Encumbrances are restrictions that the buyer receives along with the home when purchasing it with a mortgage. A person can use real estate, but not manage it in full. Certain difficulties may arise when selling an apartment, renting it out or, for example, donating it. Once the borrower repays the loan amount, the encumbrance will be removed. Let's find out how this happens and what needs to be done.

What is a mortgage encumbrance and why remove it?

A mortgage encumbrance is understood as a restriction on the ownership rights of the owner of a home or other real estate purchased with borrowed funds from the bank. In most cases, it consists of registering a house or apartment as collateral, which means that the owner cannot sell or donate the said property without the consent of the bank. The purpose of such an event is obvious and is to reduce the risks of issuing a mortgage loan for a financial institution.

The encumbrance in the form of mortgage collateral is usually removed only after full repayment of the loan obligations.

Moreover, this is usually done by the borrower himself, which is quite logical, since it is he who is interested in the complete and fastest possible transfer of full control over the property to him from the bank.

How to remove the encumbrance?

The need to remove the encumbrance after paying off the debt to the bank is obvious - this is required so that the owner has the opportunity to use the property purchased on credit at his own discretion

. Today, there are several options for implementing the event in question.

What will you need?

The first and mandatory condition for removing the encumbrance or removing the property from collateral is the full fulfillment of the borrower’s obligations to the bank. Only after paying off the mortgage debt does it make sense to start collecting documents for submission to any of the two possible registration authorities - Rosreestr or MFC. The first option is traditional, and the second has become available starting in 2017.

It is he who provides a simpler and faster procedure for registering the removal of mortgage encumbrance from an apartment or private house.

Required documents

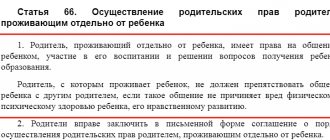

To withdraw real estate from collateral, its owner is required to provide one of the following documents:

- a statement in the established form about the need to remove the encumbrance. Typically, the document is signed both by an authorized representative of the bank and directly by the borrower;

- application from a credit institution that is the owner of a mortgage on property purchased with a mortgage. This document is drawn up if the initiator of the removal of the encumbrance is a banking institution;

- a statement from the borrower, which is supplemented by a mortgage note with a bank note indicating full payment of the debt on the mortgage loan. This form of application is submitted if the procedure for removing the property from the mortgage is carried out by its current owner;

- a court decision to terminate the borrower's obligations under a mortgage loan. Taken into account if, for some reason, legal proceedings were initiated on issues related to the credit mortgage.

In addition to the application drawn up according to one of the 4 options described above

, to remove the encumbrance from an apartment or house you must provide:

- identification document of the borrower, namely a Russian passport;

- a copy of the mortgage loan agreement;

- documents confirming the legality of ownership of the property being pledged;

- a certificate from a credit institution confirming the repayment of obligations under a previously taken out mortgage loan.

In some cases, it is necessary to provide any additional documents, as this may be related to the requirements of the local branch of Rosreestr. The easiest way to find out the exact list of required documentation is to consult with the credit or legal specialists of the bank that issued the mortgage loan.

These employees, as a rule, are well aware of the requirements imposed by a specific regional division of Rosreestr.

How to initiate the procedure yourself?

The action to remove the mortgage encumbrance placed on an apartment or other type of real estate is initiated either by the bank or by the borrower himself. The second option is most common in practice, since it is the homeowner who is most interested in getting the apartment or house out of collateral.

To start the procedure, it is enough to collect the above list of documentation. Moreover, the main document is a certificate from the bank confirming full repayment of mortgage debts or a mark made by a responsible employee of the financial institution on the collateral documents indicating that the borrower has no outstanding obligations under the mortgage. After this, an application in the prescribed form is drawn up, and then the documents are submitted to the MFC or the territorial division of the Registration Chamber, as Rosreestr is often called.

Step-by-step instruction

The procedure for releasing an apartment or other residential property from collateral involves the following actions performed by borrowers:

- Applying to a financial institution for a document confirming full fulfillment of loan obligations. This can be either a certificate of absence of debt or a note on the mortgage.

- Preparation of a package of documentation required for presentation to Rosreestr or MFC.

- Filling out an application for the need to remove the encumbrance and submitting it along with the rest of the documentation to Rosreestr or the MFC.

- Submitting an application to receive a “clean” extract from the Unified State Register of Real Estate. The presence of this document confirms the rights of the new owner to dispose of the housing at his own discretion.

Possible reasons for refusal

It also happens that instead of the long-awaited notification of the removal of the encumbrance, a refusal comes. The reasons for this may lie in the following:

- Incomplete set of documents.

- Not all owners provided the necessary documents.

- There was a technical glitch and the borrower still owes on the mortgage.

- The application can only be submitted by the owner in person. If this is not possible, it is necessary to issue a notarized power of attorney to another person.

- Errors in documents, including spelling errors. Check everything carefully before shipping.

pixabay.com/

Removing a mortgage encumbrance is not as complicated a procedure as it might seem at first glance. Experts recommend that after making the last payment, for your own peace of mind, take an extract from the Unified State Register from the MFC to once again make sure that the property is now at your complete disposal.

Features of relieving encumbrances

In practice, several types of mortgage agreements are used. Some of them have characteristic nuances

related to the removal of encumbrances from housing purchased with a mortgage.

With a military mortgage

In a situation where housing was purchased under the military mortgage program, one of the parties to the transaction is Rosvoenipoteka. That is why, when carrying out measures to remove the encumbrance from a house, townhouse or apartment, it is necessary to submit a corresponding application.

It is usually sent to the regional division of Rosreestr by mail.

In shared construction

If the mortgage loan was issued for the purchase of housing under an equity participation agreement, the following is attached to the documentation package:

- a statement signed by an authorized representative of the developer;

- an act confirming the commissioning of a residential building;

- an act confirming the fact of transfer of the apartment to the final owner.

As a rule, in such a situation, the developer himself is involved in the procedure in question.

Where should the assembled package be submitted?

Citizens can submit an application and all necessary documents to remove the encumbrance on their mortgaged property using 3 different options:

- The most reliable way is to contact the Federal Service for State Registration, Cadastre and Cartography (Rosreestr) directly. However, this option may not be convenient for many citizens due to the limited number of territorial branches of this body.

- The second popular option for submitting documents is to contact the Multifunctional Center. Currently, this method is the most relevant, since citizens can contact any nearest branch of the MFC to submit papers.

- The third way to submit an application is to use the Government Services portal.

When submitting an application through the State Services website, the borrower will still have to appear in person at the government agency to receive a new extract from the Unified State Register.

How to remove an encumbrance in Sberbank?

The procedure for releasing housing from collateral, developed and actively used in practice by Sberbank, is standard. In most cases, the client is given the right to choose the option for carrying out this activity: independently or under the direct supervision of bank specialists.

Usually the second option is chosen, which provides for the personal presence at the office of the MFC or Rosreestr of both the borrower and representatives of Sberbank. It is important to note that the necessary documents are always prepared at the central office located in the city of residence of the borrower, regardless of the specific department that issued the mortgage loan.

Differences in the list of papers when submitted through the MFC, Rosreestr and State Services

The package of documents required to remove the encumbrance is no different, regardless of the method of submission - through the MFC, Rosreestr or the State Services portal. However, when submitting papers through the State Services website, certain nuances may arise.

So, when submitting an application through the State Services portal, a citizen must register in advance and confirm his account at the MFC branch, otherwise he will not be able to submit documents. also fill out an electronic application on the State Services website.

In other words, the borrower needs to enter all the necessary information on the application in the fields specially designated on the website, and there is no need to attach a scan of the paper application. All other points remain the same.

How to remove an encumbrance at VTB?

Withdrawal from the collateral of housing purchased with a mortgage from VTB Bank occurs as follows. The first step after the last loan payment is to arrange a meeting with bank specialists. After this, the client either, within 10 days, receives a mortgage with a note from the bank about the fulfillment of its obligations and then proceeds with the event independently, or, together with the responsible employee of the credit institution, prepares the required documents and submits a general application to the MFC or the regional division of Rosreestr.

What to do with an electronic mortgage?

Since 2021, electronic mortgages have appeared in Russia.

One of the goals of introducing electronic mortgages is to eliminate the possibility of their loss. “An electronic mortgage equally ensures the fulfillment of the borrower’s obligations to the creditor bank, just like a documentary mortgage. But the form of the security itself - uncertificated - practically eliminates the risk of loss, which always exists in the presence of documentary circulation,” notes Tatyana Manakova, head of the legal department of the Padva and Epshtein law office. The electronic mortgage is signed with an electronic digital signature and transferred by Rosreestr for storage to the depository. Information about it is reflected in the Unified Register of Real Estate Rights.

There is no need to apply for cancellation of an electronic mortgage anywhere, says managing partner of the legal entity Artem Denisov. The termination of a mortgage is carried out by Rosreestr on the basis of a joint application from the bank and the owner with the provision of an account statement.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Deadlines for removing the encumbrance

The total duration of the procedure consists of two parts. The first is the preparation of documents, which is carried out by the bank and the borrower. It usually takes 1-2 weeks.

Deadlines of Rosreestr and MFC

The second part provides for the time required to check and issue the final result by specialists from the MFC or Rosreestr. This usually happens within 3 business days. In some cases, if the workload is heavy, the procedure may take a little longer, up to 5 days, of which clients are warned in advance. If it is necessary to obtain a certificate of ownership or an extract from the Unified State Register, the duration of the event is increased by the deadlines established in the regional divisions of the MFC and the Registration Chamber.

Insurance return

If the insured event does not occur, the borrower can return the insurance payments. However, it is worth remembering that this is only possible with a one-time payment for the insurance policy and early repayment of the loan. If there are no claims from the insurer, the contract is subject to termination and the borrower is returned the amount for the unused period of insurance. Insurance companies may refuse to return funds, so the client will have to go to court to protect their rights.

Find out more about the features of full or early repayment of a mortgage and get useful recommendations from experts on the official website of Rosbank Dom.

Controversial situations and possible problems

Mortgage lending is deservedly one of the most long-term and complex financial transactions. Therefore, often upon completion of cooperation between the client and the bank, which is expressed in the removal of encumbrances on housing, controversial or conflict situations arise. For example, if there are financial problems in a credit institution, the procedure can be very seriously delayed. In this case, it is advisable for the borrower to obtain all the necessary documents from the bank and then deal with the issue independently.

Final payment and certificate of no debt

Before making the final loan payment, you must request information about the amount of remaining debt from a bank employee. To do this, you can visit a bank office or call. It is believed that a more reliable option is to send an application for an extract, which will indicate the following data:

- Full name of the borrower;

- information about the status of the mortgage account;

- mortgage agreement number and closing date;

- Full name and position of the specialist who signed the certificate.

The statement must indicate that the credit institution has no claims against the client. You can receive a certificate within two weeks. An official document will protect the borrower and help prove the case in case of controversial situations.