A letter of demand for payment of debt, a sample of which is attached just below, can serve as the beginning of a constructive dialogue in business correspondence. The document is generated quickly, in compliance with the norms accepted in business correspondence. Through this letter (also called a letter of claim), the counterparty pushes its business partner to pay the existing debt.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

If we approach it from a legal point of view, then this letter, correctly drawn up, certified and registered, will be additional strong evidence in favor of the existence of the debt as such. This will be required in case of possible appeal to the courts.

Functional

The document has a number of undeniable advantages. In organizations where it is customary to seek compromises with counterparties and discuss emerging misunderstandings pre-trial, work processes are much more efficient. A letter of demand for payment of debt will allow you to:

- Maintain existing contractual relationships. Interrupting mutually beneficial cooperation with a partner who has temporary difficulties in paying is an irrational action. Business correspondence will clarify the nuances and can lead to complete mutual understanding.

- Avoid going to court, which promises additional costs, at least if a constructive dialogue arises between the parties.

- Inform the debtor about the amount of debt and specific deadlines. The organization that sends such an appeal usually sets clear boundaries for the debtor. Until this moment, he can harbor the hope that his debt is forgotten, lost in accounting documents, vanished into thin air. Especially if the amount of debt is small.

- Optimize your office work so that the business is profitable. Several unscrupulous counterparties who are given concessions can lead almost any company to bankruptcy.

- Coordinate work issues in order to avoid significant financial difficulties. Several demand letters to “forgetting” counterparties sometimes allow the organization itself to stay afloat.

In practice, the supplier very often encounters the receivable type of debt. Other organizations do not attach importance to such “little things” at all or postpone the fulfillment of their payment obligations until later.

Some rules for filing a pre-trial claim

In order for the legal force of this document to be fully realized, it is necessary not only to draw it up correctly, but also to correctly bring it to the attention of the counterparty. If the second party is a legal entity, then the claim can be delivered by courier or personally to the reception. The person authorized to accept and certify documents must put a mark on the copy indicating acceptance of the claim, indicating the date and deciphering the signature. This copy is handed over to the applicant, after which it serves as evidence of receipt by the debtor of the document.

If the debtor is located far away or is an individual, then the claim must be delivered via mail with a notification that clearly states the name of the document.

A few days after the addressee receives the claim, you can call him and ask about his intentions. Reminders will not only draw the debtor's attention to the problem, but will also help the creditor avoid litigation.

Answer

In response to a letter of demand, the debtor may receive:

- Paying off debt. This is an ideal option, it does not occur as often as we would like.

- Letter of guarantee. In it, the debtor names the exact date on which he will repay or reduce his debt. This is also the preferred development of events for both parties to the existing agreement.

- A letter informing you that it is impossible to repay the debt within the specified time frame. In this case, there is only one recommendation - going to court with all the documents in hand.

Any response at all is already good, since the debtor is ready for dialogue.

When to send

The organization draws up an outgoing document containing a request to make payment in the following cases:

- failure to comply with financial agreements;

- lack of payment for work performed or services rendered in whole or in part;

- ignoring calls, refusing to interact;

- neglect of the deadlines established in the contract for making payments.

IMPORTANT!

In accordance with Art. 125 of the Arbitration Procedure Code of the Russian Federation, the claim procedure for resolving disputes is currently mandatory for most claims. That is, the statement of claim is accompanied by confirmation of the execution of this procedure - a copy of the letter containing a request to pay the bills in the near future, otherwise the claim will be left without progress under Art. 128 Arbitration Procedure Code of the Russian Federation.

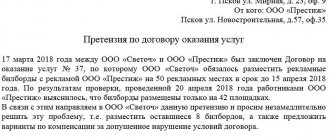

Elements of writing

Business correspondence is mostly the same type. A specific document has three parts: the head, the body of the document and the final one. At the top of the sheet there are usually details of the organization that sends the document and is the creditor. Ideally, the letter is printed on the organization’s letterhead, which contains its full name, address, contact numbers, tax identification number and other fundamentally important information.

Also, the hat, according to existing standards, must contain a number, date, polite, and most importantly, a specific address to the business partner.

If the letter is titled, for example, Romashka LLC, then it will not be clear who the recipient is. Therefore, it is better to formulate the appeal in accordance with the requirements, addressing the manager or other person responsible for repaying the debt by name and patronymic.

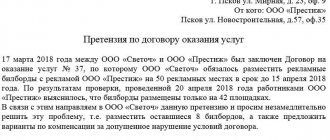

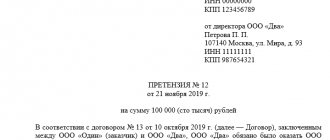

In most cases, the main part of the document states:

- A reference to the number of the contract that was concluded and according to which the goods were delivered or services were provided. You can refer to a specific clause of the contract, if possible. Quoting is not prohibited if it clarifies the situation.

- What organizations participated?

- The specific amount of debt, as well as for what goods or services it is due to be paid.

- What actions are required by the debtor company. Usually this is a transfer of funds to an account. If the account data is specified in the agreement, then it will be enough to refer to the agreement signed by both parties.

- What happens if the debt is not paid. Measures can be either soft (forfeits, penalties) or hard (appeal to the Arbitration Court). Basically, organizations resort to combined measures of influence on the debtor.

When going to court, a letter of demand for payment of debt is a prerequisite for filing a claim. Without it, the case will most likely be lost, especially if the debtor does not admit the existence of the debt.

As an addition, you can attach calculations of the penalty that is due for non-payment of the debt. However, this is not necessary for this type of business correspondence. In addition, if you refuse to pay the debt and after a long period of time, when going to court, penalties can increase significantly.

Drawing up a letter of claim for debt

A pre-trial claim is a written warning to an individual or legal entity that his actions or inactions are contrary to the law or a previously concluded agreement. For the person making the claim, this document is a kind of warning of intent. For the recipient, such a message is an incentive to action. In any case, the claim should be considered as a warning about the counterparty’s readiness to go to court.

Such a preliminary notification procedure requiring certain actions may be an attempt by the creditor to reach an amicable agreement. Sometimes the receipt of a claim may only indicate the beginning of the procedure for the counterparty to go to court.

In what cases is it compiled?

This document is drawn up in the following cases.

- If the concluded agreement contains a clause on mandatory pre-trial resolution of emerging problems. In this case, the court will simply not accept a claim for debt collection if this clause of the contract is not fulfilled.

- In order to save your time, effort and money. Court is a long and troublesome process, so the desire to solve the problem without involving the state as a mediator is quite natural and reasonable.

- The claim can be addressed not only to the debtor, but also to the creditor. For example, a bank may charge a commission when making loan payments that is not provided for in the agreement. It is not uncommon for bank clients to be indignant that, despite the repaid loan, the bank continues to withdraw loan payments from the card. All this is grounds for filing a claim.

Regardless of the purpose and reason for drawing up a warning document, in court it will always be considered as a procedure for pre-trial resolution of the problem. So in any case, the claim must be drawn up in accordance with the requirements for documents involved in legal proceedings.

How to compose it correctly?

Since this is an official document containing legal requirements, it must be drawn up in such a way that the legal basis and nature of the requirements can be clearly understood from the text. In addition, the text must indicate the amount owed, including interest and penalties, if any.

A claim is always an appeal from one person to another. This means that all counterparty data must be true. Errors made in the first name, patronymic, and, especially, in the last name can become grounds for refusal to recognize the debt. After all, such mistakes mean that you are contacting the wrong person with whom you entered into an agreement.

This document is aimed at convincing the debtor to pay the required amount. This means that it must indicate the details of the account to which the money should be transferred.

The deadlines for fulfilling the requirements should be specifically specified. Otherwise, the document loses all its legal force, since an open-ended demand means an endless deferment of payment.

Why do you need to confirm the debt?

It is obvious that the debtor agrees with his debt and - most importantly - pays it off.

This is required by the norms of civil legislation regulating business activities. In particular, by virtue of paragraph 3 of Art. 1 of the Civil Code of the Russian Federation, when establishing, exercising and protecting civil rights and when performing civil duties, participants in civil legal relations must act in good faith. According to paragraph 4 of Art. 1 of the Civil Code of the Russian Federation, no one has the right to take advantage of their illegal or dishonest behavior. In the process of transactions (execution of contract terms), the parties have rights, requirements and obligations. The latter must be executed properly in accordance with their terms and provisions of the law (Article 309 of the Civil Code of the Russian Federation). The debtor bears the costs of fulfilling the obligation based on its terms. In particular, upon receiving the goods, the buyer must pay for it. Likewise, the seller must ship the goods upon receipt of advance payment. Documents confirming the occurrence of obligations are shipping (waybills, waybills) and banking (payment orders, bank account statements) documents.

With services it is more difficult. It is more difficult to confirm the fact of their provision, and, accordingly, the emergence of an obligation to the customer to the contractor, especially if there is no tangible result. In civil legislation (neither in Chapter 37 “Contracting”, nor in Chapter 39 “Paid provision of services”) there are no clear instructions on how a contractor (performer) can record the volume and cost of work performed (services provided) and confirm them with documents. It all depends on the specific situation.

When might debt documents not be enough?

Communication services are quite specific and evidence of their provision must be data from special certified equipment.

In the absence of such proper confirmation, the service provider may be refused to collect the debt. Example - Resolution of the Ninth Arbitration Court of Appeal dated January 17, 2017 No. 09AP-60602/2016. As evidence of the stated demand for debt repayment, the contractor presented invoices, details of the invoice for communication services, invoices, certificates of work performed (services rendered) indicating their cost for the reporting period.

The basis for making payments for communication services is the readings of communication equipment, which takes into account the volume of communication services provided by the operator (Article 54 of the Communications Law). Equipment used by the telecom operator to record the volume of services provided and automated payment systems are subject to mandatory certification (Resolution of the Government of the Russian Federation dated June 25, 2009 No. 532).

During the trial, the plaintiff did not provide information about which equipment was used to record the services provided, and the connection certificates, the obligation to sign which are specified in the contract, were not presented. In particular, telephone services were provided as part of separate orders. Each of them comes into force after signing by the customer - the user of telephone services.

The operator did not submit these documents; instead, the arbitrators were offered evidence of sending primary documents through a specialized Internet resource and details of the communication services provided, which, according to the terms of the contract and the requirements of the legislation in the field of communications, was not evidence of the provision of communication services to their customer.

For comparison, in the Decree of AS PO dated December 19, 2016 No. F06-15147/2016, the operator had to submit the following documents confirming the accuracy of the information contained in the details of the provision of services: permission to operate a communication facility with an application, a certificate of conformity of equipment with an application, as well as a response Department of the Federal Service for Supervision of Communications, Information Technology and Mass Communications on the extension of permits to operate the equipment specified in the appendix to the letter. These documents confirmed the fact that the plaintiff used certified equipment to record the volume of services provided, ensuring the correct recording of connections and their duration.

Results

A claim for receivables is most often sent to the counterparty by the authorized party under the contract (but in response, the obligated party can also send a similar claim). The main thing for the claim maker is to reflect in the document the legal grounds predetermined by the provisions of the contract or law for making demands on the counterparty.

See also: “How to take into account VAT amounts when writing off accounts receivable?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for filing a claim for debt collection

A claim for collection is necessary so that in the event of an appeal to the courts, the court is sure that the defendant is aware of its debt, but due to some circumstances refuses to pay it.

You can submit a claim in one of the following ways:

- Personally, contact the office of your counterparty so that the appeal is registered, a number is assigned to it, and the date of receipt and details of the responsible recipient are stamped on the copy

- Post office. In this type of shipment, it is better to arrange everything by registered mail with notification, and also attach an inventory; if there is such a shipment, your debtor will not be able to later refer to the fact that the envelope was empty and he did not receive anything

- By courier service. The choice of the organization that will undertake the service is not so important, the main thing is that the courier is not refused to accept correspondence, as well as the speed of delivery

How to convey correctly

The response letter is sent only in writing to the address indicated on the request. Delivered by mail with a receipt confirmation and a list of attachments. Another option is delivery by courier service with delivery to an authorized person against signature.

If the demand from the injured party does not contain a shipping address, check the postal and legal addresses in the contract. If you are corresponding with an individual, then send the correspondence to the address of his place of residence.

The debtor has the opportunity to send a response letter by e-mail (clause 65 of the resolution of the Plenum of the Supreme Court No. 25 of June 23, 2015). When using electronic document management, sign documents with an electronic signature. Using an electronic signature, you identify the person and confirm the fact and date of sending the document in court. And one more thing: take screenshots while conducting email correspondence.