Pravozhil.com > Donation of real estate > Donation agreement > Is it possible to challenge a deed of gift for a house - the procedure for completing documentation

People are often faced with the question of whether it is possible to challenge a deed of gift for a house. Is a deed of gift for a house contested? Having the necessary knowledge on how to challenge a deed of deed for a house, you can be sure that this process will take less time and many difficulties will not arise.

You should carefully study the procedure and timing of challenging a gift transaction and the nuances associated with this process.

Legislation establishing the procedure for donating property

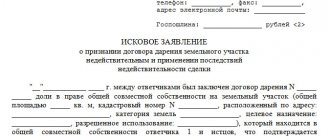

The procedure for challenging a deed of gift for real estate is a labor-intensive process in civil law.

Legal organizations often receive applications from citizens who doubt the authenticity of donation documents. The free provision of an immovable object by the donor to the donee is carried out by drawing up a deed of gift.

The donation process is regulated by Article 572 of the Civil Code of the Russian Federation.

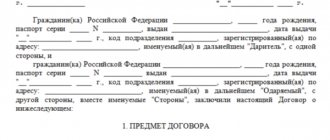

Documents for the gratuitous transfer of a house must be drawn up in writing and registered with Rosreestr. Article 572 of the Civil Code of the Russian Federation describes that the process of transfer of ownership must occur through the delivery of keys and official documentation.

The law describes that a deed of gift differs from a will in the following data:

- the right to own real estate comes into force from the moment of registration;

- when donating a house to a relative, it is allowed not to pay personal income tax;

- It is not necessary to notarize the documentation.

It is much easier to revoke a will in court. But the deed of gift can also be challenged, but this procedure is much more difficult.

What if you give it not to a relative, but just to a friend?

Will not help.

The debtor gave a friend a basement with an area of almost 1,500 square meters. The financial manager discovered this during the bankruptcy proceedings and demanded that the transaction be declared invalid. The court agreed:

From the reviews of the debtor and Dikareva N.P. it follows that the debtor and Dikareva N.P. were on friendly terms, since Dikareva N.P. is an acquaintance of the debtor’s ex-wife, took part in caring for the children, due to which the donation of non-residential premises was conditioned by good relations between the debtor and N.P. Dikareva.

Considering that the gift transaction is gratuitous, in order to declare it invalid on the basis of Article 10 of the Civil Code of the Russian Federation, it is sufficient to establish the presence of bad faith on the part of the donor, since there is no reciprocal provision on the part of the donee.

Resolution of the Arbitration Court of the North-Western District dated September 9, 2021 in case No. A56-25354/2017.

Is it possible to challenge a deed of gift for a house?

To challenge the donation of real estate, the consent of both parties or termination of the contract by a court decision is required.

If the parties have no objections, then terminating the deed of gift will not be difficult. For this procedure, you need to write and sign a termination agreement and execute it.

If one party does not agree with the cancellation of the transaction, this issue will need to be resolved in court.

Grounds for prohibiting donation

There are several reasons for prohibiting the gratuitous transfer of ownership of a house. If a document contains prohibited clauses, it automatically becomes incorrect and has no legal force. The provisions include:

- donation on behalf of a minor;

- from an incapacitated person and legal representatives;

- registration of a gift for an employee of a medical or educational institution;

- the donation will not be recognized if the person was treated or raised by the donee;

- also, a gratuitous transfer cannot be issued for people working in the social sphere on behalf of a ward;

- transfer to a citizen holding a municipal or government position (this action may be regarded as a bribe);

- It is prohibited to formalize a donation in favor of an employee of the Central Bank of the Russian Federation to receive benefits.

Cancellation of a gift agreement

What is needed to cancel a gift agreement?

The interested party and the donor have the right to challenge the deed of gift, if necessary. The fact that the donor has changed his mind about completing the transaction does not serve as a reason for canceling the gift agreement. Reasons for cancellation include:

- Causing harm to the health of the donor by the donee. If the donor dies as a result of causing harm, then the right to use the subject of the gift passes to his heirs.

- Threats to the donor and his family members.

Cancellation of a transaction is regulated by Article 578 of the Civil Code of the Russian Federation and it is necessary to challenge the donation in court.

Violation of the procedure for drawing up a gift agreement

The execution of a contract with violations is regulated by Article 168 of the Civil Code of the Russian Federation. Illegal actions include:

- incorrect form and order of signatures in the document;

- the house is not registered;

- if the donor is incapacitated due to a mental disorder (regulated by Article 171 of the Civil Code of the Russian Federation);

- the legally capable donor at the time of signing is in a state in which he is not responsible for the actions taken (for example, under the influence of alcohol or drugs);

- disagreement of the donor's spouse with the donation of common property (the consent must be notarized; if the property was acquired before marriage, then the spouse's permission is not required);

- covering another transaction with a gift agreement (in order to avoid paying taxes, some people disguise purchase and sale transactions as gifts).

If the procedure for drawing up the contract is violated, it may be declared invalid. You should complete the transaction carefully to avoid refusal of registration.

Legislator's position: formulation and process

Let us immediately note that judicial practice in the field of challenging depends on the legal complexity and individual features of this category of court cases. For example, an apartment donation agreement is subject to challenge solely on the basis of the norms established by the legislator, which in 2021 still include:

- Recognition of the nullity of a gift in court;

- invalidity of the contract;

- cancellation of the agreement.

In legal practice, every year there are more and more lawsuits on claims of feigned or imaginary deed of gift and at the request of the heirs of the donating party, which require the return of the property donated to the donee to the estate and its subsequent distribution according to the law, in accordance with the current legislation of the Russian Federation.

ASKING A LAWYER IS FASTER THAN READING! GET A FREE CONSULTATION WHILE OTHERS PAY FOR IT!

What kind of decision the court will make in the cases under consideration depends entirely on the ability of the plaintiff to prove the bad faith of the accused person by providing indisputable evidence confirming his words.

When drawing up a gift agreement, the parties are required to take into account possible conflicts and risks that may cause litigation and challenge of the executed agreement. That is why, even at the stage of preliminary agreement, the donor and recipient are recommended to familiarize themselves with all the current legal requirements that the legislator imposes on the execution of a gift transaction.

It’s even better if the participants agree to have the transaction supported by a notary. Then 90% of the important work will be transferred to an experienced specialist, and an agreement drawn up in his presence and certified by him will become a guarantor of peace of mind and will reduce the risks of litigation to zero.

Revocation of deed of gift

What is needed to revoke a gift deed?

Revocation is the cancellation of a gift transaction at the request of the donor. The donor may revoke the gift agreement for the following reasons:

- The health status, property or marital status of the donor has changed after the conclusion of the contract. And further execution of the contract may lead to a deterioration in the quality of life of the donor

- The recipient attempted to inflict serious bodily harm on the donor or his relatives.

- The fact of an attempted murder on the part of the recipient to the donor or one of his family members was recorded. If the donor or one of his family members dies, then his heirs have the right to demand the cancellation of the deed of gift.

- The donor wants to return his property after the death of the donee (only possible if this possibility was specified in the contract).

- Due to the fault of the recipient, significant material damage was caused to the property.

Cancellation of deed of gift

How to cancel a deed of gift?

If both parties agree to cancel the transfer, it must be terminated by a notary.

The recipient should transfer the property to the donor by drawing up a new document, and both parties must confirm the agreement with signatures.

If the contract provides for the option of termination at the request of the donor, then it must be canceled by a notary.

If this is not specified in the said agreement, then its cancellation must occur in court proceedings.

The form for canceling a contract for the gratuitous transfer of real estate includes:

- Title of the document;

- Indication of the city of signing;

- Date of;

- Signatures of the parties;

- Full name of the parties to the transaction.

- An indication that the contract is concluded with the participation of two parties.

- Indication of the details for canceling the donation transaction (number, date of preparation, notarial confirmation, city).

The recipient should confirm permission to return the property and set out the procedure for covering the costs associated with canceling the donation transaction.

The document must be drawn up in 3 copies: for the notary, the donor, and the recipient. The contract must include all the signatures of the parties to the transaction and the notary, the registration date, document number, and tariff rate.

The procedure for challenging a deed of gift after the death of the donor

Is it possible to challenge a gift agreement?

After the death of a loved one, you can find out that when he was alive, he transferred his property to a stranger or some distant relative. Thus depriving the remaining heirs of the right to this property.

In some cases, it is possible to challenge a gift after the death of the donor, if permitted by law. Features of challenging a donation include:

- The period from the date of conclusion of the transaction is 3 years;

- The plaintiff was not notified of the transaction.

What evidence will serve as the basis for a trial?

If the donor has died and the heirs want to challenge the transaction, then they should consider the contract for the presence of grounds:

- Forgery of documents;

- Incorrect preparation of documentation;

- Medical certificate confirming the person’s incapacity at the time of execution of the transaction;

- Causing harm to the health of the former owner;

- Participation of persons who do not have the right to accept and transfer property.

If the transfer of rights is not registered at the time of the owner’s death, then their transfer is carried out through inheritance on the basis of civil law. Only a judicial authority can declare a transaction invalid after the death of the donor.

Is it possible to challenge a deed of gift for a house during the life of the donor through the court? The interested party should provide a statement of claim and attach documents to it that describe several grounds for disputing. After considering the evidence, the court will render its verdict.

Is it possible to challenge gift transactions in bankruptcy? Or when attracting a subsidiary?

Creditors can challenge property donation transactions:

- within the framework of bringing to subsidiary liability;

- within the framework of personal bankruptcy of an individual without subsidiary liability.

Moreover, even bailiffs can challenge a property donation transaction if they receive a writ of execution, but the debtor does not have any property to collect. However, bailiffs don’t bother challenging donation transactions (or any other transactions) - they have too much work, and, as a rule, their competence is not the same.

But all this does not negate the main thing - donating property when financial clouds are gathering over your head is the most, excuse me, stupid scheme of all that you can come up with.

Time limits for challenging a deed of gift for a house

Within what period can a deed of gift be contested?

In order to challenge the gratuitous transfer of property and declare it invalid, it must be done within three years from its entry into legal force.

If during this period of time cases of illegal donation procedures are revealed, it can be proven that the plaintiff did not know about the transaction and extend the statute of limitations.

Relatives and heirs can increase the period if less than 10 years have passed since the right.

If a claim is filed after 10 years, then there is practically no opportunity to challenge the contract. An exceptional case is the situation where the donor wants to challenge the transaction, but the donee is against it. In this case, the duration of the claim can reach 5 years. For other persons, the period for challenging is 12 months from the date of clarification of the circumstances.

The process of challenging a deed of gift for a house is a labor-intensive process and requires knowledge of the timing, legislation and procedure for revoking a gift transaction.

Is it possible to appeal a deed of gift for a house? In what cases is a deed of gift for a house contested? You can learn more about deeds of gift and the procedure for donating real estate from the video:

See also Telephone numbers for consultation Jan 24, 2021 kasjanenko 1027

Share this post

Discussion: 2 comments

- MARIA says:

08/17/2017 at 18:16Hello. Please tell me what to do. Here is the situation: A house for 2 owners (each has 1/2), one of the owners is a grandmother for over 90 years. who has a son (60 years old) and a granddaughter from her deceased daughter. My granddaughter has 2 children, is pregnant with her 3rd child, does not have her own home, is registered and lives with her grandmother, whom she takes care of. At the moment, the grandmother has decided to make a deed of gift for her son and is kicking her granddaughter and children out of the house. The question is: does the granddaughter have the right to housing? and can he challenge the deed of gift?

Answer

- Elena says:

04/24/2018 at 07:39

It is very difficult to rely only on your knowledge in such matters. When I encountered a similar problem, I contacted a lawyer and the case ended in my favor. I doubt that I would have managed it without his help.

Answer

Entry into force of a court decision and the possibility of appealing it

After considering the case on the merits of the filed claim, the arbitration court makes an appropriate decision . If the claim to cancel the donation is satisfied, the donee’s right to the donated property is terminated and the right of the previous owner is restored.

If is refused to satisfy his claims, he has the right to appeal the decision of the arbitration court of first instance to a higher court. In this case, it will be an arbitration court of appeal. An appeal is filed against a court decision that has not entered into legal force. The deadline for filing an appeal is one month from the date of the decision of the arbitration court of first instance. The next authority that can review the decision of the arbitration court is cassation. The deadline for filing a cassation appeal is two months from the date of entry into force of the appealed decision.