Requirements for a will

Civil legislation provides for the opportunity for the owner to independently dispose of his property in the event of death, by drawing up a will. Ch. 62 of the Civil Code of the Russian Federation is entirely devoted to the rules for drawing up a document and its features. With its help, a citizen can distribute objects that belong to him by right of ownership between any individuals and legal entities at his own discretion.

Possibilities of a will:

- choose any citizens, legal entities or state as legal successors;

- deprive legal heirs of a share in property;

- establish a testamentary refusal or assignment (actions that the heirs must perform to receive property);

- oblige the notary to create an inheritance fund;

- distribute your property among legal successors;

- dispose of property that has not yet been acquired.

The only restriction for the testator is the right to an obligatory share. This is the legal right of the deceased's dependents to a share in property equal to ½ of the share that is required by law. In this way, the rights of disabled or retired parents, spouses and children, as well as minor children, are protected.

One of the important requirements for a will is its written form. Also, the document must be certified in the manner prescribed by law. As a rule, this is a notarized certificate.

However, a citizen does not always have the opportunity to visit a notary office. And in some localities such a service is not available at all.

In such a case, the law provides for alternative methods of identification.

Who can be a testator

Since the execution of a will is a one-sided transaction, it can only be completed by:

- legal owners of the transferred objects;

- sane and adequately thinking citizens whose legal capacity is not called into question;

- persons over 18 years of age;

- minors who have received the consent/approval of their legal representatives.

If we are talking about the category of incapacitated people, then in order to dispose of their own property they are required to obtain permission from the trustees.

Is a will valid if it is not certified by a notary?

A will drawn up in simple written form without the participation of a notary is considered invalid.

In the event of the death of a citizen, such a document will not affect the procedure for dividing property. However, the law provides for options for registering a declaration of will without the participation of a notary.

The only exception is a joint will between spouses. It cannot be certified by alternative means.

Important! Regardless of the method of authentication of the document, the rights of compulsory heirs must be protected. Otherwise, it may be challenged in court.

Certification by authorized persons

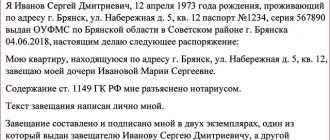

Art. 1127 of the Civil Code of the Russian Federation provides for the possibility of alternative execution of a will.

If the owner cannot visit the notary’s office, then the right to have the will certified is vested in:

- on a ship - a sea captain;

- in places of deprivation of liberty - the head of the correctional institution;

- on expeditions, at Antarctic, exploration and Arctic bases - the expedition leader;

- in places of deployment of military units - the commander of this unit.

If there is no notary office in the locality, then the powers of the notary are vested in:

- to the head of a local government body;

- for a local government specialist (by decision of the head).

The person who certified the expression of will must, within a reasonable time, send the document to the notary office at the place of registration of the applicant.

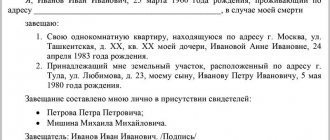

Emergency document

The law allows a citizen who finds himself in a special situation to draw up a will without the participation of a notary and persons replacing him (Article 1129 of the Civil Code of the Russian Federation).

This possibility is provided for situations where the owner was in danger or believed that he was in a life-threatening situation.

Requirements for a declaration of will issued in an emergency situation:

- simple written form;

- signature of 2 witnesses who were present at the time of compilation;

- The document is valid for 30 days from the date of expiration of the grounds (after which it must be certified by a notary).

The text must have language that directly indicates the will of the testator. Ambiguous interpretations are not allowed.

For example, the expression of will cannot provide for the transfer of rights to all the property of a daughter if the owner has 2 or more daughters.

The peculiarity of such a will is that it is not automatically given force. Like other documents signed by authorized persons.

The heir must go to court and confirm the fact of the emergency situation in which the form was drawn up.

Important! This option is not suitable for a joint will of spouses and an inheritance agreement.

How to make a will for an inheritance in secret from everyone

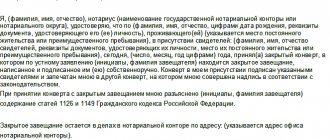

The law allows you to write a will completely alone and not show its contents to anyone, including a notary. For this purpose, there is a special type of document - a closed will, which is drawn up in a special way:

- The will must be written by hand, signed and sealed in an envelope.

- Hand over the sealed envelope with the will to the notary with two witnesses. At the time of transfer, witnesses sign on this envelope.

- The notary seals the received envelope with the will into another envelope, on which he makes certifying inscriptions. In addition, the full passport details of the witnesses, including their place of residence, are recorded on the outer envelope.

- The testator is given a certificate of acceptance of the closed will. A copy of the will itself is not made, since the envelope cannot be opened until the death of the testator.

In addition, the law also protects an ordinary will from disclosure: all persons familiar with its contents must remain silent. If the secrecy of expressing a person’s last will is violated, then it is possible to recover compensation for moral damage from the perpetrator through the court or apply other measures to protect civil rights.

Restoring the deadline

The term can be restored both in court and out of court. In the first case, you will have to prove that the deadlines were missed for a good reason. It could be:

- ignorance of the death of the testator, provided that the heir really could not establish the fact of the opening of the inheritance;

- serious illness that precludes applying for inheritance personally or through proxies;

- long-distance business trip, participation in a field expedition, etc.

The main thing is that the court considers the reason valid. For example, ignorance of the legislation on the deadline for accepting an inheritance will not be considered a basis for reinstating the deadline. But a rare personal connection can be regarded as a valid reason for late application for an inheritance.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

An alternative to judicial restoration of the period for accepting an inheritance is conciliation. To do this, the heir receives written consent from other heirs who accepted the inheritance in a timely manner. He can explain to other heirs why the deadline was missed and whether the reason is really valid. The notary will simply formalize the inheritance according to the will, if the other heirs have expressed their written consent to this.

Documents required to open an inheritance case

The heirs have 6 months from the date of death of the testator to open an inheritance case and enter into inheritance.

It is important to know!

If a person is declared dead on the basis of a court decision, then the period begins to run from the day the decision enters into legal force. If the court sets the date of death, then the period is calculated from this date.

Documents for a notary:

1. Application for acceptance of inheritance;

2. Death certificate;

3. Documents confirming family relationships;

4. Copy of passport;

5. Certificate of the last place of residence of the deceased;

6. If a car is to be inherited, an appraisal at the time of death is required;

7. Will;

8. Documents establishing the right to inherited property;

9. Extract from the Unified State Register of Real Estate, if the property is real estate;

10. Certificate of cadastral value of real estate;

11. Documents STS or PTS, if the property is movable;

12. Documents on the valuation of movable property.

Conducting an assessment of the inherited property is a mandatory step, since the state duty is based on the price of the property. There are two types of property valuation:

1. Cadastral

This certificate can be obtained through the MFC or ordered on the Rosreestr website;

2. Market

Property valuation is carried out by an appraisal company, which provides an opinion on the market price of the property. The appraisal organization must have a license to carry out appraisal activities.

You can find out about the price of notary services on the website of the Federal Tax Chamber:

https://notariat.ru/ru-ru/actions-and-tariffs/tarify-na-uslugi-pravovogo-i-tehnicheskogo-haraktera/

Registration fee

When making such transactions, there is no state duty. All you have to pay is the services of the notary receiving you. But here everything depends on the tariffs and prices of a particular specialist.

Change and cancellation

The testator has the right to make adjustments to his own application or cancel it completely. This is done as follows:

- a separate order is drawn up to cancel the entire document or some specific points;

- a new act is registered, which automatically cancels the previous one.

You can change the paper an unlimited number of times. The consent of the people mentioned in it is not required.

Inheritance by law

This type of inheritance is used if the testator did not leave a will after his death. According to the Civil Code of the Russian Federation, there are seven lines of inheritance by law.

First of all

- The spouse with whom the marriage was officially concluded; parents; children, as well as adopted children (if the adoption certificate was not canceled in court before the child reaches 18 years of age).

- Also, the surviving spouse has the right to allocate a marital share from the inherited property, which is equal to 1/2 of the jointly acquired property. To do this, you need to contact a notary so that the obligatory marital share of property is allocated. But this does not deprive the spouse of the right to receive his share of inheritance by law.

- Grandchildren inherit the share of their parents who predeceased their grandparent.

Second stage

- Grandparents, if they are listed in the parent's documents. Also, grandparents inherit if parents are deprived of parental rights.

- Brothers and sisters, half- and half-brothers, must be officially recognized.

- Nephews and nephews inherit the share of their parents if they died before the testator.

Third stage

- Aunt and uncle who are relatives of the testator;

- Cousins inherit by right of death, sharing the share of the deceased parent.

Fourth stage

- Great-grandmother and great-grandfather.

Fifth stage

- Children of nephews and nieces;

- Siblings and half-siblings of grandparents.

Sixth stage

- Great-great-grandchildren and great-grandchildren;

- Cousins and uncles;

- Cousins and nieces.

Seventh stage

- Stepmother or stepfather, if they raised the child for more than 5 years and should not be prosecuted for causing harm to the child.

- Stepdaughter or stepson, if they have lived in the same family for more than 5 years.