- home

- Reference

- Labor pension

Due to the difficult economic situation in which our country finds itself, the level of income and, accordingly, the material security of the population is falling. Among other things, this is reflected in the fact that the debt load of citizens is growing, and with it the indicator of overdue debt.

Current legislation establishes various mechanisms for its collection. Among them, the most effective is to withhold part of the funds from the citizen’s income. As a rule, in this case we are talking about wages. At the same time, deductions from various types of social payments are not allowed. In this regard, many pensioners have a question regarding the possibility of forced deduction from pensions under a writ of execution. The answer to this is contained in the article below.

Is recovery possible?

In recent years, pensioners have increasingly become clients of banks and other financial institutions. It should be noted that if previously credit institutions often refused loans to older people, now the line of banking products includes separate programs for lending to them.

Pensions in Russia are relatively small, so their recipients may also not be able to service their debt. Late payment on a loan may result in fines and penalties, which leads to an increase in the amount of debt and a complete inability to fulfill one’s obligations. In this case , banks turn to the courts, on the basis of whose decisions bailiffs initiate enforcement proceedings , within the framework of which they carry out forced collection of funds.

The income from which recovery can be carried out includes pension payments, however, with a certain reservation, which will be discussed below.

Attention! The full list of income from which collection is not allowed is established by Article 101 of the Federal Law “On Enforcement Proceedings”.

Thus, part of the pension payments may be subject to collection.

What types of pensions cannot be seized?

The State Duma of the Russian Federation, which has been simulating work for decades, has included in the Federal Law No. 14 the list of funds received in the event of the loss of a breadwinner. The meaning of the innovation is clear only to “legislators”, since such a prohibition has long been contained in clauses 2 and 10 of Art. 101 FZ-229.

The full list of 19 points is contained in Art. 101 FZ-229.

The previously existing list of funds not subject to seizure was supplemented in 2020 with two items:

It is prohibited to withhold debts or funds to compensate for damage, as well as arrears of alimony from money paid to victims during emergencies (from lump sum payments), as well as from lump sum payments in the amount of 10,000 rubles paid under Decree of the President of the Russian Federation No. 249. Last paragraph - the height of absurdity! It is not clear why it was necessary to make changes to the fundamental law regulating the activities of the FSSP for the sake of a one-time payment? Reflect that this payment is not subject to the provisions of Art. 99 FZ-229, it was possible in the decree itself.

Hotline for citizen consultations: 8-804-333-70-30

In what cases is it permissible to withhold funds?

Most often, debts arise due to failure to fulfill financial obligations to credit institutions and individuals.

However, the reasons for deductions from pensions are not limited to this. So, debts can arise:

- due to failure to pay utility bills;

- if there are delays in paying taxes and other obligatory payments;

- when imposing fines.

The debtor may not always guess that he has a debt. In order to be able to repay it in a timely manner, without waiting for deduction from the pension, it is recommended to check the presence of debts in the database of enforcement proceedings on the website of the FSSP of Russia.

In addition, there are often cases when the Russian Pension Fund accrues money to a pensioner in excess of what he is entitled to. In this situation, the Pension Fund has the right to return overpaid funds by making deductions from pension payments.

Reference! It should be noted that there are several types of pensions. Thus, deductions from insurance, social, and disability pensions are allowed. However, even if there are debts, it is impossible to collect from the survivor's pension payment. This applies to both its federal part and various supplements to it paid from regional budgets.

Refund of money collected illegally

Bailiffs do not always follow honest methods in their work. In such a situation, we recommend that you act in accordance with the following instructions:

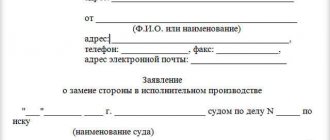

- Fill out an application for a refund addressed to the head of the division of the Executive Service in which the proceedings were carried out.

- Attach all existing evidence confirming the grounds for the return of funds. This could be an act from the court, a payment order, etc.

- Submit all documents by mail or under the incoming number to the FSSP department directly.

The above actions will help you return the amount due to you. Sample applications are taken from the Internet. If you have any difficulty filling out the forms, please contact a lawyer for qualified assistance.

How much can I charge?

Pensions, being the only source of income for most older people, cannot be used to pay off the entire debt. However, often even a simple deduction from payments leads to the fact that the pensioner is left with an amount that can be significantly less than the subsistence level.

This situation is unacceptable, since it directly contradicts the norms of the Civil Procedure Code and the Federal Law “On Enforcement Proceedings”. Thus , collection can be carried out only taking into account that after it the debtor remains with an amount the amount of which is more than the subsistence level for a pensioner established in a specific subject of the Federation.

In practice, bailiffs foreclose on pensions, regardless of these restrictions on whether the pensioner is working or not. To correct this situation, the pensioner needs to file a complaint against the actions of the bailiff to the court or to a higher official.

If the pensioner has other sources of income, then they are also taken into account when determining the amount of the remaining funds after deduction from the pension.

Holding order

If the debtor does not agree to pay the debt voluntarily, then the bailiff begins to search for the financial sources of the defaulter. This:

- Bank accounts.

- Deposits.

- Benefits.

- Property.

The first step is to seize funds from the debtor's accounts. If the executor knows in which bank the defaulter has an account, then the bailiff sends a request for seizure there. If the debtor’s bank is unknown, then requests to find the citizen’s funds are sent to all banks and credit organizations. The bank is obliged to react immediately and, if detected, seize the amount specified in the writ of execution. If there is not enough money in the account, the executor will seize amounts from further receipts.

Note!

The bailiff can seize the debtor's property. This method of debt collection is possible when:

- the debtor does not have accounts or money for them;

- if the pensioner’s income is equal to the subsistence level.

The seized property is sold at auction, and the amount received is reimbursed to the claimant. If the amount received at the auction is higher than that indicated in the writ of execution, then the excess is left to the debtor. However, the bailiff cannot arrest:

- the only dwelling;

- personal consumption items.

The debtor may refuse to pay the debt if he does not have the means to support himself or the property. In this case, the bailiff is obliged to check the creditor for fictitious transactions. If any are found, the court will declare them invalid.

The validity period of the writ of execution and court decision on debt collection is three years. Enforcement proceedings must be completed by the bailiff two months after he receives the IL.

Amount of penalty

The amount of deduction from pension payments is strictly limited by current legislation. So, it cannot exceed half its size. However, 50% is the maximum withholding amount. In practice, due to specific circumstances, it can be significantly reduced.

Important! In some cases, foreclosure is allowed at 70% of the pension payment. This is possible in exceptional cases, for example, when paying compensation to victims of unlawful actions of a pensioner.

Separately, the law establishes the maximum amount of withholding for overpaid amounts to the Pension Fund. It cannot be more than 20%.

Do bailiffs have the right to seize pensions?

Do bailiffs have the right and ability to withdraw part of the funds from pension accruals to pay off a citizen’s debt? Previously, this question was answered in the affirmative. A certain amount could be recovered from the pension, although with certain restrictions.

No more than 50% of incoming money.

Important! Sometimes the debtor could lose not 50, but immediately 70 percent of pension accruals. This measure was taken when a citizen was obliged to additionally compensate for moral damage, as well as damage caused to health.

According to the articles of the Civil Code of the Russian Federation, an unscrupulous borrower could generally be left with such a part of his benefit that corresponded to the minimum subsistence level

. At the same time, he had to prove to law enforcement officers the purpose and purpose of using his account.

Note 1.

Target account – details opened for receiving pension payments and other social charges. Accounts “for education” and “for purchasing a car” are not targeted.

The right to return debt from a pension was secured by the Federal Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ. Today, there are many benefits and payments from which bailiffs cannot collect anything at all.

This state of affairs will be realized if the State Duma passes the corresponding bill.

Note 2.

Actually, today the law has already been signed by the President, and it should come into force on June 1, 2021.

Is it possible to reduce the amount

Due to various circumstances, a 50% penalty can lead a pensioner to extreme financial difficulty. In these cases, the law establishes certain relaxations in terms of debt collection.

- Postponement. Deferment means a temporary cessation of enforcement actions. The reasons for granting a deferment must be compelling, for example, serious illness and the need for expensive treatment. If the grounds for deferment no longer exist, enforcement actions are resumed.

- Installment plan. By installments we mean a reduction in the amount of deduction. The grounds for its provision must be compelling, for example, a significant deterioration in financial situation.

To achieve a deferment or installment plan, the debtor must go to court, providing maximum evidence of his difficult situation.

How to remove restrictions after payment

As a rule, after the debt is paid, enforcement proceedings are terminated and no further deductions are made. However, in practice, citizens often find themselves in a situation where, even after repaying the debt, the pension still does not arrive in full, and the accounts remain under arrest.

In this regard, immediately after repaying the debt, the pensioner must contact his bailiff directly. As part of a personal meeting, he should obtain from him a copy of the decision to terminate enforcement proceedings. With this document, the pensioner applies to the pension fund and other institutions. Based on the resolution, all existing restrictions will be canceled and encumbrances will be lifted.

Can bailiffs withdraw money from a disability pension?

If a citizen has a disability group, he may be assigned an insurance, social or state pension (depending on the length of service earned and place of work). Disability pension is not included in the list of payments that cannot be recovered. Consequently, bailiffs have the right to withhold up to 50 or 70% of the disability pension. This is true regardless of the disability group - that is, even for disabled people of the first group (bedridden).

Article 101 of Law No. 229-FZ contains another exception. It is not allowed to withhold money from payments assigned to the debtor in the event of injury, injury or trauma received in the performance of official duties. These compensations are not classified as pension payments, as they can be awarded without proof of disability.