The procedure for collecting debt under the contract

Debt collection methods are gaining relevance, some of which are called conventional; in practice, the following are found:

- An oral reminder to the debtor of his obligations, traditionally it happens more than once.

- Filing a complaint with law enforcement agencies.

- Applying to the court by drawing up and filing a statement of claim for the collection of debt under the contract (in addition, at the same time it is possible to file a claim for the collection of a penalty under the contract as a penalty for the debt).

- Other methods of debt collection.

We do not recommend calling for help from criminal structures that operate under the guise of collection agencies, which, in fact, are not such. It is advised to deal with the issue in a planned manner, ensuring that the debt does not become a bad debt.

The repayment algorithm and methods of debt collection proposed by lawyers today imply systematic work, competently organized by specialists, these are:

- analysis and research of the situation that has arisen with the involvement of persons who can help reduce the amount of debt and repay

- launching a procedure for collecting receivables in court as a coercive measure

- possible consequences of the applied sanctions, they must be calculated by creditors in advance

USEFUL: watch a video with advice from a lawyer on arbitration cases and write a question on your topic in the comments of the video on the YouTube channel

What evidence does the court consider?

Payment of the invoice offer is equivalent to concluding an agreement (Article 435, Article 438 of the Civil Code of the Russian Federation). An invoice for payment for goods, as a rule, indicates the details of the parties, characteristics of the goods, their quantity, cost, etc.

If an invoice for payment to the buyer contains all the essential terms of the supply agreement, then such an invoice is equated to an offer (Definition of the Supreme Arbitration Court of the Russian Federation dated 02/09/2011 No. VAS-1090/11). And payment for it is an acceptance, from the date of which the contract is considered concluded (Resolutions of the Plenum of the Armed Forces of the Russian Federation dated December 25, 2018 No. 49, Eighth Arbitration Court of Appeal dated August 5, 2019 No. 08AP-4128/2019, AS of the Volga-Vyatka District dated April 27, 2017, No. A43-31817/2015).

When establishing actually existing contractual relations, the court may proceed from postal, electronic correspondence, documents indicating the intention of the parties to enter into an agreement.

Such documents may be:

- drafts of an unsigned contract with a signed specification of the supplied goods;

- payment receipt, payment order;

- consignment note, consignment note;

- invoices or UPD;

- other documents confirming the arrival of the goods;

- safety receipt;

- waybill;

- acceptance certificates for work performed or services provided;

- work order;

- technical or other assignment for the performance of work, provision of services;

- power of attorney to receive goods;

- correspondence between counterparties agreeing on the terms of the transaction. These can be letters sent by mail, telegrams, or other documents transmitted via communication channels.

The given list of documents is not exhaustive.

Methods for collecting overdue debt under a contract

There are several ways to force the debtor to repay the debt, these are:

- An agreement in which there is a claim procedure for debt repayment with the execution of a settlement agreement.

- Involvement of law enforcement agencies implies contacting law enforcement agencies in case of refusal to repay the debt voluntarily, the basis is several articles of the Criminal Code of the Russian Federation.

- Involvement of private organizations, these can be economic security agencies operating on the basis of a state license, etc.

- Going to court if out-of-court methods prove to be ineffective; in addition to the amount of debt, a claim may be filed in an arbitration court for the recovery of damages, which will require amounts arising in connection with the delay in payment under the contract.

Economic methods solve the problems of debts recognized as bad.

The listed methods of debt repayment, according to experts, are not universal; each of them is applicable in specific situations, which requires an analysis of the effectiveness of debt repayment.

How to file a claim

There are no special requirements for the execution of the document, as well as for its preparation. This means that the claim can be written on a simple blank sheet of any convenient format, or on the company’s letterhead, by hand or in printed form (the latter option is convenient because you do not need to enter the sender’s details and it is easy to make copies). But if the terms of the contract stipulate a specific format for writing and filing a claim, then, of course, you need to follow it.

The claim must be signed by the head of the company or an employee who is responsible for resolving specific issues identified in the document (the signature must only be “live”, the use of facsimile autographs is excluded).

It is not necessary to certify a claim using various types of clichés, since since 2021, companies have the right to endorse their documentation with seals and stamps only if this norm is specified in their local regulations.

The claim is drawn up in two copies , which are identical in content and equivalent in law.

After drawing up the claim, it should be registered in the document log, and the sent option should be noted in the outgoing correspondence log.

The claim can be sent by registered mail with acknowledgment of receipt, or submitted by courier or company representative (in this case, you must obtain the signature of the counterparty’s representative confirming receipt of the document).

Debt collection period under the contract

The period during which a debt can be collected is nowhere established by law; therefore, creditors file lawsuits in court at any time.

IMPORTANT : know that the law has a statute of limitations, which is the period during which the plaintiff can protect his rights in court. When collecting a debt under a contract, this period, as a general rule, is 3 years.

However, quite often, especially under loan agreements, banks or other organizations that have purchased debts from banks go to court outside the statute of limitations, usually to issue a court order.

The peculiarity of the application of the limitation period is that the court can refuse a claim on this basis only if the defendant declares it, i.e. debtor under the contract. Thus, when they go to court for the issuance of a court order, which is issued without the parties, the only opportunity to claim the statute of limitations is to submit to the court objections to the court order within the established period, which is subject to cancellation. Next, the creditor can file a claim and during the lawsuit, the debtor can exercise his right and claim that the statute of limitations has expired.

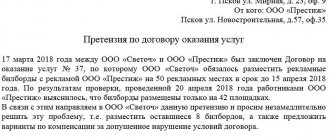

After writing a complaint

A submitted complaint can have different consequences:

- The first and most convenient for everyone is the elimination of shortcomings and further cooperation.

- The second is ignoring requirements. In this case, the law allows for the possibility of unilateral termination of the contract, even if such a clause is not in the document itself.

Also, a party that has suffered losses due to failure to comply with the terms of the service agreement has the right to go to court.

The claim in this case will serve as further evidence of a violation of obligations by the second party.

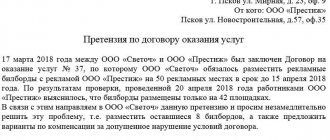

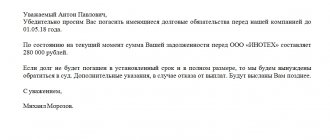

Claim for debt collection under the contract

Before going to court, especially arbitration, it is necessary to comply with the claims procedure, i.e. before the trial, contact the debtor with a demand for repayment of the debt.

A claim is something like a future lawsuit. What does the claim include?

- The claim must contain information about who it is addressed to, i.e. details of the debtor, full name or name, if it is a legal entity, address of the debtor. You can specify a phone number, email address, INN for the organization.

- The claim must be clear from whom it is being sent, i.e. data of the creditor, claimant, future plaintiff.

- Most often, claims are printed with the organization’s stamp, which includes the date and number, i.e. information about the internal registration of such a claim.

- The document can be called a “claim”. Although the title of the document does not play a big role, the main thing is that it follows from the text that this is a claim.

- The text of the claim, as a rule, sets out the circumstances of the formation of the debt, i.e. when, between whom, what the agreement was concluded about, what violations were committed by the debtors that led to the formation of debt, debt calculation. The rules of law on the obligation to properly fulfill assumed obligations, etc. are indicated.

- The petition part indicates the requirements of the creditor, i.e. what amount the debtor must return and pay to the creditor. You can specify by what date the return must be made. IMPORTANT: in some courts, most often in the Moscow Arbitration Court, the plaintiff may be refused to accept the claim due to failure to comply with the claim procedure, on the grounds that the requirements in the claim and the demands in the claim differ, for example, in amount. Therefore, it is very important to clearly formulate your requirements in the claim and then duplicate them in the claim.

- After the requirements, you can make a reference to the rule of law establishing the period for consideration of the claim or to the clause of the contract that regulates the period for responding to the claim.

- At the end of the claim, information is indicated about who is signing the claim and putting a signature.

USEFUL: watch also the video with additional advice from a lawyer on filing a claim

What is the document for?

By law, a contract for the provision of services implies the fulfillment by one of the parties of their obligations to provide any services, and the second - payment for them in a pre-agreed amount and manner.

If any of the parties violates at least one clause of this agreement, its counterparty can file a claim.

Drawing up a document is the first step towards resolving any disagreements that have arisen.

Based on this, we can say that the role of the claim is quite serious. It allows not only to identify the problems that arose during the execution of the contract, but also to promptly prevent the situation from developing to court.

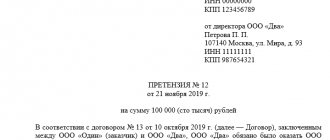

Statement of claim for debt collection under the contract

A claim for debt collection must be drawn up according to the general rules of procedural law.

NOTE : Filing a claim is not always required. In cases established by law, taking into account the amount of debt, the claimant is obliged to apply for the issuance of a court order.

What should the claim contain?

An indication of the court in which the claim is being filed;

- Information about the plaintiff (full name or name, if an organization, address of residence or location (legal address and/or postal address), TIN for the organization when applying to arbitration. You can specify telephone numbers, email address);

- Information about the defendant (full name or name, address information, TIN for the organization. If known, then telephone number and email address);

- The value of the claim is the amount of the claims. Amount of state duty;

- The name of the procedural document is “statement of claim”;

- The text of the claim must contain an indication of the circumstances in connection with which the plaintiff goes to court, information about compliance with the claim procedure, a link to evidence that confirms the circumstances and requirements of the plaintiff, references to the rules of law;

- The pleading part of the claim must directly contain the plaintiff’s demand, i.e. what amount of debt should be recovered from the defendant in favor of the plaintiff;

- The appendix lists the documents attached to the claim;

- The claim is signed by an authorized person.

USEFUL: watch also the video with additional advice from a lawyer on filing a claim in court

When should I contact you?

Depending on the reason for the request, the deadlines are as follows:

- If the customer refuses to fulfill the terms of the contract because his counterparty missed the deadline for fulfilling his obligations, he has the right to file a claim as soon as the agreed deadline is violated. At the same time, Article 28 of the Law on the Protection of Consumer Rights allows you to submit a claim not only when the agreed deadline for the completion of the provision of a service is missed, but also the agreed deadline for the start of its provision and violation of intermediate deadlines. The customer has the right to refuse on this basis if during the course of cooperation it becomes clear that the counterparty will not cope at the right time.

- The customer has the right to refuse without reason at any time, no matter at what stage the provision of services is. The main thing is to pay for what the performer has managed to do up to this point.

Law on the protection of consumer rights in art. 31 regulates the terms for the return of funds for services not provided - 10 days from the date of presentation of the corresponding demand, that is, the filing of a claim.