Organizations and individual entrepreneurs are required to report to government regulatory authorities. Based on clause 3 of Art. 40 No. 14-FZ, only the director of the company has the right to represent interests and make transactions on behalf of the company. Consequently, submitting reports to the tax and other departments is also his responsibility. What if the provision of documents to the departments is not carried out by the head of the enterprise, but by an authorized representative (employee). In such cases, a power of attorney is created to send information.

Let's consider what kind of power of attorney is needed to submit reports to the tax and statistical services, pension and insurance funds, as well as the procedure for preparing these documents.

When required

Only its head has the right to act directly on behalf of the institution. The remaining persons who are entrusted with working with the Federal Tax Service fill out a power of attorney for the tax authorities to receive documents and submit reports. The director delegates authority to:

- receiving documents, requirements, notifications, extracts, certificates from the territorial Federal Tax Service;

- submission of reports and written requests to the department;

- signing notifications of delivery of documentation.

The trust papers are filled out in several copies: during the initial visit to the department, the inspector leaves the form with him. If the next time the representative goes to another employee of the Federal Tax Service, he will also request documentary evidence of authority.

IMPORTANT!

Trust papers from legal entities are certified by the signature of the head and the seal of the institution (if there is one). But the documentary transfer of powers of an individual entrepreneur must be confirmed by a notary (clause 3 of Article 29 of the Tax Code of the Russian Federation).

Power of attorney form

There are no special requirements both for the design rules and for the form itself. Accordingly, there is no need to use a unified form here. Almost all organizations use a form for these purposes, which is developed in advance and adopted by the accounting policy. However, a regular sheet of paper is also suitable for drawing up such a document. If you wish, you can use a standard template that can be downloaded from our website. The printed form is not the only type of form allowed. It can also be submitted in handwritten form. There is no fundamental difference here.

Who can act as a proxy

The legislation in this regard does not put forward any strict requirements. The main condition is that the attorney must be an adult capable citizen. The rest of the choice rests entirely with the director of the company. If necessary, another organization can play the role of attorney. As for individuals, there are also no restrictions.

There is an opinion that only an employee should represent the interests of a company. However, it is not. The manager can hire a specialist who will act on behalf of this company in certain authorities. At the same time, for the company he is considered a complete stranger. This happens, for example, when the company does not have the right person with the necessary qualifications on staff.

( Video : “Everything about drawing up a power of attorney”)

Many people wonder who can write such a power of attorney? Here you need to understand that an ordinary employee, naturally, does not have the right to issue such documents. Usually this is the director of the company. However, there are situations when certain other employees are also granted these powers. Moreover, such powers must be prescribed in job descriptions.

How to write

Compiled in simple written form. There is no unified form; the manager delegates those responsibilities that are required for a particular institution. This is what is described in the trust document:

- Information about the principal: name, INN, OGRN, legal address, full name. and the legal basis for the manager’s actions.

- Personal information about the person being trusted: full name, passport, address.

- List of powers.

- Certified signature of the trustee (if required by the terms of the trust).

- Manager's signature. The stamp is placed if it is available at the institution.

Limits of authority and notarization

The power of attorney must clearly define the actions the power of attorney is entitled to perform. In this sense, there is a conditional (mostly popular) division of powers of attorney into one-time, special, general, etc.

In fact, such a division does not exist. Any power of attorney must provide for the limits of authority, and whether they are one-time or general are conditions, not the essence of the document.

The limits of authority may be as follows:

- performing a one-time action. After its completion, the power of attorney ceases to be valid;

- performing a limited series of actions aimed at obtaining one result. Achieving the result terminates the power of attorney;

- performing the entire range of actions aimed at achieving results (the so-called general power of attorney).

The need for notarization of a power of attorney is determined by the type of authority granted.

So, the following need to be notarized:

- powers of attorney with the right to sign particularly significant transactions;

- powers of attorney with the right to receive or transfer material assets (including money);

- powers of attorney for the right to receive documents from government bodies;

- powers of attorney for concluding real estate transactions;

- powers of attorney at the stage of enforcement proceedings, if the powers of the authorized person are related to receiving money in cash or providing information to the treasury.

Sample

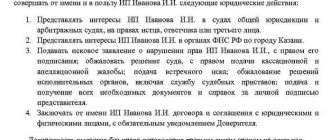

Template - power of attorney to receive a certificate from the tax office and submit reports to the Federal Tax Service:

| Power of attorney _______ date in words By this power of attorney _____________________________ (name of organization), TIN ______________, OGRN ______________, legal address: ___________________ represented by _________________________, acting on the basis of ________, this power of attorney authorizes __________________________________________, passport series _____, No. _________, issued by _____________________, registered at the address: ___________________________

This power of attorney has been issued without the right of subrogation for a period of _______. I certify the signature of the authorized representative ____________. Supervisor _______________________ (space for printing if available) |

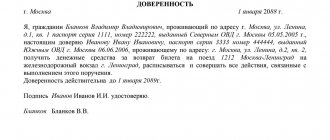

And this is what a completed power of attorney for the representation of interests in the tax office for an accountant of the institution looks like:

Power of attorney to submit reports to the Social Insurance Fund

A power of attorney for the Social Insurance Fund gives the representative the right not only to submit reports, but also to receive various documents: certificates, requests, applications, reconciliations of payment orders, payments of insurance premiums, etc. It can be drawn up by a lawyer or company secretary, and only the manager can agree and sign it.

The principal draws up a document giving the right to act as a representative in the Social Insurance Fund on behalf of the organization, without restrictions, or vests the document with part of the powers. In the second case, a power of attorney is created:

- one-time - to perform a specific function;

- special - limited in time for use.

If the validity period of the document is not specified, the power of attorney for the Social Insurance Fund can be used for one year and renewed if necessary.

A power of attorney is drawn up for any employee over eighteen years of age. Only that copy of the document that is drawn up taking into account the right of delegation is notarized.

The state does not establish a specific format for the power of attorney form for the Social Insurance Fund; it is drawn up in free form, which is prescribed in the accounting policy of the organization. This can be an A4 sheet or company letterhead.

The power of attorney for the Social Insurance Fund is drawn up in a single copy and must necessarily contain the following:

- registration address of the organization and date of drawing up the form;

- text indicating that this power of attorney was drawn up for the Social Insurance Fund;

- information about the trustor company:

- Name;

- Full name and position of the manager or deputy;

- Full name and position of the authorized employee;

- details of the identity document of the authorized employee;

It is not necessary to stamp the document.

If the power of attorney needs to be revoked, the principal notifies the FSS of the termination of the document.

Power of attorney to the Social Insurance Fund (sample blank form)

Power of attorney to submit reports to the Social Insurance Fund (sample of filling out the form)

Procedure and rules for drawing up a power of attorney from a legal entity to a legal entity in 2021

If an error was made when drawing up a deed of trust, then such a document automatically loses its legal force, and all actions carried out on its basis are declared illegal. In order to protect the organization and employees as much as possible from such troubles, it is better to use the services of a qualified lawyer.

If you decide to personally deal with this issue, we suggest that you familiarize yourself with the step-by-step instructions for filling out a trust deed.

- Filling out the trust sheet begins with the header. At the very top in the center of the document the name and serial number of the act are written. A little lower on the left is the city or other locality, on the right is the day, month and year of compilation.

- Next, data is entered about the person who entrusts certain rights and powers, namely the last name, first name and patronymic, passport details and the address at which the trustee is registered. If you fill out this part of the document incompletely, troubles may arise, as it loses its legal force.

- It is also necessary to carefully write down the information about the trusted person in the designated columns of the form, as indicated below.

- It is very important to clearly state all assigned powers that are transferred to the trustee. Here it is necessary to clearly formulate and specifically express the necessary actions.

- At the end of the document being drawn up there must be a date and the signature of the person who compiled it. According to the new legislation, the principal has the right to determine the validity period of the deed of trust, but if this moment is missed, the document will automatically be valid for one year.

With strict adherence to all of the listed recommendations, everyone will be able to competently and legally formalize their trust relationships without any problems.

Expiration of the power of attorney

Typically, the period of legal validity of the deed of trust is limited to exact dates, which are counted from the date of issue. An exception is a notarized power of attorney for actions performed abroad.

As a rule, the validity period is clearly stated in the document, but it should not exceed three years.

The legal force of the trust deed ceases from the moment:

- the final date approved;

- cancellation by the person who issued the document;

- denial by the authorized person of fulfilling the powers assigned to him;

- termination of the principal's activities;

- passing away or receiving the status of an incapacitated person assigned to the principal;

- passing away or receiving the status of an incapacitated person assigned to a trusted person;

It is necessary to notify not only the trusted person, but also the authorities to which it was prepared to be submitted, about the fact that the letter of trust has been terminated.

In case of cancellation of the act of completion, the representative is obliged to immediately return the document to the principal.

Existing varieties

There is no gradation of powers of attorney in the Civil Code. However, an unspoken classification still exists.

A power of attorney certifying the authority to act on behalf of an LLC can be:

- One-time. It is drawn up in order to carry out a one-time order.

- Special ─ involves performing an unlimited number of similar actions.

- General. It allows you to obtain the maximum number of rights without specifying each power.

Preparation of documentation and applications to a notary

If the power of attorney requires notarization, the head of the company must be present during the procedure.

Video

The authorized representative may not visit the specialist. However, the citizen’s passport data will be required to carry out notarization.

A number of documents are required, the list of which includes:

- passport of the principal and passport details of the person to whom the authority to represent the LLC is transferred;

- the charter of the institution and the order for the appointment of a director;

- company details and sample seal;

- extract from the Unified State Register of Legal Entities received within 30 calendar days.

Notary services must be paid. Their price varies from 1000 to 3000 rubles. It all depends on the specifics of the current situation and the specific city.

Video

Contents of the document

In general, a power of attorney issued by an organization must contain the following basic elements:

- Document's name.

- City, as well as the date of compilation.

- Detailed contents of the document (name, registration data and address of the principal and attorney, as well as the powers transferred).

- Validity.

- Signature of the person who is the official representative of the organization - the principal.

Civil legislation provides for situations when a power of attorney must have a notarized form (for transactions related to the pledge of property, rent agreements, etc.).

In this case, the document must also contain the notary’s signature.

Retrust

The right of subassignment implies that the authorized person has the right to transfer the functions entrusted to him to another person (Article 187 of the Civil Code of the Russian Federation). This is only possible if there is express permission for this in the power of attorney. In practice, a power of attorney with the right of substitution is rare; it is more convenient for a manager to write out several powers of attorney for different people.

Having delegated powers to another person, the attorney must notify the principal about this, otherwise he will bear full responsibility for his actions.

Possible mistakes

The legislation does not establish clear requirements regarding the form in which a power of attorney must be written (by hand or printed on a computer). The most important requirement is the readability of the text, as well as the absence of errors. To correctly fill out a power of attorney form drawn up from a legal entity to a legal entity, it is necessary, you can do this above. So, let's look at the most serious mistakes that can be made when writing a document :

- Incorrect information about the principal or attorney (for example, name of organization, addresses, etc.).

- Vague information that does not allow one to clearly distinguish the circle of persons indicated in the document from others.

- The powers transferred to another legal entity are presented in one general phrase.

- Lack of notarization for transactions subject to certification in accordance with the Civil Code of the Russian Federation.

- Does not contain the signature of the general director, as well as the seal of the organization (if the power of attorney is issued by a legal entity).

The use of a facsimile signature is unacceptable. - Lack of date when the document was drawn up (in this case it is not valid). Thus, drawing up a power of attorney to transfer part of the powers from one organization to another is not particularly difficult.

The most important thing is to adhere to the basic rules of writing and not to deviate from the requirements established by civil law.