In order to strengthen social measures to support families with children and increase the birth rate in the Russian Federation, changes were adopted in the country's legislation. In accordance with them, new types of benefits will be introduced in 2021. The innovation was announced in 2021 as a “reboot of demographic development policy,” according to which measures are being taken at the legislative level to improve the lives of families with children.

The last global change in this legislation was adopted more than 10 years ago, when it was decided to provide maternity capital to families with two or more children. Currently, this material support continues to function, since its effect has been extended until 2021. At the same time, maternity capital can be spent on various purposes, the most common of which is improving the living conditions of the family. In addition, this one-time benefit can be used to pay for children’s education, rehabilitation and social services. adaptation of disabled children, creation of pension conditions for mothers. In some regions it was planned to allow the use of maternity capital to buy a car for the family, but so far this idea has not been translated into reality.

At this point in time, it has been decided that low-income families with children need to be provided with additional targeted assistance to improve their standard of living. In this regard, as of January 1, 2018, additional benefits were introduced that have a certain nature and features.

When can you apply for low-income status and how to get it?

A low-income citizen with a low-income status may qualify for certain benefits from the state. But in order to receive them, you need to make sure whether the family is really in such a dire situation. To qualify for low-income status, you must meet several criteria at once. You can learn from social workers how to obtain the status of a low-income family in 2021, but several criteria remain important.

The main criterion for becoming a family with low-income status is compliance with family composition standards. In other words, it is important that the family has many children. This way there is a greater chance of receiving benefits, since large numbers of people officially considered one family most likely do not have such a large income.

Especially if the majority of its members are too small to bring any funds into the family budget or support themselves independently. But if the majority of members of a low-income family are able-bodied, but do not provide for themselves, obtaining low-income status will be problematic due to natural delays.

The fact of the existence of property is also important. For example, if applicants for low-income status own several apartments and a country house, it is difficult to believe that they do not have the opportunity to purchase a piece of bread. At least one of the apartments can be rented out and receive a monthly income from it. Or sell and open your own business with the money received.

And the last of the most important factors when registering status is the average income of family members for 2021 . This is not the salary of one of the parents, which can be quite high, but how much of the funds received by the family goes to each of its members. Including infants or pensioners. Income takes into account not only official salaries, but also scholarships, pensions, and rent funds. Then all this money is summed up and divided among all family members, according to a special formula.

As already mentioned, only persons whose average income is lower than the subsistence level in the region where they live in 2021 can obtain low-income status. It is the applicant who must collect all documents and certificates in order to be granted a new low-income status. So why not take advantage of this and conduct your own calculations?

Child benefits for low-income families

At the federal level, so-called “Putin” child benefits are paid to the poor in accordance with the requirements of the Federal Law “On monthly …” dated December 28, 2017 No. 418-FZ. The right to child benefits for low-income people is acquired by parents of children born after January 1, 2018 (clause 2 of article 1). Child benefits for the poor in 2021 are paid for both the first and second children.

At the same time, a monthly allowance for the first child for low-income families is issued and paid by social protection authorities, and for the second - by the Pension Fund of the Russian Federation, simultaneously with the registration of maternity capital.

From January 1, 2021, child benefits for low-income people are paid for children under 3 years of age.

Important! To receive the “Putin” benefit, the family must be recognized as low-income. In 2021, these are families where the average monthly income is less than 2 subsistence levels in the region. The presence of property for receiving child benefits for low-income people in 2021 is not taken into account.

In addition to the application, parents must submit the following documents:

- passports of citizens of the Russian Federation;

- children's birth certificates;

- certificates confirming the availability of income (salary, pension, benefits and other similar payments);

- a document with account details for transferring monthly child benefits to low-income people.

Child benefits for the poor in 2021 are paid in the amount of the regional subsistence minimum for each child. In addition to the “Putin” benefit, regions can also issue additional benefits.

Regional child benefits

Most regions also provide child benefits to low-income families until they reach the age of 18. The amounts of such benefits depend on the financial capabilities of the regions, as well as on additional criteria, and therefore can vary several times.

If a child is being raised by a single parent, one of the parents evades paying child support or is undergoing military service, the benefits will be larger.

Benefits are issued by social security authorities. You can also find out more about them there.

Note! In order for citizens to obtain information about social protection measures, special information systems have been developed that involve the provision of information, in particular, through the Unified Government Services Portal.

Families with what composition can apply for status

Registration of low-income status is available to almost everyone who needs it in 2021. But most often people ask for help:

- Large families. They have three or even more children. The composition can be complete (mother and father) or incomplete (one parent).

- Incomplete. There is a child or several in the family, but only one parent is involved in their upbringing and maintenance.

- Families with disabled people. In particular, a child or one of the parents may be disabled. The main nuance is that the person has an officially established disability and cannot work due to his health condition. It does not matter what is the factor for obtaining disability. This can be both mental disorders and physical injuries. It also does not matter whether the disease was acquired in adulthood or is congenital.

- Where is the adopted child? The status of a large family can be obtained not only by giving birth to children, but also after their adoption. Also, an adopted child is considered a family member when calculating the average income for each person. Therefore, obtaining the status of a low-income family, even if the child is adopted, is quite possible.

- If the child is raised not by parents, but by grandparents (there are no parents). We are considering a situation where a grandmother or grandfather has taken custody of their own grandson.

Even though the rules seem obvious, people sometimes get confused about who can be included in the family. Therefore, let us clarify that in the legal sense, in 2021, a family can be considered people who live together (registered in one place), are engaged in running a common household, and have all their expenses and income in common. That is, not only children and parents, but also grandparents, brothers and sisters, adoptive parents. But only if the above conditions are met.

When registering low-income status, in 2021 military conscripts, people deprived of liberty, people who are forcibly treated by a court decision, citizens who are fully provided for by the state will not be taken into account. There are other nuances, but they are individual and are decided in each individual case. To clarify them, you need to contact the appropriate social service or seek legal advice from a private specialist.

Legislator's position in 2021

In order to determine whether a family qualifies for low-income status, it is necessary to know what maximum family income is provided by law to receive a subsidy, and then calculate it for all family members.

To obtain the amount we are interested in, we must sum up all the income that the family receives and divide the total amount by the number of family members . At the same time, when making financial calculations, you need to find out exactly which income is taken into account by Russian legislation today and which is not.

The first ones include:

- Income received from the main work activity. That is, official wages.

- Money earned from interest on deposit accounts and bank investments.

- Alimony payments.

- Regular pension payments.

- So-called compensation payments related to loss of health or other reasons.

- The remaining subsidies received by any of the family members.

As you can see, when calculating total income, all funds received by family members must be summed up, regardless of their actual employment. At the same time, the amount is calculated for the last three months.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

According to the laws of the Russian Federation, a family is recognized as a group of certain persons who are registered in Russia for permanent or temporary residence and who run a common household. This means that if, for example, her mother lives with a single mother, then the income (salary, pension, subsidies, etc.) of the grandmother should also be included in the total family income.

Also, the total family size sometimes includes other persons besides children and their parents. These include:

- stepmothers and stepfathers;

- stepsons and stepdaughters;

- foster parents;

- stepchildren (adoption);

- grandparents;

- other relatives who also live together in the same house or apartment.

Low-income families are those in which the amount per person is less than the amount of the subsistence minimum established in Russia . At the same time, for calculations, the amount provided in the region of residence of the family is used.

The cost of living in 2021

In 2021, the cost of living per person is 10,701 rubles.

Calculation example:

Since total income is calculated for the last three months, for each source of actual income it is necessary to take into account the amounts for each individual month. For example, a family consists of four people with the following incomes:

- a mother of a two-year-old child who is on maternity leave and has no income of her own;

- the father of the child, who receives a fixed salary of 15,000 rubles;

- in fact, the child himself, for whom the state issues a monthly allowance in the amount of 50 rubles;

- the baby’s grandmother with a pension of 13,000 rubles.

In addition, the family owns a garage for rent, for which they are paid 4,000 rubles every month. This money should also be taken into account when calculating the overall family budget. Also, we recommend that you definitely look at our article about heirs of the first stage without a will! Everyone needs to know this.

Thus, the family’s monthly income is: 15,000+50+13,000+4,000 = 32,050 rubles .

In the event that this amount has remained fixed in the last three months, we multiply it by 3. However, if the family’s income differs in each of the three months, then all of them simply need to be added into a total amount and then divided by 3.

Considering that there are 4 citizens registered at the family’s residence address, the total amount is divided by 4, after which we receive an amount of 8012.50 rubles per family member, which is less than the amount established by the subsistence level in the Russian Federation by 2688.50 rubles. This difference was calculated at the Federal level.

ARTICLE RECOMMENDED FOR YOU:

How to cash out maternity capital

When making calculations, for example, for Moscow in 2021, it is worth starting from the cost of living of 16,160 rubles. If this hypothetical family lived in this region, then the income per member would be two times lower than that established by law.

Important

It is according to the principle described above that the status of a low-income family in Russia is determined. At the same time, each of the income taken into account when calculating must be supported by documents.

As we can see, depending on the region of residence, families with the same total income can be recognized as low-income in one subject of the Russian Federation, but not in another. It is for this reason that experienced lawyers recommend that before applying for payments, subsidies and benefits due to a family, be sure to check the criteria for a low-income family in their region of residence.

Income of low-income citizens

One of the main criteria to find out how to obtain the status of a low-income family in 2021 is financial well-being. This is a very important category - total income. The total amount of money is divided among all family members.

It turns out what income all family members contribute to the general budget for the last three months before applying for status. In 2021, the following sources of income are taken into account:

- wages and other financial payments that are provided for in remuneration;

- average earnings that citizens retain in situations provided for by law;

- compensation that a citizen receives when performing public or state work. responsibilities;

- severance pay;

- social benefits (this includes pensions, benefits for the unemployed, insurance payments, various additional payments and more);

- funds received from owned property (for example, when renting out an apartment, etc.).

Also, when registering status, other types of income may be taken into account, ranging from charitable material assistance to alimony, gifts and inheritance. But there are incomes that will not be taken into account when applying for low-income status. For example, one-time insurance payments that were paid in connection with compensation for losses or to pay for rehabilitation. Social assistance from the state is also not taken into account. Total income does not take into account taxes and other fees.

What assistance can low-income people receive from the state in 2018?

Each region of Russia provides its own types of subsidies to low-income citizens, but all people in need of support measures can apply for the following types of benefits:

- children's subsidies (including benefits for bearing a baby, childbirth, and caring for a baby);

- social assistance;

- benefits when paying for housing and communal services;

- preferences when purchasing medicines, vitamins;

- privileges for offspring when entering kindergartens, schools, clubs, sections;

- free food for pregnant women and young children;

- special one-time and monthly additional payments established by local authorities.

Living wage

In 2021, each region has its own cost of living indicators that a family must meet, since the standard of living in these places may differ. It is formed from the wages that people of various professions can receive, the amount of utility bills, etc.

As a result, the amount that a family can manage will differ significantly solely due to regional characteristics. To understand whether it is possible to qualify for benefits due to low-income families, it is important to clarify what the minimum amount is specifically in your region. The calculation is simple - income for 3 months is summed up, and the resulting amount is divided by three.

The minimum “passing” indicators for status in 2020 are presented in the table.

| For one person | 10329 rubles |

| For a person who is able to work | 11163 rubles |

| Acceptable minimum for pensioners. | 8506 rubles |

| For one child | 10160 rubles |

The table shows the results that are obtained if you divide the initial amount by the number of family members. If it is below the indicated figures, there is every reason to receive the status of the poor. But if it’s higher, at the moment you’ll have to accept that for now the state considers your income level to be quite normal for maintaining a relatively comfortable standard of living, and you won’t be given low-income status.

Reasons for refusal to recognize a low-income family

It is important to remember that such issues are the responsibility of the constituent entities of the Russian Federation, in compliance with the legislation of the Russian Federation. Consequently, the amount of benefits in Moscow and Novosibirsk will vary. This is explained by different levels of the cost of living, which in the capital, which is logical, is an order of magnitude higher. The grounds for recognizing a family as low-income or for refusing it are the same throughout the country. Among them:

- Providing incomplete or false data on income, family composition, property wealth, and all other information necessary for social security authorities to make a decision.

- Inconsistency of the current financial situation with the grounds for recognizing a family as low-income.

- Failure to comply with the basic requirements - citizenship of the Russian Federation, availability of required documents.

- Receipt of social assistance of a similar type at the time of application.

- Illegal presence on the territory of a constituent entity of the Russian Federation.

These are the most common grounds for refusing to recognize a family as low-income. Benefits and allowances for low-income families can be one-time or periodic. The benefit is paid until the grounds for assigning it completely disappear.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What documents do you need to collect to obtain status?

In order for you to receive government assistance in 2021, you need not only to contact the relevant authorities, but also to prepare documents confirming the need for such support. The standard package of papers that a potential low-income person should have is as follows:

- certificate about the number of people making up the family;

- birth certificates of children (minors);

- documentation confirming income for three months (bank details, etc.);

- work books of working people, and the unemployed can bring certificates from the employment center;

- if you have a disability, you need a certificate from the ITU;

- personal documents of each family member (passport, TIN, etc.);

- Marriage certificate;

- real estate documents or occupancy agreement (if the property is rented/rented).

This list, which includes documents for the status of a low-income family, is not complete, since depending on the situation, other papers may be required to complete everything. You can check the list of required documentation for 2021 with the social worker you contact for help. In addition, it is the social worker who must make sure that the person has brought all the documents necessary in his case to register his status. For example, additional paperwork will be required if a family member is in prison, missing in action, or serving in the military.

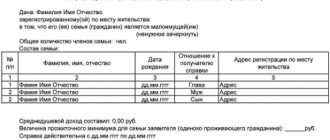

But the most important document is the statement. It must be drawn up in accordance with the law. Since people do not apply for low-income status every day, a special template can help with correct spelling. It looks like this.

Comments: 9

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Elena

09/06/2021 at 17:06 Good afternoon! They refused to confirm my status as a low-income family with children. USZN Maryino. Reason for refusal: lack of income in 2021 for mothers, i.e. me. Until April 2021, I was on maternity leave for a child up to 3 years old. The youngest son was born in 1004, 2018. as of 2021 our family is low-income. Is the refusal legal?

Reply ↓ Anna Popovich

09/06/2021 at 17:32Dear Elena, the refusal is illegal, since you were on parental leave until the child reached the age of 3 years.

Reply ↓

07/03/2021 at 02:15

I am a pensioner, my son is studying at the university, is there social assistance? we are poor

Reply ↓

- Olga Pikhotskaya

07/03/2021 at 02:58

Svetlana, hello. Contact your local social welfare office or multifunctional center. The staff will tell you what government support measures you can count on, and also tell you what documents you need to provide.

Reply ↓

04/07/2021 at 11:31

Hello. I am 53 years old, I am caring for an (incapacitated, bedridden) elderly mother (81 years old) and two other old women of the same age. We live in a village, in a private house. My husband is registered as unemployed, I have not officially worked anywhere. For a week ago we received an order that we must change the gas meter, gas stove and gas heating boiler (AOGV) by June 1st. We don’t have that kind of money. Can the social assistance service help us and are we considered low-income?

Reply ↓

- Anna Popovich

04/07/2021 at 17:43

Dear Nailya, the procedure for determining the subsistence level of a low-income family is established by the constituent entity of the Russian Federation, taking into account the subsistence minimums established for the relevant socio-demographic groups of the population. Contact the social security department at your place of residence, they will advise you in detail and tell you what benefits you are entitled to.

Reply ↓

09.20.2020 at 11:06

Hello, I would like to calculate my income, I am a single mother raising 3 children and receive 2800 rubles in benefits for them until they are 16 years old, and housing and communal services for 4. 2932 and my salary

Reply ↓

07/30/2020 at 13:22

I live in Kazakhstan (citizen of Kazakhstan). I periodically transfer money to my grandson’s (Russian Federation) bank card account on various occasions (his and his young children’s birthdays, etc.). A translation when sent is qualified as financial assistance not related to business activities. The grandson's family, by all conditions, is considered low-income (only the grandson (father of the family), pregnant wife, 2 children (3 and 5 years old) work). Are these bank transfers included in the family income calculated for receiving social assistance for children? Is this a donation (not documented)? But money can be transferred as a repayment of a debt or vice versa as a favor? Thank you for the clarification!

Reply ↓

- Anna Popovich

07/30/2020 at 15:59

Dear Alexander, you need to clarify this type of receipt of funds in the Federal Law “On the procedure for recording income and calculating the average per capita income of a family and the income of a citizen living alone for recognizing them as low-income and providing them with state social assistance,” depending on the type of benefit that your relatives receive .

Reply ↓

Assignment procedure in 2020

Having collected the entire package of documents, a person needs to go to the local branch of the Ministry of Social Protection to fill out an application. There he will be given a current application form. Having compiled it, you need to transfer the collected papers and application to a specialist. He checks all copies against the originals to ensure there are no errors or fraud. This makes it easier to check if all the papers are included.

Then the procedure begins during which the document is accepted. Documents can be received by personal visit. That is, the person himself will come to the relevant authority with a folder and give it to the responsible person. If the application has not yet been written, he can write it on the spot, under the supervision of specialists who will indicate how and what to write. You can also send the application along with documents remotely using postal services.

After the documents have been submitted and the application has been drawn up, employees of the Ministry of Social Protection check the information received. Each item will be checked, especially the indicated level of income for 2021, and how well it meets the declared size. If deception, especially premeditated deception, is discovered, a person may be accused of fraud. This is why it is so important to provide only truthful information.

If all is well, information about applicants for low-income status is entered into the database. After this, they will be provided with the benefits provided in the region. Typically this entire procedure takes 10 days. After this period, a written notice is sent to the applicant indicating whether he can rely on support or not.

Elderly pensioners or pensioners who do not work can apply for low-income status. Muscovites who are in a difficult financial situation can count on the fact that government services will be provided to them in the format of a one-time financial payment. To obtain it, you need almost the same documents as when applying for low-income status. They are only submitted to Moscow government service centers, regardless of where exactly you are registered. The decision to provide payment is made by the commission within 30 days or longer. Much depends on how to obtain the status of a low-income family and where the document was transferred.

Who belongs to the category of low-income families in 2021

If a family finds out that their total income is below the minimum residence requirement in their region or region, the family has the right to receive special status as a low-income family. But, to do this, they will need to document their low income level.

Social authorities are responsible for registering this status. To do this, you can submit an application:

- to social security;

- through MFC.

Based on our experience, we note that there are no particular differences in the work of these structures. However, the MFC acts as an intermediary between citizens and government agencies in the transfer of documents, and you can get the desired result a little later than by directly contacting social security.

At the same time, receiving services through the MFC is considered more comfortable and simpler, because this government agency works “one window” . Thus, the same specialists accept applications to different government agencies.

Question for a lawyer:

Elizaveta Hello, Oleg! Tell me, please - there are 3 people in my family (father, mother and daughter). At the same time, I am currently unemployed, and my husband receives 21,000 rubles (salary). We do not receive any payments for our daughter; she was born 5 years ago. I recently found out about the payment of benefits to low-income families and a social protection employee pointed out that in order to apply for assistance, I need to collect data on the income of the family members with whom my daughter lives/is registered - my mother, father and brother. Why is this data needed, since being a separate family, we do not receive any financial assistance from those with whom we “neighbor”? And I would provide all the information if it were not for the difficulties in obtaining such information for my mother. The fact is that she previously worked in a management position at a large enterprise, after which her bosses offered her to pay off, but take over 6 stores by registering as an individual entrepreneur (for both parties this is a very profitable deal). Thus, if the amount of income of these stores appears in the data, there will be no further talk with me about any help, as I understand it, pointing out that parents who receive such fabulous money should help!

Good afternoon, Elizaveta! Unfortunately, I must immediately note that the conditions for receiving assistance and all the necessary information for receiving benefits are established at the regional level. And if the legislator has established the availability of the certificates you described above as a prerequisite, there is nothing to be done about it. In addition, the presence of large amounts among the certificates may indeed become a reason for refusal to provide you with the desired payments. However, there is always a way out. We invite you to tell us more about the situation and we will try to help you!

Citizens can sign up to submit an application either by telephone or by receiving an electronic queue coupon. This allows you to significantly save personal time not only for citizens themselves, but also for government organizations. Indeed, in this case, they do not waste time accepting papers, but are engaged in checking them and providing certain services.

What benefits and benefits can a low-income family claim?

The amount of assistance to low-income families depends on what kind of support they are applying for. If it is federal, people will not pay income tax, students will receive scholarships, and applicants will enter universities on favorable terms. In the case of regional support, parents will receive benefits for young children, pay for utilities on preferential terms, and more.

Let's look at regional assistance in more detail, since it has many nuances in how much and when the poor will receive support. For example, support in the housing and communal services sector. The type of assistance under consideration is relevant for all regions. It provides for the establishment of a certain limit for paying utility bills. Payments above this limit do not arrive, but there may be less. This minimum is calculated as a percentage. If the payment exceeds the permissible limit, the family will be paid compensation.

Families with minors will receive assistance for children. Maximum assistance is in the first 1.5 years after the birth of the child, and then until the age of 18 (while schooling continues), but the amount is less. Help is also provided at the birth of a baby. Its size depends on the region, and sometimes on the city. For example, in Moscow it will be higher. In some regions, children can receive free meals in schools and kindergartens, travel free on public transport, etc.

In addition to the above, low-income families, or rather its members, can obtain legal assistance for free, take out housing loans with more favorable conditions, and also register land outside the general queue.

Monthly benefits for low-income families

The very fact of recognizing a family as low-income does not give the right to receive benefits, since it is not provided for either at the federal level or in the regions.

However, low-income families can receive one-time or periodic cash assistance, as well as necessary food, medicine and other things. This type of support is called social assistance.

Another important point is the opportunity to receive federal and regional payments for children.

One of the federal payments is child care benefits for up to 1.5 years. It can be received by one of the working parents or close relatives who is officially employed. In this case, the payment is made by the FSS.

ConsultantPlus experts explained how child care benefits are paid for children up to 1.5 years old. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Where to apply for social assistance

To apply for social assistance in 2021, you need to go to the right place. This must be done at your place of registration. Moreover, it does not matter whether the registration is permanent or temporary. The appeal is made to the social protection authority. The specific name of the body in question depends on where exactly the applicant is located. In different regions and even cities this may have its own organ. To find out which one specifically, you need to study the legislative acts of the specific subject of the Russian Federation where the government service you need is provided.

But the social government service for the poor is state-owned, so it is not at all necessary to personally go to the authorities to register it. Thanks to the existence of the State Services portal, registration activities can be carried out virtually. Or don’t rack your brains and go to the nearest MFC. Employees of the body in question will tell you how to proceed.

If you prefer to apply through the State Services portal, then you need to go to the website. To obtain the status of a low-income family through government services in 2021, you need to select the section “:

The next step is to select the “Help to the Poor” section. You need to find it by scrolling down the page until the required government service appears.

A page will open with government services for the poor provided in your region.

There is also information on how a family can receive a government service that has aroused interest, and every document that needs to be collected for it. It is enough to scan these documents and send the scans through a special form, which is offered by the Gosusluga service. But the originals will also be required. They will have to be shown to the social security office. Typically, the original is required for a passport, certificate of family composition, income, and also for a work book.

Low-income family: not a sentence, but help!

A low-income family is a special social status that allows them to take advantage of certain privileges and special opportunities. This status is not assigned automatically; it must be obtained according to the accepted algorithm. In the Russian Federation, there is a federal list of rules for assigning the name of a low-income family, but regional authorities have the authority to make their own additions. This is related to the standard of living and economic well-being, which differ in different regions.

In what cases will you get a refusal?

The prospect of monthly payments and other government services is attractive if the average family income is very low. But there are situations when low-income status is denied. This can happen in cases where the information provided to social services was unreliable or an error was made in the income certificate.

If certificates and other documents were filled out incorrectly, the papers submitted to the social service were overdue. They will also refuse if the applicant did not have the originals with him when transferring the documents, or the copies were not certified by a notary. When writing the application, mistakes were made.

Even if you received a refusal, but your family’s financial condition has still not stabilized, no one forbids you to repeatedly demand that the public service be provided, but to avoid the mistakes made earlier.

You can get legal assistance on issues of obtaining the status of a low-income family on our website.

How to make an application

Lawyers highlight the drafting of a document as one of the most important and difficult stages in obtaining the status of a low-income family. As a rule, it is drawn up according to all the rules of a business letter, which are not known to people far from business and legal practice.

When writing an application, you need to receive a ready-made form, which greatly facilitates the process of filling it out. The Legal Ambulance website, in turn, recommends that you adhere to the following algorithm of actions. In the document we indicate:

- The name of the local social security authority to which the applicant is sending this document.

- Personal information about yourself (registration and passport data, full name, etc.), as well as contact information and telephone number.

- The essence of the statement itself is about low actual family income with its indication for the last 3 months.

- All family members and the income of each of them, if any.

After all of the above, we apply for granting the status of a low-income family, based on all the above data. Also, we list the list of collected necessary documents and put our own signature under the contents.

Oleg Ustinov

Practicing lawyer and website author

Remember that if difficulties arise with completing this application, a citizen has the right to seek help from social security employees or the MFC! That is why most lawyers recommend filling out the document in the presence of employees of the relevant authorities. After all, in this way you can significantly save time and avoid mistakes when drawing up an application.

At the same time, if errors and corrections do occur, you must immediately ask for a new form to be issued to you.

A package of documents for a low-income family for submission to the SZN

To assign the name of the poor you will need:

- certificate of family composition (F9);

- identification papers of those listed in the family composition certificate and their family connections: passports, marriage, birth, divorce certificates, guardianship documents;

- cash receipts for the last three months: 2-NDFL from individuals, 3-NDFL from legal entities, certificates of maternity benefits, scholarships, and so on;

- copies of work books, and for the unemployed - a certificate either from the employment service or about incapacity;

- information from the Unified State Register for each person about what property is registered on it;

- the applicant’s TIN and bank account details;

- application for status.

Where can I get all the necessary certificates to register?

Information is received by:

- in the management company;

- in workplace accounting;

- lost and missing documents will be re-issued by the registry office and passport office;

- in the dean's office of a secondary school or university;

- from the head of the kindergarten;

- at the school clearinghouse;

- in Rosreestr.

Many papers, in addition to job information, can be requested through the MFC.