Home / Articles / Tax deduction for mortgage insurance

10.02.2020

Tax deduction is an amount that reduces the tax base. In essence, this is compensation for expenses of certain categories of citizens:

- Taxpayers - officially employed persons (citizens of the Russian Federation) paying income tax (13% under Article 207 of the Tax Code of the Russian Federation);

- Non-working pensioners.

Return personal income tax under Art. 219 of the Tax Code of the Russian Federation is possible with costs for:

- Education - own, close relatives;

- Treatment - own, spouse, minor children under 18 years of age (including adopted children, wards), parents;

- Charity - monetary assistance to charitable, non-profit, religious organizations;

- For funded pension provision, additional pension insurance, transfer of money to any non-state pension fund;

- Buying/selling real estate.

Tax benefits are of a declarative nature - to receive them, citizens must submit an application and documents confirming the right to deduct from personal income tax to the employer or the Federal Tax Service.

Refunds of personal income tax from the budget are carried out only in non-cash form.

Is it possible to get a tax deduction for life insurance on a mortgage?

Refunds within the framework of the tax deduction are carried out upon fulfillment of a number of requirements, including:

- the duration of the borrower’s contract with the insurance company is 5 years or more;

- insurance is issued by a company that has a valid license;

- the cost of the policy is paid by the borrower from his own funds;

- the borrower must be a Russian tax resident and pay personal income tax;

- expenses incurred under the insurance contract are documented;

- The beneficiary of the insurance is the borrower himself or his relatives.

An important feature of providing a tax deduction for a mortgage on an apartment is the ability to return funds only for life insurance. Other risks are not taken into account.

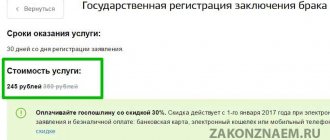

Amount of tax deduction and refund

The tax deduction for life insurance when taking out a mortgage refers to social tax deductions for which there is a certain deduction limit. It is equal to 120,000 rubles. in year. This means that you can return no more than 15,600 rubles under insurance. per year if you paid more than 120,000 rubles for it. If your costs amounted to a smaller amount, then you will return 13% of the cost of insurance.

But please note that the specified limit is 120,000 rubles. applies to all social deductions (with the exception of expensive treatment, charity and education of children). That is, for example, if in one year you paid for dental treatment, online courses for yourself and additionally bought insurance, then you need to add up all these expenses and only then compare them with the limit in order to understand how much refund you can expect .

What you need to do to get a personal income tax refund

The standard procedure for returning personal income tax is as follows:

- collection of documents, the list of which is given below;

- filling out a declaration with the tax authority (standard form 3-NDFL) and a statement of desire to receive a tax deduction;

- provision of the two specified documents to the Federal Tax Service in person or by mail;

- receiving notification from the tax office about the results of consideration of the application.

The legislation establishes a maximum period for providing a response to the applicant of 30 days. If a positive decision is made, the funds are transferred to the mortgage borrower according to the details specified in the application.

Tax refund conditions

You can receive a tax deduction if your insurance meets certain conditions. It is necessary to conclude a long-term contract, at least 5 years. You can take out insurance for the following persons:

- for yourself, that is, for a client who insures his life and pays his own money for it;

- for a spouse;

- for parents (adoptive parents are also considered parents);

- for relatives, adopted children or minors who are under your care.

Having purchased a suitable policy, you can apply for a deduction.

It must be remembered that any type of deduction is allowed to be issued only for the last 3 years. The law prohibits refunds for a policy issued in 2015 if it is 2021. Until the first of January, you can only submit an application for 2018–2020.

What documents are needed for mortgage insurance?

To receive a tax deduction for mortgage insurance, you must provide the following set of documents to the Federal Tax Service:

- borrower's passport;

- completed declaration 3-NDFL;

- a certificate from the place of official employment about the amount of the applicant’s salary (according to Form 2 of the personal income tax);

- bank details of the account where the deduction funds must be transferred;

- documents confirming payment of insurance premiums;

- an insurance contract when obtaining a mortgage, which serves as the basis for a tax deduction;

- license of the insurance company with which the borrower entered into an agreement.

Who can get a mortgage interest deduction?

Let's look at an example. Masha had long wanted to increase her living space, but there was no money for a large purchase, so she took out a targeted loan from the bank. Her parents told her about the possibility of making a refund for the overpayment. Masha is not averse to receiving benefits from the state. To understand whether she can get it, let's go through the main points.

- Is Masha a Russian citizen? Yes.

- Does Masha have “white” income, from which she gives 13% to the state? Yes.

Great! These conditions are enough for Masha to make a return.

Masha’s friend can also receive a deduction - she came from London, but has been continuously working in Russia for six months and paying taxes to the Russian treasury. She took out a mortgage from a bank and bought a building plot in Ryazan.

And Masha’s friends, the married couple Vika and Kostya, borrowed money from the bank and bought a house. We registered it for Mark’s minor son – they will also be able to receive an overpayment on the loan.

Time of circulation

You can contact the tax authority to apply for a property tax deduction at any time after the end of the tax period in which you have the right to deduct. That is, if you bought an apartment this year, you can contact the tax office at the beginning of next year.

A representative of the tax authority has the right to review the submitted package of documents within three months from the date of application. If approved, the money will be transferred to your bank account within one month.

Tips Compare.ru:

1. Declaration on the program. Filling out form 3-NDFL can cause a number of difficulties, which can be avoided using the electronic program available on the website of the Federal Tax Service. Download the latest version, install it, fill out according to the instructions and print the resulting document. This way you will significantly save your time.

2. Pay off your debt. A tax deduction can be provided to citizens who have no debts to the state. Therefore, before claiming a bonus, pay off your existing debts.

3. Arrive early. Do not wait until April to visit the tax office - long queues may await you at this time. It is best to come in January or February - the inspection staff are less busy during these months.

Amount that can be received as a deduction

- The deduction is provided in the amount of insurance premiums paid, but not more than 120 thousand rubles in total for all groups of social expenses.

- 13% (personal income tax rate) of the provided tax deduction is returned.

- The amount of the refund will not be changed if, in addition to insurance costs, there are also social expenses that provide for a tax deduction, and the amount of these expenses exceeds 120 thousand rubles.

- Regardless of the year the contract was concluded, the policyholder can claim a deduction in the amount of insurance premiums paid starting from 2015.

- If a tax deduction was accrued and received, and the payer terminated the insurance contract earlier than the stipulated period, the returned part of the tax must be withheld by the insurer or paid by the policyholder independently. This rule does not apply to cases of termination of the insurance contract for reasons independent of the parties, as well as in the presence of a document stating that the policyholder did not exercise the right to receive a deduction.

FAQ

I don’t have a mortgage, but I have life insurance - can I return personal income tax?

Yes, this possibility is provided for by law. To receive the deduction, you must meet the requirements listed above that are not related to mortgage lending. For example, the duration of the contract with the insurance company is 5 years or longer.

What documents do you need to collect when applying for a mortgage in order to receive a personal income tax refund?

To receive a personal income tax refund from the budget as part of life insurance, when applying for a mortgage, you must provide a standard set of documents for any tax deduction. It includes:

- application for a tax deduction;

- declaration filled out in form 3-NDFL;

- documents confirming the cost of the life insurance policy and payment of the insurance premium;

- a life insurance agreement for the mortgage borrower for a duration of 5 years (with a complex agreement, it is mandatory to allocate life insurance costs in a separate line);

- SK license.

Conditions for receiving a deduction

A tax deduction can only be received by a person who is a tax resident of the Russian Federation , who has taxable income and pays personal income tax on it at a rate of 13%.

Since 2021, amendments to the Tax Code have been in force, which have adjusted the list of income, by paying tax on which you can receive a deduction. Now the calculation includes:

- official salary (when executed under employment and civil law contracts);

- income in case of selling property or renting it out;

- money received from the provision of various services;

- some other income.

If you plan to receive a deduction for previous periods (years), then you can include in the calculation any income taxed at a rate of 13% (except for dividends).

If the above conditions are met, you can apply for a deduction for paid insurance if:

- the insurance contract is concluded for 5 years or more;

- The beneficiary of this agreement is you (or your close relatives), and not the bank.

Is there a statute of limitations for obtaining assistance?

It takes three years to issue a tax deduction, so citizens who want to receive a 13% tax deduction for life insurance have the opportunity to resolve this issue a year or two after issuing a life insurance contract. For example, people who made a payment on an insurance policy in 2021 may receive government assistance in 2021.

In the absence of legislative restrictions, a citizen has the opportunity to receive annual tax compensation for personal income tax when taking out life insurance throughout the validity of the insurance contract.

For clarification, advisory support and practical assistance on this issue, it is better to seek help from specialists who know all the subtleties and nuances and will save your time and money. Proper execution and timely submission of documents to the tax authorities will help you receive compensation faster!

If you are just planning to take out a mortgage, we recommend that you familiarize yourself with the most profitable life insurance options for a mortgage on our website. Prosto.Insure specialists will tell you which insurance is best to choose and how to apply for a guaranteed tax deduction.

What is a mortgage interest rebate?

The purchase of real estate entails the opportunity to apply the so-called “property deduction”. You can get a tax refund for buying an apartment in 2021 with a mortgage only for one transaction; to put it simply, such a right is given to a citizen once in a lifetime. If payment was made for a new apartment of one hundred thousand rubles, thirteen thousand will be returned as a deduction. Here we must take into account that there is a limit of 2 million rubles for calculating such a deduction. Even if the cost of housing exceeds this amount, the amount of the deduction is calculated based on two million rubles.

Loan “State support for families with children” SberBank, Individuals. No. 1481

from 0.1%

per annum

up to 12 million

up to 30 years old

Get a loan

If a mortgage loan was used to pay for housing, then a deduction can also be made for the interest paid (the maximum amount is three million rubles). Confirmation of the intended use of funds must be contained in the agreement concluded by the parties. According to the law, only those who purchase housing on the territory of the Russian Federation are given the right to deduct.

Thus, the benefit in question consists of two components. Typically, the order of their application is as follows: first of all, the tax is compensated for the cost of the purchased home, then for the mortgage interest paid to the bank.

Receipt procedure

There are two ways to get your property tax refunded:

- Through the employer this year. Income tax is not returned separately, but is included in subsequent salary payments.

- Through the Federal Tax Service next year or later. 13% of the property tax is returned to the person in the total amount for a year or several years.

Through the employer

The interest deduction can be partially transferred to your account every month: the Federal Tax Service stops withholding personal income tax, and the salary increases by this amount.

To receive a refund from the employer and avoid remitting income tax in the current year, you must request a notification from the Federal Tax Service Inspectorate confirming the possibility of receiving a deduction.

Applying for a mortgage interest deduction through your employer is not entirely convenient. Periodically, you need to request confirmation from the lender and again take a notification from the tax office.

Attention!

If you apply for a refund at the end of the year - for example, in September, the Federal Tax Service will refund the tax from the beginning of the year. 3-NDFL is not submitted when returning through the employer; an application is sufficient, which is considered within 30 days.

Through the Federal Tax Service

The tax refund procedure includes: collection and submission of documentation, inspection by the Federal Tax Service and transfer of funds. Each specific case has its own characteristics, and therefore it is advisable to clarify the exact requirements for filing a deduction.

Attention!

Copies of documents intended for submission to the tax service must be notarized.

You can submit documents in one of the following ways:

- Personally. If, when checking the certificates, the inspector reveals inconsistencies or shortages of any of the documents, you will know about it immediately on the spot.

- By post. Referring to paragraph 4 of Art. 80 of the Tax Code of the Russian Federation, documentation must be sent by valuable correspondence with an inventory of investments. The prepared documents are placed in an envelope (without sealing) and a postal inventory is drawn up in two copies. It lists all sent documents. The Federal Tax Service has 3 months to check the received documents, and another 1 month is provided for transferring the tax amount.

Important!

If the Federal Tax Service discovers an incomplete package of documents or errors in filling out, you will find out about this only after 2-3 months, when the desk audit is completed.

Documents - what do you need to collect?

As always, to process the payment you need to collect a certain package of papers that will confirm your right to receive the money. The list of documents is not fixed by the Tax Code, so it may change. We recommend requesting a complete list from your employer or viewing it on the tax website. You can also contact our experts. Below is the current set of required papers.

What documents will you need for a tax deduction for life insurance:

- 3-NDFL - original tax return;

- a certified copy of the passport, along with the page indicating registration;

- 2-NDFL - original certificate, which can be requested from the employer;

- tax refund application. Don't forget to provide the correct details for transferring funds;

- agreement with the insurance company - a certified copy;

- insurer's license - a certified copy (may not be provided if the contract contains its details);

- receipts, payment orders, bank statements confirming the transfer of the premium to the insurer - certified copies. They can be replaced with a certificate of payment of premiums from the company where you took out insurance.

When applying for a deduction for a child, spouse, or parents, a document is required that confirms the relationship. This is a birth certificate (yours or your children’s) and marriage certificate.

Advice. It is not necessary to notarize documents. You can do this yourself. To do this, on each page you need to write “Copy is correct”, put your signature, its transcript and the current date.

Size: what is it and what does the amount depend on?

Before you figure out how to get a tax deduction for life insurance, you need to understand whether you can get it at all. It belongs to the group of social deductions that are provided for expenses on education, charity, treatment, and undergoing an independent assessment of one’s qualifications. If you've already claimed one of these deductions, you may have exceeded the maximum amount available.

The most you can get using social deductions is 13% of 120,000 rubles. That is, it will not be possible to return more than 15,600 rubles per year. However, there are exceptions for expenses on charity, expensive medical services and children's education.

Do not forget that you can only make a refund within the limits of the personal income tax that you transferred to the tax office for this year. For example, if you paid personal income tax on an annual income of 50 thousand, you can return no more than 6,500 rubles. It is prohibited to transfer the lost balance to other years, unlike a property deduction.

Another subtlety: only such risks as death for any reason and survival to a certain age are accepted for deduction. Having concluded an agreement on compensation for risks associated with accidents, it will not be possible to return part of the money.

What if you already have combined insurance? You can request a certificate stating what amounts were paid for each type of insurance from the company where the document was issued. This certificate is then attached to the standard tax application.

No deduction available

There are situations in which you cannot use a property tax refund:

- The property was purchased from related parties. The deduction is not provided if housing was purchased from relatives or an employer. These categories of people are stakeholders.

- The person received the available deduction limit. You can return the money 1 time if the apartment was purchased before 2014. After 2014, adjustments were made; if the amount of the deduction received is less than the maximum limit, then the remaining funds can be received by purchasing another property.