Pravozhil.com > Real estate registration > Land registration > Who can receive a land share and what is allowed to do with it?

The legislation provides private owners with several ways to obtain a land share for personal needs. In addition to the traditional purchase/sale, you can become the owner of a plot on a shared basis. Using legal terminology - to receive a land share.

How to get a land share in Russia and what to do with it, what legal opportunities such property provides to the owner and how to register it correctly will be discussed further.

What is a land share?

How to get a share in land in Russia?

What are land shares? We are talking about the form of ownership of land exclusively for agricultural purposes.

A land share is a citizen’s shared ownership of a common plot. It is not prohibited for a legal entity to receive a share. The area is calculated in hectares, including per user. is issued free of charge.

In fairness, it must be stated that the share of one owner in the legal sense is not a personal plot. Why?

- Share boundaries exist exclusively on paper, but on the ground the matter is done without land surveying. It implies only the right to an allotment in the general area, and not the allocation of property in kind.

- The use of shared land should not violate the rights of other owners, therefore there are many restrictions for this ownership format.

Share ownership is a shaky concept. At any time, it can be taken away by the municipality as unclaimed land or used for other purposes.

Peculiarities

The peculiarities of land shares include the fact that they were provided once and free of charge, starting in 1991. They were received by employees of agricultural enterprises liquidated or subject to reorganization, as well as those who retired from this particular organization.

Among other rural residents who had the right to receive a land plot:

- medical workers;

- teachers;

- cultural workers.

Despite the fact that the share was free, the shareholder was obliged to pay for the work of the cadastral service and taxes. One of the conditions for including a citizen among shareholders was the timely privatization of land. If this did not happen, then the person was deprived of his share and, at the same time, the right to use the land.

The land share cannot be used for construction, since it is intended only for agriculture.

Land share - what to do with it? Legal regulation

- Land Code of the Russian Federation.

- Federal Law No. 101 “On the turnover of agricultural land.”

- Federal Law No. 221 “On the State Real Estate Cadastre”.

- Federal Law No. 218 “On State Registration of Real Estate” (new law of 2021, replacing Federal Law 122).

Essentially, the share provides the owner with the opportunity to engage in crop production for his own needs. To carry out land alienation operations, registration of ownership will be required. But that’s “a completely different story.”

Registration of land share

How to register a land share?

First, the land needs to be demarcated and registered with the state real estate register. Only after this can you begin to register your share. But these are the concerns of the owner of the total land mass.

The applicant for the share will have to apply to the land commission of the agricultural enterprise for a decision on the provision of the share. If the application is approved, the shareholder receives a corresponding certificate indicating:

- share size in points and hectares;

- type of ownership (arable land, pasture, etc.).

Now the share is registered as property. To do this, you need to obtain title documents for the land:

- Certificate of ownership.

- Cadastral extract and technical plan of the site.

Please note that you should start by checking the legal compliance of the technical documentation. A site plan (or technical passport) and a cadastre extract are needed to complete legal papers. If the cadastral passport is outdated or does not exist at all, land management work is carried out. In general, the stage takes from 1 to 2 months.

Legal documents are issued through the territorial department of Rosreestr at the location of the land. The following package is provided to the authority:

- minutes of the meeting of the board of the agricultural enterprise with a copy of the decision;

- shareholder certificate;

- technical documentation for the land;

- confirmation of payment of the state duty for registration of the plot.

If a representative is involved in registering the share, a notarized power of attorney is required.

What opportunities does a land share provide?

What can you do with your land share?

Well, now let's talk about the most important thing. What can be done with land shares, what benefits does the owner receive?

With proper management of the rights, the share will bring great benefits to its owner. The following actions are possible with the share:

- purchase/sale;

- exchange for other real estate;

- rental to a third party.

Taking into account the current land laws, the most profitable disposal of the share seems to be leasing or transferring it to trust management.

How to sell a share?

If the owner expects to sell his share, it is worth remembering the right of first refusal for other shareholders of farmland. Both individuals - shareholders and legal representatives - collective farms/state farms, peasant farms, municipalities have the right to act as a buyer.

Key points of the deal:

- before the sale of the share, the plot is allocated in kind;

- the agreement is concluded in simple written form in accordance with the requirements of the land code of laws and the Civil Code of the Russian Federation;

- the transfer of ownership, and not the specific transaction, is subject to registration in Rosreestr;

- shares can be purchased only for the production and receipt of agricultural products;

The share purchase/sale agreement must contain the following points:

- details, personal/statutory data of the parties;

- description of the land plot: exact coordinates on the ground, legal address;

- details of the seller's share certificate;

- accurate valuation of the share and sale price;

- capacity and good will of the parties when concluding an agreement;

- absence of mutual claims regarding the transaction.

A one-time payment or in installments is allowed, but in the second case the monthly payment will be higher than when renting an allotment.

Allocation of agricultural land from common shares

Documents that need to be collected for registration and privatization of a plot:

- Documents that need to be collected for registration and privatization of a plot

- Documents confirming the right to own land;

- Cadastral plan;

- Copying a site;

- Cadastral passport;

- Positive decision of the general meeting on land surveying;

- A copy of the newspaper in which the advertisement was published;

- Receipts for payment of services;

- Land deed issued by the local committee;

- An application containing: full name, basis for receipt, information about the site.

Bodies that need to be visited to allocate land ownership:

- BTI - for land surveying;

- Local newspaper publishing house - to place an announcement about the allocation of territory;

- Unified State Register - for copying the site;

- Administration - to hold a meeting of the array participants, it will set the place, time, date of the meeting - the result should be a positive decision on the allocation of the site;

- Geodetic company – for carrying out geodetic work and obtaining a cadastral passport;

- Cadastral Chamber - all documents are submitted here to receive a certificate of ownership within a month.

Donation of a share

Is it possible to donate a land share?

The procedure for donating a share is in many ways similar to the alienation for compensation:

- Before conducting a transaction, the owner must check the availability of a certificate of ownership of the share.

- The deed of gift itself does not need to be registered, but the transfer of ownership requires state verification in Rosreestr.

- It is necessary to notify the other participants of the partnership about the upcoming donation. But, unlike the purchase/sale, here the co-owners have no rights of non-primary possession, since the land is transferred free of charge.

Donation algorithm

- preparation of documents for concluding an agreement;

- drawing up a deed of gift independently or with the help of professional lawyers (optimally through the services of a notary);

- signing a contract;

- state registration of transfer of rights;

- transfer of land according to the deed.

Due to the simplified mechanism for carrying out, under the guise of donation transactions, a simple purchase of farmland by interested parties is carried out.

Professional players in the land market are aware of ensuring the financial and legal security of fictitious land transfers. But it is better for ignorant citizens not to try to circumvent the law:

- the buyer may not pay the bill, and the law will be on his side;

- if the truth comes out, the deal may even be declared invalid in court.

Arbitrage practice

Often, citizens draw up deeds of gift for land and other property, trying to cover up another transaction - a sale. Sellers need this to avoid paying taxes. But a feigned DD can be declared invalid, and this is confirmed by Decision No. 2-706/2016 2-706/2016~M-649/2016 M-649/2016 dated October 12, 2021 in case No. 2-706/2016.

There is another example of challenging a deed of gift, when the defendant donated property to a relative without the consent of the spouse - Decision No. 2-1279/2015 2-66/2016 2-66/2016(2-1279/2015;)~M-1189/2015 M-1189 /2015 dated March 31, 2021 in case No. 2-1279/2015. The contract was declared invalid and the right to the property was returned to the plaintiff.

Rental

The land law allows the transfer of land shares for rent. At the same time, one should not lose sight of respect for the rights and interests of other co-owners.

A lease agreement is concluded between the parties indicating:

- duration of the agreement. This can be either a long-term or short-term arrangement. When transferring an allotment for a period of 1 year or more, the agreement is subject to state registration in Rosreestr;

- detailed conditions for the use of land by the tenant;

- rights and obligations of the parties;

- terms and frequency of payment. By law, both cash and in-kind payments are acceptable.

Since share rights do not imply clear boundaries in reality, when renting a plot, it makes sense to allocate the land in kind. Then additional land surveying will be required.

Allocation of shares in kind

What needs to be done to have the right to dispose of a land share?

This procedure will be needed in transactions involving a change in the owner of a share, as well as when registering a “virtual” right to tangible property with the possibility of full disposal.

This is a troublesome matter, depending on the site, the legal form of the agricultural enterprise, and the characteristics of the shareholders' partnership.

But there are also general steps that almost any applicant must take:

- in regional print and electronic media (only official) it is published about the upcoming allocation and registration of a shared plot of land;

- a month later, a general meeting of shareholders, where the technical parameters of the allocated share are clarified and agreed upon;

- Now it’s time for land surveying – this is the longest stage. It can even last beyond one year;

- Upon completion, the boundaries are agreed upon with neighbors and government authorities. On average, the stage takes up to 30 days;

- Now it’s time to receive a cadastral plan for the site and assign a cadastral number.

Only after the favorable completion of all these “ordeals” is the owner issued a title document.

There are two options for allocating a share: for one owner and for a group of shareholders. Only the first method allows you to become a full owner of land.

You can find out how to receive land from the state by watching the video:

See also Phone numbers for consultation 06 Dec 2021 kasjanenko 1127

Share this post

Discussion: 4 comments

- 5master5 says:

03/07/2019 at 16:36I didn’t quite understand from the article. The relative had a share that was not properly registered. After his death, it is clear from the article that his closest relatives or family members will not be able to register it themselves and receive it as an inheritance? That is, while he was alive and it was necessary to register, but after death the share would be taken away?

Answer

Lenin says:

04/02/2019 at 16:21

Yes, they will take it away

Answer

08/20/2019 at 12:17

An agricultural enterprise cultivates land, which is a collection of land shares. The company does not have ownerless land. Where will it get the land to provide social services? worker, for example, land?

Answer

09/08/2020 at 23:09

If a group of people have been leasing their land shares to one company for a long time, how can the owner of one of the shares refuse to participate in the transaction and receive his share for his own use?

Answer

The nuances of inheriting agricultural land

Each type of inheritance has its own characteristics.

- By right of inheritance:

First, a notary obtains confirmation of the right to inheritance within 6 months from the date of death of the testator.

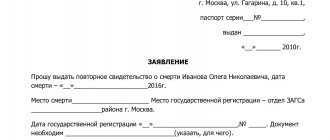

To accept an inheritance, the following documents are required:

- Death certificate;

- Confirmation of relationship;

- Certificate for the testator's land share - yes, this means that the plot was not allocated in kind, but does not prevent it from being inherited.

To form a share you need:

- Certificate of estimated value of the site;

- A document confirming that the plot is not mortgaged and is not under arrest;

- Certificate of absence of tax debts;

- Certificate of the possibility of becoming an owner and registration certificate (obtained from a notary);

Afterwards, an inheritance case is opened and passed on to the inheritance.

- Only the right of inheritance is proven through the court, and then an inheritance case is opened. If there are several heirs, then the share is divided into equal shares.

- According to the will, an inheritance case is simply opened to transfer a share in the property, only if there is no obligatory share for the testator’s dependents.