How does cancellation work?

The gift agreement can be canceled and terminated (according to Articles 577 and 578 of the Civil Code of the Russian Federation).

A deed of gift for an apartment can be revoked in court if there were violations of current legislation during its conclusion. An agreement may be invalid due to illegal content, an unspecified form, the inability of the donor for various reasons to enter into such transactions, or inconsistency with the will of the donor.

A contract can only be challenged in court, and its nullity is recognized by virtue of a direct indication of this in the law.

The possibility of canceling a deed of gift protects the rights of the donor . That is, the gift agreement has retroactive force, but this requires compelling reasons. You cannot simply cancel a gift agreement at will.

Is withdrawal allowed after state registration?

A deed of gift after state registration of property rights can be canceled in court if the fact of an attempt on the life of the donor (members of his family) or harm to health is proven.

The donor may revoke the agreement after registering the rights to the apartment and if he proves that the recipient of the gift poses a threat of destruction of the property.

It is possible to revoke a contract without the participation of a court if the recipient of the gift died before the donor, and if two conditions were met:

- this nuance was stated in the clause in the agreement;

- Until the moment of death, the recipient of the gift was the owner of the apartment (that is, the gift was not transferred or sold).

Features of a gift as a type of civil transaction

When concluding a gift transaction, the donor must take into account the peculiarities of such a civil legal relationship.

The main features of the deed of gift under which housing is donated are as follows:

- The law limits the period after which the agreement can be canceled. As a general rule, a deed of gift can be contested within three years from the date of preparation. In this case, the contesting parties must present evidence that confirms the illegitimacy of the transaction.

- If the power of attorney is drawn up by a representative of the home owner, then his powers must be certified by any notary in the manner prescribed by law. Otherwise, the transaction is considered illegal.

- The deed of gift is always drawn up in writing in two copies, each of which must be signed by the donor. One of them is transferred to the donee, and the other remains with the donor. When they are received, both parties will be able to certify the fact of the donation in the event of disputes.

- In cases where the donor or recipient is a child under 18 years of age or a person who does not have legal capacity, then the consent of the guardianship authority, as well as the appointed guardian, is required to make the gift.

- In cases where the object of the donation is housing, which, in addition to the donor, also belongs to other persons, the consent of these persons is required. If the donor is an individual owner, then the consent of third parties is not required to transfer.

Thus, the validity of a repeated donation of housing depends not only on the legitimacy of the rights of the donor, but also on the existence of the rights of other persons, the status of the parties to the transaction, and so on. Failure to comply with one of these conditions entails the invalidity of the transaction.

In addition, it is necessary to take into account the possibility of the previous owner returning the property when it cannot be transferred.

For this reason, it is better to entrust the drafting of a transaction to professionals who are well versed in the nuances of the transaction and legal norms. Security of the transaction is the main condition for any party in civil legal relations.

In a person's life, circumstances can turn out completely differently. For example, having received such a valuable gift as an apartment, sometimes there is a need to return it to the giver.

There may not be many reasons for this, but the awareness of the need to return the apartment appears in most cases after all the necessary papers have already been signed and have legal force.

But there is still an opportunity to return the apartment; it all depends on the specifics of the transaction and its nuances.

The simplest scenario would be when the recipient voluntarily gives up the apartment. If he refuses to return the gift, then the apartment can only be returned with the help of the court. And this will be quite difficult, since the court will only consider the most serious reasons, and with all the necessary evidence.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Deadlines for revoking deed of gift

Under voidable contracts, which include donation, in accordance with Art. 181 of the Civil Code of the Russian Federation, the limitation period for recognition of invalidity is one year (from the date of cessation of the threat or violence).

If a gift agreement is recognized as void, the limitation period is three years (Article 181 of the Civil Code of the Russian Federation).

When the statute of limitations for challenging a deed of gift begins to count depends on who files the lawsuit.

- If the donor, under the influence of violence, entered into a donation agreement, then this transaction can be declared invalid by filing a lawsuit within a year from the date the violence ceased.

- If a third party learns of a violation of its rights, then the period for filing a claim is three years from the date of discovery of the violation.

The statute of limitations may be reinstated or suspended under certain circumstances.

Features of a gift as a type of civil transaction

The main features of the deed of gift under which housing is donated are as follows:

- The law limits the period after which the agreement can be canceled. As a general rule, a deed of gift can be contested within three years from the date of preparation. In this case, the contesting parties must present evidence that confirms the illegitimacy of the transaction.

- If the power of attorney is drawn up by a representative of the home owner, then his powers must be certified by any notary in the manner prescribed by law. Otherwise, the transaction is considered illegal.

- The deed of gift is always drawn up in writing in two copies, each of which must be signed by the donor. One of them is transferred to the donee, and the other remains with the donor. When they are received, both parties will be able to certify the fact of the donation in the event of disputes.

- In cases where the donor or recipient is a child under 18 years of age or a person who does not have legal capacity, then the consent of the guardianship authority, as well as the appointed guardian, is required to make the gift.

- In cases where the object of the donation is housing, which, in addition to the donor, also belongs to other persons, the consent of these persons is required. If the donor is an individual owner, then the consent of third parties is not required to transfer.

Who has the right to terminate the agreement?

, as well as third parties, can terminate the gift agreement

Donor

The donor can cancel the donation transaction if the donee has made an attempt on his life or the life of close relatives. Intentional infliction of bodily harm is also grounds for termination of the contract.

The second reason for canceling the deed of gift is the commission by the recipient of the gift of actions that create the threat of irretrievable loss of the apartment (Article 578 of the Civil Code of the Russian Federation).

Only the donor himself can cancel a donation for this reason. Heirs do not have such a right.

If the donee dies before the donor, the latter has the right to revoke the gift.

The donor has the right to refuse the gift agreement if the agreement was concluded for the future. According to Art. 577 of the Civil Code of the Russian Federation, the donor can make such a decision if life circumstances have changed significantly after the conclusion of the contract, and the execution of the contract will lead to a significant decrease in his standard of living.

Recipient

Legislatively, the right of the donee to refuse a gift is enshrined in Art. 573 Civil Code of the Russian Federation. The refusal can be formalized by a deed of gift to the former owner or by concluding an agreement to cancel the gift agreement.

The easiest way is to refuse the gift before or during the conclusion of the deed of gift.

If the recipient wanted to return the donated apartment, how to return it back to the donor after signing the agreement, when he does not agree? To resolve this conflict they go to court.

Third parties

Third parties include parties whose interests were infringed as a result of the transaction (this could be government agencies or other family members).

On the part of guardianship authorities or investigative authorities, a real estate donation transaction may be canceled for the following reasons:

- The gift agreement was not registered with the Federal Registration Service.

- A mandatory condition (the transaction is free of charge) has been violated.

- The agreement contains a clause on the transfer of ownership after the death of the donor. Read more about whether it is possible to challenge a deed of gift after the death of the donor and who has the right to do so here.

- The information provided in the contract contains errors.

- In the drawn up agreement there is no signature of one of the parties (donor or donee).

- A gift agreement infringes on the rights of a minor or incapacitated person.

Cancellation of a donation may occur on the basis of a claim by interested persons or relatives of the donor.

It is possible to submit a request to cancel a donation if:

- the recipient of the gift committed actions that led to the death of the donor;

- At the time of concluding the donation agreement, the donor was incapacitated.

Third parties can challenge the deed of gift only in court.

Types of contract

Is it possible to cancel a deed of gift? It is important to understand that gift agreements vary. Today the following options are distinguished:

- An agreement that transfers property to a new owner during the lifetime of the old owner. In this case, the property is transferred to ownership after signing the contract.

- A deed of gift indicating the obligation of the donor to transfer the object to the donee in the future. For example, after death.

As a rule, in practice the first types of deeds of gift are more common. After all, canceling the second version of the document will be much easier than it seems.

Revocation of the decision by the donor

Most often, the initiator of the revocation of the deed of gift is the donor. The donor can cancel his decision pre-trial or through the court.

Pre-trial

To avoid litigation, both parties to the contract should not object to the termination of the transaction. To document the decision, you will need a notary who will draw up a new document. In such situations, the recipient of the gift writes a deed of gift to the donor.

If the first gift agreement contained a clause indicating the possibility of terminating the agreement with mutual consent of the parties, then it is possible to draw up not a new gift deed, but a termination of the agreement.

In court: step-by-step instructions

If the parties do not reach an agreement, then they need to go to court. The main task of the plaintiff will be to provide evidence that the court would consider significant.

Jurisdiction

The claim must be filed in the court that has jurisdiction over the defendant. The plaintiff can choose jurisdiction independently if the defendant’s place of residence is unknown (Article 29 of the Code of Civil Procedure of the Russian Federation). A claim regarding termination of the deed of gift can be filed at the location of the apartment or at the last known place of residence of the defendant in the Russian Federation.

If the claim concerns several defendants at once, then the claim can be filed at the residential address of one of the defendants.

Documentation

To file a claim in court, you will need the following documents:

- statement;

- donor's passport;

- copy of the deed of gift;

- an extract from the register confirming the transfer of ownership to the recipient of the gift;

- evidence confirming the validity of the claim;

- bank statement confirming payment of state duty.

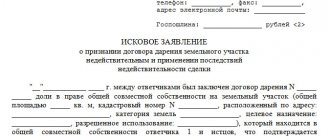

Filing a claim

When filing a claim, indicate:

- name of the court to which the appeal is sent;

- full information about the plaintiff and data about the defendant;

- the exact wording of the requirement (to invalidate the contract or terminate the agreement);

- cost of claim;

- evidence, circumstances and justification (what causes the claim);

- documents confirming these facts.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 302-76-94

Proof

In order for the court to invalidate the deed of gift, significant evidence must be presented. This can be witness testimony, certificates, medical reports, extracts, video recordings.

To recognize a gift transaction as void, you can provide a receipt for the transfer of money to the donor from the donee. Evidence may be the testimony of lawyers, notaries to whom the parties turned for help, or witnesses to the transaction.

If the transaction is disputed due to violence against the donor, then statements of a corresponding nature to the local police officer or the police, SMS messages, letters can serve as evidence.

Duration and cost of the procedure

After receiving the claim, the judge must make a decision within five days to consider the case or to refuse to consider the case.

The institution of first instance has the right to consider civil disputes within two months. The dissenting party can then appeal. Such proceedings may drag on for several months. Therefore, you need to ask whether the decision has been reversed.

The cost of legal support services starts from 10,000 rubles. State registration of a new agreement will cost the applicant 2,000 rubles, and issuing a certificate will cost 200 rubles.

If the plaintiff demands that the transaction be declared invalid, then a state fee of 300 rubles is paid. If you had to go to court to return the property, then according to Art. 333.24 of the Tax Code of the Russian Federation, you will need to pay a state duty in the amount of 13,200 rubles. plus 0.5% of the excess of 1 million rubles, but not more than 60,000 rubles. (if the value of the claim is more than 1 million rubles).

Features and nuances

Like each legal procedure, the cancellation of a gift agreement has its own characteristics. When a gift in the form of an apartment has acquired new owners - and this happens after the registration of the agreement - it is more difficult to refuse the gift also because you will need to provide the consent of the spouse, which is not always possible to obtain.

An amateur cannot know the legal subtleties due to incomplete and unsystematic knowledge of jurisprudence, so there is no need to take risks , but it is more reliable if a professional notary with experience in such cases draws up the waiver, and they are extremely rare. This type of transaction is free of charge , but entails the need to pay tax. For close people who are related by blood, this is an excellent solution : transfer ownership of housing and not pay taxes.

During the return process, the conditions remain the same; the costs include only the state duty, the cost of the service and notary expenses. It is wise to include a cost-sharing clause in the agreement. It is not easy to cancel a gift agreement, but the law is loyal precisely to the donee , who does not need to provide reasons and evidence of convincing motivation for his action.

Who is eligible?

A claim for cancellation of a deed of gift may be submitted by:

- the donor himself - if he is faced with unlawful actions of the recipient;

- heirs of the donor - if they become aware that the donation of a share of the apartment occurred in clear violation of the law (for example, the recipient of the gift put pressure on the deceased);

- guardianship authorities - in case of violation of children's rights;

- prosecutor's office;

- other persons.

Documentation

The plaintiff-applicant has to prove the illegality of the transaction.

The following documents will be required:

- statement of claim (done by hand or on a computer);

- copy of passport + original for confirmation;

- a copy of the donation agreement;

- receipt for payment of state duty (original);

- documentary and other evidence (see below).

Take into account procedural rules - documents are submitted in the form of copies (Article 132 of the Code of Civil Procedure of the Russian Federation). Be sure to take a receipt for the acceptance of the package of documents from the court office.

Evidence base

Particular importance is given to evidence of the plaintiff’s innocence. The applicant must convince the court that the deed of gift was concluded in violation of the law.

What evidence is appropriate to attach to the claim:

- medical certificates - about the state of health (physical and mental);

- results of a forensic medical examination (FME) - the plaintiff has the right to petition the court to order such an examination;

- conclusion about the bankruptcy of the donor;

- certificate from the local police officer or law enforcement agencies;

- copies of interrogation protocols, reports of delivery to a police stronghold - in case of attacks on the life and health of the donor;

- act of inspection of housing conditions from the Housing Office and BTI - violations of the rules of residence, damage to property in the apartment;

- postcards, letters, notices;

- testimony of witnesses, work colleagues, neighbors, relatives;

- electronic correspondence (mobile phone, e-mail);

- excerpts from media publications;

- other certificates and extracts.

The stronger the evidence, the higher the chances of success in canceling the deed of gift. It is advisable not to collect information alone, but to involve relatives, family members, friends, and lawyers.

Statute of limitations

The law establishes a period during which the donor has the right to protect his interests in court - this period is considered to be the statute of limitations (Article 196 of the Civil Code of the Russian Federation).

There are no special deadlines for canceling a gift agreement - general rules apply here:

- voidable transactions – 1 year from the date of establishment of the fact;

- void, invalid donation – 3 years from the date of signing the agreement between the parties.

Missing the statute of limitations does not benefit the injured party. However, the law has a clause - if the deadline for canceling the deed of gift is missed for a good reason, the donor can restore the statute of limitations and gain the right to file a claim (Article 205 of the Civil Code of the Russian Federation). Valid reasons include threats, lack of communication with the outside world, serious illness, illiteracy, etc.

Cost, expenses

Cancellation of a deed of gift for a share in an apartment relates to ordinary claim proceedings. The applicant files a claim of a property nature that is not subject to assessment - the state duty will be 300 rubles (Article 333.19 of the Tax Code of the Russian Federation).

Judicial practice knows cases when plaintiffs paid the above amount, but the judges did not accept the claim for proceedings. The response letter with an explanation contained a requirement to pay a different amount - depending on the cadastral value of the apartment share.

Can the new owner return the living space?

You can return the gift back if the recipient changes his mind for some reason about becoming the owner of the home. There can be many reasons:

- reluctance to aggravate the situation with the relatives of the generous donor;

- the apartment is donated with an encumbrance (debts, credit, there is a right of lifelong residence of other people);

- emergency condition of housing;

- doubts regarding the donor’s legal capacity;

- conflict between the donor and the recipient;

- inability to pay taxes and maintain the apartment in the future;

- Some donors deprive relatives of their inheritance this way, and recipients refuse for moral reasons.

According to Art. 573 of the Civil Code of the Russian Federation, the donee is not obliged to provide the reason for refusing the gift.

Submission of documents

extract from the Unified State Register;

certificate of number of residents;

consent of residents to cancel a previously drawn up agreement;

receipt of payment of state duty;

documents on the subject of ignition of passions - real estate, including a cadastral passport and a paper on the estimated value;

- power of attorney, if one of the parties is represented by a proxy.

- Registration Chamber of Rosreestr;

- MFC.

This is a basic list; in each specific case, there may be nuances that include the presence of additional papers .

A set of papers is submitted to one of the authorities:

Any method of providing papers is suitable: personal visit, postal mail, e-mail (if there is an electronic signature).

Of course, the fastest result will be if the personal appearance of both parties to the transaction is ensured.

Grounds and conditions for cancellation of the agreement

The legislation clearly states the reasons why the donor of an apartment can abandon his intentions. Regarding the donee who wants to return the gift, the legislation does not impose such requirements.

If before the moment of refusal of the gift the gift agreement was not registered, then it will not be difficult to refuse the gift.

The gift agreement is considered executed after registration of the donee's ownership of the real estate. According to Art. 578 of the Civil Code of the Russian Federation, in case of cancellation of the donation, the gift must be returned in the condition that was at the time of donation.

Can a creditor challenge the donation of a share of an apartment?

Entrepreneurs use donation to hide part of their property. If the transaction was completed 6 months before the declaration of bankruptcy , creditors can challenge the donation of a share in the apartment (clause 3 of Article 578 of the Civil Code of the Russian Federation). The given property of the debtor is returned back and included in the bankruptcy estate. Creditors retain the right to sell their share in the apartment at auction to offset the individual entrepreneur’s debt. It happens that the gifted relative manages to sell the entrepreneur’s property. There can be no concessions - the beneficiary is obliged to return part of the apartment or pay the cost of the sold share of housing. Creditors have the right to sue and collect the amount forcibly through bailiffs.

Sources

- https://FB.ru/article/327863/mojno-li-annulirovat-darstvennuyu-pri-kakih-usloviyah-i-kak-eto-sdelat

- https://mylawyer.club/nedvizhimost/kvartira/darenie/dokumenty-dlya-d-kv/dogovor-d-kv/rastorzhenie-d/mozhno-li-vernut-podarennuyu-kv.html

- https://sdelka.guru/darenie/annulirovat-darstvennuyu-na-dom.html

- https://law-divorce.ru/otmena-darstvennoj-na-dolyu-v-kvartire/

- https://pravo.guru/gilishnoe-pr/nedvigimost/kvartira/darenie-kvartiry/vozvrat.html

- https://ros-nasledstvo.ru/otmena-darstvennoj-na-dolyu-v-kvartire/

- https://zakon-dostupno.ru/nedvizhimost/darenie/mozhno-li-otozvat-darstvennuyu-na-dom/

- https://sdelka.guru/darenie/vernut-podarennuyu-kvartiru-obratno.html

- https://2realtor.ru/rastorzhenie-dogovora-dareniya-kvartiry/

Cancellation periods before and after registration

The donee has the legal right to refuse the gift before the transaction is completed. Regarding real estate, this is the period until the deed of gift is registered in Rosreestr. Before registering property rights, it is enough to go to the notary who certified the donation agreement and declare the need to draw up a new document. In this case, the donor’s consent is not required for refusal.

If the donee refuses the gift after registration of ownership in Rosreestr, then it is necessary to obtain the consent of the donor (preferably in writing) to cancel the transaction. When a compromise is reached, the parties enter into a new agreement, which is registered in Rosreestr.

Drawing up an agreement to terminate a gift agreement

Participants in the deed of donation can also resolve the issue of canceling the deed of gift outside the courtroom. To do this, they need to enter into an appropriate agreement. This happens, for example, due to a serious deterioration in the financial condition of the donor, as a result of which he needs the donated apartment.

In this case, the person who received the apartment must give his consent to the restitution. The agreement is drawn up in writing in free form, signed by both participants and registered with Rosreestr, since the real estate object appears in the transaction. Without state registration, reverse transfer of title will not happen.

Step-by-step return instructions

- If the return of real estate occurs before the registration of the deed of gift in Rosreestr, then the donee only needs to issue a written refusal. The application contains the donor's details and information about the apartment. Then the refusal is certified by a notary.

- If the deed of gift for the apartment has already been registered, then the recipient must also write a refusal of the gift, then the donor and donee confirm the termination of the gift with a notary. Then the parties contact Rosreestr.

In cases where one of the parties to the gift agreement does not agree with the termination of the agreement, the issue is resolved through the court.

Where to start and where to go?

The recipient of the gift must contact the donor with a written request to terminate the deed of gift. If the donor’s consent is obtained, then the notary certifies the agreement to terminate the previous contract.

Documentation

To return the apartment, the recipient of the gift must:

- original agreement;

- passports of the donor and recipient;

- certificate from the Unified State Register of Real Estate;

- certificate of number registered;

- consent of the remaining members of the recipient of the gift to cancel the deed of gift;

- bank document confirming payment of state duty;

- deed of appraised value.

Timing and cost

According to Art. 333.24 of the Tax Code of the Russian Federation, the fee for notary services for certifying agreements that require a notarial form in accordance with the law is 200 rubles.

If one of the parties to the donation agreement files a lawsuit, then you will have to pay a state fee in the amount of 13,200 rubles. plus 0.5% of the excess of 1 million rubles, but not more than 60,000 rubles. (if the value of the claim is more than 1 million rubles).

the reverse transfer of ownership of an apartment within a week. But this is the simplest and fastest option if there is agreement between the parties. Litigation lasts much longer; the court has the right to consider the case within two months. Therefore, it is worth asking whether the gift agreement was canceled and whether the property was returned.

In legal practice, there are situations in which relatives challenge or cancel apartment donation transactions. We advise you to read the articles of our experts about what are the grounds and in what cases can you challenge a deed of gift during the life of the donor and after his death.

✨ Summary

To sum it up:

- It is possible to cancel a donation in the event of the death of the donee only if the corresponding condition is specified in the deed of gift.

- If the donated property was not sold, alienated, inherited, etc., then the cancellation of the donation occurs through Rosreestr.

- In other cases, you will have to go to court.

- The law does not give a deadline for canceling a gift, but as a general rule it is better to keep it within 3 years, and if the deceased donee has heirs, then within 6 months.

Can the owner sell the apartment he bequeathed? Information for heirs

Read

What does a person registered in an apartment have the right to? Reminder for those who are not homeowners

More details

Can they collect my rent debt if I am not the owner, but am registered in the apartment?

Look

Is it possible that the property cannot be returned?

The most common reason for refusing to cancel a deed of gift is a change in the owner of the apartment. If the donee has already exercised his right to dispose of the apartment (donated it, sold it, etc.), it will be very difficult to return the property to the donor.

The agreement to terminate the deed of gift should not have two-valued interpretations or conventions. Otherwise, Rosreestr has the right to refuse registration of documents.

The court has the right to refuse the donor or donee in the absence of grounds (strong evidence) to cancel the agreement. If the court of first instance refuses the plaintiff, then if there is strong evidence, it is worth seeking the truth in the higher courts by filing an appeal.

The law reserves for the donor the right to cancel the deed of gift in order to protect his interests in the event of malicious ingratitude of the recipient of the gift. But the desire to “annoy” the donee alone will not be enough to cancel the contract.

If there is mutual agreement to terminate the contract, there will be no problems with canceling the deed of gift. But judicial practice shows that cases of reaching a compromise in real estate matters are very rare.

Reasons for the recipient's refusal to accept the apartment

Changing your financial situation for the better. Change of residence and inability to monitor this property. Subjective point of view, with a negative bias towards the actions of the donor.

Long-established hostile relationship with the donor. Moral moments, or ongoing family conflict. It is possible to induce the donor to carry out the same actions in relation to a third party. In any case, the return of a donated apartment is a legal act that must be carried out in accordance with the law.

Another situation that requires attention is the refusal of the donor to accept the apartment after decisions made by the recipient. Possibly after registering a new gift deed or agreement. For example, a court decision has entered into force, but the recipient does not accept the apartment for various reasons: deterioration of condition, without explanation.

IMPORTANT: The deed of donation, or the deed of acceptance and transfer of real estate, always contains information about the condition of the transferred housing. In this connection, the donee must draw up an inspection report in the presence and signature of two witnesses, documenting the full compliance of the housing with the condition specified at the time of the transaction. In case of deterioration, record them and evaluate them.

After which the inspection report, keys, and, if necessary, monetary compensation should be sent to the donor. This will be considered the actual transfer. The court is more accepting of declaring transactions invalid when it comes to gifts between relatives.

Since the recipient’s refusal to accept a gift is often based on intra-family conflict. In addition, donation between close relatives is another indicator of the gratuitousness of such a transaction.

Also, if the issue is resolved by mutual agreement, without going to court, it is easier to return the apartment. More often than not, the actual transfer of real estate has not taken place. Perhaps the previous owner continues to live in the donated housing.

Then there is no need for additional actions to transfer housing. In such circumstances, when the return of the apartment occurs outside the registered gift agreement, the process of notifying the donee to the first party is also simplified.

Before making a gift transaction, you need to make a responsible and meaningful decision, weigh the pros and cons. Otherwise, returning the donated real estate may bring unplanned difficulties. In addition, the termination of civil transactions entails a certain level of costs.

When returning the apartment to the recipient, it is necessary to comply with all the conditions provided by law in order to avoid future claims from the donor.

Legal grounds for revocation

The law (Article 578 of the Civil Code of Russia) establishes special circumstances in which cancellation (revocation) is possible; in these cases, the former owner himself has the right to return his living space back:

- if the donee has made an attempt on the life of the donor or members of his family;

- if the conditions for handling the subject of the deed of gift may lead to its irretrievable and complete loss;

- due to violations of the provisions of the law on insolvency (bankruptcy);

- if errors were made in the contract or it was registered.

The law also provides for circumstances in which a challenge can be initiated by entities interested in the return (these are the direct heirs of the donor):

- a person who received housing for free committed the murder of the previous owner;

- the previous owner found himself bankrupt within 6 months from the date of transfer of title (this rule applies to legal entities and individual entrepreneurs).

According to the rules of the Civil Code, the apartment is returned to the former owner if nothing happened to it (it was preserved in its original form). If it cannot be returned in the form in which it was donated, then in cases provided for by law, the previous owner will receive compensation for it in monetary terms. For example, if the citizen who received the housing has already managed to sell what he received.

Is it possible to revoke a deed of gift for a house?

If the deed of gift includes the above conditions, then the transaction is recognized as legally void and annulled. An organization can donate property that belongs to it under the right of operational management or economic management if the owner consents to the transaction.

In addition, there are other restrictions on donation:

- in case of shared ownership, property can be donated only with the consent of the co-owners;

- if the property is the joint property of spouses, then the written and notarized consent of the husband/wife is required to formalize the donation;

- In the power of attorney issued to the representative to complete the transaction, it is necessary to indicate the subject of the donation.

If these requirements are not met, most likely such a transaction can be cancelled. The parties to the agreement or any interested party can challenge or cancel the deed of gift.

Is it possible to return a donated apartment or share in an apartment back at the initiative of the donor?

In order to answer this question, it is necessary to refer to the provisions enshrined in the Civil Code of the Russian Federation. A gift agreement is a transaction and, therefore, it can be canceled just like any other agreement. Since a deed of gift is essentially a transaction with a unilateral expression of will, there are special circumstances for its cancellation. At the initiative of the donor, this can happen in the following cases:

- If the donee commits any illegal actions against the donor, for example, an attempt on his life or health.

- If, under a gift agreement, a house or apartment was transferred, and the donee treats the object of the gift in such a way as to allow its destruction or destruction.

- If the gift was transferred, for example, on the initiative of the wife, but there was no consent of the husband.

- If the contract included a clause stating that it is subject to cancellation after the death of the donor.

These are the main cases when the contract can be terminated at the initiative of the donor.

How to cancel a gift agreement according to the rules in 2019

The owner of the property has the right to dispose of the property at his own discretion: sell it, rent it out, mortgage it, bequeath it, donate it. In this case, valuable property transferred free of charge is formalized by a gift agreement.

A written conclusion is not required only if the value of the gift is less than three thousand rubles. The subject of the agreement can be any object legally owned by the owner. For real estate transactions, state registration is required.

The main aspects of the gift agreement are:

- parties to the transaction (giver and recipient of the gift);

- written form with or without notarization;

- free transfer of property;

- consent to receive a gift by the recipient.

According to the law, if necessary, such an agreement cannot be simply terminated - sufficient grounds are needed to cancel the deed of gift. The legality of termination is considered by the court, only on the basis of which the recipient can lose property.

The question may arise, why then give property as a gift and then try to get it back. But situations in life are different.

No, you probably won't be able to. Gifting is an almost irrevocable transaction. To terminate a gift agreement, it is necessary to prove that the transaction was a sham (that is, in fact it was a purchase and sale agreement, there were monetary relations). There are, of course, other options: your incapacity, your mental illness, drug addiction or alcoholism, coercion, misrepresentation. In general, don’t quarrel with your mother, you will bite your own elbows later, not because you gave your mother a share, but because you offended your mother and did not communicate normally with your mother. Take care of your mother, love your mother while you have the opportunity.

What does judicial practice say in cases of cancellation of donation?

Judicial practice in such cases is ambiguous. The court's decision directly depends on the existence of grounds for canceling the deed of gift specified in the law and the completeness of the evidence presented.

For example. The woman went to court with a demand to cancel the donation agreement for the apartment. The basis indicated was the recipient’s improper handling of the gift, which could lead to its loss.

The court refused to satisfy her request. He justified the decision by the fact that the plaintiff did not provide evidence of the non-property value of the donated apartment. And she also could not explain to the court what the recipient’s improper handling of the donated item consisted of.

Let's look at examples from judicial practice, where the parties to the transaction that they wanted to cancel were close relatives.

Example 1. A mother gave her son an apartment. A year after the deal was concluded, he began systematically beating her. She contacted the police, a medical examination was carried out and a conclusion was received about causing grievous bodily harm.

A guilty verdict was passed against the son. Based on the received judicial act, the mother went to court to cancel the deed of gift. The court granted her request.

Example 2. A father gave his daughter a car. After some time, a major quarrel occurred between them. The donor decided to cancel the transaction and return the vehicle. But the court refused him. Because a quarrel, no matter how strong it may be, is not a reason to cancel the deed of gift.

Prohibition on drawing up a contract

This document can be canceled if the deed of gift was drawn up for the following category of persons:

- Civil servants;

- Former attending physicians;

- Former teachers or employees of children's educational institutions.

Also, the donor cannot be a minor or a citizen with disabilities. Violations and liability for them are set out in the norms of the law of the Russian Federation that regulate this issue.