Often, an agreement between individuals is drawn up independently without the help of lawyers. This approach is not always justified: each contract has nuances and essential conditions. We will tell you how to draw up a competent agreement between individuals.

For your convenience, the website provides examples of claims for declaring an agreement unconcluded and invalid. As well as agreements (termination, compensation, set-off). If any doubt remains, seek legal advice online. A correctly executed agreement will allow such a document to be used as evidence in the event that one of the parties goes to court.

:

Agreement between individuals

Who enters into an agreement between individuals

Individuals are citizens of the Russian Federation, foreign citizens and stateless persons. Individual entrepreneurs can be a party to agreements between individuals, but only when acting for non-business purposes. If an individual entrepreneur enters into an agreement with an individual as a businessman, the agreement is subject to the requirements of the consumer protection law.

If a foreign citizen is a party to an agreement between individuals, be extremely careful. Especially in the field of labor (notification of employment), land relations (there is a ban on such persons owning land in the border zone), when purchasing cars (customs clearance).

SAMPLE LOAN AGREEMENT

Moscow __.__.20__

Citizen of the Russian Federation ___________________ (full name)__.__.____ year of birth (date of birth), passport of a citizen of the Russian Federation __ __ ______ (passport series number) issued __.__.____ year (date of issue) _____________________________________________________________________ (issued authority passport) subdivision code ___-___, registered at the address: ___________________________________________, hereinafter referred to as the “Lender”, on the one hand, and citizen of the Russian Federation ________________________________ (full name), __.__.____ year of birth (date of birth), passport of a citizen of the Russian Federation __ __ ______ (passport series number), issued __.__.____ (date of issue) year _____________________________________________________________________ (authority that issued the passport), department code ___-___, registered at the address: _______________________________________, hereinafter referred to as “Zemschik” ", on the other hand, have concluded this Agreement as follows: 1. Subject of the Agreement 1.1. The Lender transfers to the Borrower funds in the amount of _________________ (amount in figures) (______________ (amount in words)) rubles, and the Borrower undertakes to return the same amount of funds (loan amount) to the Lender. 1.2. The loan term is _____ months (the loan term is indicated) from the date of issuance of the loan amount. 1.3. No interest is accrued or paid for using the Loan. 2. Terms of the Loan 2.1. The loan is provided to the Borrower on the terms of urgency and repayment. 2.2. No security is provided under this Agreement. 3. Procedure for repaying the Borrower's obligations 3.1. The date of payment of funds transferred by the Borrower to repay the obligations to repay the Loan is the date of their transfer to the Lender or crediting to the Lender's current account. 3.2. Fulfillment of obligations to repay the Loan may be carried out in parts, and the Loan must be finally repaid within the period specified in clause 1.2. 3.3. The Borrower has the right, under the terms of this Agreement, to repay the Loan early, in whole or in part, by orally notifying the Lender one business day before the expected repayment date. 4. Obligations of the Lender 4.1. The Borrower undertakes to repay the Loan within the time limits established by this Agreement. 4.2. If passport data or details change, the Borrower is obliged to immediately notify the Lender. 5. Obligations of the Lender 5.1. Transfer funds to the Borrower under the terms of this Agreement. 5.2. Accept the execution of the Agreement by the Borrower on the terms of this Agreement. 6. Responsibility 6.1. In the event of a delay in repayment of the entire Loan (part thereof) due to the fault of the Borrower for more than 5 working days, the Lender may, but is not obligated to, require the Borrower to pay a penalty in the amount of 0.02 (Zero point two) percent of the amount untimely returned part of the Loan for each day of delay in its return, but not more than 5 percent of the Loan amount. 6.2. In this case, the penalty may be accrued by the Lender at any time after the delay in fulfilling the obligation occurs. The lender independently determines for what period of delay the penalty is collected. 7. Entry into force and termination of the Agreement 7.1. This Agreement comes into force on the date of actual transfer of the Loan amount and is valid until the Parties fully fulfill all their obligations under it. 7.2. This Agreement is terminated: - by agreement of the Parties; - on other grounds provided for by current legislation. 2 8. Force majeure 8.1. The Parties are released from liability for partial or complete failure to fulfill obligations under the Agreement if it was the result of force majeure circumstances, that is, extraordinary and unpreventable circumstances under the given conditions that are beyond the reasonable control of the Parties, and if these circumstances directly affected the performance of the Agreement and arose after its conclusions and do not depend on the will of the Parties. 8.2. The deadline for fulfilling obligations under the Agreement is proportionately postponed by the time during which force majeure circumstances apply, as well as the consequences caused by these circumstances. 8.3. The Party for which it is impossible to fulfill its obligations under the Agreement must immediately notify the other Party of the occurrence and (or) cessation of circumstances that impede the fulfillment of obligations. 8.4. Evidence of the existence of force majeure circumstances, their duration and impact on the execution of the Agreement lies with the Party that failed to fulfill or improperly fulfilled its obligations under the Agreement. 8.5. If force majeure circumstances or their consequences last more than two months, the Parties agree on what measures should be taken to fulfill the terms of the Agreement. 9. Dispute resolution 9.1. All disputes and disagreements that may arise between the Parties on issues that are not resolved in the text of this agreement will be resolved through negotiations on a mutually acceptable basis. 9.2. If controversial issues are not resolved during negotiations, disputes are resolved in the manner prescribed by current legislation. 10. Final provisions 10.1. The loan repayment period may be extended by mutual agreement of the Parties. 10.2. All changes and additions to this Agreement are valid only if they are made in writing and signed by authorized representatives of the Parties. 10.3. This agreement is drawn up in two copies having equal legal force, one copy for each of the parties. 10.4. In all other respects not provided for in this agreement, the Parties will be guided by the current legislation of the Russian Federation.

Addresses and bank details of the parties Lender: Full name _________________________________________ Passport of a citizen of the Russian Federation __ __ ______ issued on __.__.____ ___________________________________________ ___________________________________________ ___________________________________________ Subdivision code ___-___ Registered at the address: ___________________________________________ ___________________________________________ Lender: Full name _________________________________________ Passport of a citizen of the Russian Federation __ __ ______ issued __.__.____ city ___________________________________________ ___________________________________________ ___________________________________________ Subdivision code ___-___ Registered at the address: ___________________________________________ ___________________________________________ Signatures of the parties Lender: ________________ /_______________________ / (signature) (Full name) Lender: ________________ /_______________________ / (signature ) (FULL NAME.)

Form of agreement between individuals

Often an agreement between citizens is concluded verbally or through actions. Gifting, selling, buying, renting – we make transactions, perhaps, every day. But in accordance with Art. 161 of the Civil Code of the Russian Federation:

- transactions between citizens in an amount exceeding 10,000 rubles. must be in writing

- in cases provided for by law, a written form of agreement is mandatory regardless of its price.

For citizens, the written form presupposes the existence of a contract (agreement). A receipt is allowed (for example, about a deposit, an advance payment, about a loan). Exceptions to the law, when, regardless of the transaction price, a single document is required to be drawn up:

- agreements with real estate (purchase and sale, rent for a year or more, donation, exchange, etc., when a transfer of rights is carried out) are subject to state registration (which means an agreement is provided)

- purchase and sale of a car: the buyer must register the car, for which one copy of the contract is submitted to the traffic police

- transactions between individuals with shares (donation, purchase, etc.) are subject to notarization.

Example of a loan agreement between individuals

A specific example of an agreement can only be offered if both parties have decided on the method of formalizing the transfer of funds. This can be not only a loan agreement, but also a receipt for receipt of funds.

The required sections are:

- Subject of the agreement.

- Loan terms.

- Duties of the parties.

Example contracts vary depending on whether or not the following sections are included:

- moment of entry into force of the contract, its termination

- Force Majeure

- dispute resolution.

If the corresponding section is not in the contract, the court will be guided by the Civil Code of the Russian Federation when considering the dispute (for example, Articles 395, 809 and 810).

Algorithm for drawing up an agreement between individuals

If you decide to put the contract in writing, adhere to the following structure of the document:

- date and place of the agreement

- passport details of each person indicating the name of the party (Customer, Buyer, Contractor, etc.)

- subject of the agreement, if a thing, then its individual characteristics (if any)

- price

- responsibilities of the parties, deadlines

- duration of the contract, the date it comes into force (usually from the moment of signing)

- procedure for terminating and amending the contract (orally, in writing, by sending a notice or drawing up an additional agreement)

- signatures of the parties to an agreement between individuals.

What does a cash loan agreement include?

The contract specifies such parameters as the amount, the absence of interest on the use of funds or their availability, the term and conditions of return. The purpose of the loan is also often described (for example, the presence of an indication “for family needs” directly indicates that not only the borrower, but also his spouse is responsible for the repayment of funds). The Civil Code of the Russian Federation (Article 395) also describes other circumstances - the place of consideration of disputes, the deadlines for applying for the return of funds in court, the statute of limitations for such agreements (3 years), during which you can apply for the return of the loan.

Not required today:

- Drawing up an agreement with a notary (does not have any special force when considering disputes).

- Presence of witnesses when signing a cash loan agreement.

Receipt

To protect themselves, the borrower and lender can write receipts. The first confirms that he received the money for temporary use, and the second confirms that the funds were returned to him partially, fully or with interest.

Receipts are considered the best solution to controversial issues. Often citizens naively believe that a document is drawn up only when transferring funds on loan. In practice, it looks like this: the borrower writes that he has received the amount, and upon return he simply takes a receipt from the lender. Sometimes this course of action is justified, but it happens that a cunning creditor deceives the debtor.

An example from personal legal practice:

The woman borrowed money privately from her employer. The receipt was drawn up between individuals. Subsequently, she resigned from this place of work of her own free will, causing the anger of her boss (lender) by such an act, because the termination of the employment relationship fell on quarterly reporting, which the employee did not prepare.

The woman faithfully returned the borrowed funds and took the receipt provided earlier. Some time later she received a summons to appear in court. The plaintiff was a former boss who demanded the return of a debt that she believed had already been paid.

It turned out that the lender replaced the receipt with a copy made on a color printer, so he had a valid document in his hands confirming that the money had been transferred to them, and the defendant did not have actual evidence of repayment of the debt. Naturally, the court decision was made in favor of the plaintiff.

Important!

When returning funds, request a receipt confirming fulfillment of obligations.

You can avoid negative consequences by repaying the loan using a bank transfer. In this case, the number, date of signing the contract and purpose of payment are indicated. Sometimes a repayment receipt is additionally drawn up, but there is a risk of the opposite situation: the borrower may declare that he made two payments - in cash and through the bank.

Sample partnership agreement

Two or more individuals can enter into a partnership agreement for the purpose of jointly performing any type of joint activity in the future. Most often, the goal of each of the parties to the transaction is to make a profit for performing work.

A partnership agreement should always consist of such important elements as:

- Actions of each of the individuals who entered into a transaction.

- Responsibilities of the subjects of a specific agreement.

- Business participation, if previously provided for.

The form of the partnership agreement can be free, which directly depends on the information that was decided to be included in the document.

Agreement with the payer of professional income tax

A new way of concluding contracts with individuals has appeared since January 1, 2021 in Moscow, the Republic of Tatarstan, the Moscow and Kaluga regions thanks to an experimental tax regime - the tax on professional income (Federal Law of November 27, 2018 No. 422-FZ).

This agreement does not include non-production costs and additional tax and administrative burden on the employer. Thus, individuals themselves take on the responsibilities associated with paying taxes on the remuneration received. In addition, if a self-employed person provides a special check to the company, then the company is also exempt from charging insurance premiums (Clause 1, Article 15 of Law No. 422-FZ). The contract directly establishes the payment procedure and specifies the work, for failure to perform which a fine may be provided, and the procedure for terminating such a contract is much simpler than an employment contract.

However, the law prohibits transferring your employees to self-employed status: the income of freelancers from those companies that are (or were in the previous two years) their employers are not subject to the special regime (clause 8, clause 2, article 6 of Law No. 422-FZ). This means that when concluding an agreement with such a “special regime”, an organization must act in the same way as when concluding an agreement with an “ordinary” individual: charge insurance premiums on the remuneration paid and withhold personal income tax from it.

Lamakin Andrey Yurievich, Head of the Federal Tax Service for the Kaluga Region

Lease agreement between individuals

General provisions on concluding a lease agreement can be read in another article on our blog. Now let’s talk about the nuances of contractual relations within the framework of a lease agreement between individuals.

First of all, it is worth recalling that if an agreement regarding the rental of residential premises is concluded between individuals, then such an agreement is called a rental agreement between individuals.

The correct wording is “hiring”, not “renting”. In everyday life, these two concepts are often identified.

If non-residential property (for example, a garage, land) or other property (car, equipment, etc.) is leased, then in this case we are talking about a lease .

Essential terms of the lease agreement for residential and non-residential real estate:

- information about the parties to the agreement;

- exact description of the property: address,

- footage, number of rooms (for an apartment or house),

- description of the object (material of construction, condition);

Let me remind you that an agreement for a period of less than 1 year does not need to be registered with Rosreestr (Article 651, clause 2 of the Civil Code);

The remaining (standard) clauses of the contract are stated at the beginning of this article.

Sample rental agreement for an apartment between individuals (1 page):

You can download this form in its entirety here.

Agreement with an individual entrepreneur

From the point of view of the total tax and administrative burden, this method is very attractive for an organization - when dealing with individual entrepreneurs, the company not only does not pay insurance premiums on remuneration, but also does not fulfill the duties of a tax agent for personal income tax (clause 1 of article 420 and clause 2 of article 226 of the Tax Code of the Russian Federation). The entrepreneur pays all taxes on remuneration for work himself.

Non-productive loads do not arise when hiring individual entrepreneurs as employees - the company does not pay individual entrepreneurs for vacation or sick leave and does not pay wages twice a month. In addition, the procedure for terminating such contracts is much simpler than labor contracts - it is enough to sign an agreement to terminate the contract, and in some cases a unilateral refusal is permissible (clause 3 of Article 310 and clause 1 of Article 450 of the Civil Code of the Russian Federation).

However, under an agreement with an individual entrepreneur, it is impossible to transfer copyrights to various objects of intellectual property. Income from the creation and use of such objects does not fall under the definition of entrepreneurial activity, which is given in Art. Civil Code of the Russian Federation (see also clause 1 of Art. Tax Code of the Russian Federation). Even if an agreement, for example, to create a website is concluded with an individual entrepreneur, then the copyright to the website as a complex object of intellectual property, including software, texts and images, will be transferred not by the entrepreneur, but by an “ordinary” individual with all the ensuing tax consequences for the organization - customer.

It is also impossible to “transfer” employees to the status of individual entrepreneurs and then enter into a GPC with them. The courts clearly interpret such manipulations of status as an abuse of right and reclassify the relationship back to employment with corresponding additional charges (rulings of the RF Armed Forces dated February 27, 2017 No. 302-KG17-382 and dated May 25, 2018 No. 303-KG18-1430).

In addition, it is important to closely monitor that the essence of the work (service) entrusted to the individual entrepreneur corresponds to the codes of the types of activities that he declared in the Unified State Register of Individual Entrepreneurs. Otherwise, for tax purposes, such an agreement is regarded as concluded with an “ordinary” individual, and the organization is responsible for paying insurance premiums and withholding personal income tax on remuneration. Moreover, additional accruals are also possible when the required type of activity code was available on the date of conclusion of the agreement, and then was deleted by the entrepreneur (letter of the Ministry of Finance of Russia dated November 22, 2017 No. 03-04-06/77155). Therefore, an extract from the Unified State Register of Individual Entrepreneurs must be ordered on the date of each payment under the agreement in favor of the individual entrepreneur.

Vorobyova Elena Borisovna, head of the department for work with taxpayers of the Interdistrict Inspectorate of the Federal Tax Service of Russia for the largest taxpayers in the Moscow region

Dispute Resolution

Often, a loan agreement between individuals provokes many disputes arising on its basis. To avoid the most acute conflicts, it is advisable for the parties to agree in advance on all possible nuances, interpretations and conditions for the implementation of certain instructions.

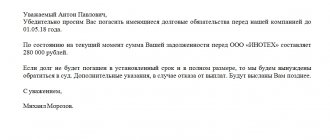

If a dispute does arise, it is desirable that it be resolved peacefully. Thus, in case of dissatisfaction, the parties can simply send each other claims and close controversial issues without court intervention.

The lender and borrower must think through every nuance of cooperation and include it in the interest-bearing loan agreement between individuals or its interest-free analogue. This especially applies to the timing of when a response to a submitted claim should be received. You also need to discuss the procedure under what circumstances to go to court if the conflict cannot be resolved peacefully. Disputes of this type are resolved in the Arbitration Court at the place of residence of the defendant.