From the moment of declaration of bankruptcy until the final liquidation of the insolvent entity, a number of actions provided for by law are carried out. One of the stages is the mandatory observation procedure. Its main task is to establish the true financial situation, preserve assets (including fixed assets) with the subsequent possibility of resuming full functioning.

Bankruptcy procedure: observation

First, the monitoring procedure is confirmed by a decision of the Arbitration Court when considering the legitimacy of the creditor’s claims to the counterparty – the debtor. The law does not stipulate a clear deadline for this stage, but it must be within the time frame allotted for bankruptcy - 7 months.

The monitoring procedure consists of several basic steps taken by the temporary manager appointed by the arbitration judge:

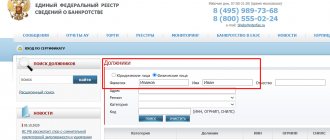

- Publication of information about the commencement of actions in a publicly accessible printed publication - the Kommersant newspaper, as well as the EFRSB portal with mandatory notification of this to the judicial authority, management of the insolvent enterprise, creditors, servicing banks, fiscal authorities and extra-budgetary funds;

- Conducting an analysis of the debtor’s financial position based on primary accounting documents, forming conclusions and recommendations regarding the subsequent course of the bankruptcy process;

- Determining the list of creditors indicating financial requirements, identifying business transactions of dubious content;

- Preparation and holding of the first meeting of creditors;

- Drawing up and submitting a report with conclusions to the Arbitration Court.

Appointment of a temporary manager at the observation stage

The mechanism for appointing a temporary administrator is not defined in detail by law, which is why controversial situations often arise. Thus, it must begin its work simultaneously with the start of the observation procedure. But it is not entirely clear who should apply for his appointment: at this stage, not all creditors are aware of the beginning of the bankruptcy procedure, and the debtor is prohibited from indicating the candidacy of the manager.

Article 59 of the bankruptcy legislation provides for the following options for appointing a temporary manager:

- from among the candidates/SROs proposed by the creditors of the legal entity;

- from candidates registered with the court as managers, in the absence of proposals.

Since all creditors are not yet aware of the start of the insolvency procedure, any creditor, even those with small claims, can file a petition. As a result, the temporary manager often begins to act in the interests of the creditor who applied for his appointment. This in practice leads to abuse.

For your information

The observation procedure can last from three to five months. Accordingly, this is exactly the duration of work of this arbitration manager. It is therefore very important to appoint a manager as quickly as possible.

The following requirements apply to the candidacy of a temporary manager:

- no criminal record;

- non-participation in the management of the debtor company;

- non-bias in favor of the debtor or creditors.

The temporary manager begins to perform his duties until:

- appointment of a temporary/administrative manager;

- declaring the debtor bankrupt and moving to the stage of bankruptcy proceedings;

- a court decision approving a settlement agreement between creditors and the debtor;

- the arbitration decision to refuse to declare the debtor bankrupt.

The Supreme Court clarified the duties of a bankruptcy trustee of a debtor in a bankruptcy case

On January 21, the Supreme Court issued Ruling No. 304-ES16-17267 (2.3) in the case of creditors challenging the inaction of the bankruptcy trustee of a bankrupt organization regarding the long-term non-termination of an agreement for the safekeeping of the debtor’s assets concluded with a third-party organization.

Several creditors were not satisfied with the conditions for storing the bankrupt’s property

In July 2014, the court opened a bankruptcy case against Biysky Elevator OJSC and introduced a monitoring procedure against it, during which the company handed over 9 buildings, 5 land plots, 1,408 units of machinery and equipment for safekeeping to Novosibirsk Flour Mill JSC. Part of this property was encumbered with collateral in favor of Rosselkhozbank.

Under the terms of the agreement, in payment for the services of the custodian, the plant was given the right to use the property of the Biysk Elevator to make a profit, including leasing it to third parties. Expenses for the maintenance and storage of property (including its repair, maintenance of working condition and current market value) were assigned to the responsible custodian, with the exception of those that could not be reliably calculated at the conclusion of the contract.

In February 2021, Biysky Elevator was declared bankrupt, and bankruptcy proceedings were opened against it: Olga Kiriyenko was appointed bankruptcy manager of the debtor.

Subsequently, Rosselkhozbank appealed in court the actions (inaction) of the bankruptcy trustee, citing the illegal gratuitous transfer of property to the flour mill under a custody agreement in the absence of the consent of the secured creditor, as well as the long-term non-termination of such an agreement. In this regard, the bank asked to remove Olga Kiriyenko from performing her duties.

In turn, the Federal Tax Service of Russia supported the demands of the credit institution to remove Olga Kiriyenko from fulfilling the duties of the bankruptcy manager of the elevator and to reduce the amount of her fixed remuneration. In support of its claims, the tax service referred to the delay by this person in the bankruptcy procedure, the failure to take measures aimed at replenishing the bankruptcy estate, and the gratuitous use of the elevator property by the flour mill.

The courts have reduced the remuneration of the bankruptcy trustee

Having considered the creditors' claims, the arbitration court reduced the amount of the bankruptcy trustee's fixed remuneration and refused to satisfy the rest of them. The ruling survived appeal and cassation.

The courts proceeded from the fact that the property was transferred to the flour mill before the court made a decision to declare the debtor bankrupt. The agreement on behalf of Biysk Elevator was concluded by its sole executive body, and not by the bankruptcy trustee. In turn, Olga Kiriyenko’s failure to take measures to terminate the storage agreement was caused by the need to ensure the safety of the property.

Three courts also referred to correspondence between Rosselkhozbank and its Altai branch, which confirmed the bank’s agreement in principle to transfer the pledged property for safekeeping subject to a number of conditions. In particular, employees of the regional branch of the bank were instructed to participate in the inventory of property and receive operational information about the current situation at the enterprise.

The courts also emphasized that information about the fact of storage was reflected in the reports of the bankruptcy trustee. Accordingly, the bank could have requested more detailed information, but it was not interested in the storage conditions. During the three years of the bankruptcy procedure, other creditors also did not request a list of specific property transferred for storage, as well as other information about the execution of the storage agreement. The requirement of Rosselkhozbank to ensure the safety of property only by the bankruptcy trustee, as the courts have indicated, is unenforceable and does not comply with the provisions of the Bankruptcy Law, and the materials of the case do not confirm the intention of the secured creditor to independently ensure the safety of the property.

They also recognized as unfounded the arguments of the Federal Tax Service of Russia that the bankruptcy trustee did not ensure the replenishment of the bankruptcy estate through paid use of the elevator property. It was noted that there was no evidence of improper fulfillment of obligations by the custodian.

Recognizing the statement of the Federal Tax Service as justified in terms of reducing the remuneration due to Olga Kiriyenko, the courts noted that the fact that she was delaying the bankruptcy procedure was established during the consideration of another separate dispute, as a result of which her actions (inaction) were recognized as not complying with the Bankruptcy Law. Having analyzed the amount of work actually done by the manager, the courts reduced the amount of her fixed remuneration from 1.2 million rubles. up to 420 thousand rubles. At the same time, the courts found that the woman had already been transferred 883 thousand rubles. in payment of remuneration, therefore they recognized that the reduced amount of remuneration is not subject to payment to the administrator at the expense of the debtor’s bankruptcy estate.

The Supreme Court did not agree with the conclusions of the lower authorities

In her cassation appeal to the Supreme Court, Olga Kiriyenko asked to cancel the judicial acts of lower authorities in terms of reducing the amount of her remuneration. In turn, Rosselkhozbank appealed the court decisions in full.

After studying the materials of case No. A03-13510/2014, the Judicial Collegium for Economic Disputes of the Supreme Court noted that in order to resolve the question of whether certain actions (inactions) of the bankruptcy trustee were consistent with the principle of good faith, one should be guided by paragraph. 3 clause 1 of the Resolution of the Plenum of the Supreme Court of June 23, 2015 No. 25 on the application by courts of certain provisions of section. I part 1 of the Civil Code of the Russian Federation. According to it, despite the fact that the manager has a certain discretion, assessing his actions as bona fide or dishonest, the court must correlate them with the behavior expected of any independent professional manager in a similar situation and taking into account the rights and legitimate interests of the civil legal community of creditors, and not individuals.

As the Court explained, the most typical contractual structure by which property used in business activities is transferred by the owner for the use of another person is a lease agreement, and the terms of such a price agreement, as a rule, allow the owner to receive income that exceeds the cost of maintaining the transferred property. rent things. “An ordinary manager, having discovered an agreement for safekeeping rather than a lease, as an anti-crisis manager with the necessary powers and competence, would determine a strategy for subsequent actions with the debtor’s property, including analyzing the feasibility of its further use by a third-party organization on the same terms, taking into account, in in particular, the presence (absence) of objective obstacles to the immediate sale of the asset, the ratio of the costs of maintaining the property and its real profitability, eliminating the possibility of the debtor not receiving all the benefits from such property, the market fee for the use of which exceeds the maintenance costs, i.e. property that can replenish the bankruptcy estate during the period of implementation of measures for its assessment, preparation for sale, etc.” – noted in the definition.

The Supreme Court added that even in cases where the termination of previously established contractual relations regarding the debtor’s property is economically unprofitable, the period for which these relations can be maintained should be determined by the period necessary and sufficient for an effective arbitration manager to carry out all procedures provided for by law, aimed at the alienation of objects belonging to the debtor for the purpose of settlements with creditors.

“Contrary to the conclusions of the courts, the insolvency practitioner does not have the right to count on the fact that a proper analysis of the current situation and an action plan to change it will be carried out for the manager and developed by creditors, including collateral (which does not exclude the possibility of interaction between the manager and these creditors, for example, through consultations). Likewise, the inaction of the manager cannot be justified by the passive behavior of the creditors. The latter, unlike the bankruptcy trustee, do not have the responsibility to establish the most productive way of disposing of the debtor’s property. In the case under consideration, the courts’ reference to the legality of the behavior of the manager Olga Kiriyenko in view of the need to ensure the safety of the property cannot be considered correct, since the amount of costs required to maintain the property and the amount of market fees for the use of the property were not established,” the Court concluded.

The lower authorities, the Supreme Court found, did not find out what measures the manager took to find potential tenants, whether he assessed the demand for the property on the market, or the circle of people who might be interested in this property. They also did not check whether the period during which the elevator property was in the possession of the flour mill (after Kiriyenko’s approval by the bankruptcy manager) under the conditions provided for in the custody agreement was reasonable, bearing in mind the objectives of the bankruptcy procedure and the objective situation at the elevator, the reduction consumer value of machinery and equipment due to their long-term operation.

The highest court also did not agree with the conclusions that Rosselkhozbank, in fact, agreed on the transfer of property for use to the flour mill. They did not establish compliance by the parties to the custody agreement with the conditions put forward by the bank. If such conditions were not fulfilled, despite the credit institution’s silence, the consent could not be recognized as issued (Article 157.1 of the Civil Code of the Russian Federation). At the same time, the Supreme Court noted that the legal conclusions of the courts on the request to reduce the amount of the manager’s remuneration correspond to the explanations of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation “On some issues related to the remuneration of the arbitration manager in bankruptcy” dated December 25, 2013. Olga Kiriyenko’s arguments about the courts’ incorrect determination of the periods for which the remuneration could be reduced, the lack of proof of her receipt of remuneration cannot be taken into account at this stage of the process, since these arguments are aimed at re-evaluating the evidence and establishing the factual circumstances of the case, which is beyond the powers of the judicial panel.

Thus, the Supreme Court of the Russian Federation canceled the judicial acts of the lower courts regarding the refusal to satisfy the stated requirements and sent the dispute for a new trial in the first instance.

AG experts commented on the Court’s findings

Partner at Bartolius Law Firm Natalya Vasilyeva noted that the Supreme Court naturally continued its previously developed position that the bankruptcy manager is, first of all, an anti-crisis manager. “He has the obligation to exercise his powers as efficiently as possible, in an economically sound manner based on the results of a comparative analysis of all possible models for the development of relations between the debtor and counterparties, confirmed by specific calculations of the amount of profit received by the debtor or at least reducing losses. In his calculations, the bankruptcy manager must always proceed from the main goal of the bankruptcy process - maximum satisfaction of creditors’ claims,” she noted.

According to the expert, the exercise of the powers of a bankruptcy trustee in the absence of any specific plan, without justification from the point of view of profitability of the decision taken, indicates a formal approach to the implementation of the duties assigned to him by the Bankruptcy Law and should inevitably entail negative consequences, primarily for the financial manager

“In the event of prolonged inaction and failure to take any effective measures to form the bankruptcy estate by all available means, including by changing the business model chosen by the debtor (for example, through repudiation of contracts concluded by the debtor), the conclusion that the arbitration manager is delaying the procedure will be justified. bankruptcy. Possible reasons for this delay may be both the desire for personal enrichment (through receiving remuneration for the longest period of time), and the manifestation of bad faith in the interests of individual creditors, while the arbitration manager is obliged to act in the interests of the entire civil community of creditors,” believes Natalya Vasilyeva .

She also called the important conclusion that the bankruptcy manager cannot justify his inaction by the passive position of creditors. Previously, the expert added, the Supreme Court of the Russian Federation expressed the position that the actions of the arbitration manager in pursuance of decisions of creditors’ meetings also cannot be qualified unconditionally under any circumstances as reasonable and conscientious, since the arbitration manager is a professional specializing in managing participants in civil transactions, are in unsatisfactory financial condition.

“The result of the systematic implementation of the course chosen by the Supreme Court is the natural “cleansing” of the profession: bankruptcy procedures, especially in enterprises with assets (and the debtor from the dispute considered by the courts had the right of ownership of 9 buildings, 5 land plots, 1408 units of equipment), should only be carried out those managers who are strong economists who are able to calculate the amount of costs required to maintain the debtor’s property and search for potential tenants, take into account the depreciation of the property during its use and compare all the data obtained with the size of the market fee for the use of the debtor’s property, taking into account the prospects for the sale of the debtor’s property with bidding These calculations and analysis should be carried out by the arbitration manager, including in a possible constructive dialogue with the secured creditor,” Natalya Vasilyeva is convinced.

In her opinion, the Supreme Court thereby demonstrated that the nominal conduct of the bankruptcy procedure should be suppressed, the arbitration manager is obliged to take the initiative, come to the enterprise and actively (with the achievement of maximum effect for creditors) take control into his own hands, develop a specific plan based on calculations and implement it as quickly as possible, taking into account the goals of the bankruptcy procedure. “When considering bankruptcy cases, the courts must examine all the circumstances, including issues of the economic validity of the decisions made by the manager, taking into account that, having a certain discretion, the bankruptcy manager is obliged, first of all, to act as an independent, reasonable, effective professional manager. The position of the RF Armed Forces in this case does not cause any disagreement; its decision is fair and consistent,” the expert concluded.

Arbitration manager, member of the Association “Moscow Self-Regulatory Organization of Professional Arbitration Managers” Alexey Leonov believes that the definition of the Supreme Court formulates in many ways a new approach to establishing standards of conduct for a conscientious and reasonable arbitration manager. “According to fairly established judicial practice, the duties of the arbitration manager did not include ensuring the most efficient and profitable use of the debtor’s property in the bankruptcy procedure. The manager’s responsibilities included minimizing costs and selling the debtor’s property at the maximum price in a short time, which, as a rule, does not involve receiving income from renting out the debtor’s property. Now the Judicial Collegium for Economic Disputes requires the manager to take all measures to find potential tenants, assess the demand for the property on the market, as well as the circle of people who may be interested in this property,” he noted.

According to the expert, improper fulfillment of such an obligation may entail not only a reduction in the amount of remuneration, but also holding the manager liable in the form of compensation for losses. “I am confident that the legal position set out in the Supreme Court’s ruling will serve as a new and inexhaustible source of inspiration for creditors in their fight against “unfriendly” arbitration managers, which, of course, significantly increases the professional risks of managers,” concluded Alexey Leonov.

Rights of a temporary arbitration manager

The list of rights of a temporary manager includes:

- Submit to the court demands for recognition of transactions concluded by a legal entity as invalid, fictitious or void and their cancellation. We are talking about contracts concluded in violation of the requirements of 127-FZ. For example, those concluded with interdependent persons and on non-market conditions. Essentially, their goal is to deliberately worsen the financial situation of the debtor and withdraw assets.

- Coordinate the conclusion of certain transactions with the management of the bankrupt company. Agreements that require approval include transactions for the disposal of real estate, property with a price of more than 10% of the book value of all assets of the debtor legal entity, transfer of property into trust management; obtaining new loans and borrowings; on obtaining bank and government guarantees; attracting guarantors; assignment agreements.

- If the debtor enters into deliberately unprofitable transactions and management fails to take the necessary measures to restore the balance of payments, the temporary manager has the right to petition for the removal of the company's management from business.

- Request any information from the managers of a legal entity, including information that constitutes a trade secret. For example, information about property rights and obligations, etc. If management refuses to provide such documents, the manager can forcefully demand them in court. The observer also has the right to request the information he needs from the debtor’s counterparties when destroying primary documentation at the debtor enterprise.

- Appeal against unlawful claims of creditors.

- Take additional measures to ensure the safety of property.

List of documents that are attached to the report

The list of documents that the financial manager attaches to the report is not contained in Art. 143 127-FZ. The legislation specifies only a mandatory list of documentation provided by the manager following the procedure for selling property and repaying creditors’ claims (under Article 147 of the 127-FZ).

This means that the list of attached documents is determined at the discretion of the bankruptcy trustee and is open. The report may need to be accompanied by:

- A copy of the register of creditors' claims.

- Documents that serve as confirmation of the sale of property.

- Personnel documents , which indicate the number of employees and dismissed employees.

- Documents that confirm the sale of property under sales and purchase agreements, etc.

- Other documents.

Responsibilities of the Observation Stage Manager

The duties of a temporary manager arise from the peculiarities of the observational stage of bankruptcy of an enterprise. At this stage of observation, the company's management remains in place and continues to perform its official duties, but under the supervision of a professional manager. At the same time, certain restrictive measures are imposed on directors. Thus, they are prohibited from reorganizing the company, creating branches and representative offices.

The key goals of this observational stage, which determine the range of responsibilities of the manager, are:

- Organize the first creditors' meeting, which will resolve the most important tasks of the case on recognizing the financial insolvency of the debtor. The meeting must be held at least 10 days before the first court hearing in the case of declaring the insolvency of the enterprise.

- Compile a register of creditor claims in relation to a potential bankrupt. Consideration of the validity of complaints from the debtor about the illegality of including claims in the register.

- Analyze and evaluate the financial assets of a legal entity.

- Find the best ways to value assets.

In addition to these basic goals, the range of additional responsibilities of a temporary manager can include:

- determining the reasons for the impossibility of fulfilling one’s obligations;

- identifying the level of liquidity of the company’s property and assets;

- forecasting the return of the normal balance of payments when rehabilitation procedures are introduced at the enterprise: external management or recovery;

- assessing the market value of the enterprise as a complex;

- development of measures to restore solvency.

The observer should also analyze whether the company has signs of a fictitious bankruptcy. Indirect evidence of this fact is distorted financial statements, their absence; concealment of information about company-owned property; failure by a legal entity to take measures to collect receivables or assignment of rights to claim them on obviously unfavorable terms; concluding contracts on non-market terms; the presence of dubious companies and shell companies among counterparties; ignoring the demands of creditors, despite the possibility of repaying debt obligations.

Information

The temporary manager is also obliged to monitor the work of the managers of the bankrupt enterprise. If management interferes with the normal performance of duties by the manager, then he must report the situation to the court and demand the temporary removal of management. Such a petition can be filed when management conceals documents, enters into transactions without the consent of the supervisor, etc.

When identifying signs of fictitious/deliberate bankruptcy, the observer assesses the possibility of bringing managers to subsidiary liability.

What does a sample bankruptcy trustee’s report look like, and what should this document contain?

The general type of documentation, requirements and rules for filling out are approved by the Law of the Ministry of Justice of the Russian Federation No. 195 of August 14, 2003. This act contains a standard reporting form. The entire report of the bankruptcy trustee on his activities consists of tables that are filled in with information about the bankruptcy proceedings. As has already become clear, the form of the bankruptcy trustee’s report consists of tables.

The manager's report records the following important points:

1. All personal information about the defaulter: name, address, TIN. Information about the judicial authority where this case is being considered.

2. Personal data of the arbitration manager: full name, INN, address where he is registered, name of the SRO in which he is registered, INN and address.

3. All information about others involved in this case for the purpose of working with property: auditors, appraisers. This item contains all the data including full name, employment contract data, position held, salary, contract period and source of payment.

4. Period of bankruptcy proceedings. If it was extended, it is also recorded.

5. The entire list of actions of the manager that he carried out while performing his direct duties. All requests submitted by him to government authorities and other actions.

6. Complaints against the manager, if any. You must specify:

- plaintiff;

- the essence of the complaint;

- qualify violations;

- indicate the authority that reviewed it and when;

- the result of the decision made;

- number of the document recording the violation.

If there are no complaints, write “Absent”.

7. Information about property that is subject to sale in order to pay off debts. This includes all assets, construction in progress (if any), investments, and accounts receivable. Data on the bankruptcy estate (how it was formed) - the property of a legal entity that will be auctioned off to pay off debts to creditors.

8. All information about the sale of property to a bankrupt company. Indicate information about the buyer, contracts and the amount of revenue.

9. Data about the money that was transferred to the accounts of the bankrupt company. Most likely, accounts receivable are repaid in this way.

10. All about the debt collection requirements that were presented to debtors.

11. List of measures that have been taken to preserve the property. This includes:

- claims to judicial authorities seeking recognition of the invalidity of transactions;

- recovery of the debtor's property that is owned by third parties;

- refusals under previously concluded contracts.

12. Data on the list of the register of creditors. This is usually done by the manager himself.

13. Information about the list of lenders:

- when and where there were publications about bankruptcy;

- list closing date;

- what claims of creditors have already been considered by the court;

- number of creditors on the lists.

14. The amount of creditors' claims in accordance with the queue for repayment.

15. The conclusion of the arbitration manager must contain information about the employees of the bankrupt company. Who was fired and who continues to work.

16. Information regarding the closure of bankrupt accounts:

- name of the bank where the accounts were opened;

- details and category of accounts;

- account balances;

- Availability of information regarding completed closure work.

17. A sample report of the bankruptcy trustee on his activities must record information on all expenses for the time period of bankruptcy proceedings. Costs for a property appraiser, amounts spent on advertisements in the media and a number of others.

The arbitration manager's conclusion on the report must have: number, signature, full name of the responsible person.

The standard form for the conclusion of the arbitration manager can be viewed here.

Responsibility of a temporary manager in bankruptcy proceedings

The responsibility of the temporary manager for failure to perform/improper performance of his professional duties may be expressed in his removal. This procedure is carried out at the initiative of the participants in the bankruptcy case. After the relevant determination is made (even if it is appealed), the manager is not subject to reinstatement.

The legislation also provides for other liability measures that may be applied to the manager:

- His exclusion from the SRO, which is designed to monitor the professional level of its members.

- Application of liability measures in the form of disqualification with publication of the corresponding mark in the Federal Register.

- Compensation for losses caused to the debtor and creditors.

- Additional measures of property liability.

- Criminal and administrative liability for causing damage on a large scale.

Removal from office

Procedure for remuneration of the bankruptcy trustee

The appointment is made by the arbitration court, taking into account the provisions of the law. There are several options for releasing a manager from his duties:

- His own statement in the prescribed form.

- Complaint by the debtor or creditors in case of improper performance of duties.

- Petition from the organization of arbitration managers.

The reasons for removal can be very different, but most often it occurs due to violation of the law:

- failure to perform or improper performance of duties that resulted in loss to any interested party;

- identification of any circumstances that may prevent a person from holding the position of temporary manager, and circumstances may arise both before and after the appointment;

- his exclusion from the list of arbitration managers, which can be done for violation of professional ethics and legislation;

- upon receipt of a criminal record or administrative offense;

- in some other cases provided by law.

Manager's action plan in the observation procedure

After the temporary manager starts work, he needs to develop a list of activities that he plans to implement within the time allotted to him. Typically they are listed with a time frame for their implementation. The plan may include the following tasks:

- Analysis of financial statements for the last three years.

- Analysis of enterprise transactions completed over the past three years, taking into account the market conditions in which they were concluded.

- Inventory and valuation of legal entity assets.

- Analysis of the circle of counterparties of a legal entity, search among them for unreliable and fly-by-night companies, offshore companies.

- Analysis of the legality of creditors' claims received at this stage.

Also in his final report, the interim manager develops a brief action plan for the future, based on the results obtained during the analysis.

The bankruptcy proceedings have been announced: what next?

From the moment the opening of the CP is announced in the Arbitration Court, the following natural consequences occur:

- the last opportunity appears to present obligations to the liquidated company;

- all types of sanctions cease to be accrued: penalties, penalties, interest, fines, etc.;

- any information about the debtor’s business ceases to be a trade secret;

- the property of the debtor company, if its quantity exceeds 5%, is prohibited from sale, rental or other alienation;

- all enforcement documents are terminated and returned to the bankruptcy trustee by the bailiffs;

- all restrictions on the use of the bankrupt’s property are removed - arrests, blocking of accounts, etc.;

- the former manager relieves himself of all powers and transfers them to the manager;

- The debtor's patents, permits and licenses are cancelled, and his registration as an individual entrepreneur becomes invalid.

Interim manager's remuneration

Based on the results of the observation stage of bankruptcy of a legal entity, the temporary manager has the right to receive remuneration for his work. It consists of the salary fixed by law, as well as accrued interest. Payments of remuneration are made from the debtor's funds and are made out of turn (before paying off creditor claims).

Information

The salary of an arbitration manager is prescribed in 127-FZ on bankruptcy. Today it is set at 30 thousand rubles. monthly. The fixed part of the remuneration may be increased by a court decision at the request of creditors or other participants in the process. But such a decision can be appealed.

If the temporary manager resigns early, payments stop. When calculating the percentage of the manager's remuneration, it is calculated based on the book value of the debtor's assets and is:

- 4% for asset value up to 250 thousand rubles;

- 10,000 rubles + 2% - with an asset value of 250 thousand rubles. up to 1 million rubles;

- 25,000 rubles + 1% - if the value of assets is more than 1 million rubles;

- 45000 rub. + 0.5% - for prices over 3 million rubles.

Why does bankruptcy proceedings exist?

This is the only procedure permitted by law, as a result of which an enterprise, company, LLC declared insolvent is liquidated.

NOTE! The debtor may not cease to exist if, during the bankruptcy proceedings, the business begins to be managed from the outside, or the matter can be resolved through an agreement.

Through the CP, absolutely all property of the debtor enterprise that is of material value must be identified and sold in the manner prescribed by law, and the proceeds must be used to repay all loan obligations (in full or in proportion).

The duration of bankruptcy proceedings is exactly six months from the date of announcement of the decision of the Arbitration Court on the final recognition of the debtor as insolvent. In some cases, this period may be extended for another 6 months (at the request of the bankruptcy trustee).

The goals that the introduction of CP implies:

- discovery of all components of the property of the debtor enterprise or, in other words, accumulation of the bankruptcy estate;

- turning the bankruptcy estate into money;

- through the sale of the bankruptcy estate, fulfillment of obligations to creditors (if full payment is not possible, it must be made proportionately);

- liquidation of a bankrupt as a legal entity or entrepreneur.

Temporary manager's expenses

In addition to remuneration, the temporary manager can count on compensation for expenses incurred during the supervision procedure. Moreover, such expenditure transactions must be economically justified and documented. Compensation is due to the manager if he was not removed from the business for improper performance of his duties.

The expenses incurred by the arbitration manager during the bankruptcy procedure are recovered from the debtor's funds. These may include costs for publishing information in the Federal Register, paying for the services of hired specialists, legal costs, organizing creditor meetings, etc.

Manager's report under observation

After completing the observation stage of insolvency, the temporary manager must provide reporting documentation to the court and the creditors' meeting. It should contain information about the results of work and information about the current financial situation of the debtor. In addition, the reporting must contain indications of the measures taken by the debtor to repay the debt.

Information

The manager’s tasks include developing a set of measures to restore the solvency of a legal entity, which are embodied in reporting.

The report reflects the following information:

- comprehensive financial analysis of the enterprise, assessment of investment and economic areas of work;

- measures taken to ensure the safety of property and identify creditors;

- petitions and statements presented to the court during bankruptcy proceedings;

- conclusion on identifying facts of deliberate/fictitious bankruptcy (if any);

- current list of creditor claims;

- minutes of the first and subsequent creditor meetings;

- justification for the possibility or impossibility of restoring the balance of payments;

- recommendations on the introduction of one or another bankruptcy procedure;

- other information about the performance of their duties.

Report frequency

The bankruptcy trustee is obliged to report to the meeting of creditors on the progress of the bankruptcy procedure. This is necessary to provide creditors with data on the current financial situation of the debtor as of the date of opening of the bankruptcy proceedings stage and up-to-date information on the progress of the process. Receiving the report allows creditors to quickly adjust the course of the procedure and point out gaps in the work to the manager.

According to the provisions of paragraph 1 of Art. 143 127-FZ, the bankruptcy trustee provides the meeting of creditors with reports at least once every three months. But the meeting of creditors has the right to provide for a different frequency for submitting reports.

According to paragraph 3 of Art. 143 127-FZ, the manager’s reporting to the court is provided upon his request. It is the direct responsibility of the bankruptcy trustee to transmit to the court all requested information about the progress of bankruptcy.

Appeal against the actions of the temporary manager

Unlawful actions of a temporary manager or improper performance of his professional duties may be appealed in court. The complaint can be filed by the management of the enterprise, creditors or the Tax Inspectorate. If the complaint is satisfied, the manager may be subject to one of the penalties or removed.

Important

Not all actions of the observer can be appealed, but only those that violated the legal rights and interests of the plaintiffs in the bankruptcy case, provoked losses for creditors or worsened the financial position of the legal entity.

Thus, observation can be considered as a preliminary stage of the bankruptcy procedure. At this stage, the manager must form an objective picture of the financial situation at the enterprise and protect property from illegal withdrawal.

Submission of the report to the court and its consideration by arbitration

The reporting document of the arbitration manager's conclusion must be submitted to the arbitration judicial body. The arbitration tribunal must review the bankruptcy proceedings reports. The court controls the conclusion of the arbitration manager.

Important point! If during the case a complaint was filed against the manager, the court has the right to remove the bankruptcy representative from the case and replace him with another representative.

Usually there are no serious problems. Property is sold, debts are paid off, accounts are closed, and employees are laid off.

The conclusions of the arbitration managers end the debtor's bankruptcy case. The court reviews the documents and makes a verdict. The verdict can be appealed.