Penalty under a contract for the provision of paid services: concept, legal regulation

The main regulatory legal act regulating the establishment of a penalty, its form, size, etc., is the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code), in which § 2 in Chapter 22 is devoted to this method of securing obligations, as well as a number of separate rules (in particular, Art. 12, 64, 207, etc.).

In addition, important sources of regulation of the issue are business customs, as well as judicial practice. Thus, the rules on penalties are further considered and specified in the resolution of the Plenum of the Supreme Court “On the application by courts of certain provisions of the Civil Code of the Russian Federation on liability for violation of obligations” dated March 24, 2016 No. 7, Review of judicial practice of the Supreme Court No. 2 (2016), approved by the Presidium Sun 07/06/2016, and a number of other judicial acts.

In accordance with paragraphs. 1 and 2 tbsp. 330 of the Civil Code, a penalty as a way to ensure that the parties fulfill their obligations under a transaction has the following characteristics:

- represents a certain amount of money;

- is established by agreement of the parties or may follow from a rule of law;

- occurs as a result of a party’s failure to fulfill its obligations or performance in violation of certain terms of the contract, for example deadlines;

- paid in the interests of the injured party (creditor);

- is not related to the existence of losses of the party whose interests in the transaction were violated;

- should only be done in cases of guilt in the actions of the performer (for failure to fulfill an obligation due to the actions of the creditor himself, no one has the right to demand payment of a penalty).

These signs constitute the concept of a penalty.

Legal penalty under a service agreement

Penalty, including under a contract for the provision of services, by virtue of clause 1 of Art. 330 of the Civil Code can be established by the parties as one of the conditions of the concluded transaction or follow from a legislative act. In the second case, its additional stipulation in the contract or a separate agreement is not required, and the customer has the right to demand its payment regardless of the presence of a corresponding condition in the contract.

Legal penalties under a service agreement are established by various regulatory documents, including:

- for violation of the rules and terms of transportation under contracts for the provision of services for the transportation of passengers, baggage or cargo by various modes of transport - the Charter of road transport and urban ground electric transport, the Charter of railway transport, the Code of Inland Water Transport, the Air Code;

- violation of the terms of provision of services by an economic entity to an individual under the relevant agreement - clause 5 of Art. 28, art. 30, paragraph 3, art. 31 of the Law “On the Protection of Consumer Rights” dated 02/07/1992 No. 2300-1 (3% of the cost of services or the total price of the contract, if it is not possible to separate the cost of services separately);

- refusal to voluntarily satisfy the consumer’s legal requirement under a service agreement - clause 6 of Art. 13 of the Law “On the Protection of Consumer Rights” dated 02/07/1992 No. 2300-1 (50% of the amount awarded by the court in favor of the recoverer-consumer);

- violation of the terms of delivery of a postal item or money transfer under an agreement for the provision of postal services - Art. 34 of the Law “On Postal Services” dated July 17, 1999 No. 176-FZ (3% of the postage fee per day when sent by ground transport or the difference between the cost of air and ground postage when sent by plane).

There are other types of legal penalties, including in relation to the recipient of services, including utilities.

The Supreme Court explained the nuances of offsetting penalties in case of violation of contractual obligations

The Judicial Collegium for Economic Disputes of the Supreme Court issued Ruling No. 309-ES20-24330 in case No. A07-22417/2019 on the collection of debt from the customer under a contract, as well as penalties for violation of contractual obligations at the request of both parties.

In February 2021, Ural Institute of Urbanism LLC (contractor) and the non-profit organization Housing Development Fund of the Republic of Bashkortostan (customer) entered into an agreement to carry out design work until August 30 at a cost of 11.8 million rubles. The conditions provided for the contractor's liability for violating the terms of the work in the form of a penalty in the amount of 0.2% of the contract price for each day of delay (clause 6.4 of the contract). If payment deadlines for work performed were violated, he could also demand payment by the customer of a similar penalty (clause 6.5 of the contract).

Since the institute completed all contractual work, the design and working documentation for the facility was received by the customer, who then received a positive conclusion from state and independent examinations and a construction permit, upon completion of which multi-apartment residential buildings were put into operation. At the same time, the fund paid for the work only on the first 11 stages for a total amount of 11.1 million rubles. Next, a dispute arose between the parties regarding payment for the last stage of developing estimate documentation, the cost of which amounted to 765 thousand rubles. Despite the fact that the contractor completed these works, the customer did not pay for them.

In this regard, the institute filed a lawsuit against the fund to collect from it the amount of debt and penalties in excess of 6.8 million rubles. and 118 thousand rubles. interest for the use of other people's funds. The defendant filed a counterclaim for the collection of penalties for late delivery of the disputed work in the amount of over 9 million rubles.

The first instance established the fact of violation both on the part of the contractor and on the part of the customer. In this regard, the court offset the counterclaims and came to the conclusion that there were grounds for collecting the principal debt in the amount of 59.6 thousand rubles. and penalties in the amount of 223 thousand rubles. on the original claim, refusing to satisfy the counterclaim. In turn, the appeal and cassation supported this decision.

At the same time, the courts recognized the existence of grounds for collecting a penalty on the claims of the parties, calculated not from the price of the contract, as agreed by the parties at its conclusion, but from the price of the last unpaid stage of work. Thus, according to the initial claim, 765 thousand rubles were recovered. debt and 223 thousand rubles. penalties for failure to pay for work on time; according to the counterclaim, the recovery of 705 thousand rubles was recognized as justified. penalties for violation of deadlines for completing work for the period from August 31, 2021 to December 4, 2021.

In addition, the courts took into account the fund’s statement about the offset of counter-similar claims, namely the accrued penalty for violating the terms of the institute’s work, calculated by the customer based on the contract price. At the same time, the courts considered that when the offset took place, but using their own procedure for calculating the penalty (from the price of the 12th stage of work, and not from the contract price, as agreed by the parties), on the contrary, the contractor’s payment obligations to the customer were fully repaid penalties for violation of deadlines for completing work in the amount of 705 thousand rubles, and, accordingly, the principal debt of the customer in the amount of 59.6 thousand rubles remained partially outstanding for this amount. and a penalty in the amount of 223 thousand rubles, which were collected from the fund.

Next, both parties filed cassation appeals to the Supreme Court, whose Judicial Collegium for Economic Disputes reminded that the interpretation of the contract should not lead to an understanding of the terms of the contract that the parties obviously could not have in mind. In the disputed agreement, the Court emphasized, the amount of liability for violation of obligations was agreed upon by the parties to the dispute in the amount of 0.2% of the contract price for each day of delay, and not from the price of an individual stage.

“The literal content of clauses 6.4 and 6.5 of the agreement indicates that the will of the parties was aimed at calculating the penalty depending on the contract price, which, according to the generally accepted understanding of this expression, means the amount of the entire consideration for the work performed under the contract. A different understanding of the terms of the agreement did not follow from the business practices of the parties and other circumstances of the case. None of the evidence presented and the circumstances established by the courts allowed us to assert that the parties had a different understanding of the terms of the contract under consideration,” the RF Supreme Court noted in its ruling.

Thus, he emphasized, the lower courts had no grounds for applying other terms of the agreement on the procedure for determining the penalty that were not agreed upon by the parties. If there is a petition to reduce the amount of the penalty according to the rules of Art. 333 of the Civil Code of the Russian Federation, courts must, in particular, check the equivalence of the terms of the contract in terms of the liability of the parties in the event of a violation of their obligations, find out whether the amount of the penalty declared for collection is disproportionate to the consequences of the violation of the obligation, as well as the presence of the fact of improper fulfillment of the obligation through the fault of both parties .

“In addition, when considering the present dispute, the courts, when determining the amounts of debt and penalties to be paid, essentially reviewed the earlier settlement of similar counterclaims made by the fund, calculated by it under the terms of the agreement, to which the institution had not previously filed any objections before going to court. By virtue of clause 2 of Art. 154, art. 410 of the Civil Code, offset as a method of complete or partial termination of an obligation is a unilateral transaction, for the completion of which, as a general rule, certain conditions are necessary: the demands must be counter-claims, homogeneous, with deadlines for fulfillment. For offset, a statement from one party is sufficient,” the Court recalled.

He added that the admissibility of contractual set-off in the pre-trial dispute resolution procedure is due to the freedom of contract (Article 421 of the Civil Code of the Russian Federation), and after filing a claim, the defendant has the right to send the plaintiff an application for set-off and indicate in the objection to the claim that the claim for which the claim was brought is terminated by set-off . In turn, objections regarding the offset or its amount may be considered by the court as part of the resolution of a dispute regarding the collection of the corresponding debt or penalty. A party, at its own discretion, has the right to state its objections to the set-off both when filing claims and in objections to the claim or by filing a counterclaim.

“The offset of the amounts of the penalty does not prevent the party from also raising the issue of applying the rules of Art. 333 of the Civil Code to the offset penalty (if there is a statement from the party), in connection with which the court may establish the existence of grounds for changing the amount of the penalty and, accordingly, for revising the amount of the claim that was presented for offset, according to the rules for reducing the penalty declared for collection according to the claim. However, in the absence of an application to reduce the penalty from each party and its justification, the courts, using a different approach when calculating the penalty within the framework of the offset that took place and revising its terms, determined the amount of the penalty on the fund’s claim at 705,574.33 rubles, thereby reducing its amount by 17 times relative to the amount calculated by the fund on the basis of the terms of the contract, thereby violating the freedom of contract when concluding it, the balance of interests of the parties, reducing the security, including compensatory, function of the penalty,” noted the Supreme Court, which canceled the judicial acts of the lower courts and returned the case for a new trial at first instance.

Calculation of penalties under a service agreement

Penalty based on clause 1 of Art. 330 of the Civil Code can be established in the form of a penalty or a fine. In the case of a fine, no additional calculations are required, since it is established in the form of a firm fixed amount and is payable regardless of the period of delay in fulfilling the obligation. Penalties are calculated using a special formula, the multipliers of which also follow from the decision of the Supreme Arbitration Court dated February 20, 1996 No. 8244/95.

The formula for calculating penalties in the form of penalties under a contract for paid services is as follows:

P = Rn × Co × Dpr,

Where:

- P - penalty in the form of a penalty;

- Rn - the amount of the sanction for failure to properly provide services within the period established by the contract, established as a percentage for each day of delay;

- Co - the cost of a service that was not provided or was provided in violation of the terms of the contract or the quality of provision;

- DPR - the period of delay in the proper provision of services, measured in calendar days.

Results

Thus, the penalty under a service agreement, despite the specifics of the legal relationship, is calculated according to the standard formula when it comes to penalties. In this case, the amount of the penalty interest is either established by agreement of the parties or follows from a legislative act. The fine is a fixed amount of money that must be paid by the contractor in the event of failure to properly provide the service within the period specified in the contract.

See our materials on calculating penalties under other contracts:

- “Forfeit under a supply agreement - procedure for calculation and collection”;

- “Forfeit under a contract - the procedure for calculation and collection.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The penalty has been calculated. What's next?

Simply calculating the penalty is not enough; you also need to collect it correctly. It is generally accepted that in order to collect a penalty you should immediately go to court, but this is not so: you must first try to obtain funds voluntarily (pre-trial). For some categories of agreements, compliance with the voluntary order is a mandatory step. If you cannot provide proof that you have already tried to collect the money, the court will not accept the application at all.

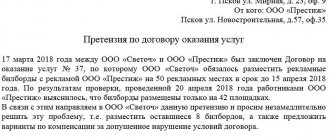

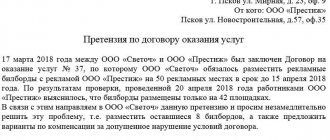

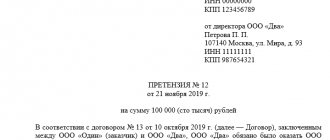

To receive a penalty, you first need to draw up a claim and send it to the counterparty. The claim should refer to the provisions of the contract, indicate the fact of non-fulfillment of obligations and demand payment of a penalty (we must attach its calculation to the document). If you do not receive any reaction from the violator of the agreement, then you can proceed to preparing and submitting an application to the court (calculations are also attached to the application). You can read more about pre-trial and judicial collection procedures here.

Important! The judge checks the correctness of the calculation of the penalty, so you need to take a responsible approach to determining the amount. If an error is discovered, the court will definitely point this fact out to the applicant.

You can receive a penalty if the court rules in your favor and obliges the offender to pay you money. To enforce collection after making a decision, you will need to contact the bailiff service. At the same time, even if the counterparty pays the penalties, this does not mean that he will relieve himself of all obligations: the obligations established in the contract still need to be fulfilled.

Let's summarize. Collection of penalties begins with calculating the amount that can be demanded from the counterparty. But, as practice shows, it is much more difficult to achieve real collection of penalties. Therefore, the optimal solution in such a situation is to contact a lawyer: a specialist will help with both the calculations and the subsequent preparation of documents for the collection of funds.

Sources:

Civil Code of the Russian Federation. Article 330. Concept of penalty

Civil Code of the Russian Federation. Article 332. Legal penalty