceased are in, the fund will not initiate the inheritance procedure.

The initiative to receive an inheritance pension comes from the heirs themselves, who must submit an application to the Pension Fund or Non-State Pension Fund and attach the necessary papers.

The list of documents can be clarified at the fund. As a rule, this is: a death certificate of the insured person, a passport of the heir, SNILS of the deceased and the heir, documents confirming family relationships.

The application period is limited - no later than six months from the date of death of the insured person (Article 1154 of the Civil Code of the Russian Federation). A missed deadline can only be restored through a judicial procedure.

How to draw up an application for payment of pension savings to a legal successor?

The application for payment must meet certain requirements set forth in the Rules. It can be written by hand in block letters on a blank sheet of paper in compliance with the established form, or printed on a computer.

The following must be indicated:

- Full name of the deceased insured person;

- his SNILS number;

- date of his birth;

- basis for succession (by application/by law);

- order of succession;

- relation degree;

- Full name of the legal successor;

- Date and place of birth;

- addresses of registration and actual residence;

- passport details, second identification document, SNILS number;

- the selected payment method;

- information known to the successor about other relatives of the deceased;

- a list of attached documents;

- contacts and consent to the processing of personal data.

Points to be aware of when applying

A legal successor who is under 14 years of age at the time of applying for payment of the deceased person’s pension savings cannot independently sign an application for payment/refusal of it. This right is transferred to the legal representative.

If the age of the legal successor is between 14 and 18 years, he can independently sign documents in agreement with his representative, who is also obliged to document the right to represent the interests of the person on whose behalf he is acting.

If a package of documents is sent to the fund by post, notarization of copies and signatures of the applicant is required. What to do if there is no notary in the place of residence of the legal successor?

In this case, you can apply for certification of copies and signatures to local government bodies, which are vested with the functions of a notary in certain cases by Federal Law No. 131-FZ. The head of the administration or an official vested with special powers can perform notarial acts due to the absence of a notary, otherwise the document certified by the local government will not have legal force. The same applies to the absence in the papers sent to the fund of a certified copy of a document confirming that the official is vested with the functions of a notary.

A legal successor located outside the Russian Federation retains the right to contact officials of Russian consulates, who can certify his signature and certify the accuracy of copies of documents.

There is a formality that must be observed: if the document consists of several sheets (more than one), they should be bound, numbered and sealed.

The procedure and terms for payment of pension savings of the deceased to legal successors

The date of acceptance by the fund of the application and package of documents is considered the starting point for the five working days allocated for issuing a receipt notification of registration of securities.

A decision on accepted applications must be made no later than on the last working day of the seventh month from the date of death of the owner of the pension “piggy bank”: applications are accepted within six months, another month is allotted for their consideration and decision-making. Let's say the six-month period expires on any day in September, the decision on payment or refusal must be made no later than October 31. If the court restores the deadline for applying for payment, the period for consideration of the application is determined by law to be 10 days.

Within the next five working days, all applicants must be familiarized with the fund’s verdict. If applications are approved by the 20th day of the following month, legal successors must receive their shares of the deceased’s “accumulative pension capital” by postal or bank transfer. The method is chosen independently and indicated in the application.

Since 2010, savings issued after the death of the owner to his relatives are not taxed; previously, 13% of personal income tax was withheld from them. When transferring through Russian Post, an amount equal to the postage fee will be withheld; banks do not charge commission.

But if you prefer a bank transfer, you should pay attention to two points. Firstly, the payment of pension savings to the legal successors of the deceased breadwinner is made on a general basis, but experts recommend that legal representatives open personal deposits for each child.

Secondly, all legal successors should carefully study the terms of their bank deposit (if it exists) and take into account that pension savings are not credited to deposits marked “Special”, “Term”, “Compensation”, etc. Conditions are better in advance Check with the bank and, if necessary, open an additional account specifically for transferring savings.

What does the pension market think?

The calculation proposed by the Ministry of Labor is more correct and convenient, Yakushev believes. According to him, if the calculated funded pension is small, the transaction costs of paying it are unreasonably high. It makes no sense, if a person has 30–50 thousand rubles in his account, to pay them for life or even for ten years (term pension), the expert believes. The number of funded pension recipients will increase significantly when women born in 1967 reach 55 years of age in 2022 (the increase in the retirement age does not apply to savings). Then the amount of payments will increase, Yakushev is optimistic.

Only if very small savings have been formed, lump sum payments look preferable, insists Biezbardis from Safmar. The Ministry of Labor actually recommends paying out pension savings in a lump sum instead of forming a funded pension. Meanwhile, a pension is a lifelong payment intended to insure a person against the risk of poverty, the expert noted, proposing that funds be given the right, on their own initiative, to increase the ratio between the insurance pension and the calculated funded pension, for example from 5 to 10%. “This would create an element of competition, especially for clients of pre-retirement age,” concluded Biezbardis.

How can the legal successors of a deceased person receive the insurance part of the pension?

If a pensioner died before receiving a pension for the current month, then the amount of the monthly payment can be received by members of his family who lived with the deceased.

Example. Ivan Pavlovich lived in the apartment with his legal wife, which is confirmed by the corresponding entry in the house register/registration stamp in the passport/cards in the house management, etc. On August 2, the pensioner died suddenly. From September 1, the accrual and payment of an insurance pension to a person will be stopped due to his death. But even in August, Ivan Pavlovich did not receive the due payments that his wife could receive.

The children and parents of the deceased registered in the apartment also have the right and legal grounds to apply for the due part of the pension: the monthly payment that the person did not manage to receive will be divided among all applicants. The period for applying for an unpaid pension is 6 months. This time is given to relatives to express their desire to receive the pension of the deceased person.

As for the amount of payments, not all additional payments and accruals received by a pensioner are subject to distribution to his relatives, so the amount of money paid may differ significantly.

There is another option that should not be neglected if the deceased was dependent on a disabled close relative. In this case, it is worth taking care of applying for a survivor’s pension, which will become a help for a person who finds himself in a difficult life situation, who previously counted only on the help of a deceased loved one.

How to receive pension savings after the death of a pensioner

Legal successors (heirs) of the deceased may receive:

- all funds

of pension savings, if the citizen did not have time to apply for a funded pension and died before he was assigned a funded pension; - all

pension savings from additional contributions if the citizen died

before

he was assigned an urgent pension payment; - only the balance

of pension savings not paid to the pensioner in the form of an urgent pension payment, if the pensioner died

after the appointment of an urgent pension payment

.

There is a separate procedure for receiving the amount of funded pension due to a pensioner in the current month and remaining not received due to his death in the specified month. In this case, this monthly amount is paid to disabled family members of the deceased, provided that they lived with the pensioner on the day of his death.

If the pensioner died after the funded pension

, then his pension savings

are not paid

.