Often parents and other close relatives are faced with the question of how best to formalize an inheritance, namely, what is better, a deed of gift or a will? Of course, it is best to seek advice from a lawyer or a notary, but before that it would not hurt to find out about the essence, differences, positive and negative aspects of these two seemingly identical orders of the property owner. Most often, this choice is made when determining the fate of expensive real estate objects - an apartment, a residential building, a cottage.

First, let's define the concepts:

- A will is a personal order of a citizen regarding his property in the event of death, with the appointment of heirs.

- A deed of gift (donation agreement) is an agreement on the transfer of ownership rights to property by one person free of charge to another person, regardless of whether he is a relative or not.

What is the essence of a will and deed of gift?

Both in the case of a will and in the case of a deed of gift, the ownership right passes to the heirs (legal successors). But what are their differences?

| WILL | DONATION | |

| Registration deadlines | The procedure is complicated by the fact that entering into an inheritance is possible only after 6 months after the death of the citizen who made the will | When all the documents are ready, an agreement is drawn up, the state fee is paid and documents are submitted for the state registration. registration. According to the law, the donee's ownership of property is registered within no more than 9 working days. |

| Moment of transfer of ownership | The transfer of ownership occurs only after the death of the testator and registration of the inheritance, and this:

| The transfer of ownership to the donee under a gift agreement occurs after registration of ownership, that is, during the life of the donor. |

| Possibility of cancellation | A will implies freedom of choice - changing a decision or canceling it, drawing up more than 1 will (not contradicting each other), bequeathing property that is not yet owned by the testator, you can appoint sub-heirs, determine an executor. | A donation is a transaction that practically cannot be canceled, except in extreme cases - the incapacity of the donor at the time of the transaction or the transaction was carried out under the influence of threats or violence (according to a lawsuit by the victim). |

| Registration costs |

|

|

| Taxes | When entering into an inheritance, heirs pay taxes:

| When donating real estate to a non-close relative, the recipient is required to pay 13% personal income tax on the market (cadastral) value of an apartment or house (see apartment gift tax). |

| Potentially problematic | It should be remembered that old-age pensioners, disabled people and minor children have the right to a share, regardless of the last will of the testator indicated in the will. | For the donor, the deed of gift is the final decision, so this choice should be treated exclusively carefully, since no changes can be made or the decision can be canceled (as in a will). For the donee, the deed of gift is safe and profitable. |

So which is better? A will is the safest way for the testator to dispose of his property, since it gives the right to change his decision. For the donee, the deed of gift is considered very profitable and safe, because it is very difficult to challenge it (see whether it is possible to challenge a deed of gift for an apartment). If disabled people, minor children and old-age pensioners are not included in the will, and they have the right to a share of the property REGARDLESS of what is specified in the will, then potential problems with the division of property with them arise for the heirs indicated in the will (see whether it is possible to challenge a will on apartment).

Financial expenses

When choosing a method for transferring property to heirs, it is necessary to take into account the financial side of the issue.

- For a person who wants to transfer his property to another, it is cheaper to enter into a gift agreement. To register a deed of gift, you just need to pay a state fee (and even then not always), which can be shared with the recipient. When drawing up a will, in addition to notarization, you will have to pay a notary for drawing up each page of the document.

- For a person receiving an inheritance, material expenses depend on family ties. For close relatives, the best option would be a tax-free gift.

- For strangers, receiving property by any means entails payment of state tax. When receiving an inheritance under a will, the tax amount is much less than when accepting a gift.

Basic Rules for Making a Good Will

To draw up a will correctly, you should follow some basic rules for drafting it:

- In a will, you should clearly and unambiguously formulate your thoughts, draw it up legally competently, without possible ambiguous interpretation of the will.

- It is better to avoid the regime of common shared ownership. This is necessary to eliminate possible conflicts among the heirs regarding the determination of the use of this property or the allocation of a share. If there are several heirs and real estate objects, then ideally, for each object transmitted by inheritance, different heirs should be established.

- When drawing up a will, you have the opportunity to nominate heirs. This means that it is necessary to determine to whom the property will be bequeathed in the event of the death of the heir before the opening of the inheritance or simultaneously with its opening, or in the event of the heir’s refusal of the property for any reason.

- Care must be taken to protect inherited property. What does this mean?

There are situations when first-line heirs live far from the inherited property, and heirs to other objects or relatives not specified in the will, having access to an apartment or house, illegally take away valuables, household appliances, and furniture. That is, before the heirs appear. It is difficult to return property disposed of in this way.

To avoid any problems when dividing property between heirs, distribute everything strictly according to the will and take measures to protect the inheritance by appointing an Executor of the will or an Executor. This could be a lawyer or a lawyer, a faithful friend of the testator, it could be the heir himself, or, in the end, any disinterested person. His powers are specified in the will and certified by a certificate issued by a notary.

Is spousal consent required?

A husband and wife who are legally married can dispose of common property only by mutual consent.

The transfer of property jointly acquired by spouses to another person without the knowledge of one of them is impossible and can be challenged in court.

You can donate or bequeath property without the other half only in 2 cases:

- The property was acquired personally by one of the spouses before the official marriage.

- The property transferred to another person was received through a gift.

In other cases, the spouses must jointly decide on the transfer of property, or one of them can bequeath his share of the joint property.

Which method of transferring property is better and more profitable depends on specific circumstances. Each of the above documents has its own characteristics, pros and cons.

Important information! Property can be bequeathed, donated or received only in accordance with current legal regulations. All legal aspects of the transfer of property, through donation or will, are outlined in the Civil Code of the Russian Federation.

What taxes are imposed on gift deeds?

Property that a citizen receives as a gift (free of charge) is income that is subject to personal income tax (personal income tax). Today in the Russian Federation it is 13% of the market value of real estate. However, in the case of donating real estate to close relatives, the recipient is exempt from paying it. Close relatives include:

- spouses;

- children, parents, including adopted children and adoptive parents;

- grandchildren, grandparents;

- sisters and brothers, both full-blooded and having only a common mother or father.

This list of close relatives under the Family Code does not imply a broad interpretation and is closed. Other persons, including relatives who are not on this list (aunts, uncles, nephews, second cousins, etc.), are required to pay personal income tax. On what amount is this tax charged? According to the Law, from the market value, but in fact, from the value indicated in the gift agreement. Usually the cost is not specified in the contract, then the cadastral value of the property (at least 70%) is used for calculation. The 3-NDFL declaration must be submitted by April 30 of the next year, and paid by July 15.

In the case of donating real estate to a non-close relative, it is cheaper to draw up a purchase and sale agreement for a residential building or apartment. At the same time, the Odaryamy does not pay personal income tax, and can even take advantage of the property tax deduction when purchasing real estate (if he has not used this deduction before).

What can be challenged in court?

Both the deed of gift and the will can be challenged in court.

If the donor signed the agreement without coercion, in a legally capable state, and the text of the agreement and the actions of the parties did not contradict the law, it will be difficult to challenge this transaction. However, the donor has the right to cancel the donation in the cases provided for in Article 578 of the Civil Code of the Russian Federation if:

- the donee made an attempt on the life of the donor and members of his family or close relatives;

- the donee intentionally caused bodily harm to the donor;

- the donee handles the donated item, which is of great value to the donor, inappropriately, creating the threat of its loss;

- The gift agreement provides for the right of the donor to cancel the gift if he survives the donee.

If the donee intentionally deprived the donor of his life, the donor’s heirs have the right to demand in court the cancellation of the gift agreement.

In case of cancellation of the donation, the donee is obliged to return the donated item.

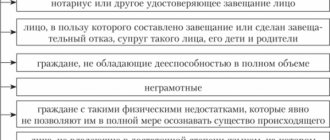

The will may be declared invalid by the court. A person whose rights or legitimate interests have been violated files a claim in court.

Circumstances under which a will may be invalidated:

- does not comply with the law or other legal acts;

- committed for a purpose contrary to the foundations of law and order and morality; imaginary and feigned;

- committed by a citizen declared legally incompetent;

- committed by a minor citizen (if, in accordance with Articles 21 and 27 of the Civil Code, he did not acquire full legal capacity before reaching the age of majority);

- committed by a citizen whose legal capacity has been limited by a court; committed by a citizen incapable of understanding the meaning of his actions or managing them.

Misprints and other minor violations of the procedure for drawing up a will, signing or certification cannot serve as a basis for the invalidity of the will if the court has established that they do not affect the understanding of the will of the testator.

What documents are required to complete a transaction under a gift agreement?

To register a donation agreement for an apartment or residential building, the following list of documents is required:

- Passports or birth certificates of persons involved in the transaction, marriage certificate (required);

- Donation agreement () - number of copies depending on the number of persons participating in the transaction + 1 copy for Rosreestr (required);

- State payment receipt. duties for government registration of ownership of real estate (required);

- Real estate cadastral passport (optional).

- An extract from the Unified State Register of Real Estate for the object (a copy of the certificate of state registration of the donor's ownership, if the ownership is long-standing) - optional.

If the property is jointly owned by spouses, the spouse’s consent to donate real estate is additionally required. If the object of the agreement is real estate owned by minor children, permission from the guardianship and trusteeship authority is additionally required (see how to properly draw up a deed of gift).

Entry into ownership

The heir legally becomes the owner of the property bequeathed to him six months after the death of the former owner. First, you need to submit an application for inheritance to the notary who kept the order of the deceased. The notary will set the date of entry into the inheritance. For those included in the will, it is enough to have a passport with them. To obtain a certificate of inheritance, you need to pay the state fee, which was mentioned earlier. Documents issued by a notary are needed to register ownership of a house or apartment.

Expert commentary

Shadrin Alexey

Lawyer

According to the law, the gift agreement must be registered in the register. Therefore, the requirements of Art. 223 of the Civil Code of the Russian Federation stating that under such contracts the right of ownership is transferred after being entered into the register. There is a gift agreement with a deferred deadline for execution. Based on Art. 574 of the Civil Code of the Russian Federation, a promise to transfer the right to property in the future can be recognized as a donation if it is formalized in writing. Such an agreement specifies the object that will be donated and the moment of its transfer. It is impossible to write such an agreement, indicating the time of death of the owner of the property as the date of transfer; such a transaction is considered void.

Who should be present when signing the gift agreement?

Documents are submitted to Rosreestr through the MFC already signed.

Although the donation agreement can be signed in the presence of an MFC employee. If the donor or recipient cannot be present for any reason (health status, residence in different cities, etc.), he can be replaced by a representative, for whom a notarized power of attorney is issued, giving him the right to sign the gift agreement, submitting documents for registration. In this case, the parties risk absolutely nothing, since such a power of attorney implies the completion of formal procedures for drawing up papers and it is impossible for the representative to dispose of the property. A power of attorney costs about 1000 rubles. A notary can formalize it both in a notary’s office and at home (more expensive). The power of attorney must necessarily indicate the object of the donation and the Donee, otherwise such a power of attorney is considered void.

Design features

Bequeathing property and registering a deed of gift for it are two completely different processes , each of which has its own legal nuances.

Drawing up a document on the right of inheritance

A document on the will of property is drawn up in writing by one person, in the presence of a notary or other authorized body. At the request of the testator, during the execution of the document and its legal certification, a witness who is not interested in receiving the inheritance may be present . The heirs mentioned in the will are prohibited by current legislation from being present during the execution of the document.

An act defining the posthumous will of a person regarding the further disposal of his property must be certified by the personal signature of the testator . In cases where, for good reasons (illiteracy, serious illness or physical disabilities), the person bequeathing his fortune cannot put his own signature on the document, then, at his request, the legislator provides for the possibility of signing by another person.

Important! A will that is not certified by an authorized body does not officially have legal force and can be challenged by the heirs, with the exception of rare cases provided for by the legislator.

In such a situation, the document being drawn up states the reason why the testator was unable to sign the will himself and full information about the person who signed.

What documents will be needed to register an inheritance?

What needs to be included in the gift deed?

Registration and preparation of a deed of gift directly depends on the donated property and its value .

Drawing up a donation document in writing is mandatory only in two cases:

- The property is donated to a legal entity and its value is above 3,000 rubles.

- The contract contains a promised obligation to donate property in the future.

In other cases, property can be donated orally , through symbolic delivery. For example, when donating a car, give the recipient the keys or documents.

Attention! The fact of donating real estate and transferring ownership of it to another person must be registered with the authorized government bodies.

The gift agreement is valid even without legal certification . But, at the request of one of the parties, the transfer of the gift can be certified by a lawyer or notary . In this case, the authorized person will be a witness that the donor, at the time of concluding the transaction, was responsible for his actions and actions, was of sound mind, with full legal capacity, and made the gift of his own free will, without external pressure and threats.

Notarization of such an agreement is, first of all, beneficial to the donor, since such a document provides a guarantee that the transaction will not be contested or canceled in the future.

Is it possible to challenge a deed of gift through the court?

According to the claim of the victim, a transaction can be declared invalid if it was made under the influence of threat, violence, deception, and also if the citizen (donor) at the time of such transaction was in an inadequate state, did not understand, was not aware of the result of such actions.

The statute of limitations for challenging a gift agreement or declaring the transaction invalid is only one year.

The limitation period begins from the day when the violence or threat ceased, or from the day when the victim learned about the circumstances that constitute the basis for declaring the transaction invalid. Read more about how to challenge a deed of gift for an apartment in our article.

What is more beneficial for the testator and heir?

What is more profitable and for whom depends on the subject of the transaction, the relationship between the parties and life circumstances.

For the person transferring his property, a will is more beneficial. The testator has the right to change it, cancel it, or create a new one. He can manipulate his relatives and third parties, while remaining the owner of his property and with the right to dispose of it at his own discretion. The property will pass to the heirs only after the death of the testator.

For the recipient of the property, a deed of gift is a beneficial option. Ownership of the object of donation arises after signing the agreement and entering information into the Unified State Register. During the lifetime of the donor, the recipient can dispose of the gift independently at his own discretion.

Is it possible to protect the housing interests of the donor after registering the deed of gift?

Most often, after registering a gift agreement, the Donor remains to live in the donated residential property with fear for his future. The relationship with the recipient may deteriorate and he will demand to vacate his home. There is a safety net - include in the terms of the contract the possibility of the donor living until death.

However, in the event of a legal conflict, this condition may be debatable, since a donation implies full ownership of the property free of charge, the donor cannot demand anything from the recipient, for this there is a lease agreement. If you are not sure that there is no such potential problem, it would be more advisable to draw up a donation agreement not for the entire property, but for part of it, for example, donate 9/10 of the share, and bequeath 1/10, which will allow you to use the entire premises as the owner.

So, in order to decide in your case whether a will or a deed of gift for an apartment or residential building is better, you should take into account all the nuances described in this article and seek advice from a lawyer.

How much and who will have to pay?

All costs associated with the preparation of a will or deed of gift are divided into three categories:

- State duty;

- Notarial services;

- Taxes.

Payment for notary services is determined in each region, region, and republic by notary chambers. This is usually done once a year. The established tariffs are mandatory for public and private offices. For example, today drawing up a will in Moscow costs 1200-2500 rubles, in St. Petersburg 1500-2000 rubles, in the regions it is a little cheaper. The state fee for registering a will is 100 rubles. This includes certification of a personal signature and entering the document into the register.

Inheritance in Russia today is not subject to tax. However, when entering into inheritance rights, you need to pay a state duty as a percentage of the value of what you receive under the will:

- 0,3%, but not more than 100,000 rubles. for close relatives (children, parents, grandparents, brothers, sisters).

- 6%, but not more than 1,000,000 rubles. for everyone else.

Important! If several people received an inheritance, the state duty is divided in proportion to the shares received. Veterans of the Second World War, heroes of the Russian Federation, awarded the Order of Glory may not pay the duty. Family members of the deceased who lived with him in the inherited premises, children under 18 years of age, and incapacitated persons are also exempt from payment.

In the case of donating property, you will definitely have to pay a state fee for an extract from the cadastre and personal income tax:

| State duty amount | Personal income tax |

| 2000 rub. | 13% of the value of the donated property |

Art. 217 of the Tax Code of the Russian Federation, when concluding a gift agreement between family members, exempts income in the form of the value of the gift from income tax. Of course, it is difficult to draw up a contract on your own; most likely, you will have to seek help from lawyers, realtors, or a notary. This will incur additional costs. All the same, in financial terms, transferring property to family members under a gift agreement is certainly more profitable than by inheritance.

The owner’s right to use the apartment after the transaction is completed

As a general rule, with the transfer of ownership under a gift agreement, the donor loses the right to use the apartment. However, the deed of gift can include a condition that the donor retains the right to reside in the apartment. However, this condition cannot fully protect the owner from dishonest actions of the donee, who, for example, can create unbearable conditions for living in an apartment with the intention of evicting the donor. When making a will, the owner avoids the above risks, because Until his death, he retains the right to own, use and dispose of the apartment in full.

Transaction form

The gift agreement can be concluded either in simple written form or (at the request of the parties) in notarial form. A mandatory notarial form of donation is required only if the donor of the apartment is a minor or a citizen with limited legal capacity. A deed of gift is a bilateral transaction that will be valid only if the agreement is signed by both parties - the donor and the donee.

A will, unlike a gift, requires mandatory certification by a notary. To draw up a will, only the testator must be present.

Subtleties of each method

Entering into ownership rights under a gift agreement differs from a similar process under a will. Let's take a closer look at what the difference is:

- Entry deadlines

. If a Will has been drawn up, then you can enter into these rights only six months after the death of the testator. If we are talking about a gift agreement, then you can enter into rights immediately, even during the life of the person who executed the gift deed. To do this, you need to carry out the procedure for registering the relevant documents with government agencies of the Register of the Russian Federation. - Possibility of reversing the decision

. The will can be completely revised and even canceled, since this document is characterized by complete freedom of choice. A gift agreement is a procedure that is either very difficult or impossible to cancel. The only way to cancel the validity of a deed of gift is to prove that the donor was either incapacitated at the time the document was drawn up, or the signing of the gift agreement was carried out under duress. - Design features

. The deed of gift may not be notarized, since its registration is carried out by government agencies. If the gift agreement is not registered in the State Register, then the document will not be recognized as valid. The will must be certified by a notary.