Free legal consultation over the Internet 24 hoursLawyer on housing issues in St. Petersburg. Free legal consultation on labor disputes.

5/5 (3)

How to draw up a document correctly

If a representative will represent the interests of a third party in an insured event, you will need to draw up a special power of attorney. Both on the part of the principal and on the part of the trustee there may be individuals. and legal faces. The document is secured by the signature of the principal. The company's seal is affixed if the policyholder is a legal entity.

By drawing up a power of attorney, the principal gives the attorney the right to represent his interests.

There are separate requirements for document preparation.

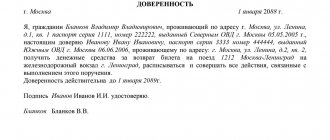

Sample power of attorney to represent interests in an insurance company in 2021

By whom can it be issued?

Anyone can create a trust document. As a rule, this is the owner of the property that was registered with this insurance company. The rules for drawing up a document may vary slightly, depending on who exactly the principal is:

- Entity . The Civil Code stipulates that only its manager can issue a power of attorney on behalf of a company. It is he who must appoint a representative who will protect the interests of the organization. Accordingly, his autograph is required in the trust document. You will also need to affix the company seal.

- Private person . In this case, the person independently determines for whom to issue a power of attorney. Here he has no restrictions. If the principal is an individual recognized as incompetent, then all decisions, including the issuance of a power of attorney, are made for him by his legal guardians.

As a rule, such a power of attorney does not require mandatory notarization. But under certain circumstances, for example, the insurance object is too expensive, insurers may require a notarized power of attorney. In a specific situation, it is better to ask the company in what form the power of attorney must be provided.

( Video : “Everything about drawing up a power of attorney”)

Do I need to certify?

When answering the question about certification of a power of attorney at a notary’s office, it should be noted that some of them actually require a notary’s signature. Notarization is required for a document that deals with the right of subrogation. In all other cases, it is drawn up in the usual form and a notary’s signature is not required.

Note! To avoid problems with insurers who do not recognize powers of attorney without assurances, clarify the issue with the insurers in advance.

When issuing a power of attorney from a legal entity. The person's signature and company seal are affixed at the end.

Notarized power of attorney for representation of interests

How to issue a power of attorney for the right to sign, read here.

How to file a claim against an insurance company under compulsory motor liability insurance, read the link:

How to write a power of attorney to represent interests in an insurance company?

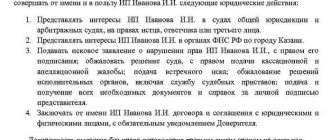

To ensure that the insurer does not have any questions, the power of attorney must be properly executed. There are certain requirements for this document:

- Its name is written in the center of the document;

- The date of compilation is indicated;

- The name of the locality in which the document was drawn up;

- Principal's passport details;

- Detailed information about the representative;

- For legal entities, their names, tax payer code, and other information are indicated;

- The insurer whose office the attorney is going to visit is indicated;

- The powers vested in the representative are described in detail;

- Validity period of the document;

- Is it possible to draw up a power of attorney;

- Signatures of the parties with transcripts.

There is no special form for drawing up a power of attorney of this type. But it is still recommended to adhere to certain rules for drawing up such documents. Of course, if necessary, you can change and add important points here. It all depends on the specific circumstances.

Do not forget that the rules of Rosgosstrakh stipulate that if there are any serious errors, the document may be declared invalid. For example, if the manager of an insurance company asks a representative to present a passport, and his data differs from the information specified in the power of attorney, the document will be invalidated. Major errors also include illegible handwriting, which makes the information unreadable. That is why it is recommended to fill out the document on a computer, or by hand using printed characters. You need to know that these rules are used not only by Rosgosstrakh, but also by all other insurance companies.

( Video : “How to issue a power of attorney”)

Documents for certification

In most cases, the document is certified by the insurance company itself. So, to certify it you will need to provide the following documentation:

- passports of both parties;

- insurance policy;

- certificate confirming ownership;

- registration documents for legal entities.

Only the basic package of documents that will be needed for certification is listed here. It is possible that different insurers may request additional documentation.

What operations can be performed

A power of attorney is a legal document.

The person to whom it is issued has the right to perform various legal actions:

- sign various documents;

- participate in the consideration of the insurance situation;

- accept and transfer compensation payments;

- draw up and terminate insurance agreements.

The attorney has the right to perform only those actions and operations that are clearly stated in the power of attorney. These actions must not be contrary to the law. They can also be agreed upon with the principal.

For what period is the document issued?

Just a few years ago, the maximum term of a power of attorney was determined by law. It was allowed to issue a trust document for a period of no more than three years. This rule was recently lifted. Thus, in 2021, the principal has every right to independently determine the validity period. There are no restrictions on the minimum period. As a rule, the validity period is indicated in the power of attorney. In the absence of this information, the document will be valid for one year from the date of registration. There are several situations in which a power of attorney loses its force:

- The principal lost confidence, so he revoked the document;

- Expiration of the specified validity period;

- Death of the principal or attorney;

- The representative of one of the parties is declared incompetent;

- The attorney refuses the assigned obligations;

- If the power of attorney is from a legal entity that has ceased its activities.

A power of attorney can be issued for several days or for several decades. The originator of the document may specify the time period during which the attorney is permitted to use it. You can set a specific date, upon which the document automatically ceases to be valid. In addition, when entering data, you can indicate for which specific obligations the power of attorney is issued. Naturally, after their implementation it will lose its legal force.

Do I need to get it certified by the insurance company?

Of course, every person who issues a power of attorney has the right to have it notarized. It must be remembered that it is precisely such a document that inspires maximum confidence among third parties to whom it will be presented. In addition to certification, notary office specialists will check the correctness of the document and help correct any errors. However, practice shows that if it is necessary to represent interests in an insurance company, they rarely turn to a notary. The need for the services of this lawyer arises when the list of powers of a trustee includes delegation of trust.

According to the law, the principal has the right to do without certification of the document at all. But insurers often doubt the authenticity of the power of attorney, so they may simply refuse the representative. To avoid such a problem, it is still recommended to have the document certified. In most cases, there is no need to visit a notary office for this. After all, the document can be certified directly by the insurer. To do this, the principal must come to the company and present a power of attorney drawn up in his own hand.

The insurer's representative, usually a customer service manager, signs and seals the document with the company. The principal himself must also sign his autograph here. After this procedure, the power of attorney can be considered certified. Such a document will certainly be accepted by the insurance company. However, here you need to remember that the insurer will be able to certify such a document only if the principal is present in person. It is advisable that the document be signed by the party accepting certain obligations. Although this is not a prerequisite.

In general, before applying, it would be a good idea to contact a representative of the insurer to clarify the points of interest.

Principal and attorney

The principal can be an individual or an organization. If the principal is an individual, he must personally sign a permission to represent interests for the insurance company. Notarization of a representative office in an insurance organization is not required. The identity of the principal, according to the legislation of the Russian Federation, is identified by a Russian passport.

When issuing permission to represent the interests of a legal entity, the power of attorney is considered valid if the signature of the head is present. Instead, another employee may certify the document if such powers are specified in the charter or other corporate documents. If the company works with a seal, it must also be affixed.

REFERENCE! The document issued on behalf of the organization contains the full name of the company, OGRN and TIN, legal address, and full name. leader. If the certificate is certified by another person, the details of the authorized employee are recorded.

The authorized person is an adult citizen of the Russian Federation. His passport details are written after the information about the principal. If there are several attorneys, information about all participants and their powers is indicated. In the absence of information about what each attorney must do, their powers are taken into account in the aggregate.

Types of car insurance

Currently, there are several types of car insurance in the Russian Federation:

- OSAGO is compulsory motor third party liability insurance. The car owner's liability to other road users for possible damage to property or health in a road traffic accident (RTA) is insured.

- CASCO - vehicle insurance. It is worth considering that the word is not an abbreviation, but is translated from Dutch. like "hull". This type of insurance implies a complex of risks for vehicles that can be insured. The list of risks depends on the wishes of the policyholder and the capabilities of the insurer. The difference from OSAGO is that it is not liability that is insured, but the vehicle itself.

The most common type of car insurance is compulsory motor liability insurance because it is mandatory for every car owner. Lack of insurance when operating a vehicle entails the imposition of administrative liability in the form of a fine in the amount of 800 rubles ( Article 12.37, Part 2 of the Code of Administrative Offenses (CAO) of the Russian Federation ).

Advantages

Our employees have been specializing in the field of insurance legislation for many years. Legal support from lawyers will help you overcome possible difficulties and allow you to comply with all the requirements of regulations. Advantages of contacting our specialists:

- optimal solutions to assigned tasks;

- the vast majority of insurance disputes are resolved in favor of our clients;

- thorough analysis of each situation;

- extensive experience in interaction with insurance companies and authorities;

- qualified information and legal support;

- conflict resolution with minimal losses;

- a wide range of legal services;

- client-oriented approach;

- saving time for our clients;

- confidentiality;

- competitive prices.

We work until the desired result is achieved in all legal and most effective ways. The professionalism of the lawyers of the Alfa consulting group reduces the likelihood of developing conflict situations with other participants in legal relations and government bodies. In our activities to protect individual rights, we are guided by humanistic values and ideals of justice.

Our competence is a guarantee of your protection and success!

How to upload to the FSS portal

Those who submit electronic reports to the fund confirm their rights to act on behalf of the organization in electronic form. Here's how to upload a power of attorney to the FSS portal from the policyholder:

- Go to your personal account.

- Open the “Form 4-FSS” section, and in it - the “Authorized” tab.

- Select the “Add” action and find the policyholder from the proposed list. Save.

- Load the form from the “File” tab and find the one you need in the PC system. Save changes.

- Submit the original trust papers and the trustee’s passport to the territorial office of the fund for verification of personal information.

Results

Thus, drawing up a power of attorney is not difficult, but you need to think about what kind of powers you want to transfer to the representative and for how long the document will be issued.

This is complete freedom of action. We remind you that a sample power of attorney can be downloaded in the “Documents and Forms” section at the beginning of the article. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to pay attention to

When preparing a document, you must be extremely careful, since one error in the data can cost a lot of money and wasted time. Be sure to verify the attorney's integrity. So, for example, when drawing up a general sample document, the attorney is endowed with a large list of functions and rights. If the trustee is not entirely reliable, it is better to refrain from entering into an agreement.

Special and one-time versions of documents are the safest for the principal. They contain a specific list of transactions, and the powers of the attorney are limited. Of course, in order to prevent typical mistakes in drawing up official paper, it is better to download the power of attorney to the insurance company in advance. By studying the document in a calm home environment, you can avoid unnecessary financial expenses and loss of time associated with re-issuing the document.

What powers can a power of attorney confer?

In the case of the Social Insurance Fund, the list of functions that a representative of the principal can perform is quite wide. This includes submitting reports, transferring or receiving various types of documents: certificates, requests, applications, reconciling payment orders, paying insurance premiums, etc. In other words, if desired, the principal can issue a general power of attorney to his representative, which practically does not limit the person for whom it is drawn up. If the author of the power of attorney wants to grant the representative only part of the powers, then it makes sense for him to write:

- or a one-time power of attorney (for a specific matter),

- or special (with a clear validity period).

For whom to make a power of attorney?

A power of attorney can be drawn up for any employee of the company, provided that he has reached the age of majority and enjoys absolute trust from management. As a rule, the document is drawn up without the right of subrogation, but in some cases, such a possibility is provided.

If the manager is ready to grant the representative the right of subrogation, such a power of attorney must be certified by a notary.

In most cases, in order to prevent situations where a power of attorney could fall into the hands of unscrupulous people, organizational leaders prefer to write several similar documents for those employees they know personally.

Registration procedure

To formalize a power of attorney, to purchase compulsory motor liability insurance, you must contact a notary. In this case, the document is drawn up exclusively in the presence of the car owner, an authorized representative and a notary.

Before drawing up a power of attorney, the notary is obliged not only to check the documents, but also to make sure that both parties are legally capable. If everything meets generally accepted requirements, then the text of the document is compiled. As a rule, each notary has special templates.

After the text has been agreed upon, a document is prepared on a special form with watermarks and certified with a signature and seal. It is important to take into account that the document is always drawn up in two copies, which have equal legal force. One copy will be kept by the notary, the second will be handed over to the owner of the car. In addition to the paper copy, the number is entered in a special notary book and the unified state register.

Required documents

To issue a power of attorney for car insurance, you need to prepare a small package of documents.

Be prepared to provide:

- passport of the principal, in this case the one in whose name the vehicle is registered;

- passport of the representative who receives the license for the car;

- document confirming ownership of the car: PTS or STS.

All documents are accepted only in originals. It should be borne in mind that the notary does not have the right to demand other documents.

Important! A notary may refuse to issue a power of attorney on a legal basis if he has a suspicion that the principal or authorized person is drawing up a power of attorney unconsciously or is under the influence of alcohol or other intoxication.

Contents of the power of attorney

A power of attorney to represent interests in an insurance office must include:

- FULL NAME. principal and attorney, passport details, registration and place of actual residence of each person.

- The name of the legal organization in which the interests of the trustee will be represented.

- List of powers of the representative.

- Date of preparation of the document.

- Validity.

- The presence of the right to transfer powers (assignment) to third parties.

- Signatures of the parties.

IT IS IMPORTANT! It is recommended to enter not only the main actions, but also instructions that may arise in the process of contacting representatives of the insurance company. For example, if an attorney has brought a document certifying his right to sign a policy and contracts on behalf of the trustee, it is recommended to indicate the possibility of drawing up and re-signing contracts, obtaining related certificates and all actions arising in the process of fulfilling this order.

What powers can be delegated?

The most popular ways of representing interests in insurance are:

- Signature right. On behalf of a company or as a private client, an attorney can sign contracts, policies, checks and other certificates. This usually includes the ability to submit and collect information.

- Receipt of the insurance amount. After an insured event, a representative can apply on behalf of the principal for compensation. A personal visit to the office of the insurance company or online correspondence is allowed. An example is permission to receive compensation under a compulsory motor liability insurance policy after an accident.

- Payment and renewal of insurance, re-registration. For example, purchasing or renewing a CASCO policy.

- Representing the interests of the plaintiff in court. An insurance client can file a claim against the firm's services. By power of attorney, interests in insurance and court can be protected by a professional lawyer or lawyer.

- Other options provided by the insurance market.

Validity

The validity period of the authority to represent interests in the insurance company does not necessarily have to coincide with the contract. If we are talking about representation of interests in general, for example, when issuing certificates and affixing signatures, then the principal can draw it up for a period of 5 years or more, so that it does not have to be reissued annually.

NOTE! If the validity period is not specified, it is considered equal to 1 year, starting from the date of registration. If the date of registration is not indicated, then such a document is considered invalid.