What is a power of attorney for the right to sign documents, and what types exist?

Each director of an institution has the most important power - legal power.

This means that only he has the right to carry out all legal procedures for the enterprise until he issues a so-called power of attorney with the right to sign for his subordinate. A document of trust with the right to sign documents is a form that authorizes the attorney to carry out all legal actions in various institutions, while being a representative of the interests of his company. It must be taken into account that the trustee is vested only with those rights that will be written directly on the trust form.

This means that this type of trust document is divided into three types:

- One-time . This type of trust is issued to an authorized person only for signing documents in a single case, that is, one-time use.

- Special . This type is made up for a subordinate in the case when it is necessary to perform a transaction on papers only in a certain place, that is, on behalf of the head of the company.

- General . A trust of this type gives the attorney, roughly speaking, all the powers of an official representative of the institution. With the help of a general trust, he has the right to endorse documents and carry out orders of a various nature for the company for several years.

( Video : “How to transfer the right to sign primary documents”)

Who and to whom can issue a power of attorney for the right to sign

Any institution implements certain procedures, for which there is a package of so-called supporting documentation. All acts contained in this package refer to primary documents. Those employees who have specific competencies directly to do so have the right to sign such documents. Typically, the list of such rights depends on the position of the employee of the institution. However, it is possible to grant such powers to other employees using a special document of trust with the right to sign certain materials. For example, according to the rules, all primary documents must be signed directly by the general director of the company.

The formation of a document of a trust nature with the right to sign is provided for both individuals and the head of the institution. At the same time, it is issued to an employee of the company or a private person. There are two parties to this agreement:

- A witness is a person who gives away his rights;

- An attorney is a person who receives certain competencies from the management of an institution.

Typically, legal entities issue this trust deed to their subordinate institutions. These include: lawyers, accountants, department administrators, and so on. Consequently, a power of attorney can be issued to any employee, regardless of his position, but the period of validity of such a trust will be limited.

Who can be assigned this function?

Who can enter into contracts, sign agreements, and perform all sorts of actions aimed at developing the company? Such a responsibility cannot be assigned to any employee. This must be a person who is highly qualified, has extensive experience, knows the specifics of the company’s work well, and is a competent and responsible employee. Usually for this purpose they choose a deputy director, an experienced accountant, or a lawyer who is an employee of the company.

Sometimes a boss, looking for an assistant who would make deals instead of him and solve complex, important problems, attracts an outsider for this purpose. And then not only an individual, but also a legal entity can represent the management.

To avoid confusion, disputes, and litigation in the future, the regulatory legal acts of the organization itself must provide clear information about who can be a trustee and who can be entrusted with signing and concluding contracts. This will help reduce the risks of abuse of such rights and partial treatment of employees by management.

Main features of a power of attorney for the right to sign

We have already said earlier that a document of trust with the right to sign is divided into three types, each of which implies certain actions, these are: general (the entire package of powers); special (designed to carry out instructions from the manager in certain places) and one-time (used once to carry out a legal procedure over a document).

It should be noted that if the power of attorney is drawn up purely for the signing of special documents, they must be clearly stated in the text. It is recommended that you list this documentation on separate lines.

Once the trust document is already in hand, the attorney has the right to dispose of it in various institutions - government or commercial.

I would also like to add to the features of such a power of attorney that there are no legal norms for filling out the text, but it is required to comply with the rules of the civil code. All personal information about both parties, their signatures must be present here and, above all, the validity period of the document itself must be indicated.

A trust of this type does not require certification by a notary - this is most likely the main feature of this document. To confirm his legal capacity, just the director’s signature and the institution’s seal itself are enough. However, there are still cases when such a trust document must be certified by a notary. According to federal law, when signing documents in government agencies or in court, a power of attorney of this type must undergo a certification procedure by a notary service. This is done so that the trust document contains a special mark, which confirms its authenticity.

How to write

Next, we should examine topics related to the design of the text of the trust for the right to sign documents. As we have already clarified earlier, the text of the trust document is not regulated by law. Usually it is compiled in free form, while observing some mandatory clauses that will be used directly in the text of the trust itself. Such items are personal details about the witness and the trustee, a number of competencies providing and the period of validity of the trust form. For the power of attorney to come into force, it is necessary to affix the signatures of both parties.

When writing the trust text, it is important to ensure that the competencies being transferred are precisely defined. Moreover, if there are quite a lot of such powers, then information about them should be as clear and concise as possible.

( Video : “All working hours for signing documents? How to sign documents.”)

Nuances in signing papers by the chief accountant

Before changes were made to legal acts in 2014, the mandatory presence of a chief accountant’s visa in some papers, as well as the understanding that this is the right of a second signature, were enshrined at the legislative level.

Currently there is no definition provided in the legislation. In essence, this is the approval of some acts by another employee, in addition to the manager, the chief accountant. It is not provided on its own upon appointment to the position of chief accountant. The order states that the chief accountant receives the authority to sign specific papers, and this right of financial signature in the event of his vacation or illness will be temporarily transferred to another person.

How to issue a power of attorney for the right to sign documents in 2021?

Drawing up a trust document is a time-consuming procedure, since it is necessary to be vigilant in writing the text so as not to miss important aspects. Typically, filling out such a document is entrusted to secretaries, lawyers or chief accountants of an institution who have experience in writing this type of documentation. In the case where the power of attorney is filled out independently, the text of the trust must include all important information that you need to be familiar with in advance. The following data is included here:

- name and registration number of the letter of trust (“Power of Attorney”);

- date and place of drawing up the trust document;

- passport details of the witness. Due to the fact that it is a legal entity, certain information is required:

- name of company;

- registration state number;

- registration reason code;

- taxpayer identification number;

- business location address.

When a power of attorney is issued on behalf of a specific employee holding a position, the following data must be entered here:

- Last name, first name, patronymic, passport details, place of registration;

- personal information of the attorney, with the help of which he will confirm his identity to third parties;

- a list of documents to be signed that the attorney will be able to carry out in the future;

- validity period of the trust document;

- specified parameter with permission or prohibition of the right of subrogation;

- The final note in drawing up a trust is the signature of the witness and the seal of the institution.

Representative powers

The type of power of attorney in question is drawn up so that the person to whom the manager entrusts such powers signs documents in the interests of the organization.

In some cases, a power of attorney is issued for an employee’s one-time trip on a business trip, where he will represent the organization in negotiations with partners.

The person to whom the power of attorney has been issued has the right to sign commercial contracts under which the organization will subsequently perform work or supply products.

Instructions for filling

In order to avoid mistakes in writing a trust document, we will provide you with instructions for filling out a trust sheet with further rights to sign. Usually, the instructions can help those people who fill it out in any form, that is, from start to finish with their own hands.

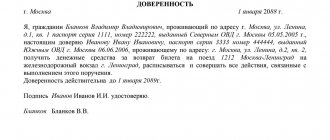

- First, at the top of the paper you need to write a word that will mean the name of the document - “Power of Attorney”. Here, if necessary, enter the document number assigned to it according to internal document flow. Below these entries, you must indicate the date of filling out the trust paper and the locality where it is being done.

- The next step is to indicate all the important data of the certifier (legal entity), namely: the full name of the company, its abbreviation, banking information, address, both actual and legal. It is also worth including the registration state number, identification number and registration code. Please enter the full name of the principal here. Typically this includes directors, deputies and other persons authorized to issue such documents. And you also need to refer to the protocol on the basis of which this person acts (this is usually reflected using the following words: “based on ...” charter, power of attorney or regulations).

- In the next line, the text of the trust must contain all the exact information of the powers transferred from the witness to the attorney, that is, a list of documents that he can sign at business meetings, and so on.

- At the end of the text of the trust document, its validity period should be indicated. It is worth considering that if such a period is not specified, the trust will last for one year. Also in the same line it is necessary to put a mark prohibiting the transfer of this power of attorney to third parties, that is, without the right of subrogation.

- The result of drawing up this paper is the signatures of both parties.

Power of attorney for the right to sign documents for the director

Power of attorney for the right to sign primary documents

Power of attorney for the right to sign documents of an individual

Power of attorney for the right to sign documents as an individual entrepreneur

Tax returns

The rules for signing tax returns and calculations are established in Article 80 of the Tax Code. They state that these documents must be signed by the taxpayer or his representative. A taxpayer is understood to be the head of a company or an individual entrepreneur, that is, a person who can act without a power of attorney. The signature of this person must be affixed to the declaration or calculation. If the document is signed by, say, the chief accountant, then it is necessary to give him such powers through a power of attorney.

Note! The tax authorities must be notified of the transfer of these powers. Before submitting a report signed by an authorized person to the Federal Tax Service, you must send there a copy of the power of attorney. In addition, its details must be entered in the appropriate field of the declaration, and a copy of the power of attorney must be attached to it.

VAT reporting

As you know, since last year all companies have been reporting VAT electronically. An exception is tax agents who are not VAT payers. The electronic declaration is signed by UKEP and transmitted via telecommunications channels (TCC) using an electronic document management operator (EDO).

How can you delegate the authority to sign a VAT return to another person? In general, everything is the same - you need to draw up a power of attorney and notify the tax authority about the transfer of powers. The only difference is that this can be done electronically, and an information message about the power of attorney must be attached to the declaration each time. This procedure applies to any tax report (calculation) submitted through TCS channels.

Duration of power of attorney

Each trust form has a limiting period of legal capacity. It is customary to indicate the validity period of the trust certificate at the end of the trust text. The maximum period of legal capacity is three years. If this period is exceeded, the trust automatically becomes ineffective. In some cases, this period is not reflected in the text, therefore, according to the civil code of the Russian Federation, the trust document will retain its legal force for one year.

However, in addition to the expiration of the period specified directly in the document itself, the trust document may interrupt its properties for other reasons. These include:

- early revocation of the power of attorney by the witness;

- refusal of the attorney to act on this document;

- death of the principal, his incapacity or limited legal capacity, or is considered missing;

- death of the attorney, his incapacity or limited legal capacity, or is considered missing.