On the occasion of the birth of children, citizens are entitled to benefits provided for in Art. 3 of the Federal Law of May 19, 1995 No. 81-FZ. On January 1, 2021, the provisions of Federal Law No. 418-FZ of December 28, 2017 came into force, providing families with a small average per capita income with additional social support measures in the event of the birth (adoption) of a first and (or) second child. 1C:ITS experts told us what benefits can be obtained and where to apply for them.

The employer does not make such payments. To obtain them you must contact:

- at the birth (adoption) of the first child - to the social protection authority at the place of residence (clause 4 of article 2 of Law No. 418-FZ);

- at the birth (adoption) of a second child - to the Pension Fund of the Russian Federation at the place of residence (clause 5 of Article 2 of Law No. 418-FZ).

In the event of the birth (adoption) of two or more children, you need to apply for payments for one child to the social protection authority, and for the second child - to the Pension Fund of the Russian Federation (clause 6 of Article 2 of Law No. 418-FZ).

Benefit for registration in early pregnancy

Starting from July 1, 2021, the benefit for women who registered in the early stages of pregnancy became monthly (previously it was a one-time payment).

The new benefit amount is 50% of the regional subsistence level for the working population in the corresponding constituent entity of the Russian Federation. Not everyone has the right to benefits. Women for whom two conditions are simultaneously met are eligible for payments:

- the pregnancy period is 6 or more weeks, and registration with a medical organization occurred before 12 weeks;

- The average per capita family income is not more than the subsistence level per capita in a constituent entity of the Russian Federation on the date of application for benefits.

In general, benefits are paid from the month of registration with a medical organization (but not earlier than 6 weeks of pregnancy) until the moment of birth or termination of pregnancy. This follows from the new Article 9.1 of Federal Law No. 81-FZ dated May 19, 1995 (see “Benefits for registration in the early stages of pregnancy will be paid according to the new rules”).

IMPORTANT

From 2021, benefits for registration in the early stages of pregnancy are paid directly by the Social Insurance Fund, bypassing the employer (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the Social Insurance Fund”).

Generate and submit documents for benefit payments directly to the Social Insurance Fund Submit for free

Maternity benefit

These payments accompany maternity leave. They are only available to mothers and are designed to compensate for the loss of income during a forced break from work. Accordingly, the same categories of women can receive benefits as when registering in early pregnancy. The unemployed, if they were fired not due to the liquidation of the organization, are not entitled to payments.

Female students and military personnel will receive payments in the amount of a scholarship or allowance. For those working under an employment contract, the amount of benefits is calculated using the formula:

PPBiR = income 2 years before maternity leave ÷ 730 or 731 days × number of days of maternity leave.

In this case, payments cannot exceed 340,795 rubles and be lower than 58,878 rubles if maternity leave lasts 140 days. This is the usual duration, but it can increase - for example, with multiple pregnancies. The benefit is also available to mothers who have adopted a baby under three months old. They receive payments in 70 days.

Entrepreneurs pay contributions based on the minimum wage. This means that child benefits will be calculated according to the same indicator. Mothers who were fired during the liquidation of the organization will receive 708.23 Federal Law of May 19, 1995 N 81-FZ ruble. Some regions, for example Moscow On social support for families with children in the city of Moscow, are ready to support them additionally.

To receive payments, you need to apply with a sick leave certificate at your place of work or with a certificate from the antenatal clinic at your place of service or study. Entrepreneurs apply directly to the Social Insurance Fund.

One-time benefit for the birth of a child in 2021

One of the parents (adoptive parents) has the right to claim a one-time benefit at the birth of a child (Article 12 of Law No. 81-FZ).

In 2021, the benefit amount is:

- in January - 18,004.12 rubles;

- from February to December - 18,886.32 rubles. (see “Children’s benefits increased by 4.9%”).

IMPORTANT!

Since 2021, a lump sum benefit for the birth of a child will be paid directly by the Social Insurance Fund, bypassing the employer (see “From 2021, in all regions of Russia, benefits will be paid directly from the Social Insurance Fund”).

What payments to expect at birth

At the birth of a child, these funds are provided:

- Monthly payments.

- One-time support.

- Providing a certificate.

To receive funds, you need to process payments.

Privileges

Pregnant women are given a birth certificate. This document refers to three papers:

- For presentation to representatives of the antenatal clinic.

- For the maternity hospital.

- For presentation to representatives of the clinic.

If two or more babies were born, you can receive maternity capital. Its size is approximately 453,000 rubles. Funds are allocated for established purposes.

If there are three or more children, a family is considered to have many children. Such a family is provided with additional benefits and compensation.

In addition, the wives of men serving in military service are provided with the following aids:

- A one-time payment of 25,900 rubles.

- Monthly payments of 11,100 rubles.

Compensation is provided if the child does not receive a place in kindergarten.

There is also a program “Housing for young families”. Let's consider its conditions:

- Age up to 35 years.

- Availability of real estate with an area of up to 15 square meters. m. for one person.

- Availability of income certificate.

Not only families, but also single mothers can participate in this program. Funds can be used for construction, purchase of real estate, or obtaining a mortgage.

FOR YOUR INFORMATION! There are many child benefits available. There are programs aimed at all parents. There are also benefits available under certain circumstances.

Maternity payments in 2021

A woman who has given birth to a child (or adopted a baby under the age of 3 months) receives a one-time maternity benefit (Article 8 of Law No. 81-FZ). To assign it, you need, in particular, a sick leave certificate.

Work with electronic sick leave with a “complicated” salary with bonuses and coefficients

In general, the payment amount is the average daily earnings (it is calculated for the two years preceding the one in which the maternity leave began), multiplied by the number of days of maternity leave. Regardless of the employee’s length of service, the B&R benefit is always multiplied by 100%. Personal income tax is not withheld (for more details, see: “Maternity benefits in 2021: how to correctly calculate maternity benefits”).

Maternity payments cannot be as large or as small as desired. If the average earnings are less than the minimum wage, then the benefit is calculated based on the minimum wage established on the start date of the maternity leave. If actual earnings exceed the limit value of the base for calculating contributions approved for the corresponding year, the benefit is calculated based on the limit value (see Table 1).

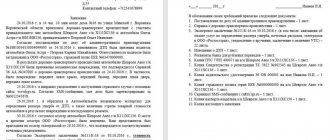

Table 1

Minimum and maximum amount of maternity payments in 2021

| Number of vacation days according to BiR | Minimum benefit amount (based on the minimum wage) | Maximum benefit amount (based on cap) |

| 140 days | RUB 58,878.4 | RUB 340,795 |

| 156 days | RUB 65,607.36 | RUB 379,743 |

| 194 days | RUB 81,588.64 | RUB 472,244.5 |

IMPORTANT!

Starting from 2021, maternity benefits are paid directly by the Social Insurance Fund, bypassing the employer (see “Starting from 2021, benefits will be paid directly from the Social Insurance Fund in all regions of Russia”).

From July 1, 2021, this benefit will be transferred only to Mir cards (see “From July, maternity and child benefits will be transferred only to Mir cards”). Calculate maternity benefits taking into account current indicators Calculate

Amount of financial assistance

In 2021, the amounts paid for the first child differ depending on the region. The size of payments is determined by the cost of living for a child, established for the second quarter of 2021 in a specific subject of the Russian Federation. In cities of federal significance the figures are as follows: in St. Petersburg - 11,176.2 rubles, in Moscow - 15,225 rubles, in Sevastopol - 12,094 rubles. For your regions, check the information in government decrees approving the cost of living indicators for the 2nd quarter of 2021.

Monthly allowance for child care up to 1.5 years

As a general rule, the amount of payment for a full month is the average daily earnings (it is calculated for the two years preceding the one in which the maternity leave began), multiplied by 30.4 and 40% (Article 15 of Law No. 81-FZ; for more details, see "Hospital and "children's" benefits: current rules for calculation, payment and reimbursement").

The maximum and minimum possible values are set.

From January 2021, the maximum amount of child care benefits per month is RUB 29,600.48.

IMPORTANT!

From 2021, benefits for child care up to 1.5 years are paid directly by the Social Insurance Fund, bypassing the employer (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the Social Insurance Fund”). From July 1, 2021, this benefit will be transferred only to Mir cards (see “From July, maternity and child benefits will be transferred only to Mir cards”).

Minimum amount of benefit for child care up to 1.5 years

From June 2021, the minimum allowable amount of child care benefits is RUB 6,752. This follows from the new wording of Article 15 of Law No. 81-FZ (see “New “anti-virus” benefits: deduction for the self-employed, increase in child benefits, rent discount”).

This value is indexed annually. Since February 2021, the coefficient is 1.049. The minimum amount of benefits for child care up to 1.5 years is 7,082.85 rubles (6,752 rubles x 1,049; see “Children’s benefits increased by 4.9%)”).

ATTENTION

Now the following rule for calculating monthly benefits has lost its practical meaning: “if the average monthly earnings are less than or equal to the minimum wage, the benefit is considered 40% of the minimum wage.”

In 2021, the minimum wage is 12,792 rubles, and 40% of it is 5,116.8 rubles. The resulting value is less than RUB 7,082.85. Therefore, they should not pay 5,116.8 rubles. (according to the minimum wage), and 7,082.85 rubles. (minimum allowable benefit amount). Calculate your salary and benefits taking into account the annual increase in the minimum wage Calculate for free

table 2

Minimum values of child care benefits up to 1.5 years in 2021

| Period | Minimum benefit for a full month (if there is a regional coefficient, you need to multiply by it): | |

| for the first child | for the second child and subsequent children | |

| January | RUB 6,752 | RUB 6,752 |

| February - December | RUB 7,082.85 | RUB 7,082.85 |

Payment of one-time benefit

The established one-time benefit for a mother in connection with the birth of a second child is 18,886 rubles 32 kopecks .

The payment is made at the parent’s place of work, provided that he has submitted an application for social assistance, attaching a package of documents necessary for this. The appointment and payment are made no less than ten days from the date of submission of the set of documents, but no more than six months after the child was born.

Benefits are also paid for caring for a child up to one and a half years old. In this case, the amount is about 40% of the established average income over the past period of time, two years. In fact, benefits can be received by other relatives if it is proven that they are caring for the child.

Monthly payment for the first and second child under 3 years of age (the so-called “Putin’s”)

Such benefits have been awarded before. In 2021, it was paid until the child reached the age of 1.5 years. Families whose income per person did not exceed one and a half times the regional subsistence minimum for the second quarter of the previous year had the right to this benefit.

Changes have occurred since 2021. Now money is given out longer - until the child reaches the age of three. Families with an average per capita income of no more than two regional subsistence levels for an able-bodied person, established for the second quarter of last year (current version of Federal Law No. 418-FZ dated December 28, 2017) have the right to payment.

REFERENCE

For which children are funds allocated?

For the first and second child born (adopted) during the period from January 1, 2021 to December 31, 2022 inclusive. Payments are not provided for the third and subsequent children. The amount of the benefit is the minimum cost of living per child, established in the constituent entity of the Russian Federation for the second quarter of the previous year. For example, in the Moscow region in the second quarter of 2021, this amount was equal to 13,317 rubles. This means that in 2021 the payment for the first and second child under 3 years old in the Moscow region is 13,317 rubles. per month.

Dissatisfaction No. 1. Child's date of birth

Benefits up to 3 years of age will be paid for children born in 2021 and later.

“Are our children worse?” parents of babies born in 2021 are indignant. An initiative has been published on the ROI website, the author of which demands that restrictions on the year of birth be removed from the above-mentioned law so that children born in 2021 can receive benefits on an equal basis with other children.

“Somehow this can be understood, the child was born before the law was adopted, and the law does not have retroactive force. But the new changes simply do not fit into my head. Why then doesn’t the Government accept these amendments for children born in 2021?” the active citizen is indignant.

Maternity capital in 2021 for 1, 2 and 3 children

In 2021 and earlier, family capital was not provided to those who gave birth (adopted) their first child. Starting from 2021 - expected.

If a child was born (adopted) in 2021, maternity capital is equal to:

- for the first child - 483,881.83 rubles;

- for the first and second child - 639,431.83 rubles. (RUB 483,881.83 for the first-born + RUB 155,550 for the second child);

- for the second child (if the first was born before 2021) - 639,431.83 rubles;

- for the third or subsequent children (if the right to family capital did not previously arise) - 639,431.83 rubles.

REFERENCE

If the right to maternity capital arose in 2021 or earlier, then the unused part is indexed.

The new amount depends on how much of the capital the family did not manage to dispose of before January 1, 2021. So, when transferring 100% of the capital, the new amount is 483,881.83 rubles, 50% - 241,940.92 rubles (483,881.83 rubles × 50%); 25% - 120,970.46 rubles (483,881.83 rubles × 25%), etc. Innovations were introduced by Federal Law dated March 1, 2020 No. 35-FZ.

We arrange maternity capital

Capital is assigned when a second or subsequent child appears on the account. If the capital was not registered for the second child, a family capital certificate is provided at the birth of the third child. Money can be received by both a woman and a man. The second payment is issued if the person is the sole adoptive parent of two or more children. The corresponding decision of the judicial authority must come into force from the beginning of 2007 to December 31, 2021. The size of MK is 453,000.26 rubles.

The money is paid from the Pension Fund. You can receive them either at once or in part. The purposes for which funds are spent are stipulated by Federal Law No. 256 “On additional measures of state support” dated December 29, 2006. Let's look at them in more detail:

- Improving living conditions.

- Payment for the child's education.

- Compensation for the purchase of equipment and services for the social adaptation of a disabled child.

- Creation of a funded part of a woman’s labor pension.

Previously, parents could receive a lump sum payment from the capital. However, this program was closed in 2021. Maternity capital is registered with the Pension Fund. You need to go to the branch at your place of residence. You can contact the authority at any time. To confirm your rights to capital, you must present a personal certificate. Pension Fund employees are presented with the following documents:

- Statement.

- Passport of both father and mother.

- Baby's birth certificate.

IMPORTANT! All payments given in the article must be formalized. They are not automatically provided at the birth of a child. To obtain them you need to collect documents. A birth certificate is required. Parents should also not forget that some benefits require registration within a certain time frame. As a rule, this is 6 months from the date of birth of the baby. If parents do not make it on time, they will not receive any money.

Benefit for disabled children in 2021

One of the persons caring for a disabled child or a person disabled since childhood of group I is entitled to a monthly payment. Its size in 2021 is:

- for a parent, adoptive parent, guardian, trustee - 10,000 rubles;

- for other persons - 1,200 rubles.

If a regional coefficient is established, the benefit is multiplied by this coefficient.

To qualify for this payment, the caregiver must be able-bodied but not working (Presidential Decree No. 175 dated February 26, 2013).

Plus, the Pension Fund transfers a monthly cash payment (MCA). For disabled children from February 2021 it is 1,707.36 rubles.

A set of social services (NSS) is also provided: medicines, sanatorium vouchers and travel to the place of treatment. In 2021, the cost of the set is RUB 1,211.66. This amount can be obtained in cash equivalent. Then, together with the EDV, the payment will be 2,919.02 rubles. per month (1,707.36 + 1,211.66). This figure is given on the website of the Pension Fund.

The monthly cash payment is established by Federal Law No. 181-FZ dated November 24, 1995. The transfer procedure was approved by Government Decree No. 35n dated January 22, 2015.

Calculate your salary taking into account all current local and regional coefficients and allowances

Benefits for the wife of a conscripted soldier

The state is ready to support the wife of a serviceman with money to compensate for his absence from the side during important and difficult moments. These child benefits are paid not instead of, but in addition to the others.

You need to contact the social security authorities for them.

For pregnancy

If a husband undergoes military service by conscription, then his pregnant wife can receive 29,908.46 rubles. It is important that the gestational age must be at least 180 days Federal Law of May 19, 1995 N 81-FZ.

Per child

A wife or other relative caring for a child under three years old can receive 12,817.91 rubles monthly while his father is serving in conscription.

Allowance for children from 3 to 7 years old

This payment is provided to families whose average per capita income does not exceed a certain amount. It is equal to the regional subsistence minimum per capita for the second quarter of the year preceding the one in which the parents applied for the payment.

Let's give an example. Let's say parents apply for benefits in 2021. Then they should compare the income per person in their family with the cost of living in their constituent entity of the Russian Federation for the second quarter of 20120 (for information on how to determine the billing period and calculate the average per capita income, see: “What payments for children can be received in 2020” ).

How much can you get? Half of the regional subsistence level for children approved for the second quarter of the previous year.

Additional conditions have been introduced in 2021. If, taking into account the specified amount, the average per capita family income is still below the subsistence level per capita, the payment amount is 75%. If the subsistence level is not reached again, the payment will be 100% of the subsistence level for children. For those who received benefits in 2020 without taking into account the above conditions, the amount will be recalculated upward.

In addition, the benefits assigned last year will be recalculated this year based on the new subsistence level.

The corresponding amount is transferred monthly for each child who is a citizen of the Russian Federation from 3 to 7 years old. The start of the payment period is the day the child reaches 3 years of age (but not earlier than January 1, 2021). Graduation is the date when he turns 8 years old.

The benefit was established by Presidential Decree No. 199 dated March 20, 2020. The basic requirements for the procedure for assigning funds were approved by Government Decree No. 384 dated March 31, 2020.

New benefit for the birth of the first child in 2018

Also, starting from 2021, a new monthly benefit has been introduced for the birth of the first child until he or she reaches 1.5 years of age. It is paid through social security benefits. However, not everyone is entitled to it. To obtain it, family income is taken into account. See “Monthly payment for the first child from 2021”. To obtain the right to payments (for the first or second child), the average per capita family income should not exceed 1.5 times the subsistence level of the working-age population of a constituent entity of the Russian Federation for the second quarter of the year preceding the year of application. The table shows the amounts of new benefits broken down by region for 2018.

| The subject of the Russian Federation | The amount of monthly payment to the family is the cost of living of a child in a constituent entity of the Russian Federation |

| In general in the Russian Federation and in the city of Baikonur | 10 160,00 |

| Chukotka Autonomous Okrug | 22 222,00 |

| Nenets Autonomous Okrug | 22 135,00 |

| Kamchatka Krai | 21 124,00 |

| Magadan Region | 19 073,00 |

| The Republic of Sakha (Yakutia) | 17 023,00 |

| Yamalo-Nenets Autonomous Okrug | 15 897,00 |

| Murmansk region | 15 048,00 |

| Sakhalin region | 14 734,00 |

| Moscow | 14 252,00 |

| Khanty-Mansiysk Autonomous Okrug – Ugra | 13 958,00 |

| Primorsky Krai | 13 553,00 |

| Khabarovsk region | 13 386,00 |

| Jewish Autonomous Region | 13 327,00 |

| Kabardino-Balkarian Republic | 12 778,00 |

| Komi Republic | 12 487,00 |

| Krasnoyarsk region | 12 020,00 |

| Amur region | 11 979,00 |

| Republic of Karelia | 11 978,00 |

| Arhangelsk region | 11 734,00 |

| Novosibirsk region | 11 545,00 |

| Moscow region | 11 522,00 |

| Transbaikal region | 11 363,00 |

| Tomsk region | 11 251,00 |

| Sevastopol | 10 935,00 |

| Tyumen region | 10 832,00 |

| Vologda Region | 10 732,00 |

| Pskov region | 10 652,00 |

| Tver region | 10 625,00 |

| Rostov region | 10 501,00 |

| Republic of Crimea | 10 487,00 |

| Irkutsk region | 10 390,00 |

| Astrakhan region | 10 382,00 |

| Saint Petersburg | 10 367,90 |

| Tyva Republic | 10 347,00 |

| Perm region | 10 289,00 |

| The Republic of Buryatia | 10 270,00 |

| Chelyabinsk region | 10 221,00 |

| Kurgan region | 10 217,00 |

| Sverdlovsk region | 10 210,00 |

| Smolensk region | 10 201,00 |

| Novgorod region | 10 176,00 |

| Kaliningrad region | 10 138,00 |

| Ivanovo region | 9 999,00 |

| Samara Region | 9 967,00 |

| Altai Republic | 9 954,00 |

| Kemerovo region | 9 857,00 |

| Krasnodar region | 9 845,00 |

| Ulyanovsk region | 9 818,00 |

| The Republic of Khakassia | 9 811,00 |

| The Republic of Dagestan | 9 774,00 |

| Vladimir region | 9 752,00 |

| Bryansk region | 9 677,00 |

| Volgograd region | 9 664,00 |

| Kirov region | 9 662,00 |

| Chechen Republic | 9 650,00 |

| Mari El Republic | 9 645,00 |

| Nizhny Novgorod Region | 9 612,00 |

| Kostroma region | 9 566,00 |

| Yaroslavl region | 9 547,00 |

| Kaluga region | 9 487,00 |

| Penza region | 9 470,00 |

| Altai region | 9 434,00 |

| Oryol Region | 9 429,00 |

| Karachay-Cherkess Republic | 9 428,00 |

| Republic of North Ossetia-Alania | 9 372,00 |

| Republic of Adygea | 9 325,00 |

| Omsk region | 9 323,00 |

| Leningrad region | 9 259,00 |

| Tula region | 9 256,00 |

| The Republic of Ingushetia | 9 241,00 |

| Ryazan Oblast | 9 215,00 |

| Saratov region | 9 159,00 |

| Stavropol region | 9 123,00 |

| Lipetsk region | 9 078,00 |

| Kursk region | 8 993,00 |

| Udmurt republic | 8 964,00 |

| Orenburg region | 8 958,00 |

| Republic of Kalmykia | 8 944,00 |

| Chuvash Republic – Chuvashia | 8 910,00 |

| Republic of Bashkortostan | 8 892,00 |

| The Republic of Mordovia | 8 714,00 |

| Tambov Region | 8 634,00 |

| Republic of Tatarstan | 8 490,00 |

| Voronezh region | 8 428,00 |

| Belgorod region | 8 247,00 |

Note that if a second child is born in the family, then the new benefit can be received from maternity capital funds.

Allowance for single parents for children from 8 to 17 years old

From July 1, 2021, single parents can receive benefits for children aged 8 to 17 years. The parents (other legal representatives) of the child for whom alimony is paid by court decision have the same right.

The payment is due only if the average per capita income does not exceed the regional subsistence level per capita.

The amount of the payment is half the regional subsistence level for children in the constituent entity of the Russian Federation at the place of residence (stay) or actual residence of the applicant (see “The law on new monthly benefits for children from 8 to 17 years old has been adopted”).

The payment is established by Article 10.1. Federal Law of May 19, 1995 No. 81-FZ.

All child benefits in 2021: table with changes

| Type of benefit | Amount (rub.) | Who is entitled to | |

| One-time payments | |||

| At the birth of a child | 18,004.12 (in January) | 18,886.32 (February-December) | One of the parents (adoptive parents). |

| Maternity benefits (maternity benefits) | Average daily earnings x number of days of maternity leave x 100% (personal income tax is not withheld). Minimum value (depending on the number of vacation days according to the BiR): 140 days — 58,878.4 156 days — 65,607.36 194 days — 81,588.64 Maximum value (depending on the number of vacation days according to the BiR): 140 days — 340 795 156 days — 379 743 194 days — 472,244.5 | A woman who has given birth to a child or adopted a child under 3 months of age. | |

| Maternal capital | Depends on the number of children and when the previous children were born: — for the first child — 483,881.83; - for the first and second child - 639,431.83 (483,881.83 for the first + 155,550 for the second); - for the second child (if the first was born before 2021) - 639,431.83; - for the third or subsequent children (if the right to maternity capital did not previously arise) - 639,431.83. | To a woman, who gave birth to or adopted a child (a man who is the child’s adoptive parent), if the right to family capital did not previously arise. | |

| Student allowance | 10 000 | Parent, adoptive parent, guardian, trustee of children from 6 to 18 years old (provided that the child turned 6 years old no later than September 1, 2021) and a disabled person, a person with disabilities from 18 to 23 years old, if he is studying in basic general education programs | |

| Monthly payments | |||

| When registering in early pregnancy | 50% of the regional subsistence level for the working population | Women whose pregnancy is 6 weeks or more, registered before 12 weeks, and whose average per capita family income is no more than the subsistence level per capita in a constituent entity of the Russian Federation | |

| Child care up to 1.5 years old | Average daily earnings x 30.4 x 40%. Maximum amount: 29,600.48 per month. Minimum amount for the first child per month: — 6,752 (in January); - 7,082.85 (February - December) Minimum amount for the second child and subsequent children per month: — 6,752 (in January); - 7,082.85 (February - December) | A person who is on parental leave. | |

| Payment for the first and second child under 3 years of age | Monthly in the amount of the subsistence minimum for children established in the constituent entity of the Russian Federation for the second quarter of the previous year. | A family in which the first or second child was born (adopted) between January 1, 2021 and December 31, 2022. The average per capita family income should not exceed two regional subsistence levels for an able-bodied person, established for the second quarter of last year. Parents and children must be citizens of the Russian Federation and permanently reside in Russia. | |

| Allowance for children from 3 to 7 years old | Monthly in the amount of 50% (or 75%, 100%) of the subsistence minimum for children established in the constituent entity of the Russian Federation for the second quarter of the previous year. | The parent (or other legal representative) of a child aged 3 to 7 years. The average per capita family income should not exceed two regional subsistence minimums per capita, established for the second quarter of last year. Parents and children must be citizens of the Russian Federation and permanently reside in Russia | |

| Allowance for single parents for children from 8 to 17 years old | Monthly in the amount of 50% of the regional subsistence level for children (paid from July 2021) | A single parent, or a parent (other legal representative) who receives child support by court decision. Average per capita income should not exceed the regional subsistence level per capita | |

| Allowance for disabled children | Monthly allowance: — 10,000 (for a parent, adoptive parent, guardian, trustee); — 1,200 (for other persons). | Monthly cash payment (MAP) — RUB 1,707.36; set of social services (NSS) - 1,211.66 per month. NSO can be obtained in money. | Monthly allowance - to an able-bodied non-working person caring for a disabled child, or a person disabled since childhood, group I. EDV and NSU - for every disabled child. |

Work with electronic sick leave with a “complicated” salary with bonuses and coefficients

Regional payments

Parents can receive funds through regional programs, i.e. adopted only in certain constituent entities of the Russian Federation.

Moscow program

Moscow residents receive one-time payments. For one child, the benefit will be 5,500 rubles, for two or more – 14,500 rubles.

Luzhkov payments

Luzhkov's payments appeared in 2004. They were approved by the Moscow Government No. 199-PP dated April 6, 2004. Receiving them in 2018 is subject to the same rules as before. Payments are provided if parents meet these requirements:

- Age up to 30 years.

- Permanent residence in Moscow.

- Russian citizenship for at least one of the parents.

The amount of payments is equal to five times the subsistence level adopted in 2021. If there is a second baby, the payment will be equal to seven times the subsistence minimum. If a third child is born, the payment will be ten times the monthly minimum. The benefit is paid for each child.

IMPORTANT! If there are more than three children in a family, a one-time payment of 50,000 rubles is assigned.

How to apply for child benefit

Maternity

To apply for accounting benefits, you need to bring to the accounting department:

- certificate of incapacity for work;

- applications for benefits;

- certificate of earnings from other places of work (if they were in two calendar years preceding the one in which the maternity leave began). Also see: “Certificate 182n on the amount of wages.”

The documents must be submitted no later than 6 months after the end of maternity leave.

Starting from 2022, the basis for calculating benefits will be an electronic certificate of incapacity for work (see “How the Social Insurance Fund will pay sick leave and maternity leave from 2022 and what employers should do”).

Benefit for registration in early pregnancy

From July 2021, in order to receive benefits, you must submit an application for payment on the State Services portal or at the client service of the Pension Fund (see “The Pension Fund announced when and how it will begin accepting applications for the payment of new benefits”).

Payment upon birth of a child

Those who are employed should contact their employer, the unemployed should contact the social security agency or the MFC. The application period is no later than 6 months from the date of birth of the child.

The package of documents includes: application; original certificate from the registry office according to form No. 1; child's birth certificate; a certificate stating that the second parent did not receive benefits.

Starting from 2022, no documents need to be provided. FSS employees will independently find all the necessary information in the unified state register of civil status records (see “How the rules for assigning “children’s” benefits at the expense of FSS funds will change from 2022”).

Child care allowance up to 1.5 years old

The application is written in the name of the employer and submitted within 6 months after the birth (adoption) of the child (see “Is it necessary to require an application from an employee for child care benefits: explanation from the Social Insurance Fund”). Unemployed people should contact the social security authority or the MFC within the same period.

A number of documents must be attached to the application: the child’s birth certificate, a certificate from the other parent’s place of work stating that he does not receive benefits, and some others.

Starting in 2022, to receive benefits, you must submit two applications to your employer: for parental leave for up to 3 years and for a monthly benefit. If there are several employers, you need to select one and confirm your choice. For the selected employer, the FSS will begin to pay benefits (see “How the rules for assigning “children’s” benefits at the expense of FSS funds will change from 2022”).

Calculate wages and benefits according to labor accounting at an enterprise with different remuneration systems, coefficients and allowances

Maternal capital

An application for a family capital certificate can be submitted in person to any territorial office of the Pension Fund (not necessarily at your place of residence) or to the MFC. There are other ways - send by mail, or submit electronically through the citizen’s personal account on the Pension Fund website. There is no time limit for submitting an application.

To issue a certificate, you will also need the applicant’s passport, birth (adoption) certificates of children, confirmation of the children’s citizenship of the Russian Federation and a number of other papers.

Detailed information on obtaining a certificate for maternal capital can be found on the Pension Fund website.

We issue a one-time benefit

The size of the one-time benefit was 16,873 rubles. You need to start applying for this benefit before the child turns six months old. To receive funds, you must send an application to the HR department. If the parent is not employed, you need to go to the social service. If a woman is studying, you need to contact the dean’s office of the educational institution. The following documents will be required for registration:

- Application requesting assistance.

- Birth certificate.

- An extract from the housing department stating that the applicant lives with the child.

- Pension certificate.

- Passports.

- Copies of the work book.

- A document confirming that the family has not previously received benefits.

Unemployed persons must present a copy of their passport, as well as a work record book. If the payment is made to the USZN, you need to present these documents:

- Application.

- Passport.

- Birth certificate.

- A document confirming cohabitation with the newborn.

The amount of payment issued by the USZN is 5,000 rubles.

The latest news about the introduction of new payments for children

On April 21, 2021, Russian President V. Putin delivered a message to the Federal Assembly, in which he announced a number of new payments for young mothers, pregnant women and families with children.

- From July 1, 2021, single parents, mother or father, raising a child aged 8 to 16 years inclusive will receive an allowance in the amount of 5,650 rubles. We are talking about single-parent families.

- Pregnant Russian women who find themselves in difficult financial situations will receive government assistance in the amount of 6,350 rubles per month after the sixth week of pregnancy until childbirth.

- In August, families with school-age children receive 10,000 rubles per child to prepare the child for school.

- The most important thing for young mothers or fathers is 100% payment of sick leave for child care. That is, length of service does not affect the payment of such sick leave. Sick leave will be paid 100% until the child reaches the age of 7 years.