- October 26, 2018

- Finance

- Lazareva Valeria

The government regularly calculates the living wage, focusing on the prices of food products, as well as services that are included in the consumer basket. Taking into account inflation, the state regularly revises this indicator. Other important economic indicators are tied to the cost of living. For example, the minimum wage, student scholarships, social benefits, etc.

What is it needed for?

All families in the Russian Federation have different income levels. Some people are almost on the brink of survival and need government support. The government cannot ignore this layer of society when developing various social support measures in the form of benefits, allowances, subsidies and other payments.

The living wage is an important socio-economic indicator. It is on this basis that the real standard of living of Russian citizens is determined. It is expressed in a certain amount, which includes expenses for goods and services necessary for life and maintaining health.

In fact, it is the subsistence minimum that determines the state’s social policy in terms of financial obligations. It is this indicator that is used as the basis for calculating the federal budget for the coming year. On its basis, pensions, salaries, scholarships, and benefits are assigned.

In addition, based on the cost of living, the state determines the standard of living of citizens.

This is why it is so important to know how to calculate the cost of living. Abbreviated as PM.

Families whose income is below the subsistence level can apply to government agencies to receive social assistance in the form of subsidies and benefits. Typically, such calculations are made by a social worker. However, this does not prevent you from learning how to calculate the cost of living and making calculations yourself in order to understand the advisability of contacting the relevant authorities.

"Dirty income"

It seems unfair to people that income is recorded before personal income tax is deducted from it. That is, Social Security is interested in your “dirty” salary, and you can only manage that part of the salary that is actually paid to you, that is, minus personal income tax.

A petition has been created on the Change.org website calling for a change in the situation regarding personal income tax as part of family income.

“We demand a calculation after deduction of personal income tax, since families do not see this money, which means the family’s income is much lower!!!,” writes the author of the petition.

In comments on this topic in our Zen channel, people also expressed more exotic proposals regarding accounting for “net” income.

For example, one reader believes that the mortgage payment should be deducted . After all, after paying off the mortgage, the family has at its disposal an amount much less than the “dirty” income from the 2-NDFL certificate.

However, to some, this view of income accounting seems wrong.

Here's what they write in the comments:

Maybe you could also get a loan for an iPhone and a vacation in Thailand? Mortgage is your personal initiative and your problem.

Another subscriber believes that income should not include alimony , which the child’s father pays to his ex-wife for the child from his first marriage:

It is necessary to mention alimony, which for some reason is also taken into account in the family income, but in fact it is the income of different families, but it is taken into account for both parties - both the one who receives and the one who pays. This is complete injustice.

Some are outraged that income includes deductions from wages in the form of trade union membership dues , as well as voluntary pension contributions to non-state pension funds . And utilities and other expenses are not deducted from income.

The fact of having a mortgage and exorbitant utilities is not taken into account. Prices for everything possible are rising, the child has to pay for kindergarten, section. To collect someone for school. Nothing is taken into account. According to your documents, you are wealthy, but in fact, you are left with crumbs on your hands...

- write in the comments

By the way, as for accounting for personal income tax, as our readers write, sometimes it is even taken into account twice:

We were denied benefits because, in addition to salaries and taxes, they also took into account the tax deduction that we received during the specified period. Those. They calculated the same amount twice (first it was in the salary, then in the deduction). And it’s simply impossible to prove anything.

At the same time, there are opposing opinions regarding the accounting of “dirty” rather than “clean” wages:

I don’t think this is a scam, personal income tax is a tax that is deducted from an individual’s income. Therefore, it is fair that dirty income is taken to calculate benefits, because tax is your personal expenses, the same as, for example, rent, property tax. Maybe you should also deduct these amounts?

What is taken into account?

The mechanism for calculating the cost of living is quite complex. In addition, this indicator is subject to constant fluctuations that are associated with inflation and other changes in the country’s economy. Simply put, with an increase in prices for food, other goods and services that the government includes in the cost of living.

The more expensive the set of things necessary for life becomes, the more money each citizen needs.

In fact, the cost of living is the total amount of compulsory goods and other payments included in the consumer basket. The cost of living is calculated separately for several categories of citizens, considering that the needs and, accordingly, the expenses of each of them are different.

What do you need to know?

If the family has a very modest income, this may become a reason to contact the social service and further assign a special status.

After all, if you calculate the cost of living for 4 people and understand that the family income is below this level, it is easy to conclude that in such conditions it is incredibly difficult, if not impossible, to provide children with comfortable living conditions and nutritious food, as well as provide quality education.

That is why the state does not abandon such families to the mercy of fate, but tries to help them. However, to apply for social assistance you need to know how to calculate the cost of living. The state updates this indicator quarterly. Moreover, it is calculated separately for each socio-demographic group of Russian citizens. In practice, this means that calculating the cost of living for children and for adults is not the same thing. For the latter it will be slightly higher.

In all regions of Russia the standard of living is different. Accordingly, local authorities are empowered to set a living wage for their own region. Various payments will also be calculated on its basis: benefits, social benefits, scholarships, pensions, salaries.

Comments: 21

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Yuri

07/13/2021 at 22:49 Why in Ryazan do I get paid PM differently every month?

Reply ↓ Anna Popovich

07/19/2021 at 16:11Dear Yuri, every quarter the amount of the subsistence minimum is approved by Government Decree. Its value is also influenced by seasonal fluctuations in food prices, economic, demographic, social and other factors.

Reply ↓

04/18/2021 at 10:47

Hello. The cost of living in our region is 35,000, the salary minus income tax is 31,000. Is this legal?

Reply ↓

- Anna Popovich

04/18/2021 at 20:33

Dear Lilia, according to the law, the minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage, and not the subsistence level.

Reply ↓

09.10.2020 at 00:50

Tell me, I’m a pensioner with a non-working pension 14915, this includes children’s benefits. I have a minor child. It turns out that my child’s living allowance is 1920 rubles. And I read that it should be 11200. Am I understanding correctly or am I confusing something. And where should I contact about this issue?

Reply ↓

- Anna Popovich

09.10.2020 at 10:12

Dear Natalya Pavlovna, for a full consultation, we recommend contacting the social protection department of your city.

Reply ↓

10/08/2020 at 01:04

I wanted to know that we are a family of 4 people, husband, wife, daughter and son. My husband’s salary is a maximum of dirty 36 thousand. I’m on maternity leave. And I have two children. We were told that in the Krasnodar region the cost of living should not exceed 44 thousand. And as I read, they wrote that the amount is then divided by 3 and then the number of family members. Then it’s rude my husband says 35,000 + I was paid maternity leave this month 18,000 = 53,000 thousand. We do everything by 3 = 17.700 and divide by 4. It turns out 4.417. So, or am I wrong about something???

Reply ↓

- Anna Popovich

08.10.2020 at 17:03

Dear Daria, The cost of living is calculated as follows: SD (average per capita family income) = D (profit of all members): Km (Calculation period for 3 months): H (number of people).

Reply ↓

09.21.2020 at 18:43

Hello! Please tell me why the minimum wage is equal to the federal minimum wage, and not the regional monthly wage? In Vorkuta the PM is larger than the federal PM. Why then is the regional subsistence level calculated if all calculations are made according to the federal one?

Reply ↓

- Anna Popovich

09.22.2020 at 09:26

Dear Elena, the procedure for calculating the minimum wage is established by law and is regulated by Federal Law No. 82-FZ “On the minimum wage.”

Reply ↓

09.21.2020 at 11:55

Hello! Please tell me, I gave birth to a second child, we want to apply for additional one-time benefits, we need to collect documents, and it is written not to exceed one and a half subsistence minimum for three months, tell me how to calculate this?

Reply ↓

- Anna Popovich

09.21.2020 at 12:36

Dear Irina, each region has its own cost of living. We recommend that you use for calculations the Government Decree “On approval of Methodological recommendations for determining the consumer basket for the main socio-demographic groups of the population in the constituent entities of the Russian Federation” and the Federal Law “On the subsistence level in the Russian Federation” No. 134-FZ.

Reply ↓

09.18.2020 at 18:48

Can a pension be lower than the subsistence level?

Reply ↓

- Anna Popovich

09.19.2020 at 19:19

Dear Irina, all non-working pensioners whose total amount of material support does not reach the pensioner’s subsistence level (PLS) in the region of his residence are provided with a federal or regional social supplement to their pension up to the PMS amount established in the region of residence of the pensioner.

Reply ↓

06/04/2020 at 12:07

Can a working pensioner receive a salary of 3 minimum wages, or should it be fixed?

Reply ↓

- Anna Popovich

06/04/2020 at 14:50

Dear Boris, the current Labor Code establishes time-based, piece-rate and commission wages, from which we can conclude that wages may not be fixed. But at the same time, the amount of remuneration cannot be expressed in variable quantities - that is, even non-fixed remuneration must have an established monetary equivalent in Russian rubles, and not in the size and quantity of the minimum wage.

Reply ↓

04/19/2020 at 00:13

I have been working in a hotel since November 1, 2019. Due to the pandemic, the hotel was not closed for quarantine. I work. There are 5 shifts of 12 hours a month, a shift costs 1300 with a tax deduction of 13%. There are no more payments. How correct is this on the part of the employer. When the cost of living is 11 thousand. How can you live for a month on 5655 rubles? Is the Organization doing the right thing by forcing you to work, and even for such pennies?

Reply ↓

- Anna Popovich

04/20/2020 at 20:37

Dear Lina, as a general rule, the employer is obliged to give the employee the opportunity to work out the norm of working hours established by law and enshrined in the contract for a specified period, and at the same time, for working out the norm for a month, the employee must be paid a salary of at least the minimum wage. Moreover, even when maintaining a time-based wage system and summarized recording of working time, payment cannot be lower than the minimum wage. But this issue can only be resolved with a detailed study of the conditions of your work and the employment contract.

Reply ↓

03/30/2020 at 14:45

We need to lock up the deputies for a month, give them the minimum wage, and let them bring food according to their orders. Let's see how they howl. In another month they would have adopted a law on the minimum wage = 25,000 rubles.

Reply ↓

01/20/2020 at 21:01

If for some reason the employee’s salary is less than the minimum wage, the employer must pay the missing amount through bonuses, allowances, or increase the salary by an additional agreement.© Don’t you think this is wrong. A bonus is an incentive BONUS, and “hold out” the salary up to the minimum wage at the expense of a bonus, this means depriving the employee of INCREASED wages for high-quality and conscientious work. Instead of “reinventing the wheel” and deceiving the people by raising wages to the minimum wage with incentive bonuses, it is necessary to return to the Labor Code an article about equating the rate of the first grade to the minimum wage, which was in the previous Labor Code and which was removed from the new one, which is where the movement into poverty began...

Reply ↓

- Anna Popovich

01/20/2020 at 23:19

Dear author, in the commentary material we are only talking about legal literacy and the employer’s obligation to pay employees in accordance with the minimum wage. As for bonuses, they are also part of the salary in accordance with Article 129 of the Labor Code of the Russian Federation, which means that at their expense the legally established minimum wage level can be achieved and this is legal.

Reply ↓

How to calculate the cost of living?

First of all, let's find out what definitions the state relies on when setting this indicator.

- Consumer basket. Includes a mandatory set of industrial and food products, as well as public services, which provide a person with the opportunity to lead a normal life and maintain health.

- Average per capita income is the amount that falls on each family member. To calculate this indicator, first determine the total income of a particular family, and then divide the resulting indicator by the number of its members.

- Socio-demographic group. These are categories of Russian citizens that differ in significant characteristics. For example, before calculating the cost of living, the entire population is conventionally divided into several large categories. These include children, able-bodied citizens and pensioners.

These are the main indicators that specialists take into account, whose task is to calculate the cost of living.

How do specialists act?

- First, the cost of the food basket is determined. To do this, calculate the number of products a person needs for a year, and then divide the resulting figure by twelve.

- The calculation result is multiplied by the average price of services and goods.

- The results are added up.

If we are talking not about an individual citizen, but about a family, then slightly different calculation rules apply. To receive benefits, you need to contact the social protection department.

For correct calculations, you need to provide information about the full composition of the family in need of social support from the state, as well as the amount of income of each able-bodied member for the last three months. In addition, employees request information about the property owned by a particular family.

Not only wages are taken into account as income, but also other sources determined by law. For example, this could be the average income that must be paid to an employee when he is laid off from the enterprise.

Also included in income are various benefits, payments for occupational diseases, alimony, etc.

However, there is a category of income that is not taken into account for benefits. What does this mean?

- Income of the spouse if he is serving a sentence or is in military service.

- Income of children who live separately or are on state support.

- Income of parents who were deprived of their rights.

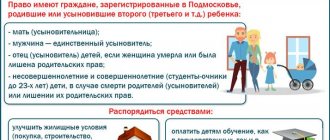

For benefits for children from 3 to 7 years old

The basic requirements for the procedure for assigning and making monthly cash payments for a child aged 3 to 7 years inclusive have been approved:

- Decree of the Government of the Russian Federation dated March 31, 2021 N 384 “On approval of the basic requirements for the procedure for assigning and making a monthly cash payment for a child aged 3 to 7 years inclusive, an approximate list of documents (information) necessary for assigning the specified monthly payment, and a standard application form for her appointment" as amended from March 31, 2021 No. 489

- Decree of the Governor of the Perm Territory dated April 30, 2021 No. 57 “On approval of the procedure for assigning and making monthly cash payments for a child aged 3 to 7 years inclusive” as amended on April 13, 2021.

Term

The average per capita family income for assigning a monthly payment is calculated based on the amount of income of all family members for the last 12 months preceding the four calendar months before the month of filing the application for assigning a monthly payment. We apply for payment in June 2021, counting income for February 2020 - January 2021. Divide the result by 12 and by all family members.

Income composition

Incomes that are taken into account when obtaining the status of a low-income family are taken into account, but only those received in cash. Plus, the property of the applicants is taken into account. Low-income families who have:

- one apartment of any size or several apartments if the area for each family member is less than 24 sq.m.;

- one house of any size or several houses if the area for each family member is less than 40 sq.m;

- one dacha;

- one garage, a parking space or two, if the family has many children, the family has a disabled citizen, or the family has been issued a motor vehicle or motor vehicle as part of social support measures;

- a land plot with a total area of no more than 0.25 hectares in urban settlements or no more than 1 hectare if the plots are located in rural settlements or inter-settlement areas. Land plots provided as a measure of support for large families, as well as a Far Eastern hectare, are not taken into account when calculating need;

- one non-residential premises. Outbuildings on plots intended for individual housing construction, personal subsidiary plots, or on garden plots of land are not taken into account;

- one car, or two, if the family has many children, a family member has a disability, or the car was received as a measure of social support;

- one motorcycle, or two, if the family has many children, a family member has a disability, or the motorcycle was received as a measure of support;

- one unit of self-propelled equipment under 5 years old (these are tractors, combines and other pieces of agricultural equipment);

- one boat or motorboat under 5 years old;

- savings, annual interest income for which does not exceed the subsistence level per capita in Russia as a whole (approximately 250 thousand rubles).

Families with new (up to 5 years old) powerful (over 250 hp) cars will not be able to receive benefits, except in cases where we are talking about a family with four or more children, and this is a minibus or other car with more than five seats.

When calculating income, the “zero income rule” applies. To assign a payment, there must be a receipt of funds in at least one of the categories:

- income from labor or creative activities (salaries, royalties, payments under civil contracts);

- income from business activities, including income of the self-employed;

- pensions;

- scholarships;

- caring for a disabled child or a disabled citizen or an elderly person over 80 years of age.

If the applicant or another adult family member has not received funds throughout the year, that is, he declares “zero income,” the benefit will be assigned only if the reason for “zero income” is objective. These reasons are recognized:

- child care, if this is one of the parents in a large family (i.e. one of the parents in a large family may have zero income for all 12 months, and the second parent must have income from labor, entrepreneurial, creative activities or pensions, scholarships);

- child care if we are talking about a single parent (i.e. the child officially has only one parent, the second parent has died, is not listed on the birth certificate or is missing);

- caring for a child until he reaches the age of three;

- caring for a disabled citizen or an elderly person over 80 years of age;

- Full-time education for family members under 23 years of age;

- military service and a 3-month period after demobilization;

- undergoing treatment lasting 3 months or more;

- unemployment (confirmation of official registration as unemployed at the center is required; employment, up to 6 months of being in this status is taken into account);

- serving the sentence and a 3-month period after release from prison.

If in total the parents had no income for an objective reason for 10 months out of 12, then the benefit will be assigned despite the “zero income”.

In this case, both parents may have objective reasons. For example, dad served in the army, and then for 3 months he was unable to find a job, joined the labor exchange and had no income from work for the whole year, and mom was caring for a child under 3 years of age. In this case, despite the fact that both mom and dad have no earned income, benefits will be assigned since both parents have objective reasons for the lack of income.

The income and property of grandparents and other family members are not taken into account when assigning benefits for children from 3 to 7 years old.

Family composition

The main difference from receiving low-income status is that grandparents and other family members, even those living together, are not included in the family. But the supervised children come in. Starting from 2021, a supervised child can also receive a payment for children from 3 to 7 years old inclusive, if he lives in a family. Includes family members and guardians of the child who have submitted an application for a monthly payment, and children under the age of 23 studying full-time, including those under guardianship (with the exception of such children who are married).

Who is not part of the family?

- persons deprived of parental rights (limited parental rights) in relation to the child (children) for whom an application for a monthly payment is submitted;

- persons who are fully supported by the state (with the exception of children under guardianship);

- persons undergoing conscription military service, as well as military personnel studying in military professional organizations and military educational organizations of higher education and who have not concluded a contract for military service;

- persons serving a sentence of imprisonment;

- persons undergoing compulsory treatment by court decision;

- persons against whom a preventive measure in the form of detention was applied.

Basic principles

The following rules allow you to correctly calculate this indicator:

- The entire population of the country must be taken into account. This approach allows us to assess the well-being of the nation as a whole, and not just of individual categories of Russian citizens.

- They take into account price increases not only for food products, but also for other categories of expenses included in the consumer basket. These are goods and services that a citizen needs to live a full life and maintain health.

- To know how to calculate the cost of living, it is important to take into account the division of citizens into several categories. This will allow you to correctly calculate the amount of social benefits. For example, different amounts are provided for children and pensioners.

- How to calculate the cost of living? This indicator includes the size of the consumer basket, as well as monthly payments (for example, utility bills). The cost of living is conventionally divided into three categories, each of which is allocated a certain share. Products should account for no more than fifty percent of the subsistence level, services, as well as non-food products - no more than twenty-five percent each.

- The cost of living is calculated separately for each citizen and for the family. In this case, the total income of people living at the same address is taken into account. An exception to this rule is communal apartments. For the reason that they often contain people who are not united by family ties. In this case, the family can only include close relatives. In this case, the total income will be divided by the number of its members.

Subsidies and compensation

When calculating family income today, they take into account both compensation received for caring for disabled citizens and subsidies for housing and communal services for parents raising a disabled child.

State Duma deputy Alexei Zhuravlev, leader of the Rodina party, turned to Prime Minister Mikhail Mishustin with a request to eliminate this legislative misunderstanding, the Voronezh publication Bloknot reports.

“A paradoxical situation arose: citizens, being recognized as poor in the manner prescribed by law, according to Decree No. 384, were among those who were not entitled to payments under the Decree. At the same time, the problem affected the least protected segments of the population - low-income families with disabled children, the parliamentary request notes. “Taking into account the above, as well as the fact that the wording of Resolution No. 384 most likely contains an unfortunate error, I ask you to consider the possibility of making appropriate changes to it in order to cover the widest range of citizens in need of material support from the state.”

Size

To better understand how to calculate the cost of living, let's pay attention to what indicators are set by the Russian government. For example, let’s take just two regions – Moscow and St. Petersburg. This will allow you to understand the difference in the established cost of living. You need to understand that in other Russian cities the numbers will also be different.

So, below are examples for the following categories:

- able-bodied citizens;

- pensioners;

- children and minors.

PM sizes for different categories in 2021

When calculating this size, the government divides the population into three categories:

- Pensioners.

- Children.

- able-bodied citizens.

Let's look at this issue in more detail, taking two cities as examples - Moscow and St. Petersburg.

| Category | Who goes there? | PM size in the capital | PM value in St. Petersburg |

| Working population | This includes persons who are able to take part in work activities, including:

It is worth noting that years may vary. This group also does not include disabled people of groups 1 and 2 | 17,219 rubles | 11,568 rubles |

| Pensioners | People who have reached retirement age | 8,419 rubles | 10,715 rubles |

| Children (under age) | Persons who cannot work because they are underage | 12,989 rubles | 10,144 rubles |

| Size per capita | The average meaning that applies to all citizens | 15,092 rubles | 10,526 rubles |

These PM sizes are established by decrees of the Government of Moscow and St. Petersburg. In other regions, the cost of living is also set by the Government or local self-government bodies.

Formula

How to calculate the cost of living for a family? This question is relevant not only for specialists who set this indicator quarterly, but also for ordinary citizens.

First of all, you need to know the formula.

PM = ((PM tn * N tn) + (PM p * N p) + (PM d * N d))/( N tn + N p + N d)

This formula uses the following notation:

- PM - subsistence minimum.

PM tn – PM for the working population.

PM p - PM for pensioners.

PM d - PM for children.

N is the number of able-bodied citizens belonging to the relevant socio-demographic groups. For example, N d is the number of able-bodied children.

Step-by-step instruction

Now you can understand how to calculate the cost of living for 3 or more people. To do this, simply follow the instructions below.

- First of all, you need to understand how many socio-demographic groups there are in your family and how many are included in each of them. Conventionally, all citizens are divided into three categories: children, able-bodied people, and pensioners. If there are no representatives of any category in the family, then they do not need to be taken into account in the formula.

- Next, you need to find out what the cost of living is for each category in your region. It is important to take into account current data, as the government reviews the established indicator quarterly. Citizens can check with the administration or social protection for information on the cost of living.

- Having found out all the input data, all that remains is to substitute them into the formula and find out the result for your own family. If the indicator is below the established subsistence level, this may be a reason to apply for social assistance.

Example

It is not enough to just know in theory how to calculate the cost of living per person. You need to be able to apply information in practice.

Using the above information and formula, let's try to calculate the cost of living for a family consisting of two able-bodied adults, two children and one pensioner.

First you need to add up the income of all family members, multiplied by the cost of living separately for each category. The result is 51,845 rubles 70 kopecks.

Now the result must be divided by the number of family members, that is, five people in this example. The result is 10,369 rubles 14 kopecks.

In this example, this is below the subsistence level for the working population.

What do minimum wages and PM affect?

The minimum wage and the cost of living affect the following payments:

- Wage. In 2021, a citizen cannot receive an income per month below the established figure. If the salary is below the subsistence level, the employee has the right to file a complaint with the appropriate organization. After this, sanctions are applied to the company owner and fines are imposed. At the same time, real earnings may be lower than the minimum wage if a citizen works part-time, does not meet the time and labor standards, or works part-time.

- Benefits. Benefits for pregnancy, childbirth, child care up to 1.5 years old, and sick leave payments depend on the minimum income.

- Taxes. The amount of taxes also depends on the minimum wage. As the minimum wage increases, tax deductions increase.

- Regional coefficient . Additional payments are assigned to those citizens who work in special climatic zones.

Minimum wages can have a negative impact on small businesses. Entrepreneurs are not able to pay salaries in this amount. In addition, a number of citizens have reduced motivation to develop and improve professional skills.

If a Russian’s pension is less than the minimum subsistence level, then the payments reach the required level. The pensioner will need to contact the social protection fund at the place of residence or the Pension Fund and submit a written application.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Benefits

This question is relevant for citizens who plan to apply for social assistance. The status of a low-income family gives the right to receive benefits and subsidies from the state.

Family wealth is affected by the number of people who do not bring in income. In addition, the professional activities of some individuals may not provide a decent standard of living or require certain expenses for its implementation. In addition, the cost of living for children takes into account education costs. That is why this figure is higher for minors than for pensioners.

The lower the income per family member, the higher the likelihood of receiving social support from the state.

Income from the sale of housing

The list of income that is taken into account when assigning benefits also includes income from the sale of real estate.

A petition has been published on Change.org calling for this situation to be corrected. If income is taken into account, then the cost of buying a new apartment must also be taken into account.

“Families who sold their apartment, added money by taking out a loan, and bought a larger apartment are not eligible for these payments. By trying to improve their living conditions for their children, parents lose the right to such necessary payments for a low-income family,” writes the author of the petition.

For children

Since 2021, the Government has adopted a law on the basis of which families can receive payments for their first child up to one and a half years old.

How to calculate the cost of living for child benefits?

- First you need to calculate the average per capita income for each family member. An important nuance is that income is taken into account before taxes are paid. That is, the calculation uses the amount of salary before payment of income tax. However, everyone understands that the amount that a citizen will actually receive will be lower.

- Next, you need to find out what the cost of living is established in your region for the working population. Moreover, you need to take into account the indicator for the second quarter of the previous year.

- Now the cost of living needs to be multiplied by one and a half, and the resulting amount compared with the average per capita income of your family. If the second indicator is lower, in accordance with the law, you can count on receiving child benefits for the first child.

How to calculate the cost of living for child benefits? First of all, you need to make sure that the income for each family member is below the level established for your region. This will be a reason to contact the social assistance department. If a family is recognized as low-income, it can count on social support from the state.

What income is excluded from the calculation?

The following receipts are excluded from the calculation:

- presidential benefits for children from 3 to 7 years old, including those accrued for previous periods;

- coronavirus payments for children. This is 10,000 rubles - one-time for a child from 3 to 16 years old. And 5,000 rubles monthly for April-June 2020 for children under 3 years old;

- material assistance of a one-time nature in connection with a natural disaster or other emergency circumstances or in connection with a terrorist act;

- If the family pays alimony, its amount is deducted from the total income.

When to contact?

Now you know how to calculate the cost of living for benefits. However, the next question arises, when should you apply for payment? It is very important. Do not put off providing documents until later.

The law allows parents to apply for benefits at any time within one and a half years from the date of birth of the child. However, if you provide documents six months later or later from this point, you may lose part of the payments. Since they will be accrued only from the date of application, and not from the day the child is born.

If government authorities make a positive decision, the benefit is paid within a year. Then you will again need to provide documents to extend the payment period until the child is one and a half years old.